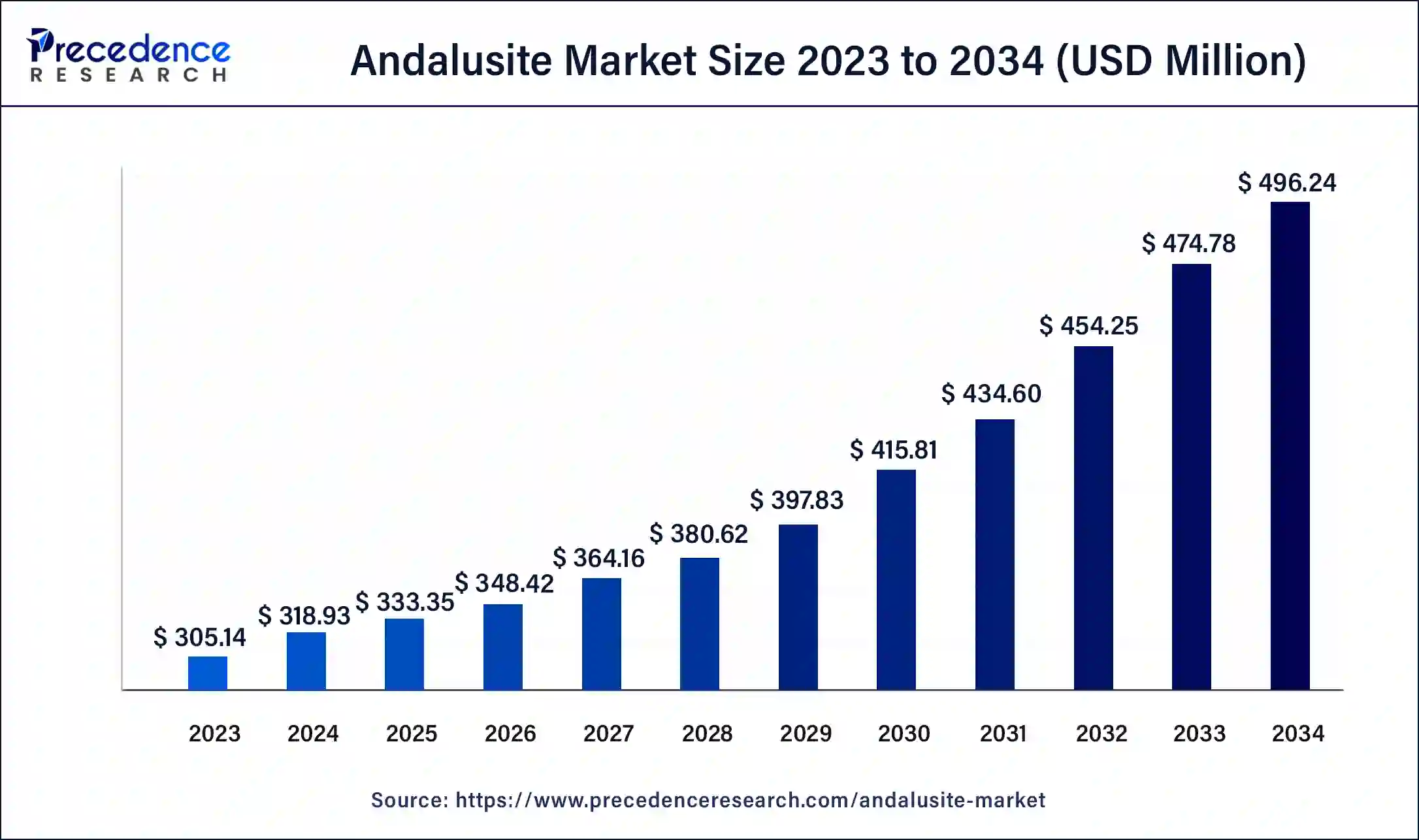

The global andalusite market size was USD 305.14 million in 2023, calculated at USD 318.93 million in 2024 and is expected to be worth around USD 496.24 million by 2034. The market is slated to expand at 4.52% CAGR from 2024 to 2034.

The global andalusite market size is worth around USD 318.93 million in 2024 and is anticipated to reach around USD 496.24 million by 2034, growing at a CAGR of 4.52% over the forecast period 2024 to 2034. The growing solar energy industrial sector, expanding automotive, industrial sector, and energy-efficient buildings rising demand and uses in pieces of jewelry, alternative healing, etc., contribute to the growth of the market.

