List of Contents

What is Aesthetic Devices Market Size?

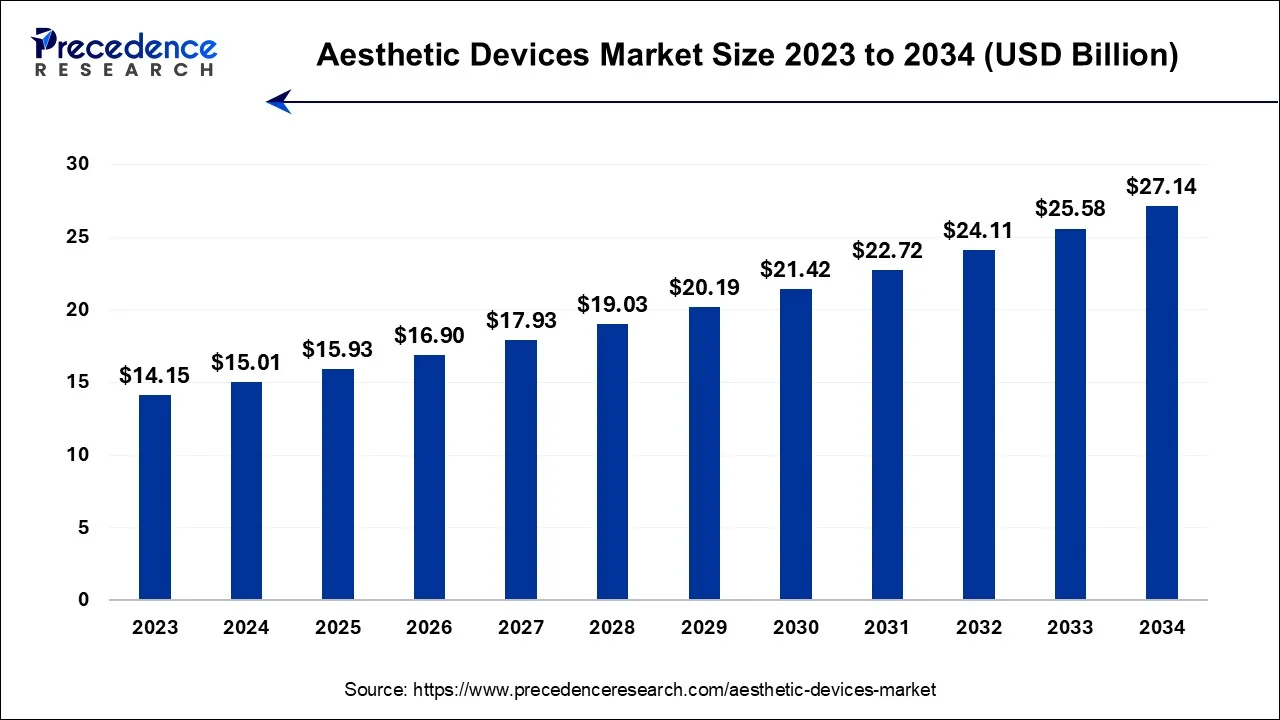

The global aesthetic devices market size accounted at USD 15.93 billion in 2025 and is anticipated to reach around USD 27.14 billion by 2034, expanding at a CAGR of 6.10% between 2025 and 2034.

