January 2025

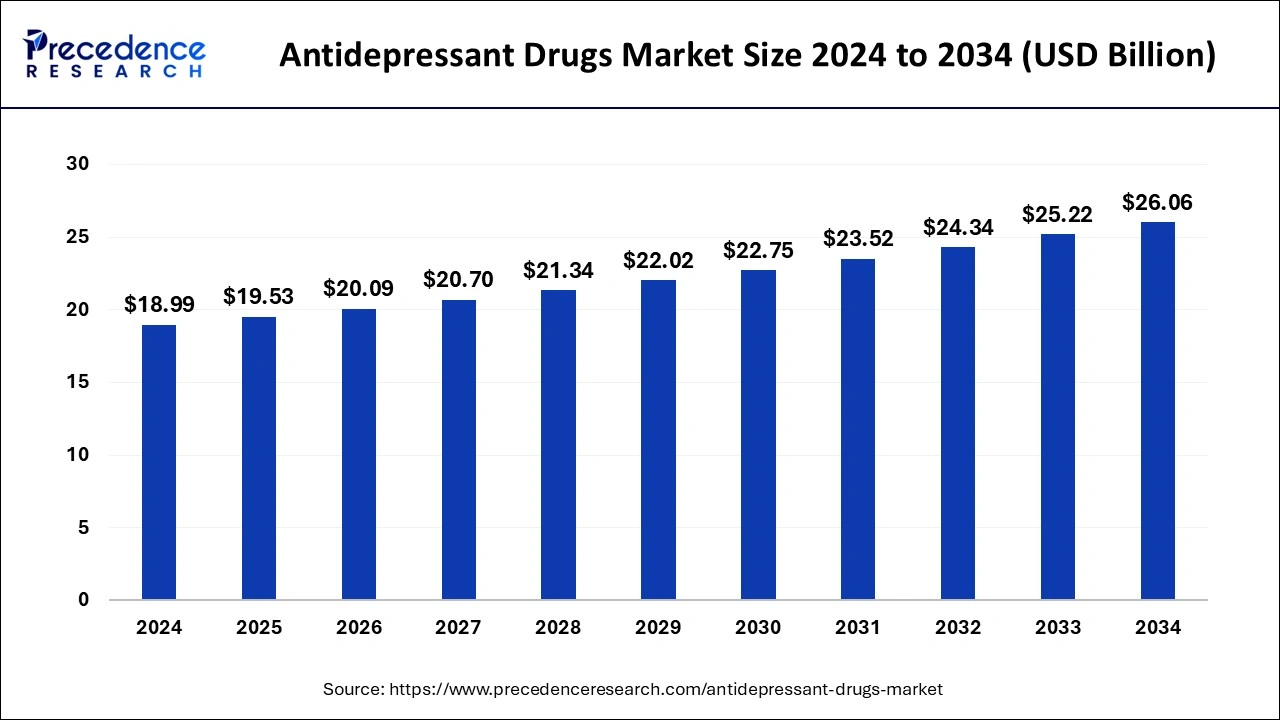

The global antidepressant drugs market size is accounted at USD 19.53 billion in 2025 and is forecasted to hit around USD 26.06 billion by 2034, representing a CAGR of 3.22% from 2025 to 2034. The North America market size was estimated at USD 8.93 billion in 2024 and is expanding at a CAGR of 3.25% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global antidepressant drugs market size was estimated at USD 18.99 billion in 2024 and is predicted to increase from USD 19.53 billion in 2025 to approximately USD 26.06 billion by 2034, expanding at a CAGR of 3.22% from 2025 to 2034.

