December 2024

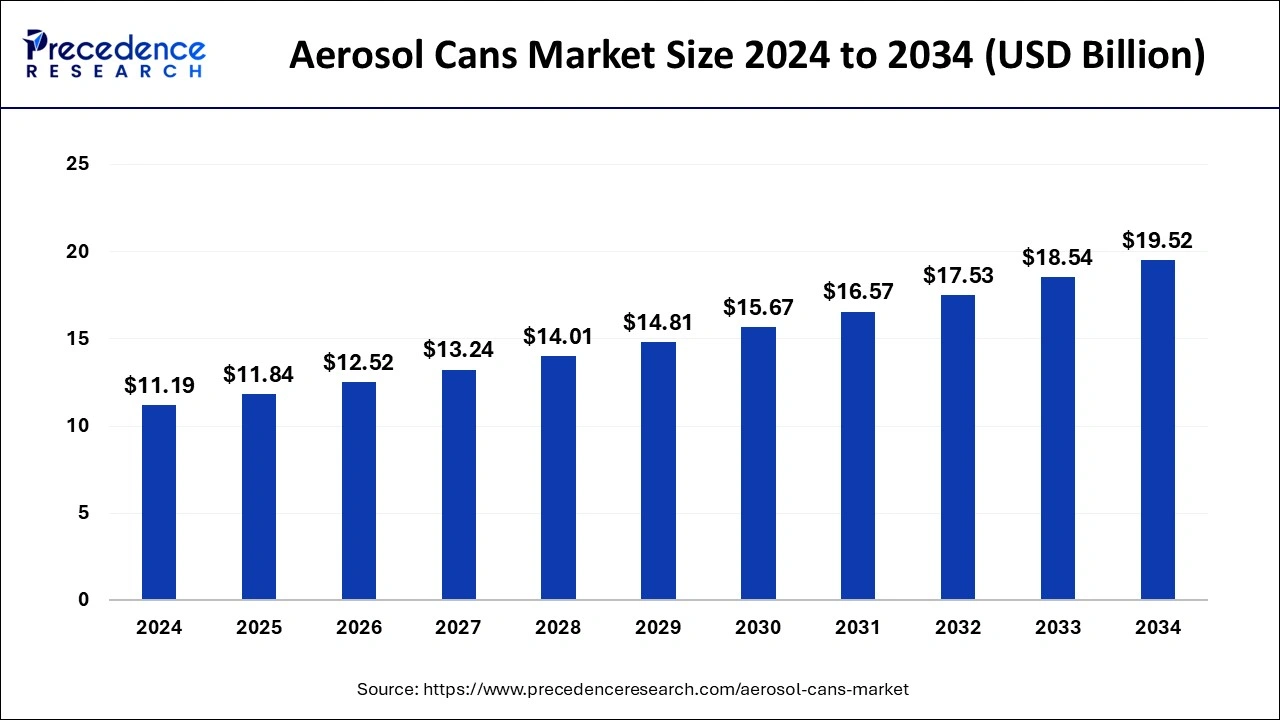

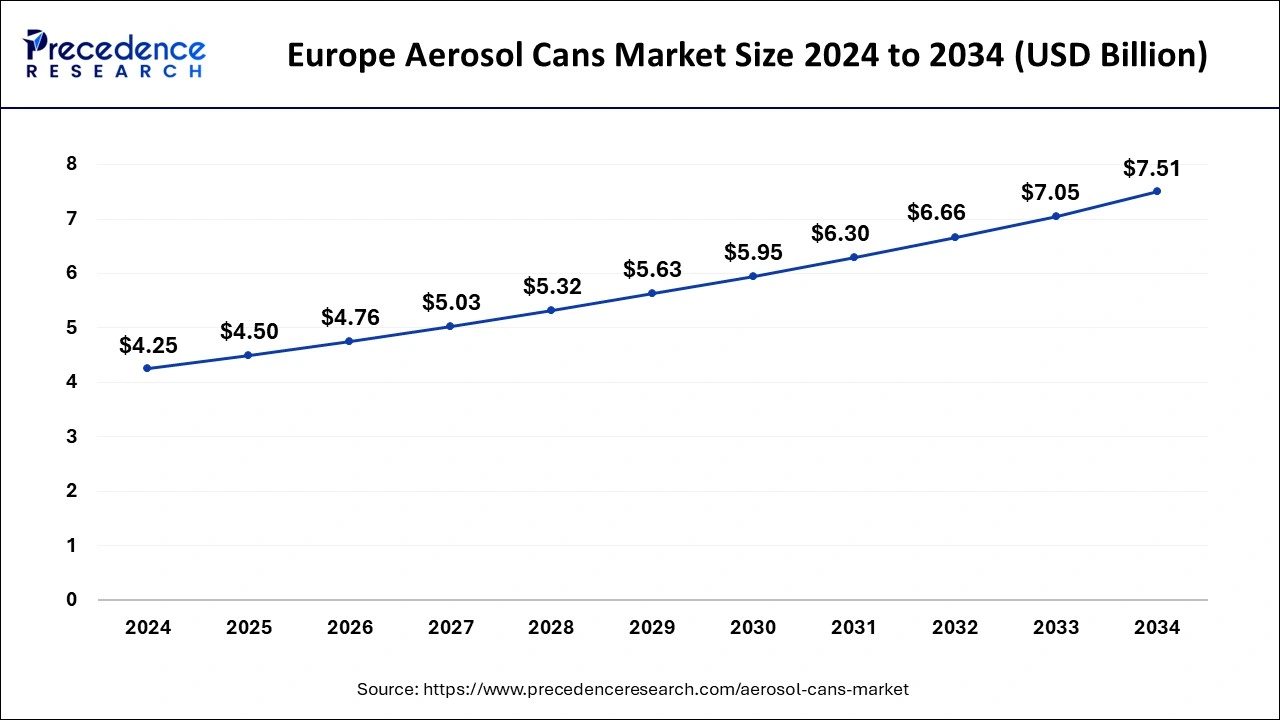

The global aerosol cans market size is calculated at USD 11.84 billion in 2025 and is forecasted to reach around USD 19.52 billion by 2034, accelerating at a CAGR of 5.72% from 2025 to 2034. The Europe aerosol cans market size surpassed USD 4.50 billion in 2025 and is expanding at a CAGR of 5.86% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aerosol cans market size was estimated at USD 11.19 billion in 2024 and is predicted to increase from USD 11.84 billion in 2025 to approximately USD 19.52 billion by 2034, expanding at a CAGR of 5.72% from 2025 to 2034. The rise in consumers’ preference for styling and personal care products with appealing packaging options, such as sprays, dry shampoos, and showers, is expected to spur the sales of aerosol cans in the coming years.

The Europe aerosol cans market size was estimated at USD 4.25 billion in 2024 and is predicted to hit around USD 7.51 billion by 2034, at a CAGR of 5.86% from 2025 to 2034.

