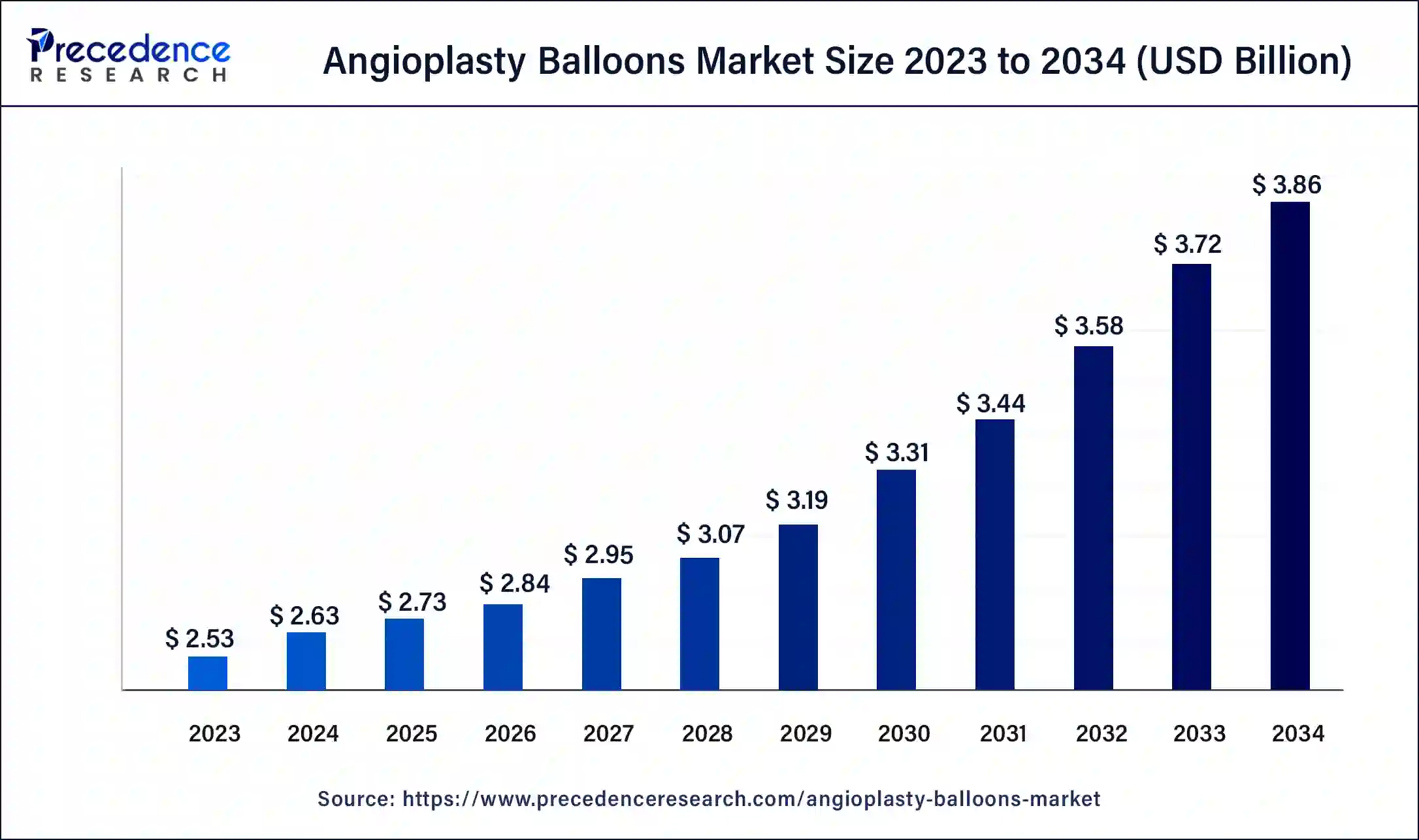

The global angioplasty balloons market size surpassed USD 2.53 billion in 2023 and is estimated to increase from USD 2.63 billion in 2024 to approximately USD 3.86 billion by 2034. It is projected to grow at a CAGR of 3.92% from 2024 to 2034.

