January 2025

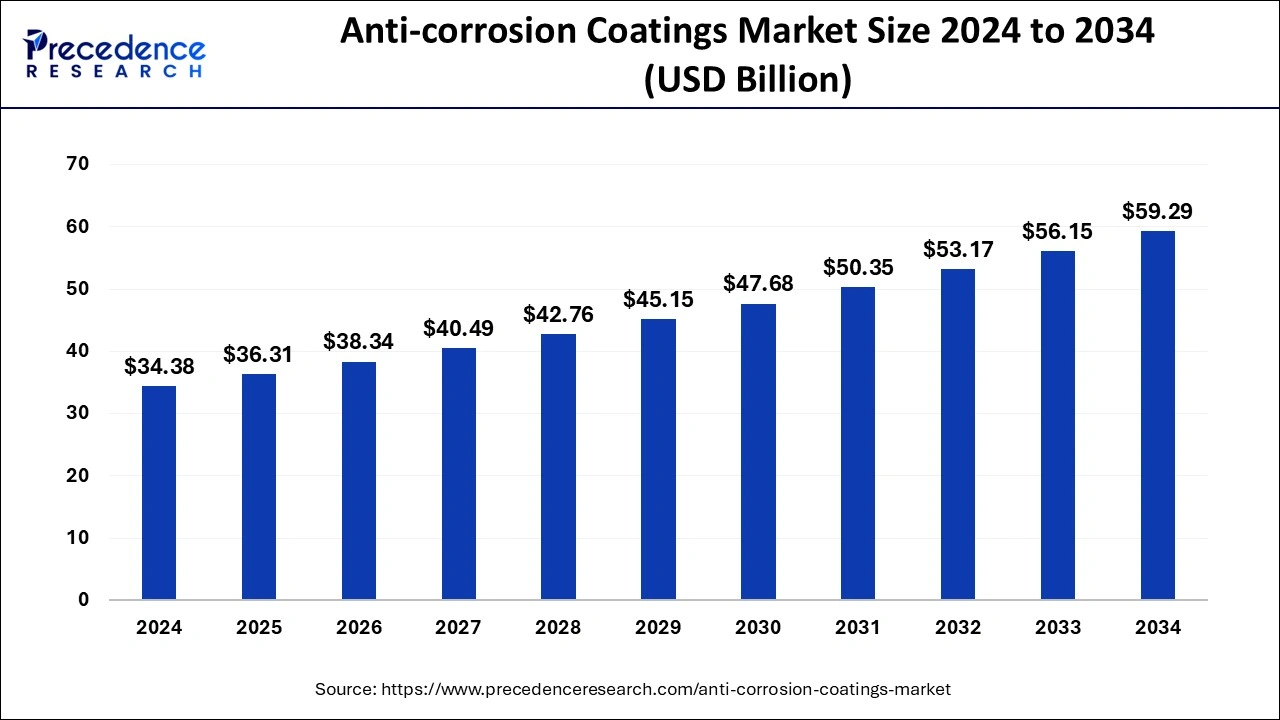

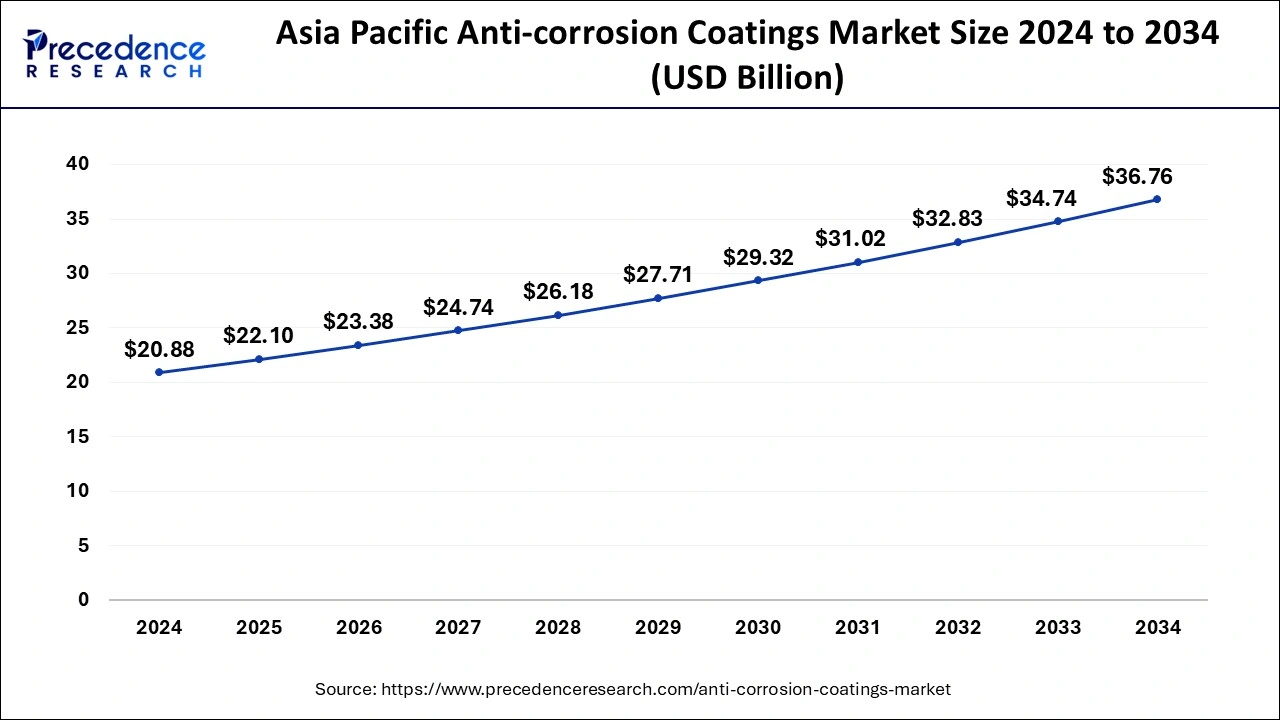

The global anti-corrosion coatings market size is calculated at USD 36.31 billion in 2025 and is forecasted to reach around USD 59.29 billion by 2034, accelerating at a CAGR of 5.60% from 2025 to 2034. The Asia Pacific anti-corrosion coatings market size surpassed USD 22.10 billion in 2025 and is expanding at a CAGR of 5.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global anti-corrosion coatings market size was estimated at USD 34.38 billion in 2024 and is anticipated to reach around USD 59.29 billion by 2034, expanding at a CAGR of 5.60% from 2025 to 2034.

The Asia Pacific anti-corrosion coatings market size was evaluated at USD 20.88 billion in 2024 and is predicted to be worth around USD 36.76 billion by 2034, rising at a CAGR of 5.80% from 2025 to 2034.