Market Highlights

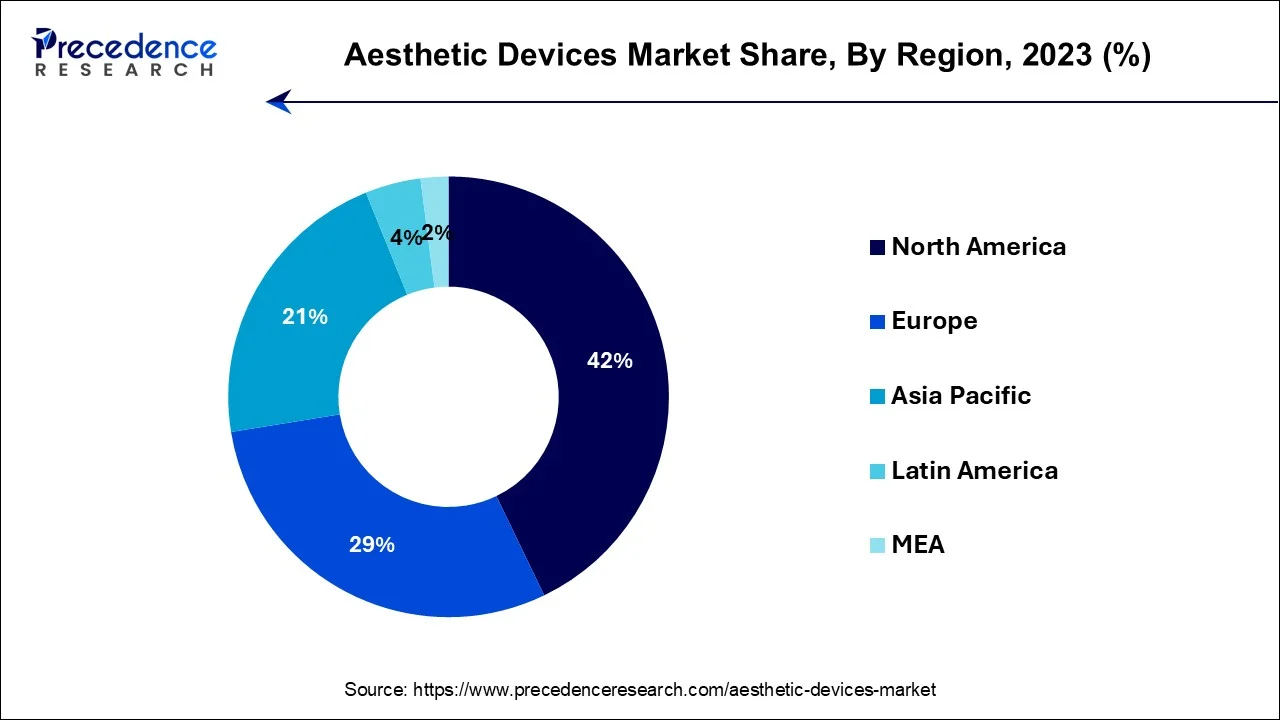

- North America contributed more than 42% of revenue share in 2024.

- The Asia-Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

- By Products, the facial aesthetic products segment has held the largest market share of 45% in 2024.

- By Products, the others segment is anticipated to grow at a remarkable CAGR of 7.2% between 2025 and 2034.

- By Raw Material, the polymers segment generated over 60% of revenue share in 2024.

- By Raw Material, the metals segment is expected to expand at the fastest CAGR over the projected period.

- By End User, the hospitals segment generated over 40% of revenue share in 2024.

- By End User, the others segment is expected to expand at the fastest CAGR over the projected period.

