February 2025

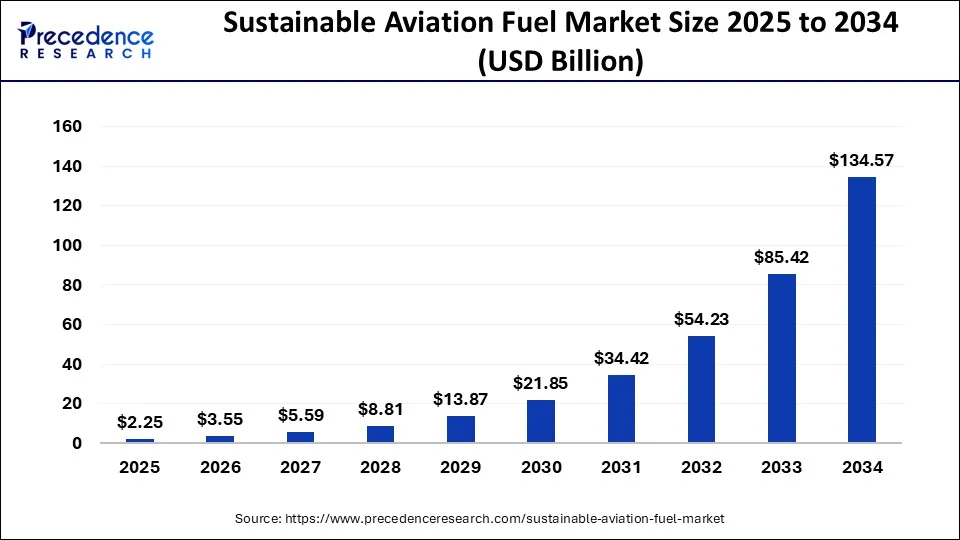

The global sustainable aviation fuel market size accounted for USD 1,250.78 million in 2024, grew to USD 1,780.99 million in 2025, and is expected to be worth around USD 42,852.45 million by 2034, poised to grow at a CAGR of 42.39% between 2024 and 2034. The North America sustainable aviation fuel market size is predicted to increase from USD 375.23 million in 2024 and is estimated to grow at the fastest CAGR of 42.63% during the forecast year.

The global sustainable aviation fuel market size is expected to be valued at USD 1,250.78 million in 2024 and is anticipated to reach around USD 42,852.45 million by 2034, expanding at a CAGR of 42.39% over the forecast period from 2024 to 2034.

