October 2024

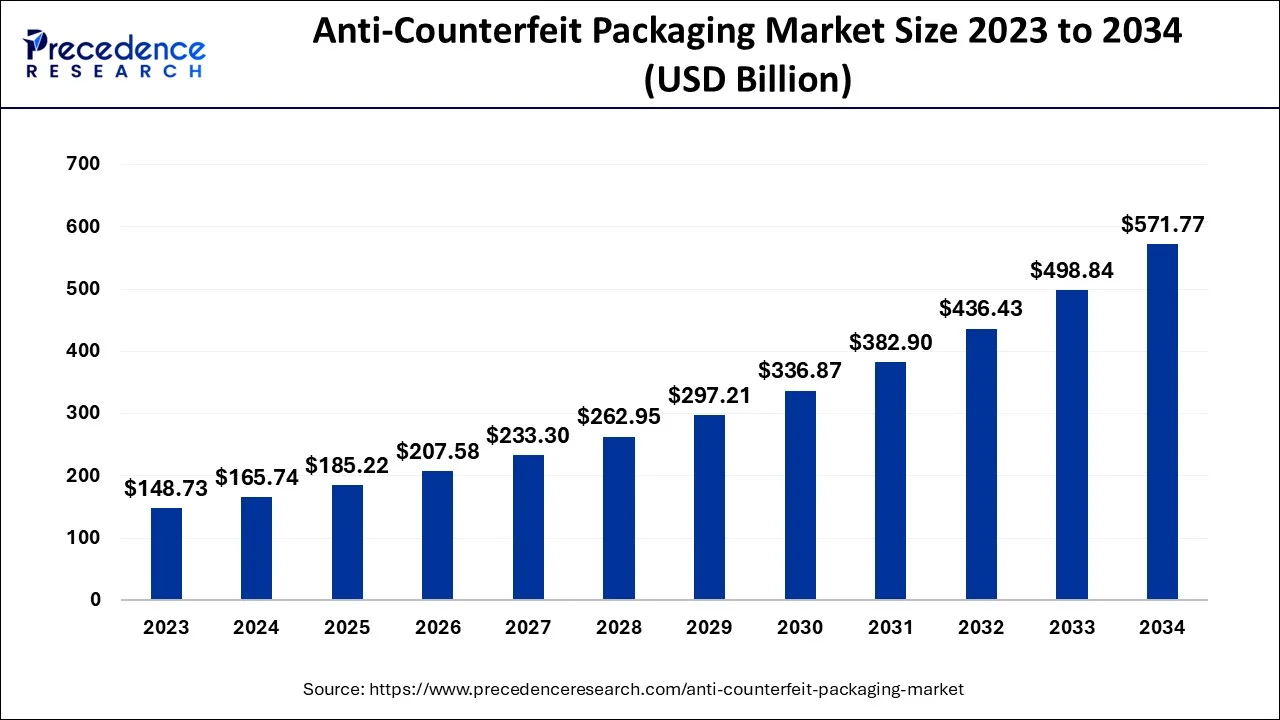

The global anti-counterfeit packaging market size is estimated at USD 165.74 billion in 2024, grew to USD 185.22 billion in 2025 and is predicted to surpass around USD 571.77 billion by 2034, expanding at a CAGR of 13.18% between 2024 and 2034. The North America anti-counterfeit packaging market size accounted for USD 65.05 billion in 2024 and is anticipated to grow at a fastest CAGR of 12.79% during the forecast year.

The global anti-counterfeit packaging market size accounted for USD 165.74 billion in 2024 and is anticipated to reach around USD 571.77 billion by 2034, expanding at a CAGR of 13.18% between 2024 and 2034. The anti-counterfeit packaging market growth is fueled by several factors, including the increasing need for brand protection solutions in the pharmaceutical sector and the enhanced ability to monitor products across the supply chain. Moreover, concerted efforts by governments and corporations globally to combat counterfeiting activities, driven by concerns for both brand integrity and consumer safety, are anticipated to propel the demand for anti-counterfeit packaging at a notable pace throughout the forecast period.

