January 2025

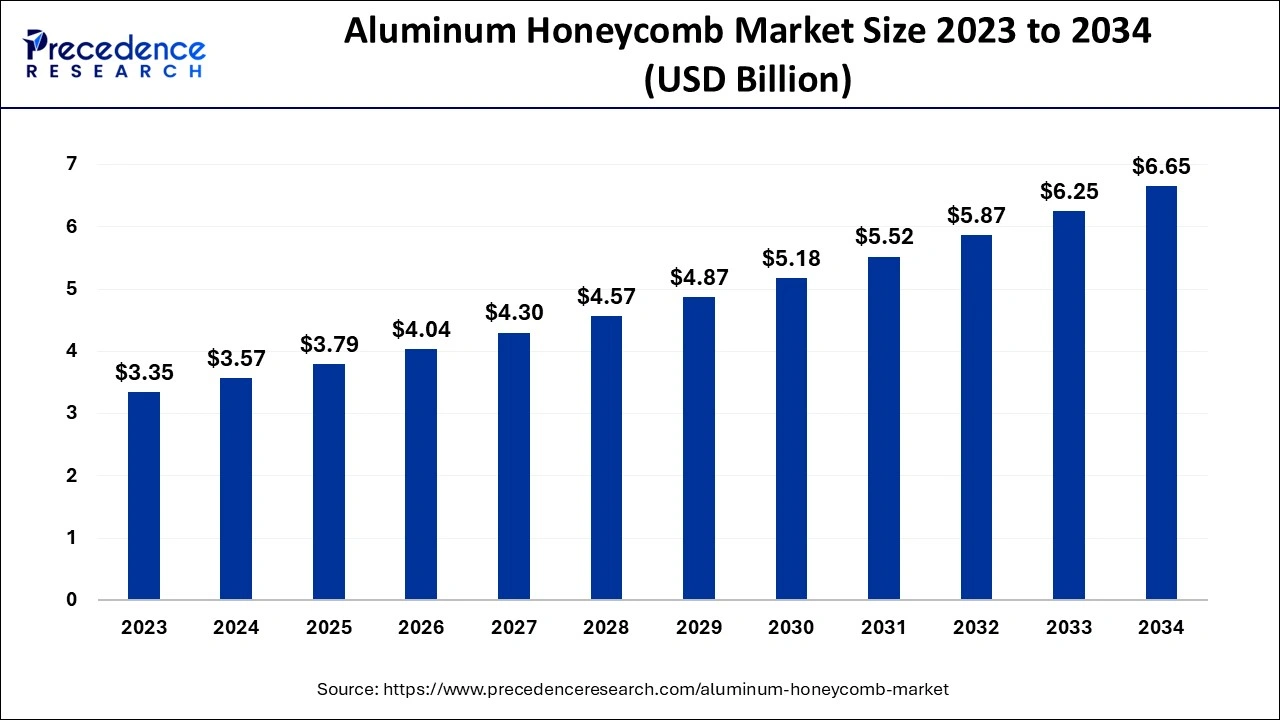

The global aluminum honeycomb market size is calculated at USD 3.57 billion in 2024, grew to USD 3.79 billion in 2025 and is predicted to hit around USD 6.65 billion by 2034, expanding at a solid CAGR of 6.43 % between 2024 and 2034.

The global aluminum honeycomb market size accounted for USD 3.57 billion in 2024 and is expected to exceed USD 6.65 billion by 2034, growing at a CAGR of 6.43% from 2024 to 2034. The aluminum honeycomb market growth is attributed to the increasing demand for lightweight, energy-efficient materials in industries, including aerospace, automotive, and construction.

Artificial intelligence is actively transforming industries by providing data-driven, autonomous, and predictive technologies that have a direct impact on the aluminum honeycomb market. The introduction of these innovations from the field of artificial intelligence leads to the effective organization of production processes and minimization of resources used in production, thus improving efficiency.

AI in supply chain forecasting and decision-making also improves supply chain management strategy by helping key players in the aluminum honeycomb market forecast the probable shift in demand that might occur. The use of AI also contributes to advancements in technology and produces materials that are highly efficient for their required usage.

Rising demand for high-performance and lightweight materials will facilitate the aluminum honeycomb market in the coming years. With the greater competition in the aerospace market and the push to reduce fuel burn and increase efficiency, manufacturers are looking at higher-order materials such as composites or light alloys. The global thermoplastic composites market is expected to be led by the type, considering it uniquely boasts of its high strength-to-weight ratio, good corrosion resistance, and thermal stability. It remains envisaged that this move to lightweight materials is expected to be central in cutting operations costs and increasing the efficiency of fuel and energy in both civil and military aviation markets.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.65 Billion |

| Market Size in 2024 | USD 3.57 Billion |

| Market Size in 2025 | USD 3.79 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.43% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East and Africa |

Growing demand for lightweight materials in aerospace

Growing demand for lightweight materials in aerospace is anticipated to drive the adoption of the aluminum honeycomb market. Such initiatives as Horizon Europe in the EU with a focus on sustainable innovation: In the 2023 Work Programme, it was pointed out that the EU’s innovative strategy in green aviation was to invest in research on pursuing lightweight materials. Furthermore, additive manufacturing and other practices raise the work characteristics of these materials and expand their application in aerospace.

