July 2024

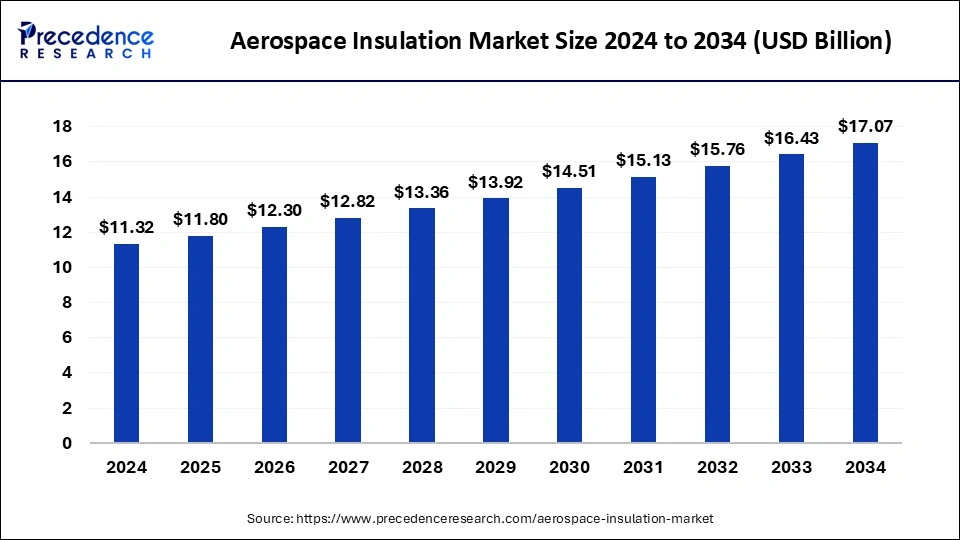

The global aerospace insulation market size is accounted at USD 11.80 billion in 2025 and is forecasted to hit around USD 17.07 billion by 2034, representing a CAGR of 4.19% from 2025 to 2034. The North America market size was estimated at USD 5.09 billion in 2024 and is expanding at a CAGR of 4.22% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aerospace insulation market size was calculated at USD 11.32 billion in 2024 and is predicted to increase from USD 11.80 billion in 2025 to approximately USD 17.07 billion by 2034, expanding at a CAGR of 4.19% from 2025 to 2034. A rise in the fleet replacement rate, which replaces older aircraft with newer innovative models, is estimated to drive the growth of the global aerospace insulation market over the forecast period.

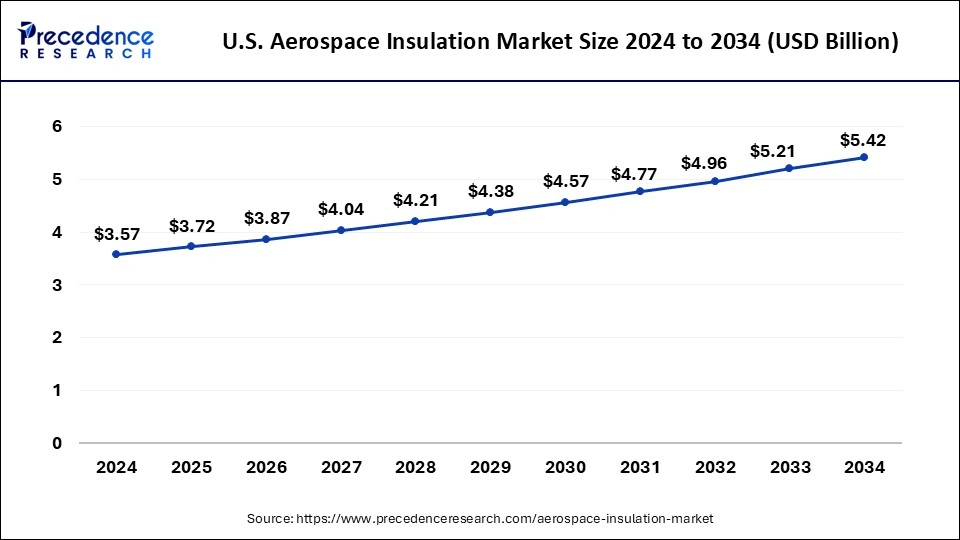

The U.S. aerospace insulation market size was exhibited at USD 3.57 billion in 2024 and is projected to be worth around USD 5.42 billion by 2034, growing at a CAGR of 4.26% from 2025 to 2034.