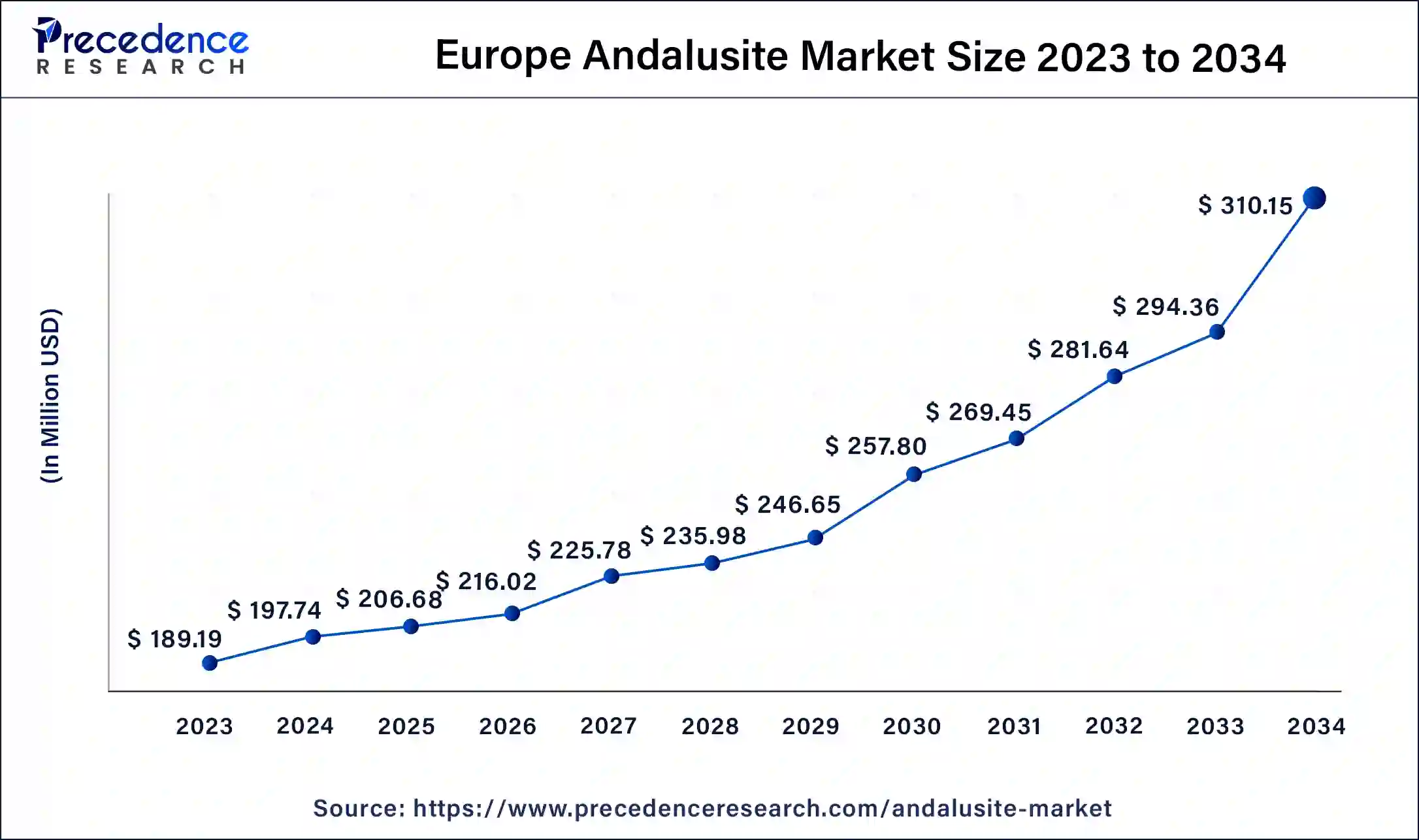

The Europe andalusite market size was exhibited at USD 189.19 million in 2023 and is projected to be worth around USD 310.15 million by 2034, expanding at a CAGR of 4.59% from 2024 to 2034.