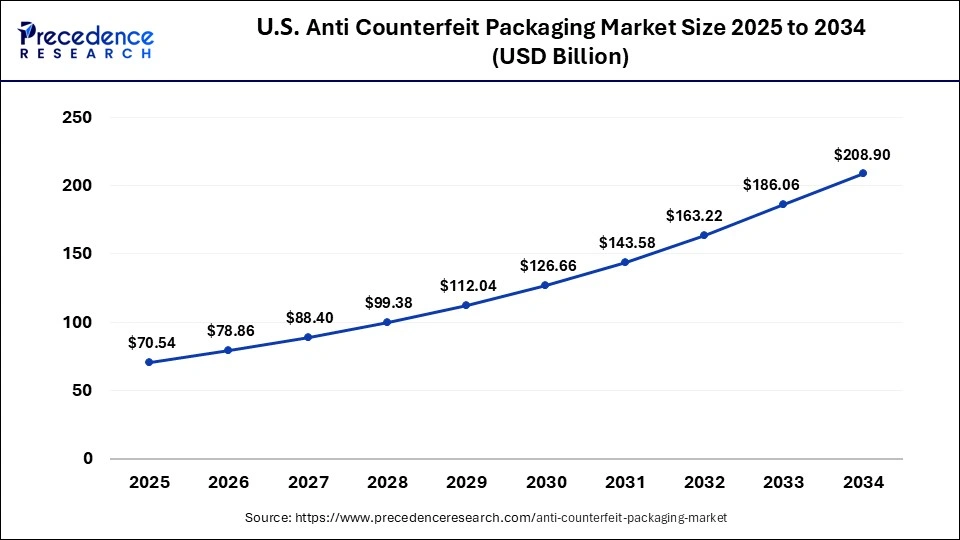

The U.S. anti-counterfeit packaging market size is estimated at USD 56.92 billion in 2024 and expected to be worth around USD 186.06 billion by 2034 with a CAGR of 12.57% from 2024 to 2034.

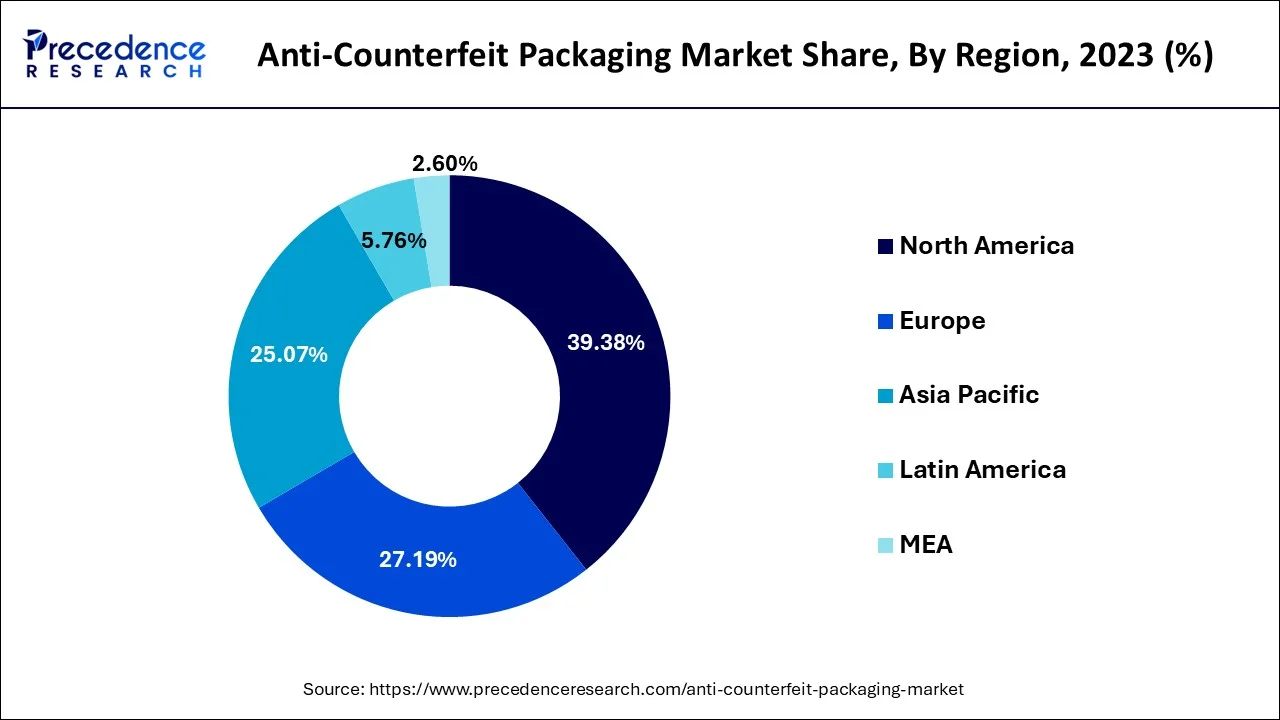

North America held the majority of the market share of around 39.38% in 2023. The anti-counterfeit packaging sector in North America is primarily driven by government measures to combat the counterfeit market in the United States and Canada. Product traceability is essential due to consumer desire for more accessibility.

The enforcement of anti-counterfeiting laws has assisted in growing its market share. To facilitate item tracking and identification, manufacturers are gradually incorporating more sophisticated technologies into machines.

Asia-Pacific had the market's quickest growth rate in 2023 because companies there always come up with new ways to guarantee the quality of their products and follow stringent health and safety regulations. For instance, the fact that many pharmaceutical firms manufacture their products in China has prompted the country to take more proactive measures to safeguard customers from food and medical device fraud as well as phony drugs.

That implies that understanding product authenticity and anti-counterfeiting technologies like barcodes, holograms, labeling, and RFIDs is more crucial than ever (radio frequency identification).

Anti-counterfeit packaging refers to packaging solutions that are designed to prevent the production and sale of counterfeit products. Counterfeit products are produced and sold under the guise of being authentic products. Anti-counterfeit packaging is designed to prevent such practices by making it difficult or impossible for counterfeiters to replicate the packaging of genuine products.

The anti-counterfeit packaging market has been growing rapidly in recent years due to the increasing demand for counterfeit protection in various industries such as pharmaceuticals, food and beverage, consumer electronics, automotive, and luxury goods. The market is driven by factors such as rising concerns regarding product safety and authenticity, government regulations mandating the use of anti-counterfeit packaging, and the growing demand for high-quality packaging solutions.

Anti-counterfeit packaging solutions can include various features such as holograms, security inks, RFID tags, tamper-evident seals, and unique product identification codes. These features are designed to make it difficult for counterfeiters to replicate the packaging of genuine products and make it easy for consumers to verify the authenticity of the products they are purchasing. The anti-counterfeit packaging market is highly competitive, with numerous companies offering a range of solutions to meet the needs of different industries.

| Report Coverage | Details |

| Market Size in 2024 | USD 165.74 Billion |

| Market Size by 2034 | USD 571.77 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 13.18% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Technology, By Packaging Format and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase in the number of counterfeit products

Government regulations

Pharmaceuticals and healthcare to drive the market demand

High cost of production and investment

Lack of awareness

Growing demand from emerging markets

Adoption of smart packaging solutions.

The anti-counterfeit packaging market is segmented into holograms, RFID, mass encoding, forensic markers, tamper evidence, and others. In 2023, the mass encoding segment held the largest share in anti-counterfeit packaging market. When it comes to anti-counterfeit packaging, mass encoding is the act of giving a lot of items or packaging units unique identifiers like barcodes, QR codes, RFID tags, or serial numbers. Throughout the supply chain, these IDs are used to verify items and stop counterfeiting. The supply chain can be more transparent because each product or packaging unit can be tracked back to its original location. This aids in locating the supplier of fake goods and putting specific preventative measures in place to stop them from happening again. Retailers, consumers, and government agencies can all confirm the legitimacy of products by scanning or examining their unique identifiers. This aids in separating real goods from fakes, safeguarding both the reputation of the company and its customers.