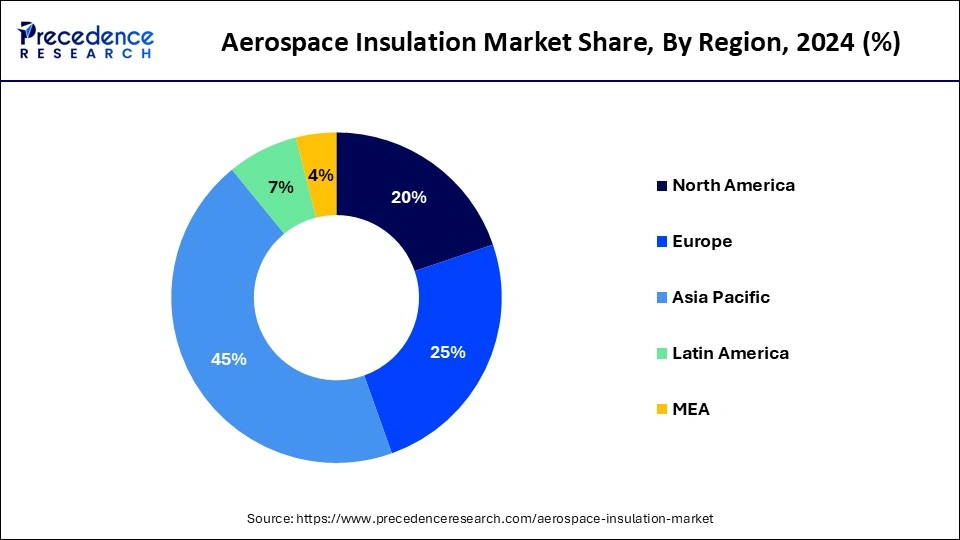

North America dominated the global aerospace insulation market in 2024. Due to rising fuel prices, the region is projected to see an increase in demand for fuel-efficient aircraft. Throughout the projected period, there will likely be a rise in demand for aircraft insulation due to the growth of the developed aerospace industry fueled by the high replacement rate, mostly for regional aircraft.

Air travel is the recommended mode of transportation for travelers longer than 300 miles (480 km), such as business and long-distance vacationers, due to the topography of the United States and the generally great distances between major cities. Increasing research and development activity to meet the rising demand for commercial aircraft is expected to drive the growth of the aerospace insulation market over the forecast period in the region.

Asia Pacific is expected to grow at a significant rate in the aerospace insulation market during the forecast period. Due to the emergence of the aircraft manufacturing industry in the region, emerging economies such as China, India, and Japan are playing a major role in driving the growth of the aerospace industry. This, in turn, is expected to drive the demand for aerospace insulation over the forecast period. Moreover, the increase in terrorist attacks, as well as the threat of war, has raised the demand and innovation of aircraft in the region.

Although aviation-grade aluminum alloy has historically been used extensively in the construction of GA aircraft models, carbon fiber reinforced polymer, or CFRP, is increasingly being used in the production of modern aircraft models. The markets for businesses that produce business aircraft are expanding, and these include China, and India. Improvements made to the interior of the business planes also drew in new clients. This creates a tremendous demand for insulating materials used in the aerospace industry, which are found in many business jet cockpits and other upscale equipment.