| Year | Investment/Initiative | Region |

| 2023 | USD 114 billion allocated for modernization in defense and aerospace | United States |

| 2023 | Euro 7.9 billion allocated for defense research and development | European Union |

| 2023 | 12.5% increase in U.S. aerospace R&D funding from the previous year | United States |

| 2024 | Growing adoption of lightweight materials in commercial aircraft | Global (focus on North America and Europe) |

| 2023 | Investment in hypersonic aircraft development | United States |

High production costs

Hamper high production costs are anticipated to restrain the growth of the aluminum honeycomb market, particularly in developing regions. The production is complex and, therefore, requires hi-tech methods and equipment. This causes high costs for the acquisition of raw materials, production, and quality control. These costs must be added to the final cost of the products and prove prohibitive in industries that can afford them, such as consumer goods and construction. Current systems of small and medium business operations mean that there are problems with the expansion of production due to capital restrictions, which in turn slows down market saturation. Furthermore, the volatility of aluminum prices in the global market due to tensions and disruptions in the supply chain is expected to increase cost aspects.

Increasing applications in defense and aerospace

Growing applications in the defense and aerospace sectors provide lucrative opportunities for aluminum honeycomb market manufacturers. High-performance materials, such as lightweight composites, are the key focus of the government’s global spending, owing to the importance of military vehicles, aircraft, and drones in contemporary warfare and flight operations at lower expenses. Such investments, particularly in the areas that already have an established aerospace industry, are expected to continue buoying demand for aluminum honeycomb panels, given their superior strength and lightweight nature.

The regular grade segment held a dominant presence in the aluminum honeycomb market in 2023 due to its efficiency and versatility, which makes it useful for a very large number of corporate organizations. Especially notable have been the construction and transportation industries owing to the favorable middling characteristics of regular-grade panels in terms of strength, weight, and cost. The DOT’s 2023 campaign that promotes the use of sustainable and lightweight material in structures has boosted the uptake of these panels. Perfect integration of this material in the construction of commercial buildings, a rise in demand for energy-efficient structures, and new lightweight structures in the construction industry also boosted the segment. Moreover, the construction activity, as per World Bank (2023), is increasing across the globe, especially in emerging markets, which further increases the need for efficient materials such as regular-grade aluminum honeycomb panels.

The high-quality grade segment is expected to grow at the fastest rate in the aluminum honeycomb market during the forecast period of 2024 to 2034, owing to the rising demand from the aerospace and defense industries is responsible. Various types of honeycomb panels can be made from different quality aluminum materials, such as high-stress use, aircraft, space crafts, and military vehicles. In a 2023 report on the government’s focus on advanced materials for defense and aerospace applications, reinforcement, including aluminum honeycomb panels, took the following positions. As the U.S. Air Force plans to bring better technology aircraft into their fleet by 2024 using lightweight advanced material, the demand for aluminum honeycomb panels will soar. As is the case with the EU’s aerospace projects backed by the European Defence Fund (2023), the focus is on the incorporation of lightweight and high-strength materials in the aircraft of the future and drones. Moreover, the expansion of the aerospace industry and the projected increase in passenger and military airline travel, along with expenditure on defense.

The floor structure & stairways segment accounted for a considerable share of the aluminum honeycomb market in 2023 due to its importance in construction and construction transportation and its uses where high-strength metals and lightweight metals are required. Aluminum honeycomb panels are used in flooring and stairways in both commercial and residential buildings. These panels provide stability and flexibility to suit various applications in floorings and even stairway constructions of tuned special structural designs in industrial areas. The construction industry around the world has increasingly shifted its preference toward lighter and stronger building materials over the last few years due to ever-growing demands for efficient energy, energy-utilizing, and environmentally friendly structures. Moreover, the U.S. Green Building Council (2023) points out that facilities use lightweight and efficient construction material, and aluminum honeycomb panel meets these requirements.

The architectural & building panels segment is anticipated to grow with the highest CAGR in the aluminum honeycomb market during the studied years, owing to their good looks, high strength, and low thermal conductivity. Architects and designers are searching for a lightweight but sturdy material that also has insulation and weather resistance, so honeycomb aluminum panels are ideal. This is expected to increase, especially in developing nations, especially within the region, where rapid infrastructure development is occurring. Moreover, the European Union’s construction directives of 2023 recommend Energy-efficient and sustainable building materials, which add to the attractiveness of aluminum honeycomb panels.

Asia Pacific dominated the aluminum honeycomb market in 2023 and is observed to sustain the position in the coming years, owing to the growing industrialization, urbanization, and the construction of new infrastructures in Asian countries such as China, India, and Japan. The increased use of light and strong structural material in construction, automobile, and aerospace industries makes aluminum honeycomb panels suitable. China is expected to continue to exert a strong influence on the market, as the country’s status as a manufacturing powerhouse worldwide. The government of India has encouraged infrastructure growth in the country, which is linked to its national plans encompassing smart cities and make-in India, which create situated demands for aluminum honeycomb in building facades, flooring, and stairways.

North America is observed to grow at the fastest rate during the forecast period due to their regional aerospace, defense, and construction Industries, which are one of the major end-use segments in the aluminum honeycomb panels market. The largest contribution has been experienced by the United States as the strong defense budgets for space exploration and aerospace industries.

The use of lightweight, high-strength material in structures required for military and aeronautical purposes through the U.S. Department of Defense has directed the good demand for aluminum honeycomb panels in structural and safety factors. Furthermore, the current trend is that NASA and giant airplane makers, such as Boeing and Lockheed Martin, persist in using aluminum honeycomb panels in aircraft and spaceships to lower their weights and increase fuel efficiency.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

October 2024