January 2025

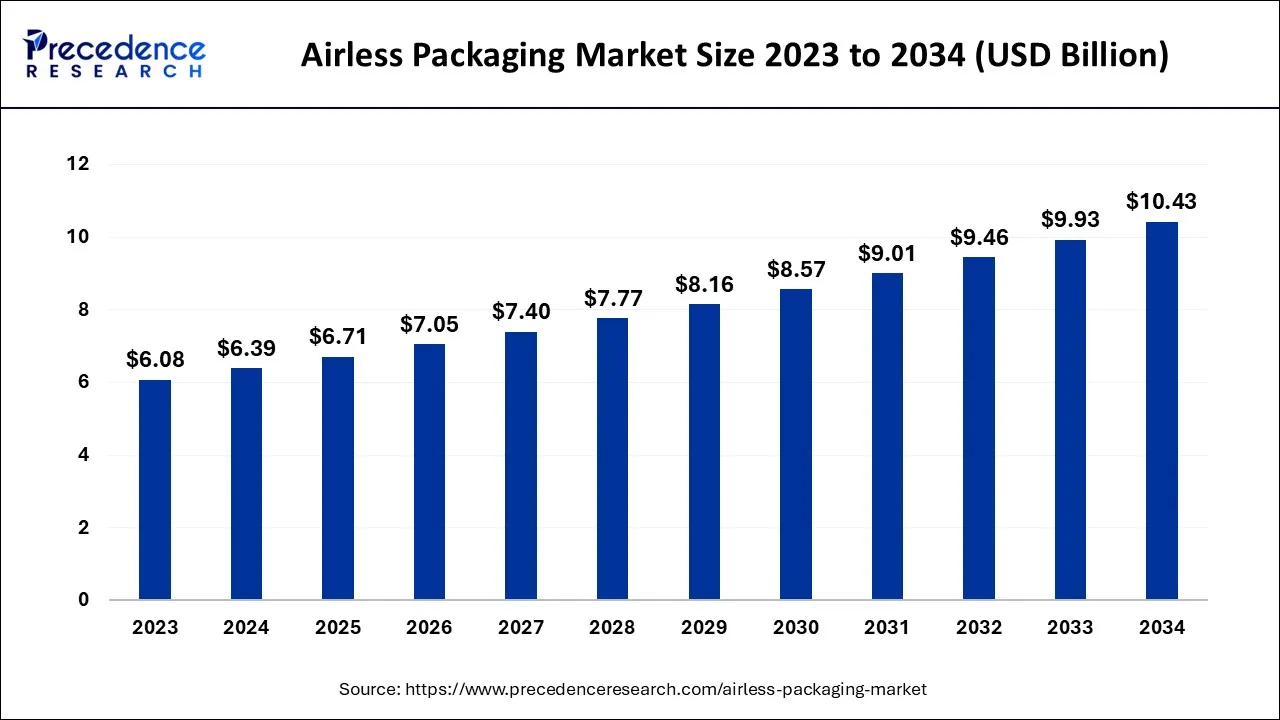

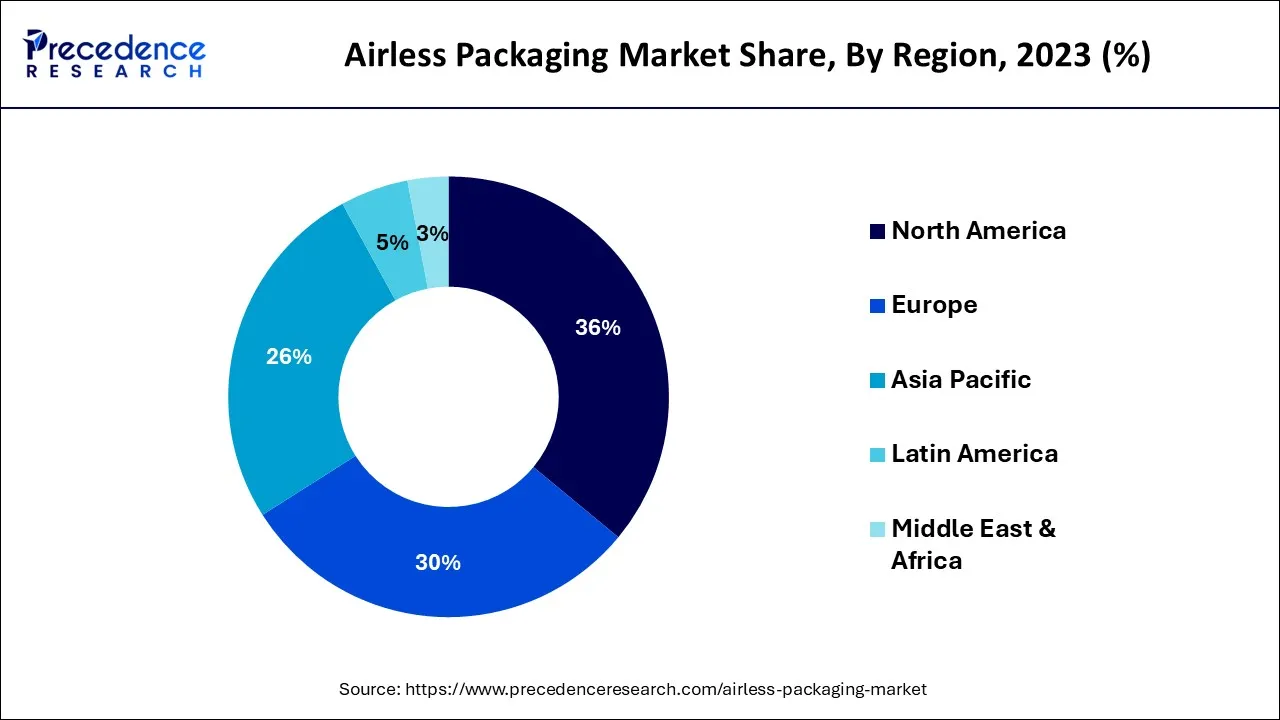

The global airless packaging market size accounted for USD 6.39 billion in 2024, grew to USD 6.71 billion in 2025, and is expected to be worth around USD 10.43 billion by 2034, poised to grow at a CAGR of 5.02% between 2024 and 2034. The North America airless packaging market size is predicted to increase from USD 2.30 billion in 2024 and is estimated to grow at the fastest CAGR of 5.17% during the forecast year.

