January 2025

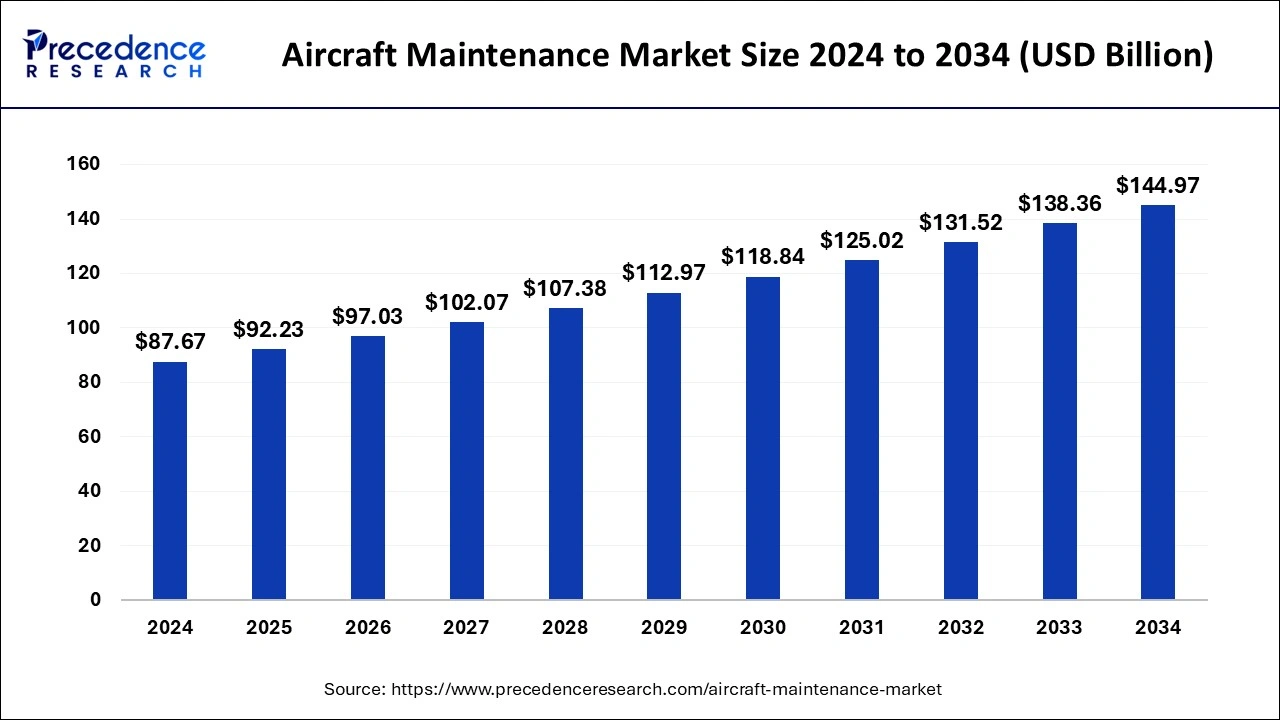

The global aircraft maintenance market size is calculated at USD 92.23 billion in 2025 and is forecasted to reach around USD 144.97 billion by 2034, accelerating at a CAGR of 5.16% from 2025 to 2034. The Asia Pacific market size surpassed USD 28.93 billion in 2024 and is expanding at a CAGR of 5.32% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aircraft maintenance market size accounted for USD 87.67 billion in 2024 and is predicted to increase from USD 92.23 billion in 2025 to approximately USD 144.97 billion by 2034, expanding at a CAGR of 5.16% from 2025 to 2034.

