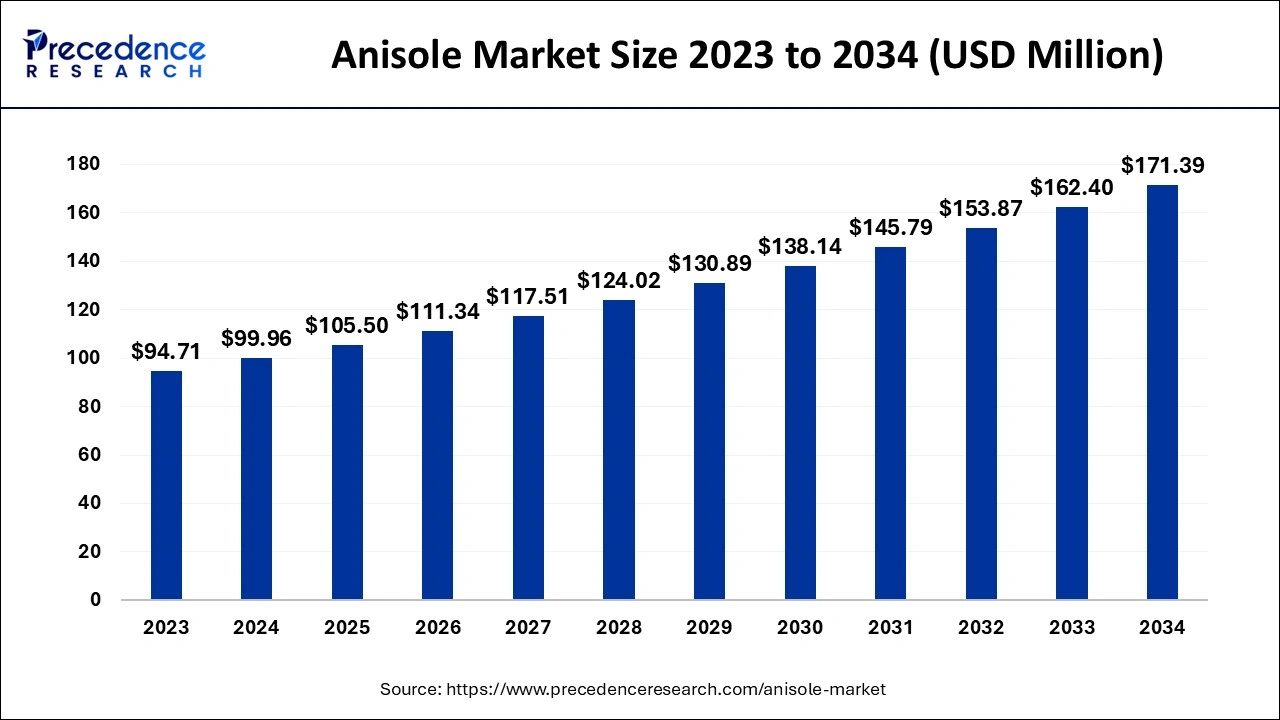

The global anisole market size accounted for USD 99.96 million in 2024, grew to USD 105.50 million in 2025 and is projected to surpass around USD 171.39 million by 2034, representing a CAGR of 5.52% between 2024 and 2034. The North America anisole market size is evaluated at USD 29.99 million in 2024 and is expected to grow at a CAGR of 5.54% during the forecast year.

The global anisole market size is worth around USD 99.96 million in 2024 and is expected to hit around USD 171.39 million by 2034, growing at a CAGR of 5.52% from 2024 to 2034. The anisole market growth is attributed to the increasing demand for eco-friendly chemicals, particularly bio-based anisole.

Artificial intelligence (AI) is enabling improvement in various sectors of business operations and processes in the anisole market. In chemical logistics, it increases effectiveness in chemical manufacturing by improving the process of maintenance, supply chain, and synthesis. It speeds up innovation by using analysis tools to understand large sets of information in order to come up with solutions quicker without the need for excessive expenditures on testing. Furthermore, algorithms derived from AI assist in market analysis, provide demand trends, and predict price trends, helping stakeholders come to better decisions.