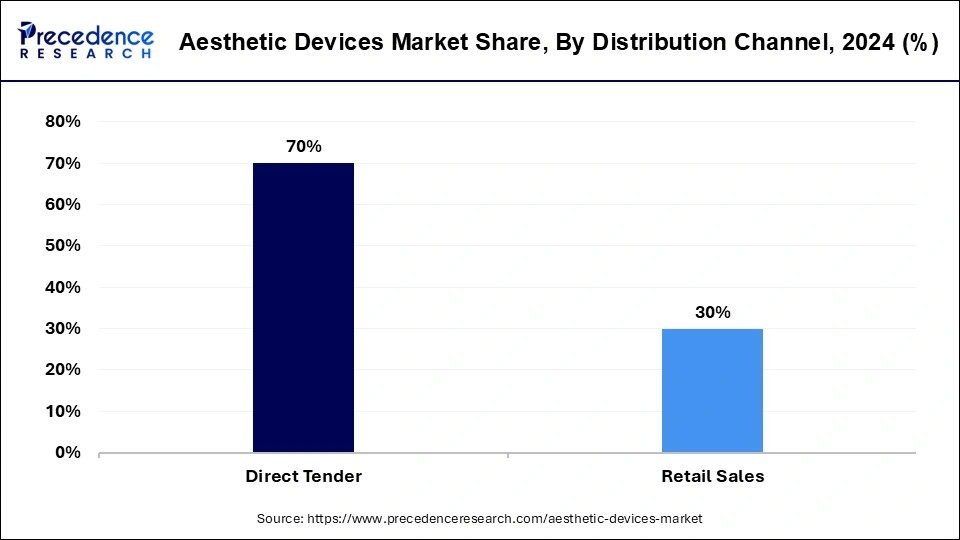

- By Distribution Channel, the direct tender segment generated over 70% of revenue share in 2024.

- By Distribution Channel, the retail sales segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 15.93 Billion

- Market Size in 2026: USD 16.90 Billion

- Forecasted Market Size by 2034: USD 27.14 Billion

- CAGR (2025-2034): 6.10%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Strategic Overview of the Global Aesthetic Devices Industry

Aesthetic devices, often termed as artistic or creative tools, serve as the nuanced methods employed by writers, artists, and creators to amplify the elegance, emotional resonance, and overall allure of their artistic endeavors. These tools are essential in diverse forms of expression, spanning literature, poetry, visual arts, music, and cinema, empowering artists to effectively convey their ideas and elicit profound reactions from their audience.

Within the realm of aesthetic devices lie a rich tapestry of techniques and strategies, ranging from symbolism, allegory, and vivid visual imageries in literary and poetic works, to the employment of principles such as color schemes, compositional intricacies, and perspective in visual arts. Music finds its essence in the harmonious interplay of rhythms, melodies, and tonal variations, while cinema hinges on techniques like cinematography, lighting nuances, and the meticulous design of auditory landscapes. These inventive devices enable artists to communicate intricate emotions, themes, and concepts, infusing their creations with layers of meaning and profound profundity. Through the discerning selection and adept application of these tools, artists have the power to metamorphose ordinary works into mesmerizing, thought-provoking, and emotionally evocative masterpieces that leave an enduring imprint on their audience.

Aesthetic Devices Market Growth Factors

- Increasing Demand for Non-Invasive Procedures: Growing consumer preference for non-invasive or minimally invasive aesthetic treatments drives the market.

- Aging Population: The global aging population is seeking anti-aging solutions, boosting the demand for aesthetic devices.

- Technological Advancements: Ongoing innovations in aesthetic device technologies lead to more effective and safer treatments.

- Rising Disposable Income: Higher disposable income allows more individuals to afford aesthetic procedures.

- Social Media Influence: The desire to look good in photos shared on social media platforms has spurred interest in aesthetic enhancements.

- Medical Tourism: The rise in medical tourism contributes to the global demand for aesthetic procedures and devices.

- Wider Acceptance: Aesthetic procedures are becoming more socially accepted, reducing the stigma associated with such treatments.

- FDA Approvals: Regulatory approvals, such as those from the U.S. Food and Drug Administration (FDA), enhance market credibility.

- Customization and Personalization: Aesthetic devices are increasingly offering tailored solutions for individual patient needs.

- Growing Beauty Industry: The overall growth of the beauty and cosmetics industry fuels the aesthetic device market.

- Consumer Awareness: Better access to information and education on aesthetic treatments increases consumer awareness.

- Rising Male Market: A growing male consumer base seeking aesthetic procedures contributes to market expansion.

- Emerging Markets: Developing countries are witnessing rapid adoption of aesthetic procedures.

- Health and Wellness Trends: Aesthetic enhancements are considered part of a broader trend towards health and wellness.

- Insurance Coverage: Increasing insurance coverage for certain aesthetic procedures makes them more accessible.

- Patient Safety Concerns: The focus on patient safety and quality of care drives the use of advanced aesthetic devices.

- Combination Therapies: The trend of combining different aesthetic procedures for optimal results spurs device usage.

- Telemedicine and Consultations: The growth of telemedicine facilitates consultations and expands the market reach.

- Research and Development: Ongoing research and development efforts lead to the introduction of more advanced devices.

