What is the Acrylic Polymer Market Size?

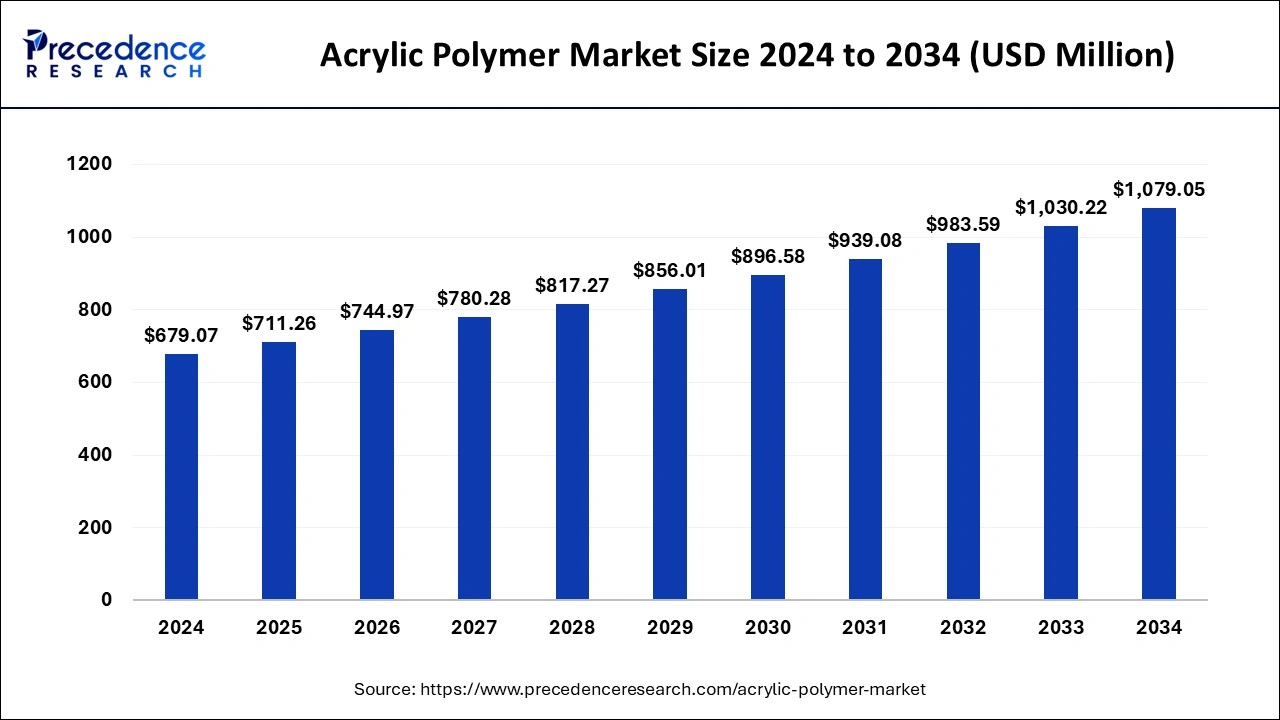

The global acrylic polymer market size was estimated at USD 711.26 million in 2025 and is predicted to increase from USD 744.97 million in 2026 to approximately USD 1,126.41 million by 2035, expanding at a CAGR of 4.70% from 2026 to 2035.

Acrylic Polymer MarketKey Takeaways

- The global acrylic polymer market was valued at USD 711.26million in 2025.

- It is projected to reach USD 1,126.41million by 2035.

- The acrylic polymer market is expected to grow at a CAGR of 4.70% from 2026 to 2035.

