List of Contents

Rechargeable Batteries MarketSize and Companies

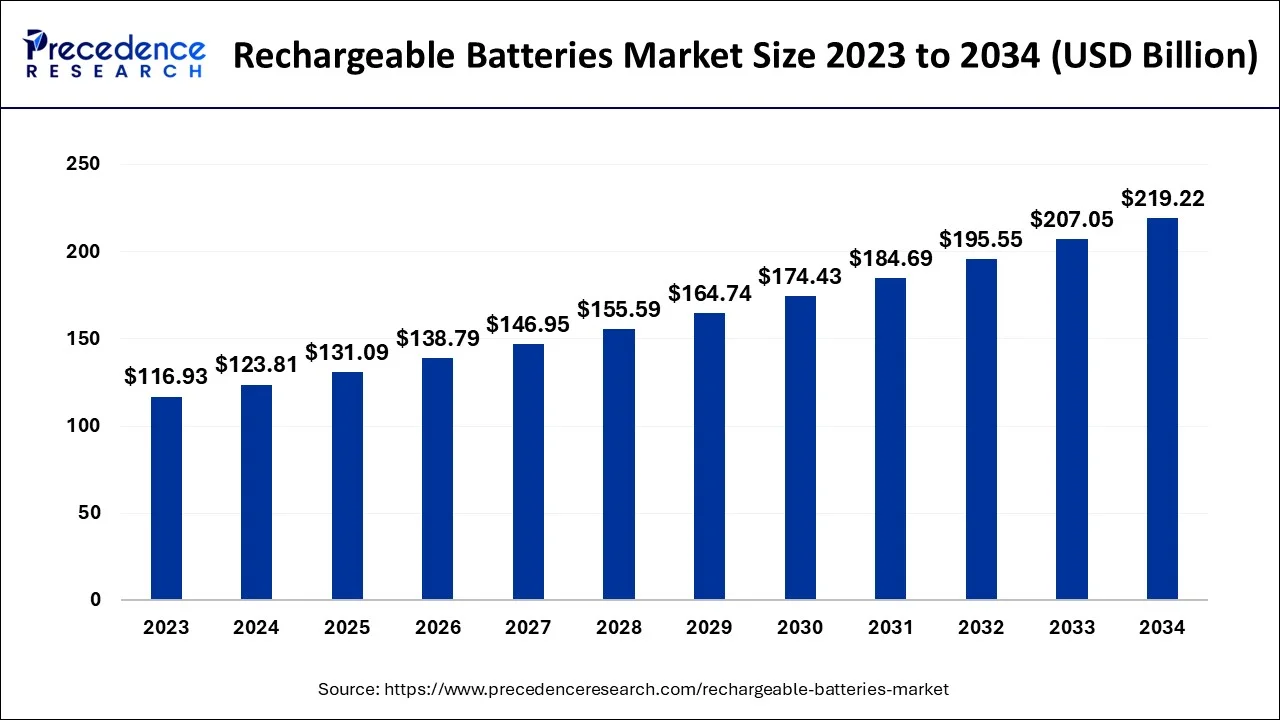

The global rechargeable batteries market size accounted for USD 123.81 billion in 2024 and is anticipated to reach around USD 219.22 billion by 2034, expanding at a CAGR of 5.88% between 2024 and 2034.

Rechargeable Batteries Market Key Takeaways

- Asia Pacific captured the largest market share in 2023 and is expected to expand at the fastest CAGR from 2024 to 2034.