- Evolving Beauty Standards: Changing beauty standards and preferences influence the types of aesthetic procedures and devices in demand.

- Bausch Health Companies Incannual revenue for 2022 was $8,124M, a 3.7% decrease from 2021. Bausch Health Companies Incannual revenue for 2021 was $8,434M, a 5.1% increase from 2020.

Market Outlook

- Market Growth Overview: The Aesthetic Devices market is expected to grow significantly between 2025 and 2034, driven by the rising health and appearance consciousness, an ageing global population, and rapid technological advancements in energy-based devices and digital integration.

- Sustainability Trends: Sustainability trends involve Eco-conscious manufacturing processes, circular economy and device lifecycle management, and responsible sourcing and ingredient transparency.

- Major Investors: Major investors in the Hologic (Cynosure) and AbbVie (Allergan Aesthetics), and BlackRock.

- Startup Economy:The startup economy in the market is focused on AI and AR for personalized treatment, expansion of home-use devices and platforms, and digital marketing and social commerce.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.93 Billion |

| Market Size in 2026 | USD 16.90 Billion |

| Market Size by 2034 | USD 27.14 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Products, Raw Material, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Changing beauty standards

Changing beauty standards are a significant driver of growth in the aesthetic devices market. As societal ideals of beauty evolve, individuals increasingly seek aesthetic enhancements to align with these new norms. The desire to meet current beauty standards, often influenced by celebrities, social media, and fashion trends, motivates people to consider a wide range of aesthetic procedures. These changing standards also contribute to the diversification of the market. Different cultures and regions may have their own unique beauty ideals, prompting the development and adoption of specific aesthetic devices to cater to these preferences.

For instance, facial contouring and skin treatments are highly sought after in some regions, while body sculpting and hair removal may be in higher demand in others. Aesthetic device manufacturers respond to these shifts by developing innovative products that can help individuals achieve the desired look. The dynamic interplay between changing beauty standards and the aesthetic devices market ensures continued growth as consumers strive to meet evolving ideals of attractiveness and self-image.

Restraints

Limited insurance coverage

The constraint of limited insurance coverage exerts a notable impediment on the expansion of the aesthetic devices market. Many aesthetic treatments fall into the category of elective and cosmetic procedures, rendering them ineligible for coverage by health insurance plans. This places the full financial onus on individuals seeking these enhancements. This financial barrier can serve as a deterrent for prospective patients, as the substantial out-of-pocket expenses associated with aesthetic procedures can be prohibitive. Limited insurance coverage introduces a stark accessibility gap, particularly affecting those with more modest financial resources.

It may, in fact, discourage individuals with genuine interests or medical justifications for specific treatments from pursuing their aesthetic aspirations. The lack of insurance support not only stifles market growth but also perpetuates disparities in access to aesthetic enhancements, potentially marginalizing a significant segment of the population. Addressing this impediment necessitates advocacy for broader insurance coverage or the establishment of alternative financing mechanisms to foster inclusivity and facilitate access to aesthetic procedures.

Opportunities

Eco-friendly and sustainable devices

Incorporating eco-conscious and sustainable elements into the realm of aesthetic devices is forging compelling opportunities. As the global consciousness around environmental issues continues to rise, there is an increasing appetite for aesthetic devices designed with a diminished ecological footprint, employing eco-friendly materials, and adopting sustainable manufacturing processes. This progressive approach toward sustainability not only resonates with worldwide environmental objectives but also captures the attention of discerning consumers who prioritize environmentally responsible products.

Manufacturers embracing these principles can harness this growing appetite by conceiving aesthetic devices that curtail waste, energy consumption, and environmental repercussions. By placing a strong emphasis on ecological considerations and sustainability in product innovation, companies can not only allure eco-aware consumers but also showcase a steadfast dedication to conscientious business practices, thereby bolstering their reputation and competitive edge within the market.

This transition toward ecologically conscious aesthetics aligns harmoniously with the overarching sustainability trends seen across various industries, emphasizing the immense potential for advancement and originality within the aesthetic devices market.

