February 2025

Nickel Market (By Class Type: Class 1 (99.8%), Class 2 (<99.8%); By Application: Stainless Steel, Special Steels, Batteries, Electroplating, Alloys, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

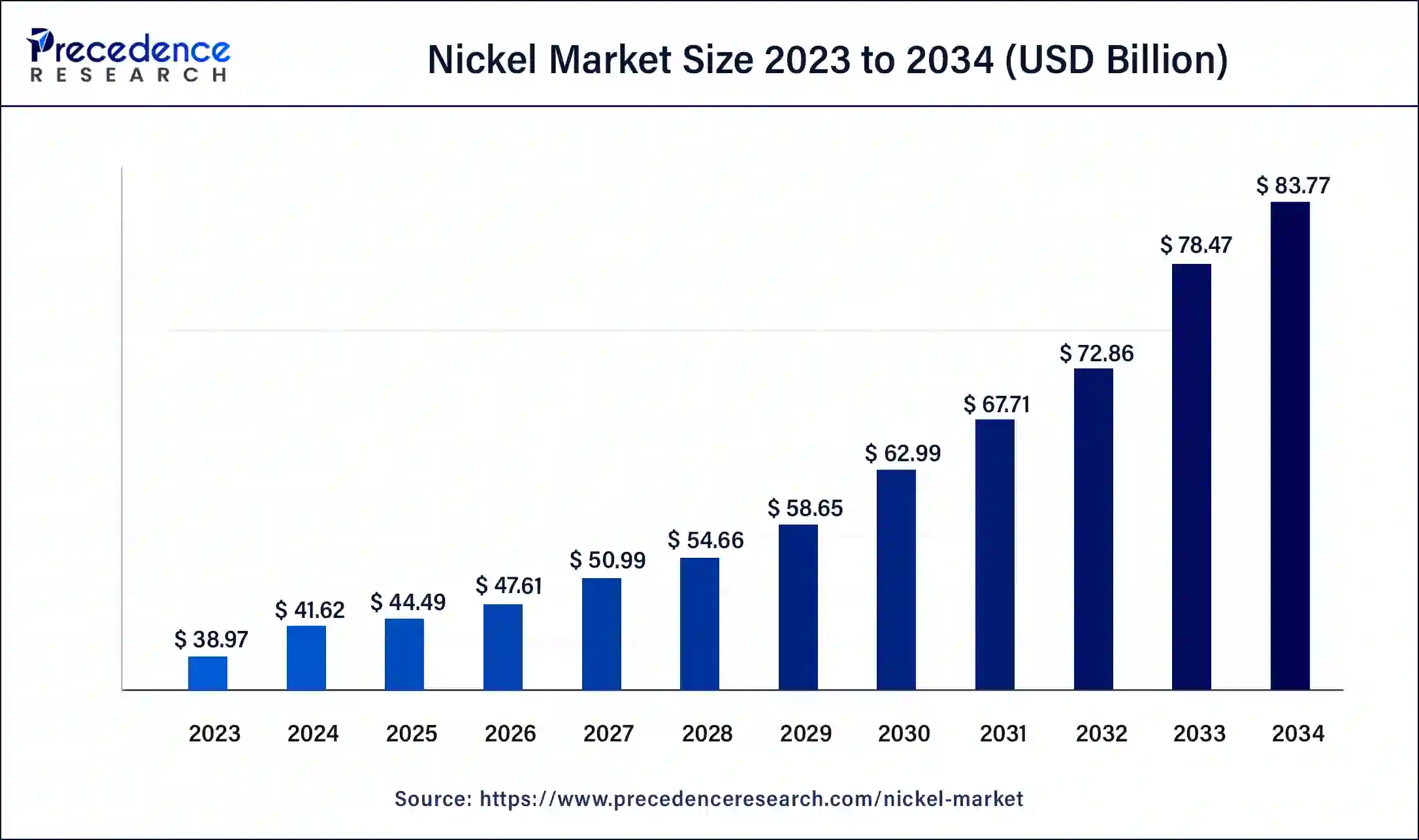

The global nickel market size was USD 38.97 billion in 2023, calculated at USD 41.62 billion in 2024 and is expected to reach around USD 83.77 billion by 2034, expanding at a CAGR of 7.25% from 2024 to 2034.