Europe holds a significant share of the global aerospace insulation market due to the existence of significant manufacturers of corporate, military, and commercial planes. The general aviation sector is currently concentrating on growing its market share in Europe. The use of composite materials by airplane makers to provide noise-free cabins is a response to the growing demand for aircraft and the growth in passenger traffic.

Throughout the course of the forecast period, the expanding usage of aerospace insulation in the manufacturing of airplanes in Germany, France, the U.K., and other European countries is anticipated to fuel the growth of the regional market. Furthermore, increasing government initiatives and funding for the development of advanced technology aircraft is expected to drive the growth of aerospace insulation in Europe.

The atmosphere and space are generally referred to as aerospace. There is a wide range of military, commercial, and industrial uses for aerospace activities. Aeronautics and astronautics are the two branches of aerospace engineering. Organizations dedicated to aerospace research, design, manufacturing, operation, maintenance, and repair of spacecraft and aircraft. Modern airplane designs must use aerospace insulation in order to improve fuel efficiency and guarantee passenger comfort and safety. Alloys made of aluminum, titanium, steel, and composite materials are the primary material types utilized in aeronautical structures. Apart from these materials, alloys based on nickel play a significant role in jet engine structural materials. For aircraft and aerospace vehicles, polymer's open-cell melamine foam offers superior thermal and acoustic insulation.

Some of the leading companies in the airplane insulation market include BASF SE, Polymer Technologies Inc., Triumph Group Inc., Boyd Corporation, and DuPont de Nemours, Inc. New insulating materials and other innovations will help the players land new contracts. Also, the players are concentrating on creating new insulation materials, namely thermal/acoustic insulations, due to the aviation industry's growing emphasis on lightweight components. Some of the top market players manufacturing acoustic insulation have been mentioned here as follows: Saint-Gobain S.A., Armacell International, Owens Corning, Rockwool A/S, Knauf, Kingspan Group, Autex, and Fletcher Insulation, among others.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.07 Billion |

| Market Size in 2025 | USD 11.80 Billion |

| Market Size in 2024 | USD 11.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.19% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in both freight and passenger traffic

The increase in aviation traffic has been significantly influenced by globalization. The demand for the aerospace insulation market is rising due to increased global connectivity, promoting trade, tourism, and cross-cultural interactions. The need for air freight services has increased due to the growth of international business. The surge in freight and passenger traffic in the country has led to a rise in MRO–maintenance, repairs, and operations activities for commercial aircraft, which is expected to drive the growth of the global market over the forecast period.

Challenges associated with insulation reliability and fluctuating raw material prices

The aerospace insulation market has been significantly impacted by the pandemic scenario. The airlines are running on minimum profit due to constraints on domestic and international passenger movement, which could impact aircraft orders. It is anticipated that fluctuating raw material prices could negatively impact the market for aircraft insulation. In More Electric Engines (MEE), inorganic materials, like carbon composites, are employed to insulate the wire because standard organic materials cannot withstand temperatures as high as 450°C. While inorganic materials have been used for a long time in high-voltage components outside of the aerospace industry, it is unclear from their behavior how consistent the insulation will be on electrical lines.

Increasing adoption of inorganic growth strategies

There are many different types of jobs and skills associated with working in the aviation industry. These include pilots and air traffic controllers; technicians who build and maintain aircraft; technical engineering jobs, ranging from aircraft and engine design to component production; air traffic control and airspace design planning; and airline and airport logistics. As this list shows, many positions in the aviation industry require a highly skilled workforce and extensive training. The key players operating in the market are focused on adopting inorganic growth strategies like collaboration for launching a new training school of aviation, which is expected to create lucrative opportunities for the growth of the aerospace insulation market over the forecast period.

The ceramic segment dominated the aerospace insulation market in 2024. Ceramic materials provide advantageous qualities, like their exceptional heat resistance, resistance to corrosion, and lightweight nature, which are the reason for this. These materials are extensively employed in many aerospace applications, such as engines and exhaust systems, heat shields, brakes, bearings, seals, and other wear-resistant parts.