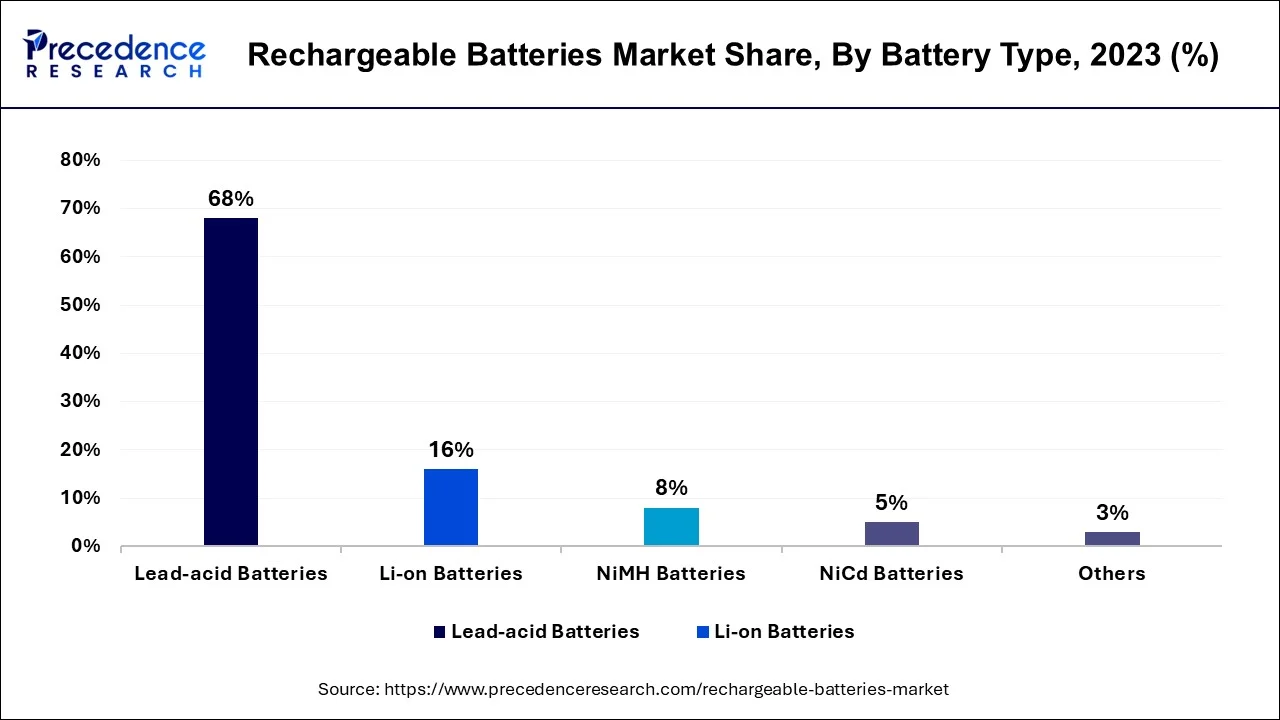

- By Battery Type, the lead-acid segment is predicted to register the largest market share from 20234 to 2034.

- By Battery Type, the lithium-ion segment holds a significant market share and is expected to grow at a remarkable CAGR from 2024 to 2034.

- By Application, the automotive segment led the market in 2022 and is predicted to hold the largest share of the market from 2024 to 2034.

- By Capacity, the 600-1000 mAh battery capacity segment is expected to hold the largest share of the market between 2024 and 2034.

Market Overview

The rechargeable batteries market refers to the industry that produces and sells batteries that can be recharged and used multiple times. These batteries are commonly used in a wide range of devices such as smartphones, laptops, tablets, cameras, electric vehicles, and many more. Rechargeable batteries are commonly used in a wide range of devices, including cell phones, laptops, digital cameras, and cordless power tools. They are often more cost-effective and environmentally friendly than disposable batteries, as they can be used multiple times before needing to be recycled or disposed of.

The market for rechargeable batteries has been growing rapidly due to the increasing demand for portable electronic devices and the need for sustainable energy storage solutions. The use of rechargeable batteries also helps to reduce waste and the environmental impact of disposable batteries. Moreover, the innovation in rechargeable batteries along with substantial funding for development from the automotive sector promotes market growth.

Production, manufacturing, and investment data:

- In June 2023, the Japanese government offered approximately $853 million subsidy to Toyota in order to expand the production of rechargeable batteries for electric vehicles. Toyota will be utilizing the amount for the development of the next-generation lithium-ion rechargeable batteries.

Country-wise production capacity:

| Sr. No. | Country | Battery Production Capacity in 2022, GWh | % of Total Production |

| 1. | China | 893 | 77% |

| 2. | Poland | 73 | 6% |

| 3. | United States | 70 | 6% |

| 4. | Hungary | 38 | 3% |

| 5. | Germany | 31 | 3% |

- In June 2023,Tata Group, India invested $1.6 billion in electric vehicle rechargeable battery production plant in Gujrat. The plan for the new plant is done in collaboration with the Gujrat state government that aims to boost the production of electric vehicles to achieve sustainability.