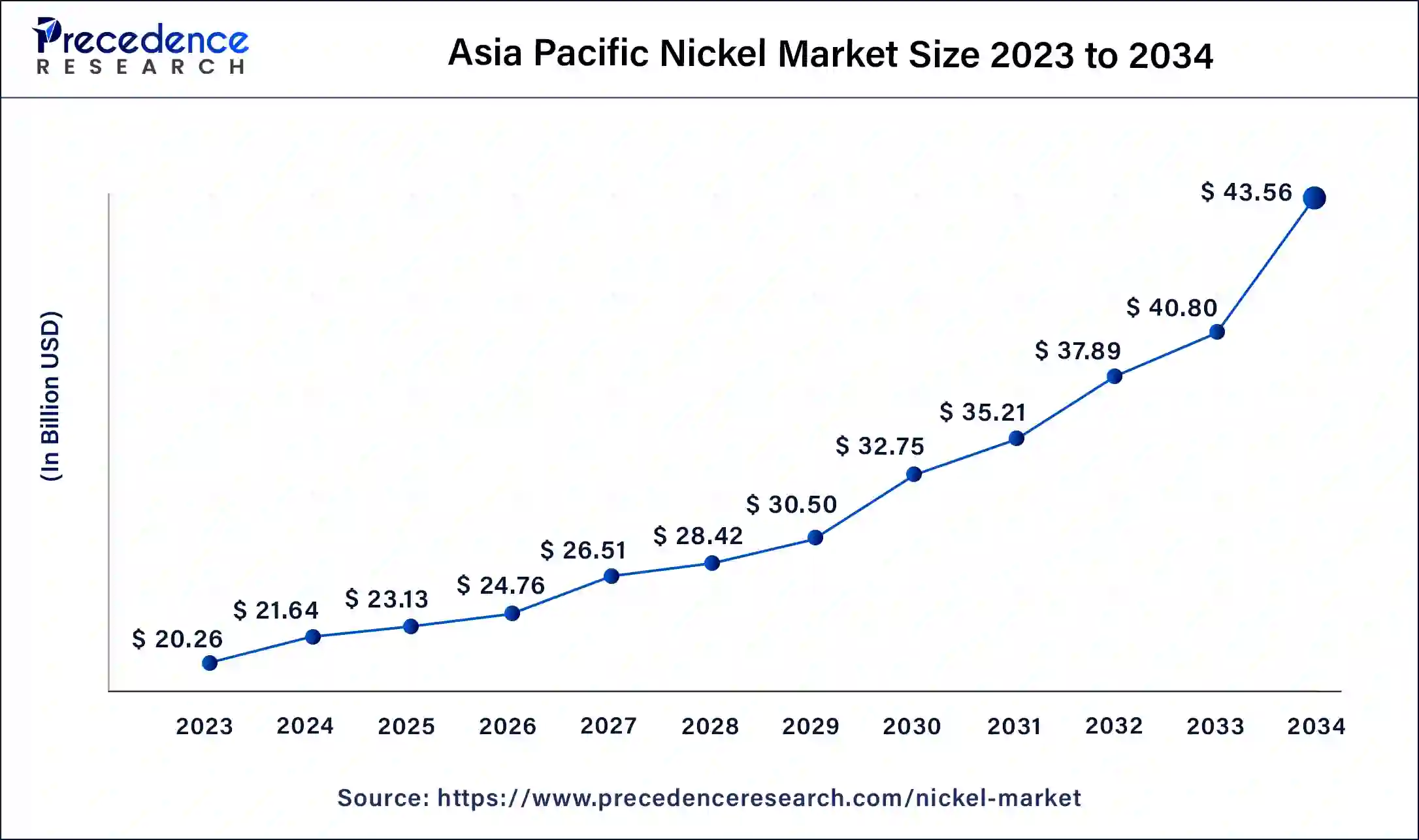

The Asia Pacific nickel market size was valued at USD 20.26 billion in 2023 and is expected to reach around USD 43.56 billion by 2034, growing at a CAGR of 7.40% from 2024 to 2034.

