What is the Alkaline Battery Market Size?

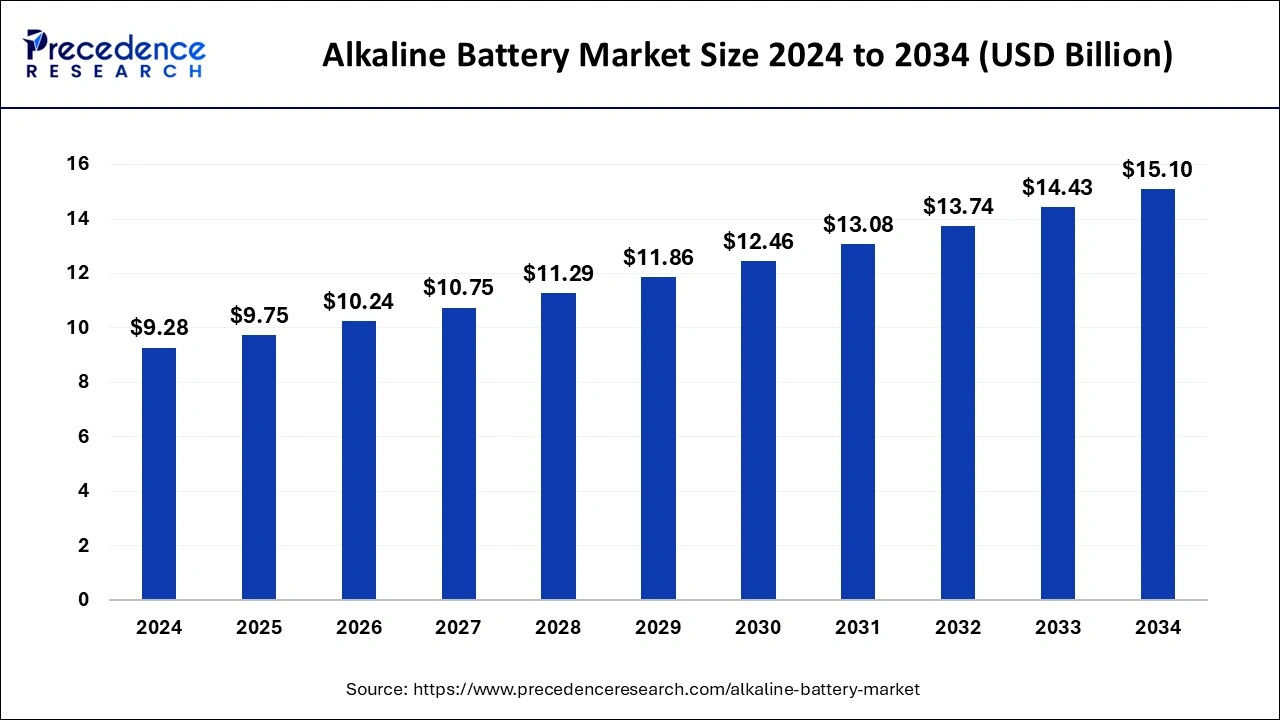

The alkaline battery market size is accounted at USD 9.75 billion in 2025 and predicted to increase from USD 10.24 billion in 2026 to approximately USD 15.10 billion by 2034, expanding at a CAGR of 4.99% from 2025 to 2034. The rising demand for alkaline batteries in consumer electronic devices is driving the growth of the alkaline battery market.

Alkaline Battery MarketKey Takeaways

- In terms of revenue, the global alkaline battery market was valued at USD 9.28 billion in 2024.

- It is projected to reach USD 15.10billion by 2034.

- The market is expected to grow at a CAGR of 4.99% from 2025 to 2034.