- According to International Energy Agency, the demand for lithium-ion batteries in the automotive sector grew by about 65% in 2022.

- The International Energy Agency stated that the demand for batteries for vehicles in China increased by 70% in 2022.

Rechargeable Batteries Market Growth Factors

Considering the high performance and numerous other benefits offered by rechargeable batteries, multiple battery manufacturers are shifting their preferences toward the production of rechargeable batteries. This factor is observed to propel the growth of the market.

- In June 2022, a prominent developer of next-generation batteries, Alsym Energy, announced that the company is emerging from stealth to promote the next-generation rechargeable batteries. Alsym has decided to offer energy storage solutions for electric vehicles with high-performance -ion rechargeable batteries at low cost.

The demand for portable electronic devices such as smartphones, laptops, tablets, and wearables is increasing rapidly. Rechargeable batteries are essential components of these devices, which is driving the growth of the rechargeable batteries market. Renewable energy sources such as solar and wind power require energy storage solutions to address intermittent issues. Rechargeable batteries are one of the key energy storage solutions which are driving the growth of the rechargeable batteries market.

Advancements in battery technology, such as increased energy density, faster charging times, and longer battery life, make rechargeable batteries more attractive to consumers. This is driving the growth of the rechargeable batteries market.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 123.81 Billion |

| Market Size by 2034 | USD 219.22 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.88% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Battery Type, By Application, and By Capacity |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Driver

Growing production of electric vehicles

The adoption of electric vehicles is increasing worldwide due to the need for sustainable transportation solutions. The demand for EVs is increasing due to concerns over climate change, air pollution, and energy security. Multiple governments are offering incentives and subsidies to promote the adoption of electric vehicles. As a result of such increasing demand, the automotive industry is shifting its preferences toward the production of electric vehicles.

- Mainland China sold total of 5.9 million electric vehicles in 2022. China's electric vehicle sales increased by a whopping 87% in 2022. Whereas the sales in Europe reached up to 2.6 million in 2022.

Rechargeable batteries are a critical component of electric vehicles, which is observed to boost the growth of the market. Lithium-ion rechargeable batteries carry higher density than a typical nickel-cadmium battery.

Electric vehicles demand large rechargeable batteries to provide sufficient range and performance. This means that the EV market is a significant consumer of rechargeable batteries, which is driving the growth of the rechargeable batteries market.

The development of new battery technologies such as lithium-ion batteries is making EVs more affordable and practical. This is increasing the demand for EVs, which is driving the growth of the rechargeable batteries market.

Rising Concerns about Environmental Sustainability

Growing concerns about environmental sustainability are a major factor boosting the demand for rechargeable batteries. Rechargeable batteries are eco-friendly, affordable, and reliable alternatives to single-use disposable batteries. Due to their capacity for repeated charging, rechargeable batteries reduce carbon emissions and environmental impacts, leading to reduced e-waste. Rechargeable batteries produce 28% less toxic gases than disposable batteries. Additionally, 90% of rechargeable batteries are recyclable, reducing greenhouse gas emissions. Rechargeable batteries offer long-lasting power and are convenient for a busy lifestyle.

Restraint

High cost of the product

Rechargeable batteries are often more expensive than non-rechargeable batteries. This can limit their adoption, particularly in price-sensitive markets. Rechargeable batteries require rare and valuable materials such as lithium, cobalt, and nickel. The availability and cost of these materials can impact the cost and supply of rechargeable batteries.

- According to Internation Energy Agency, the average price of a battery in 2022 was $150 per kWh. Along with this the battery production cost also increased as compared to the cost of production in 2021.

Rechargeable batteries have been associated with safety issues such as explosions and fires. This has led to regulatory scrutiny and safety standards that can increase costs and limit adoption.

Opportunity

Rising adoption of wearable devices

The rise of wearable technology such as smartwatches and fitness trackers is driving the demand for small, lightweight rechargeable batteries. This presents an opportunity for manufacturers to develop new rechargeable batteries that are smaller, lighter, and more efficient. Wearable devices are designed to be portable and convenient, allowing users to wear them throughout the day without hindrance. Rechargeable batteries provide the necessary power without the need for frequent battery replacements, making them an ideal choice for wearables. The rechargeable battery industry has seen significant advancements in recent years. Improved battery capacities, such as lithium-polymer batteries that offer higher energy densities, faster charging capabilities and improved safety features are observed as technological advancements in the market. These technological advancements make rechargeable batteries a viable and attractive option for wearable device manufacturers.