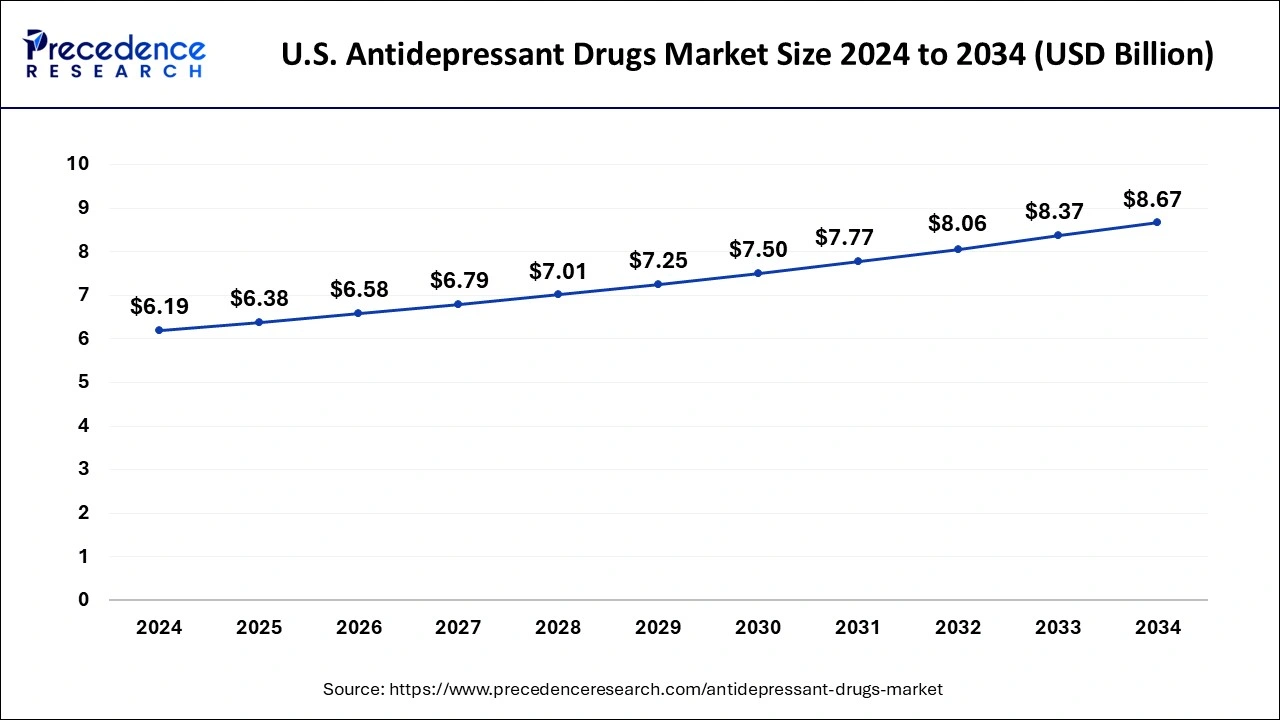

The U.S. antidepressant drugs market size was exhibited at USD 6.19 billion in 2024 and is projected to be worth around USD 8.67 billion by 2034, growing at a CAGR of 3.43% from 2025 to 2034.