The global airless packaging market size is expected to be valued at USD 6.39 billion in 2024 and is anticipated to reach around USD 10.43 billion by 2034, expanding at a CAGR of 5.02% over the forecast period 2024 to 2034.

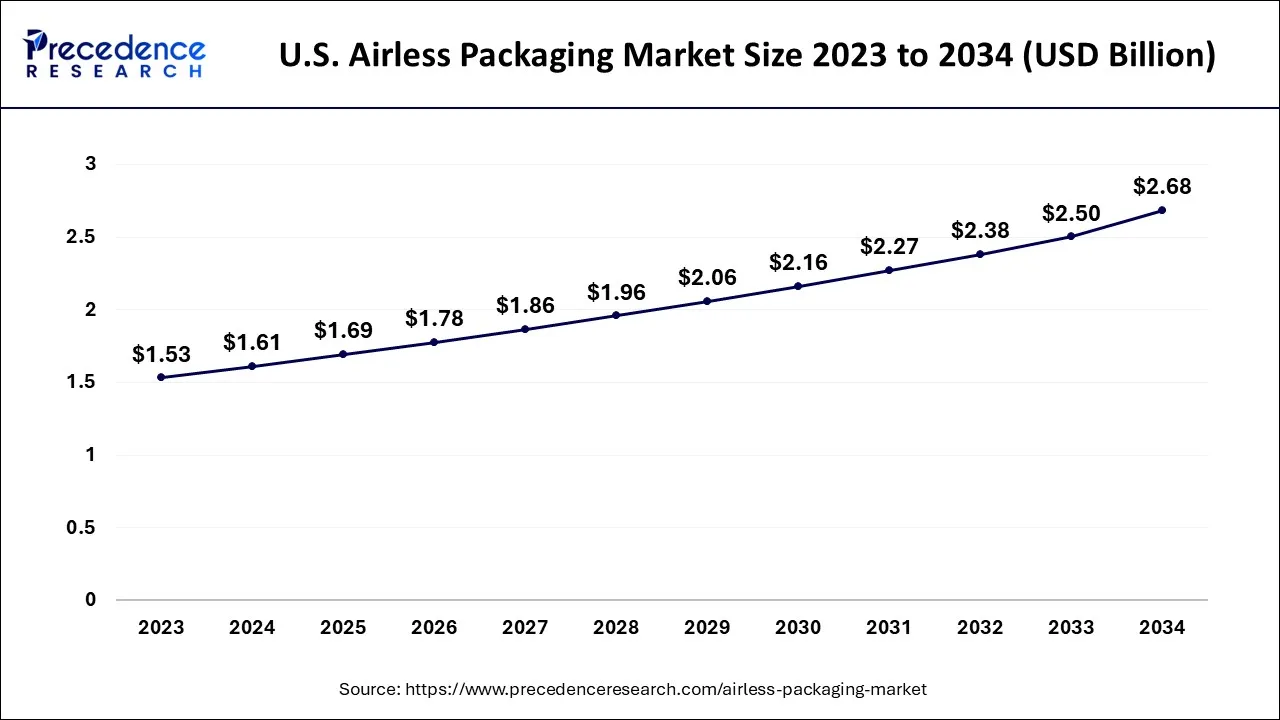

The U.S. airless packaging market size is exhibited at USD 1.61 billion in 2024 and is projected to beairless packaging market worth around USD 2.68 billion by 2034, growing at a CAGR of 5.24% from 2024 to 2034.

