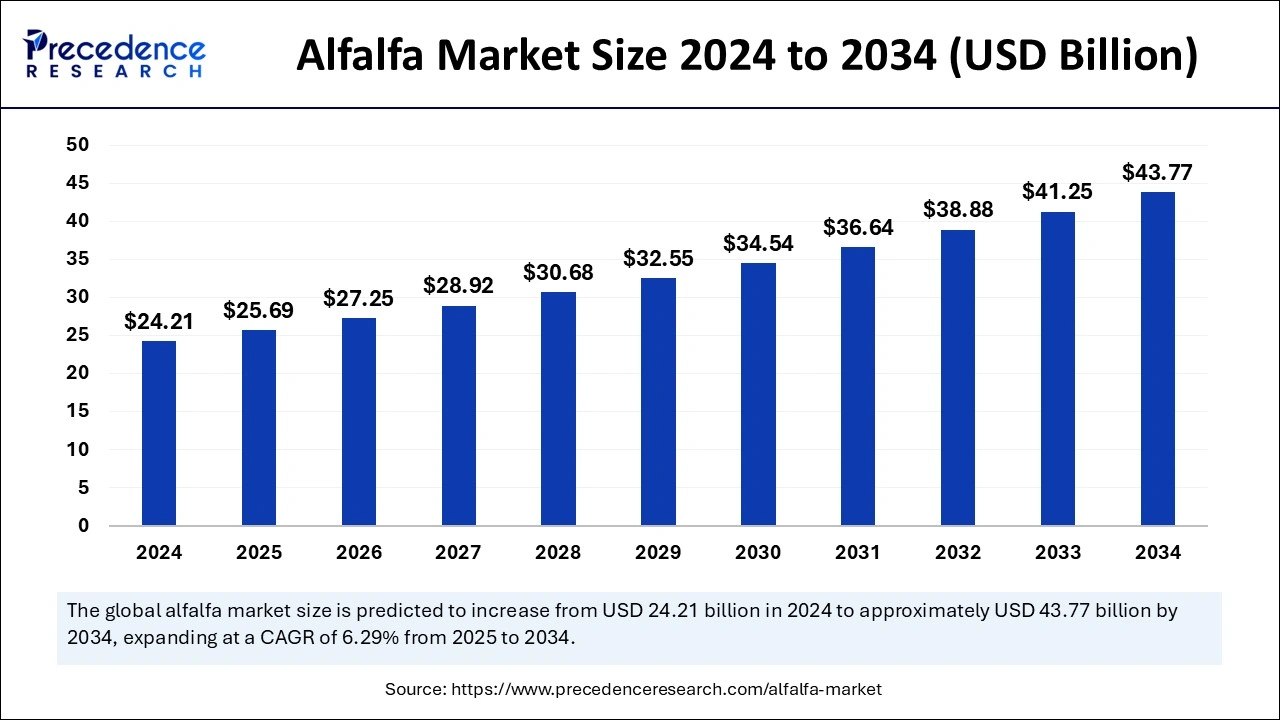

The global alfalfa market size is calculated at USD 25.69 billion in 2025 and is forecasted to reach around USD 43.77 billion by 2034, accelerating at a CAGR of 6.10% from 2025 to 2034. The North America market size surpassed USD 10.41 billion in 2024 and is expanding at a CAGR of 6.22% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global alfalfa market size was estimated at USD 24.21 billion in 2024 and is predicted to increase from USD 25.69 billion in 2025 to approximately USD 43.77 billion by 2034, expanding at a CAGR of 6.10% from 2025 to 2034. Increasing demand for high-quality livestock forage is the key factor driving the growth of the market. Also, the rising emphasis on dairy production coupled with the increasing demand for organic and natural products can fuel market growth further.

Artificial intelligence is transforming the alfalfa market by improving efficiency and productivity across different stages of the supply chain. The AI system can optimize irrigation and enable accurate crop management, pest control, and fertilization, which can lead to decreased resource consumption and higher yields. Furthermore, the adoption of an automated processing and harvesting system can result in decreased labor costs and enhanced operational efficiency.

