October 2024

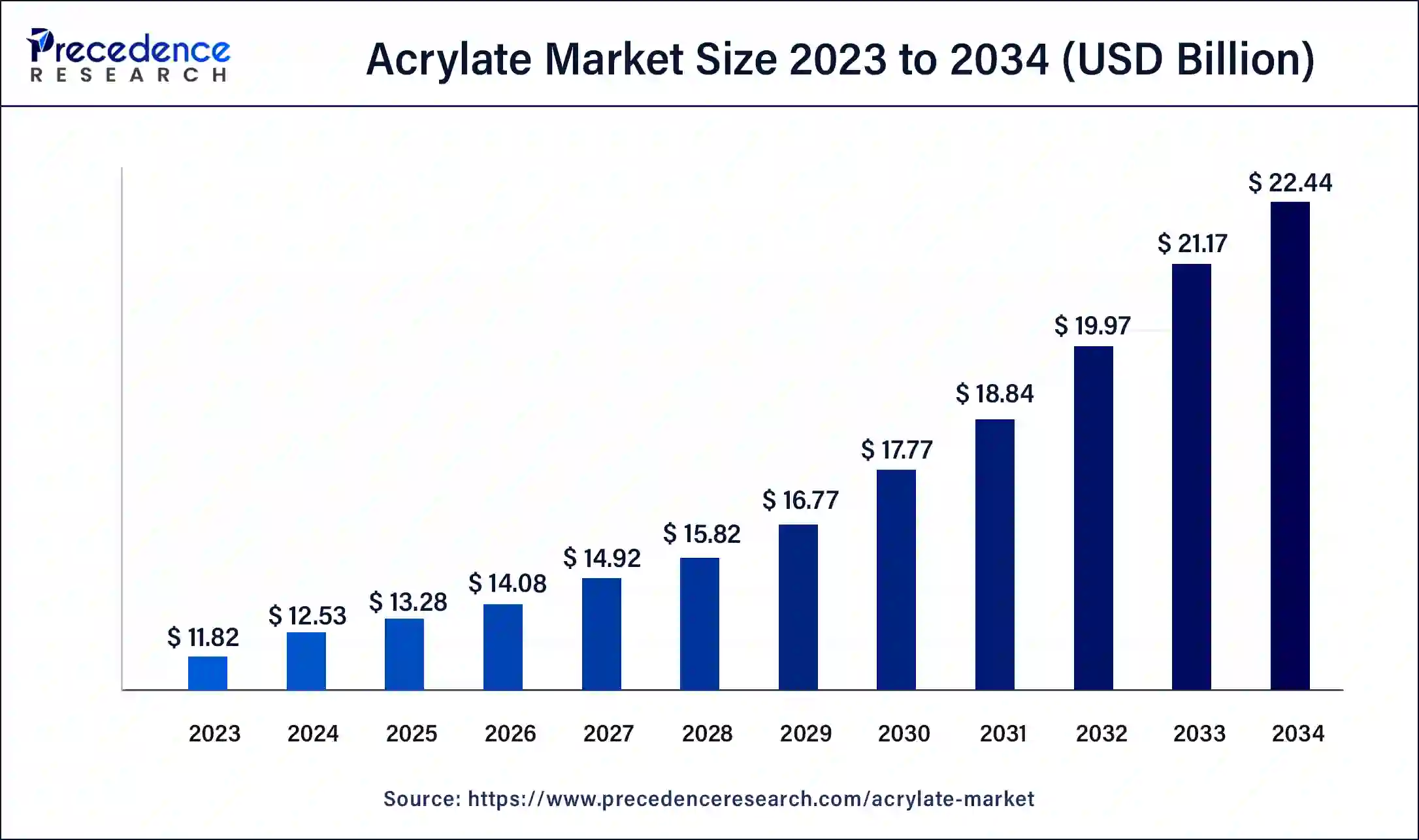

The global acrylate market size accounted for USD 12.53 billion in 2024, grew to USD 13.28 billion in 2025 and is projected to surpass around USD 22.44 billion by 2034, representing a healthy CAGR of 6% between 2024 and 2034.