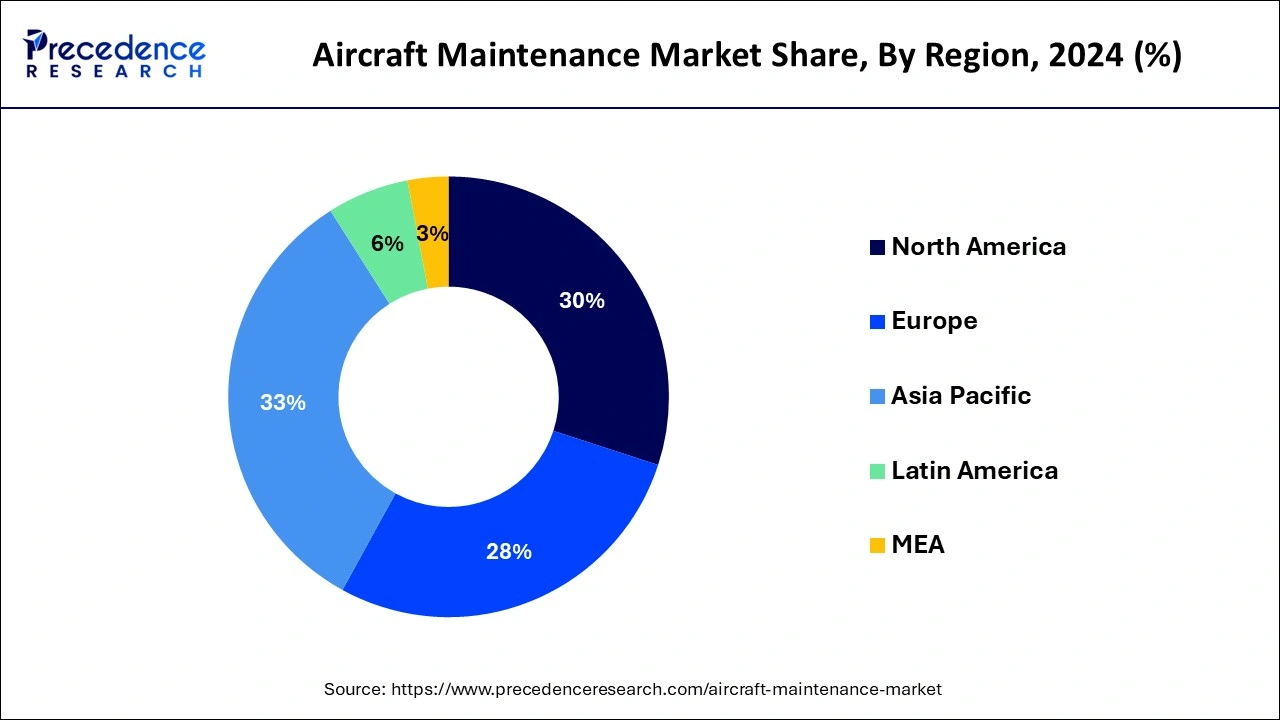

The Asia Pacific aircraft maintenance market size was evaluated at USD 28.93 billion in 2024 and is projected to be worth around USD 48.57 billion by 2034, growing at a CAGR of 5.32% from 2025 to 2034.

Asia Pacific held the largest revenue share in 2024. The Asia Pacific aircraft maintenance market is driven by factors such as the expanding aviation industry, increasing air travel demand, and the modernization of fleets. The region has been one of the fastest-growing aviation markets globally. The rise of middle-class populations, economic growth, and increased connectivity have led to a surge in air travel demand.

North America is estimated to observe the fastest expansion. The region is known for its early adoption of advanced aviation technologies. This includes the incorporation of modern avionics, digital systems, and other innovations that drive the need for specialized maintenance practices. The Federal Aviation Administration (FAA) in the United States sets stringent safety and maintenance standards. Compliance with these regulations is a critical factor for operators, leading to a continuous demand for high-quality maintenance services.

The market's growth in Europe is mainly due to the European Union Aviation Safety Agency (EASA) sets and enforces strict safety and maintenance standards for the region. Compliance with EASA regulations is a crucial factor for all aviation operators, driving a high demand for maintenance services across the region.

The aircraft maintenance market provides services to ensure the proper functioning, safety, and airworthiness of aircraft. The market includes a range of activities designed for repairing, inspecting, and maintaining aircraft to meet regulatory standards and ensure their safe operation. It is a critical component of the broader aviation industry and plays a vital role in sustaining the operational integrity of aircraft. The aircraft maintenance market is driven by factors such as regulatory requirements, advancements in technology, safety considerations, and the overall health of the aviation industry. It is a dynamic and evolving sector that requires continuous adaptation to new technologies, materials, and industry standards.

The ICAO (International Civil Aviation Organization) provides international standards used to manage national civil aviation regulations. The local airworthiness authority must device ICAO standards to manage personnel, maintenance tasks, and inspection systems. In civil aviation, a block or maintenance check is a set of maintenance tasks that must be executed on an aircraft after a certain period or use. Packages are formed by separating maintenance tasks into small, convenient chunks to lessen aircraft downtime, reduce maintenance workload, and maximize utilization of maintenance facilities.

| Report Coverage | Details |

| Market Size in 2025 | USD 92.23 Billion |

| Market Size in 2024 | USD 87.67 Billion |

| Market Size by 2034 | USD 144.97 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.16% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Maintenance Type, End-Use, and Aircraft Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth in global air passenger traffic

The surge in global air passenger traffic has become a pivotal catalyst propelling the demand for the aircraft maintenance market. As airlines respond to heightened demand by increasing the utilization of their fleets, the imperative for more frequent and meticulous maintenance procedures becomes paramount. The intensified flight cycles and prolonged operational hours place heightened stress on aircraft components, necessitating regular inspections and timely maintenance interventions to ensure optimal safety and reliability.