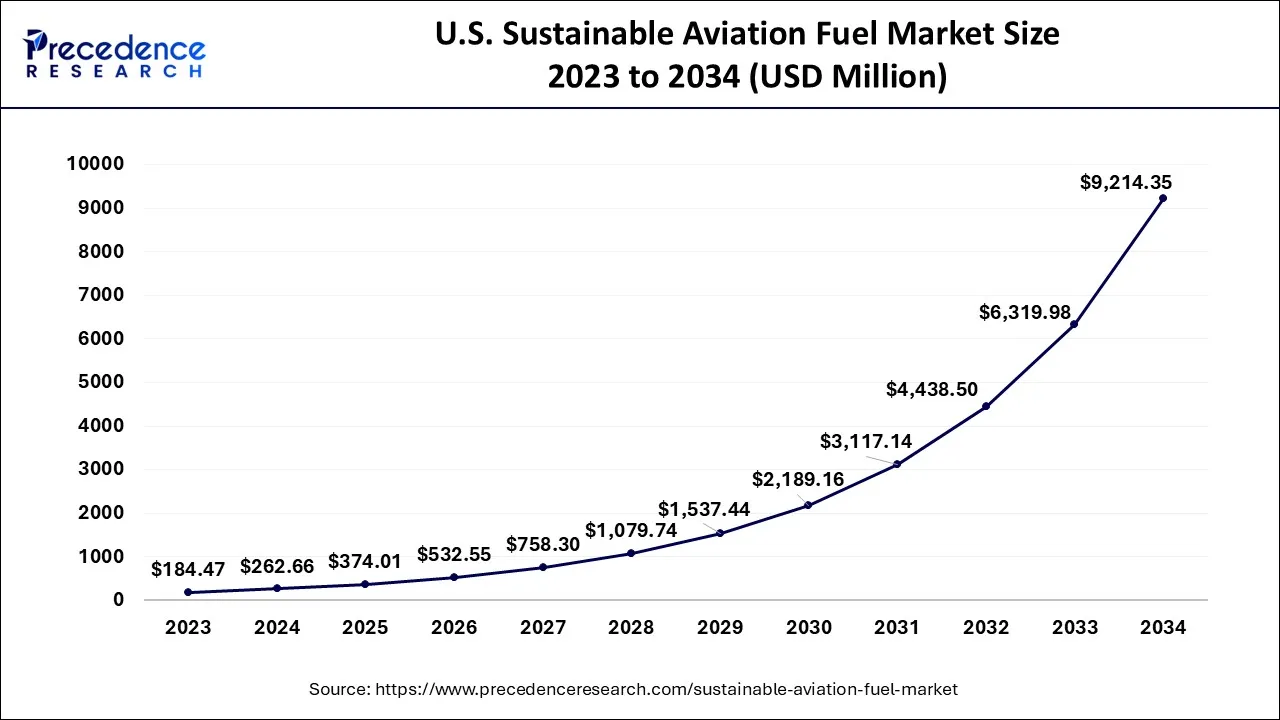

The U.S. sustainable aviation fuel market size was valued at USD 262.66 million in 2024 and is expected to reach USD 9,214.35 million by 2034, growing at a CAGR of 42.73% from 2024 to 2034.

North America was the major market for worldwide sustainable aviation fuel. Due to increased air traffic and passengers, North America leads the market for sustainable aviation fuel. Additionally, the accelerated adoption of advanced techniques and initiatives by the government to encourage the use of sustainable aviation fuels contribute to the region's market growth.

Furthermore, the Asia-Pacific is predicted to grow at the fastest rate of more than 60.1% during the forecast timeframe. This expansion is due to the proliferation of low-cost airlines and the rapid advancement of infrastructure in emerging economies. Furthermore, rising public and private spending on developing aviation facilities in developing economies will aid market growth over the projected period.

| Report Coverage | Details |

| Market Size in 2024 | USD 1,250.78 Million |

| Market Size by 2034 | USD 42,852.45 Million |

| Growth Rate from 2024 to 2034 | CAGR of 42.39% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Fuel Type, By Technology, By Biofuel Blending Capacity and By Aircraft Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

There is an increasing need to reduce GNG production in the aviation sector.

The rising number of air travelers is connected to a rise in emissions of carbon dioxide in the aviation sector. The carbon capture technique is being actively adopted by governments around the world in an attempt to cut CO2 emissions. Increased SAF utilization decreases carbon dioxide emissions in the aviation business, driving the worldwide market.

To accomplish net zero emissions, the aircraft industry must reduce emissions by approximately 65% by 2050. SAF reduces carbon dioxide emissions by approximately 80% over the value chain of the fuel, especially in comparison to jet fuel, based on the renewable raw material used, method of production, and distribution network to the aircraft.

Increased airline passenger traffic combined with rising disposable income

Most passengers worldwide choose to travel by air over traditional modes of transport like road and sea because it is the safest and fastest means of transportation, with very few canceled flights. This allows airline travel to be more dependable than other transportation methods and provides a more comfortable trip.

Despite the high cost, customers prefer air travel due to increased disposable income and shorter travel times. Furthermore, according to data published by the International Civil Aviation Organization (ICAO), airlines carried 4.3 billion passengers. Moreover, the percentage of airline travelers is anticipated to exceed 10 billion by 2040, entailing the requirement for more airplanes to transport travelers from point A to point B.

Inadequate feedstock as well as refinery availability to meet up SAF future requirements

Raw materials for alternative aviation fuels such as synthetic fuels, e-fuels, and bio-jet fuels include non-biological and biological resources such as sugar crops, oil crops, waste oil, algae, and so on. The insufficient raw material supply needed for the production of sustainable aviation fuels may bring the market to a halt.

Furthermore, the lack of refineries, which play an important role in properly utilizing these feedstocks, contributes to the overall procedure of SAF manufacturing. Furthermore, the scarcity of fuel imposes an obstacle to the fuel's blending capacity, resulting in less efficiency.

SAF's drop-in capability boosts its demand to decrease its carbon footprint

SAF is a fully exchangeable drop-in fuel after blending with petroleum-based fuel. Depending on the methods, technological frameworks, and feedstocks employed in production, these fuels may also be referred to as alternative jet fuels, synthetic fuels, e-fuels, green fuels, renewable jet fuels, or conventional bio-jet fuels.