Technological Advancement

Technological advancements in the aesthetic devices market feature AI-powered solutions, minimally invasive procedures, energy-based devices, and robotic surgery. Energy-based devices provide laser treatment, a technology that enables effective treatment for body contouring, hair removal, and skin resurfacing. The radio frequency system tightens and rejuvenates the skin, suggesting non-invasive alternatives to surgical procedures. Ultrasound technology is mainly used for fat reduction treatment and body contouring. The minimally invasive procedures are in demand for their less downtime devices. Robotic surgery helps in finding applications to select accurate aesthetic procedures.

AI-powered solutions are an integration of the aesthetic devices for enhancing, personalizing, for satisfying patients' experience. Advanced laser systems contain multiple wavelengths used for various applications, including tattoo removal. Technological advancement is an important part of this market, with the highest demand for aesthetic treatment among customers and patients. The innovation contributes a large amount to the market globally.

Segment Insights

Products Insights

According to the products, the facial aesthetic products has held a 45% revenue share in 2024. The facial aesthetic products segment commands a substantial share in the aesthetic devices market primarily due to its high demand and versatile applications. Facial aesthetics, encompassing treatments like dermal fillers, Botox, and laser therapy, are favored by a broad demographic seeking non-invasive solutions for skin rejuvenation and anti-aging. Additionally, the face is often considered the most prominent and visible part of the body, driving people to invest in enhancing its appearance. The convenience and relatively low downtime associated with facial aesthetic treatments further contribute to this segment's dominance in the market.

The others segment is anticipated to expand at a significant CAGR of 7.2% during the projected period. The "Others" segment holds significant growth in the aesthetic devices market due to its diverse range of products that do not fit into conventional categories. This segment encompasses innovative, specialized, and niche devices, often associated with cutting-edge technologies and unique applications. As aesthetic preferences and treatments become more individualized and sophisticated, the "Others" category accommodates this demand by offering a broad spectrum of solutions. Patients and practitioners increasingly turn to these unconventional devices to address specific aesthetic needs, driving the growth and dominance of the "Others" segment in the market.

Raw Material Insights

In 2024, the polymers segment had the highest market share of 31.8% on the basis of the raw material. The polymers segment holds a significant share in the aesthetic devices market primarily due to the versatility and compatibility of polymer materials in aesthetic procedures. Polymers are used in various applications, such as dermal fillers, implants, and sutures, offering durable and biocompatible solutions. Their non-invasive and minimally invasive nature contributes to their popularity, attracting patients seeking safer and more accessible aesthetic treatments. Additionally, ongoing research and development efforts in polymer technology continually expand the range of available devices, driving the growth of this segment in the aesthetic devices market.

The metals segment is anticipated to expand fastest over the projected period. The prominence growth of the metals segment in the aesthetic devices market can be attributed to its prominence in offering a balance of adaptability, longevity, and visual appeal. Materials like titanium, stainless steel, and aluminum are frequently selected for crafting medical and aesthetic devices due to their commendable combination of mechanical strength, resistance to corrosion, and compatibility with the human body. These materials exhibit exceptional tolerance to various manufacturing techniques and enable the creation of polished, high-quality finished products, establishing their favored status in the market for devices such as dermal fillers, implants, and instruments, thereby consolidating the metals segment's growth.

End User Insights

In 2024, the hospitals segment had the highest market share of 40% on the basis of the end user. Hospitals hold a substantial share in the aesthetic devices market due to their role as trusted medical institutions. Patients often prefer hospitals for aesthetic procedures as they offer a sense of security, skilled healthcare professionals, and access to a wide range of treatments. Additionally, hospitals have advanced infrastructure and the capability to handle complex cases, making them the go-to choice for various aesthetic procedures, including surgical and non-surgical treatments. This strong healthcare association and comprehensive service offering position hospitals as a major player in the aesthetic devices market, instilling confidence in patients seeking aesthetic enhancements.

