July 2024

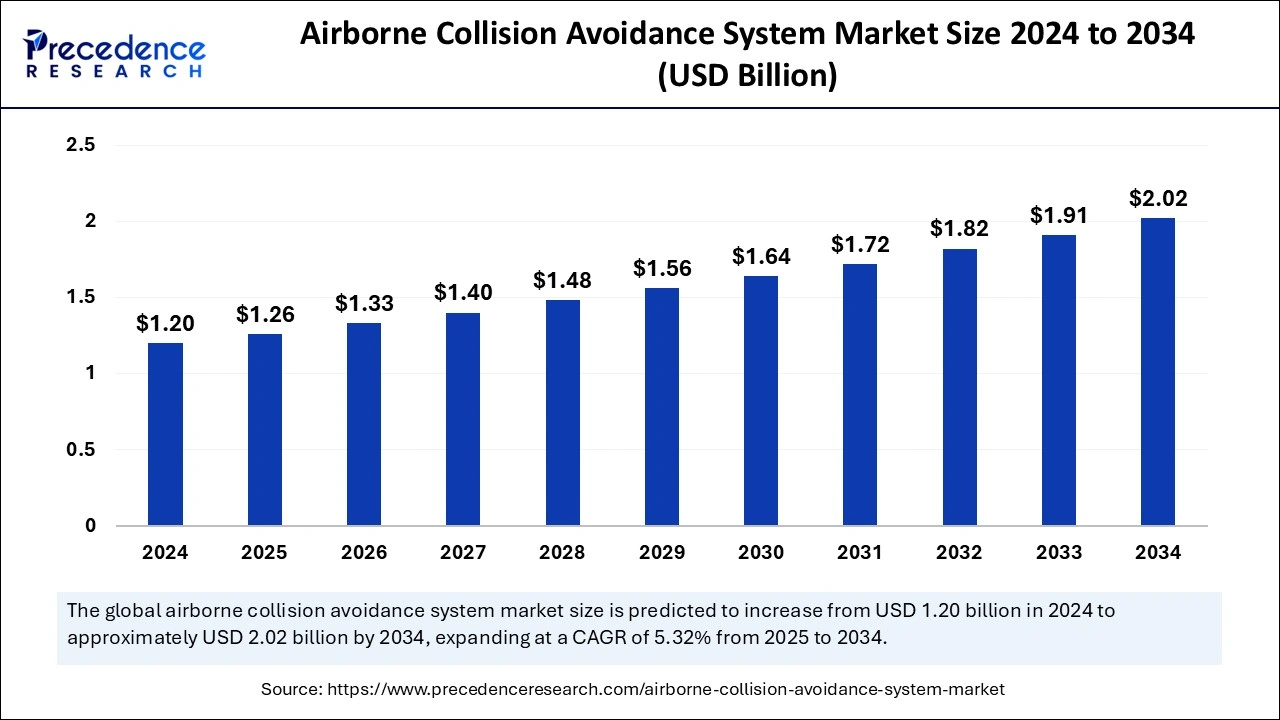

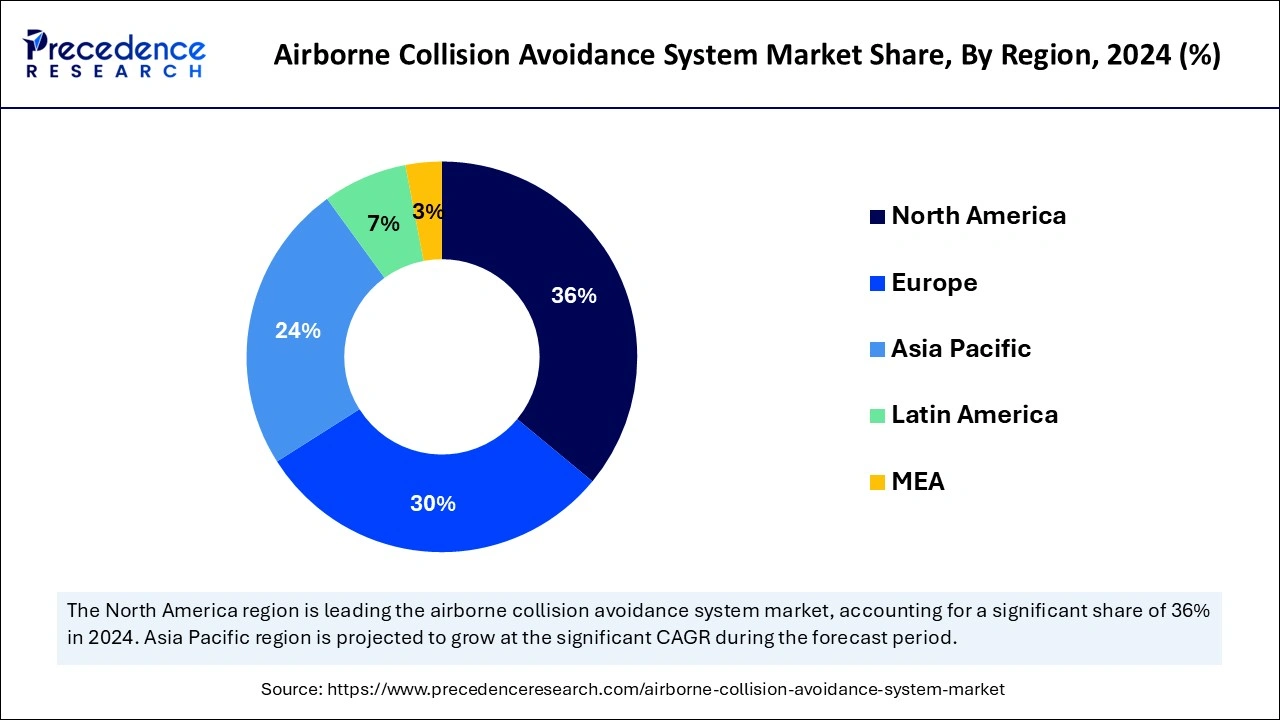

The global airborne collision avoidance system market size is calculated at USD 1.26 billion in 2025 and is forecasted to reach around USD 2.02 billion by 2034, accelerating at a CAGR of 5.32% from 2025 to 2034. The North America market size surpassed USD 430 million in 2024 and is expanding at a CAGR of 5.57% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global airborne collision avoidance system market size was estimated at USD 1.20 billion in 2024 and is predicted to increase from USD 1.26 billion in 2025 to approximately USD 2.02 billion by 2034, expanding at a CAGR of 5.32% from 2025 to 2034. The airborne collision avoidance systems market is affected by increased air traffic, stricter safety regulations, and technological advancements.

The airborne collision avoidance system uses artificial intelligence to detect other aircraft through real-time data analysis, which goes beyond traditional ACAS capabilities in the identification and avoidance of mid-air collisions. The airborne collision avoidance system market experienced growth because advanced sensor technologies and data processing with AI capabilities have transformed the market dynamics. Improved sensor technology enables better detection abilities to deliver dependable and precise data results.

Flight safety benefits significantly from AI integration because it provides advanced collision threat predictions with adaptive response capabilities. The expanding needs of the modern aviation industry prompt airlines and aircraft manufacturers to adopt state-of-the-art collision avoidance equipment. The innovations improve aviation safety standards and drive up airborne collision avoidance system market penetration.