The global acrylate market size is estimated at USD 12.53 billion in 2024 and is anticipated to reach around USD 22.44 billion by 2034, representing a healthy CAGR of 6% between 2024 and 2034.

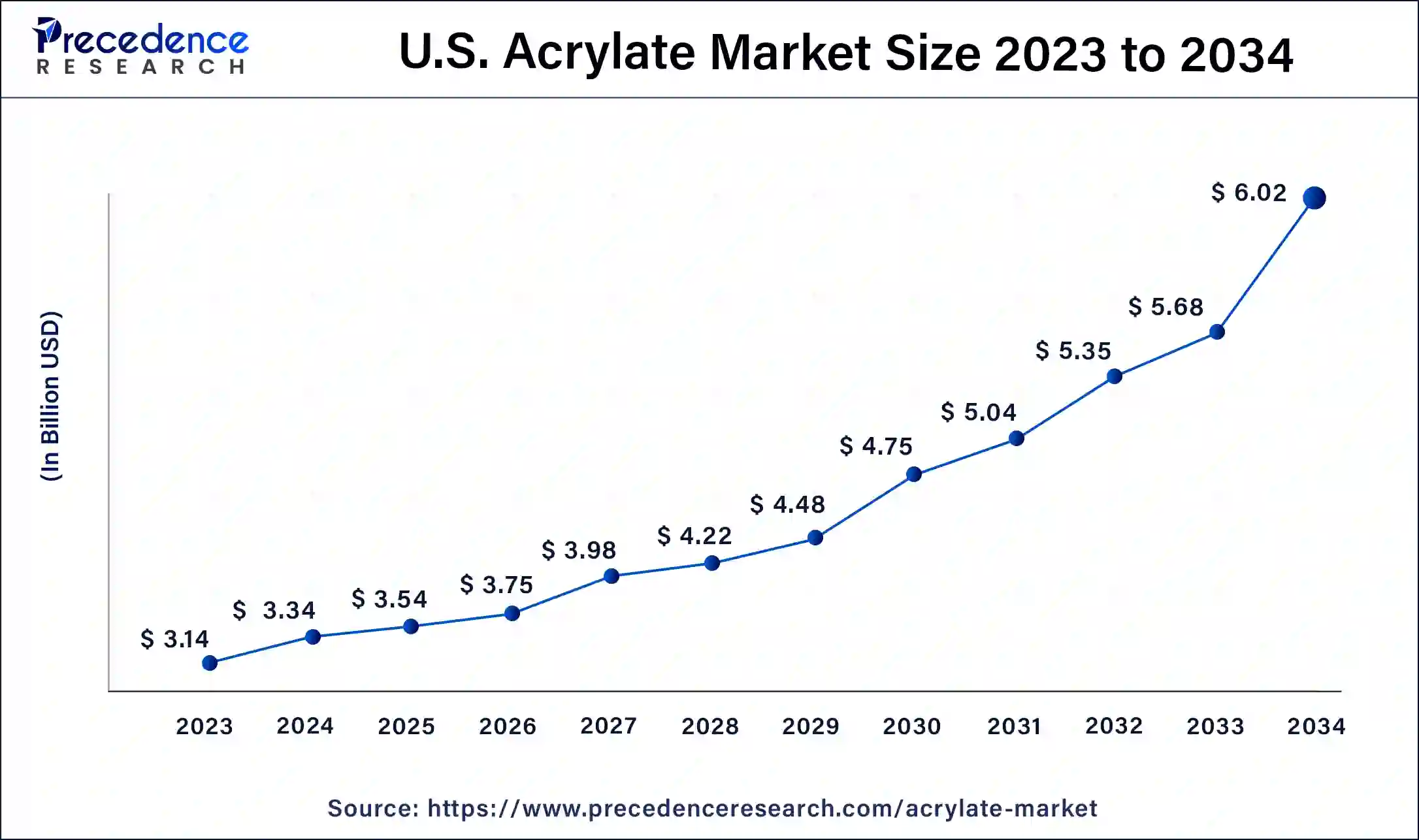

The U.S. acrylate market size was valued at USD 3.14 billion in 2023 and is predicted to surpass around USD 6.02 billion by 2032, growing at a CAGR of 6.08% from 2024 to 2034.