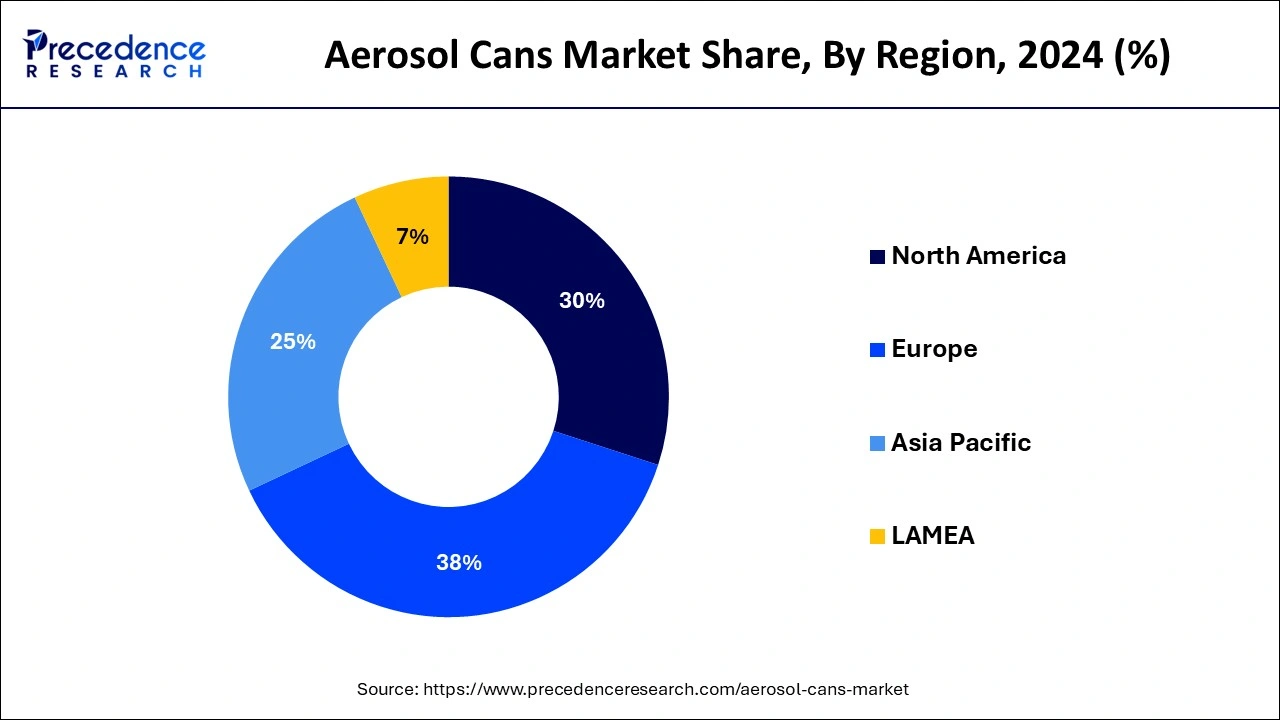

Europe dominated the aerosol cans market in 2024. Europe benefits from a well-established and diverse consumer market that includes personal care, household products, and industrial sectors. The region's leadership in aerosol packaging is driven by stringent environmental regulations and a strong focus on sustainability. Key countries like Germany, France, and the United Kingdom play significant roles in fostering innovation and sustainability efforts within the aerosol packaging industry. European consumers appreciate the convenience and precision offered by aerosol packaging while prompting manufacturers to invest in eco-friendly materials and propellants to address environmental concerns by delivering user-friendly packaging solutions across various industries.

North America is the second-largest marketplace for aerosol cans. In North America, a diverse consumer base values convenience and practicality in their everyday routines. Aerosol can meet this demand by offering convenient and portable packaging solutions for a wide range of products, including personal care items, household cleaners, and automotive products. The United States plays a significant role in boosting market growth, with a robust presence of manufacturers and consumers across various sectors such as personal care, healthcare, household goods, and automotive products.

Asia Pacific is the fastest-growing region during the projected period. The region is experiencing a surge in demand for personal care, household care, and automotive products, which drives the growth in the aerosol cans market. Countries like China and India are at the forefront of this trend, benefiting from their flourishing economies and increasing disposable incomes. China stands out as the world's largest consumer of personal care products, driving substantial growth in the aerosol cans sector. Similarly, India's expanding automotive sector and growing emphasis on personal grooming are contributing to the rising demand for aerosol cans in the region.

An aerosol can is a container that holds liquid or fine particles, usually under pressure. When you press the valve, it releases a spray or mist. These cans are used for products like deodorant, paint, hairspray, and household cleaners. They're made from recyclable materials, so people can easily recycle them. This aligns with the growing focus on eco-friendly packaging. The global trend toward environmentally friendly packaging is making the market for metal aerosol packaging more competitive. Moreover, suppliers and brands are working to create packaging that's both environmentally responsible and eye-catching on store shelves. There's also a rising demand for aerosol cans because of the high number of people, especially older individuals, with respiratory issues like asthma.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.72% |

| Market Size in 2025 | USD 11.84 Billion |

| Market Size by 2034 | USD 19.52 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Product Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sustainability initiatives can drive market growth

The cans industry is playing a vital role in supporting sustainability efforts across businesses. Manufacturers are actively engaging in sustainability initiatives to meet consumer demands and regulatory standards. These cans are made from lightweight and durable materials, which are highly recyclable, thus can reduce environmental impact and waste in landfills. Some companies are even exploring innovative options like using bio-based propellants sourced from renewable resources, offering a greener alternative to traditional ones. These initiatives not only lower the carbon footprint of cans but also demonstrate the industry's commitment to environmental conservation on a broader scale.

