November 2023

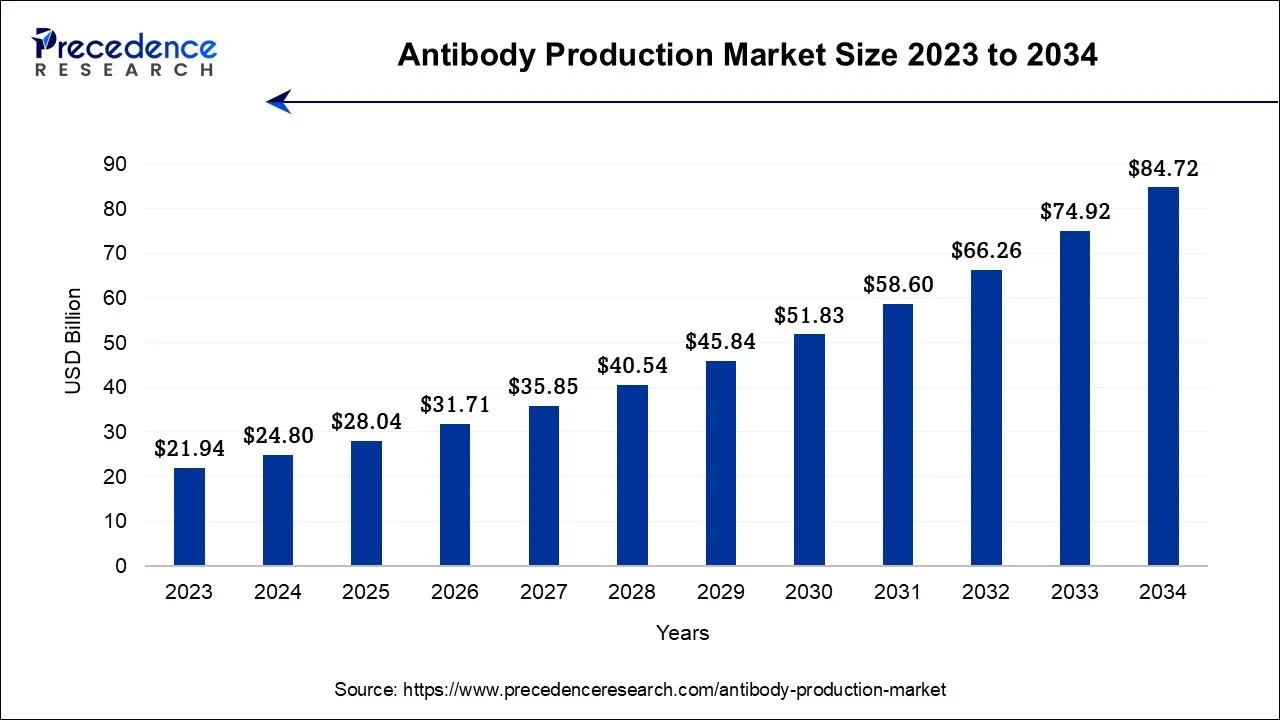

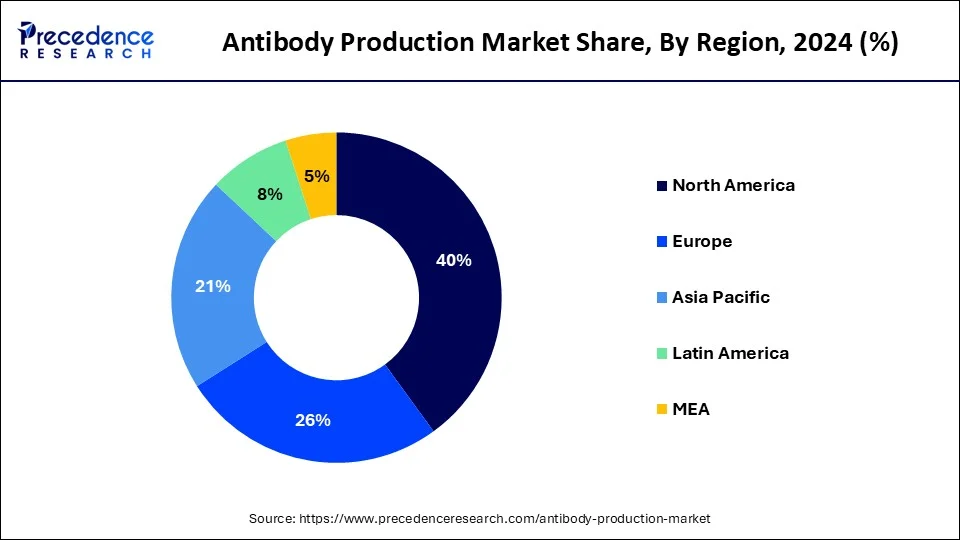

The global antibody production market size is calculated at USD 24.80 billion in 2024, grew to USD 28.04 billion in 2025, and is predicted to hit around USD 84.72 billion by 2034, poised to grow at a CAGR of 13.07% between 2024 and 2034. The North America antibody production market size accounted for USD 9.92 billion in 2024 and is anticipated to grow at the fastest CAGR of 13.21% during the forecast year.

The global antibody production market size is expected to be valued at USD 24.80 billion in 2024 and is anticipated to reach around USD 84.72 billion by 2034, expanding at a CAGR of 13.07% over the forecast period from 2024 to 2034.