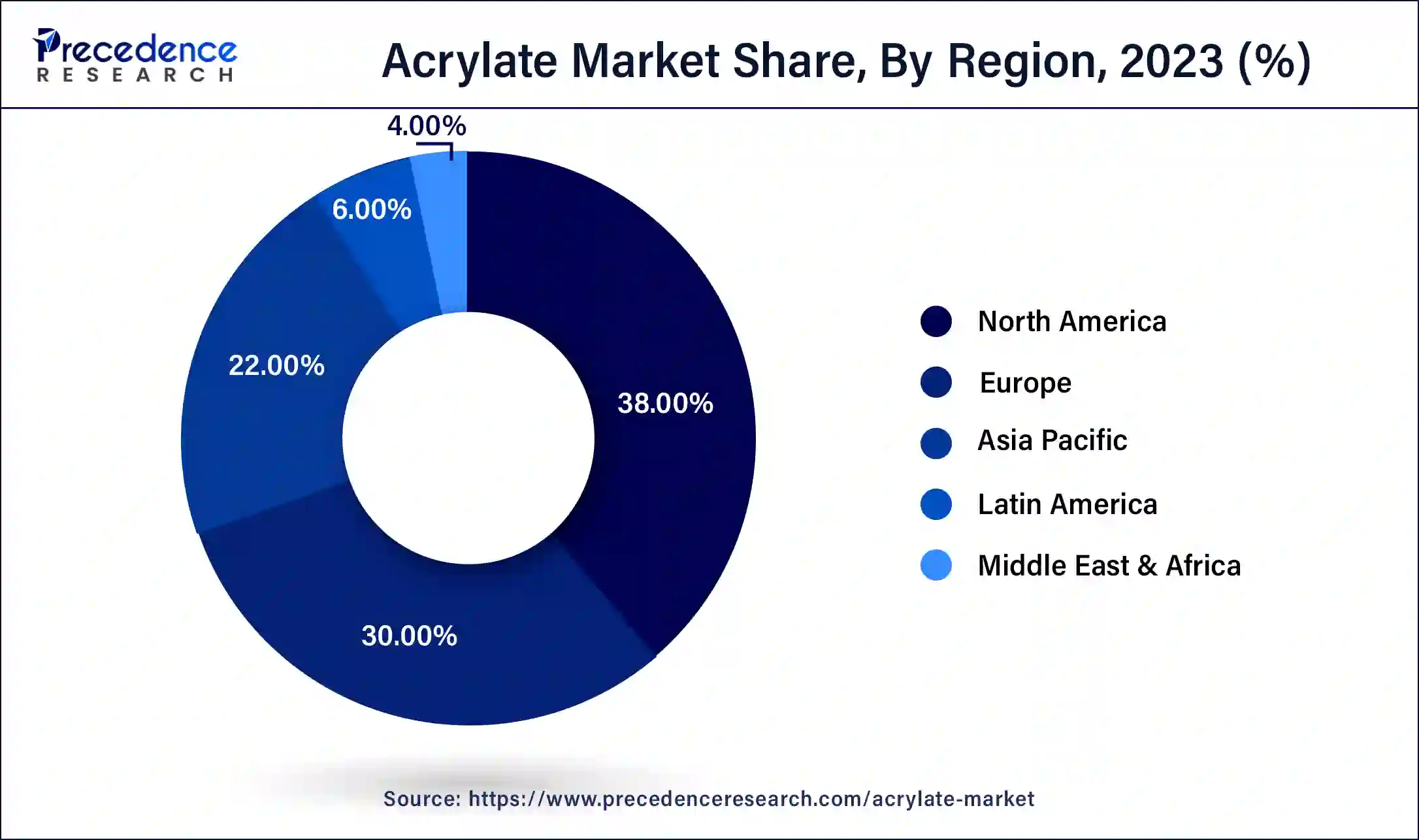

North America has held the largest revenue share 38% in 2023. North America commands a significant share of the acrylate market due to a robust demand across diverse industries such as construction, automotive, and healthcare. The region's well-established infrastructure, technological advancements, and a strong focus on innovation contribute to its leadership in acrylate consumption. Additionally, stringent environmental regulations have spurred the adoption of eco-friendly acrylate formulations. The presence of key market players and a high level of industrialization further solidify North America's position as a major contributor to the thriving acrylate market.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific dominates the acrylate market due to robust industrialization, construction activities, and a flourishing automotive sector. The region's economic growth fuels increased demand for acrylate-based products in paints, coatings, adhesives, and textiles. Moreover, the rising population and urbanization drive construction projects, further propelling the acrylate market. Asia Pacific's strategic position as a manufacturing hub, combined with strong consumer demand, positions it as a key player in the global acrylate market, with continued growth expected in various end-use industries.

Acrylates are a family of chemical compounds originating from acrylic acid. These compounds feature a distinctive structure with a vinyl group (carbon-carbon double bond) and a carbonyl group (carbon-oxygen double bond). Acrylates find extensive use in manufacturing polymers, adhesives, and coatings due to their special chemical characteristics.

A notable member of the acrylate family is methyl acrylate, a crucial building block for polymethyl acrylate, a type of acrylic resin widely employed for its exceptional adhesion, transparency, and resistance to weathering. Acrylate polymers offer versatility in tailoring material properties, making them indispensable across various industries, including medical devices and automotive coatings.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6% |

| Market Size in 2024 | USD 12.53 Billion |

| Market Size by 2034 | USD 22.44 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Grade, Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing medical imaging demand and prevalence of chronic diseases

The rise in medical device manufacturing and the growth of the construction industry synergistically contribute to a substantial surge in demand for the acrylate market. In the medical sector, acrylate polymers are increasingly sought after for their biocompatibility and versatility, playing a vital role in the production of adhesives and materials used in medical devices. Their ability to adhere securely, coupled with resistance to various environmental conditions, positions acrylates as key components in the development of advanced and reliable medical equipment.

