January 2025

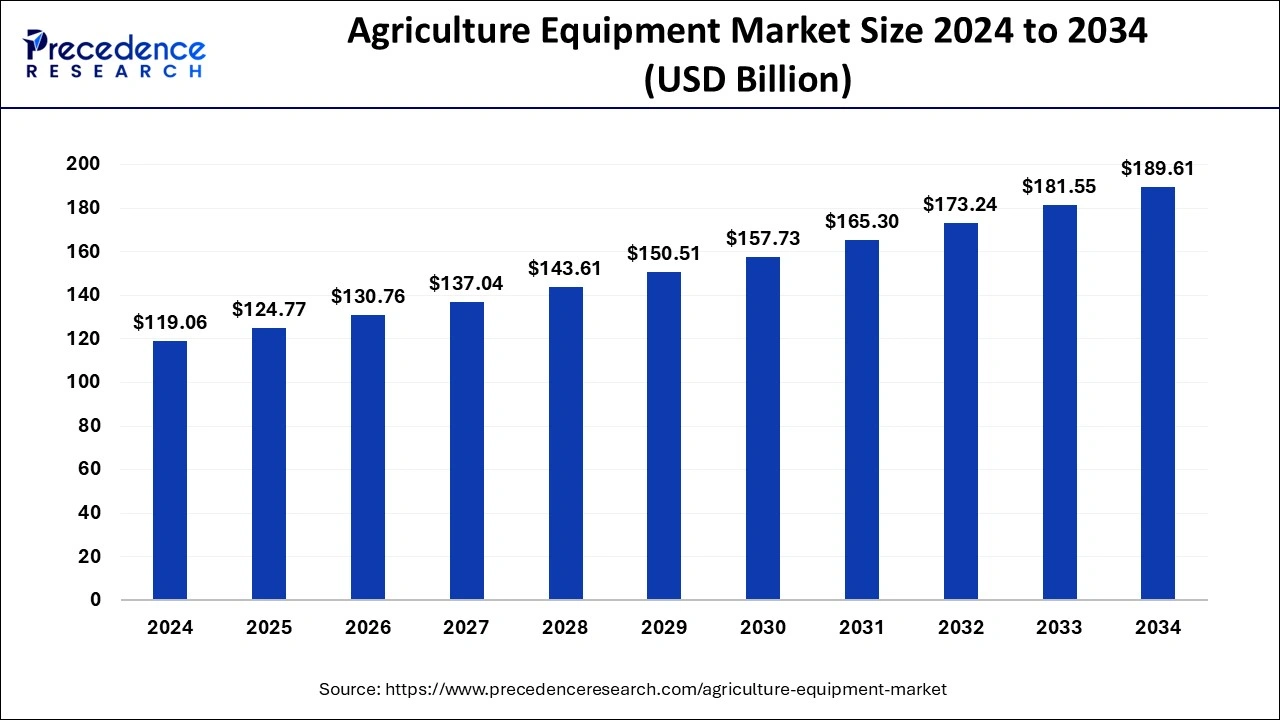

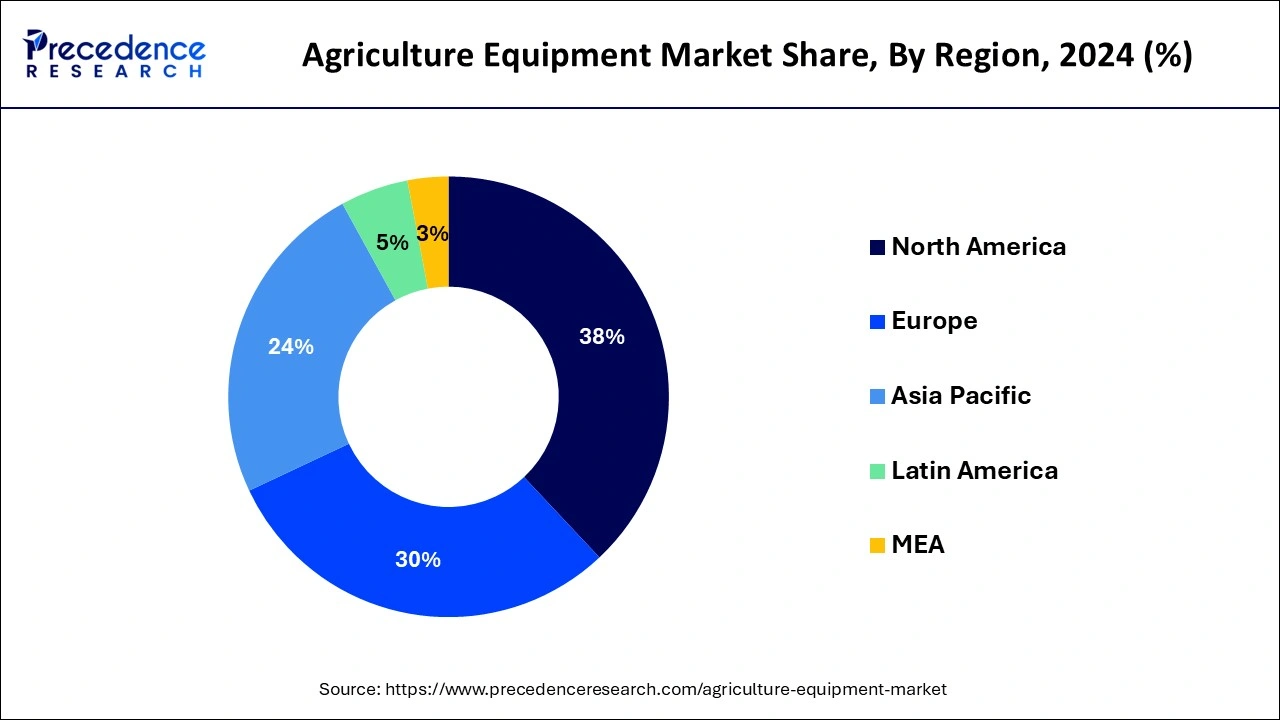

The global agriculture equipment market size is calculated at USD 124.77 billion in 2025 and is forecasted to reach around USD 189.61 billion by 2034, accelerating at a CAGR of 4.80% from 2025 to 2034. The North America agriculture equipment market size surpassed USD 45.24 billion in 2024 and is expanding at a CAGR of 4.84% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global agriculture equipment market size accounted for USD 119.06 billion in 2024, and is expected to reach around USD 189.61 billion by 2034, expanding at a CAGR of 4.80% from 2025 to 2034. The rising demand for tools to help farmers optimise productivity, reduce costs, and satisfy the requirements of the growing population requires adequate tools, which boosts the growth of the agriculture equipment market.

Integration of artificial intelligence into agriculture equipment is best used to conduct labour-intensive farming which spares farmers from indulging in other essential tasks. One of the biggest incorporations of AI in farming is noticed to be automated tractors or self-driving farmer equipment. These driverless tractors have the potential to harvest 24x7 and they are able to withstand any weather conditions resulting in lowering a farmer’s stress. These tractors are lightweight and reduce soil compaction compared to the traditional heavy tractors.