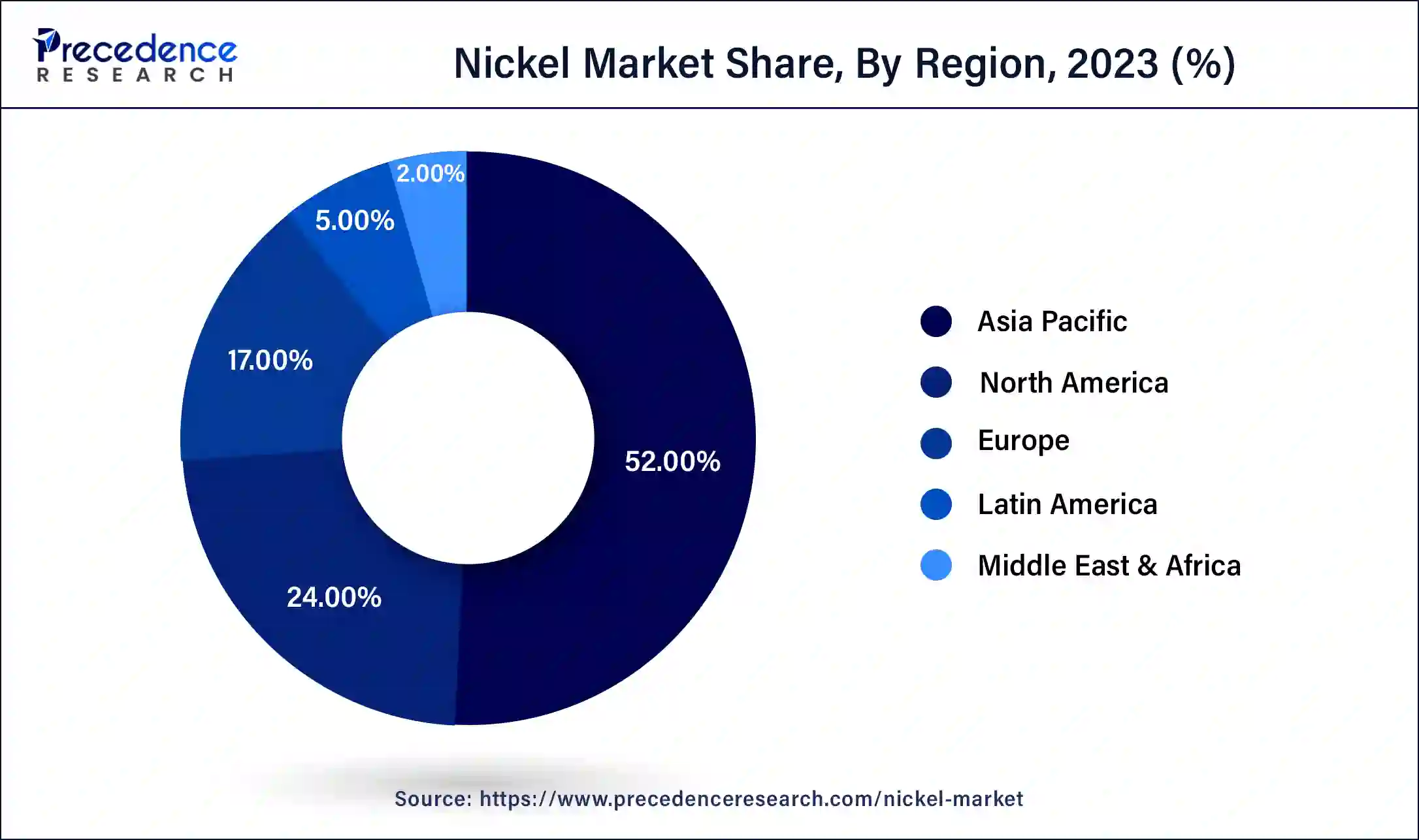

Asia-Pacific held a dominating share of 52% in the nickel market due to rapid industrialization, robust infrastructure development, and the region's dominance in key industries.

China, a major contributor, leads in stainless steel production and the electric vehicle market, both driving nickel demand. Moreover, the expanding manufacturing and construction sectors in emerging economies within the Asia-Pacific region further contribute to the substantial market share. The continuous growth in these industries, coupled with a rising focus on renewable energy, positions Asia-Pacific as a key player in the global nickel market.

North America is gearing up for accelerated growth in the nickel market, primarily propelled by rising demand in electric vehicles (EVs) and renewable energy applications. The region's commitment to clean energy transitions is fueling substantial investments in EV infrastructure and energy storage projects, where nickel plays a pivotal role. As North America intensifies its green initiatives and modernizes industrial practices, the demand for nickel, essential in batteries and alloys, is set to experience significant expansion.

Europe is experiencing noteworthy growth in the nickel market due to several factors. The region's increased emphasis on electric vehicle adoption and the growing demand for renewable energy storage systems are key drivers. Additionally, the expanding aerospace and construction sectors contribute to higher nickel consumption. Europe's commitment to sustainability and environmental initiatives further drives the use of nickel in green technologies. As the continent strives for technological advancements and a reduced carbon footprint, the nickel market is positioned for significant growth in meeting the evolving demands of these industries.

Nickel, denoted by the symbol Ni and atomic number 28, is a versatile metallic element valued for its corrosion resistance and silvery-white appearance. This transition metal finds extensive use in industry, particularly in the production of stainless steel, alloys, and currency. Its robust properties, including high-temperature resilience and resistance to oxidation, make nickel a key component in manufacturing processes for industrial equipment, aerospace components, and electrical appliances.