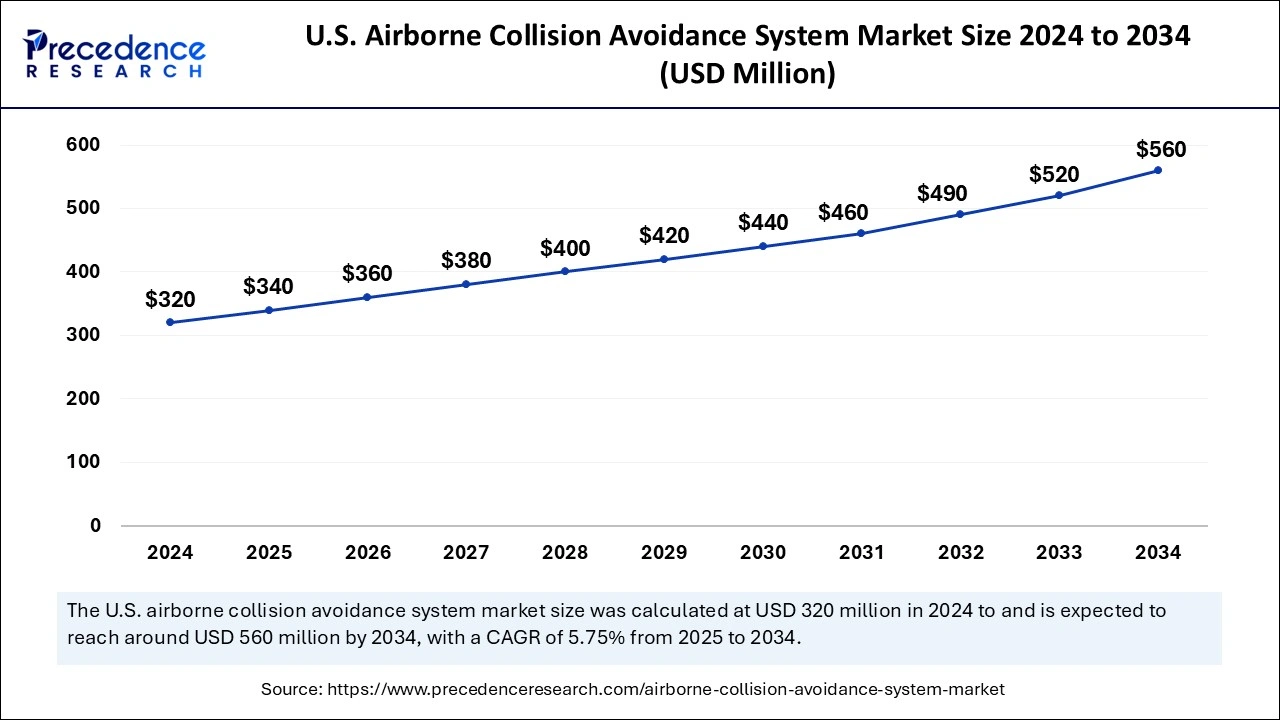

The U.S. airborne collision avoidance system market size was exhibited at USD 320 million in 2024 and is projected to be worth around USD 560 million by 2034, growing at a CAGR of 5.75% from 2025 to 2034.

North America accounted for the largest market share in 2024. The adoption of ACAS systems has increased in the United States and Canada because airlines focus on implementing state-of-the-art safety technology. Expansion in the airborne collision avoidance system market is driven by Federal Aviation Administration (FAA) requirements about safety standards and their ongoing advancements in air traffic management systems.

Sophisticated ACAS technologies are essential as the regional aviation sector is growing quickly, even though safety regulations are stringent. The increase in collision avoidance systems is directly linked to the rise in air traffic trends within both commercial and private aviation sectors. The integration of key players' technological innovation initiatives and industry research activities propels the growth of North America's airborne collision avoidance system market.

Asia Pacific is anticipated to witness the fastest growth in the airborne collision avoidance system market during the forecasted years because of its strong economic growth and rising population. An increasing middle class is fueling the demand for aviation services, resulting in the growth of aircraft operations and the development of infrastructure. The growing number of air passengers receives support from government-owned investments that focus on airport modernization and air traffic management technologies to ensure safe operations.

The major economic powers include China, South Korea, and India. These nations augmented their defense infrastructure budget and simultaneously initiated programs to enhance air transportation capabilities and space science development. The area executes strategic plans aimed at transforming into a global aviation center while also boosting local industries and enticing international investments for regional development growth.

Airborne collision avoidance systems (ACAS) represent high-tech safety equipment used for protecting aircraft from mid-air accidents. A risk is identified by the system, and it instantly provides pilots with the necessary information and appropriate drills to maintain a safe distance from other aircraft. It enhances both situational awareness and operational decisions for aircraft performing in crowded airspace, and the system delivers substantial improvements in flight safety. The system is used throughout commercial airliner fleets and military aircraft with both manned and unmanned aerial vehicles to represent a vital element in aviation security systems.

The global airborne collision avoidance system industry is experiencing growth due to growing air traffic, regulatory mandates, and the growth of UAV usage. The airborne collision avoidance system market will experience development through factors such as expanding aviation sectors in emerging regions and the development & integration of next-generation technologies. The rapid growth of worldwide air traffic requires modern collision detection systems that push forward sales within aviation safety markets. Increased operational safety requirements because of rising air traffic compel companies to invest in better systems to fuel market growth and sales expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.02 Billion |

| Market Size in 2025 | USD 1.26 Billion |

| Market Size in 2024 | USD 1.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform, Component, Type, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising aircraft and drone traffic

The airborne collision avoidance system and traffic alert and collision avoidance system provide aircraft safety systems for avoiding mid-air collisions. The drone market growth has driven up the necessity of ACAS as an airspace protection system. The growth of commercial aviation alongside drone technology has increased the demand for airborne safety systems that avert aircraft collisions.