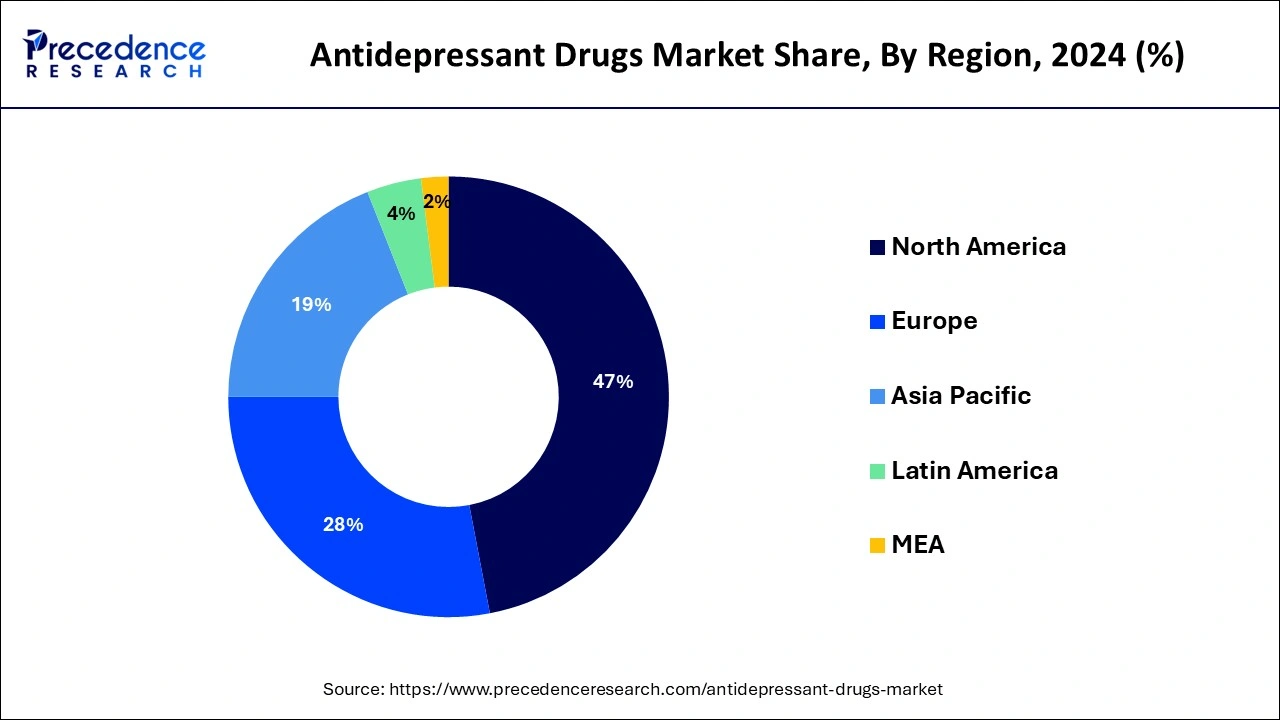

North America had the largest market share of 47% in 2024, the region is observed to maintain growth during the forecast period. Anxiety and depression are two major mental health problems that are notably more common in North America. The need for antidepressant medications is rising due to increased knowledge and diagnosis of these illnesses. The area has a robust regulatory framework, research facilities, well-established pharmaceutical companies, and cutting-edge healthcare infrastructure. This makes it easier to create, produce, and distribute antidepressant medications.

Asia-Pacific is expected to witness the fastest growth in the antidepressant drugs market during the forecast period. Modifications in the economy, society, and way of life can raise the prevalence of mental health conditions, such as depression, which in turn increases the demand for antidepressant medications. The population is getting older, which increases the risk of mental health problems, such as depression. This change in demographics may help the market for antidepressants expand.

The development, production, marketing, and distribution of pharmaceutical products intended to treat depression and other associated mental health issues are all included in the worldwide or regional antidepressant drug market. In certain cultures, going to therapy or using antidepressants is seen as a sign of weakness or failure. Because they fear what other people might think of these interventions, people may choose not to use them even though they could be beneficial.

To emphasize essential factors for researchers looking into the use of psychedelic drugs for the treatment of medical illnesses, such as psychiatric or substance use disorders, the U.S. food and drug administration released a new draft guidance in 2023.

Antidepressant Drugs Market Data and Statistics

| Report Coverage | Details |

| Market Size in 2025 | USD 19.53 Billion |

| Market Size by 2034 | USD 26.06 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Depressive Disorder, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased destigmatization of mental health issues

There is an increasing awareness of the incidence and effects of mental health illnesses, including depression and anxiety, as society views mental health change. The need for effective therapies has increased because of this shifting perception, which has pushed more people to seek help for mental health issues. Furthermore, the decreased stigma has motivated pharmaceutical companies to spend money on developing fresh, more effective antidepressant medications. As a result, the market has grown to offer a wider variety of treatment alternatives to meet the demands of many patients.

Expanded access to healthcare and medication

Depression and other mental health issues are becoming more widely recognized and diagnosed as more individuals have access to healthcare services. This increased accessibility enables people to get the support they need, including antidepressants, and to see a specialist. Better mental health knowledge, less stigma associated with mental health concerns, and improved infrastructure are all necessary for improved access to healthcare. When these conditions are met, there is a greater likelihood that people may seek the advice of medical professionals and be prescribed antidepressant drugs. The increasing need for antidepressant medications is a result of both the growing awareness of the significance of mental health and the rising prevalence of mental health issues.

Societal pressures for seeing a therapist and relying on antidepressants

The social stigma around mental health problems are still present. Many people are afraid that if they seek therapy or publicly admit their issues with mental health, they will be judged and discriminated against. People may be discouraged from taking antidepressants and consulting a physician because of this stigma. Social pressures might arise from a lack of knowledge and awareness of mental health concerns. Skepticism and resistance to therapy and antidepressant medication may arise from a lack of knowledge regarding their efficaciousness. One may prefer instant relief over devoting time and energy to treatment in a society that frequently favors quick fixes. This may cause people to look for treatment alternatives like self-medication or shunning medical assistance altogether.

The expectations of society and cultural conventions around emotional health can differ significantly. There could be a stigma associated with publicly discussing mental health issues in some communities. People could experience pressure to live up to social norms and refrain from using antidepressants or going to treatment, even when it's necessary.

Growth in personalized and targeted therapies

Adults with moderate to severe depression can experience less symptoms when using antidepressants. However, the experiences that people have with these drugs vary greatly. Customizing treatment plans according to a patient's unique genetic composition, biomarkers, and response patterns is known as personalized therapy. This method addresses the distinct biological components that contribute to each person's depression, allowing for more effective and efficient treatment. New paths for creative therapeutic methods have been made possible by developments in neuroscience and pharmacogenomics. Scientists are pursuing new avenues for drug discovery and creating drugs that target molecular pathways linked to depression.

Leveraging technology and data

Artificial intelligence (AI) and machine learning are examples of advanced technologies that can more effectively uncover possible medication candidates by analyzing large datasets. This shortens the time and expense required to get new antidepressant medications to the market by speeding up the drug discovery process. Due to technological advancements, mental health patients can be remotely monitored, enabling medical professionals to monitor treatment outcomes and make necessary drug adjustments.

Platforms for telemedicine also improve access to mental health care, particularly in underprivileged areas. Utilizing actual data from electronic health records and patient-reported results offers insightful information about how well antidepressant medications work in a range of demographics. This data helps to improve treatment plans and guarantee that drugs are appropriate for different patient types.

The selective serotonin reuptake inhibitors segment dominated the antidepressant drugs market in 2024. A class of medications known as selective serotonin reuptake inhibitors, or SSRIs, is mainly used to treat mental health diseases, including anxiety disorders, depression, and other psychiatric conditions. SSRIs work by preventing serotonin from being reabsorbed, which raises serotonin levels. In clinical practice, SSRIs are now widely accepted and frequently suggested as the first line of treatment for depression. This has helped to explain why they are so widely used. It has less of an effect on the cholinergic system, which lowers the possibility of adverse effects that are common to several other antidepressant classes, like constipation, dry mouth, and blurred vision.

The serotonin norepinephrine reuptake inhibitors (SNRI) segment is the fastest growing segment in the antidepressant drugs market. SNRIs are often commended for treating a wide range of depression symptoms effectively. When compared to certain other antidepressant classes, the combined effect on the serotonin and norepinephrine pathways may offer a more all-encompassing therapeutic effect. When patents on SNRIs expire, generic versions of these drugs may become more widely available and reasonably priced, depending on how the market dynamics are affected.

The major depressive disorder segment is expected to sustain dominance during the forecast period. A considerable fraction of all mental health issues worldwide is classified as major depressive disorder (MDD), with many people suffering from symptoms of depression. To address the incidence of MDD, there is a strong demand for effective antidepressant drugs.

Furthermore, current R&D initiatives are concentrated on developing novel antidepressants that are specially made to target and treat MDD. Pharmaceutical companies allocate resources to create innovative substances and formulations that enhance efficacy and reduce adverse effects to get a more significant market share.

The obsessive-compulsive disorder segment is the fastest growing in the antidepressant drugs market. People with obsessive-compulsive disorder (OCD) experience undesirable thoughts, ideas, or sensations regularly (obsessions). OCD is a relatively widespread mental health condition, and as awareness grows, so does the number of people seek treatment. The need for efficient antidepressant drugs may be fueled by this expanding patient base. Pharmaceutical corporations may contribute to the research and development of medications intended to treat OCD symptoms. This focused approach may result in the development of medications that are less harmful to OCD sufferers and more effective.

The offline segment held the largest market share in 2024. Antidepressant medications frequently need a prescription, and patients usually see doctors in person for a diagnosis and prescription. This dependence on in-person meetings may be a factor in the emergence of a dominant offline market. Patients and healthcare professionals frequently have a close-knit and continuing interaction when dealing with mental health concerns, including depression. Face-to-face contact may be a more effective means of fostering this intimate connection, which would explain why offline methods are more prevalent.

The online segment is observed to expand at the fastest rate during the forecast period. Online resources make it simple for people to learn about antidepressant medications, enabling them to do their research and educate themselves about their alternatives without having to visit actual pharmacies or clinics.

Antidepressant medications are among the many pharmaceutical items that online pharmacies and e-commerce sites now provide. This has made online drug purchases more convenient for people. With the growth of telemedicine, people may now consult with doctors virtually, making it easier to get antidepressants prescribed and bought from the comfort of their own homes.

By Product

By Depressive Disorder

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

March 2025

March 2025