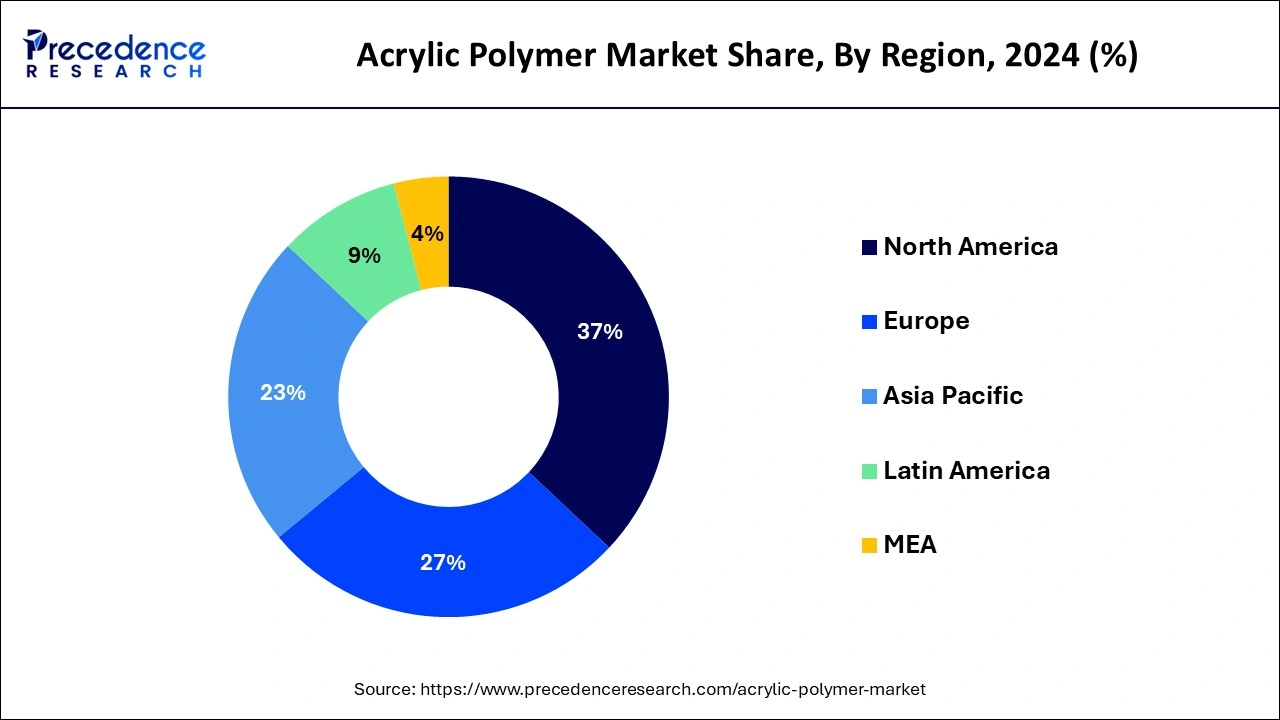

- North America dominated the market with largest market share of 37% in 2025.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2026 and 2035.

- By type, the polymethyl methacrylate segment held the largest market share 22% in 2025.

- By type, the polyvinyl acetate segment is anticipated to grow at a remarkable CAGR between 2026 to 2035.

- By solution type, the water-borne segment generated the biggest market share 28% in 2025.

- By solution type, the solvent-borne segment is expected to expand at the fastest CAGR over the projected period.

- By application, the cosmetics segment has held a major market share of 31% in 2025.

- By application, the paints & coatings segment is expected to expand at the fastest CAGR over the projected period.

What is the Acrylic Polymer?

Acrylic polymer is a type of synthetic material made from acrylic acid or its derivatives. It is widely used in various industries for its versatility and durability. Imagine it like a building block that can be molded into different shapes and forms for different purposes. From paints and coatings to adhesives and even artificial nails, acrylic polymer finds its way into many everyday products. One of the key features of acrylic polymer is its ability to resist damage from sunlight and harsh weather conditions, making it popular for outdoor applications like signage and outdoor furniture. It is also known for its clarity and transparency, which is why it is often used in clear plastics and lenses. Overall, acrylic polymer is valued for its strength, flexibility, and wide range of applications, making it an essential material in modern manufacturing and construction.

How is AI contributing to the Acrylic Polymer Industry?

Predictive material design, real-time process control, and optimization of sustainability, AI alters the way acrylic polymer is developed. It substitutes the experimental trial means, shortens the formulation cycles, minimizes defects, enhances energy efficiency, and helps in the innovative use of recyclable, bio-based polymers throughout manufacturing and use phases.

Acrylic Polymer Market Data and Statistics

- The International Association for Soaps, Detergents, and Maintenance Products (A.I.S.E.) reported that the European market for professional cleaning and hygiene products reached a value of USD 9.8 billion in 2020.

- In a paper released on February 14, 2022, scientists demonstrated the antibacterial and anti-biofouling properties of nanopatterned polymers at a scale below 100 nanometers, integrated into acrylic nanostructured films intended for use in food packaging.

- As per the United Nations, the global urban population is projected to reach 68% by 2050, indicating significant urbanization trends that will fuel demand for acrylic polymers in urban infrastructure and consumer goods.