Battery Type Insights

The lead-acid segment dominated the market in 2023. The increased adoption of smart battery management systems (BMS) contributed to segmental dominance. BMS monitors and controls the batteries, optimizes their performance, and enhances the life span of the batteries. The adoption of BMS is high in electronic cars, two-wheelers, and trucks due to its properties of marinating battery health and improving battery lifespan. Manufacturers have developed efficient and reliable manufacturing processes, quality control procedures, and recycling infrastructure for lead-acid batteries. Additionally, the weight efficiency of BMS makes them suitable for drones and electric planes.

The lithium-ion segment is predicted to expand at the rapid pace in the coming years. Lithium-ion batteries have 5000 charge cycles compared to 1200 lead-acid, which helps to reduce the cost. Lithium-ion batteries require 2.5 hours to be charged from 20% to 80%, whereas lead-acid batteries require 6 hours to be charged. Lithium-ion batteries offer more advantages compared to conventional lead-acid batteries. Additionally, lithium-ion batteries produce zero emissions and need less maintenance, which increases the demand for lithium-ion batteries.

The demand for lithium-ion batteries is rising in grid-energy storage applications and electric vehicles. Lithium-ion batteries can be charged quickly compared to many other rechargeable battery types. This fast-charging capability is highly valued in consumer electronics and electric vehicles.

Application Insights

The automotive segment dominated the market in 2023, the segment is expected is predicted to hold the largest share of the market during the predicted timeframe. The increasing adoption of electric vehicles is one of the primary factors driving the dominance of the automotive application segment. EVs rely on rechargeable batteries to power their electric drivetrains, making them an integral component of the vehicle's functionality.

The global automotive sector is more likely to witness innovation in rechargeable batteries with advanced performances, this element promotes the segment's growth. Multiple battery manufacturers are shifting their focus to the development of more powerful rechargeable batteries for electric vehicles. Such innovations highlight the growth of the automotive segment for the upcoming period.

For instance, in June 2023, Nyobolt, headquartered in the United Kingdom, announced the innovation in EV rechargeable batteries. The company has unveiled a concept electric vehicle with a six-minute charging capacity; this is observed to be the first concept vehicle with breakthrough battery technology.

On the other hand, consumer electronics is another lucrative segment of the market; the segment is expected to witness growth at a robust pace during the forecast period. Continuous technological advancements and innovation drive the consumer electronics industry. These advancements, along with innovations in battery chemistries, have enabled rechargeable batteries to meet the evolving needs of the consumer electronics market.

Battery Capacity Insights

The 600-1000 mAh battery capacity segment is expected to hold the largest share of the market during the forecast period. The 600-1000 mAh battery capacity range is well-suited for a wide range of automotive applications and consumer electronic devices, including smartphones, tablets, wireless earphones, electric vehicles and smartwatches. These devices require compact batteries that can provide sufficient power to support their functionalities while maintaining a small form factor, making it popular in the consumer electronics segment.

Regional Insights

Asia Pacific has the largest market share in 2023; the region is expected to grow at the fastest rate during the forecast period. The Asia-Pacific rechargeable batteries market is expected to grow rapidly due to factors such as the increasing adoption of electric vehicles, the growth of renewable energy, and the increasing demand for consumer electronics. China, India, Japan, and South Korea are the largest markets in this region.

China is considered one of the most dominating countries that manufacture electric vehicle batteries. Six of the ten leading manufacturers of batteries are headquartered in China. China's dominance over the battery production industry is attributed to its control over cathode, anode, and other refined battery material production. China has significant reserves of the raw materials used in battery production, such as lithium, cobalt, and nickel. This gives China a strategic advantage in the battery production market.

The Chinese government has been actively supporting the development of the battery industry through policies such as tax incentives, subsidies, and research and development funding. This support has helped to foster a favorable environment for battery production in China.