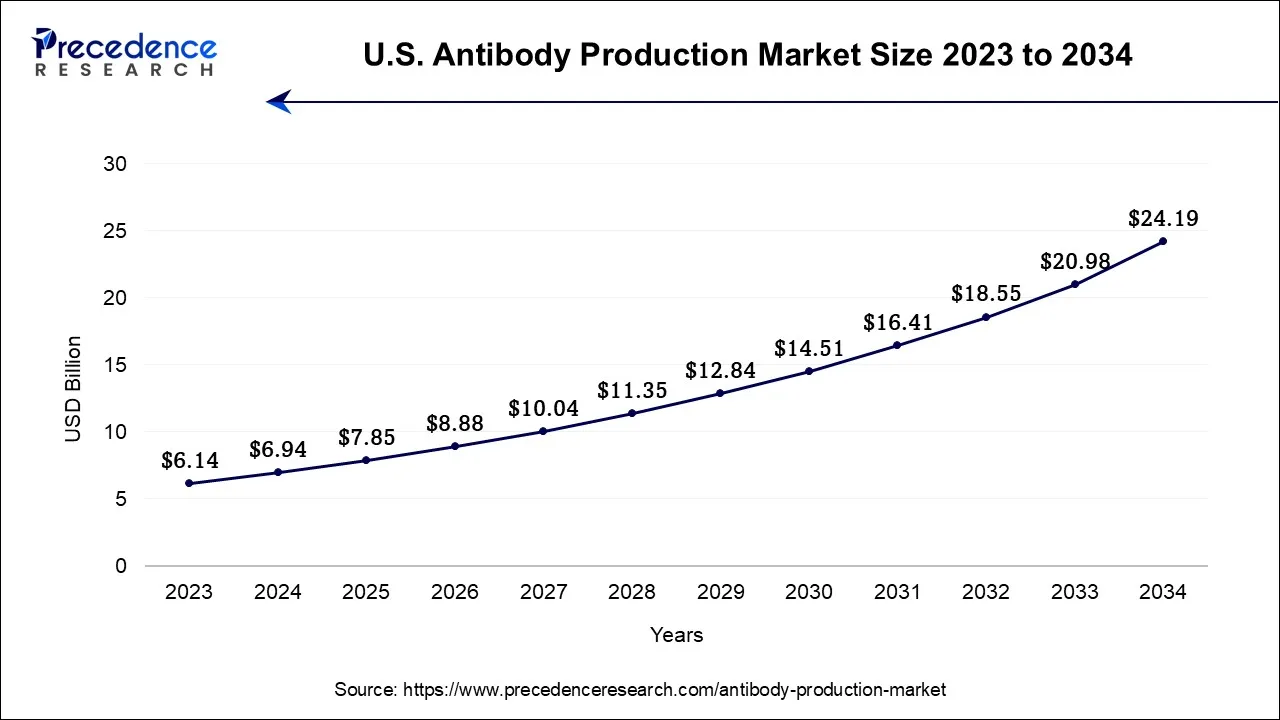

The U.S. antibody production market size is accounted for USD 6.94 billion in 2024 and is projected to be worth around USD 24.19 billion by 2034, poised to grow at a CAGR of 13.29% from 2024 to 2034.

North America is expected to dominate the market over the forecast period. The growth in the region is attributed to the presence of major biotechnology and pharmaceutical companies such as Pfizer, Merck, Sanofi and others. These companies are actively involved in antibody research and production where they develop monoclonal antibodies for a wide range of applications, including cancer therapy, autoimmune diseases, infectious diseases and others.

For instance, in August 2023, Pfizer Inc. reported that the US Food and Drug Administration (FDA) has given ELREXFIOTM (elranatamab-bcmm) accelerated approval for the treatment of adult patients with relapsed or refractory multiple myeloma. The willingness to adopt advanced technologies in the biotechnology sector also promotes the growth of the market in North America. Therefore, the increasing company research and development and rising FDA approvals are expected to drive market growth over the forecast period.

Asia Pacific is expected to witness the fastest rate of growth during the forecast period. The region’s ongoing emphasis on clinical trials and drug development is observed to promote the market’s growth in the upcoming years. Countries such as India, Japan, South Korea and China carry huge potential to grow in the biotechnology and pharmaceutical sectors. The presence of strict regulatory framework for the biotechnology industry in these countries also play a significant role in the market’s development. The rising population, especially in countries including China and India along with the presence of huge geriatric population in Japan supplements the development of potential therapeutics in the region, this element is observed to fuel the market’s growth in Asia Pacific.