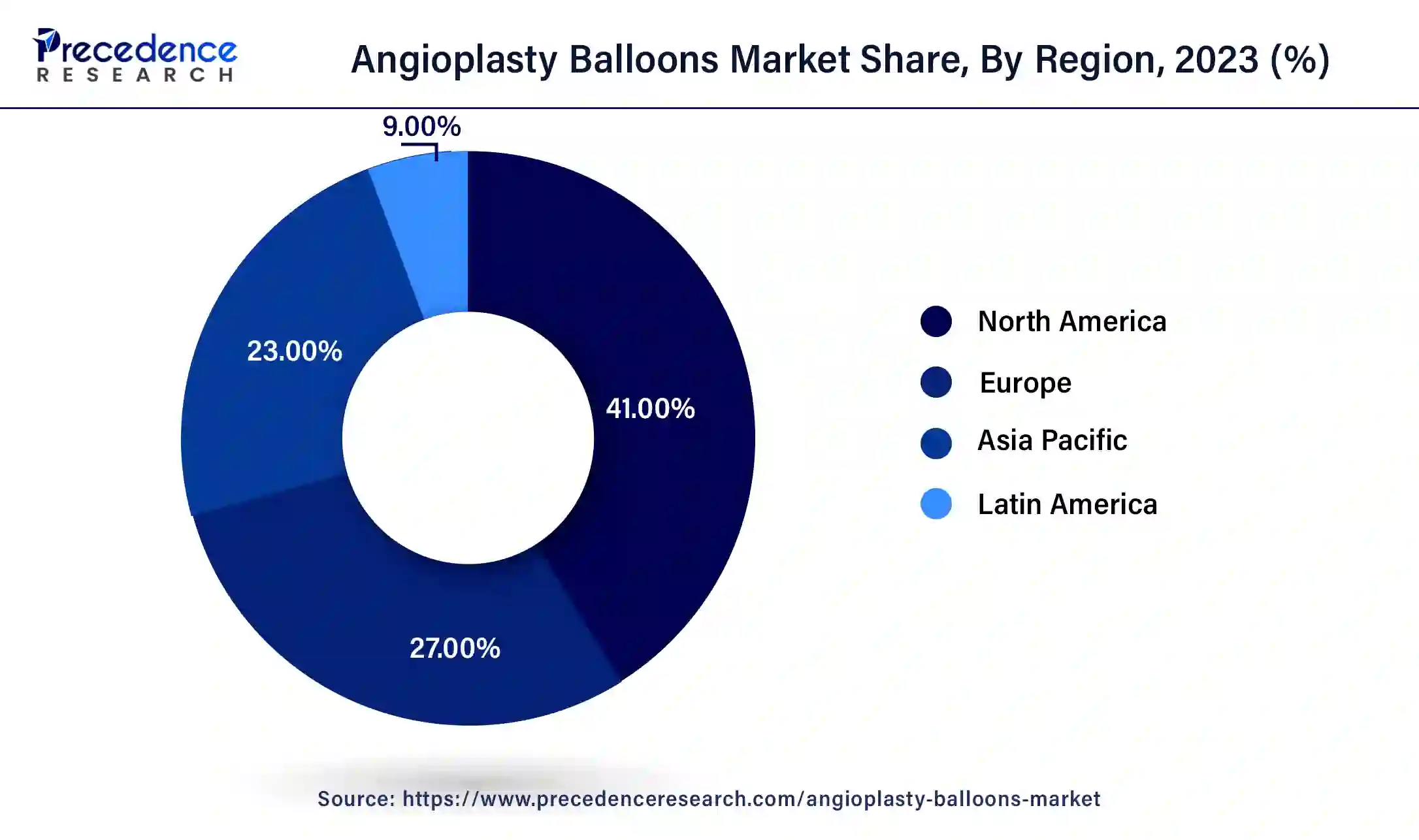

The global angioplasty balloons market size is projected to be worth around USD 3.86 billion by 2034 from USD 2.63 billion in 2024, at a CAGR of 3.92% from 2024 to 2034. The North America angioplasty balloons market size reached USD 1.04 billion in 2023. The increasing prevalence of cardiovascular diseases across the world driving the growth of the market.

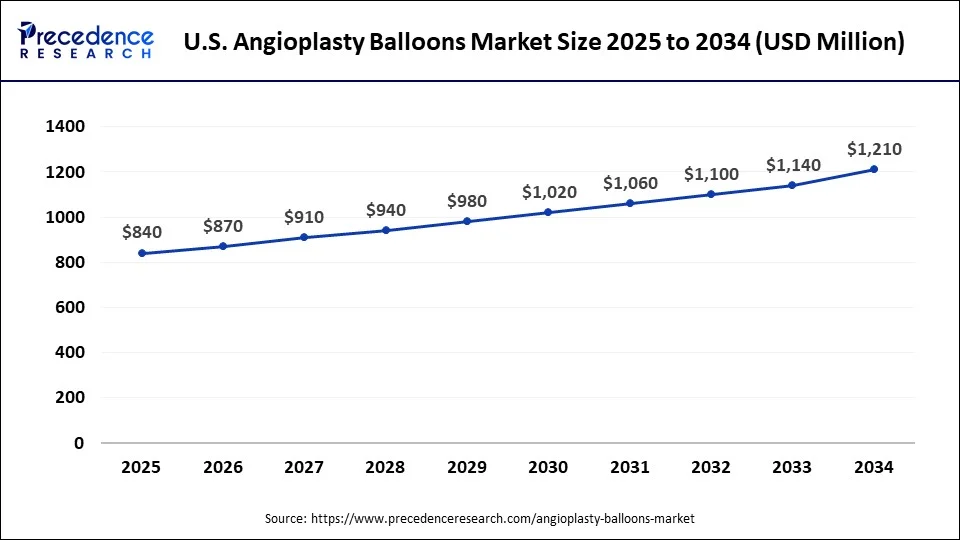

The U.S. angioplasty balloons market size was exhibited at USD 780 million in 2023 and is projected to be worth around USD 1,210 million by 2034, poised to grow at a CAGR of 4.07% from 2024 to 2034.

North America has contributed the highest market share of 41% in 2023. With the increasing number of percutaneous coronary interventions, changes in the United States FDA policies, and the presence of industry key players. These factors help to the growth of the market. The high prevalence of cardiovascular diseases like coronary artery disease leads to the development of the market in the U.S. and Canada.

The U.S. dominated the market in North America due to its advanced healthcare system and the contribution of the government and key market players. The country is also known for the largest number of fast food chains, which is the main cause of obesity and other health issues. These health issues are leading to various heart and circulatory systems-related disorders.

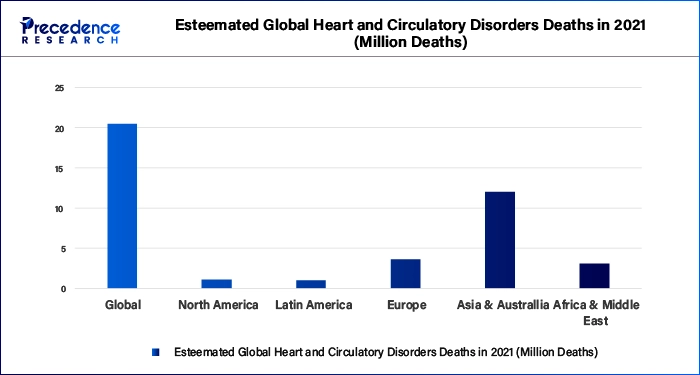

Asia Pacific is poised to grow at a CAGR of 4.71% during the forecast period of 2024-2033. Positive government support and increasing healthcare expenditure contribute to the growth of the angioplasty balloons market. The increasing expenditure is due to the growing heart and circulatory disorders in countries like India due to sedentary lifestyles and unhealthy eating habits.

The angioplasty balloons market consists of service providers of angioplasty balloons, which are minimally invasive procedures that treat narrowed or blocked arteries. It includes inserting a small balloon into a small vessel and inflating it to treat blockages and enhance blood flow. The benefits of angioplasty balloons include helping to reduce severe angina and also helping people recover from physical activity restricted due to angina. It can help to relieve symptoms of peripheral artery diseases (PAD) and enhance the flow of blood to the legs. Angioplasty balloon is a lifesaving procedure in heart attack that helps to restore the flow of blood to the heart, preventing heart damage and enhancing survival.

What are the Benefits of AI in the Angioplasty Balloons?

The benefits of artificial intelligence (AI) in angioplasty balloons include providing cardiologists with precise information related to plaque morphology, a stent (tube), balloon dimensions, and post-tube deployment assessment; this leads to total tube expansion and healthier long-term outcomes, which help to the angioplasty balloons market growth. AI in angioplasty balloons helps to improve the hospital’s diagnostic capabilities, enhance procedural accuracy, and help to better patient care. Modern technologies meet life-saving techniques. An Angioplasty balloon is a critical medical treatment for heart health, and it is modified by AI.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.86 Billion |

| Market Size in 2023 | USD 2.53 Billion |

| Market Size in 2024 | USD 2.63 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.92% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Unhealthy lifestyle and rising senior population

The changing unhealthy lifestyle and rising senior population lead to an increase in the prevalence of cardiovascular diseases. It helps to reduce chest pain in coronary artery blockages. This type of pain is known as angina. Angioplasty balloons treat these specific types. In case of a heart attack, angioplasty balloons, an emergency treatment, help to recover or limit the damage right after or during a heart attack. These factors help to grow the angioplasty balloons market.

Risks of angioplasty balloons

The risks of angioplasty balloons include abnormal heart rhythms, a blood clot may form and block a blood vessel in the brain (or stroke), kidney damage specifically in people who suffer from kidney disorders, coronary artery damage, a heart attack can occur at the time of the procedure, accidental perforation caused by incorrect catheter guidewire or catheter, restenosis due to narrowing of the vessel after completing procedure resulting in retreatment that can hamper the angioplasty balloons market growth.

Growth and innovation opportunity

The future growth and innovation opportunities of angioplasty balloons play an important role in the angioplasty balloons market. The use of bioresorbable & biodegradable materials eliminates long-term risks and enhances patient outcomes. Increasing focus on personalized medicine and rising investment in healthcare infrastructure. Evaluating procedural efficacy and safety and standardizing preprocedural planning will be crucial for its success. Enhancing remote monitoring and telemedicine and solutions to improve patient follow-up and care that contribute to the growth of the market.

The normal balloons segment dominated the angioplasty balloons market with the largest market share of 55% in 2023. The benefits of normal angioplasty balloons include favorable reimbursement policies, a submission process for approval, supportive government policies, and low costs of devices leading to the growth of the market.

The scoring balloons segment is expected to grow at a CAGR of 5.63% during the forecast period. The scoring/cutting balloons were linked with a lower risk of TLR unaccompanied by an increased risk of clinical adverse events as compared to conventional events. The device has good trackability and flexibility that can make it an ideal device for calcified lesions. The scoring balloons are less noncompliant at high pressure, and their diameter tends to increase.

The drug-eluting balloons (DEB) segment is expected to be significantly growing during the forecast period. Drug-eluting balloons (DEB) are coated with medication, and the balloons help prevent artery re-narrowing by stopping cell growth and dividing too much. The benefits of drug-eluting balloons include no acute recoil tackle dissection, abdominal trapping, less drug spillage into the circulation, less requirement of prolonged DAPT mechanical support, accessibility to long segments and complex lesions, leaving no implants, large surface area, and less drug localization in the vessel wall that leads to the growth of the angioplasty balloons market.

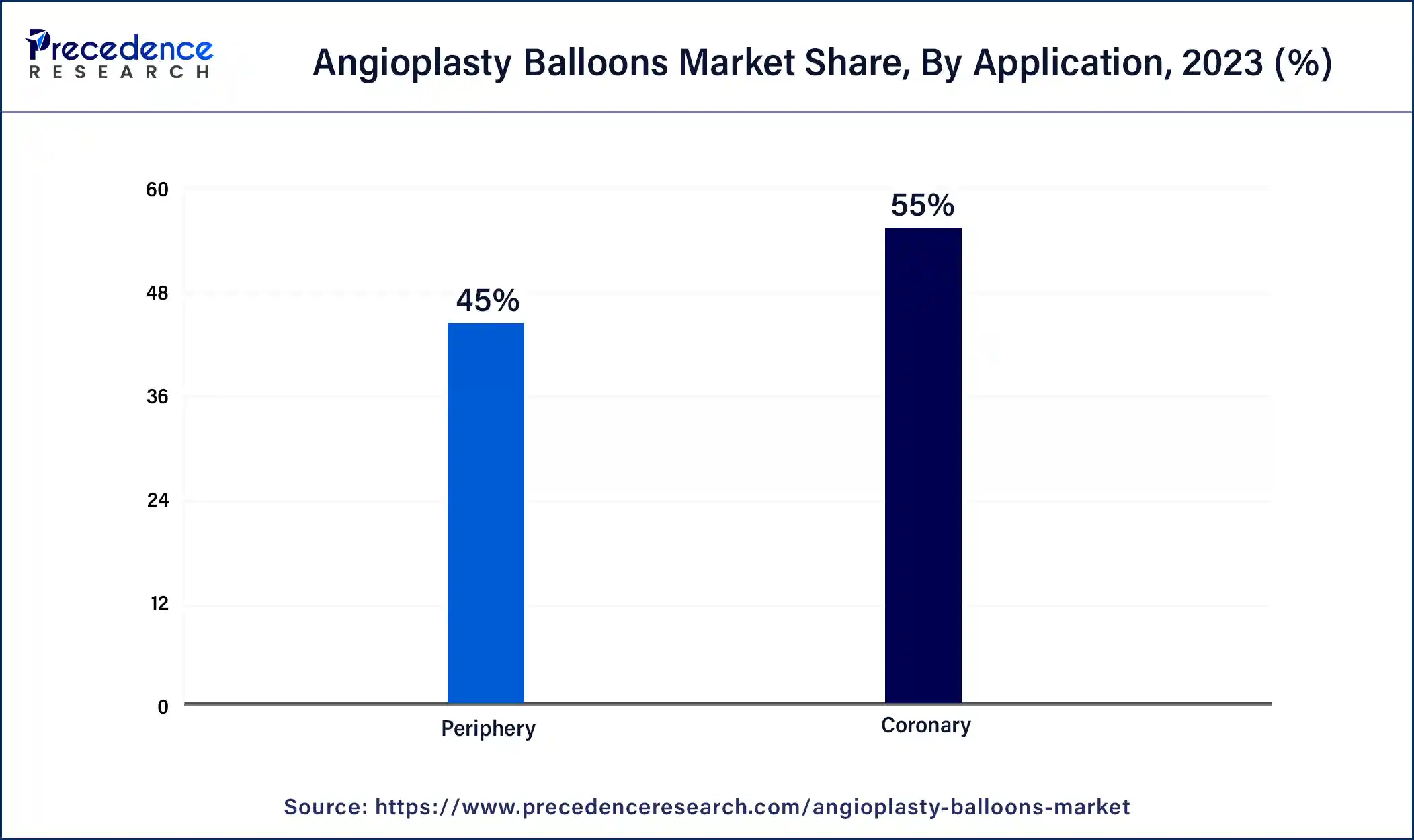

The coronary segment has recorded more than 55% of the market share in 2023. In the coronary disorders, angioplasty balloons play an important role. The coronary angioplasty balloon is a procedure to open clogged blood vessels of the heart and treat vessels. It is a small balloon on a narrow tube known as a catheter, which is used to widen a clogged artery and enhance blood flow to help the market’s growth.

The peripheral vascular diseases segment is growing at a CAGR of 4.51% during the forecast period. The angioplasty balloons play an important role in peripheral vascular diseases. The angioplasty balloon can help to reduce severe angina and also help people recover from physical activity restricted due to angina. The angioplasty balloons can recover symptoms of PAD and enhance the flow of blood to the legs helping to the growth of the angioplasty balloons market.