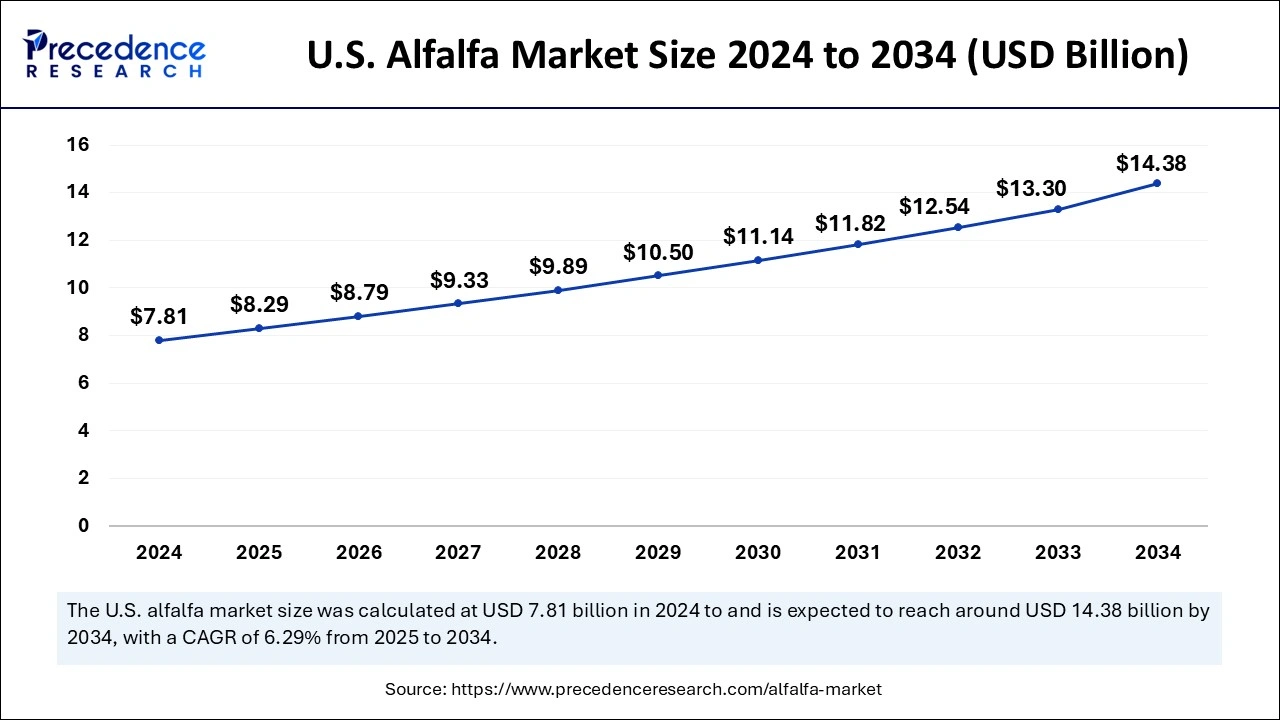

The U.S. alfalfa market size was exhibited at USD 7.81 billion in 2024 and is projected to be worth around USD 14.38 billion by 2034, growing at a CAGR of 6.29% from 2025 to 2034.

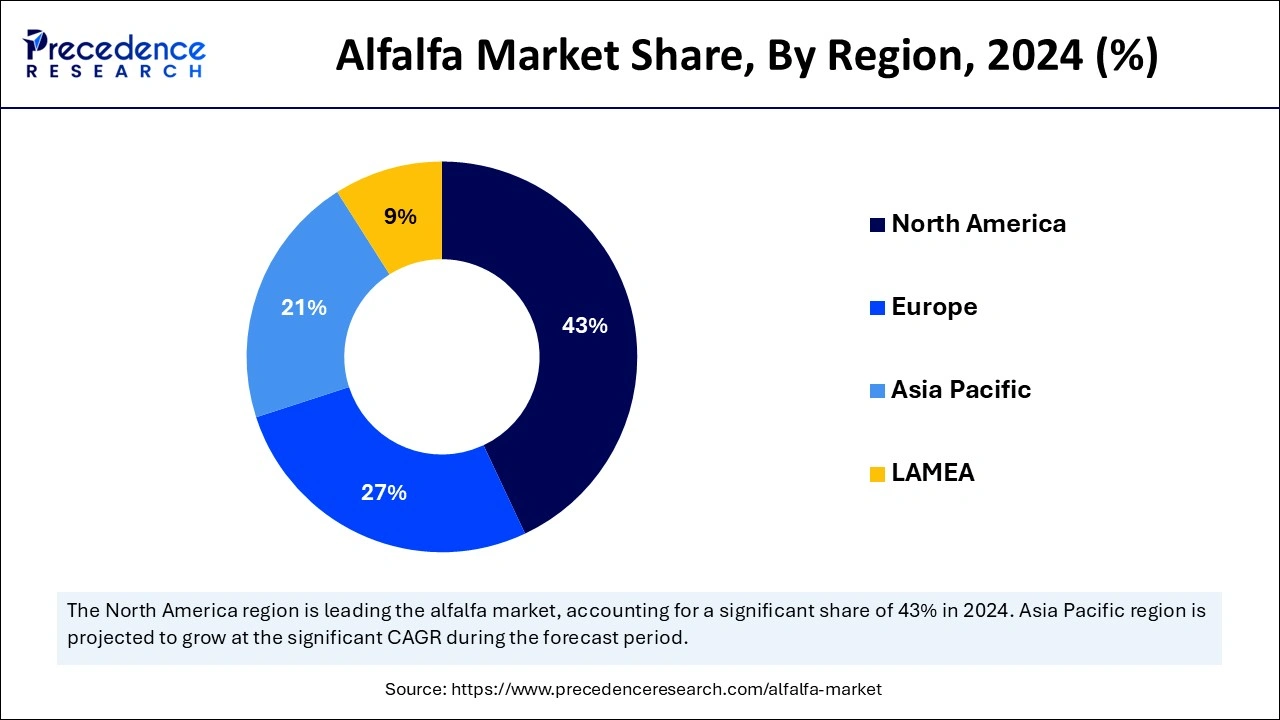

North America dominated the global alfalfa market in 2024. The dominance of the segment can be attributed to the increasing manufacturing and exports of the product from the North American region to other countries in the world. Moreover, in North America, the U.S. led the market owing to the extensive use of Alfalfa in the U.S. equestrian industry. The dairy industry in the country is a major booster of the product demand.

Asia Pacific is expected to grow at the fastest rate in the alfalfa market over the forecast period. The growth of the region can be credited to the rising consumption of meat and dairy products, which is fuelling the requirement for high-quality forage. Furthermore, emerging economies in the region, such as China and Japan, have limited water resources and arable land for forage production. These countries depend on imports of alfalfa and other crops to fulfill the dietary demands of their livestock.

Alfalfa is a crop for livestock, offering a high source of nutrients. Its clusters of flowers and trifoliate leaves make it recognizable. Alfalfa has been identified for its role in enhancing soil fertility. It is administered by humans in the form of alfalfa sprouts. This is popular in sandwiches and salads. Increasing adoption of innovative farming technologies, such as precision agriculture and advanced irrigation methods, is the latest trend in the alfalfa market.

| Report Coverage | Details |

| Market Size by 2034 | USD 43.77 Billion |

| Market Size in 2025 | USD 25.69 Billion |

| Market Size in 2024 | USD 24.21 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Livestock, Type, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Advancements in alfalfa hay processing and storage

The growing technological innovations in the processing and storage abilities of hay are transforming the alfalfa market. Innovative technologies such as baling, dehydration, and ensiling are being used to improve the shelf life, nutritional value, and quality of products. In addition, market players are using advanced harvesting and processing machinery to create long-fiber cubes and hay products with improved fiber content.

Drought conditions and water scarcity

Being a crop, alfalfa consumes a high amount of water, which can pose significant challenges in areas confronting drought conditions or water scarcity. This limited water availability can further present hurdles to the alfalfa market. Moreover, in such cases, alfalfa requires keen resource management and l consideration to ensure the productivity and viability of alfalfa cultivation despite the challenges it faces.

Increased demand for forage crops

Growing demand for forage crops is the latest trend in the alfalfa market. Forage crops like alfalfa are used for silage and hay and have also seen substantial growth in international trade in recent years. The global demand for these crops has grown significantly, which makes them an extensively traded crop on international markets. Furthermore, an increase in the industrialization of agriculture facilitates the demand for standard animal feed, such as micro-ingredients extracted from forage crops.

