May 2025

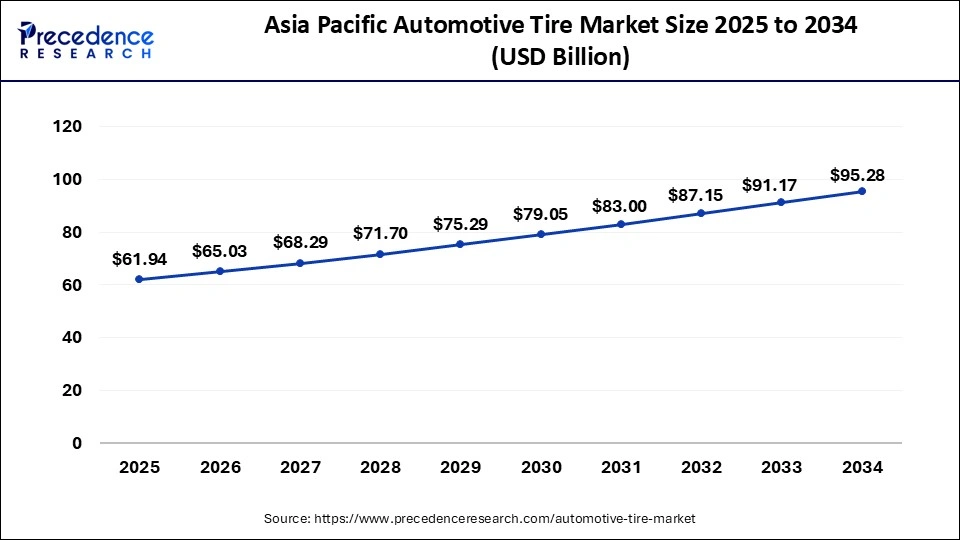

The global automotive tire market size is estimated at USD 151.07 billion in 2025 and is anticipated to reach around USD 242.38 billion by 2034, expanding at a CAGR of 4.91% from 2025 to 2034. The Asia Pacific automotive tire market was valued at USD 61.94 billion in 2025 and is expanding at a CAGR of 5% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive tire market size accounted for USD 143.88 billion in 2024 and is predicted to increase from USD 151.07 billion in 2025 to approximately USD 242.38 billion by 2034, expanding at a CAGR of 4.91% from 2025 to 2034.

The Asia Pacific automotive tire market was exhibited at USD 58.99 billion in 2024 and is expected to be worth around USD 95.28 billion by 2034, at a CAGR of 5% from 2025 to 2034.

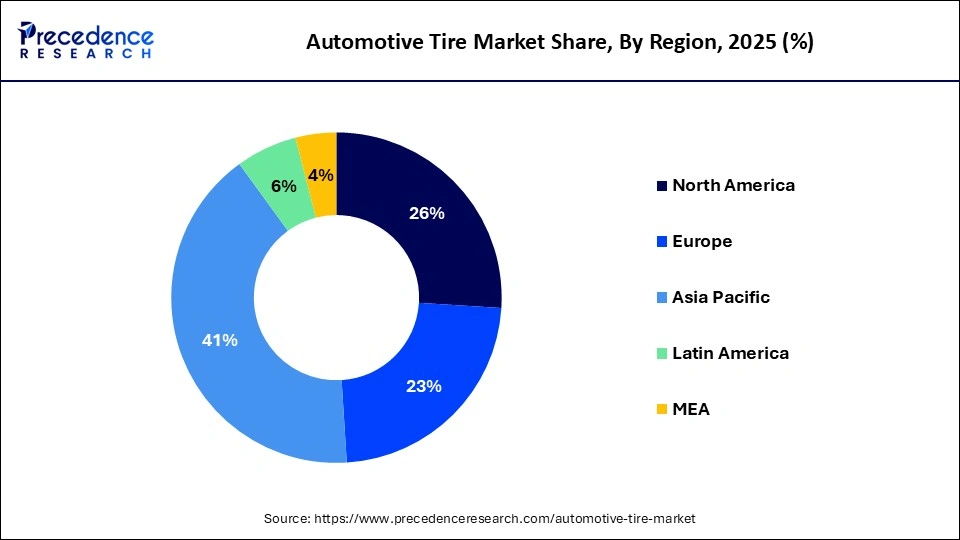

The Asia Pacific is the major automotive tire market with revenue contribution of around 41% in 2024 and analyzed to exhibit accelerating growth during the forecast period. Some of the fastest developing countries in the region such as India and China drive the market growth significantly in the region. Low labor cost, increased standard of living, high domestic consumption, and large population base are the prime factors behind the lucrative growth of automotive tire in China and India. In addition, increased number of accidents also triggers market for aftermarket sales of tire. According to The Economic Times article published on June 2019, tire replacement is likely to witness better growth of nearly 7-8% compared to Original Equipment Manufacturers (OEMs) in the coming years particularly in passenger vehicle segment.

Europe is the most prominent region in automotive and automotive parts sales. Strong demand from larger markets is likely to drive the sales of new cars in the region. Furthermore, the region is famous for sports activities such as car racing that again propels the demand for advanced and intelligent tires for sports cars.

