December 2024

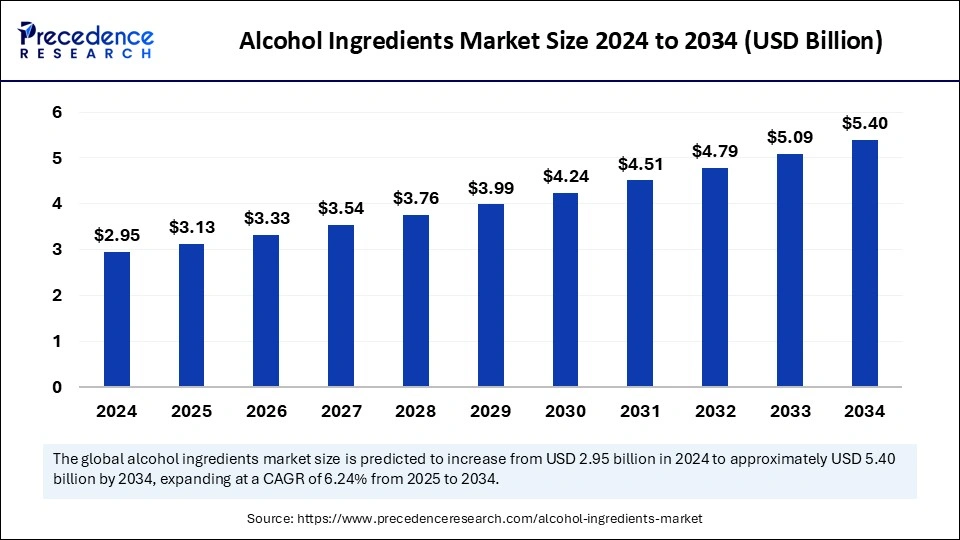

The global alcohol ingredients market size is calculated at USD 3.13 billion in 2025 and is forecasted to reach around USD 5.40 billion by 2034, accelerating at a CAGR of 6.24% from 2025 to 2034. The Europe market size surpassed USD 1.00 billion in 2024 and is expanding at a CAGR of 6.29% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global alcohol ingredients market size was estimated at USD 2.95 billion in 2024 and is predicted to increase from USD 3.13 billion in 2025 to approximately USD 5.40 billion by 2034, expanding at a CAGR of 6.24% from 2025 to 2034. The market encompasses raw materials such as yeast, enzymes, flavors, and colors used in the production of alcoholic beverages like beer, wine, and spirits. Driven by rising consumer demand for premium and craft beverages, the market is expanding with innovations in fermentation processes, natural ingredients, and sustainable production methods.

Artificial Intelligence is transforming the alcohol ingredients market by enhancing fermentation processes, ingredient optimization, and quality control AI is transforming the market by enhancing fermentation processes, ingredient optimization, and quality control. Advanced AI-driven analytics help breweries and distilleries predict flavor profiles, improve efficiency, and reduce waste, leading to more sustainable and cost-effective production.

Additionally, AI-driven predictive modeling allows manufacturers to analyze vast datasets on ingredient interactions, helping them refine recipes and enhance the quality of alcoholic beverages. This results in greater efficiency, reduced raw material wastage, and sustainable production practices. AI enhances supply chain management by forecasting demand trends, identifying potential disruptions, and optimizing procurement strategies, thereby streamlining operations.

Beyond production, AI is reshaping consumer experience through personalization and innovation. AI-powered recommendation engines analyze individual taste preferences, purchase history, and market trends to develop unique and tailored beverage offerings. This has led to the rise of customized craft beers, wines, and spirits, catering to evolving consumer demands.

