October 2024

Acrylonitrile Butadiene Styrene Market (By Type: Opaque, Transparent, Colored; By Application: Appliances, Electrical and Electronics, Automotive, Consumer Goods, Construction, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

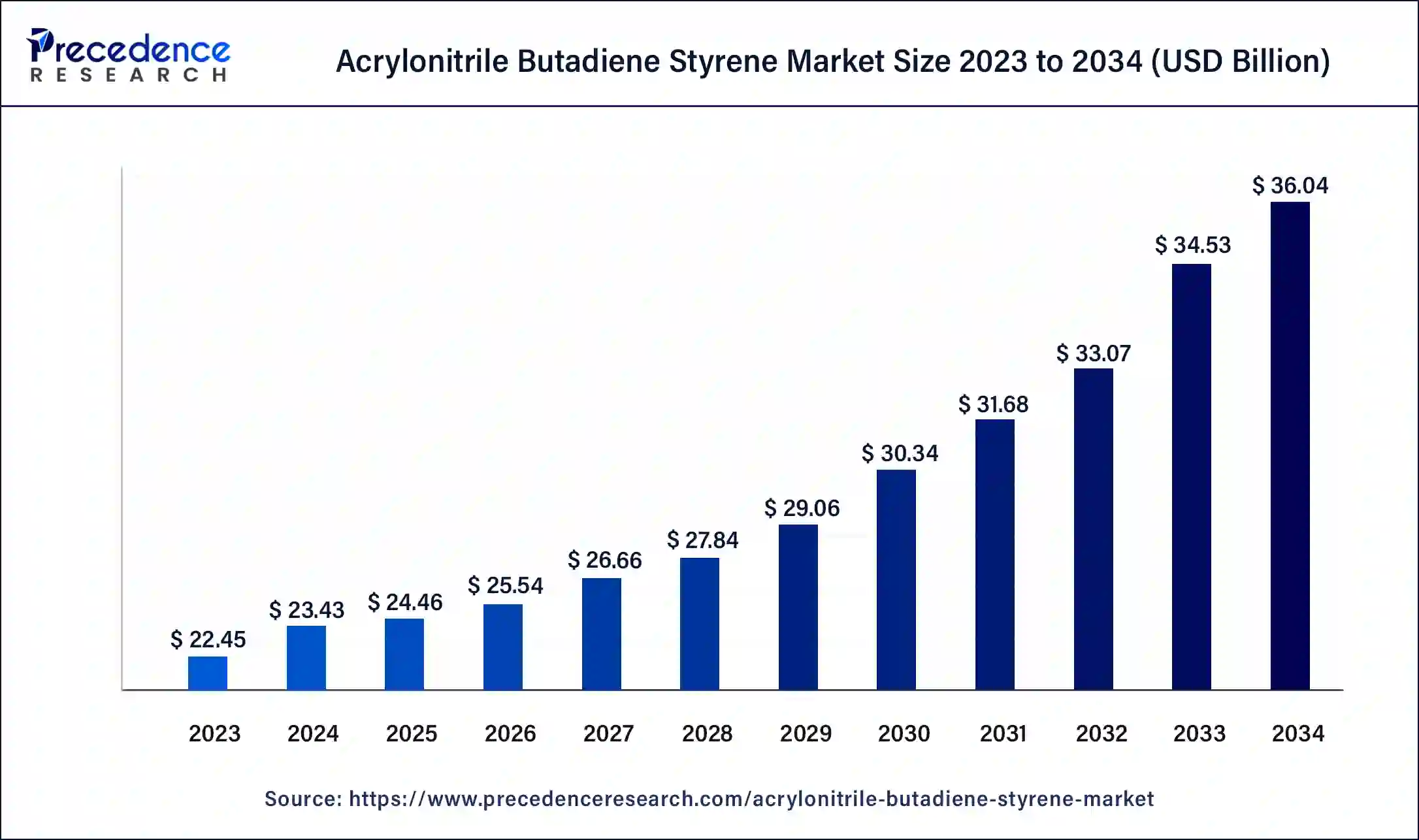

The global acrylonitrile butadiene styrene market size was USD 22.45 billion in 2023, accounted for USD 23.43 billion in 2024, and is expected to reach around USD 36.04 billion by 2034, expanding at a CAGR of 4.4% from 2024 to 2034.

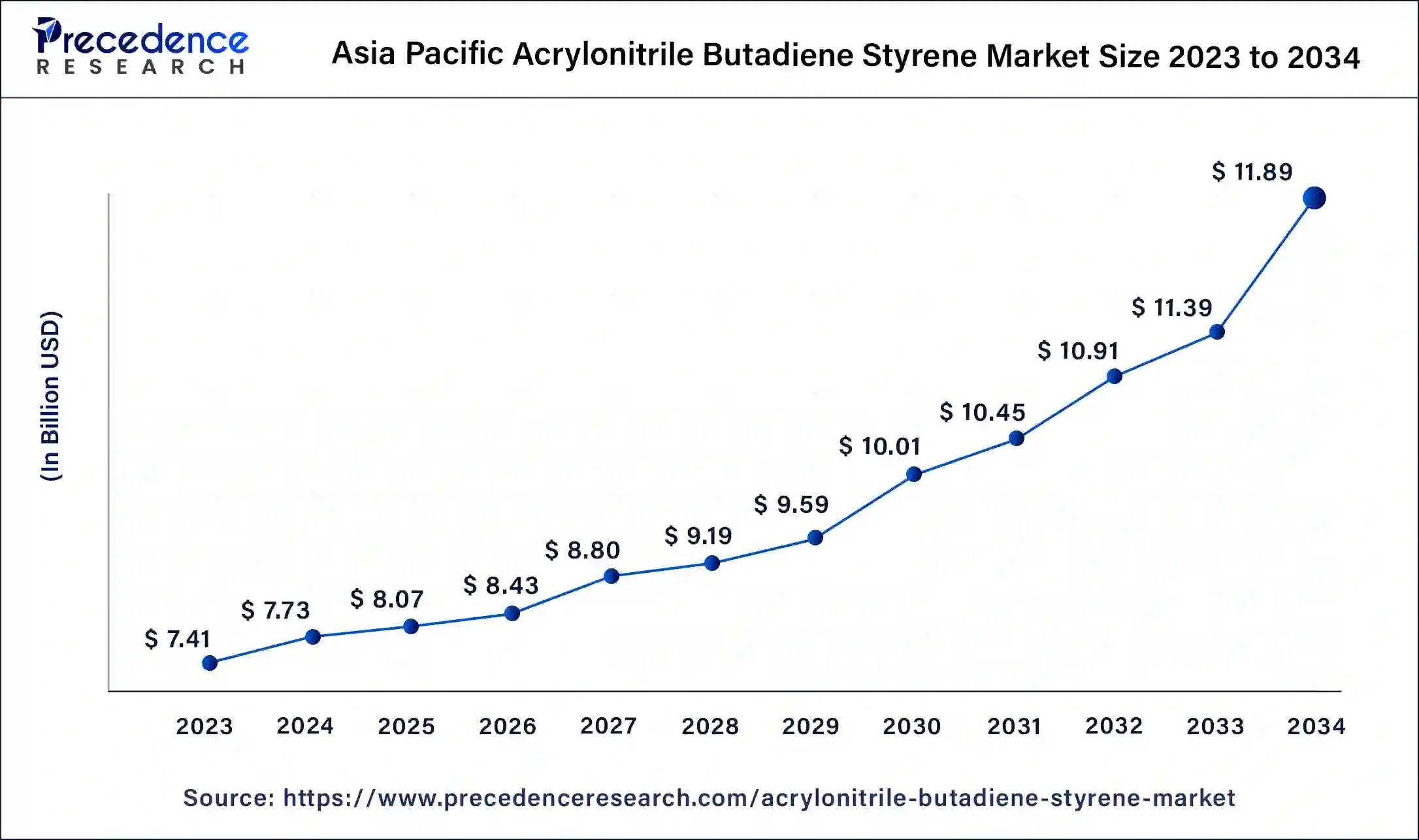

The Asia Pacific acrylonitrile butadiene styrene market size was estimated at USD 7.41 billion in 2023 and is predicted to be worth around USD 11.89 billion by 2034, at a CAGR of 4.6% from 2024 to 2034.

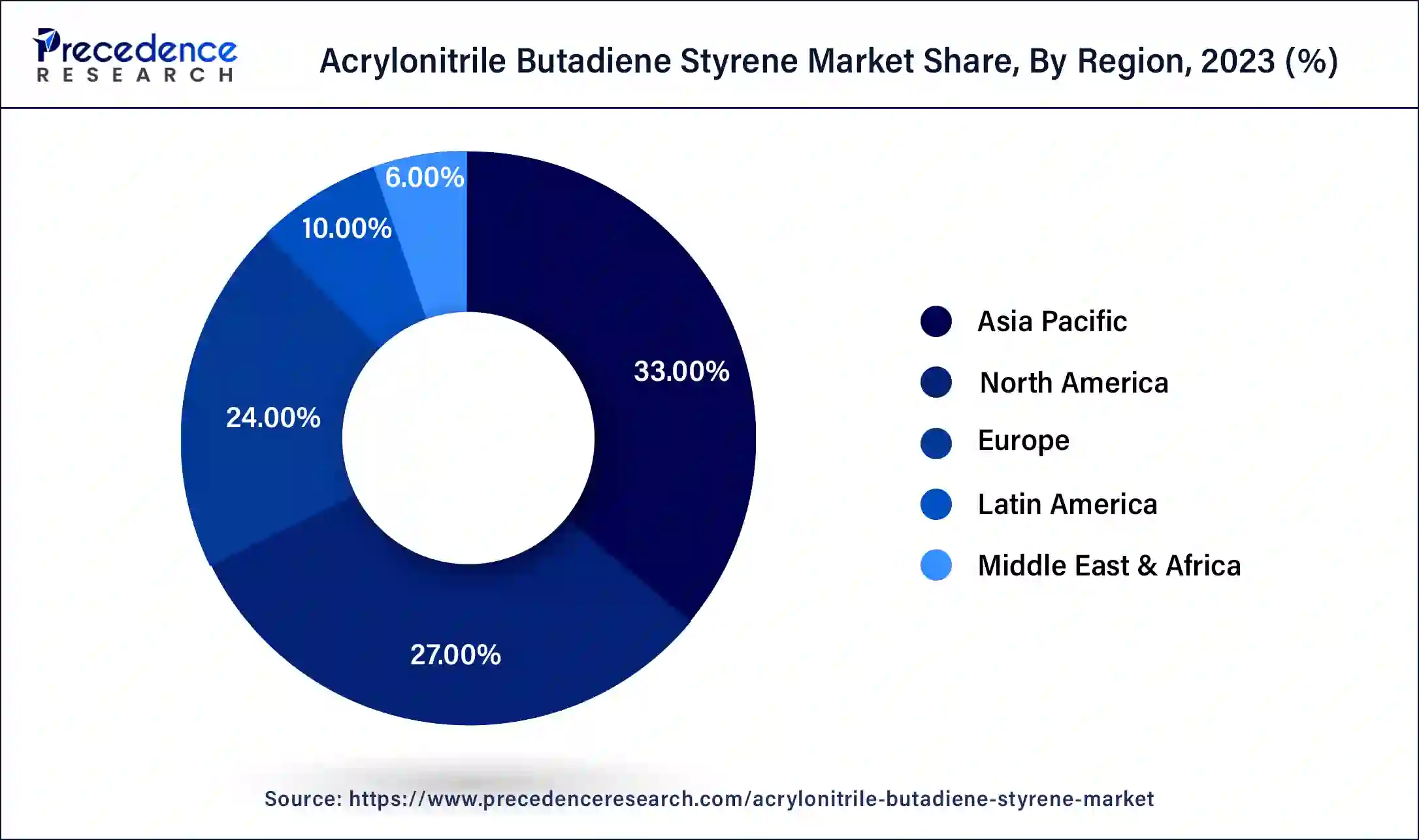

Asia Pacific has held the largest revenue share of 33% in 2023. Asia Pacific commands a major share in the acrylonitrile butadiene styrenes market due to robust industrialization, increased manufacturing activities, and a booming automotive sector. The region's economic growth has propelled demand for ABS in diverse applications, including automotive components, consumer goods, and construction materials. Additionally, a large population base and rising middle-class consumers contribute to the high demand for durable and affordable goods, further fueling the ABS market in Asia Pacific. The region's strategic position as a manufacturing hub and its expanding markets make it a key player in the global ABS industry.

North America is estimated to observe the fastest expansion. North America holds a major growth in the acrylonitrile butadiene styrenes market due to robust demand from key industries. The region benefits from a thriving automotive sector, where ABS is extensively used for manufacturing lightweight and durable components. Additionally, the well-established 3D printing industry contributes to the increased demand for ABS filaments. The region's focus on technological advancements, stringent safety standards, and a strong presence of key market players further solidify North America's significant share in the ABS market.

Market Overview

Acrylonitrile butadiene styrene (ABS) is a versatile thermoplastic polymer composed of three key monomers such as acrylonitrile, butadiene, and styrene. This combination results in a material renowned for its exceptional strength, toughness, and resistance to impact. ABS finds widespread use across industries, including automotive, electronics, and consumer goods. ABS stands out due to its impressive mechanical properties, making it a preferred choice for applications demanding durability and resilience to physical stress. Its capacity to be molded into intricate shapes without compromising structural integrity makes it a popular material in manufacturing.

Furthermore, ABS showcases commendable chemical resistance, making it capable of withstanding exposure to various substances. Whether in the form of 3D printing filaments, automotive parts, or household appliances, ABS remains a favored material, providing a harmonious blend of mechanical robustness and processing versatility for a diverse array of products.

| Report Coverage | Details |

| Market Size in 2023 | USD 22.45 Billion |

| Market Size in 2024 | USD 23.43 Billion |

| Market Size by 2034 | USD 36.04 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.4% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

3D Printing applications and medical industry requirements

The surge in 3D printing applications and the evolving requirements of the medical industry significantly contribute to the heightened demand for acrylonitrile butadiene styrene (ABS) in the market. In the realm of 3D printing, ABS's versatility and ease of use make it a preferred material for producing durable prototypes, intricate designs, and functional components.

The ability of ABS to maintain structural integrity while being molded into complex shapes aligns well with the intricate requirements of additive manufacturing, fueling its adoption in various industries, including automotive, aerospace, and consumer goods. Within the medical industry, ABS plays a crucial role in meeting the demand for lightweight, sterile, and durable medical devices.

Its use in manufacturing components like housings, connectors, and equipment enclosures underscores ABS's compliance with stringent regulatory standards while offering the necessary mechanical properties required in medical applications. The combination of ABS's versatility in 3D printing and its suitability for medical devices positions it as a sought-after material, driving sustained market growth in these key sectors.

Limited heat resistance

Limited heat resistance poses a significant restraint on the growth of the acrylonitrile butadiene styrenes market. While ABS exhibits excellent mechanical properties, its relatively lower heat resistance compared to some other engineering plastics restricts its application in environments with elevated temperatures. In industries such as automotive and electronics, where exposure to heat is common, alternative materials with higher heat resistance may be preferred.

This limitation hinders the broader adoption of ABS in high-temperature applications, impacting its market share in segments where heat stability is a critical consideration. Manufacturers and industries seeking materials for applications involving elevated temperatures may explore alternatives with superior thermal performance, leading to a challenge for ABS in capturing certain market segments and influencing the overall growth trajectory of the ABS market.

Rising demand in the automotive industry

The rising demand in the automotive industry is a significant catalyst for opportunities within the acrylonitrile butadiene styrenes market. As the automotive sector increasingly prioritizes fuel efficiency and sustainability, ABS emerges as a favored material due to its lightweight nature and excellent mechanical properties. The demand for ABS is propelled by its application in manufacturing various automotive components, including interior trims, dashboards, and exterior body parts.

Additionally, the trend toward electric vehicles, where weight reduction is crucial for enhancing battery efficiency, further underscores ABS's relevance. Manufacturers have the opportunity to collaborate with automotive companies to develop innovative solutions, leveraging ABS to meet the industry's evolving needs and contribute to advancements in vehicle design, performance, and environmental impact, thus solidifying ABS's position as a key material in the automotive sector.

The opaque segment had the highest market share of 40% in 2023. The opaque segment in the acrylonitrile butadiene styrenes market refers to ABS materials that are not transparent or translucent, exhibiting solid and non-transparent characteristics. Opaque ABS finds extensive use in various industries, particularly in applications where visual clarity is not a primary requirement. This segment has witnessed a growing demand, driven by its suitability for automotive interiors, electronic housings, and consumer goods. The trend towards utilizing opaque ABS for its robustness and versatile molding capabilities underscores its significance in addressing diverse industrial needs and market preferences.

The transparent segment is anticipated to expand at a significant CAGR of 4.8% during the projected period. The transparent segment in the acrylonitrile butadiene styrenes market refers to a specialized category of ABS characterized by its clarity and translucency. Transparent ABS is widely used in applications where a combination of strength and see-through properties is desired, such as in consumer electronics, automotive interiors, and medical devices. Recent trends indicate a growing demand for transparent ABS in product design, particularly in the consumer goods sector, where aesthetics and visibility of internal components play a crucial role in the overall appeal and functionality of the end product.

According to the application, the appliances segment held a 25% revenue share in 2023. In the acrylonitrile butadiene styrenes market, the appliances segment refers to the use of ABS in manufacturing various household appliances such as washing machine parts, refrigerator components, and small kitchen appliances. ABS is preferred in this segment due to its impact resistance, durability, and versatility in molding intricate designs. The trend in the appliances segment involves a growing demand for aesthetically pleasing and durable products, where ABS's ability to provide both structural integrity and a smooth, customizable surface contributes to its prominence in appliance manufacturing.

The automotive segment is anticipated to expand fastest over the projected period. In the acrylonitrile butadiene styrenes market, the automotive segment encompasses the use of ABS in manufacturing various components for vehicles, such as interior trims, dashboards, and exterior body parts. The automotive sector's trend towards lightweight materials to improve fuel efficiency aligns with ABS's properties, making it a preferred choice. As the automotive industry continues to evolve, the ABS market is witnessing a surge in demand driven by the growing need for durable and lightweight solutions in vehicle design and manufacturing.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

December 2023

September 2024

November 2024