North America is expected to grow significantly in the automotive tire market during the forecast period. The increasing demand and use of vehicles in North America is increasing the demand for automotive tires. At the same time, the use of advanced technologies, tries that can detect the pressure and temperature, is also being developed. Moreover, the use of electric vehicles is also driving their demand. Thus, this promotes the market growth.

U.S. Automotive Tire Market Trends:

The automotive industries in the U.S. consist of advanced technologies. Hence, with the help of these technologies, new developments are being conducted to enhance the safety and performance of the automotive tires. Thus, sensors that can monitor the temperature and pressure in tires are being developed. This, in turn, increases the collaboration between them.

Canada Automotive Tire Market Trends:

The production as well as the sale of vehicles in Canada is increasing, which in turn increases the demand for automotive tires. Furthermore, the growing use of electric vehicles also

contributes to the same. Thus, this increases the production of automotive tries to meet the rising demand.

Tires are the most crucial component of an automotive vehicle. The demand of automotive tire is significantly driven by the rise in production and sales of automotive vehicles globally. In 2024, the global automotive production was 93 Mn. In addition, introduction of electric vehicles have significantly surged the vehicle demand across the globe. Declining prices of various electric vehicle parts for example transmission, battery, and alternator fuel the adoption of electric vehicles across the globe. Safety regulations along with technological advancements in the manufacturing process propel market growth. Use of advanced materials for automotive tires to enhance their performance and life are the prime motive of tire manufacturers. For instance, in November 2019, Bridgestone developed first polymer ‘Susym’ that bonds resins and rubber on their molecular level. The company aimed to increase the application of polymer in tire making owing to its advanced and attractive features.

On the contrary, volatile prices along with stringent government regulations for the availability of the raw materials projected to restrict the market growth. Nonetheless, integration of sensor technology in the tire manufacturing has uplifted the tire market to the next level. Intelligent tires have created numerous opportunities for industry players to boost their market position.

| Report Coverage | Details |

| Market Size by 2034 | USD 242.38 Billion |

| Market Size in 2025 | USD 151.07 Billion |

| Market Size in 2024 | USD 143.88 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.91% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Season Tire Type, Rim Size, Vehicle Type, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Which Vehicle Type Segment Held the Dominating Share of the Automotive Tire Market in 2024?

The passenger vehicles segment, by vehicle type, held the dominating share of the market with a significant revenue share of nearly 47% in the year 2024. The increased acceptance rates, as well as new developments, have enhanced their demand in the market. Moreover, a significant rise in passenger vehicle production and sales is the prime factor that drives the segment growth.

As per International Organization of Motor Vehicle Manufacturers (OICA) statistics 2019, passenger vehicles captured nearly 74% of the total vehicle production. In addition, several advancements, such as driver assistance systems, sensors, and other vehicle technologies, boost the demand for passenger vehicles worldwide. Furthermore, increasing demand for semi-luxury and luxury cars due to the rise in purchasing power of people is predicted to boost the demand for passenger vehicles over the forecast period. Thus, all these factors enhanced the safety and performance of passenger vehicles, contributing to the market growth.

Passenger vehicles led the global automotive tire market with a significant revenue share of nearly 47% in the year 2024. A significant rise in passenger vehicle production and sales is the prime factor that drives the segment growth. As per International Organization of Motor Vehicle Manufacturers (OICA) statistics 2019, passenger vehicles captured nearly 74% of the total vehicle production. In addition, several advancements such as driver assistance system, sensors, and other vehicle technology boost the demand for passenger vehicles worldwide. Furthermore, increasing demand for semi-luxury and luxury cars due to rise in purchasing power of people is predicted to boost the demand for passenger vehicles over the forecast period.

Meanwhile, accelerating demand of online and retail business have triggered the sales of light commercial vehicles. In addition, the current trend of the recreational vehicle along its increased adoption for travel & tourism in western countries expected to uplift the market for light commercial vehicles. Improves logistics & transportation sector have also created prominent growth in demand for light commercial vehicles. The aforementioned factors projected to boost the sales of light commercial vehicles during the forecast period.

Even though there are numerous international as well as regional players present in the global automotive tire market, the market is highly consolidated in nature. Top four companies that include Michelin Group, Goodyear Tire & Rubber Company Bridgestone Corporation, and Continental AG capture nearly half of the market revenue. The manufacturers face intense competition in terms of price owing to presence of several regional players in the market. Furthermore, cheaper tires offered by the Chinese players likely to negatively impact the profit margin of other industry players. Thus, major players are largely focused towards offering advanced tires that offer excellent driving experience and enhanced safety. Apart from this, leading tire manufacturers are also investing prominently in the developing countries because of low labor cost that further decreases the overall production cost.

This report analyses and projects market revenue and growth trend at global, regional, and country levels and offers an analysis of the modern industry developments in each of the sub-segments from 2025 to 2034. The global automotive tire market report is categorized on the basis of season tire type, rim size, vehicle type, distribution channel, and region:

By Season Tire Type

By Rim Size

By Vehicle Type

By Distribution Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

April 2025

April 2025

January 2025