January 2025

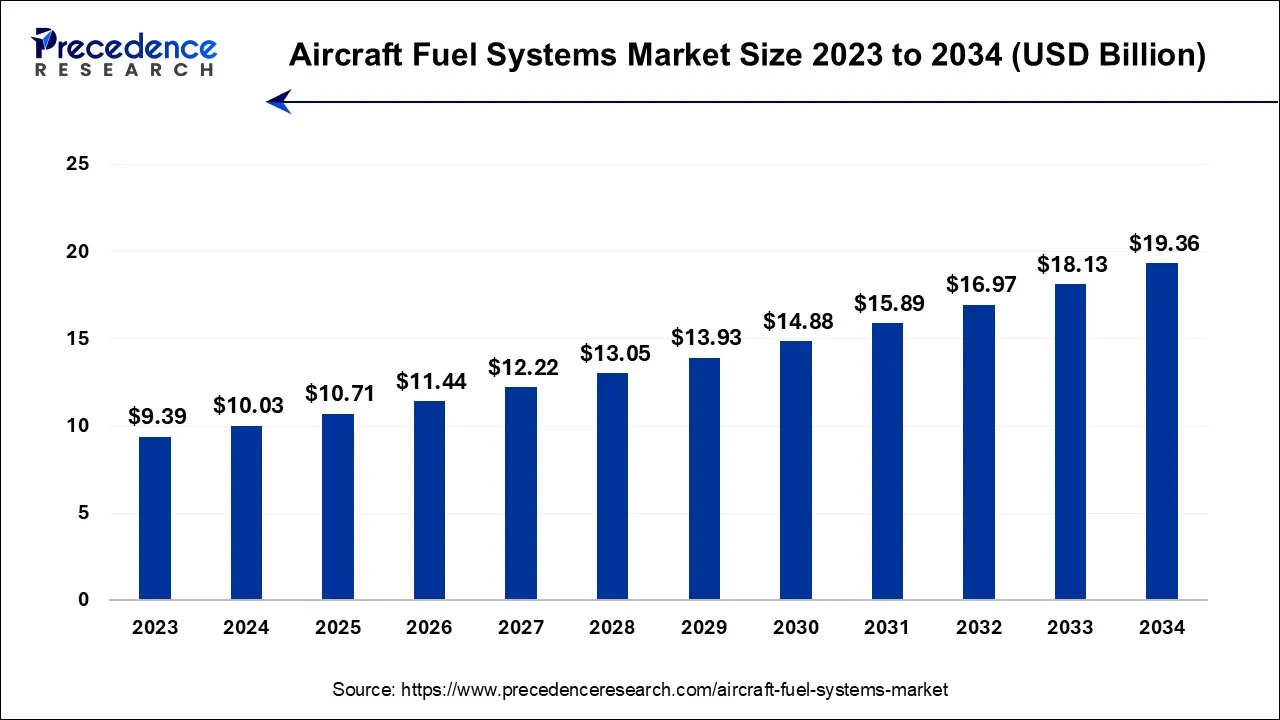

The global aircraft fuel systems market size is calculated at USD 10.03 billion in 2024, grew to USD 10.71 billion in 2025, and is predicted to hit around USD 19.36 billion by 2034, poised to grow at a CAGR of 6.8% between 2024 and 2034.

The global aircraft fuel systems market size is expected to be valued at USD 10.03 billion in 2024 and is anticipated to reach around USD 19.36 billion by 2034, expanding at a CAGR of 6.8% over the forecast period from 2024 to 2034.

An aircraft fuel system is a complex network of components and equipment designed to store, manage, and deliver fuel to the aircraft's engines safely and efficiently. Its key responsibility is to offer the essential fuel to power the engines, safeguarding the aircraft's operation during flight. It includes various components such as fuel pumps, fuel lines, fuel tanks, filters, valves, and sensors. These components work together to supply fuel to the engines at the appropriate pressures and flow rates, accounting for factors such as speed, altitude, and engine demands. The fuel system also preserves the fuel's quality by eliminating contaminants and avoiding issues such as fuel freezing at high altitudes. Thus, a well-designed and maintained aircraft fuel system is crucial for the safety and reliability of aviation operations.