Acrylic Polymer MarketGrowth Factors

- Acrylic polymers are extensively used in construction for paints, coatings, sealants, and adhesives due to their durability, weather resistance, and aesthetic appeal. As urbanization and infrastructure development projects continue worldwide, the demand for acrylic polymers in construction is expected to grow steadily.

- Acrylic polymers find applications in automotive coatings, adhesives, and interior components owing to their lightweight nature and excellent performance properties. With the automotive industry witnessing steady growth globally, especially in emerging economies, the demand for acrylic polymers is anticipated to increase.

- Amid growing environmental concerns, there's a shift towards eco-friendly materials in various industries. Acrylic polymers offer advantages such as low volatile organic compound (VOC) emissions and recyclability, making them increasingly preferred in green building initiatives and sustainable product development.

- Ongoing advancements in polymer chemistry and manufacturing processes are leading to the development of novel acrylic polymer formulations with enhanced properties and functionalities. These technological innovations are expanding the potential applications of acrylic polymers across industries, driving the acrylic polymer market's growth.

- Acrylic polymers play a vital role in the packaging sector, offering clarity, strength, and barrier properties suitable for various packaging applications. With the rising demand for packaged goods globally, particularly in sectors such as food and beverage, pharmaceuticals, and consumer electronics, the demand for acrylic polymer-based packaging materials is on the rise.

- Acrylic polymers are widely used in consumer goods such as electronics, appliances, and household products due to their versatility and cost-effectiveness. As disposable incomes rise and consumer preferences evolve, there is a growing demand for innovative products incorporating acrylic polymer-based materials, fueling market growth in this segment.

Market Outlook

- Industry Growth Overview: There are increases in demand for durable coatings, adhesives, and building materials on both the industrial and consumer markets.

- Sustainability Trends: Lower VOC waterborne formulations and alternatives based on bio-based feedstocks become the preference in making sustainable material transitions.

- Major Investors: Acrylic innovation is expanded by BASF SE, Dow Inc., Arkema, Nippon Shokubai, Evonik, and LG Chem.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 4.70% |

| Market Size in 2025 | USD 711.26 Million |

| Market Size by 2035 | USD 1,126.41Million |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Solution Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Preference for eco-friendly materials

The increasing preference for eco-friendly materials is driving the demand for acrylic polymers in the market. People are becoming more aware of environmental issues and are seeking products that have minimal impact on the planet. Acrylic polymers offer several eco-friendly advantages, such as low volatile organic compound (VOC) emissions and recyclability. This makes them appealing choices for industries aiming to reduce their environmental footprint. Additionally, governments and regulatory bodies are implementing stricter environmental regulations, encouraging industries to adopt sustainable practices and materials. As a result, manufacturers are increasingly turning to acrylic polymers as viable alternatives to traditional materials in various applications such as paints, coatings, and packaging. With the shift towards sustainability becoming a significant trend in consumer preferences, the demand for acrylic polymers is expected to continue surging in the acrylic polymer market.

Restraint

Volatility in end-user industries

The market faces restraints due to the volatility in end-user industries. Industries like construction, automotive, and consumer goods, which heavily rely on acrylic polymers, are susceptible to economic fluctuations and market uncertainties. For example, during economic downturns, construction projects may be postponed or scaled back, leading to reduced demand for acrylic polymer-based paints, coatings, and adhesives. Similarly, in the automotive sector, a decrease in vehicle production due to factors like reduced consumer spending or supply chain disruptions can directly impact the demand for acrylic polymer components and coatings. Moreover, uncertainties in consumer goods markets can also affect acrylic polymer demand. When consumer confidence declines, people may delay purchases of electronics, appliances, or other products that utilize acrylic polymers, further dampening market demand. This volatility creates challenges for acrylic polymer manufacturers in forecasting demand and planning production, as they must adapt to fluctuating market conditions, potentially leading to revenue instability and decreased acrylic polymer market growth.

Opportunity

Increasing focus on infrastructure development

The increasing focus on infrastructure development worldwide is creating significant opportunities for the acrylic polymer market. As governments invest in building and upgrading infrastructure such as roads, bridges, and public utilities, there is a growing demand for durable and weather-resistant materials like acrylic polymers. These polymers are utilized in various construction applications, including paints, coatings, sealants, and adhesives, due to their ability to withstand harsh environmental conditions and provide long-lasting protection. By providing high-quality acrylic polymer-based construction materials, manufacturers can cater to the needs of infrastructure projects and capitalize on the expanding market demand.

