February 2025

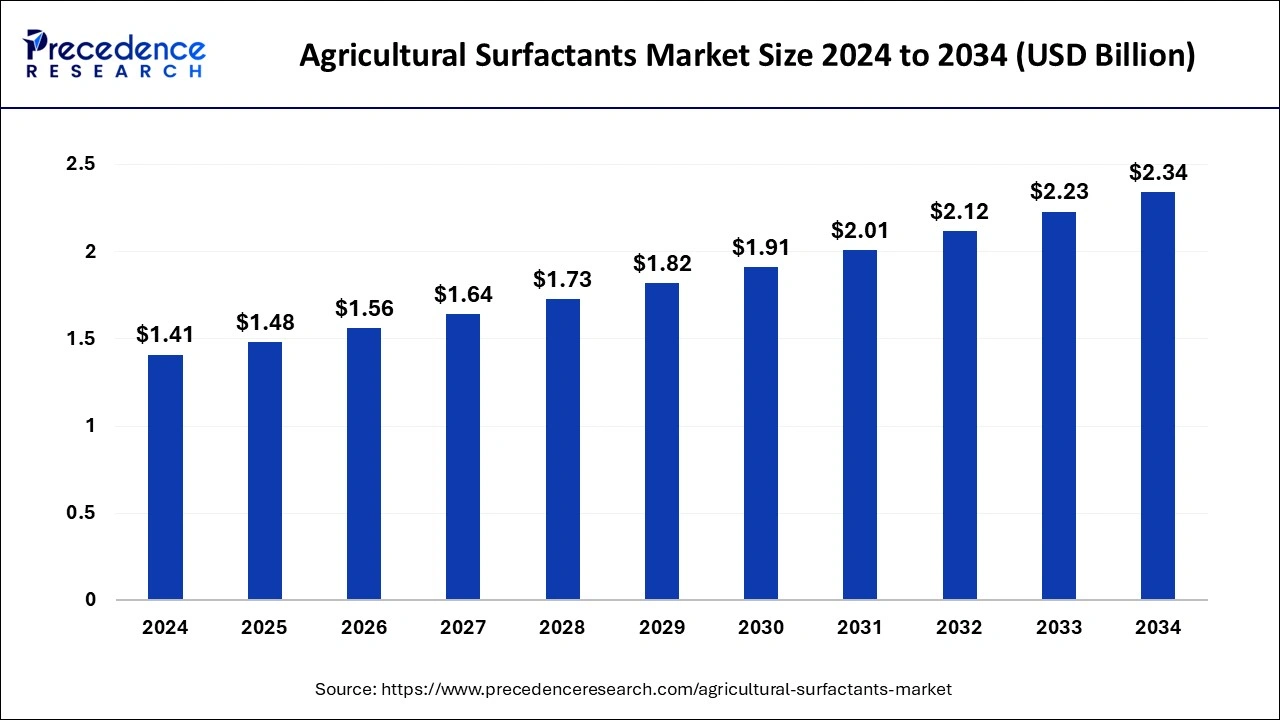

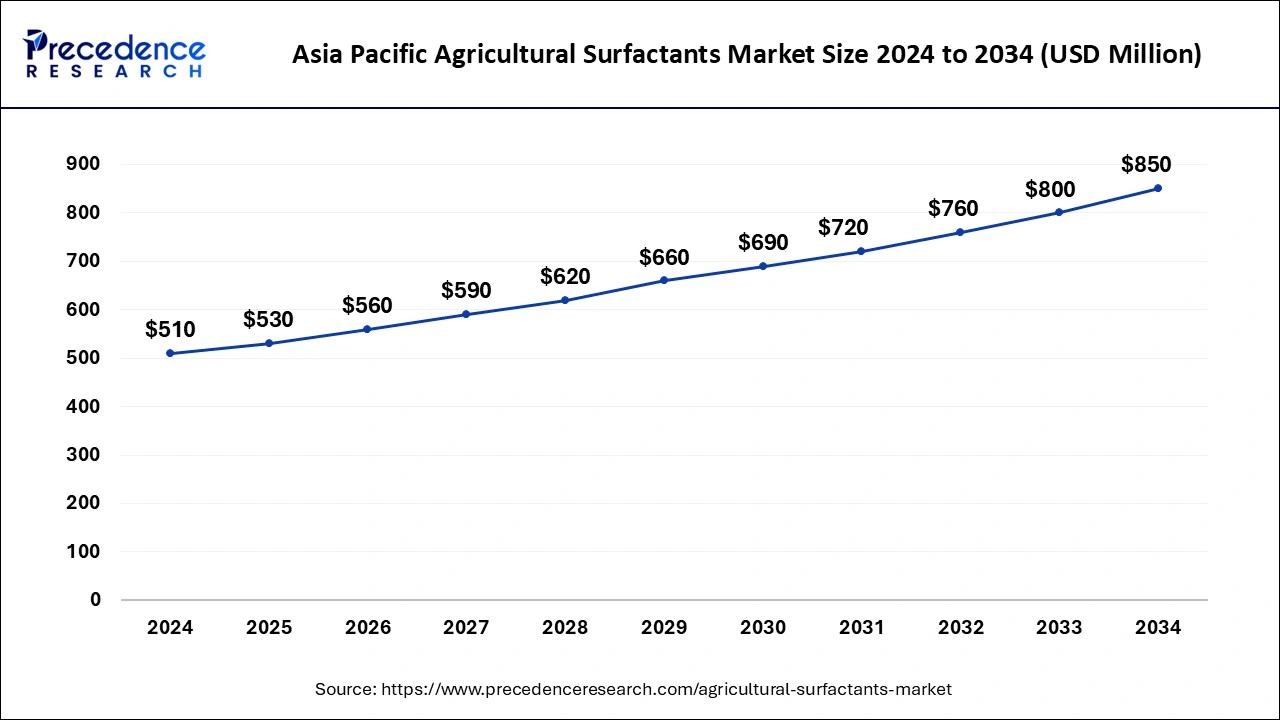

The global agricultural surfactants market size is estimated at USD 1.48 billion in 2025 and is predicted to reach around USD 2.34 billion by 2034, accelerating at a CAGR of 5.20% from 2025 to 2034. The Asia Pacific agricultural surfactants market size surpassed USD 530 million in 2025 and is expanding at a CAGR of 5.24% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global agricultural surfactants market size was valued at USD 1.41 billion in 2024 and is anticipated to reach around USD 2.34 billion by 2034, growing at a CAGR of 5.20% from 2025 to 2034. The rising global food demand and the growing emphasis on sustainable farming practices are boosting the growth of the market.

AI helps improve the quality of surfactants and optimize usage. It helps to determine accurate doses of each component of the mixture depending on the type of soil, crop, and climate. This further enhances surfactants' efficacy, resulting in increased crop yields and minimal soil pollution. In addition, AI helps researchers develop innovative formulations for agricultural surfactants by providing detailed insights into the efficacy of ingredients.

The Asia Pacific agricultural surfactants market size reached USD 510 million in 2024 and is expected to be worth around USD 850 million by 2034 at a CAGR of 5.24% from 2025 to 2034.