The aircraft fuel system market is the segment of the aviation industry focused on the production, sales, and maintenance of equipment and components related to aircraft fuel systems. The market includes a wide range of products and services aimed at ensuring the safe and effective delivery of fuel to aircraft engines. As the aviation industry continues to develop and advance fuel efficiency, reduce emissions, and enhance safety, the aircraft fuel system market plays a crucial role in solving innovative solutions to meet objectives.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.8% |

| Market Size in 2024 | USD 10.03 Billion |

| Market Size by 2034 | USD 19.36 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Application, By Engine, By Type, and By Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in demand for sustainable aviation fuel (SAF)

As environmental concerns and regulatory pressures to reduce carbon emissions intensify, the aviation industry is actively seeking ways to mitigate its environmental impact. SAF, which is derived from renewable sources and produces lower carbon emissions compared to traditional jet fuels, has emerged as a key solution.

The adoption of SAF necessitates modifications and enhancements to aircraft fuel systems. SAF often has different properties compared to conventional aviation fuels, requiring adjustments to fuel system components and materials to ensure compatibility and optimal performance. These adaptations present a substantial opportunity for the aircraft fuel system market, as manufacturers and suppliers develop specialized systems capable of handling SAF.

Airlines and aircraft operators are progressively integrating SAF into their operations to meet sustainability goals and reduce their carbon footprint. This shift fuels demand for aircraft fuel systems that can efficiently store, manage, and distribute SAF. It opens the door to innovation in fuel system technology, materials, and components designed to accommodate the unique characteristics of SAF.

As the aviation industry makes strides toward increased SAF usage, the aircraft fuel system market stands to benefit from the growing demand for SAF-compatible systems. This alignment with environmental sustainability objectives not only enhances the market's growth prospects but also contributes to a greener and more responsible aviation sector. In conclusion, the surge in SAF demand not only aligns with environmental goals but also serves as a driving factor for the aircraft fuel system market, creating opportunities for innovation and industry advancement.

Fluctuating fuel prices

The aviation industry is highly sensitive to variations in fuel costs, as fuel represents a significant portion of airlines' operational expenses. When fuel prices are high and unpredictable, airlines tend to focus on cost-cutting measures, including deferring investments in new, more fuel-efficient aircraft and related fuel systems. This can lead to delays in fleet upgrades, reducing the immediate demand for advanced fuel systems.

Moreover, during periods of volatile fuel prices, airlines may prioritize short-term cost-saving measures over long-term investments in fuel-efficient technologies, such as upgrading their existing aircraft with more advanced fuel systems. This can slow down the adoption of cutting-edge fuel system components and materials, affecting market growth.

In addition, the uncertainty and financial pressures stemming from fluctuating fuel costs can impact airlines' overall profitability and financial stability. In such circumstances, airlines may have limited resources available for capital expenditures, including investments in new or upgraded fuel systems. To mitigate these challenges, companies in the aircraft fuel system market must develop cost-effective, highly efficient solutions that offer tangible and rapid returns on investment.

Furthermore, industry stakeholders need to closely monitor fuel price trends and work collaboratively to address the economic challenges presented by fuel price fluctuations, ensuring the long-term sustainability of the market.

Growth in global air travel demand

With more people choosing air travel for business, tourism, and personal reasons, airlines are consistently expanding their fleets to meet this surging demand. To ensure efficient and sustainable aviation operations, the industry is increasingly focused on adopting advanced fuel-efficient aircraft. This paradigm shift requires cutting-edge fuel systems that can optimize fuel consumption, enhance overall performance, and contribute to reduced emissions.

As airlines seek to balance economic efficiency and environmental responsibility, the aircraft fuel system market is uniquely positioned to provide innovative solutions. These solutions may include next-generation fuel pumps, advanced fuel tanks, and state-of-the-art fuel management software. All these components play a vital role in achieving better fuel efficiency and meeting stringent emissions standards.