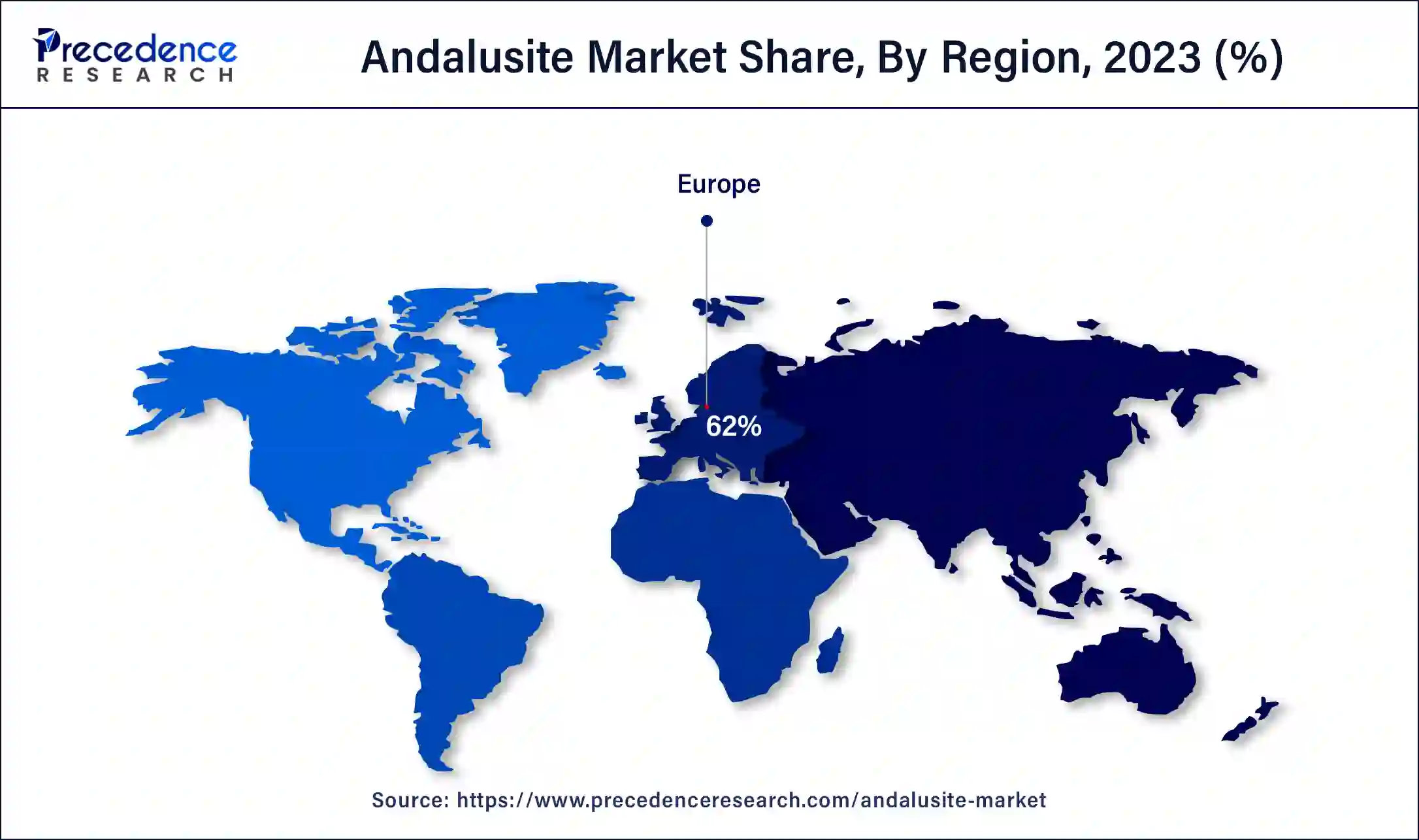

Europe Dominated the andalusite market in 2023. Growing industrialization and strong manufacturing sectors power the European market. Furthermore, refractory materials like andalusite are crucial to the functioning of established industries like steel, cement, glass, and ceramics in order to fulfill the steady and significant demand for their goods. Europe has a competitive edge in supply chain efficiency due to its strategically located mineral resources. Another significant element driving expansion is the ease of extraction, processing, and transportation made possible by being close to these deposits. This guarantees a consistent and dependable supply of andalusite-based goods to fulfill demand both domestically and internationally. The market is expanding more quickly because of Europe's dedication to research and development (R&D), as well as the increased focus on innovation and technical improvements to improve the quality and uses of andalusite goods.