The antibody production market refers to the commercial ecosystem encompassing the research, development, manufacturing, and distribution of antibodies for various applications, including research, diagnostics, and therapeutics. Antibodies are specialized proteins produced by the immune system in response to specific antigens, and they play a crucial role in immune defense, disease detection, and targeted treatments. The market involves a range of stakeholders, including pharmaceutical and biotechnology companies, research institutions, diagnostic companies, contract research organizations, and more, who collaborate to advance antibody-related technologies and products.

Antibodies production is not only a central aspect of fighting infections but also a cornerstone of vaccine-induced immunity. The market growth is driven by several factors including the growing product approvals, increasing research and development and rising government initiatives. Moreover, the rising prevalence of cancer across the globe is observed to promote the growth of the global antibody production market. For instance, according to the National Institute of Health’s estimation, there will be 1,958,310 cancer cases in 2023 in the United States.

| Report Coverage | Details |

| Market Size in 2024 | USD 24.80 Billion |

| Market Size by 2034 | USD 84.72 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 13.07% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Process, By Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in chronic disease along with an increasing elderly population

The rising chronic incidence coupled with the increasing aging population is expected to drive the market growth over the forecast period. For instance, according to the PAHO estimated that there will be 20 million new cancer instances worldwide. In the upcoming two decades, the burden of cancer will rise by approximately 60%, placing additional strain on healthcare systems, individuals, and communities. By 2040, it is anticipated that there will be roughly 30 million additional instances of cancer worldwide. Such rising cases of diseases will force the industry to boost its capability of production as well as research activities for innovation and advancements. Therefore, the aforementioned facts drive the market growth over the forecast period.