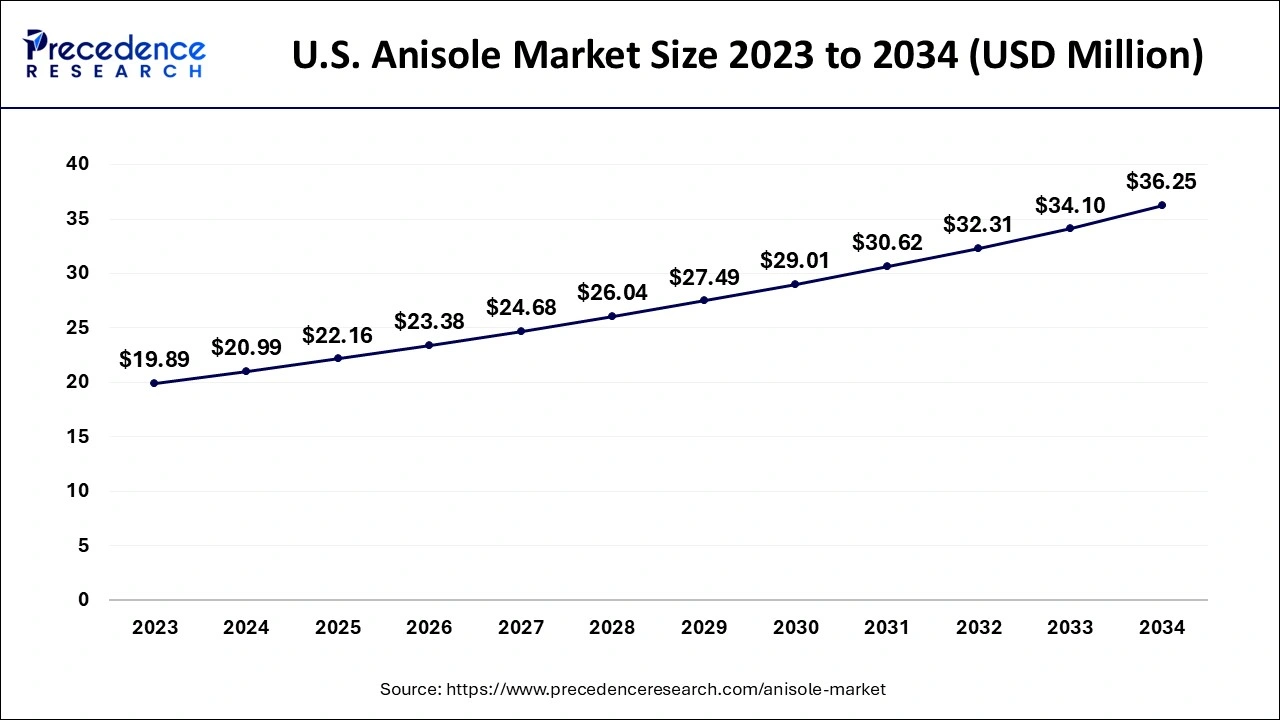

The U.S. anisole market size is evaluated at USD 20.99 million in 2024 and is expected to be worth around USD 36.25 million by 2034, growing at a CAGR of 5.61% from 2024 to 2034.