The real-time threat identification and resolution guidance offered by the airborne collision avoidance system market assists in safeguarding aircraft against in-flight collisions. The market has grown quickly due to the increase in commercial flights and drone activities. Furthermore, an increase in aircraft safety has become necessary, so governments are implementing tighter regulations with airborne collision avoidance system requirements for different aircraft types. A growing number of airlines with drone operators choose ACAS due to safety concerns.

High cost of ACAS installation

An airborne collision avoidance system, also known as a traffic alert and collision avoidance system, refers to an aircraft technology that detects potential mid-air collisions with other aircraft and provides pilots with automated instructions to avoid them but installs such a system often comes with a high initial investment, the upfront cost of purchasing and installing the equipment on an aircraft can be substantial, acting as a barrier for some operators, particularly smaller airlines or private pilots, to adopt this safety feature. Significant upfront costs deter prospective buyers from entering the market. Moreover, continuous maintenance costs can burden operational budgets, postponing routine updates and adherence to evolving safety regulations.

Rise of ACAS application in aviation

The growing focus on aviation with expanding air traffic requires better implementation of ACAS technology to maintain aviation safety. The focus on aviation safety encourages airlines to use ACAS as their essential prevention tool against mid-air accidents. The safety requirements of airlines and aviation authorities generate increased demand for sophisticated collision avoidance systems because of their prioritized safety measures.

Modern aviation safety protocols have elevated the necessity for systems like ACAS since aviation industry leaders are making safety their primary priority. Airlines invest in state-of-the-art avionics to improve airspace safety and comply with stringent safety standards. Market expansion occurs due to the increasing adoption of airborne collision avoidance systems.