The fiberglass segment is estimated to witness significant growth over the forecast period. This is because the material performs optimally as an acoustical and thermal insulator at temperatures up to 450 °F. It is best utilized for insulating commercial aircraft's fuselage wall cavities.

Tthe fiberglass segment is expected to witness significant growth in the aerospace insulation market over the forecast period. Foamed polymers are often used as insulation in commercial airplanes to increase passenger safety, acoustic comfort, fuel efficiency, and ease of installation and maintenance. The material's outstanding thermal and acoustic properties, fire resistance, and lightweight make it favored.

The thermal segment held a significant share of the aerospace insulation market in 2024 due to the extensive utilization of thermal insulation in aircraft manufacturing. The thermal insulation's main purpose is to act as a heat shield for thrust reversers, ducts, and engine parts. By applying thermal insulation, the components are protected from high temperatures by the essential fire barrier. Fire resistance is provided via thermal insulation in high-intensity settings. The location and kind of aircraft determine the cost-effectiveness of producing a suitable cabin temperature, which is aided by thermal insulation. Fiberglass is utilized for thermal insulation more often than ceramic materials.

The electric insulation is estimated to grow at the fastest rate in the aerospace insulation market over the forecast period due to vital electric systems, such as navigation and communication systems and in-flight control systems, which are equipped with electric insulation. Also, the category will increase faster due to the regular requirement for electrical insulation replacement.

The acoustic insulation segment holds a considerable share of the global aerospace insulation market. Materials for acoustic insulation, including fiberglass and polyimides, block vibrations from moving from one place to another by absorbing sound waves. In order to lessen the impacts of engine vibration, exhaust, and boundary-level excitation, the damping treatment is also applied directly to the skin of an aircraft. They are also used to lessen the effects of noise on the inside trim structure.

Acoustic insulation is utilized to lessen the noise and vibrations caused by engines and aerodynamics and to ensure comfort inside the flight deck and passenger cabin. Although acoustic insulation types differ from aircraft to aircraft, fiberglass is frequently chosen due to its great efficiency as an acoustic attenuator. The increased usage of aerospace insulation in the fuselage for acoustic and anti-vibration qualities is likely to drive considerable growth in the business and general aviation segment throughout the projection period. Additionally, insulation greatly enhances passenger comfort, particularly in the business aviation market.