Additionally, the primary function of artificial intelligence is to collect data, analyse it, and make the right decisions benefiting the farmers. The application of AI is diverse in the agricultural industry. Agricultural Bots are a combination of mechanics and software implementation that mitigates the need for manpower. An agricultural bot is applicable at several stages of framing including harvesting, weeding, potting, picking, and spraying, it makes a farmer’s life easier.

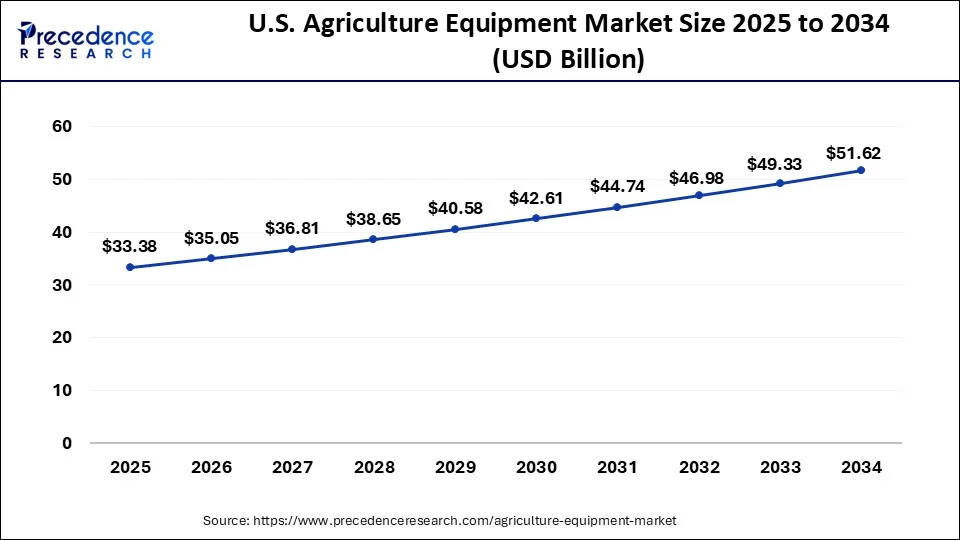

The U.S. agriculture equipment market size was estimated at USD 31.79 billion in 2024 and is predicted to be worth around USD 51.62 billion by 2034, at a CAGR of 5% from 2025 to 2034.

North America accounted the largest revenue share in 2024 and is estimated to sustain its dominance during the forecast period. This is attributed to the increased penetration of automatic equipment in agriculture and higher and faster adoption rate of latest technologies in the region. The increased focus of the government by introducing technological advancements in the agriculture sector has fostered the growth of the agriculture sector in the countries like the US and Canada. Therefore, North America is expected to sustain its position during the forecast period.