Furthermore, nickel's contribution to rechargeable batteries, such as lithium-ion batteries prevalent in electronics and electric vehicles, underscores its significance in advancing technology and renewable energy. While indispensable in various applications, it's important to note that prolonged exposure to nickel may pose health risks, particularly for individuals prone to allergic reactions.

Nickel Market Data and Statistics

| Report Coverage | Details |

| Global Market Size by 2034 | USD 83.77 Billion |

| Global Market Size in 2023 | USD 38.97 Billion |

| Global Market Size in 2024 | USD 38.97 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.25% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Class Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Infrastructure demand

China's Belt and Road Initiative, a massive infrastructure project, alone is expected to involve investments exceeding $1 trillion, boosting nickel consumption in construction and transportation sectors.

The surge in infrastructure demand is a substantial driver for the increased market demand for nickel. Infrastructure projects, spanning construction, transportation, and utilities, often require materials with high corrosion resistance, making nickel-containing alloys a preferred choice. The robust properties of nickel contribute to the durability and longevity of structures, particularly in challenging environments. As emerging economies embark on extensive infrastructure development initiatives, the demand for nickel rises significantly, fueling its market growth.

Moreover, the use of nickel extends beyond traditional construction to encompass modern infrastructure requirements such as bridges, tunnels, and advanced energy systems. Nickel's role in creating materials with superior strength and resistance to harsh conditions positions it as a critical component in the evolving landscape of global infrastructure. This sustained demand is poised to persist as nations continue to invest in large-scale infrastructure projects, further establishing nickel's integral role in meeting the challenges of contemporary construction and development needs.