North America holds the most significant market share; the region is expected to maintain its dominance during the forecast period. The rising environmental concerns, including marine litter and other general impacts of packaging in North America, have led to the innovation of sustainable airless packaging options. In addition, the presence of potential consumers buying luxurious cosmetic and personal care products highlights the development of the airless packaging market in North America.

Key players in the North American airless packaging market include AptarGroup, Inc., Silgan Dispensing Systems, LUMSON SPA, HCP Packaging, Inc., and Quadpack Industries. These companies are focused on product innovation, expanding their product portfolios, and adopting sustainable practices to gain a competitive edge in the market.

Europe has been the most attractive marketplace for airless packaging; the region is expected to maintain its rank during the analyzed period. The rising demand for luxurious packaging specially designed for the cosmetics and personal care industry, along with the willingness of the population to pay for premium products, are significant factors in supplementing the growth of airless packaging in Europe.

The European market for airless packaging is driven by factors such as the growing demand for sustainable packaging solutions, the competitiveness of the beauty and personal care market, and government regulations promoting sustainable packaging. The United Kingdom, Germany, France, and Italy are the largest markets in the region.

The Asia Pacific region is the fastest-growing market for airless packaging, with countries like China, Japan, India, and South Korea leading the way. There is a growing awareness of sustainable packaging solutions in China, and consumers are becoming more conscious of the environmental impact of packaging and are looking for eco-friendly options. Airless packaging is a sustainable solution as it reduces waste and can be easily recycled.

The Latin American market for airless packaging is driven by factors such as the growing demand for sustainable packaging solutions and the presence of established beauty and personal care brands. Brazil and Mexico are the largest markets in the region.

The Middle East and Africa market for airless packaging is driven by factors such as the growth of the beauty and personal care market and increasing consumer awareness of sustainability. South Africa and the United Arab Emirates are the largest markets in the region.

The airless packaging market refers to the market for packaging solutions that use airless technology to dispense and preserve various products. Airless packaging is designed to prevent air from entering the container, which helps to protect the contents from degradation and maintain their quality. Unlike traditional packaging solutions that rely on air pressure or a pump to dispense the contents, airless packaging uses a vacuum-sealed system that creates a barrier between the contents and the outside environment. This helps to prevent oxidation, contamination, and other factors that can impact the quality and safety of the product.

The global shift towards sustainable and environmentally friendly packaging solutions is creating significant opportunities for the airless packaging market. As consumers become more environmentally conscious, they are seeking out products that are packaged in a way that minimizes waste and reduces their environmental impact. Airless packaging, often made from recyclable materials and can help reduce packaging waste, is well positioned to benefit from this trend. The rising focus towards sustainability in packaging has forced manufacturers to focus on the development of sustainable airless packaging solutions; this is intended to act as a driver for the market’s growth.

In July 2022, a leading provider of packaging solutions designed for the beauty industry, UA, announced the launch of ALU-Airless, an aluminum airless packaging solution to reduce the environmental impacts caused by plastic packaging materials. The company aims to achieve its 100% recyclability objective with the launch of ALU-Airless packaging.

Technological advancements are enabling the development of new and innovative airless packaging solutions. For example, new materials and manufacturing processes are being developed that can improve the performance and durability of airless packaging while also reducing costs. These advancements are opening up new opportunities for the airless packaging market.

Government regulations and initiatives aimed at reducing packaging waste and promoting sustainable packaging solutions are also creating opportunities for the airless packaging market. For example, the European Union's Circular Economy Action Plan includes regulations aimed at increasing the use of sustainable packaging solutions, such as airless packaging. As more governments adopt similar initiatives, the demand for airless packaging will likely increase.

The airless packaging market is a dynamic and growing segment of the packaging industry, driven by changing consumer preferences, regulatory requirements, and technological advancements. Additionally, the rising focus on developing innovative solutions in the global packaging market is subject to support the market’s growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.39 Billion |

| Market Size by 2034 | USD 10.43 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.02% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Packaging Type, By Dispensing System, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for hygienic solutions for packaging

Consumers are increasingly concerned about hygiene and cleanliness, particularly in light of the Covid-19 pandemic. The pandemic has led to increased demand for products that are packaged in hygienic and sanitary ways. Many industries, such as pharmaceuticals and cosmetics, are subject to strict regulations around product safety and hygiene.