Moreover, acrylic polymers offer advantages such as versatility, ease of application, and cost-effectiveness, making them preferred choices for infrastructure development projects. With urbanization and population growth driving the need for enhanced infrastructure globally, there is a steady and sustained demand for acrylic polymer-based products in the construction sector. By focusing on innovation, product development, and strategic partnerships with construction companies, acrylic polymer manufacturers can seize the opportunities presented by the increasing focus on infrastructure development and position themselves for growth in the acrylic polymer market.

Segment Insights

Type Insights

The polymethyl methacrylate segment held the highest market share of 22% in 2025. Polymethyl methacrylate (PMMA) is a transparent thermoplastic known for its clarity, scratch resistance, and weatherability. In the acrylic polymer market, the PMMA segment encompasses various applications such as optical lenses, signage, automotive components, and construction materials like acrylic sheets and panels. One notable trend in the PMMA segment is the growing demand for sustainable and eco-friendly PMMA alternatives, driven by environmental concerns and regulatory pressures. Manufacturers are increasingly focusing on developing bio-based PMMA formulations and recycling technologies to meet the rising demand for environmentally responsible materials in various industries.

The polyvinyl acetate segment is anticipated to witness rapid growth at a significant CAGR of 5.5% during the projected period. Polyvinyl acetate (PVA) is a type of acrylic polymer known for its adhesive properties. It's commonly used in industries such as woodworking, paper packaging, and construction for bonding various substrates. In the acrylic polymer market, the PVA segment is witnessing growth driven by the increasing demand for adhesives in construction and packaging applications. Additionally, technological advancements have led to the development of high-performance PVA formulations with improved bonding strength and durability, further fueling the segment's expansion. As industries continue to seek efficient and reliable bonding solutions, the polyvinyl acetate segment is expected to continue its upward trend in the acrylic polymer market.

Solution Type Insights

The water-borne segment has held a 28% market share in 2025. In the acrylic polymer market, the water-borne segment refers to acrylic polymers that are dispersed in water. These water-based solutions offer eco-friendly alternatives to solvent-based acrylic polymers, as they have lower volatile organic compound (VOC) emissions and are safer to handle. Recent trends in the water-borne segment include increasing adoption due to stringent environmental regulations, growing demand for sustainable coatings and paints, and advancements in technology leading to improved performance and application properties. As environmental consciousness continues to rise, the water-borne segment is expected to witness further growth and expansion in the acrylic polymer market.

The solvent-borne segment is anticipated to witness rapid growth over the projected period. In the acrylic polymer market, the solvent-borne segment refers to acrylic polymer solutions that are dispersed in organic solvents. These solutions are commonly used in paints, coatings, and adhesives due to their excellent film-forming properties and durability. Despite concerns over volatile organic compound (VOC) emissions, solvent-borne acrylic polymers continue to dominate certain applications due to their fast drying times, superior adhesion, and resistance to environmental elements. However, there's a growing trend towards water-based acrylic polymer solutions driven by increasing environmental regulations and consumer demand for eco-friendly alternatives.

Application Insights

The cosmetics segment will hold a 31% market share in 2025. In the acrylic polymer market, the cosmetics segment refers to the use of acrylic polymers in various beauty and personal care products. These polymers are commonly employed in cosmetics formulations for their versatility and ability to enhance product performance. Acrylic polymers are utilized in cosmetics such as nail polishes, hair styling gels, mascaras, and skin care creams to improve texture, stability, and longevity. A key trend in this segment is the growing demand for long-wearing and water-resistant cosmetics, driving the adoption of acrylic polymer-based formulations that offer enhanced durability and staying power, catering to consumer preferences for products that last longer and withstand daily activities.

The paints & coatings segment is anticipated to witness rapid growth over the projected period. In the acrylic polymer market, the paints and coatings segment involves the utilization of acrylic polymers as key ingredients in paint formulations and surface coatings. Acrylic polymers offer properties such as durability, weather resistance, and color retention, making them popular choices for both interior and exterior applications. Trends in this segment include a growing preference for water-based acrylic paints due to their low VOC content, environmental friendliness, and ease of application. Additionally, advancements in acrylic polymer technology have led to the development of high-performance coatings with improved adhesion, scratch resistance, and UV protection, catering to the evolving needs of consumers and industries.

Regional Insights

What is the U.S. Acrylic Polymer Market Size?