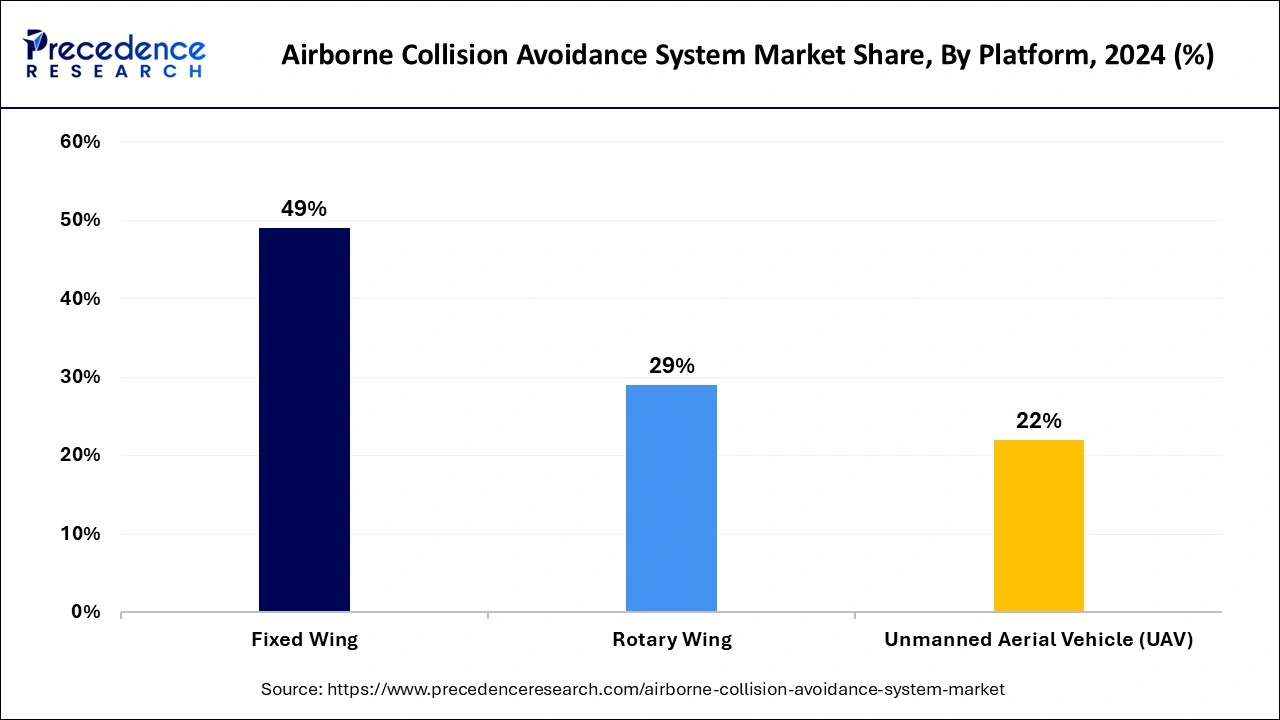

The fixed-wing segment has generated a significant airborne collision avoidance system market share in 2024. The increasing global demand for air travel requires additional aircraft to advanced security systems. The modernized air traffic management systems, along with increased airline fleet growth, primarily in emerging markets, create new demand. Avionics innovations and aircraft retrofit demand lead to rising sales numbers of fixed-wing aircraft that incorporate ACAS systems. The airborne collision avoidance systems platform market in the fixed-wing segment is expanding because commercial aviation operations grow simultaneously with increases in air travel.

The unmanned aerial vehicle segment is projected to witness the fastest growth in the market during the forecast period. UAVs' rising applications across multiple sectors, including logistics, agriculture, surveillance, entertainment, and fuel market expansion. These drive an increasing need for specialized collision avoidance systems that work specifically for unmanned platforms. UAVs gain better airspace system integration through airborne collision avoidance systems, which minimize the hazards they pose in flight. The positive effects on the market result from unmanned aerial vehicle manufacturers and operators focusing on safety standards and airspace congestion solutions. The exponential growth of unmanned aerial vehicles in business and industrial sectors will drive an increased demand for advanced collision systems for these unmanned vehicles. The increasing market demand for UAVs creates an important business opportunity that drives developers to focus on building customized UAV collision avoidance systems.

The processor segment dominated the global airborne collision avoidance system market in 2024. The system manages flight data through its pivotal position. An airborne collision avoidance system processor that operates like a system brain to determine necessary actions and aircraft collision avoidance by processing airspace data while providing instant alerts to the pilot. Advanced processors have become necessary because the drive to add advanced AI and machine learning capabilities into collision avoidance systems continues to grow steadily. The expanding worldwide commercial aviation manufacturing requires the implementation of dependable processors to sustain the essential growth of this industry segment.

The ACAS II and TCAS II segments noted the largest market share in 2024. The developments concern regulations that enforce their installation on large aircraft and commercial fleets to support aviation security. The ACAS II and TCAS II serve as safety systems that prevent mid-air aircraft collisions. Guidance for pilots and aircraft tracking through radar and communication signals stands among their operational capabilities. The growing air traffic patterns in markets require better collision avoidance solutions due to increased operational requirements. Future market demand will surge substantially because commercial airspace is expanding and airlines are modernizing their aging aircraft fleet. The growing airspace congestion requires stronger reliance on ACAS II and TCAS II systems to detect threats and provide real-time resolution guidance because these systems maintain their vital position within future aviation safety mechanisms.

The original equipment manufacturer segment generated a significant share in the airborne collision avoidance system market in 2024. The aircraft manufacturing industry maintains steady expansion, which drives its development. Modern aircraft receive next-generation collision warning systems when they exit production facilities because these safety features satisfy mandatory standards and boost commercial performance. Emerging markets generate increased demand for new aircraft, which supports the necessity for these advanced systems. The demand for cutting-edge safety systems from aviation safety advances requires original equipment manufacturers to lead the integration of essential safety features in their product designs.

The industrial safety segment is estimated to witness the fastest growth during the forecast period. The increase in aircraft aftermarket component requirements has encouraged this trend during the maintenance and upgrade of aircraft equipment. After delivering new aircraft to airlines, the manufacturer provides these components. The aftermarket sales channel mainly focuses on providing ACAS upgrades or replacements to current aircraft that did not have the technology initially, frequently aimed at older aircraft fleets wanting to boost safety by incorporating collision avoidance systems.

By Platform

By Component

By Type

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

July 2024

August 2024