Airless packaging can help manufacturers to meet these regulatory requirements by providing a hygienic packaging solution. Products that are prone to contamination, such as skincare and cosmetic products, can have their efficacy compromised by exposure to air and bacteria. Airless packaging can help to maintain the effectiveness of these products by protecting them from external contaminants.

Airless packaging is designed to be easy to use and dispense, which can help to maintain hygiene and cleanliness by reducing the risk of product contamination from the user. As awareness around hygiene and cleanliness continues to grow, the demand for airless packaging will likely continue to increase.

Compatibility with multiple products

Airless packaging is typically made from materials that are compatible with a wide range of product formulations. However, some products may contain ingredients that are not compatible with the packaging material, which can lead to degradation, leaching, or other issues that can impact product quality and safety. Airless packaging is designed to work with products of different viscosities. Still, specific products, such as thick or highly viscous formulations, may not work well with airless packaging due to the pressure required to dispense the product.

These compatibility issues can limit the types of products that can be packaged in airless packaging and may lead to additional costs or challenges for manufacturers. Overall, while airless packaging is a popular and effective form of packaging, its compatibility with multiple products is a critical factor that can restrain its growth in specific markets or product categories.

Rising demand for alternative solutions for plastic packaging

Considering the rising environmental concerns caused due to plastic, the demand for packaging solutions produced with alternative raw material including paper or recyclable metal is boosting. Multiple stable and capable market players are responding to the beauty industry’s shifting desire towards sustainable and environmentally friendly packaging solutions with the launch of packaging solutions as an alternative for plastic packaging. Along with this, many governments are focused on promoting sustainable and environmentally friendly packaging options to address environmental concerns. Considering the same, the Japanese government implemented a new ‘plastic recyclability law’ from April 2022 that promotes the recyclability of plastic as well as the law promotes the usage of paper packaging.

In October 2022, a leading primary packaging solution provider, Lumson and Pustrela announced their strategic collaboration to offer an alternative packaging solution for plastic and glass packaging with a 100% recyclable paper airless container.

The bottles segment held the dominating share of the global market in 2023; the segment is predicted to maintain its dominance during the forecast period owing to the versatility offered by bottles with airless packaging. Bottle airless packaging is versatile and can be used for a wide range of products, including creams, lotions, serums, and other liquids. Consumer preference is another factor behind the development of the segment; the preference from consumers is observed to increase due to the easy use and cost-effectiveness of bottles. On the other side, the durability, reusability, and aesthetic appeal of jar airless packaging are expected to boost the growth of the jar product type segment during the analyzed period of 2024-2034.

The pump segment held the largest share of the market in 2023; the segment is expected to sustain its dominance during the forecast period. The pump dispensing system offers an equal dispensing solution. Pump dispensers are easy to use and provide a controlled amount of product with each use, reducing waste and ensuring consistent application. Airless bottles with pump dispensers are also more hygienic compared to other types of packaging, as they reduce the risk of contamination from finger or hand contact; the emergence of cosmetics and consumption of airless packaging from the pharmaceuticals industry is intended to boost the growth of pump dispensing system.

On the other hand, the dropper segment is expected to increase significantly during the forecast period owing to the precise dispensing offered by dropper dispensers. In addition, the enormous demand from the pharmaceuticals sector for dropper airless packaging, for precise drug delivery methods is expected to act as a driver for the segment’s growth.

Personal care and cosmetics is the largest segment of the airless packaging market; the segment is expected to maintain its dominance throughout the forecast period owing to the rising consumption of premium cosmetics and personal care products across the world. In addition, the emerging demand for extended shelf life for personal care and cosmetics products will supplement the segment’s growth. The precise and controlled use offered by airless packaging for the cosmetics industry is intended to act as a driver for the segment’s development.

The pharmaceutical is observed to witness a significant boost during the forecast period; the enormous demand for innovative packaging by the pharmaceuticals industry is honored to act as a driver for the segment’s growth. Moreover, airless packaging dispensers such as click, and dropper dispensers have succeeded in offering precise and controlled dosages of drugs; the accurate dosing factor acts as another significant driver for the segment’s growth.

The hygiene factor drives the growth of the pharmaceuticals segment; airless packaging helps maintain the sterility and cleanliness of pharmaceutical products, which is crucial for products injected or applied to open wounds.

Segments Covered in the Report

By Packaging Type

By Dispensing System

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025