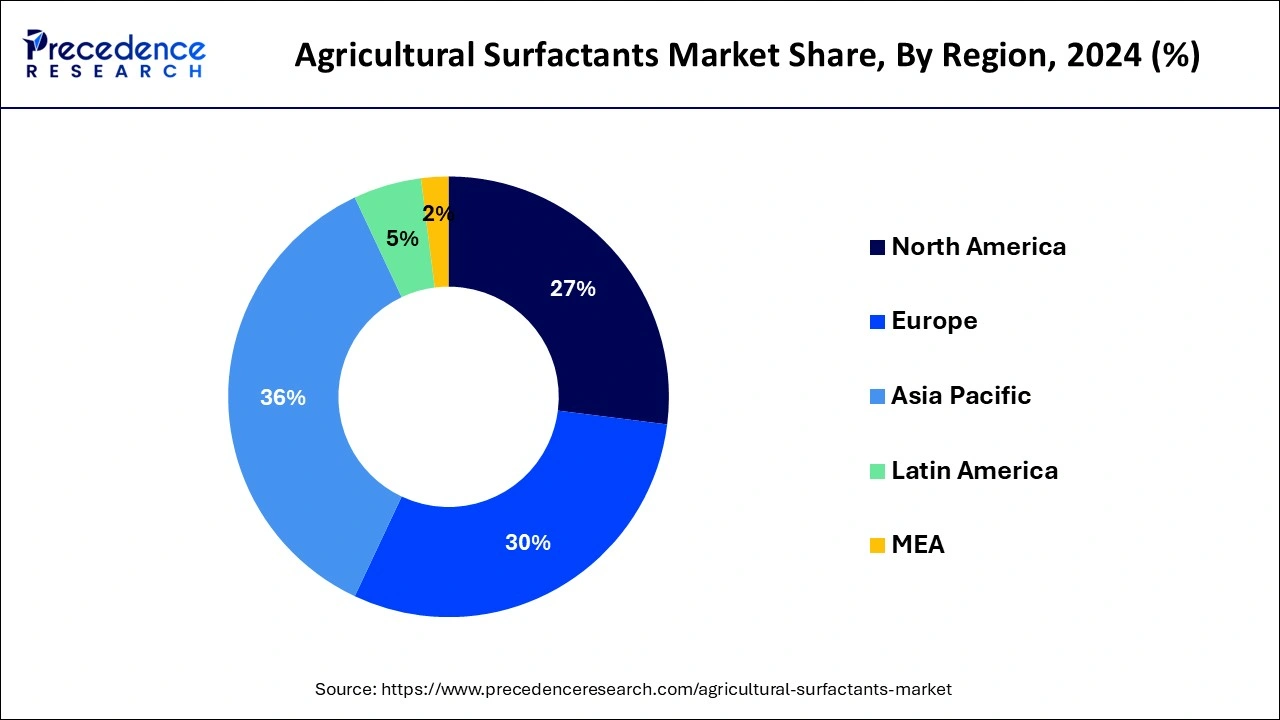

Asia Pacific held the largest share of the market in 2024 due to the occurrence of countries with vast arable lands, rising populations, and high demand for developed crops. Due to rapid industrialization and urbanization, Asia Pacific is expected to grow fastest. In the Asia Pacific region, India, China, Japan, and South Korea are the emerging countries.

India is the largest country in terms of agricultural surfactants, and the pesticide production industry plays an important role in ensuring food security and safeguarding crops. Agricultural surfactants provide a unique range of surfactants designed to address the needs of the Indian pesticide manufacturing industry. The agricultural surfactants are produced with accuracy to ensure regulatory observance without sacrificing the quality of the product. Eco-friendly surfactants reduce the environmental effect of agrochemicals and make them a preferable choice for advanced agriculture. Surfactants protect the environment while increasing product performance. Agrochemical surfactants offer customized solutions to meet the most critical concerns, from regulative compliance to renewable agriculture. Therefore, agricultural surfactants are the future of Indian agriculture.

North America is observed to have a notable rate of growth in the agricultural surfactants market during the forecast period. North America grows various types of crops, such as specialty crops, vegetables and fruits, oilseeds, and cereals. North American agribusinesses and farmers are at the cutting edge of effective chemical application, as well as essential precise and advanced agriculture techniques. The United States and Canada are the emerging countries in North America.

In the United States, herbicides are highly used in pesticides and other agrochemicals. The adoption of herbicide-resistant crop techniques has led to a rise in herbicide usage by a total of 239 million kilograms. The United States is a dynamic and significant country in the agricultural surfactants market. Increasing adoption of advanced agriculture practices is the major driver boosting the market growth. In the United States, increasing the efficiency of crop safety activities, particularly in the face of disease challenges and evolving pests, is a key driver in the market growth. Sustainable surfactants and increasing demand for bio-based products are significant trends in the United States.

The agricultural surfactants market covers a diverse range of chemical elements used in agriculture to boost the performance and efficacy of agrochemicals, including fungicides, herbicides, and pesticides. In specific, surfactants improve the foliar uptake of defoliants, growth regulators, and herbicides. The market serves several agricultural sectors, such as specialty crops, vegetables, fruits, and row crops. Therefore, they are fulfilling the need for effective solutions to weed infestations and diseases and combat pests.