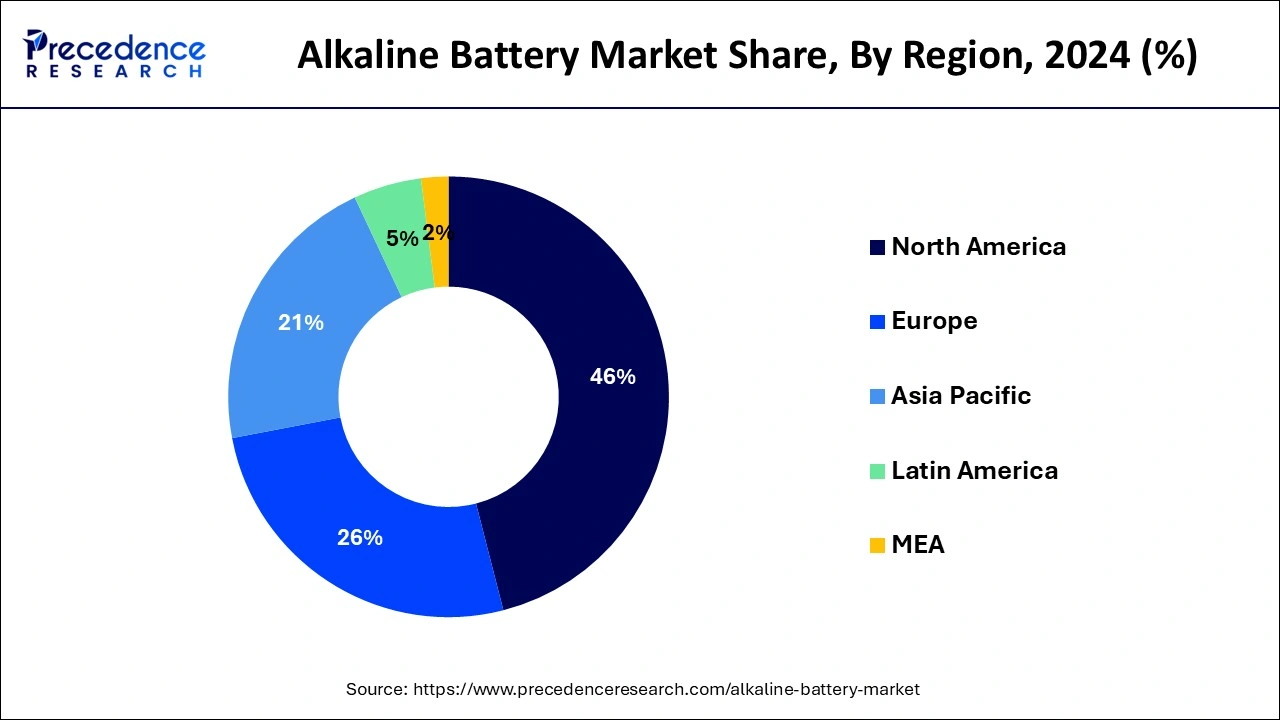

- North America held the largest market share of 46% in 2024.

- Asia Pacific is observed to have the fastest rate of growth during the forecast period.

- By product, the primary battery segment dominated the market with the largest share in 2024.

- By product, the secondary battery segment is expected to grow at the fastest CAGR during the forecast period.

- By size, the AA segment dominated the market in 2024.

- By size, the AAA segment is expected to grow at a significant rate during the forecast period.

- By application, the consumer electronics segment dominated the market with the largest share in 2024.

- By application, the remote control segment is observed to witness the fastest rate of expansion during the forecast period.

Powering the Future

Alkaline batteries are made by alkaline electrolyte and are also known as the primary batteries. Alkaline batteries are the most commonly used batteries in the household and commercially in the market. Alkaline batteries are used in various applications and come in different sizes and shapes which makes them a suitable fit for different applications. The alkaline batteries have a lifespan of about 5-10 years of easy handling. Alkaline batteries have an average voltage of 1.5V, which provides 2500 mAh capacity that increases depending on the load connected. The low-current drain applications preferably use alkaline batteries such as flashlights, portable radios, MP3 players, alarm clocks, remote controls, digital cameras, toys, etc.