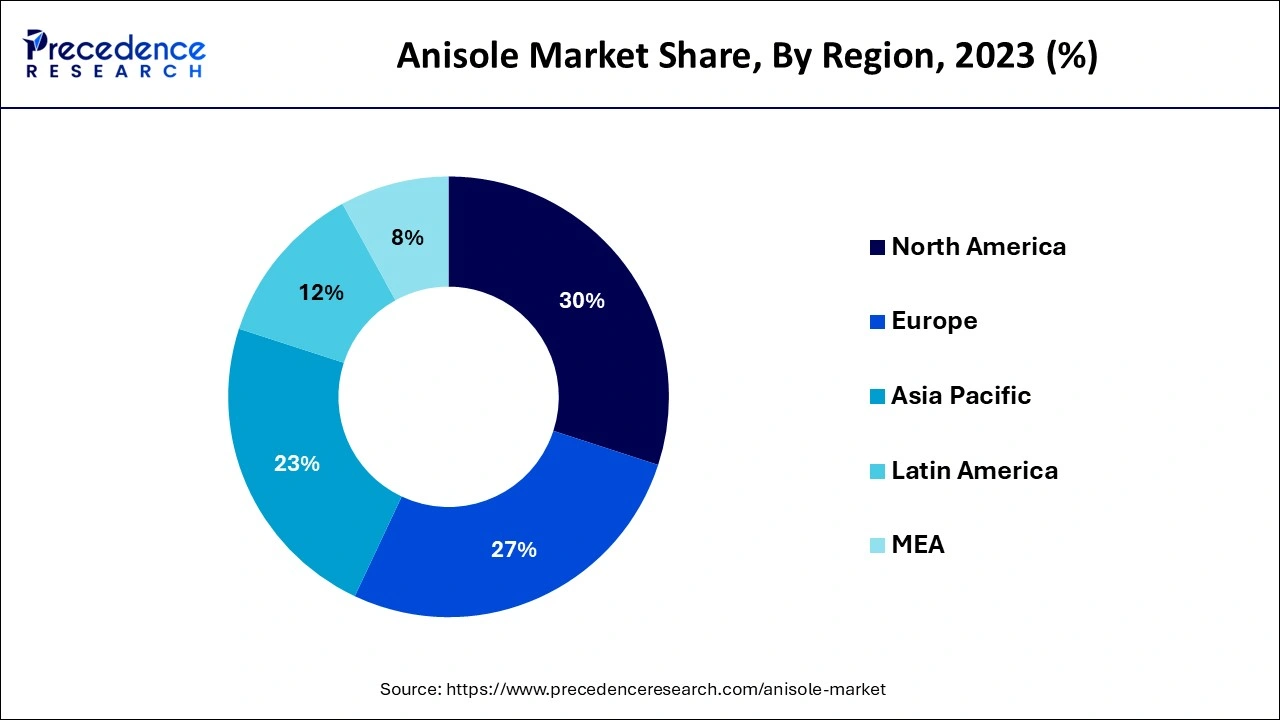

North America dominated the global anisole market by registering the highest revenue share in 2023, owing to the increased production of drugs and chemicals. Purified anisole is used chiefly as a synthetic intermediate in the production of pharmaceuticals and fragrances. Thus, the growing need for better chemicals for drug synthesis and fragrances will drive anisole consumption in the future, particularly in the United States and Canada. Furthermore, the increasing consciousness about natural and green chemical products is also expected to contribute to the growth of bio-based anisole when consumed by clients and used in production in the region.

Asia Pacific is anticipated to grow at the fastest rate in the anisole market during the forecast period, owing to its increasing industrial capacity and rising usage of anisole in end-use industries such as fragrances, drugs and chemicals, pesticides, and others. Many countries in the region have achieved high levels of economic growth in recent times, such as China and India, meaning that the consumption profile tends to shift towards the purchase of such items as perfumes. Furthermore, there is an increasing emphasis on green or bio-derived chemicals in countries such as Japan and South Korea, as well as the general search for bio-based anisole.

With the rising usage in various important industries such as pharma, cosmetics, food and beverages, and agrochemicals, the anisole market is growing. This anisole market is especially strengthened by the general application of anisole in synthesizing fragrances, active pharmaceutical ingredients (APIs), and agrochemical products. In the manufacture of pharmaceuticals, anisole acts as an intermediate in the synthesis of important drugs necessary for human health.

Solvent application in the production of different chemicals has also boosted its market demand. The United Nations Industrial Development Organisation, UNIDO, is positive on the outlook of higher demand for chemicals such as anisole, as the region’s expansion of its industrial base ends higher consumer spending power. Furthermore, the ever-expanding pharmaceutical and cosmetics.

| Report Coverage | Details |

| Market Size by 2034 | USD 171.39 Million |

| Market Size in 2024 | USD 99.96 Million |

| Market Size in 2025 | USD 105.50 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Grade, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Growing demand in the pharmaceutical sector

Growing demand for anisole in the pharmaceutical sector is projected to drive the anisole market growth due to its application as an intermediate in the synthesis of key drugs. The continual use of anisole is needed in the fabrication of active pharmaceutical ingredients required in cancer treatment and cardiovascular illness. Cancer cases estimated at 20 million globally in 2023, as cited by WHO, show that the world needs new drugs.

According to the American Cancer Society, in 2024, annual cancer-related deaths exceed 10 million, and as a result, pharmaceutical companies will have to shift their attention to the use of anisole to achieve higher yields in drug synthesis. Furthermore, cardiovascular diseases remain the top killer in the world and are reported to have caused 18.6 million deaths in 2023, as estimated by the Global Heart Hub, thus increasing the production of anisole-based compounds in the manufacture of drugs.

Environmental regulations

Stringent environmental regulations are likely to hamper the expansion of the anisole market due to concerns over its production and waste management processes. Some reagents employed in anisole synthesis produce toxic products; therefore, compliance with safety and the disposal of chemicals used is a critical requirement. In the ECHA 2023 update, the agency piled pressure on chemical manufacturers on calls for tighter restrictions to minimize emissions and pollution. These policies put a lot of pressure on manufacturers to fund sustainable technologies, raising both operating costs and potentially reducing profitability.

Growing demand for bio-based anisole

Growing demand for bio-based anisole is anticipated to create significant opportunities in the anisole market as industries shift toward sustainable practices. The market need for bio-based anisoles is increasing as the rising global trends toward the use of sustainable chemical products. This change has been aggravated by regulatory policies, such as the European Green Deal and the UN/enforcement of greener industrial policies.

With cited emission targets and tax incentives for green material, the use of bio-based chemicals in Europe in 2023 increased by over 15%, as stated by the European Bioplastics. Furthermore, new achievements in green chemistry, employing the use of zeolite-supported nickel catalysts for anisole synthesis, have enhanced the effectiveness of biomass-derived production techniques, thus further fuelling the market.