The agricultural surfactant market plays an important role in ensuring global food security and supporting environmental impact by minimizing environmental impact and increasing focus on optimizing agricultural inputs. In addition, the increasing adoption of integrated pest management is also responsible for driving the market growth.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Market Size in 2025 | USD 1.48 Billion |

| Market Size by 2034 | USD 2.34 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Crop, By Function, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for crop protection

Due to the rising global population, there is significant growth in food demand. The agriculture landscape continues to be a major source of food manufacturing, according to the Food and Agricultural Organization. Advanced farming techniques and a greater rate of insecticide and pesticide adoption are considered to minimize supply pressure and food demand by yielding ample manufacturing. The rising prevalence of insect attacks and crop diseases has surged the demand for the manufacturing of high-quality crops, and due to this, the demand for insecticides and pesticides has increased. Therefore, these are major factors responsible for driving the growth and demand for the agricultural surfactants market.

Increasing demand for green solutions

The increasing demand for eco-friendly, sustainable solutions is driving substantial growth in the market. Agribusinesses and farmers are searching for greener solutions to conventional chemical inputs due to the escalating concerns through ecological impact. The ability of agricultural surfactants helps to improve the efficiency of agrochemicals and minimize chemical wastage. These agricultural surfactants focus on application and enable precise fertilizers and pesticides, reducing overflow and environmental spoilation.

The initiative for green solutions is boosting research and development and hard work towards the manufacturing of low-toxicity and biodegradable surfactants, which can further drive market growth. As sustainability becomes a keystone of advanced agriculture, the market is facing considerable growth due to its crucial role in encouraging eco-friendly, responsible practices. These major factors are expected to drive the growth of agricultural surfactants market growth.

The harmful effect of agricultural surfactants

A customer’s choice of food with limited chemical residues has minimized the use of chemical insecticides and pesticides and decreased the agricultural surfactant demand. Customer awareness of the harmful effects of agrochemicals and pesticides can hinder market growth. Fertilizers and organic pesticides have also decreased the demand for agrochemicals and chemical pesticides. Agriculture uses GM seeds, which increase yield with agrochemicals and few pesticides and may limit the growth of the market. These are the major challenges that are expected to restrain the agricultural surfactants market growth.

Cost-effective manufacturing methods

The productivity and costs prevent the commercial bio-based surfactant from producing notable foaming. R&D has surged due to downstream pow productivity, manufacturing foam, and costs. Researchers are working on decreasing foam formation, enhancing production yield, and decreasing raw material prices using oxygen techniques. There are many factors that increase bio-based surfactant output, including computer modeling, control of growing conditions (growth medium, pH, and temperature), and genetic alterations. During agitation and aeration, bioreactors manufacture bio-based surfactants, which further produce notable foaming.

Low-cost substrates like waste materials like soybean oil refinery, waste fatty acids, waste glycerin, and biodiesel production reduce the bio-based surfactant synthesis prizes. These are the major opportunities that may drive the agricultural surfactants market growth in the coming years.

The non-ionic surfactant segment dominated the agricultural surfactant market in 2024. Non-ionic surfactants are strong tools in advanced agriculture and contribute notably to boosting nutrient management, soil treatment, and crop protection. They offer several advantages, but their sustainability must be ensured to ensure minimum environmental impact. Future developments in non-ionic surfactant technology will doubtlessly continue to shape and support the improving platform of sustainable agriculture.