The ruminant livestock segment dominated the alfalfa market in 2024. The dominance of the segment can be attributed to the nutritional compatibility and characteristics of the product with the gut system of these animals. Alfalfa is recognized for its protein-rich content, which is necessary for milk production, growth, and health of ruminants. Additionally, the product is a great source of calcium, which is required for milk production and bone health in dairy cows.

The horse segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the high amount of protein, which can be good for growing young horses, lactating or pregnant mares, and horses with raised protein requirements, like working or performance horses. Also, carbohydrates provide energy, which can fulfill the energy needs of horses, especially those engaged in highly functional activities.

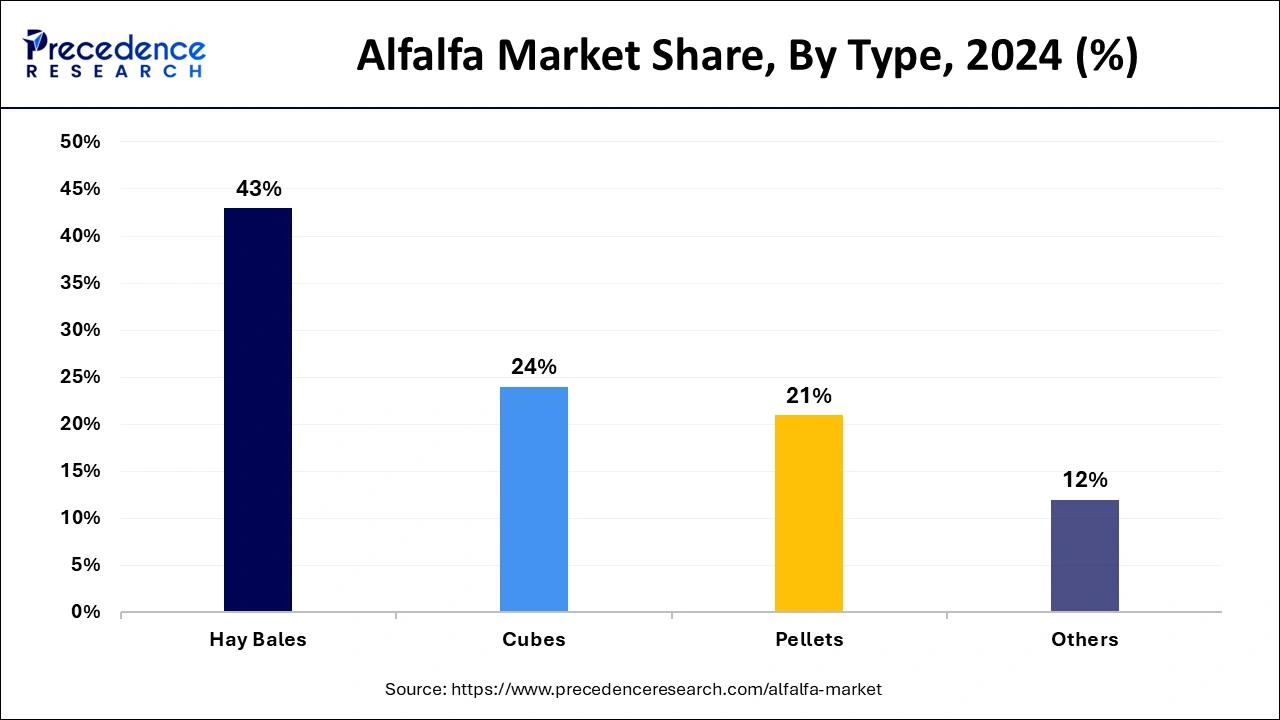

In 2024, The hay bales segment led the market by holding the largest alfalfa market share. The dominance of the segment can be driven by the benefits offered by hay bales as they offer an unprocessed and natural form of forage, which is advantageous for the physical and psychological well-being of some livestock, like cows and horses. However, these bales have a good shelf life as compared to other types and do not get affected if exposed to moisture.

The cubes segment is expected to grow at the fastest rate over the projected period. The growth of the segment is due to the highly compact and easy-to-handle nature of this cube, which makes it a sophisticated choice for feeding and storage. Furthermore, these cubes are less bulky than hay bales and convenient to transport. They have less dust compared to loose hay, making it a healthier and cleaner option for handlers and animals.

By Type

By Livestock

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client