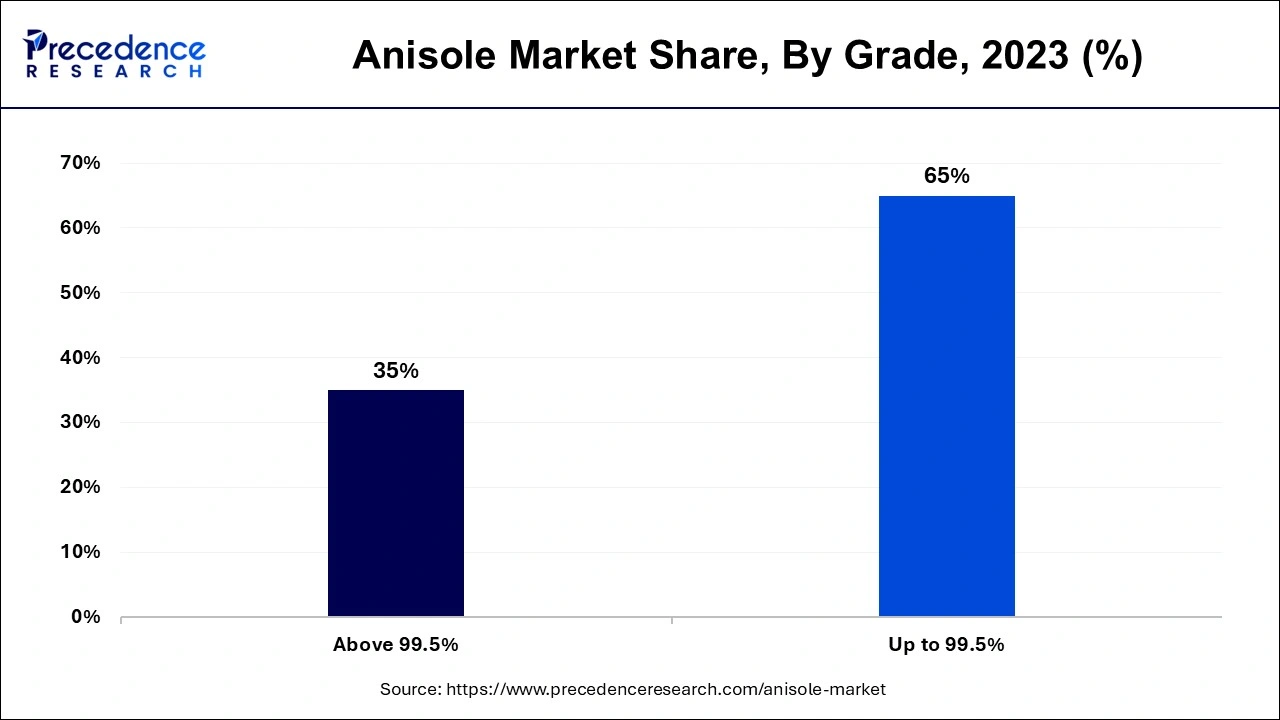

The up to 99.5% segment held a dominant presence in the anisole market in 2023 due to the extensive use of anisole as a solvent for creating intermediates used in agrochemicals and fragrances. This grade is better for environments where high purity is not completely necessary, but at the same time, it is inexpensive enough to maintain a good standard at a lower price. Furthermore, the growing demand for aromatic chemicals at a lower cost further fuels the market.

The above 99.5% segment is expected to grow at the fastest rate in the anisole market during the forecast period of 2024 to 2034, owing to their high applications in the high-precision products manufacturing industries, including pharmaceuticals and electronics. Ani-(tert)sole is known to be utilized in the synthesis of APIs, especially in cancer and cardiovascular diseases, and there is demand for ultra-high purity ani-(tert)sole. Moreover, in the electronics industry, the highly purified anisole is used in the production of semiconductors and other high-value components to respond to the demands of new technologies and even higher standards.

The perfumes segment accounted for a considerable share of the anisole market in 2023 due to its primary purpose as a flavoring aid in the cosmetics trade. Due to its frail, sweet scent, anisole is incorporated into cheap or lower-ranked perfumes and luxury-grade perfumes. Such a segment also persists in experiencing steady increments due to the increased demand for new and individualistic scents by consumers across the world. Additionally, according to the 2023 report by international market research firm Euromonitor International, the global rates for fragrance consumption had stabilized. The emerging markets in China and India for the substance lifted the usage of anisole in the perfume production cycle.

The pharmaceuticals segment is anticipated to grow with the highest CAGR in the anisole market during the studied years, owing to the critical function of APIs in the manufacturing of active pharmaceutical ingredients. The demand for drugs is growing rapidly, especially in developing countries where the infrastructure of the healthcare sector is actively developing. Moreover, there is a growing use of anisole in the pharmaceutical industry, especially in the synthesis of drugs and as a precursor in APIs.

By Grade

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client