Moreover, as the aviation sector embraces technological advancements and alternative fuels like sustainable aviation fuel (SAF), there is a growing need for adaptable fuel systems capable of handling these evolving requirements. This dynamic landscape creates a substantial opportunity for manufacturers and suppliers in the aircraft fuel system market to develop and provide cutting-edge solutions that meet the evolving demands of the aviation industry. In conclusion, the exponential growth in global air travel demand not only signifies a significant market opportunity but also drives innovation and efficiency in aircraft fuel systems, ultimately contributing to the sustainability and advancement of the aviation sector.

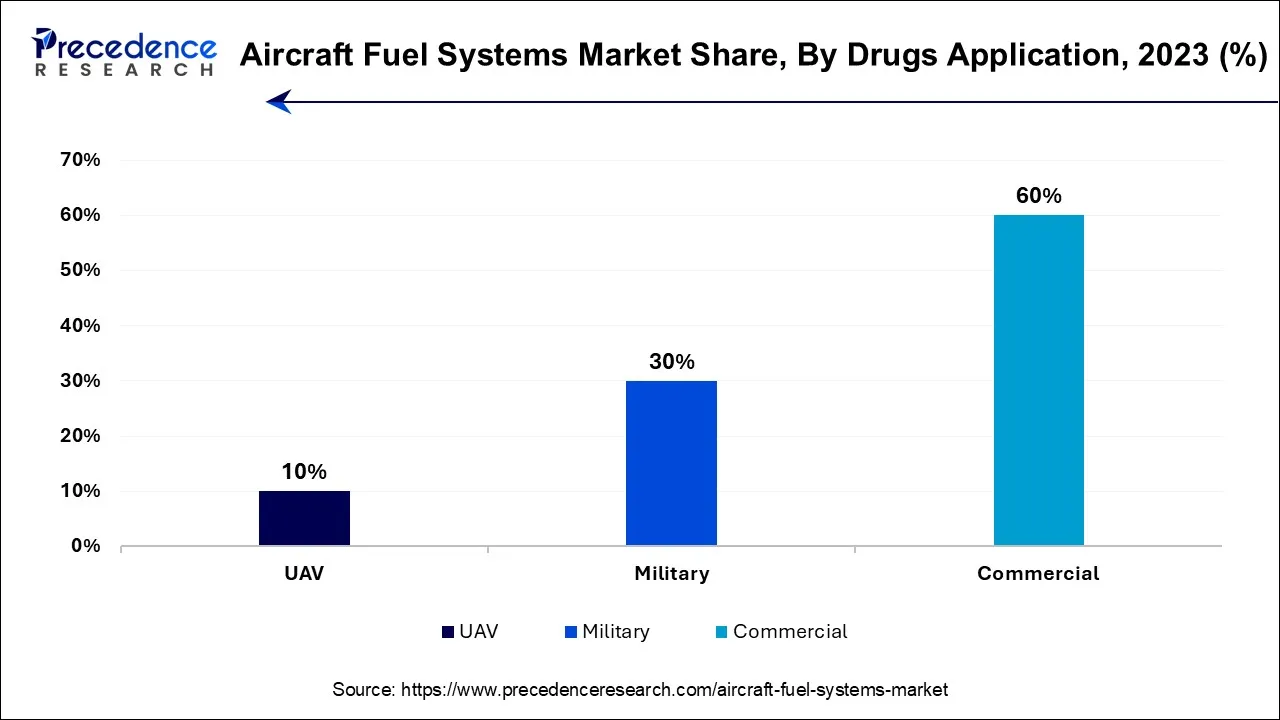

According to the application, the commercial segment has held the highest revenue share of 60% in 2023. Commercial aircraft, used for passenger and cargo transportation, prioritize efficiency, safety, and environmental compliance. Fuel systems in commercial aircraft are designed to optimize fuel consumption, reduce emissions, and ensure the safety of passengers and crew. Commercial airliners have large fuel tanks and sophisticated management systems to balance fuel load during flight. The aviation industry's focus on sustainability has led to increased research and development of fuel-efficient systems, as well as the exploration of sustainable aviation fuels (SAF).

The UAV segment is anticipated to expand fastest over the projected period. UAVs, including drones and remotely piloted aircraft, rely on fuel systems to power their engines or propulsion systems. These systems can vary significantly in size, capacity, and technology, depending on the specific application of the UAV. Some UAVs use internal combustion engines and traditional aviation fuels, while others employ electric or hybrid systems. The fuel system in UAVs is crucial for mission endurance, range, and operational effectiveness.

In 2023, the jet aircraft engine segment had the highest market share on the basis of the engine type. Jet engines are commonly used in both military and commercial aircraft. They operate on the principle of jet propulsion and are known for their high-speed, high-altitude performance. Fuel systems for jet engines must provide a steady and precise supply of aviation fuel at the required flow rates and pressures. These systems are essential for the efficient and safe operation of modern aircraft, which often include features like thrust-reversers and afterburners.

The UAV engine segment is anticipated to expand fastest over the projected period. Unmanned Aerial Vehicle (UAV) engines encompass a wide range of propulsion methods, including internal combustion engines, electric motors, and even hybrid systems. Fuel systems for UAV engines are adapted to the specific requirements of the UAV, taking into account factors like size, weight, endurance, and mission objectives. Some UAVs use traditional aviation fuels, while others employ alternative power sources.

In 2023, the fuel injection system segment had the highest market share on the basis of the technology and is anticipated to rapidly expand over the projected period. Fuel injection systems are more advanced and commonly used in modern aircraft, especially in reciprocating (piston) engines. These systems precisely control the amount of fuel delivered to the engine's combustion chambers. Fuel injection improves fuel efficiency, engine performance, and emissions control compared to carbureted systems. It is crucial for optimizing fuel-air mixture ratios, enhancing engine reliability, and reducing fuel consumption. Fuel injection systems are typically found in general aviation aircraft, business jets, and turboprop aircraft.

In 2023, the inerting systems segment had the highest market share on the basis of the engine type. Inerting systems are designed to reduce the risk of fuel tank explosions caused by the buildup of flammable vapors. By replacing oxygen with an inert gas, these systems enhance safety during flight and in emergency situations.

The piping segment is anticipated to expand fastest over the projected period. Piping or fuel lines transport fuel from the aircraft's fuel tanks to the engines. These lines must be designed to withstand various environmental factors, including temperature fluctuations and pressure changes. They are essential for maintaining a constant flow of fuel and ensuring it reaches the engines without leakage or contamination.

North America has held the largest revenue share in 2023. North America is a global hub for aircraft manufacturing, with major companies like Boeing, Lockheed Martin, and Bombardier having a significant presence in the region. These manufacturers drive the demand for advanced fuel systems for both commercial and military aircraft. The North America aircraft fuel systems market benefits from the region's prominence in both military and commercial aviation, as well as its commitment to innovation, environmental responsibility, and safety in aviation operations. The demand for advanced and efficient fuel systems is expected to remain strong as the aerospace industry continues to evolve and expand in the region.

Asia Pacific is estimated to observe the fastest expansion. The region is home to some of the world's largest and fastest-growing airlines. To meet this increasing demand, airlines are investing in more fuel-efficient aircraft, driving the market for advanced fuel systems. Several countries in Asia Pacific such as China and India have substantial defense budgets, leading to the procurement of modern military aircraft with specialized fuel systems. The need for fuel efficiency and operational capabilities presents opportunities for fuel system providers across the region.

The Europe aircraft fuel systems market is a vital component of the continent's aerospace and aviation industry. Europe boasts of a rich history of aviation, with a strong presence in both commercial and military sectors. The region's thriving aerospace industry, coupled with its dedication to technological advancement and environmental responsibility, ensures a steady demand for advanced and efficient fuel systems that meet the evolving needs of the aviation sector.

Segments Covered in the Report

By Application

By Engine

By Type

By Component

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

January 2025

January 2025