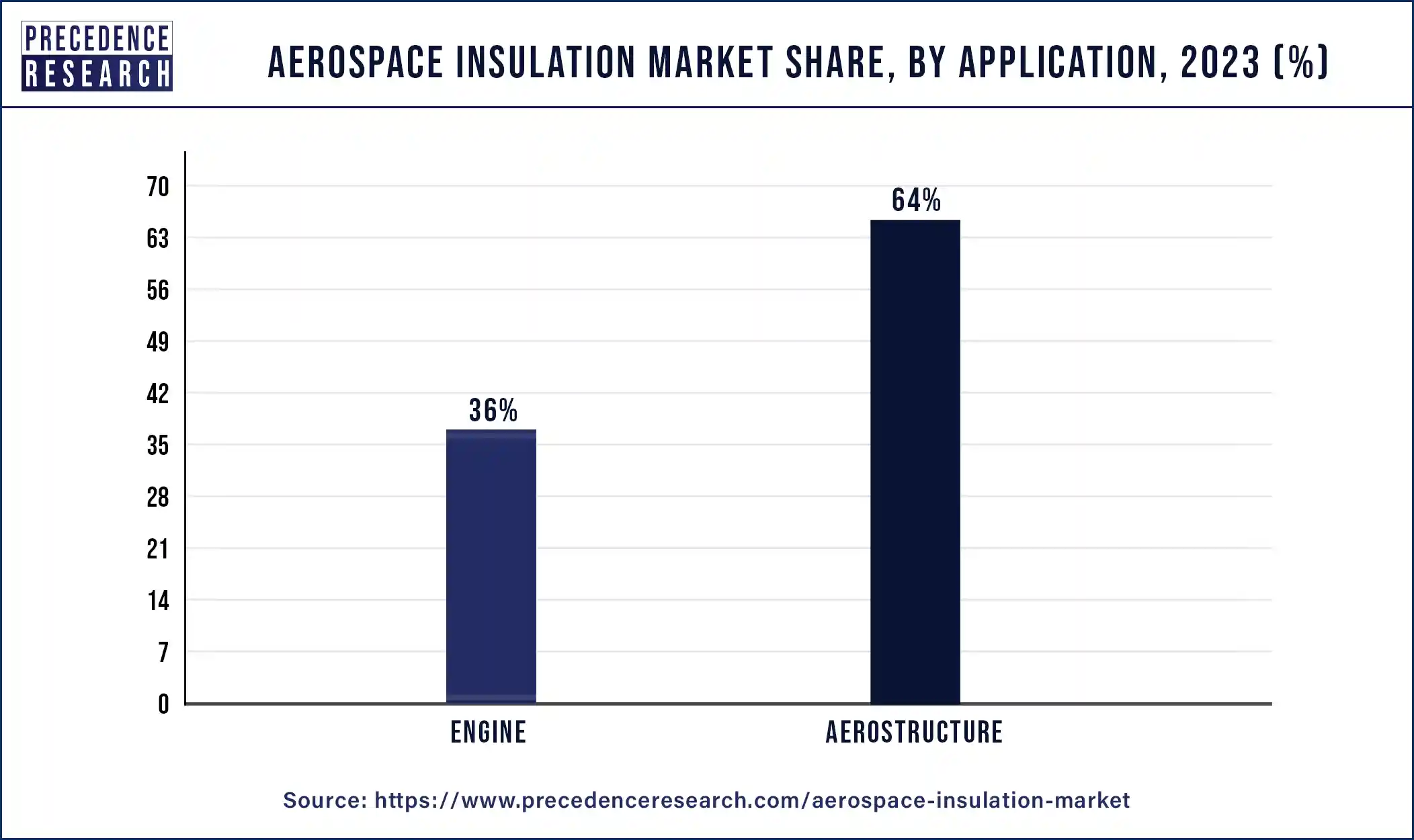

The aerostructure segment led the global aerospace insulation market in 2024. The segment comprises door pairings, airframe, fuselage, and wings, which require insulation to maintain a safe and secure temperature in the cabin interior and flight deck and cabin interior.

The increasing launch of aerostructure is expected to drive the growth of the segment over the forecast period. For instance, in June 2024, Collins Aerospace, a company focused on providing advanced technology aerostructure, revealed the introduction of the ACES 5 ejection seats.

The commercial segment held the largest share of the aerospace insulation market in 2024. The aerospace industry uses insulation extensively in the commercial segment, which includes freight liners and passenger aircraft. Aircraft insulation helps with both thermal and acoustic insulation, which enhances passenger comfort and experience even more.

Furthermore, the main purpose of the insulation materials put in freight liners is to enhance thermal insulation, which safeguards the cargo during transportation. Furthermore, increasing adoption of inorganic growth strategies like partnerships for innovating and launching new commercial aircraft training programs to meet the demand of the growing airline industry is expected to drive the growth of the segment over the forecast period.

The military segment accounts for a significant share of the aerospace insulation market due to the growing usage of aerospace insulation for engine bay thermal damping. Additionally, insulation materials, including blankets, lining, firewalls, and seals, are widely used for electrical insulation and fire barriers in military aircraft, including cargo and jets, which will increase their demand throughout the projection period. Furthermore, increasing research and development activity for the launch of new military aircraft equipment is expected to drive the growth of the segment over the forecast period.

By Material

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

November 2024

November 2023

October 2024