The others segment is anticipated to expand fastest over the projected period. The "others" segment in the aesthetic devices market holds a substantial growth due to its diverse nature. This category encompasses end users beyond the typical medical and cosmetic sectors, including tattoo parlors, wellness centers, and non-traditional providers. The growing popularity of aesthetic enhancements in various settings, such as tattoo removal and holistic wellness, contributes to the segment's prominence. Moreover, the evolving landscape of beauty and self-care has led to the emergence of niche practices, expanding the demand for aesthetic devices in these non-conventional settings and thus consolidating the "others" segment's significant market growth.

Distribution Channel Insights

In 2024, the direct tender segment had the highest market share of 70% on the basis of the distribution channel. The direct tender segment holds a significant share in the aesthetic devices market primarily due to its close alignment with healthcare facilities and professionals. Direct tenders enable medical institutions to source aesthetic devices directly from manufacturers, ensuring competitive pricing, tailored product selection, and prompt customer support. This approach streamlines procurement processes, provides opportunities for bulk purchasing, and often results in cost savings. Moreover, the direct tender channel fosters stronger manufacturer-customer relationships, offers product customization, and ensures reliable after-sales service, making it a preferred choice for healthcare providers seeking quality and efficiency in their aesthetic device acquisitions.

The retail sales segment is anticipated to expand fastest over the projected period. The dominance of the retail sales segment in the aesthetic devices market can be attributed to its direct connection with consumers. This distribution channel provides a straightforward and instant avenue for individuals to access aesthetic devices, encompassing both over-the-counter options and products with lower associated risks. By circumventing intermediaries, it grants consumers the ability to make well-informed choices, whether through in-store assistance or online resources. Furthermore, retail sales channels frequently serve a diverse clientele, offering a wide spectrum of products tailored to meet a range of aesthetic preferences, bolstering their prominent growth within the market.