Mass encoding makes it possible to automatically track things over the course of their lifetime, which makes inventory management more effective. This lowers the possibility of fake goods entering the market, optimizes inventory levels, and cuts down on stockouts. Mass encoding is required by regulatory agencies in several industries for anti-counterfeit packaging in order to prevent counterfeiting and guarantee product safety

Anti-Counterfeit Packaging Market Revenue, By Technology, 2021-2023 (USD, Bn)

| Technologies | 2021 | 2022 | 2023 |

| Holograms | 15.7 | 17.5 | 19.5 |

| RFID | 30.3 | 33.5 | 37.1 |

| Mass Encoding | 35.3 | 38.9 | 43.0 |

| Forensic Markers | 7.3 | 8.3 | 9.4 |

| Tamper Evidence | 19.5 | 21.5 | 23.7 |

| Others | 12.7 | 14.2 | 16.0 |

The pharmaceuticals market segment held the greatest market share in 2023 and is poised to grow at a CAGR of 13.5% during the forecast period. A growing understanding of anti-counterfeit packaging and human health & safety is one of the factors impacting the surge in demand for anti-counterfeiting technologies in packaging. The pharmaceutical segment held the largest share in anti-counterfeit packaging market in 2023. To secure its products and shield consumers from fake drugs, the pharmaceutical industry makes large investments in anti-counterfeit packaging solutions. The public's health is seriously threatened by counterfeit medications since they may include dangerous compounds, inaccurate ingredients, or incorrect dosages. Pharmaceutical businesses can tackle this issue by using anti-counterfeit packaging technologies, which incorporate a variety of security elements that are difficult for counterfeiters to imitate. A unique identifying code, such as a serial number, QR code, or barcode, is assigned to each shipment or product. Using smartphones or specialized programs, consumers can scan these codes to confirm the product's validity.

Packaging is designed with tamper-evident seals or features that reveal if the product has been opened or tampered with before being purchased. This aids customers in spotting possibly fake goods. Pharmaceutical businesses and regulatory agencies can keep an eye on the flow of medicines via the supply chain thanks to sophisticated track and trace systems. This aids in locating fake goods and stops their dissemination. An extra layer of verification is provided by printing covert security features with invisible inks or marks that become visible only in certain situations, as under UV light. Certain pharmaceutical businesses offer specific mobile applications that enable customers to scan product packaging codes or photos to confirm the legitimacy of the items.

In Asia-Pacific, it is projected that the market for anti-counterfeit packaging will rise. The strict laws against counterfeiting necessitate an efficient supply chain. Due to the availability of low-cost counterfeiting techniques, packaging companies have selected anti-counterfeiting technology to save money and safeguard their brands.

Anti-Counterfeit Packaging Market Revenue, By End-Use, 2021-2023 (USD, Bn)

| End Users | 2021 | 2022 | 2023 |

| Pharmaceuticals | 29.0 | 32.4 | 36.1 |

| Food and Beverage | 25.7 | 28.7 | 32.2 |

| Automotive | 14.1 | 15.5 | 17.1 |

| Personal Care | 15.8 | 17.5 | 19.3 |

| Electrical & Electronics | 10.3 | 11.3 | 12.5 |

| Luxury Products | 6.8 | 7.4 | 8.1 |

| Others | 19.1 | 21.1 | 23.4 |

The jars and bottle segment held the largest share in anti-counterfeit packaging market. The growing worries about product safety and authenticity have led to a major growth in the market for anti-counterfeit packaging, which includes jars and bottles. For businesses in a variety of industries, counterfeiting poses a severe risk to revenue streams, brand reputation, and consumer health. Common packaging types for a variety of goods, such as food, beverages, cosmetics, and medications, are jars and bottles, which makes them vulnerable to counterfeiting. Technological advances targeting the development of advanced anti-counterfeit packaging solutions have surged in the industry. These include of several security features including invisible inks, RFID tags, tamper-evident seals, holograms, and QR codes, among others.

By Technology

By Packaging Format

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

January 2025

January 2025