Strict regulations on hazardous waste disposal

Strict regulations on hazardous waste disposal, especially regarding volatile organic compounds (VOCs) found in traditional propellants, are driving the demand for eco-friendly alternatives in aerosol cans. Concerns about air pollution and health risks are prompting consumers and manufacturers to shift towards recyclable materials like aluminum or steel, which can impact the industry's growth. Additionally, lack of awareness about the convenience of aerosol cans for on-the-go use and concerns about misuse or accidents are also affecting consumer perception and market growth.

Growing demand from the cosmetics and personal care industries

Customers appreciate the convenience and precision of aerosol cans, which are widely used for packaging various cosmetic products such as body sprays, deodorants, and hairsprays. The compact and user-friendly design makes them popular for travel purposes. Cosmetic manufacturers often utilize aerosol packaging for innovative product formulations like foams and mousses, meeting evolving consumer preferences.

Furthermore, aerosol cans offer excellent branding opportunities due to their customizable appearance and labeling options, by enhancing product visibility and sales. With their airtight and sealed packaging, aerosol cans help extend the shelf life of cosmetics by protecting them from external impurities and ensuring product effectiveness and purity.

The aluminum segment dominated the aerosol cans market in 2024 and is also expected to sustain its dominance throughout the forecast period. Aluminum aerosol cans have become widely favored across industries for their outstanding qualities. Their lightweight nature, corrosion resistance, and superior barrier properties make them ideal for preserving the integrity and prolonging the shelf life of various products. As a result, aluminum cans are the preferred packaging option for personal care items, household goods, and food products. In the global aerosol cans market, the aluminum segment dominates in terms of market size, holding a significant share of the global market.

The plastic segment is observed to grow significantly over the projected period. Plastic cans serve as a specialized segment in the market, catering to products like insect repellents, air fresheners, or specialty coatings. Their lightweight and durable nature akes them a preferred choice for certain applications, because of the added safety benefits due to their shatterproof properties. The selection of plastic cans is usually dictated by the product's unique requirements and consumer preferences for packaging that is both lightweight and recyclable.

The necked-in segment dominated the aerosol cans market in 2024. Necked-in cans feature a slender neck design at the top, rendering them suitable for a wide array of products such as personal care items, household cleaners, and industrial aerosols. Their construction enables precise dispensing of contents, minimizing wastage and providing controlled application. Manufacturers frequently opt for necked-in cans when their products necessitate accurate dosage, highlighting the segment's appeal due to its adaptability and extensive use across various industries.

The straight-wall segment is observed to be the fastest growing during the forecast period. The advantage of straight wall cans over domed or waisted cans of similar size lies in their ability to accommodate a larger filling volume. This feature is particularly beneficial for products intended for extended use or larger quantities. the straight wall design enhances the user experience by providing a comfortable grip while using the can, by improving usability.

The personal care segment dominated the aerosol cans market in 2024. The personal care sector holds a prominent position in the aerosol packaging market, primarily due to the rising demand for aerosol packaging across cosmetics, skincare, and hair care industries. As consumers increasingly prioritize personal grooming and beauty routines, they favor packaging solutions that offer convenience and efficiency. Aerosol cans excel in providing precise and controlled dispensing, ensuring user-friendly application and prolonged product freshness, thus making them highly favored for a diverse array of personal care items. This segment is expected to experience significant growth shortly, driven by various factors.

The homecare segment is observed to grow at the fastest rate in the aerosol cans market during the forecast period. Aerosol cans are widely utilized for household products, including air fresheners, furniture polish, cleaning solutions, insect repellents, and oven cleaners. These cans are preferred for household use because they are convenient and enable even and efficient distribution of these products.

By Material

By Product Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

March 2025

January 2025