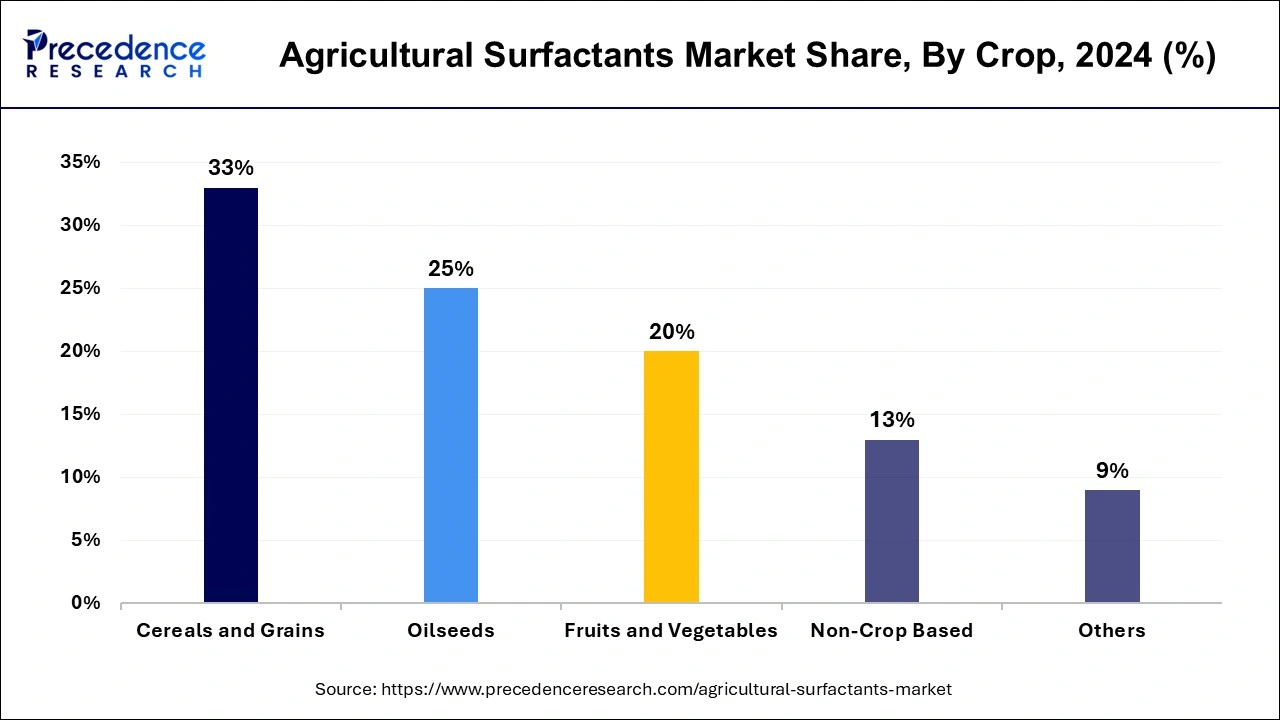

The grains and cereals segment dominated the agricultural surfactants market in 2024 due to their economic significance and rapid spread of cultivation. These grains and cereals cover the largest portion of agriculture manufacturing. Agricultural surfactants play a crucial role in enhancing pesticide quality by improving absorption, spreading, and adhesion on grain and cereal surfaces. The demand for higher crop efficiency to feed the rising population highlighted the importance of accurate agrochemical application.

The demand for agrochemical development has become growing grains and positioning cereals are the major benefits of surfactant technology. In addition, the huge availability of sugarcane bagasse, especially in regions with a lot of sugar manufacture, offers renewable and cost-effective resources for agricultural surfactant production. These grains and cereals segments are expected to drive the growth of the agricultural surfactants market.

The wetting agents are expected to grow fastest in the forecast period. Reapplication of wetting agents during crop making helps reduce wetting issues after crops leave the protective enclosure of the greenhouse production facilities. Moreover, saturating with a wetting agent gives priority to shipping and can highly minimize the plant stress associated with retail exhibits, which eventually benefits the customer. Wetting agents used at low costs constantly offer the best insurance against wetting problems. In addition, reapplication of wetting agents permits the plant to use 100% of the rising medium for nutrients and water to minimize plant stress and enhance plant health. Therefore, the wetting agent is the significant segment expected to drive the agricultural surfactants market growth.

The herbicides dominated the market in 2024. Herbicides clear weeds that would be competitive for nutrients, moisture, and light with the crops, affecting the quantity and quality of the products. Herbicides can be positively used in different crop positions. They can get rid of deep-seated weeds. A combination of chemical herbicides might be essential for effective weed control. Herbicides prevent weeds from increasing for a long duration.

By Type

By Crop

By Function

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2023

July 2024

July 2024