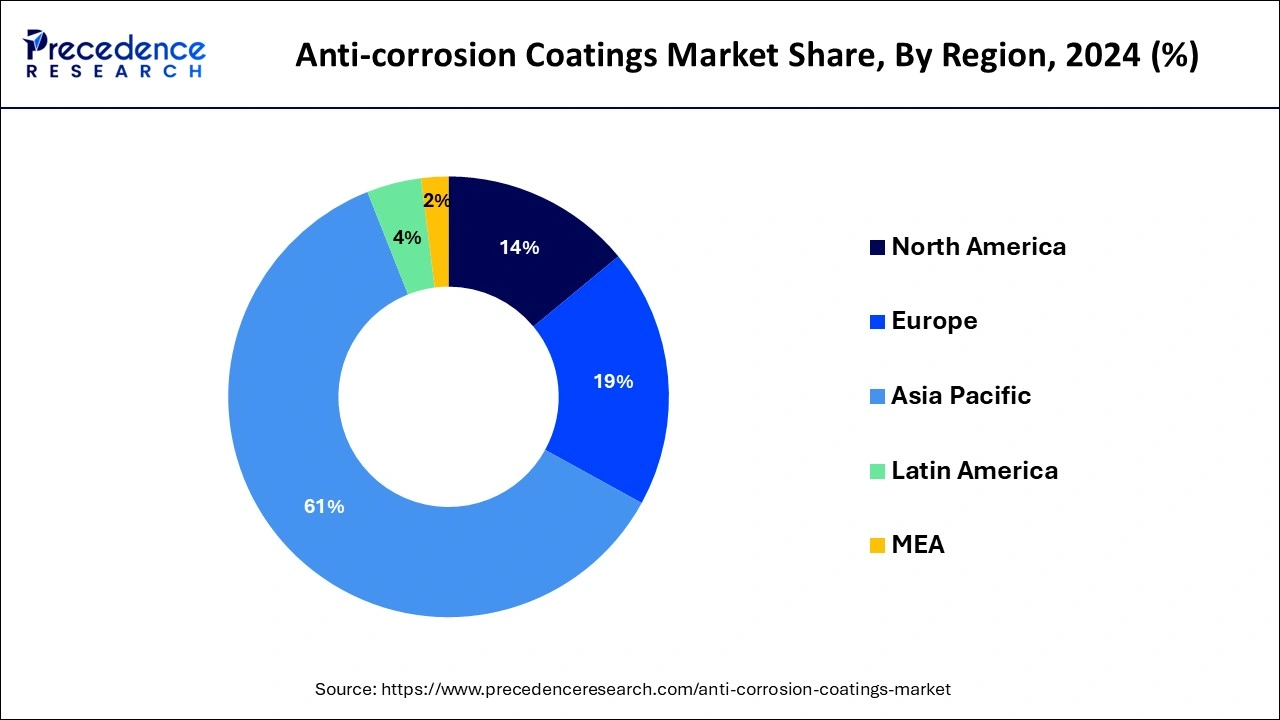

Asia Pacific has held the largest market share in 2024. Augmented investments in the marine, construction, and energy sectors in India and China are responsible for changing industry tendencies, which is projected to stimulate the growth of anti-corrosion coatings market. China is the largest user of anti-corrosion coatings across the world. This is mainly due to the increasing energy demand and the necessity of maintenance in the transportation sector.

North America region is estimated to expand the fastest CAGR between 2025 and 2034. In the past few years, the U.S. has exceeded both Saudi Arabia and Russia as the world’s leading producers of natural gas and oil. As the installation of pipelines upsurges, so does the risk of corrosion which emphasizes the necessity for pipeline protection. As per, National Association of Corrosion Engineers, global cost of corrosion was around USD 2.5 trillion in 2016. If the industry endures its upward path, the influence of corroded steel pipelines on the financial data is anticipated to increase.

Anti-corrosion coatings are crucial tool for preventing challenges of rust across several industries. This type of coating finds application under several areas including automobiles tunnels, bridges, and protection of structures in few of the toughest environments. Anti-corrosion coatings have become an inevitability for businesses to defend the enormous investments they make in terms of property, money, and protection of workforces. These coatings are employed extensively in sectors like oil and gas, marine, petrochemical, power generation, infrastructure, and others.

| Report Highlights | Details |

| Market Size in 2024 | USD 34.38 Billion |

| Market Size in 2025 | USD 36.31 Billion |

| Market Size by 2034 | USD 59.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Material, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Solvent-Based Technology Segment Recorded Prime Market Share in 2024

The solvent-based technology segment led the global anti-corrosion coatings market in 2024. This high market stake is responsible to the intensifying demand for manufacturing machines, industrial tanks, pipes, chemical storage tanks, ballast tanks, gas ducts, smoke stacks and cooling towers. Furthermore, solvent-based corrosion protection coating needs low drying time, displays humidity, enhanced temperature, and abrasion resistance.

Oil and Gas Application Sector Foretold to Emerge as Dominant Segment during Estimate Period

Anti-corrosion coating finds usage in care homes, hospitals, and drop-in centers for the product such as handles, floors, beds, ceiling paints and walls. Among all, oil & gas application segment dominated the overall market in 2024. This high market cut is credited to the high importance and widespread practice of corrosion protection coating in this application segment. Further, the anti-corrosion coating reduces the risk of microbes and expands surface finish and abrasion resistance.

Acrylic Material Segment is Projected to Govern the Anti-corrosion Coatings Market Revenue

Out of different material segment covered in the report, acrylic material segment conquered the market in 2024. This high share is credited to outstanding properties offered by these materials including resistance to oxidation and weathering. Acrylic coatings are principally water-based, which bid comfort of handling and improved performance in a extensive range of areas such as roof coating, wall coating, and less cost in comparison with other materials

By Type

By End-User

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

January 2025

January 2025