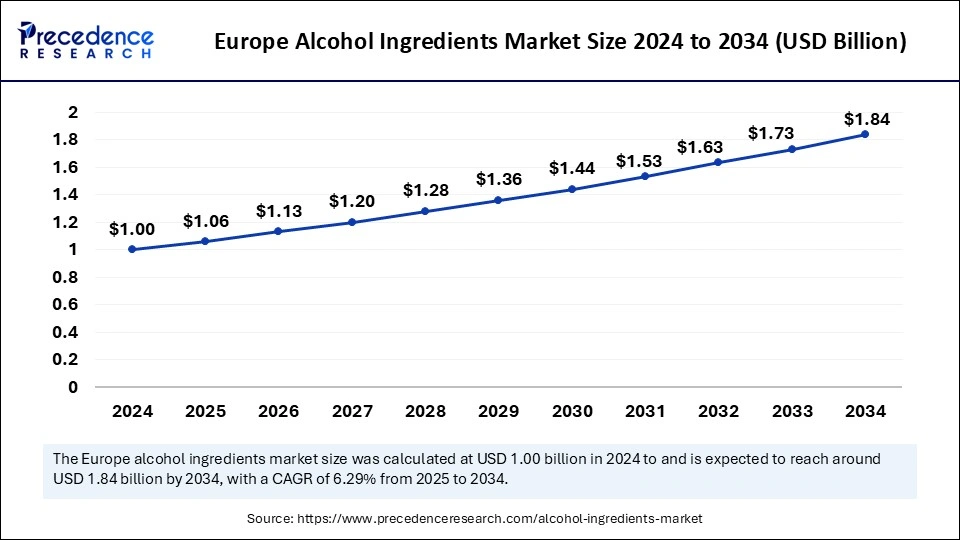

The Europe alcohol ingredients market size was exhibited at USD 1.00 billion in 2024 and is projected to be worth around USD 1.84 billion by 2034, growing at a CAGR of 6.29% from 2025 to 2034.

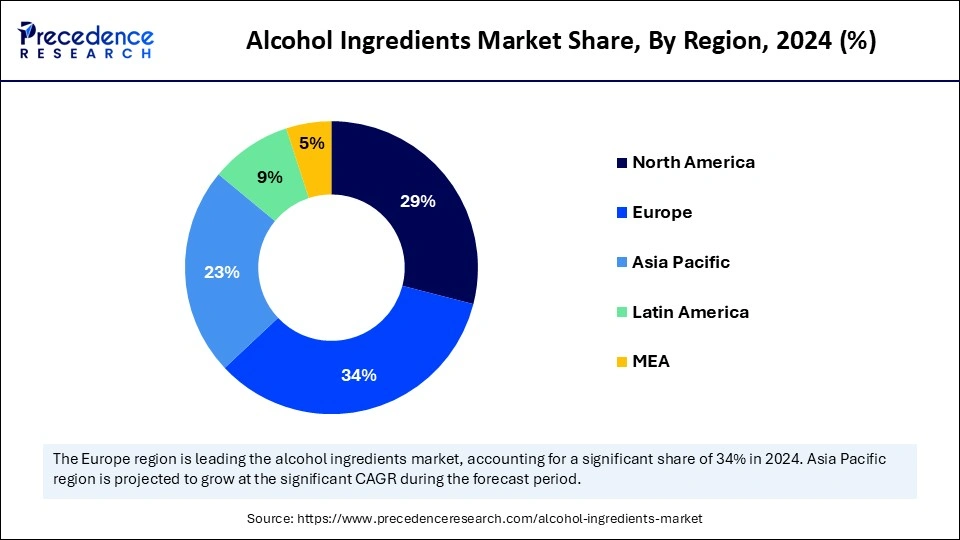

In 2024, Europe remained the largest market due to the well-established brewing and distilling industry, high consumer demand for premium and craft beverages, and continuous innovations in flavor and ingredient development. Germany and France are at the forefront of the market, with a strong preference for organic, natural, and sustainable ingredients in alcohol production. The rise of low-alcohol and alcohol-free beverages, along with AI-driven innovations in fermentation and flavor profiling, is further shaping the industry. Additionally, the demand for low-calorie and botanical-infused alcoholic beverages has surged, prompting ingredient manufacturers to develop natural sweeteners, herbal extracts, and alternative fermentation enhancers.

On the other hand, Asia Pacific is experiencing the fastest growth in the alcohol ingredients market, driven by rising disposable incomes, urbanization, and shifting consumer preferences. Additionally, the rise of health-conscious drinking trends is accelerating the use of natural, plant-based, and functional ingredients in alcoholic beverages.

Countries like China and Japan are witnessing increased demand for premium spirits, craft beers, and flavored alcoholic beverages. Meanwhile, India’s rapidly growing craft beer industry has led to increased demand for high-quality hops, malt extracts, and fermentation enhancers, positioning the region as a key emerging market for alcohol ingredient suppliers.

The alcohol ingredients market plays a crucial role in the production of various alcoholic beverages, supplying essential components such as yeast, enzymes, flavors, and colorants. Driven by the increasing demand for premium, craft, and flavored alcoholic drinks, the market is experiencing significant growth. Innovations in fermentation technology and ingredient enhancement are further propelling expansion, with manufacturers focusing on natural and sustainable ingredients to align with evolving consumer preferences.

Rising health consciousness has also influenced market trends, leading to a surge in demand for low-alcohol and alcohol-free beverages and encouraging producers to develop innovative formulations. Additionally, advancements in artificial intelligence (AI) and biotechnology are optimizing production efficiency, enhancing quality control, and enabling personalized product offerings. With growing investments and technological developments, the alcohol ingredients market is poised for continuous expansion in the coming years.