North America held a significant share of the andalusite market in 2023. The demand for andalusite may be closely associated with infrastructure development and industrial activities. The United States' increasing investment in construction projects, including the construction of novel industrial infrastructure and facilities and the necessity of refractory materials, including andalusite, in sectors like cement and steel, is driving the growth of the market. The U.S. has an important steel industry and andalusite is used for steel production facilities in refractory linings.

The andalusite market refers to the manufacturing, production, and distribution of andalusite, which is an aluminum nesosilicate mineral with the chemical formula Al2OsiO5. The benefits of andalusite include industrial applications in porcelain, refractories, and ceramics, grounding spiritual energy, improving memory, addressing cellular disorders, improving deep and peaceful sleep, therapeutic benefits for treating phobias and anxiety disorders, weight loss, pain relief, cell regeneration and production, etc. Andalusite is used to manufacture spark plugs, specific ceramics, and other high-temperature applications.

What is the role of AI in the Andalusite?

Nowadays, artificial intelligence (AI) is increasingly used in the mining and processing of minerals such as andalusite. AI can improve the supply chain from mining to the andalusite market. AI helps to minimize the environmental impact on andalusite by reducing waste and improving resource use. AI-based predictive maintenance systems are helpful in monitoring the health of mining equipment. AI systems can monitor, improve, and evaluate processing and ensure consistent quality. AI algorithms can analyze geological data to identify the capacity of andalusite deposits more effectively and accurately.

| Report Coverage | Details |

| Market Size by 2034 | USD 496.24 Million |

| Market Size in 2024 | USD 318.93 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.52% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Energy efficient buildings increasing demand

Andalusite is highly used in industries like porcelain, refractories, and ceramics production because of its ability to maintain its integrity under high-temperature conditions, which contributes to the growth of the andalusite market. It plays an important role in these applications, including providing resistance to chemical and mechanical stresses, structural stability, and thermal insulation.

More expensive

Andalusite is relatively rare; it may not be suitable for all types of jewelry, and it is not as well known as any other gemstone, making it more expensive. Some other challenges include rapidly evolving technology, the necessity of changing market demand adoption, and high competition. These factors can hamper the growth of the andalusite market.

Advanced technologies of andalusite

Future opportunities for andalusite include advanced technologies, regulatory changes, and consumer preferences, which will help the growth of the andalusite market. In green manufacturing, the use of andalusite plates is increased. Environmental benefits of andalusite plates include minimum waste, thermal efficiency, high durability, low emissions, recyclability, resource efficiency, energy efficiency, and low pollution. Advanced processing technologies help to ensure that the raw materials used are effective and that any other waste produced may be recycled back into the process of production. Advanced technologies help to make life more convenient. The use of advanced technologies includes the education revolution, convenience and accessibility, automation, communication revolution, productivity, and efficiency.

The pink segment dominated the andalusite market in 2023. Andalusites are quite similar in color, but any specimen with noticeable pink, red gleam, or orange is more valuable. The color itself affects the price, but we look at the movement of color across the gemstone from one angle to another. The pink-colored andalusite crystals are mainly beneficial for emotional healing, which helps the growth of the market. It can help to reduce sadness, stress, and fears and make room for serenity and peace. The pink andalusite appears in a light pink shade and helps with focus and problem-solving.

The gray segment is expected to be the fastest-growing during the forecast period. Andalusite-colored stone is beneficial for balancing the root chakra. These chakras are helpful for our sense of security and safety. It is also helpful in balancing and opening the heart chakras. Gray andalusite is a non-transparent variety in a light gray shade. This variety is used to improve spiritual understanding, which helps the growth of the andalusite market.

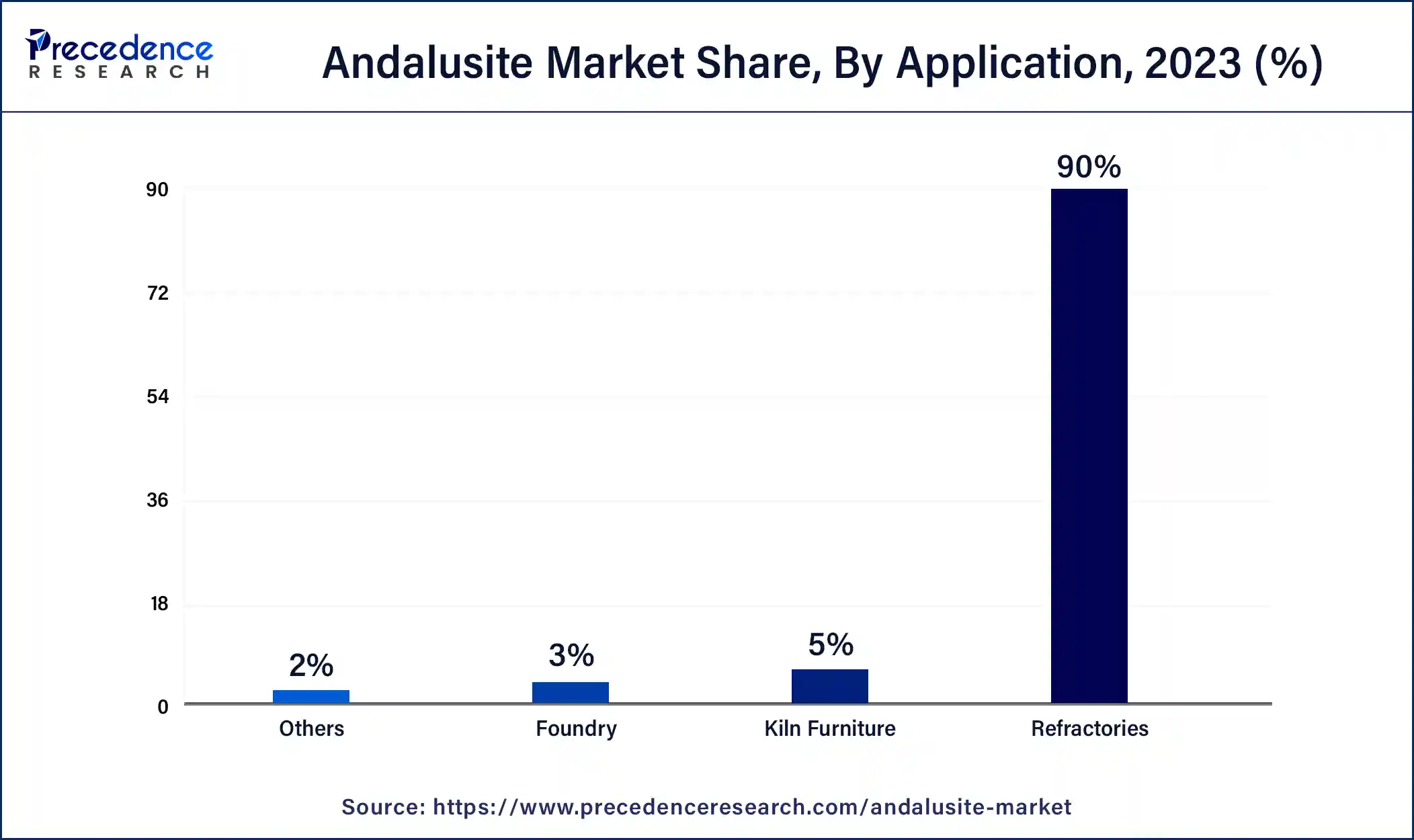

The steel segment dominated the andalusite market in 2023. In the steel industry, for steel casting, andalusite and silica sand are mixed to make the refractory molds to obtain molten steel. Because of its intrinsic characteristics, andalusite is highly used for many refractory solutions, especially in the iron and steel industry. In the steel industry, andalusite is resistant to high temperatures and plays an important role in refractory applications for ladles and furnaces by improving steel production efficiency.

The glass segment is estimated to be the fastest-growing during the forecast period. Andalusite’s resistance to chemical reactions and thermal stability make it a suitable component for glass manufacturing, which helps the growth of the andalusite market. In glass formulations, it can be added to improve its ability to withstand high temperatures at the time of forming and melting processes and to enhance the refractory properties of the glass.

The refractories segment dominated the andalusite market in 2023. The Andalusite plays an important role in refractory materials production, which are designed to withstand mechanical stresses, high temperatures, and corrosive environments. Refractories are necessary for industries like non-ferrous metal, glass, cement, and steel production, where they line kilns, furnaces, and other high-temperature equipment. Andalusite is an ideal choice for refractory applications because it is resistant to thermal shock and thermally stable. It helps to maintain the structural integrity of refractory linings and ensures that they can withstand high conditions in current industrial processes.