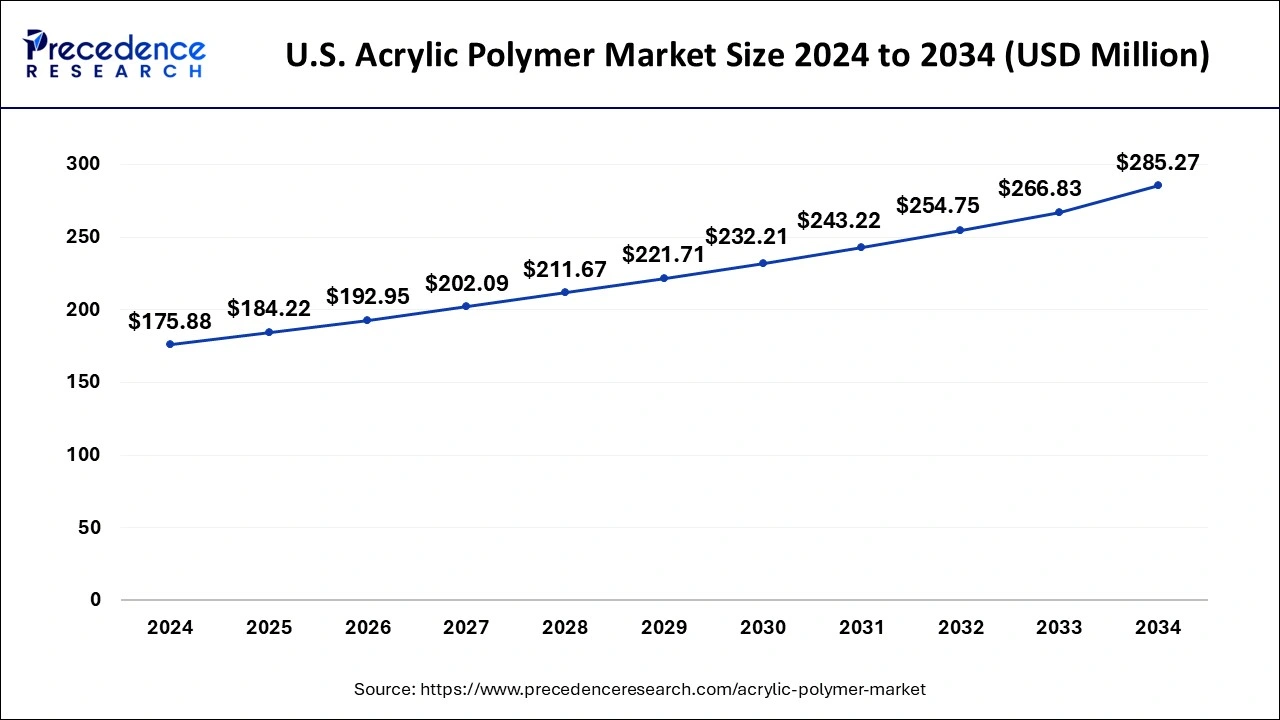

The U.S. acrylic polymer market size was evaluated at USD 184.22 million in 2025 and is predicted to be worth around USD 299.47 million by 2035, rising at a CAGR of 4.98% from 2026 to 2035.

North America held the largest market share of 37% in 2025. The region benefits from a robust construction industry, where acrylic polymers are extensively used in paints, coatings, and adhesives. Additionally, the automotive sector in North America relies on acrylic polymers for various applications. Moreover, the region's focus on sustainability drives the demand for eco-friendly materials like acrylic polymers. Furthermore, technological advancements and strong research and development activities contribute to North America's dominance in the acrylic polymer market.

U.S. Acrylic Polymer Market Trends

The hygiene products that use superabsorbent polymers are experiencing increased demand for acrylic in the U.S. Acrylic recycling is an innovation based on regulatory pressure. The expansion of e-commerce boosts the pressure-sensitive adhesive solutions that are water-based and underpin the efficiency, durability, and environmental requirements of the logistics operations.

Asia-Pacific is poised for rapid growth in the acrylic polymer market due to several factors. The region's booming construction and automotive industries are driving substantial demand for acrylic polymers in paints, coatings, and adhesives. Additionally, increasing urbanization, rising disposable incomes, and infrastructure development initiatives across countries like China and India further fuel market expansion. Moreover, advancements in manufacturing capabilities and a growing focus on sustainability are attracting investments in acrylic polymer production facilities in the region, positioning Asia-Pacific as a key growth hub for the market.

China Acrylic Polymer Market Trends

China increases the capacity of domestic acrylic to limit imports. Ecological laws accelerate the use of emulsions based on water. The production of electric vehicles and the development of the infrastructure are the primary stimulators of the demand for specialty acrylic resins, encouraging the advancement of lightweighting, durability, and performance improvement of various automotive and construction industries.

Meanwhile, Europe is experiencing notable growth in the acrylic polymer market due to several factors. One key driver is the region's robust construction sector, where acrylic polymers are widely used in paints, coatings, sealants, and adhesives for both residential and commercial projects. Additionally, there is an increasing demand for eco-friendly materials, and acrylic polymers, with their low VOC emissions and recyclability, are gaining traction. Moreover, advancements in technology and innovation are expanding the application scope of acrylic polymers across industries, further fueling market growth in Europe.

Germany Acrylic Polymer Market Trends

Germany is the pioneer in the recycling of acrylic based on depolymerization technology that supports the recycling of materials in a circular manner. The high concentration of bio-based MMA and low-VOC resins is in line with sustainability objectives. There is still a high demand for high-quality UV-curing coatings and adhesives applicable in the high-technology and automotive fields.

Value Chain Analysis of the Acrylic Polymer Market

- Feedstock Procurement: Ensures the supply of monomers on a strategic basis, supplies that are stable, costs are controlled, and the operations of producing polymers are uninterrupted.

Key Players: Dow Inc., BASF SE, SABIC, ExxonMobil, Mitsubishi Chemical - Chemical Synthesis and Processing: Conducts polymerization and purification of converting monomers into usable acrylic resin.

Key Players: Arkema, Evonik Industries, Sumitomo Chemical, LG Chem - Compound Formulation and Blending: Incorporates additives into the polymers to tailor performance to meet specific industry needs.

Key Players: Sika AG, Wacker Chemie, RPM International, DIC Corporation - Quality testing and certification: This checks chemical performance, compliance, and reliability with the regulatory and customer standards.

Key players: SGS, Intertek, TÜV SÜD, Bureau Veritas, Eurofins Scientific - Packaging and Labelling: Sorts the polymers to be transported safely with packaging and proper identification of the product.

Key Players: Amcor, Berry Global, Avery Dennison, CCL Industries, Sonoco

Acrylic Polymer Market Companies

- BASF SE: Provides superabsorbent polymers, acrylic dispersions, and performance resins to serve coatings, adhesives, hygiene, and industrial markets worldwide.

- Dow Chemical Company: Produces acrylic binding agents and emulsions that are used in architectural paints, construction products, and in long-life fixed industrial uses.

- Arkema SA: Provides acrylic monomers, emulsions, and rheology modifiers in favor of sustainable paints, adhesives, and sophisticated material solutions.

Other Major Key Players

- Mitsubishi Chemical Corporation

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- LG Chem Ltd.

- Solvay SA

- Formosa Plastics Corporation

- Kuraray Co., Ltd.

- Nippon Shokubai Co., Ltd.

- DIC Corporation

- Celanese Corporation

- Mitsui Chemicals, Inc.

- Saudi Basic Industries Corporation (SABIC)

Recent Developments

- In October 2025, Walplast Products Pvt. Ltd. launches HomeSure Mastertouch Waterlock Expert, a premium waterproofing solution using Ultra Elastic Technology. It provides 10 years of assured protection against seepage, dampness, and weather-induced damage for building exteriors. (Source:https://www.passionateinmarketing.com )

- In August 2025, Sherwin-Williams Protective & Marine launched three new water-based coatings under the CarClad platform, offering significant cost savings for the railcar market. This line includes CarClad WB 2600 (a topcoat), CarClad WB 1400 (an anti-corrosive primer), and CarClad 600 (fast-drying coating), emphasizing durability and application efficiencies, resulting in lower total applied costs. (Source: https://www.coatingsworld.com )

- On February 9, 2023, Roehm, a chemical company based in Germany, unveiled two acrylic-based copolymer compounds, Cyrolite GP-20 and MD zk6, during the 2023 MD&M West trade show. Designed for injection molding and extrusion processes, these compounds demonstrated an outstanding combination of properties ideal for medical device applications.

Segments Covered in the Report

By Type

- Polymethyl Methacrylate

- Sodium Polyacrylate

- Polyvinyl Acetate

- Polyacrylamide

- Others

By Solution Type

- Water-Borne

- Solvent-Borne

By Application

- Dentistry

- Cosmetics

- Paints & Coatings

- Cleaning

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting