September 2024

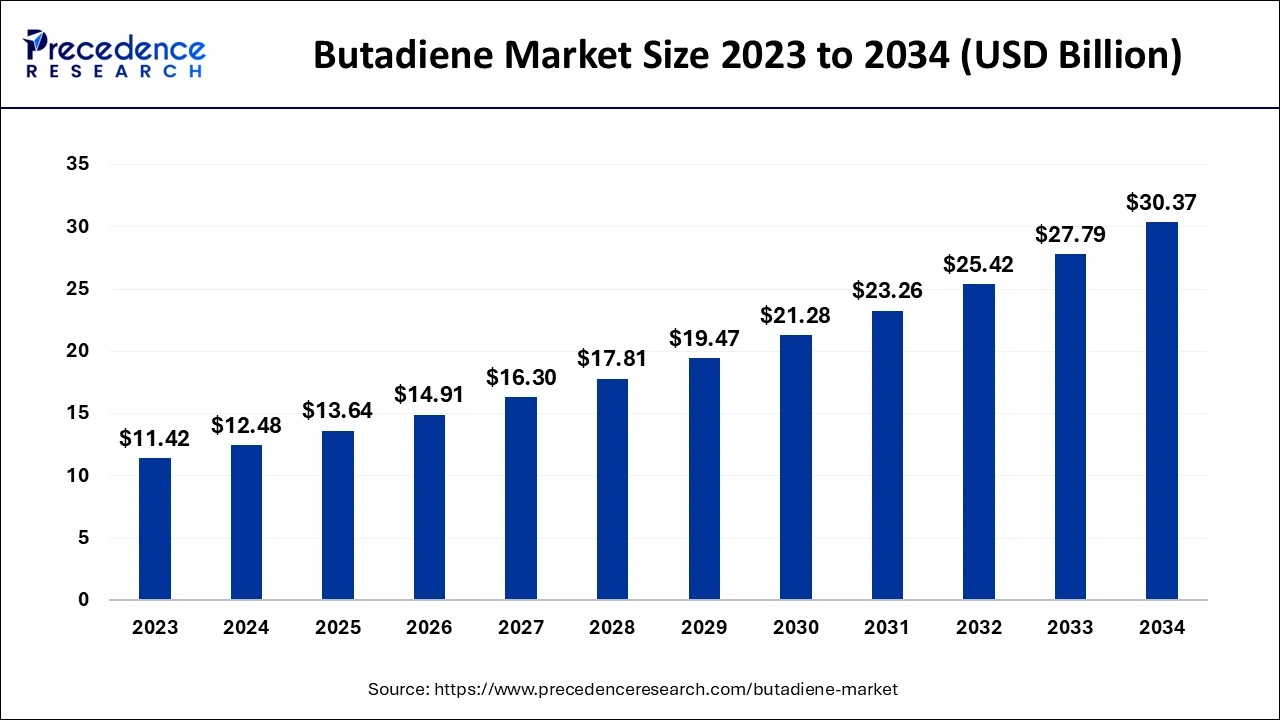

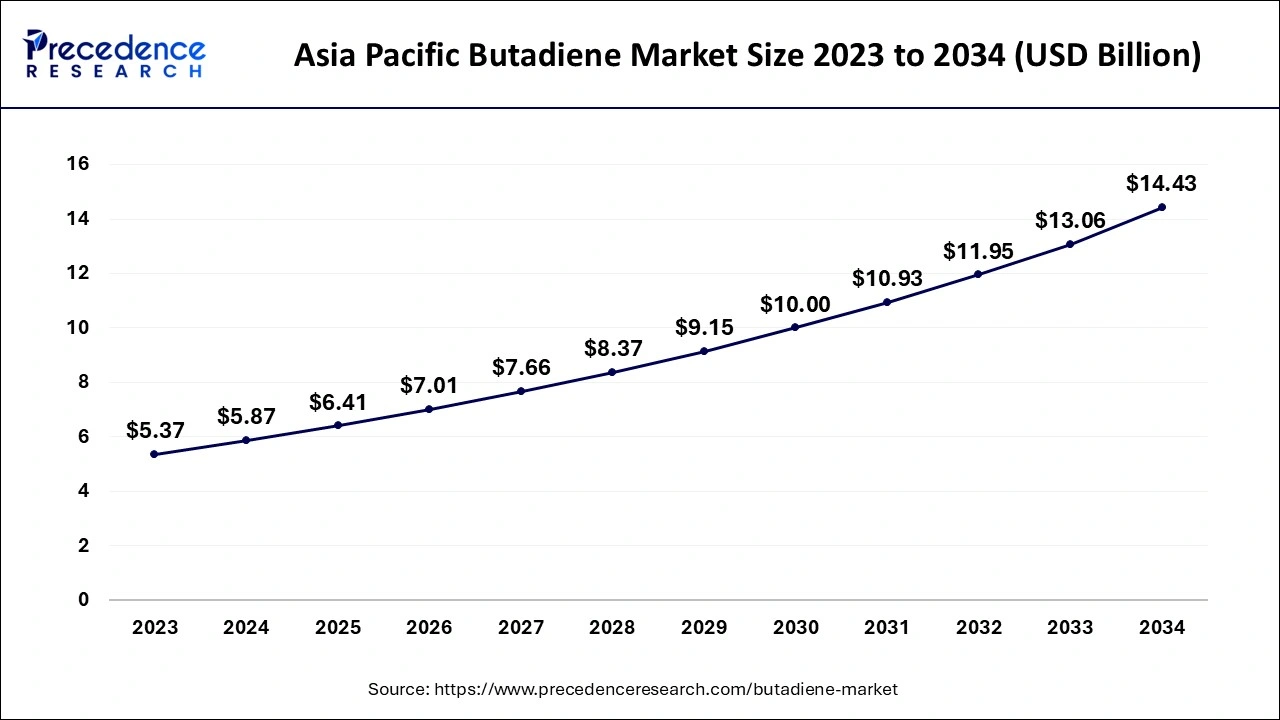

The global butadiene market size accounted for USD 13.64 billion in 2025 and is predicted to surpass around USD 30.37 billion by 2034, representing a healthy CAGR of 9.30 % between 2025 and 2034. The Asia Pacific butadiene market size accounted for USD 6.41 billion in 2025 and is expanding at a CAGR of 9.41% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global butadiene market size was estimated at USD 12.48 billion in 2024 and is anticipated to reach around USD 30.37 billion by 2034, expanding at a CAGR of 9.30 % from 2025 to 2034.

The Asia Pacific butadiene market size was evaluated at USD 5.87 billion in 2024 and is predicted to be worth around USD 14.43 billion by 2034, rising at a CAGR of 9.41% from 2025 to 2034.

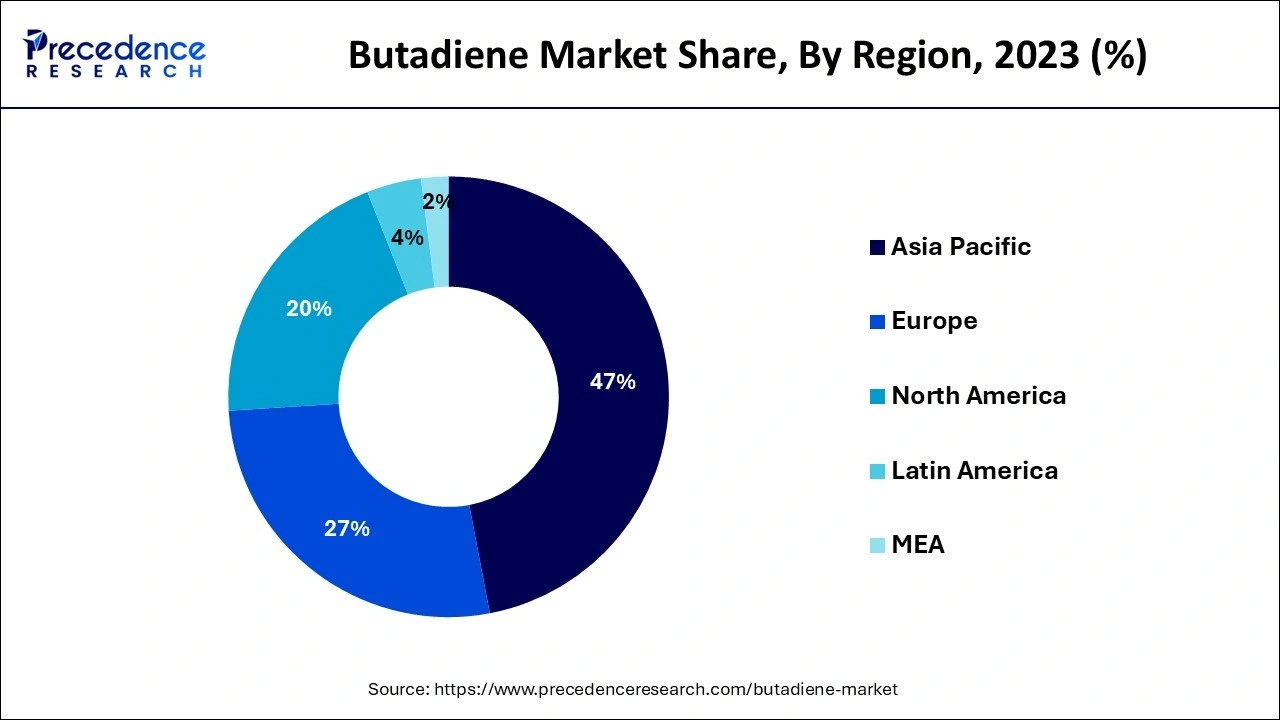

On the basis of geography, Asia-Pacific region accounted for the majority revenue share in 2024. Asia-Pacific currently has a dominant position in the butadiene market and is anticipated to expand at the highest rate during the forecast period as a result of the region's rapid industrialization and increased demand for butadiene in automotive and rubber applications. The fastest-growing market in the region is China, which consumes the most butadiene, followed by India and other South-East Asian nations. This is due to rising car manufacturing. Sales and production of commercial vehicles, which represent an important growth of 91 percent and 73.8 percent over March, respectively, reached 5,01,000 and 4,68,000 units in April 2021, according to the China Association of Automobile Manufacturers (CAAM). This creates lucrative opportunities for butadiene market participants. Additionally, the textile industry's expanding usage of butadiene derivatives in the manufacture of shoes, gloves, and belts is promoting regional market expansion.

A major percentage of the market in 2023 was in North America. In well-established businesses like paints and coatings and the polymer industry, the need for butadiene derivatives is rising. The United States is the dominant nation in the region due to the presence of important critical companies like Exxon, Dow, and TPC Group.

North America is the fastest growing market for the butadiene market with a significant CAGR during the forecast period, spurred by increased automotive production, greater demand for synthetic rubber, and investments in petrochemical infrastructure. The region is supported by a well-established refining and cracking capacity, especially in the U.S., which ensures a reliable supply of raw materials. Furthermore, improvements in shale gas exploration have reduced feedstock costs, leading to increased butadiene production. Growth in the construction and consumer goods sectors also drives the demand for butadiene-based polymers, further promoting market growth.

United States

The United States is at the forefront of butadiene growth in North America, because of its strong refining infrastructure, availability of low-cost feedstocks from shale gas, and large-scale automotive manufacturing. The country’s plans for capacity expansion and technological advancements in production and recovery processes support a stable supply. High demand for tires, polymers, and adhesives further strengthens the country's position as a key player in the region’s butadiene market.

Moreover, Europe is predicted to have significant increase throughout the projection period as a result of the widespread use of butadiene and its derivatives in the manufacturing of auto parts such wheel covers, dashboard trims, tires, and other components. Germany is the top-ranking nation due to its rising automobile exports.

Europe is observed to grow at a considerable growth rate in the upcoming period due to strong demand from the automotive and packaging industries. The increasing focus on sustainability and bio-based alternatives is fostering innovation in methods of producing butadiene. Regulatory pressure to cut emissions is leading to the creation of cleaner technologies. Additionally, the presence of major automotive manufacturers and strong infrastructure in countries like Germany and France ensures a steady demand for butadiene derivatives such as SBR and ABS.

Germany

Germany is a crucial player in Europe's butadiene market, bolstered by its strong automotive and chemical sectors. The nation’s solid industrial base requires synthetic rubber and plastic derivatives, driving butadiene consumption. Moreover, Germany's dedication to sustainable practices encourages research into alternative production technologies. With leading chemical companies based here, Germany remains a vital center for innovation and demand in the European butadiene value chain.

The demand for synthetic rubbers, which in turn affects the butadiene market, is significantly influenced by the automotive industry, while the supply is dependent on the ethylene industry because it is a key component needed for the steam cracking process. As a result, the butadiene industry is significantly impacted by the supply-demand tensions in other markets. The development of eco-friendly techniques for producing polymer emulsions, the rise in demand for water-based solvents and coatings, as well as the expansion of industrial sectors like autos and consumer durables, are some of the drivers driving the worldwide market.

Among other elastomers, butadiene serves as the main raw ingredient in the production of styrene-butadiene rubber (SBR), acrylonitrile butadiene styrene (ABS), polybutadiene, latex, styrene-butadiene, and nitrile rubber. Although butane or butene dehydrogenation can also be used to create it, steam cracking is the main technique. The various applications and demand for by product has driven the butadiene market.

Many ends user industry has become more dependent on synthetic rubber as a result of rising demand for consumer goods, footwear, and tires on a worldwide scale since it provides superior performance at a cheaper price than natural rubber. The production and consumption of butadiene are rising as a result of rising demand for tires, shoes, and consumer products since butadiene is a crucial raw ingredient in the creation of synthetic rubber.

Additionally, butadiene is utilized in the production of ABS, a material that is frequently used in commercial and industrial applications like automotive, electronics, communications, etc. where it is necessary to have materials that are durable yet lightweight, heat resistant, and readily processed. Therefore, expansion in these industries would likewise fuel demand for ABS, which in turn would fuel the butadiene market.

The major component of acrylonitrile-butadiene-styrene (ABS) resin, which has several uses, is used to create plastics when butadiene-based rubber is used as the basis material. Tire production generally involves the usage of polybutadiene. About 70% of the world's polybutadiene output is thought to be used in the making of tires. It is mostly utilized as a sidewall in tires to reduce strain brought on by constant bending when running. Butadiene has other uses in addition to this, including in other vehicle components.

| Report Coverage | Details |

| Market Size in 2024 |

USD 12.48 Billion |

| Market Size in 2025 |

USD 13.64 Billion |

| Market Size by 2034 |

USD 30.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.30% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Production Process, End-User, and Geography |

Acute and chronic effects on health

Due to the dangerous carcinogenic properties of shale oil and its acute and long-term effects, production has been reduced. Acute low exposures may irritate the lungs, nose, throat, and eyes. Skin exposure can also result in frostbite. Acute high exposures may harm the central nervous system or result in symptoms including headaches, nausea, dizziness, fainting, distorted vision, vertigo, general exhaustion, low blood pressure, and headaches. There is debate concerning the long-term consequences of exposure to butadiene. Numerous epidemiological studies on humans have revealed an upsurge in cancer and cardiovascular illnesses.

On the basis of product, the styrene butadiene rubber (SBR) segment has had largest market share in 2024 in terms of revenue. Styrene Butadiene Rubber (SBR), which is derived from butadiene and combined with rubber from natural sources to manufacture tires, is the primary component. Tires' performance-enhancing aspects, such as rolling resistance, wear, and traction, are provided by the physical and chemical properties of these rubber polymers. In industrial applications, SBR rubber often replaces natural rubber directly. Some of its advantages include excellent aging qualities, crack endurance, and abrasion resistance. Styrene-butadiene also exhibits high water and compression set resistance. A synthetic copolymer called SBR was first developed to replace natural rubber in tires. SBR is created by combining BD with styrene. Together with natural rubber, it currently accounts for 90% of all rubber consumed globally. In conditions involving water, hydraulic fluids, or alcohol, SBR is widely used. SBR can therefore be found, for example, in tires, tubes, compressors, and conveyor belt coverings.

The category with the quickest growth is anticipated to be Styrene-butadiene (SB) latex during the forecast period. Styrene-butadiene (SB) latex is a common type of emulsified polymer used in a variety of commercial and industrial applications. Because it is made of two distinct monomers, styrene and butadiene, SB latex is classified as a polymerization. While styrene is produced when benzene and ethylene mix, butadiene is a byproduct of the production of ethylene. Styrene-butadiene latex is used to create transparent, glossy, and luminescent paper coverings and products including coated canvas and white chipboard, as well as data capture papers like pneumatically paper and infrared paper that are used in brochures, journals, and SB latex. Additionally, SB latex is used in the back coats of tufted carpets. SB latex is a popular solution for adhesives in various sectors, including the flooring industry.

On the basis of end-user, the automobile segment is expected to have the largest market share in the coming years period.

Butadiene is used to make the majority of synthetic rubbers and elastomers, including polybutadiene rubber (PBR), nitrile rubber (NR), styrene-butadiene rubber (SBR), and polychloroprene (Neoprene). These are subsequently used to produce a range of goods and raw materials. When butadiene-based rubber is used as the starting material, the main component of acrylonitrile-butadiene-styrene (ABS) resin, which has several applications, is utilized to manufacture plastics. Polybutadiene is often used in tire manufacture.

The production of polybutadiene is believed to account for over 70% of all tires produced worldwide. It is mostly used in tires as a sidewall to lessen strain caused by continual bending when running. Hence, the application of butadiene in the automotive segment is expected to increase in the projected period.

By Product Type

By Production Process

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

July 2024

September 2024

May 2025