The highest agriculture equipment market shares are held by the United States, primarily due to the presence of key players such as John Deere, Case IH, New Holland, Caterpillar Inc., AGCO Corporation and many more, which bring technological innovations such as precision agriculture tools in the industry, the establishment of advanced tractors and harvests benefit the farming industry. With the help of industry leaders, the region is expected to witness the evolving integration of advanced technologies in the future, at both domestic and international levels.

The rising focus towards autonomous and electric vehicles offering more efficient and eco-friendly transport, enhancing the use of GPS and IoT to track real-time data and predict maintenance and logistics is anticipated to boost the market growth in the region.

On the other hand, Asia Pacific was the second largest agriculture equipment market and is expected to grow at a considerable growth rate during the forecast period. Asia Pacific is also forecasted to be the fastest-growing market during the forecast period. This is attributed to the strong and growing economy of the major countries such as China, India, and Indonesia. China itself holds a major market share of over 30%. Further, the rising awareness, higher population, increased dependency of the majority of the population on agriculture, and growing government initiatives to boost the agricultural development are the major factors that made Asia Pacific the dominant and the fastest-growing market for the agriculture equipment in the global market.

The agriculture equipment market is propelling in China with the encouragement of Chinese government strategies which ensure the food is sufficient for the increasing population. China is also under top country for agriculture imported worldwide which includes land-intensive bulk commodities such as soybeans, sorghum and cotton, along with that China is increasingly meeting the demand for beef and beef products imported with an annual 48% of importers.

The agriculture equipment is a significant tool used in the cultivation of crops to obtain higher yield by applying minimum efforts in farms. The growing population in developing and developed economies is a major factor building a pressure on the food supply chain due to the increasing demand for the agricultural food. The agriculture equipment such as tractors, harvesters, and crop processing equipment are increasing used in the agricultural activities across the globe to gain higher volume of yields faster and with minimal efforts. This is a primary driver of the global agricultural equipment market. Further, this agriculture equipment helps to reduce labor cost. Especially, the semi-automatic and automatic agriculture equipment helps to provide work efficiency and eliminate the use of excess labor, thereby propelling the demand for the agriculture equipment across the globe.

The technological advancements in the field of agriculture equipment and rising mechanization of different agricultural activities have fostered the development of various modern and automatic agriculture equipments. Further, the rising awareness regarding the benefits of using modern mechanized agriculture equipment has fostered the demand for the agriculture equipment among the farmers, all over the globe. The increasing demand for agricultural food from the food and beverage industry coupled with the rising population and increased demand for food has significantly propelled the demand for the agriculture equipment in order to produce higher yields in a short time period.

| Report Coverage | Details |

| Market Size in 2024 | USD 119.06 Billion |

| Market Size in 2025 | USD 124.77 Billion |

| Market Size by 2034 | USD 189.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By Automation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The tractors segment led the market with notable revenue share of more than 25% in 2024 and is expected to retain its dominance throughout the forecast period. This is attributed to the increased use of tractors in the primary and basic agriculture activities such as ploughing, harvesting, sowing, harrowing, and transporting.

On the other hand, the harvesting segment is expected to hit fastest CAGR during the forecast period. The increasing trend of mechanization is expected to propel the growth of the harvesters segment. Harvesters help in higher yields with limited dependency of the labors.

The land development segment dominated largest revenue share of more than 20% in 2024 and is expected to retain its dominance over the forecast period. The higher dependency on the labor as agriculture is a time taking process and labor-intensive sector is major factor behind the growth of this segment. The increasing cost of labor coupled with the lack of labor is fostering the growth of this segment.

On the other hand, the plant protection segment is estimated to witness highest CAGR during the forecast period. This is due to the growing importance of plant protection. The increasing demand for food and the higher yields are obtained by implanting proper modern mechanized equipment for protecting the plants.

The manual segment led the market with largest revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the extensive use of labor in the major agriculture based developing and underdeveloped economies. Agriculture is a labor-intensive industry and hence the higher usage of labor in agricultural activities from the ancient times had resulted in its higher market share.

On the other hand, the automatic segment is expanding with a fastest growth rate in the market over the forecast period. The rising awareness regarding the benefits of using automatic agriculture equipment such as less labor, cost saving, and higher yields are the major factors that is expected to boost the adoption of the automatic agriculture equipment during the forecast period.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improvedproducts. Moreover, they are also focusing on maintaining competitive pricing.

In September 2019, CNH Industrial opened its service center in China. This development was focused on the expansion of the business in China and to deliver the products and services at less time to the customers.

This type of strategical developments adopted by the key players operating in the global agriculture equipment market will open new avenues and opportunities of growth during the forecast period.

By Product Type

By Application

By Automation

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

September 2024