Alkaline Battery MarketGrowth Factors

- The rising disposable income and changing lifestyle result in the increasing demand for consumer electronics like phones, laptops, smart devices, radios, electronic games, etc, which are accelerating the growth of the alkaline battery market.

- The technological development in the alkaline battery type and increasing performance capacities.

- Alkaline batteries are used in emergency power backup for applications like emergency lights, medical services, clean water electrical and communication services, etc. are boosting the growth of the market.

- The increasing demand for alkaline batteries in commercial applications such as telecommunication, data centers, manufacturing plants, packaging plants, agricultural operations, commercial buildings, and production facilities accelerating the growth of the market.

- The rising expenditure on R&D and ongoing development in alkaline batteries also promote the market's expansion.

Alkaline Battery Market Outlook: Charging Towards the Future

- Industry Growth Overview: The growing demand for affordable and reliable power for remote control and household electronics is driving the industrial growth in the market.

- Major Investors: Large diversified corporations and institutional investment firms are the major investors in the market.

- Startup Ecosystem: The development of rechargeable alkaline technologies is the focus of the startup ecosystem.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Market Size in 2025 | USD 9.75 Billion |

| Market Size in 2026 | USD 10.24 Billion |

| Market Size by 2034 | USD 15.10 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Size, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Expansion of consumer electronics sector

Alkaline batteries are versatile power sources that can be used in a wide range of consumer electronics applications. They offer reliable performance, long shelf life, and consistent voltage output, making them suitable for powering various devices across different categories within the consumer electronics sector. The consumer electronics industry is characterized by the proliferation of portable devices such as smartphones, tablets, laptops, wearables, and wireless headphones.

While many of these devices are rechargeable, there is still a demand for alkaline batteries as backup power sources or for devices that do not support rechargeable batteries. The convenience and availability of alkaline batteries make them a popular choice for powering portable electronics. As consumer preferences shift towards portable and wireless gadgets, the demand for reliable, convenient, and cost-effective power solutions provided by alkaline batteries is expected to continue growing.

Restraint

Availability of alternatives

Alkaline batteries face competition from alternative battery technologies such as lithium-ion, nickel-metal hydride, and rechargeable batteries. These alternative technologies offer advantages such as higher energy density, longer lifespan, and rechargeability, which can make them more attractive options for consumers and businesses seeking power solutions. With increasing awareness of environmental issues, there is a growing preference for eco-friendly alternatives to traditional alkaline batteries. Rechargeable batteries, in particular, are perceived as more environmentally sustainable because they can be reused multiple times, reducing the amount of disposable waste generated. This environmental consideration can lead to a shift away from alkaline batteries in favor of more sustainable options.

Opportunity

Product advancement

Advances in battery technology lead to improvements in performance metrics such as energy density, lifespan, and power output. Enhanced performance allows alkaline batteries to be used in a wider range of applications, including high-drain devices such as digital cameras, electronic toys, and portable electronics. As consumers seek batteries with longer runtime and reliability, product advancements can drive increased adoption of alkaline batteries.

As new electronic devices and technologies emerge, there is a need for batteries that can meet the unique requirements of these applications. Product advancements in alkaline batteries may involve the development of specialized variants tailored to specific uses, such as low-self-discharge (LSD) alkaline batteries for wireless devices, or high-capacity alkaline batteries for power-hungry gadgets. By addressing the evolving needs of emerging technologies, alkaline battery manufacturers can capture new market opportunities.

Product Insights

The primary battery segment dominated the alkaline battery market with the highest share in 2024. The dominance of the segment is attributed to the rising demand for the primary alkaline batteries in domestic use. The wider use of non-rechargeable battery applications for domestic as well as commercial purposes is driving the demand for primary alkaline batteries. The increasing demand for consumer electronics for everyday needs such as mobile phones, laptops, flashlights, kitchen electronic gadgets, etc. is boosting the demand for the primary alkaline battery segment in the market.