India has recently discovered a significant reserve of lithium in the states of Rajasthan and Jammu & Kashmir; the discovery is observed as a game changer for electric vehicle production in the country. These reserves are claimed to fulfill almost 80% of the country's lithium requirement. The discovery is expected to boost the production of electric vehicles with lithium batteries by declining the country's dependency on lithium imports. For past years, India was dependent on imports from Japan and China.

Moreover, India is the leading country in the production of lithium-ion batteries due to the nation's growing demand for EV batteries. To satisfy this demand, Indian companies are significantly making efforts to boost the development of cutting-edge lithium-ion battery technologies with advanced charging capabilities, energy density, and affordability.

- For instant, in August 2024, Godrej & Boyce, a part of the Godrej Enterprises Group, announced the launch of its lithium-ion battery-powered forklifts with an indigenously developed Battery Management System.

Asia Pacific has a large and relatively low-cost labor force, which makes it an attractive location for battery production. This has allowed battery manufacturers to offer competitive pricing in the global market. Asia Pacific has the largest consumer market for electric vehicles and consumer electronics, which are significant users of rechargeable batteries.

The North American rechargeable batteries market is expected to grow significantly due to factors such as the increasing adoption of electric vehicles, the growth of renewable energy, and the increasing demand for consumer electronics. The United States is the largest market in this region, with significant growth expected in Canada.

North America has a well-developed manufacturing infrastructure and has been investing heavily in the production of batteries in recent years. This has allowed manufacturers to achieve economies of scale and reduce production costs, making them more competitive in the global market.

- In October 2022, the federal government of the United States and the Department of Energy announced the funding of approximately $2.8 billion for projects that can kick-start the production of materials associated with batteries.

The market for rechargeable batteries in Latin America is expected to grow due to factors such as the increasing adoption of electric vehicles and the growth of renewable energy. Moreover, the growing demand for consumer electronics. Brazil is observed to be the most significant contributor to the market's growth in Latin America, followed by Argentina.

The sales of light electric vehicles in the Brazilian market boosted by 55.5% in March 2023 compared to the sales of March 2022. According to the report published by Latam Mobility, the sales increase in sales in the first quarter of 2023 represented the historical number in the Brazilian electric vehicle market.

Rechargeable Batteries Market Companies

The global rechargeable batteries market is fragmented with multiple small-scale and large-scale players. A few prominent players in the global rechargeable batteries market are:

- GPB International Limited

- SAMSUNG

- Godrej.com

- Camelion Batterien GmbH

- Fedco Batteries

- Illinois Capacitor

- Sony Corporation of America

- Spectrum Brands, INC

- Energizer

- Optimum Nano Energy Co. Ltd

- Panasonic Corporation

Recent Developments

- In October 2024, Samsung announced that it had developed an ultra-compact all-solid-state battery tailored for wearable devices, with an energy density of 200 watt-hours per liter. These rechargeable batteries have solid electrolytes, maintaining the space between the anode and cathode electrodes.

- In June 2024, TDK Corporation announced the development of a material for CeraCharge, a next-generation solid-state battery with 1,000 Wh/L energy density. This material has been developed using oxide-based solid electrolytes and lithium alloy anodes.

- In April 2023,Xiaomi announced the launch of a multifunctional desk lamp with a rechargeable battery. The company has presented this portable desk lamp in the China market. Xiaomi's Mijia, a conventional desk lamp comes in a 3-in-2 design with color rendering index RA90. The desk lamp has a 2,000 mAh rechargeable battery with USB Type-C cable.

- In January 2022, Toshiba announced the launch of 20Ah HP lithium-ion battery to its SCib product range. The new rechargeable battery launched by Toshiba promises to offer high energy and high power simultaneously. With the launch of this rechargeable battery, the company has claimed that the new cell will allow vehicles to drive on a single charge.

Segments Covered in the Report:

By Battery Type

- Lead-acid Batteries

- Li-on Batteries

- NiMH Batteries

- NiCd Batteries

- Others

By Application

- Consumer Electronics

- Industrial

- Automobile

- Defense

- Others

By Capacity

- 150-1000 mAh

- 1300-2700 mAh

- 3000-4000 mAh

- 4000-6000 mAh

- 6000-10000 mAh

- More than 10000 mAh

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client