Simultaneously, the construction industry's expansion significantly bolsters the acrylate market. Acrylates are integral in construction materials such as adhesives, sealants, and coatings, enhancing durability and performance. With the construction sector experiencing robust growth globally, the demand for acrylate-based solutions continues to rise, driven by their versatility, adhesive properties, and capacity to meet the evolving requirements of modern construction practices.

As both industries advance, the acrylate market stands to benefit from their continued reliance on these versatile compounds, showcasing the interconnectedness of technological progress and market dynamics.

Environmental and health concerns

Environmental and health concerns pose significant restraints on the acrylate market growth. Certain acrylate compounds can contribute to air pollution through volatile organic compound (VOC) emissions during production and application processes. This has led to heightened regulatory scrutiny and the implementation of stringent guidelines, impacting the formulation and usage of acrylate-based products. Additionally, some acrylates have been associated with potential health risks, leading to concerns among consumers and regulatory bodies.

As sustainability becomes a focal point across industries, the environmental impact of acrylate polymers, which may have limited biodegradability, presents challenges. Increased awareness of these issues has prompted a shift towards eco-friendly alternatives. Addressing these environmental and health concerns necessitates innovation in the development of greener formulations and production processes within the acrylate market, ensuring compliance with regulations and meeting the growing demand for environmentally responsible solutions.

UV-curable technologies

UV-curable technologies are creating exciting opportunities in the acrylate market. These technologies involve the rapid curing of UV-curable acrylates when exposed to ultraviolet light, offering quick and eco-friendly processes. Industries such as coatings, adhesives, and 3D printing benefit from this technology due to its ability to provide high-performance coatings with excellent adhesion and scratch resistance. The growing demand for sustainable and efficient solutions is propelling the adoption of UV-curable acrylates, particularly in the packaging, automotive, and electronics sectors.

As the emphasis on eco-friendly practices increases, UV-curable technologies present opportunities for the acrylate market to provide innovative, energy-efficient, and fast-curing solutions, meeting the evolving needs of modern industries while minimizing environmental impact.

The methyl acrylate segment had the highest market share of 32% in 2023. Methyl acrylate is a key segment in the acrylate market, representing a chemical compound derived from acrylic acid. It is widely utilized as a monomer in the production of polymethyl acrylate, a versatile acrylic resin with applications in adhesives, coatings, and textiles.