Supply chain disruptions

Supply chain disruptions serve as significant restraints in the nickel market, impacting market demand in various ways. The nickel market is highly dependent on a complex global supply chain involving mining, processing, transportation, and manufacturing. Any disruption at any stage, whether due to geopolitical tensions, trade restrictions, or unexpected events like natural disasters, can lead to shortages and hinder the market's ability to meet demand. These disruptions not only affect the availability of nickel but also contribute to price volatility, making it challenging for industries relying on nickel to plan and maintain stable operations.

Moreover, the interconnected nature of the global economy means that disruptions in one region can have cascading effects on the entire nickel supply chain. In recent years, events like trade disputes and the COVID-19 pandemic have highlighted the vulnerability of the nickel market to such disruptions. To mitigate these restraints, stakeholders in the nickel industry need to focus on building resilient supply chains, diversifying sources, and implementing contingency plans to navigate unforeseen challenges and ensure a more stable and sustainable market.

Recycling initiatives

Recycling initiatives present promising opportunities in the nickel market by addressing sustainability concerns and fostering a circular economy. As the global focus on environmental responsibility intensifies, there is an increasing emphasis on recycling nickel-containing materials, such as batteries and stainless steel. Developing efficient recycling processes for these materials not only mitigates the environmental impact of nickel extraction but also ensures a more secure and sustainable supply chain.

Furthermore, recycling initiatives contribute to the conservation of valuable resources, reducing the dependence on primary nickel production. Industries are recognizing the economic and environmental benefits of incorporating recycled nickel into manufacturing processes, leading to the emergence of new markets and applications. The growth of recycling in the nickel market aligns with broader environmental goals, creating a win-win scenario where sustainable practices meet the increasing demand for nickel in various industries.