Rising demand for premium and craft beverages: Consumers are increasingly seeking high-quality, craft, and flavored alcoholic drinks, driving innovation in ingredient selection and formulation.

Health-conscious consumer trends: The growing preference for low-alcohol, alcohol-free, and organic beverages has led to increased demand for natural and functional ingredients.

Advancements in fermentation and biotechnology: Cutting-edge fermentation techniques, enzyme applications, and AI-driven analytics are enhancing production efficiency, improving flavor profiles, and reducing waste.

Sustainability and clean-label ingredients: The shift towards sustainable sourcing, plant-based ingredients, and eco-friendly production methods is influencing market dynamics.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.40 Billion |

| Market Size in 2025 | USD 3.13 Billion |

| Market Size in 2024 | USD 2.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.24% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Ingredient Type, Source, Application, Regulatory Compliance, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for low-alcohol and alcohol-free beverages

A key factor driving the alcohol ingredients market is the growing consumer shift towards low-alcohol and alcohol-free beverages, influenced by increasing health awareness and lifestyle changes. Consumers are actively seeking alternatives that offer the traditional taste and experience of alcoholic drinks while reducing alcohol content. This has led to a surge in demand for high-quality ingredients, including natural sweeteners, fermentation enhancers, and flavor optimizers, which help mimic the sensory attributes of traditional alcoholic beverages.

Additionally, leading breweries have expanded their low-ABV (alcohol by volume) product lines, integrating plant-based and functional ingredients to appeal to health-conscious and wellness-focused consumers. As this trend continues to gain momentum, the alcohol ingredients market is expected to witness significant innovation and diversification in the coming years.

Stringent regulation and compliance challenges

One of the major challenges in the alcohol ingredients market is the strict regulatory framework governing the production, labeling, and marketing of alcoholic beverages. Governments and regulatory bodies impose stringent safety, quality, and ingredient compliance standards, making it difficult for manufacturers to introduce new formulations and expand into global markets.

These regulations vary across regions, requiring companies to invest in rigorous testing, certification, and compliance procedures, which can increase production costs and delay product launches. These are forcing manufacturers to reformulate products, seek alternative ingredients, and adapt to evolving compliance requirements, posing significant challenges to the growth of the alcohol ingredients market.

A significant opportunity in the alcohol ingredients market lies in the growing consumer preference for sustainable, organic, and natural ingredients. With increasing awareness of health, environmental impact, and clean-label products, consumers are seeking alcoholic beverages made with plant-based, non-GMO, and chemical-free ingredients. This trend is driving manufacturers to develop eco-friendly fermentation processes, organic flavoring agents, and sustainable sourcing methods, creating a lucrative market for innovative ingredient suppliers.

In 2024, the yeast segment dominated the alcohol ingredients market, holding the largest share as they are essential for fermentation, influencing alcohol content, flavor, and aroma. The increasing demand for premium craft beverages and innovations in bioengineered yeast strains have strengthened this segment’s market position. With breweries and distillers focusing on an optimized fermentation technique, the demand for high-quality yeast and enzyme solutions remains strong.

On the other hand, the flavoring segment is witnessing the fastest growth, driven by the rising popularity of flavored alcoholic beverages, botanical-infused spirits, and low-alcohol drinks. Consumers are increasingly seeking unique, natural, and exotic flavors, prompting manufacturers to invest in natural extracts, fruit infusions, and plant-based sweeteners.

The synthetic segment leads the global market due to advancements in biotechnology and AI-driven ingredient optimization. Innovations in lab-grown yeast, precision fermentation, and bioengineered flavor compounds are enabling manufacturers to enhance consistency, efficiency, and sustainability in alcohol production. These ingredients help replicate traditional aging effects and improve fermentation efficiency while reducing waste.

In 2024, the spirits segment dominated the market, holding the largest share due to global demand for whiskey, vodka, rum, gin, and tequila. Premiumization trends, craft distilleries, and innovations in barrel aging and flavor enhancement have contributed to sustained growth in this segment. Consumers are increasingly opting for premium, aged, and infused spirits, further driving the need for high-quality ingredients such as specialty yeasts, enzymes, and natural flavoring agents.

The food grade segment held a significant share of the global market in 2024, fueled by rising health consciousness, regulatory changes, and lifestyle preferences. Furthermore, consumers are increasingly shifting towards zero-proof cocktails, alcohol-free beers, and low-ABV wines, leading to a surge in demand for specialty ingredients like natural sweeteners, fermentation enhancers, and botanical extracts to replicate traditional alcoholic flavors.

By Ingredient Type

By Market Application Type

By Market Source Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

October 2024

February 2025

January 2025