The secondary battery segment is expected to grow at the fastest CAGR in the alkaline battery market during the forecast period. The growth of the segment is attributed to the higher use of secondary alkaline batteries in various commercial applications such as heavy-duty industrial applications, railway signaling, mining vehicles, material handling trucks, and diesel engine starting, and can used as an emergency or standby power option. Thus, the rising industrialization, regional development, and construction activities are contributing to the growth of the secondary alkaline battery segment in the market.

Size Insights

The AA segment dominated the alkaline battery market with the largest market share in 2024. The growth of the segment is attributed to the higher storage capacity and longer life span that supports the application of such batteries in multiple industries. The AA batteries stand for alkaline-manganese and aluminum-calcium. AA alkaline batteries are widely used in commonly used consumer electronic devices such as alarm clocks, children's watches, toys, etc. AA alkaline batteries are widely available for purchase.

AA batteries are versatile and compatible with a vast array of devices, making them a preferred choice for consumers and manufacturers alike. Their standardized size and shape allow for easy replacement and interchangeability, providing convenience and flexibility to users. AA alkaline batteries are cost-effective in terms of both production and purchase. They are mass-produced by numerous manufacturers, leading to economies of scale and competitive pricing. Additionally, the widespread availability of AA batteries from various brands and suppliers fosters price competition, driving down costs for consumers.

The AAA segment is expected to grow at a significant rate during the predicted period. The increased adoption of AAA batteries in portable devices like TV remote control, MP3 players, digital cameras, etc. are driving the growth of the alkaline battery market. AAA batteries are slightly lower energy capacity batteries.

The AAA batteries are cost-efficient and used in low-power-consuming applications. AAA batteries typically have lower manufacturing costs compared to larger battery sizes like AA or C batteries. As a result, they are often more affordable for consumers, making them an attractive option for powering everyday devices and gadgets. The lower price point contributes to the widespread adoption of AAA alkaline batteries in the consumer market.

Applications Insights

The consumer electronics segment dominated the alkaline battery market in 2024. The rising demand for alkaline batteries for the efficient operations of consumer electronics is driving the demand for alkaline batteries in consumer electronics. Alkaline batteries are ideal for the use of the continuous flow of current in devices like flashlights, radios, and remote controllers. With the rising demand for alkaline batteries in consumer electronics such as computers, laptops, MP3 players, GPs, smartphones, etc. additionally, toys and radios have the largest consumption of alkaline batteries. Thus, all the factors are collectively contributing to the growth of the alkaline battery market.

The remote control segment is expected to grow in the market during the forecast period. Remote controls are widely used in various electronic devices, including televisions, air conditioners, DVD players, gaming consoles, and toys. As such, they represent a significant portion of the overall alkaline battery market's demand. Nearly every household has multiple remote-controlled devices, creating a consistent need for alkaline batteries.

Alkaline batteries are known for their compatibility with a wide range of devices, including remote controls. They provide reliable power and have a long shelf life, making them ideal for devices that are not used continuously but still require dependable battery performance when activated. Remote controls can sit idle for extended periods, and alkaline batteries ensure they are ready for use when needed.