Regional Insights

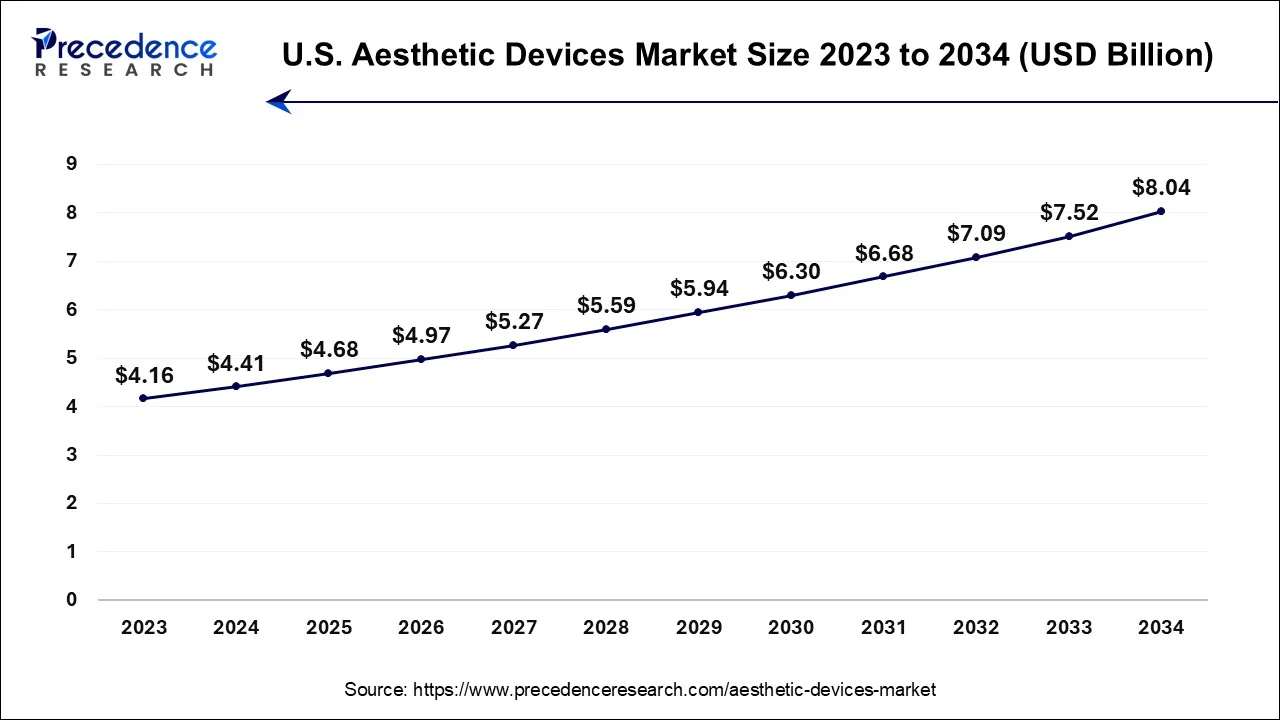

U.S. Aesthetic Devices Market Size and Growth 2025 to 2034

The U.S. aesthetic devices market size is estimated at USD 4.68 billion in 2025 and is expected to be worth around USD 8.04 billion by 2034, growing at a CAGR of 6.19% from 2025 to 2034.

North America has held the largest revenue share 42% in 2024. North America commands a substantial share in the aesthetic devices market due to several factors. The region boasts a well-established healthcare infrastructure, high healthcare expenditure, and a robust economy, enabling a larger consumer base to access aesthetic treatments and devices. Additionally, the increasing emphasis on physical appearance, anti-aging solutions, and wellness drives the demand for aesthetic procedures. Stringent regulatory standards and FDA approvals enhance consumer confidence in the safety of these devices. Moreover, a culture that promotes beauty ideals and the strong presence of leading aesthetic device manufacturers in North America further solidify the region's dominance in the market.

North America is dominating the aesthetic devices market. The increased geriatric population demands anti-aging solutions to rejuvenate skin is the major area of growth for this region. The vast scope of innovations and advancements ranks the region in first place. The acceleration of surgical and non-surgical procedures is drastically growing in North America. The increased obesity rate of this region approaches aesthetic treatments.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific commands substantial growth in the aesthetic devices market due to several key factors. The region's robust economic growth has led to a rising middle class with higher disposable income, increasing the demand for aesthetic procedures. Moreover, changing beauty standards and a strong cultural emphasis on appearance have driven the adoption of aesthetic devices. The availability of advanced technologies and a growing number of aesthetic clinics and practitioners in countries like South Korea and India further boost the market. With a large and diverse population, Asia-Pacific remains a lucrative market for aesthetic devices and treatments.

Aesthetic Devices Market Value Chain Analysis

- R&D and Product Design This foundational stage involves scientific research into new energy-based technologies, mechanical engineering, and software development, including AI integration.

Key Players: Hologic Inc. (Cynosure), AbbVie Inc. (Allergan Aesthetics), Lumenis, Inc., Candela Corporation, Bausch Health Companies Inc. (Solta Medical), Merz Pharma, Cutera, Inc., and startups specializing in AI and new technology. - Raw Material and Component Sourcing This stage involves the procurement of electronic components (semiconductors, sensors, screens), specialized materials (laser components, plastic housings), and optics.

Key Players: Various electronic component suppliers, optics manufacturers, and raw material providers globally who supply to Tier 1 device manufacturers. - Device Assembly and Manufacturing Components are assembled into finished aesthetic devices in highly controlled manufacturing facilities, adhering to strict quality management systems (e.g., ISO 13485) and regional regulations (e.g., FDA, CE, NMPA).

Key Players: Hologic Inc. (Cynosure), Lumenis, Inc., Candela Corporation, Bausch Health Companies Inc., InMode Ltd., and third-party contract manufacturers. - Distribution and Logistics Finished devices are transported through specialized channels to dermatology clinics, medical spas, beauty centers, and retail channels (including e-commerce platforms).

Key Players: Amazon and Alibaba

Key Players in Aesthetic Devices Market and Their Offerings

- Lumenis: Lumenis is a leading provider of energy-based medical devices, offering a broad range of laser, intense pulsed light (IPL), and radiofrequency (RF) technologies for various aesthetic applications.