Fuels use is not handled differently than existing petroleum fuels, and aviation fuel storage, as well as hydrant systems, are used and save money on development costs. Significant efforts to reuse infrastructure and equipment, as well as co-processing with specific other streams, are potentially being used to reduce capital costs. Drop-in fuel is considered to be similar to traditional jet fuel and is used in existing infrastructure and engines without modification.

On the basis of fuel type, the biofuel sector held the maximum share of the worldwide industry in 2023 and is expected to maintain its supremacy throughout the projected period. The majority of the raw materials used in the production of biofuels are common natural biomass, such as animal manure, charcoal, and fuelwood. These fuels also match the operation of petroleum-based jet fuels while emitting only a trace amount of carbon dioxide.

The increased use of biofuels is expected to drive the global market. This increase is attributed to the increasing focus of governments around the world on tackling the alarming levels of greenhouse gas caused by the aviation industry.

The growing need to develop renewable aviation fuels is propelling the growth of the aviation fuel market's power-to-liquid (PtL) segment. PtL is generated by integrating hydrogen, which is able to separate from water (it's the "H" in H2O), with carbon derived from the environment or industrial effluents gas in a process known as electrolysis. When using energy from renewable sources like solar and wind energy, PtL produces higher area-related yields than biofuels.

The amount of water required for PtL output is also significantly less than that needed for biofuel production. As a result, PtL is viewed as a critical technology for enabling a fully renewable, sustainable, post-fossil fuel source of aviation in the long term while preventing potential risks as well as adverse side effects associated with the energized use of cultured biomass or in land use.

With the largest market share and the highest market revenue, the Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK) sector dominated the market in 2023. Coal, natural gas, or biomass feedstocks have been gasified into syngas of hydrogen and carbon monoxide in the FTSPK process. In the FT reactor, this syngas is enzymatically transformed into a liquid hydrocarbon fuel mixing component. The raw material used in the kerosene process includes wood waste, municipal solid waste, and grass.

Furthermore, by 2030, the hydro-processed fatty acid esters and fatty acids synthetic paraffinic kerosene (HEFA-SPK) sector dominates the market because it produces the majority of commercially available biofuels. The HEFA-SPK sector uses vegetable oil, which is initially oxygenated and then hydrogenated to decompose the lipids compounds into hydrocarbons.

These fatty compounds undergo refinement to produce a variety of liquids that combine further. The increasing adoption of HEFA-SPK technology has a positive impact on the outlook for the Sustainable Aviation Fuel Market.

Business and general aviation, military aviation, unmanned aerial vehicle, and commercial aviation are the aircraft type segments. Military aviation dominated the market in 2023. Military aviation involves both transport and fight aircraft, as well as fixed-wing aircraft, rotary-wing aircraft (RWA), and unmanned aerial vehicles (UAV). This increase is owing to a rise in the defense budget and numerous government plans toward using sustainable aviation fuel.

According to Vision 2030, the Saudi government intends to increase local army equipment expenditure to 50% by 2030 in order to boost local manufacturing. Furthermore, under the "Make in India" proposal, India intends to contribute approximately 64% of its defense budget (about USD 8 billion) to domestic manufacturers.

Furthermore, due to the rising number of passengers traveling by commercial and aircraft flights, the commercial aviation segment is expected to lead the market by 2030. Commercial aircraft are an essential component of the global aviation system, contributing to long-term improvements in economic, social, and environmental conditions.

Furthermore, as aerospace technology advances, the use of lightweight carbon materials in manufacturing, as well as the growing adoption of fuel-efficient airplanes, propel the worldwide commercial aircraft sector.

The biofuel blending capacity is classified as less than 30%, 30% to 50%, and above 50%. In 2023, the 30% to 50% segment dominated the market. The drop-in capability, moderate blend capacity, supply logistics transportation, as well as aircraft fleet allows for lower overall costs while meeting commercial and military aviation capacity demands.

Furthermore, increasing research and development in innovation pathways aids in improving the blending potential of sustainable energy aviation fuel with conventional aviation fuel.

By Fuel Type

By Technology

By Aircraft Type

By Biofuel Blending Capacity

By Aircraft Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

September 2024

January 2025