Regional Insights

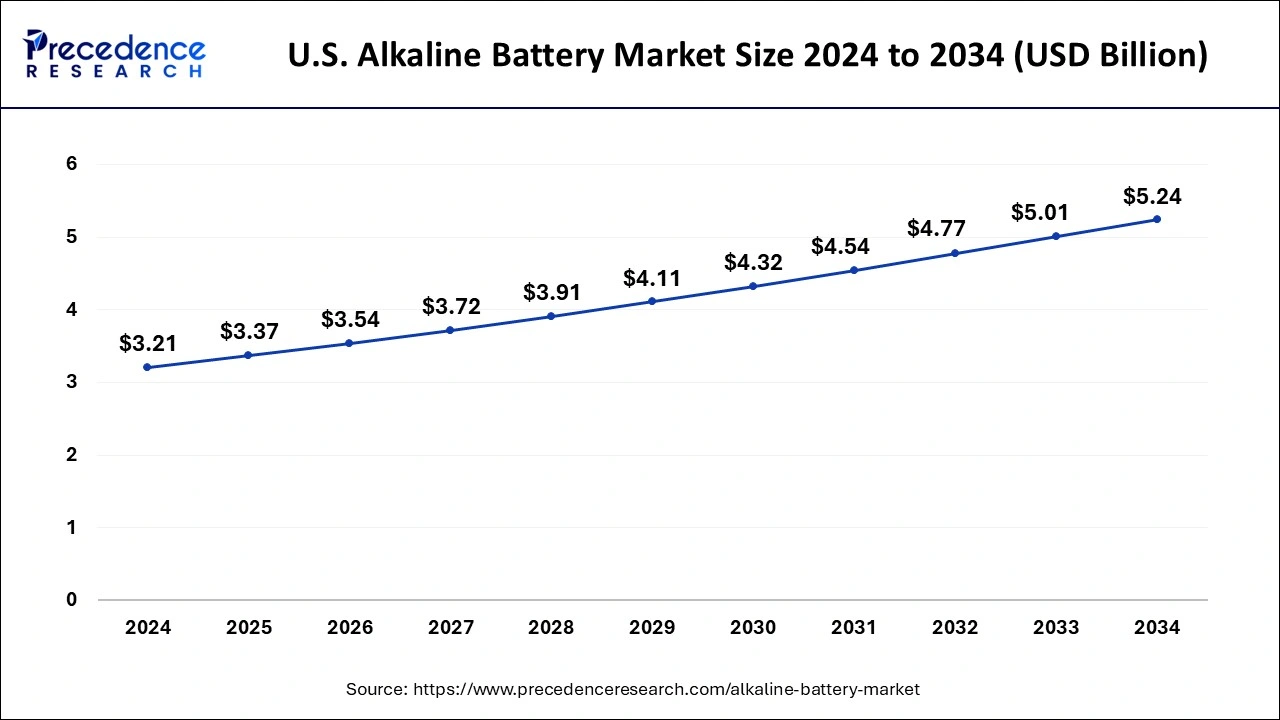

U.S.Alkaline Battery Market Size and Growth 2025 to 2034

The U.S. alkaline battery market size is valued at USD 3.37 billion in 2025 and is anticipated to reach around USD 5.24 billion by 2034, poised to grow at a CAGR of 5.02% from 2025 to 2034.

Growing Consumer Demands Drive North America

North America dominated the alkaline battery market with the largest market share of 46% in 2024. The growth of the market is attributed to therising demand for consumer electronic products and the rising technological adoption in the region is boosting the growth of the market. The rising presence of the major consumer electronics manufacturing firms and the rising investments in the development of technologies and power batteries in the countries like the United States, and Canada are driving the growth of the alkaline battery market across the region.

Increasing Population Boosts Asia Pacific

Asia Pacific is expected to be the fastest growing region in the alkaline battery market during the forecast period. The growth of the market in the region is attributed to the rising population which boosts the demand for consumer electronic products. The rising spending on personal electronic devices such as smartphones, laptops, tablets, computers, etc. is highly contributing to the growth of the alkaline battery market. Rising technological developments and disposable income among the people raise the living standards and drive the demand for luxury electronic products which results in a higher demand for alkaline batteries for their working which drives the growth of the alkaline battery market in the region.