The kiln furniture segment is anticipated to grow at a significant rate during the forecast period. Andalusite is used in kiln furniture, which supports and structures inside kilns. For the production of mullite kiln furniture, andalusite-based compositions have been developed. The mixture of clay, andalusite, and alumina was fired at 1560°C to form excellent thermal properties of pure mullite products. These factors help to the growth of the andalusite market. In kiln furniture, the use of andalusite can reduce moisture content and improve strength. The benefits of kiln furniture include recyclability, resource efficiency, energy efficiency, low pollution, minimum waste, thermal efficiency, high durability, and low emissions, etc.

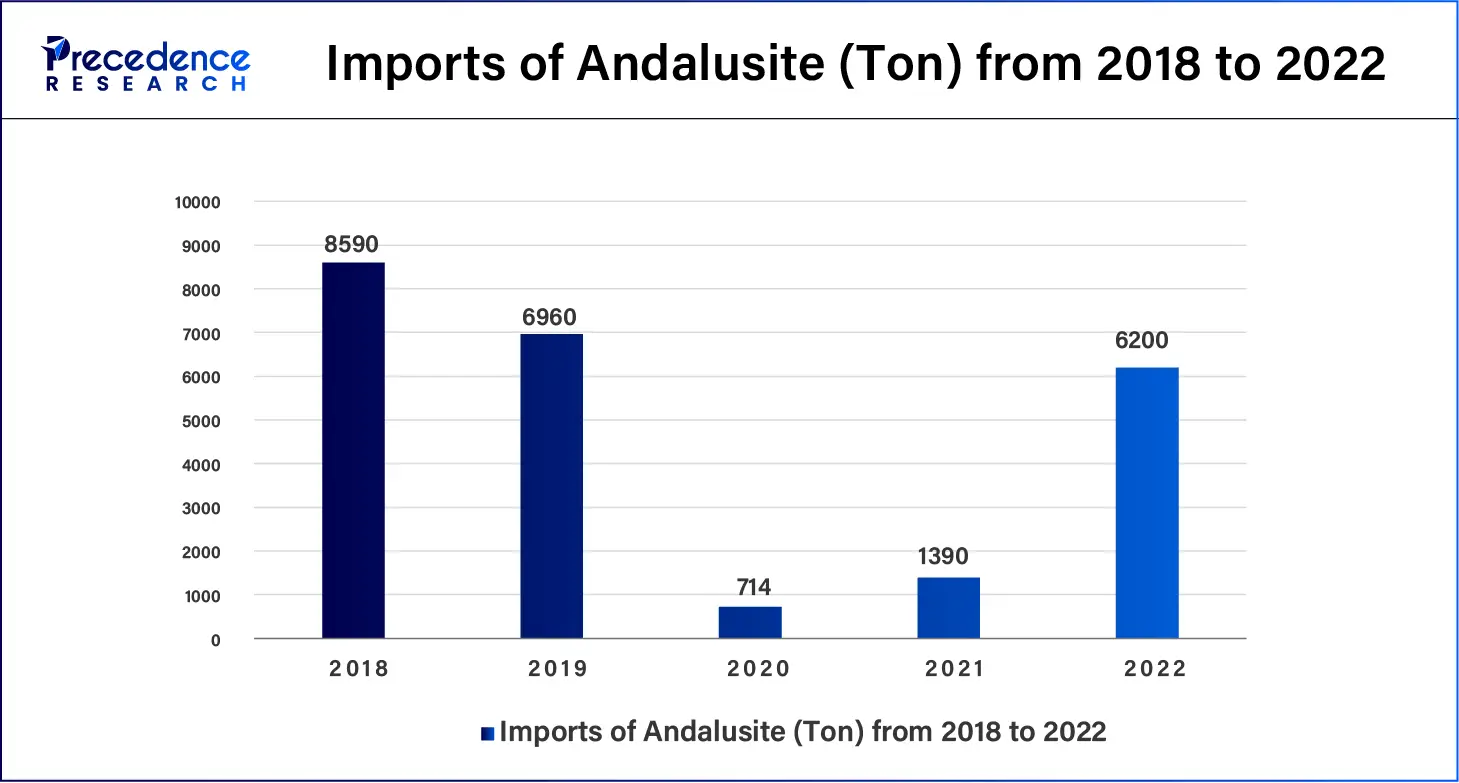

Imports for Andalusite from the period 2018 to 2022:

Asia Pacific is estimated to grow significantly during the forecast period of 2024-2034. The rising refractory production in the Asia Pacific region contributed to the growth of the andalusite market. Refractories are used to produce cement and increase the growth of the construction industry. In industries like ceramic, glass, cement, and steel, there is a need for refractory materials like andalusite, which help the growth of the market. China and India are the leading countries for the growth of the market in the Asia Pacific region.

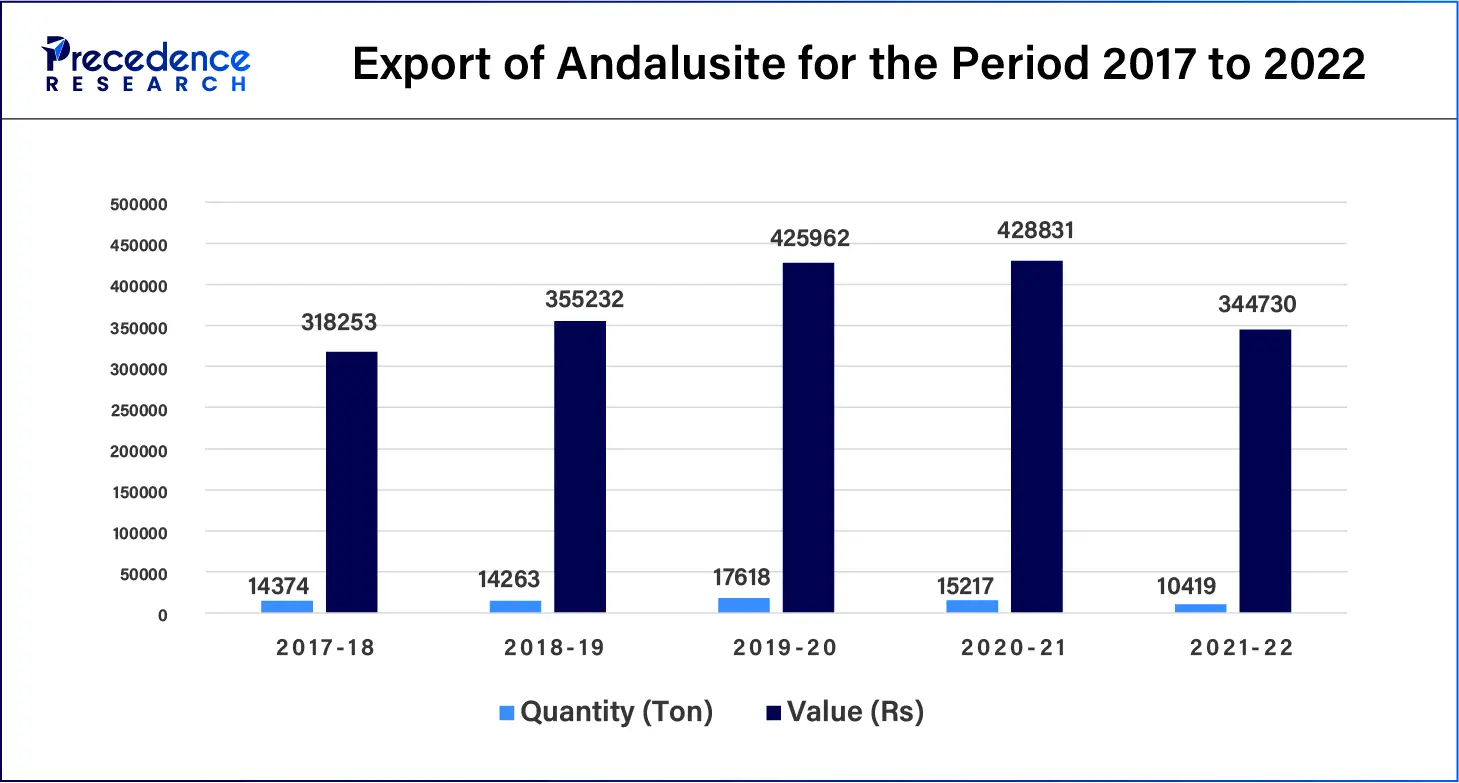

Export of Andalusite for the period 2017-18 to 2021-22 according to a report 2022-23 Govt. of India Ministry of Mines.

Segments Covered in the Report

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client