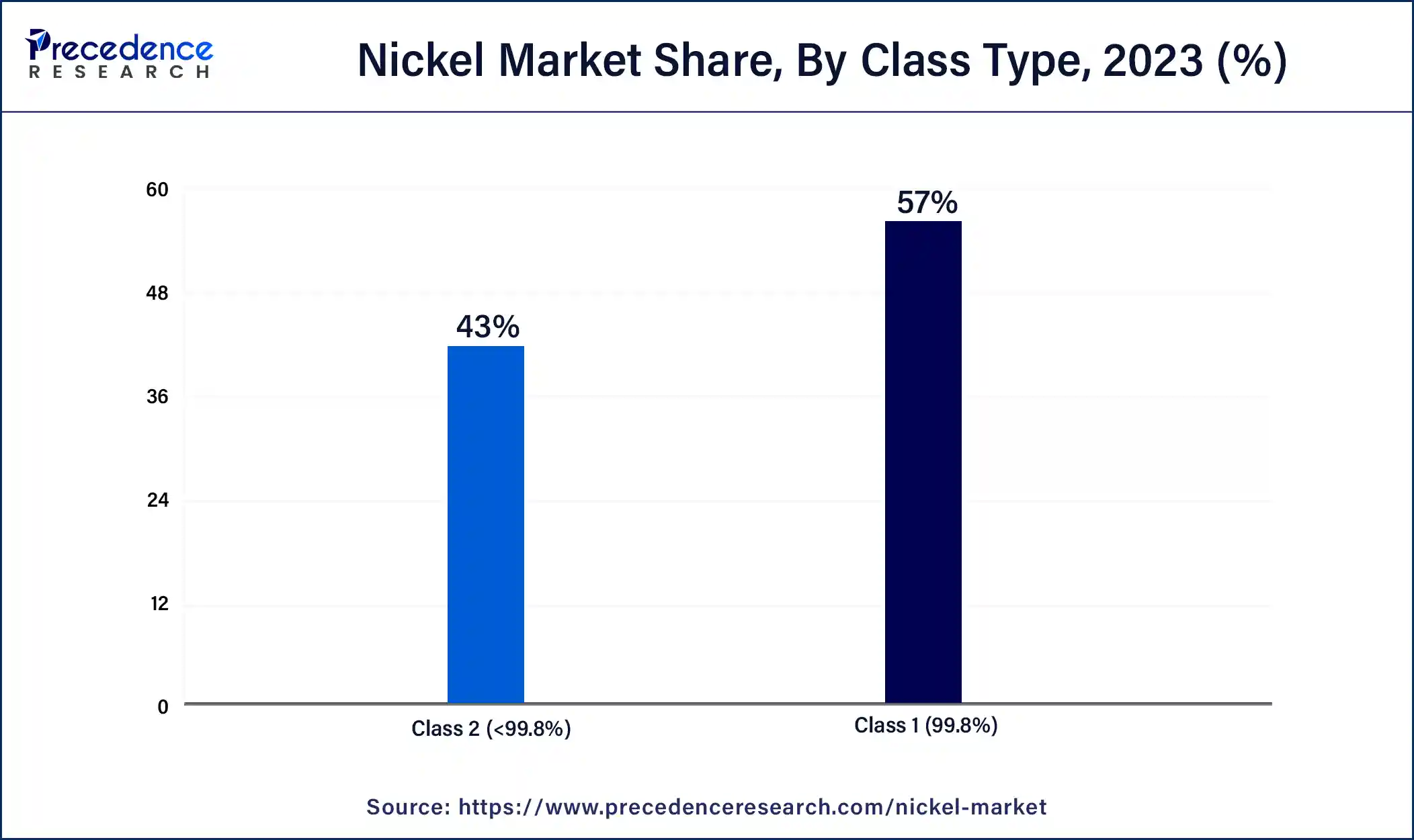

The class 1 (99.8%) segment had the highest market share of 57% in 2023. In the nickel market, Class 1 nickel, characterized by its high purity level of 99.8% or above, represents a premium category of nickel products. This segment is primarily sourced from sulphide ores and is known for its superior quality, making it a preferred choice in critical applications, including aerospace, electronics, and high-performance alloys. The Class 1 nickel market is witnessing a growing demand trend, driven by the increasing requirements for advanced materials in technological and industrial sectors that prioritize the exceptional properties and reliability offered by high-purity nickel.

The class 2 (<99.8%) segment is anticipated to expand at a significant CAGR of 8.12% during the projected period. In the nickel market, Class 2 nickel refers to material with a purity level below 99.8%. This segment includes nickel derived from various sources, such as nickel pig iron and ferronickel. Despite its slightly lower purity, Class 2 nickel is crucial for stainless steel production and the manufacturing of nickel alloys. Recent trends indicate a steady demand for Class 2 nickel, driven by the robust growth in stainless steel applications, infrastructure development, and the expanding electric vehicle market, where nickel is a key component in battery production.

The stainless steel has held a 32% market share in 2023. In the nickel market, the stainless steel segment refers to the utilization of nickel in the production of stainless steel alloys. Stainless steel, renowned for its corrosion resistance and durability, finds extensive applications in construction, automotive, and manufacturing sectors. The trend in this segment involves continuous innovations in stainless steel formulations, production processes, and the rising demand for high-performance materials. As global infrastructure and construction projects expand, the stainless steel segment is poised for growth, driving sustained demand for nickel in the development of corrosion-resistant and robust stainless steel products.

The electroplating segment is anticipated to expand fastest over the projected period. In the nickel market, the electroplating segment involves the application of a thin layer of nickel onto a metal surface through electrochemical processes. This enhances corrosion resistance, durability, and aesthetics, making it pivotal in industries like automotive, electronics, and aerospace. A growing trend in electroplating includes the adoption of advanced techniques to improve efficiency and reduce environmental impact. Innovations in green electroplating methods, such as pulse plating and non-toxic electrolytes, align with sustainability goals and contribute to the evolution of the nickel market in this application.

Segments Covered in the Report

By Class Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

September 2024

January 2025