Asia Pacific has emerged as a global manufacturing hub for consumer electronics, appliances, toys, and other products that utilize alkaline batteries. Countries like China, South Korea, Japan, Taiwan, and Singapore host large-scale manufacturing facilities for electronic goods, contributing to the demand for alkaline batteries both domestically and for export markets. Urbanization trends in the Asia Pacific region have led to increased adoption of portable electronic devices and gadgets, driven by the need for connectivity, entertainment, and convenience in urban lifestyles. Alkaline batteries play a crucial role in powering these devices, fueling demand in urban centers across the region.

Electronics Surge Sparks U.S. Growth

The growing usage of electronics in the U.S is increasing the use of alkaline batteries. The growing demand for portable power is increasing its adoption rates, where its enhanced availability is increasing its use. Companies are developing advanced product innovations like sensors, home automation, and remote switches, which are powered by these batteries.

Urbanization Powering India

The growing urbanization in India is increasing the use of these batteries. The expanding electronics sector is also increasing the use of portable devices, where the increasing population is increasing the use of long-lasting alkaline batteries.

Europe Driven by High Quality Batteries

Europe is expected to grow significantly in the alkaline batteries market during the forecast period, due to growing demand for high-quality and long-lasting batteries. They are also being used in household gadgets, cameras, toys, and remote controls. The stringent regulations and their expanding applications are also enhancing the market growth.

Advanced Retail Ecosystem Energize UK

The presence of an advanced retail ecosystem is increasing the availability of alkaline batteries in the UK. The growing use of electronics and high-performance battery demand is also increasing their adoption. The growing use of security sensors and smart home devices is also leveraging these batteries.

Alkaline Battery Market Value Chain Analysis: The Growth Ahead

- Resource Extraction

The resource extraction of alkaline batteries involves the mining and processing of materials like zinc, steel, potassium hydroxide, and manganese dioxide.

Key players: Duracell Inc., Energizer Holdings, Panasonic Corporation. - Power Generation

The power generation of an alkaline battery involves electrochemical reactions.

Key players: Duracell Inc., Energizer Holdings, Panasonic Corporation. - Regulatory Compliance and Energy Trading

The regulatory compliance and energy trading of alkaline batteries must comply with the environmental regulations, like restricted use of hazardous substances, labelling, and end-of-life collection.

Key players: Duracell Inc., Energizer Holdings.

Key Players' Offering

- Duracell Inc.: The company provides Duracell Optimum, Duracell Ultra, and Duracell Coppertop.

Energizer Holdings: Products like Energizer Alkaline power, Energizer MAX, and Energizer MAX PLUS are provided by the company. - Toshiba International Limited: The company offers Toshiba super alkaline batteries and specialty alkaline batteries.

- Panasonic Corporation: The company provides products like Alkaline power and Evolta.

Maxell Holdings Limited: Alkaline button batteries and Maxell gold alkaline general-purpose batteries are provided by the company. - Maxell Holdings Limited: Alkaline button batteries and Maxell gold alkaline general-purpose batteries are provided by the company.

Alkaline Battery Market Companies

- Duracell Inc.

- Energizer Holdings

- Gold Peak Industries Limited

- Camelion Batterien GmbH

- Sony

- Toshiba International Limited

- Zhejiang Mustang Battery Co. Limited

- Panasonic Corporation

- Maxell Holdings Limited

- GBP International Limited

- FDK Corporation

Recent Developments

- In February 2024, Xiaomi is about to launch wearable devices that alert users about hidden cameras and wherever they are secretly being photographed. As per the Gizmochina, Xiaomi Mobile Software Co. Ltd acquires the patent for anti-peep prompt methods, electronic equipment, devices, and storage media.

- In January 2024, Rishi Tandan, a specialist in consumer electronics launched the UDropMore, the revolutionary platform for the realm of digital shopping. UDropMore launched the Price Drop Sales, transforming the traditional online shopping experience.

Segments Covered in the Report

By Product

- Primary Battery

- Secondary Battery

By Size

- AA

- AAA

- 9 Volts

By Application

- Consumer Electronics

- Remote Control

- Toys and Radios

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting