December 2024

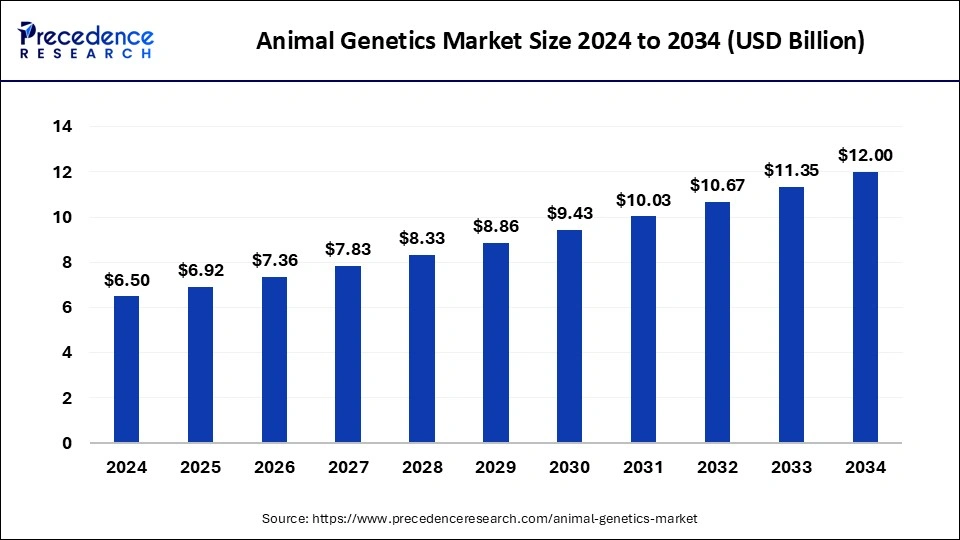

The global animal genetics market size is accounted at USD 6.92 billion in 2025 and is forecasted to hit around USD 12.00 billion by 2034, representing a CAGR of 6.32% from 2025 to 2034. The North America market size was estimated at USD 2.15 billion in 2024 and is expanding at a CAGR of 6.35% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global animal genetics market size was calculated at USD 6.50 billion in 2024 and is predicted to increase from USD 6.92 billion in 2025 to approximately USD 12.00 billion by 2034, expanding at a CAGR of 6.32% from 2025 to 2034. The animal genetics market is driven by the growing consumer demand for premium proteins.

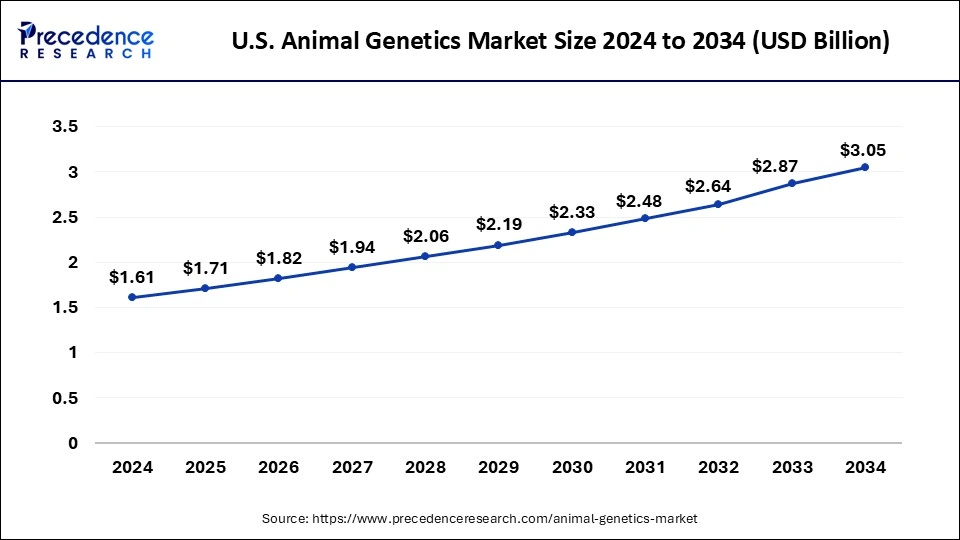

The U.S. animal genetics market size was exhibited at USD 1.61 billion in 2024 and is projected to be worth around USD 3.05 billion by 2034, growing at a CAGR of 6.60% from 2025 to 2034.

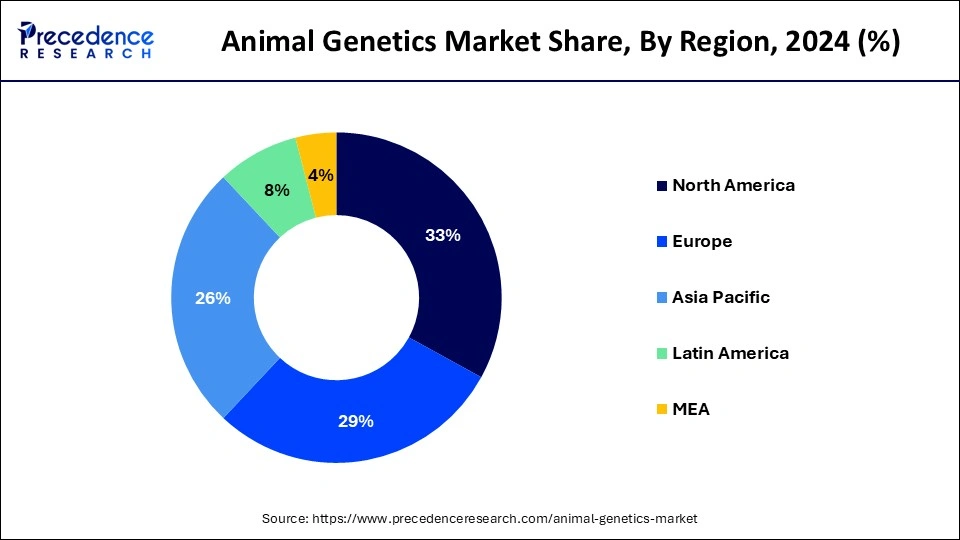

North America had dominated the animal genetics market in 2024. Breeding programs have become more accurate and productive with genome selection and gene-editing tools like CRISPR. These developments make it possible to choose animals with desired qualities, such as increased output, resistance to disease, and higher-quality milk or meat.

Due to efficient supply systems, genetic materials and technology are guaranteed to reach farms and breeding centers promptly and efficiently. Excellent veterinary care guarantees the well-being and productivity of animals with superior genetic makeup while facilitating the application of advanced breeding methods.

North America Animal Genetics Market Trends

Asia-Pacific is observed to be the fastest-growing in the animal genetics market during the forecast period. To guarantee food security and increase livestock output, numerous governments in the Asia-Pacific area are actively supporting developments in animal genetics. They carry out policies encouraging genetic enhancement initiatives, giving subsidies, and investing in research and development. To satisfy the nation's expanding need for meat, the Chinese government, for example, strongly emphasizes creating livestock breeds with high yields.

Asia Pacific Animal Genetics Market Trends

The animal genetics market is significant for many areas of science, veterinary care, and agriculture. Animals with desired qualities, such as improved disease resistance, quicker development rates, and higher milk output, can be chosen and bred thanks to animal genetics. This results in animal production that is more sustainable and effective. The field of animal genetics research adds to our understanding of genetics, inheritance, and evolutionary biology, among other topics. This can be used in fields other than agriculture, like biotechnology and human medicine. The animal genetics market involves the study and application of genetics in animals, primarily focused on breeding and improving desired traits in livestock and companion animals.

Companies offer genetic testing services to evaluate genetic potential, predict traits, and screen for genetic disorders in animals. This helps breeders make informed decisions about breeding selections.

The animal genetics market plays a crucial role in enhancing agricultural productivity, improving animal welfare, and meeting global food demands sustainably. Major players in this market include companies like Genus PLC, Zoetis, and Neogen Corporation, which specialize in genetic solutions for both commercial and companion animal sectors.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.00 Billion |

| Market Size in 2025 | USD 6.92 Billion |

| Market Size in 2024 | USD 6.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.32% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Animal Type, Type, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for animal-derived products

Incomes increase when economies expand, especially in emerging countries. More people include animal proteins in their diets due to having more income. The term "nutrition transition" describes this process. Increased animal disease resistance can result from genetic advancements, lowering mortality and raising output. This is especially crucial in areas where certain animal diseases are common. This drives the growth of the animal genetics market.

Government investments in research and development

Governments contribute large sums to universities, research centers, and private businesses that work with animal genetics. This financial backing is essential for carrying out basic and applied research. For example, the Agriculture and Food Research Initiative (AFRI) in the United States is one of the programs the USDA uses to fund agricultural research, including animal genetics.

Governments frequently encourage public-private collaborations to capitalize on the advantages of each industry. Partnerships between public and private research organizations speed up the commercialization of genetic advances by facilitating the transfer of technology and knowledge.

Shortage of professionals with expertise in animal genetics

The lack of skilled geneticists can hinder research and development (R&D) efforts, which are critical for identifying novel genetic markers, creating sophisticated breeding methods, and developing instruments for genetic modification. Without sufficient human resources, it could be difficult for businesses engaged in animal genetics to grow and market novel genetic products. This may reduce their market penetration and make room for expansion. This limits the growth of the animal genetics market.

Increasing demand for animal protein

For the animal agricultural sector to fulfill the increasing demand for animal protein, efficiency and productivity must be increased. Herein lies the role of animal genetics. Genetic breakthroughs can result in breeds that produce more meat, milk, or eggs, grow faster, and are more resistant to disease. This can lead to higher yields and cheaper costs for farmers. Furthermore, genetic developments can increase an animal's resilience to sickness, which lowers the requirement for antibiotics and other drugs. This enhances animal welfare while addressing antibiotic resistance-related public health issues. Longer lifespans and higher productivity in healthier animals can increase the financial success of animal husbandry. This opens an opportunity for the growth of the animal genetics market.

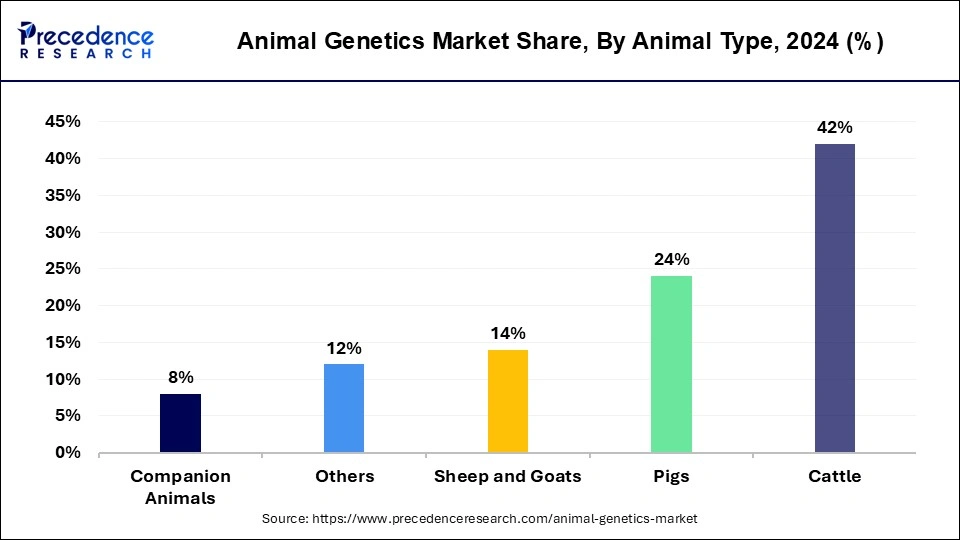

The cattle segment dominated in the animal genetics market in 2024. The dairy and beef industries both depend heavily on cattle. Dairy goods such as milk, cheese, yogurt, and beef have always been in great demand worldwide. This economic significance motivates investments in enhancing cattle genetics to increase productivity and profitability. There is a growing consumer demand for safe and high-quality dairy and meat products. Genetic advancements help meet these demands by developing cattle with improved meat quality and increased milk production efficiency.

The companion animals segment is observed to be the fastest growing in the animal genetics market during the forecast period. Pet ownership is rising as more people live in cities and embrace lifestyles prioritizing emotional support and companionship. This trend is especially noticeable in industrialized and emerging economies where disposable incomes are increasing. The need for companion animals is further driven by an increase in single-person homes and aging populations in many areas, who are turning to dogs for company.

Advances in companion animal genetic testing enable breeders and pet owners to understand genetic illnesses better, optimize breeding practices, and improve the general health of their animals. As a result of these services' increasing affordability and accessibility, the market is expanding.

The assistive reproduction technologies segment dominated in the animal genetics market in 2024. Due to IVF, which enables the fertilization of eggs outside the body, more control over the genetic composition of the progeny is possible. This method is quite helpful for breeding programs that want to improve particular qualities. Reduced breeding expenses, fewer infections, and higher production are among the long-term economic benefits, even though the initial setup and technology costs can be costly. The implementation of ART is motivated by the increasing demand for premium animal products, which aims to effectively match consumer demands.

The genomic/genomic testing segment is observed to be the fastest growing in the animal genetics market during the forecast period. Animals with enhanced productivity traits, such as dairy cattle with larger milk yields, poultry with faster development rates, and swine with better feed efficiency, are in greater demand. Genetic testing can help breeders find and choose animals with these desirable features, increasing total output. Enhancing animal health and disease resistance is a growing priority for breeders. By detecting genetic predispositions to diseases early on, genomic testing lowers the occurrence of hereditary problems and facilitates the selection of healthier breeding stock.

The private segment dominated in the animal genetics market in 2024. Leading-edge technologies like CRISPR, gene editing, and genomic selection have seen significant private institutions' investments. Genetically superior breeds have developed faster thanks to these methods. Businesses spend money on biotechnological research to enhance animal characteristics, including growth rate, feed efficiency, and disease resistance, increasing their products' competitiveness. Due to their financial capabilities, private companies can make significant investments in infrastructure, R&D, and market expansion. Their extensive operations result in cost efficiencies, raising their products' affordability and consumer appeal.

By Animal Type

By Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

October 2024

February 2024