July 2024

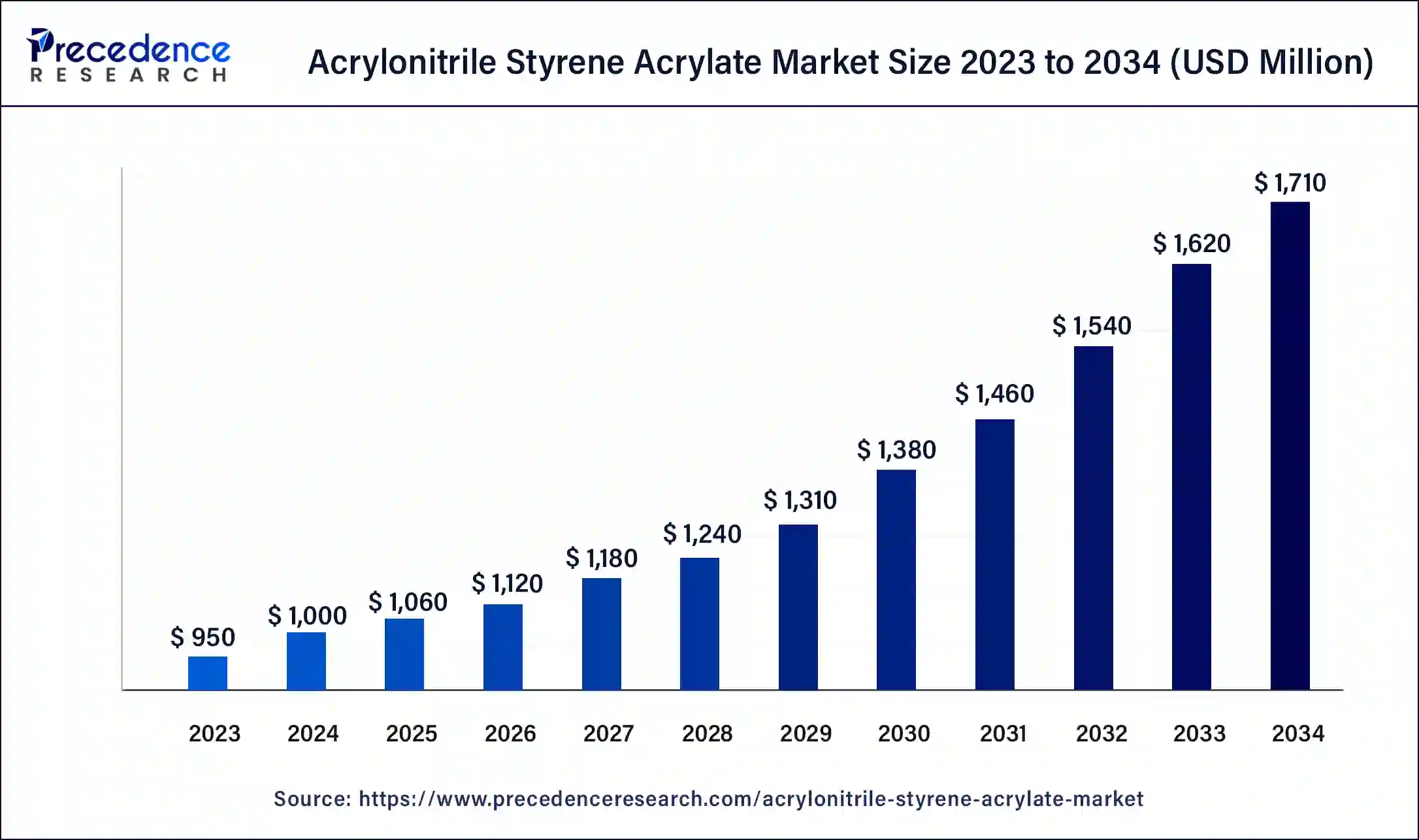

The global acrylonitrile styrene acrylate market size was USD 0.95 billion in 2023, estimated at USD 1 billion in 2024 and is expected to be worth around USD 1.71 billion by 2034, expanding at a CAGR of 8.90% from 2024 to 2034.

The global acrylonitrile styrene acrylate market size accounted for USD 1 billion in 2024 and is anticipated to reach around USD 1486.16 billion by 2034, expanding at a CAGR of 8.90% from 2024 to 2034.

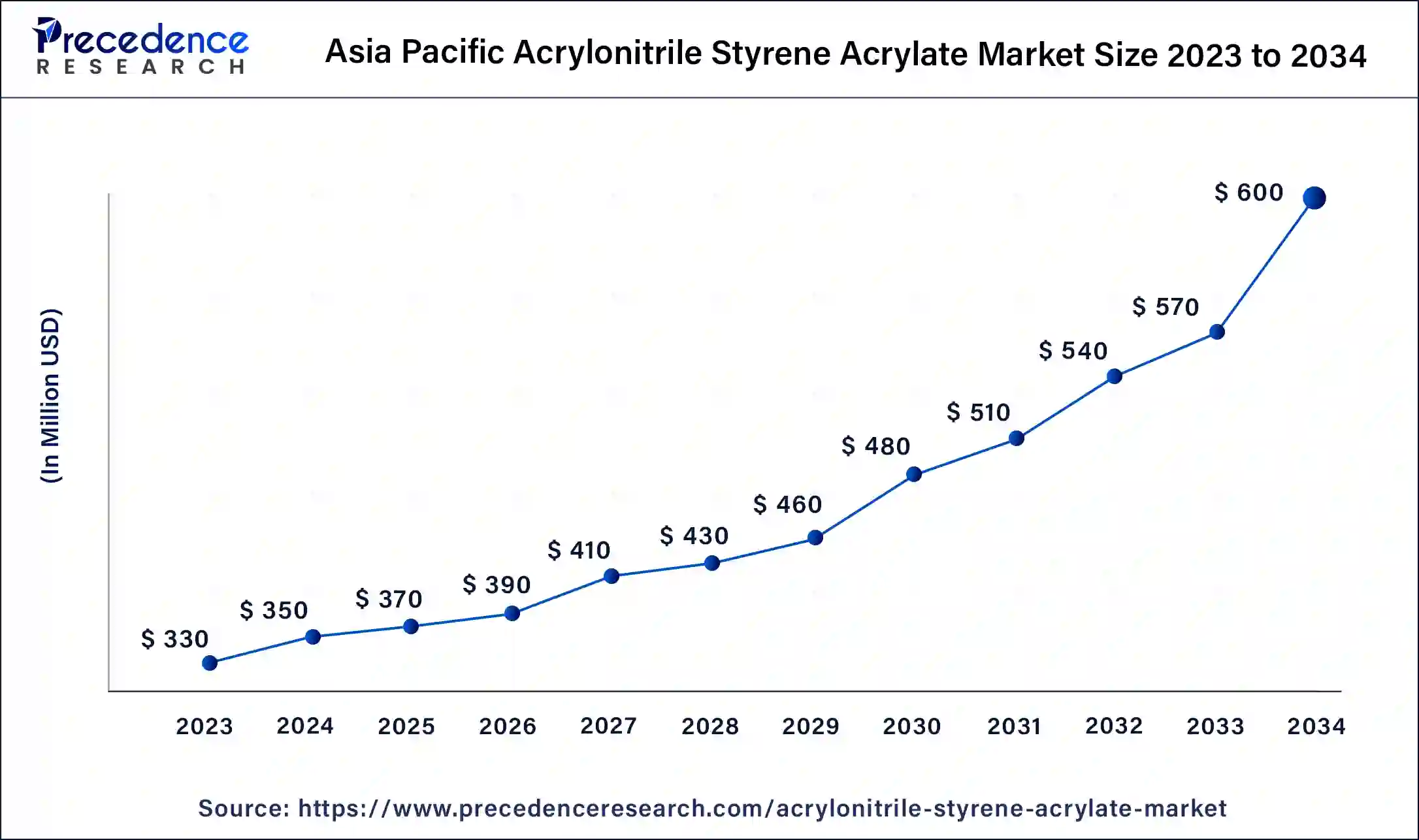

The Asia Pacific acrylonitrile styrene acrylate market size was valued at USD 330 million in 2023 and is expected to reach USD 600 million by 2034, poised to grow at a CAGR of 5.54% from 2024 to 2034.

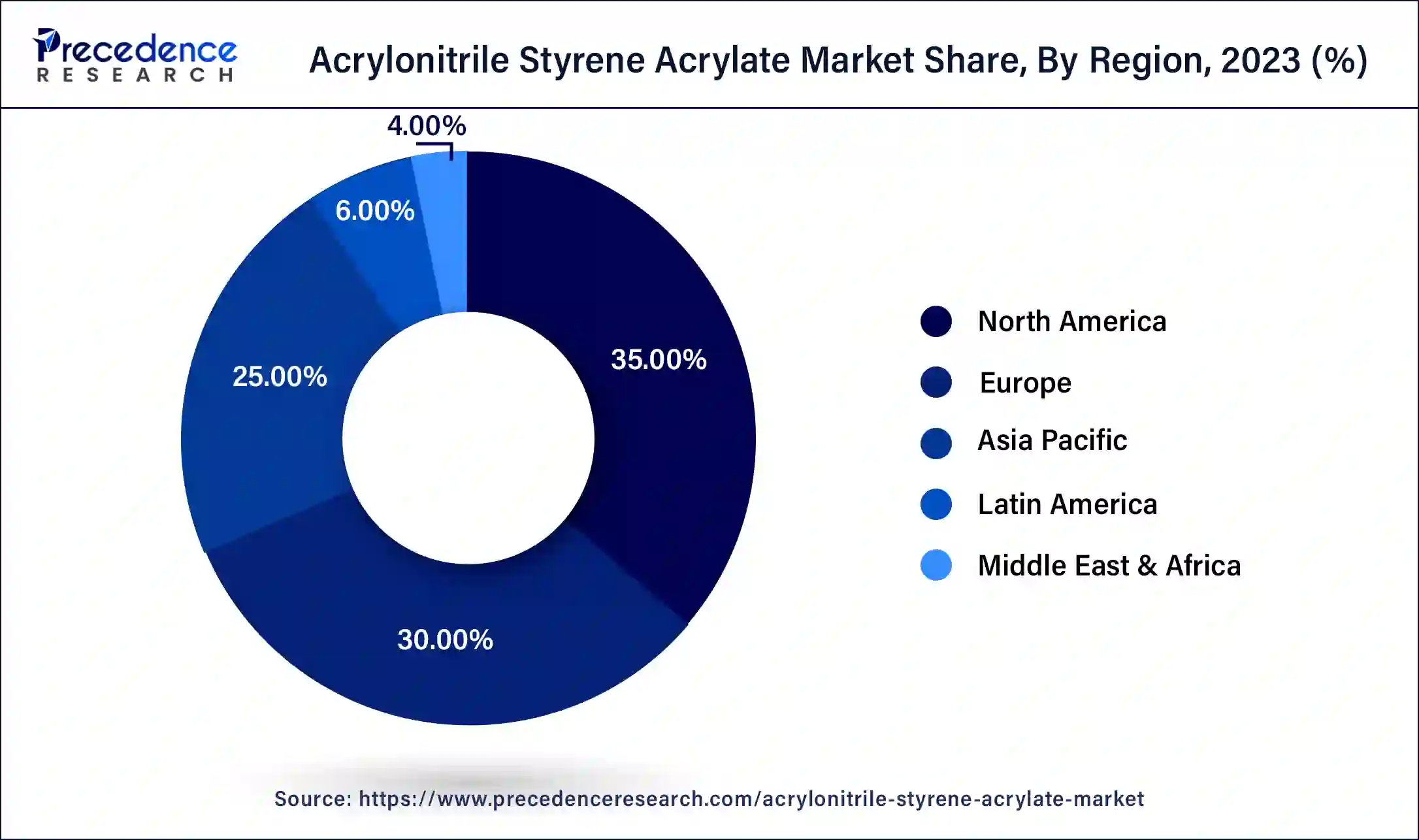

Asia-Pacific has held the largest revenue share 35% in 2023. Asia-Pacific holds a major share in the acrylonitrile styrene acrylates market due to rapid industrialization, infrastructure development, and robust automotive production in the region. The demand for durable and weather-resistant materials in construction and automotive applications drives the adoption of ASA. Additionally, the growing awareness of sustainable solutions aligns with ASA's eco-friendly attributes. With a burgeoning consumer goods market and a focus on advanced materials, Asia-Pacific remains a key player in the global ASA market, experiencing significant growth in various end-use industries.

North America is estimated to observe the fastest expansion. North America holds significant growth in the acrylonitrile styrene acrylates market due to a robust demand from industries like automotive, construction, and consumer goods. The region benefits from a mature automotive sector, where ASA is extensively used for durable and weather-resistant exterior components. Additionally, increased construction activities and a growing emphasis on sustainable materials further contribute to the dominance of North America in the ASA market. The region's established industrial infrastructure and focus on innovative applications position it as a key player in driving overall market growth.

Acrylonitrile styrene acrylate (ASA) is a robust thermoplastic blend recognized for its outstanding durability and resilience against weathering. It is composed of three essential building blocks, acrylonitrile, styrene, and acrylate—each contributing distinct quality. The acrylonitrile component enhances resistance to chemicals, styrene imparts rigidity and ease of processing, while acrylate ensures resistance to UV radiation. ASA stands out for its remarkable ability to withstand prolonged exposure to sunlight without deteriorating, making it a preferred choice for outdoor applications and automotive components.

Common uses include crafting durable automotive trims, resilient outdoor signage, and reliable construction materials. ASA's versatility, coupled with its capacity to maintain color stability and mechanical integrity in challenging environments, positions it as a valuable material for manufacturers seeking enduring and aesthetically pleasing solutions for outdoor use.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.51% |

| Market Size in 2023 | USD 0.95 Billion |

| Market Size in 2024 | USD 1 Billion |

| Market Size by 2034 | USD 1.71 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Weather resistance and versatility

The robust weather resistance and remarkable versatility of acrylonitrile styrene acrylate (ASA) play pivotal roles in surging market demand. ASA's exceptional ability to withstand harsh weather conditions, including prolonged exposure to UV radiation, positions it as an ideal choice for outdoor applications. This weather resilience is particularly crucial in the automotive sector, where ASA is increasingly favored for exterior components, ensuring long-lasting and aesthetically pleasing surfaces even in challenging environmental conditions.

The versatility of ASA further contributes to heightened market demand, as it can be easily processed using various manufacturing techniques such as extrusion and injection molding. This adaptability enables its use across diverse industries, ranging from construction to signage, allowing manufacturers to create a wide array of durable products. The combination of weather resistance and versatility makes ASA a go-to material for applications where durability, color stability, and performance in outdoor settings are paramount, propelling its sustained growth in the market.

Limited heat resistance

The limited heat resistance of acrylonitrile styrene acrylate (ASA) poses a notable constraint on its market growth. While ASA excels in weather resistance and durability, its relatively lower heat resistance compared to some alternative materials can restrict its adoption in applications subjected to elevated temperatures. Industries requiring components to withstand high thermal loads, such as automotive under-the-hood parts or certain industrial settings, may prefer materials with superior heat resistance.

This limitation hinders the expansion of ASA into sectors where exposure to elevated temperatures is a critical consideration. Manufacturers and end-users seeking materials for applications with stringent heat requirements may opt for alternatives like high-temperature engineering plastics. Addressing this restraint may involve research and development efforts to enhance ASA's heat-resistant properties or strategic market positioning in applications where its existing strengths outweigh the demand for elevated thermal performance.

Increasing demand for sustainable solutions

The increasing demand for sustainable solutions is a significant catalyst for opportunities in the acrylonitrile styrene acrylates market. ASA's recyclability and eco-friendly attributes align with the global shift toward sustainability, creating avenues for growth. As industries and consumers prioritize environmentally responsible materials, ASA stands poised to meet these demands, offering a durable and weather-resistant alternative with a lower environmental impact. Positioning ASA as a sustainable choice opens doors to new markets and applications, especially in industries emphasizing green practices.

Manufacturers can leverage this trend by promoting ASA's recyclability and communicating its environmental benefits to attract environmentally conscious consumers. With sustainability becoming a key driver of purchasing decisions, the ASA market has the opportunity to expand its reach across diverse sectors seeking durable, performance-oriented materials with a reduced ecological footprint.

In 2023, the plastics segment had the highest market share of 42% based on the type. In the plastics segment of the Acrylonitrile Styrene Acrylate (ASA) market, the material finds extensive application in various industries. ASA's excellent weather resistance and durability make it a preferred choice for manufacturing automotive exterior components, construction materials, and outdoor signage. Recent trends indicate a growing demand for ASA in 3D printing processes, where its compatibility and versatility offer unique opportunities for prototyping and customized plastic applications. This highlights ASA's evolving role beyond traditional uses, driven by its distinctive properties in the dynamic plastics market.

The fabrics segment is anticipated to expand at a significant CAGR of 6.2% during the projected period. In the acrylonitrile styrene acrylates market, the fabrics segment refers to the application of ASA in outdoor textiles and materials. ASA's weather resistance and durability make it an ideal choice for outdoor fabrics, including awnings, canopies, and upholstery. The trend in this segment involves the increasing adoption of ASA for manufacturing fabrics that can withstand harsh weather conditions, providing longevity and color stability. ASA's versatility in textile applications is contributing to a growing demand for durable and weather-resistant outdoor fabrics in various industries, from furniture to recreational equipment.

According to the end user, the consumer electronic and home appliances segment has held a 35% revenue share in 2023. In the acrylonitrile styrene acrylates market, the consumer electronics and home appliances segment pertains to the utilization of ASA in manufacturing casings and components for devices such as smartphones, laptops, and household appliances. A notable trend in this segment is the increasing demand for ASA due to its durable and aesthetically pleasing properties, meeting consumer preferences for sleek, resilient products. ASA's resistance to weathering and UV radiation enhances the longevity of electronic and appliance exteriors, contributing to the material's growing adoption in this sector.

The automotive segment is anticipated to expand fastest over the projected period. In the acrylonitrile styrene acrylates market, the automotive segment refers to the utilization of ASA in manufacturing exterior components and trims for vehicles. This includes applications such as automotive grilles, mirror housings, and exterior panels. A notable trend in this segment is the increasing preference for ASA due to its exceptional weather resistance, UV stability, and durability. As automakers prioritize lightweight, aesthetically pleasing materials that can withstand harsh environmental conditions, ASA emerges as a preferred choice for enhancing the longevity and visual appeal of automotive exteriors.

Segments Covered in the Report

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

December 2023

January 2025

September 2024