- Syneron-Candela:Syneron-Candela (now known simply as Candela Corporation) is a major player known for developing and commercializing a wide portfolio of energy-based aesthetic devices, including laser, light-based, and RF technologies.

- Cynosure:A subsidiary of Hologic, Cynosure provides a comprehensive portfolio of laser and energy-based aesthetic treatment systems for various procedures like hair removal, skin revitalization, and tattoo removal.

- Allergan:Allergan Aesthetics, an AbbVie company, is a dominant force in the market, primarily through their widely popular injectable products like Botox and Juvederm, rather than devices themselves.

- Cutera:Cutera designs, develops, manufactures, and markets a broad range of aesthetic systems for practitioners worldwide, focusing on laser and energy-based platforms.

- BTL Industries:BTL specializes in the development of advanced non-invasive aesthetic solutions, including popular devices for body contouring and muscle toning like Emsculpt and Exilis.

- Hologic, Inc.:Hologic, through its Cynosure subsidiary, is a key investor and manufacturer in the aesthetic devices market, providing capital and R&D support for energy-based systems.

- Alma Lasers:Alma Lasers provides a comprehensive portfolio of innovative, state-of-the-art platforms based on laser, light, radiofrequency, and ultrasound technologies for the aesthetic and surgical markets.

- Merz Pharma:Merz Pharma is a prominent player in the aesthetic market, primarily through their injectables portfolio including neuromodulators (Botox competitors) and dermal fillers.

- Solta Medical:A subsidiary of Bausch Health, Solta Medical is known for premium aesthetic devices like Thermage (radiofrequency skin tightening) and Clear + Brilliant (laser skin treatment).

- Sientra:Sientra is primarily a medical aesthetics company focusing on breast reconstruction and augmentation products, including breast implants, rather than energy-based devices.

- Sciton, Inc.:Sciton is a privately held company that manufactures advanced laser and light systems for aesthetic and surgical procedures, known for the Joule platform which offers multiple applications.

- InMode:InMode is a medical device company that develops minimally invasive aesthetic solutions using radiofrequency-assisted lipolysis (RFAL) and other technologies.

- Lutronic:Lutronic develops and manufactures aesthetic and medical laser systems for skin rejuvenation, hair removal, and other applications, including their LaseMD platform.

- Fotona:Fotona is a leading global producer of high-performance laser systems for aesthetic applications as well as dentistry and medicine. They contribute by providing a wide range of professional laser devices that are used for diverse treatments from skin resurfacing to body contouring.

Recent Developments

- In December 2024, Cartessa Aesthetics introduced three new technologies to give providers a head start for 2025. Three unique devices are Prisma, Everesse, and SKNLAB. These devices will benefit practitioners.

- In October 2024, Evolus announced EU approval of Estyme injectable hyaluronic acid gels under the new medical device regulation. Evolus, a beauty company, is approaching the aesthetic portfolio of consumer brands.

- In February 2025, Euromedic introduced WonderFace muscle toning to Morocco. Euromedic, an aesthetic medicine company in Morocco, announced European technology for muscle toning. It's a device to treat facial areas.

- In June 2022,Cynosure unveiled the PicoSure Pro, an advanced iteration of the PicoSure platform. This latest innovation is among the initial 755nm picosecond lasers to receive FDA clearance in the United States.

- In January 2021, Candela, a prominent global player in medical aesthetic devices, announced the introduction of the Frax Pro system. This FDA-approved system offers non-ablative fractional skin resurfacing and includes the Frax 1550 and the innovative Frax 1940 applicators. This strategic move expanded Candela's aesthetics product portfolio, enhancing its presence in the market.

Segments Covered in the Report

By Products

- Facial Aesthetic Products

- Body Contouring Devices

- Cosmetic Implants

- Hair Removal Devices

- Skin Aesthetic Devices

- Others

By Raw Material

- Polymers

- Metals

- Biomaterials

By End User

- Hospitals

- Dermatology Clinics

- Clinics

- Academic And Private Research Institutes

- Others

By Distribution Channel

- Direct Tender

- Retail Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client