A notable trend in the methyl acrylate segment is its increasing demand for adhesives and sealants, driven by the construction and automotive industries. Its excellent adhesion properties and suitability for various surfaces contribute to the segment's growth, aligning with the market's focus on performance-driven applications in diverse sectors.

The butyl acrylate segment is anticipated to expand at a significant CAGR of 7.5% during the projected period. A notable trend in the butyl acrylate segment is its increasing adoption in water-based formulations, aligning with the industry's shift towards environmentally friendly products. Additionally, the demand for butyl acrylate is influenced by the construction and automotive sectors, where it finds applications in coatings and adhesives, reflecting the market's responsiveness to evolving industry needs for durable and sustainable solutions.

According to the grade, the standard grade segment has held 34% revenue share in 2023. In the acrylate market, the standard grade segment refers to acrylate products meeting industry-standard specifications. These acrylates are characterized by their balanced performance, cost-effectiveness, and versatility, making them widely utilized in various applications.

Trends indicate a sustained demand for standard-grade acrylates, particularly in construction, adhesives, and coatings, where consistent quality and reliability are paramount. The segment's growth is driven by its ability to cater to a broad range of industries, providing essential characteristics without the premium costs associated with specialized or high-performance grades.

The chemical grade segment is anticipated to expand fastest over the projected period. In the acrylate market, the chemical grade segment pertains to acrylates produced with high purity and adherence to stringent chemical standards. This grade is essential for applications in industries like pharmaceuticals, electronics, and specialty chemicals. The increasing demand for precision and quality in these sectors is driving a trend toward the use of high-grade acrylates. As industries prioritize stringent chemical specifications, the chemical grade segment is witnessing growth, ensuring the reliable and consistent performance of acrylate-based products in applications requiring the highest levels of purity and quality.

According to the application, the adhesives & sealants segment has held a 25% revenue share in 2023. In the acrylate market, the adhesives and sealants segment encompasses products formulated from acrylate compounds, serving as bonding agents and protective sealants. A notable trend in this segment is the increasing demand for environmentally friendly formulations, driving research into low-VOC and sustainable adhesives.

Acrylate-based adhesives and sealants are favored for their versatility, providing strong and durable bonds in various industries, from construction to automotive. This trend aligns with the broader market shift towards eco-friendly solutions, emphasizing the pivotal role of acrylates in adhesive and sealant applications.

The personal care products segment is anticipated to expand fastest over the projected period. The personal care products segment in the acrylate market refers to the utilization of acrylate polymers in formulations such as hair styling gels, nail enhancements, and skincare products. These acrylate-based solutions offer benefits such as enhanced adhesion, film-forming properties, and resistance to environmental factors. A notable trend in this segment includes a growing demand for acrylate polymers with improved flexibility and compatibility with diverse cosmetic ingredients, facilitating the formulation of innovative and long-lasting personal care products to meet evolving consumer preferences.

According to the end use, the construction has held a 35% revenue share in 2023. In the acrylate market, the construction segment refers to the utilization of acrylates in various construction materials, including adhesives, sealants, and coatings. A significant trend in this segment involves the increasing demand for acrylate-based products in construction due to their ability to enhance durability and performance. As the construction industry continues to grow globally, acrylates play a pivotal role in addressing the evolving needs of modern construction practices, contributing to the sector's development through their versatile applications in adhesive and coating formulations.

The paints & coatings segment is anticipated to expand fastest over the projected period. The paints and coatings segment in the acrylate market encompasses the use of acrylate polymers in formulating paints, varnishes, and protective coatings. Noteworthy trends include the rising demand for environmentally friendly water-based formulations, driven by regulatory pressures and consumer preferences.

Additionally, the development of high-performance acrylate coatings, offering enhanced durability and weather resistance, is gaining prominence in industries like construction and automotive. The paints and coatings sector continues to be a key driver for acrylate market growth, with a focus on sustainability and performance driving innovation in formulations.

Segments Covered in the Report

By Product Type

By Grade

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024