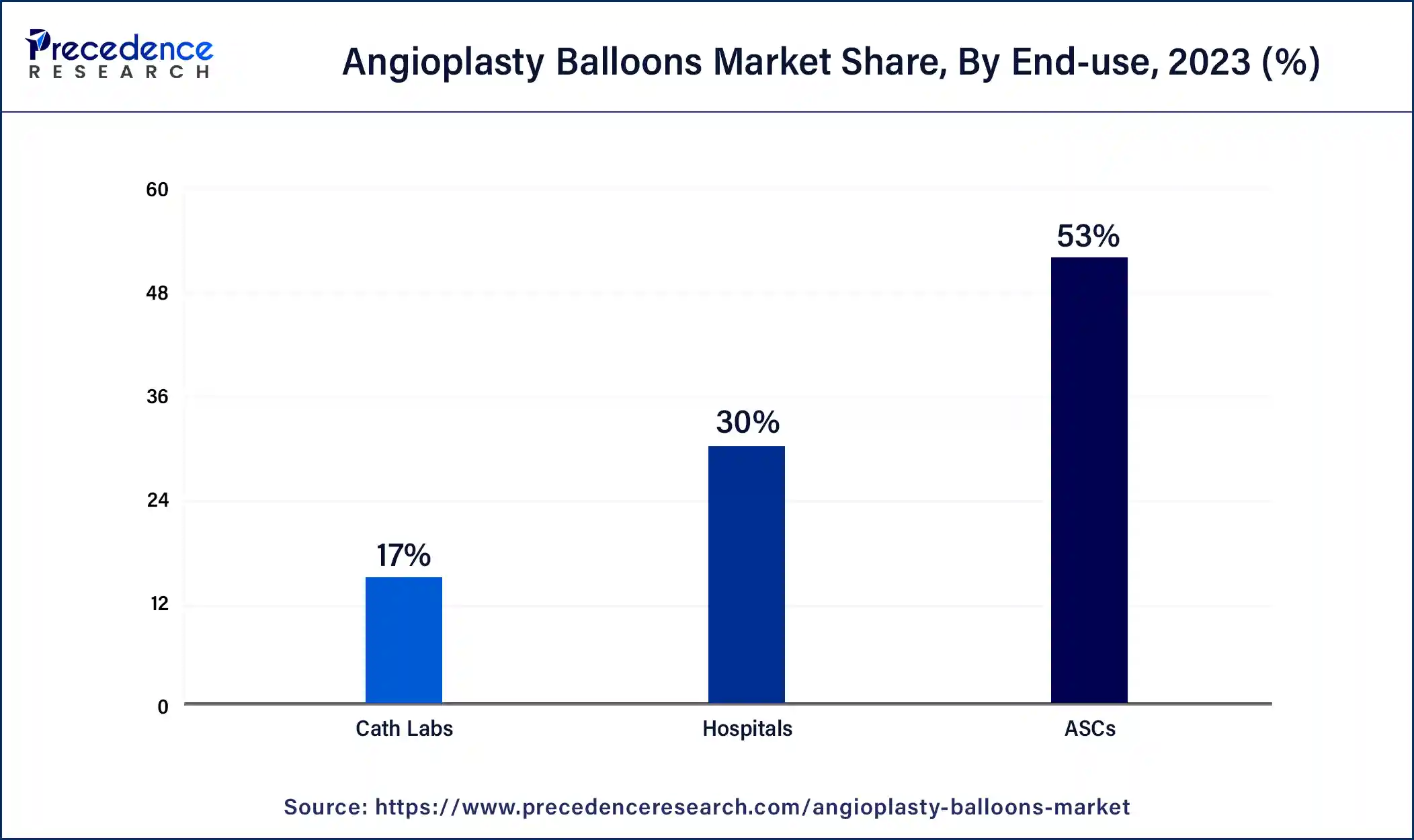

The ambulatory surgical centres (ASCs) segment accounted more than 53% of market share in 2023. These ambulatory surgical centers (ASCs) offer patients many benefits over traditional hospital-based surgical procedures, including smaller chances of infectious disease exposure, lower costs, and shorter wait times.

The hospitals segment held the second-largest share of the market in 2023. Hospital benefits include insurance coverage for expenses related to visiting a hospital for health care. The benefits include ambulance services, stays in rehabilitation facilities, emergency room visits, outpatient surgery, intensive care, medical supplies, medical treatments, and room and board.

Segments Covered in the Report

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client