Complexity and high cost of production

The purification of antibodies from complex mixtures can be challenging and time-consuming. High purity requirements and the need to remove impurities can lead to labor-intensive and costly processes. In addition, antibody production, especially for therapeutic purposes, can be expensive due to the need for specialized equipment, cell culture media, and purification methods. The costs associated with large-scale production can impact the accessibility of antibody-based treatments. Thus, this is expected to be a major restraining factor for the market growth over the forecast period.

Growing approvals for monoclonal antibodies

The increasing FDA approvals of monoclonal antibodies are expected to offer a lucrative opportunity for market growth over the forecast period. For instance, in May 2023, the Food and Drug Administation (FDA) approved EPKINLYTM, for the treatment of adult patients with diffuse large B-cell lymphoma. The rising cases of multiple communicable and non-communicable diseases also force FDA or other approving agencies and administrative bodies to boost their pace of approving monoclonal antibodies that can be further used for research and development purposes. Thus, the growing approval of monoclonal antibodies is anticipated to propel the market’s growth.

Based on the product, the global antibody production market is segmented into instruments, consumables and software. The consumables segment is expected to hold the largest market share over the forecast period. In antibody production, various consumables are used to support the growth, maintenance, and purification of cells involved in producing antibodies. These consumables are essential for creating the optimal environment for cell cultures and for facilitating the isolation and purification of the produced antibodies. Cell culture media are nutrient-rich solutions that provide the necessary nutrients, growth factors, and conditions to support the growth of cells, such as B cells or hybridomas, that produce antibodies. Thus, the growing use of consumables in the production of antibodies is expected to drive market growth during the forecast period.

Based on the process, the global antibody production market is segmented into upstream processing and downstream processing. The downstream segment held a significant market share in 2023 and is expected to continue the same pattern during the forecast period. The segment growth is attributed to their benefits including purity enhancement, increased specific activity, consistency and reproducibility and others.

Downstream processing allows for the removal of impurities, contaminants, and unwanted proteins that might be present in the culture medium or produced alongside the antibodies. This results in highly purified antibodies, which are essential for accurate and reliable experimental results and safe therapeutic use. Moreover, the standardized downstream processing methods contribute to consistent and reproducible antibody preparations across batches. This is vital for research and diagnostics, where consistent antibody performance is essential for reliable results. Therefore, these advantages are expected to drive the segment growth.

Based on the type, the global antibody production market is segmented into monoclonal antibodies and polyclonal antibodies. The monoclonal antibody segment is expected to dominate the market over the forecast period. Monoclonal antibodies are a class of antibodies that are produced by identical immune cells, all derived from a single parent cell. These antibodies are highly specific in their recognition of a single antigenic epitope, making them valuable tools in research, diagnostics, and therapeutic applications. Monoclonal antibodies are used to target specific molecules, cells, or pathogens with high precision, and they have revolutionized the fields of medicine and biotechnology.

In addition, monoclonal antibodies are used for different type of cancer and the burden of cancer rises globally, which in turn, drive the segment growth over the projected period. For instance, as per National Cancer Institutes, it is anticipated that by 2040, there would be 16.4 million cancer-related deaths and 29.5 million new cases of cancer annually.

Based on the end-use, the global antibody production market is segmented into pharmaceutical and biotechnology companies, research laboratories and CROs and CDMOs. The pharmaceutical and biotechnology companies segment is expected to capture the largest market share over the forecast period. Antibody production is a crucial aspect of research and development activities in pharmaceutical and biotechnology companies.

In drug discovery, antibodies are often used to target specific proteins associated with diseases. They can serve as tools to study the function of these proteins, identify potential drug targets, and validate therapeutic concepts. Moreover, the therapeutic potential of antibodies has led to the development of numerous antibody-based drugs for treating various diseases. Thereby, driving the segment growth over the forecast period.

Segments Covered in the Report:

By Product

By Process

By Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2023

September 2024

October 2024

July 2024