Airlines recognize the symbiotic relationship between robust maintenance practices and the sustained airworthiness of their fleets, which is indispensable for passenger safety. With regulatory bodies mandating stringent adherence to maintenance standards, the upswing in global air travel not only amplifies the need for routine checks but also underscores the significance of preventive maintenance measures. This escalating demand for frequent, high-quality maintenance services presents a compelling opportunity for the aircraft maintenance market.

Maintenance, Repair, and Overhaul (MRO) providers stand at the forefront of addressing this surge, offering specialized services that not only meet regulatory requirements but also contribute to the operational longevity and safety of the expanding global air fleet. As the aviation industry continues to experience upward momentum, the aircraft maintenance market is projected for sustained growth, driven by the imperative of ensuring safety in the face of heightened aircraft utilization.

High costs

High costs pose a significant restraint for the aircraft maintenance market as they impact the financial viability of airlines and operators. Aircraft maintenance, particularly major overhauls and repairs, incurs substantial expenses, contributing to the operational costs of aviation companies. In an industry where profit margins are often slim, the burden of these high maintenance costs can strain financial resources, limiting the ability of airlines to invest in crucial safety and reliability measures.

Additionally, the competitive nature of the aviation sector further exacerbates the challenge, as carriers are compelled to seek cost efficiencies to remain competitive. Consequently, some operators may opt for delayed or deferred maintenance, potentially compromising safety and regulatory compliance. The reluctance to invest in comprehensive maintenance due to financial constraints can also lead to an increased risk of unscheduled maintenance events, disrupting flight schedules and impacting overall operational efficiency.

The challenge of high costs in aircraft maintenance highlights the delicate balance that airlines must strike between ensuring safety, meeting regulatory requirements, and managing financial constraints, thereby restraining the demand for maintenance services in the aircraft maintenance market.

Fleet expansion and modernization

Fleet expansion and modernization initiatives within the aviation industry are catalyzing significant opportunities for the aircraft maintenance market. As airlines globally seek to meet the growing demands of air travel, they are concurrently expanding their fleets by introducing new, technologically advanced aircraft.

The integration of these modern and sophisticated aircraft models not only necessitates specialized maintenance practices but also opens a spectrum of opportunities for maintenance, repair, and overhaul (MRO) providers. Newer aircraft often come equipped with advanced avionics, complex systems, and cutting-edge technologies, requiring maintenance expertise that aligns with the latest industry standards. Airlines are increasingly recognizing the strategic importance of proactive and specialized maintenance services to ensure the optimal performance, safety, and longevity of their modernized fleets. Consequently, this surge in fleet expansion and modernization efforts translates into a heightened demand for MRO services, ranging from routine inspections to comprehensive overhauls.

MRO providers, equipped with the technical proficiency to address the intricacies of contemporary aircraft, are well-positioned to capitalize on this trend, offering tailored solutions that contribute to the operational efficiency and airworthiness of the evolving global air fleet. The symbiotic relationship between fleet expansion, modernization, and the demand for specialized maintenance services underscores a promising trajectory for the aircraft maintenance market.

In 2024, the engine segment had the highest market share based on the maintenance type. This segment concentrates on the maintenance, repair, and overhaul of aircraft engines to ensure optimal performance and efficiency. It involves inspections, component replacements, and testing to address wear and tear and comply with regulatory requirements.

The component segment is anticipated to expand fastest over the projected period. The component segment focuses on ensuring the reliability and functionality of specific aircraft parts through inspections, repairs, and overhauls. It consists of specialized maintenance of individual aircraft components, such as avionics, landing gear, and other crucial systems.

In 2024, the narrow-body aircraft segment had the highest market share based on the aircraft type. The narrow-body segment includes smaller, single-aisle aircraft commonly used for short to medium-haul flights, such as Boeing 737 and Airbus A320 families. Maintenance for narrow-body aircraft focuses on optimizing operational efficiency and ensuring safety.

The wide-body aircraft segment is anticipated to expand fastest over the projected period. Wide-body aircraft maintenance activities include comprehensive checks, inspections, and overhauls, considering complex systems and extended flight ranges. It encompasses larger, long-haul aircraft with a wide fuselage, such as the Boeing 747 and Airbus A380.

In 2023, the commercial segment had the highest market share on the basis of the end-use. This is due to commercial aircraft focuses 4n adhering to stringent safety standards and minimizing downtime to meet the demands of busy flight schedules. Maintenance activities for commercial end-users are geared towards ensuring the airworthiness and reliability of aircraft used for passenger and cargo services.

The military segment is anticipated to expand fastest over the projected period. This segment involves defense organizations, air forces, and other entities operating military aircraft for defense and security purposes. Maintenance for military end-users is specialized and often includes strategic planning to ensure the readiness and capability of military aircraft for various missions. In addition to routine maintenance, military aircraft may undergo modifications, upgrades, and overhauls to meet evolving defense requirements.

By Maintenance Type

By End-Use

By Aircraft Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

August 2024

January 2025