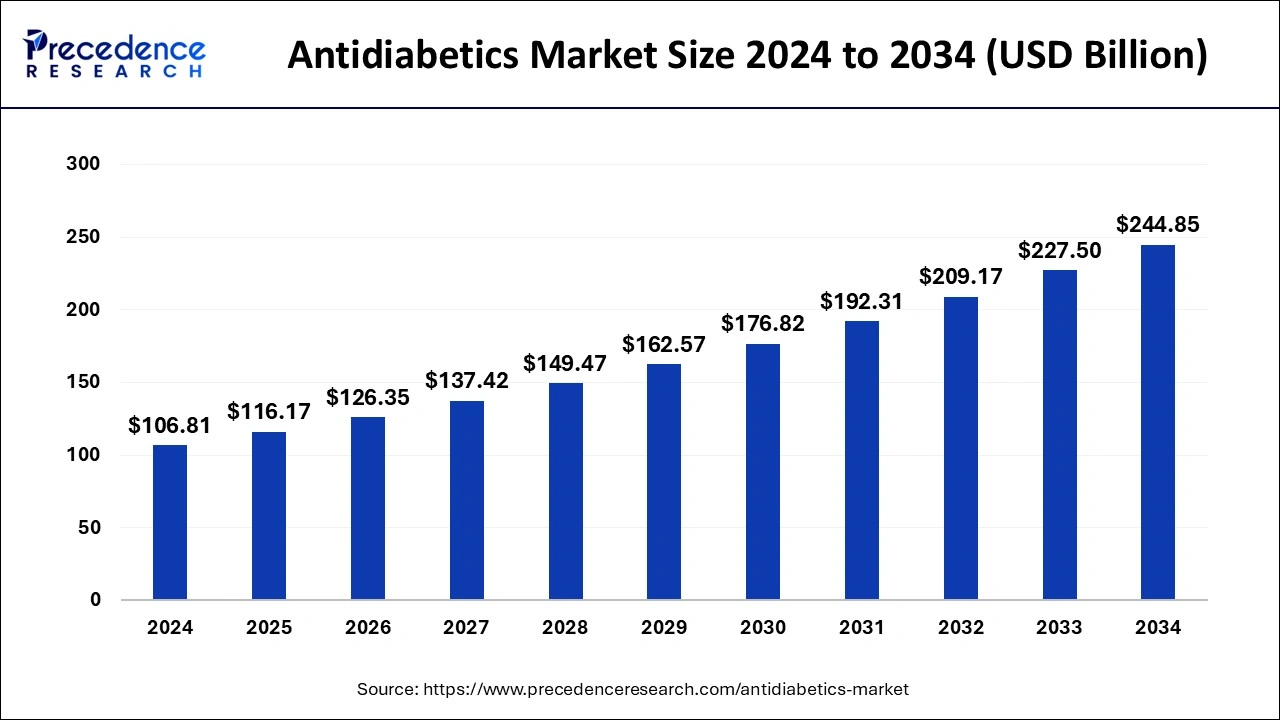

The global antidiabetics market size is calculated at USD 116.17 billion in 2025 and is forecasted to reach around USD 244.85 billion by 2034, accelerating at a CAGR of 8.65% from 2025 to 2034. The North America antidiabetics market size surpassed USD 41.66 billion in 2024 and is expanding at a CAGR of 8.79% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global antidiabetics market size was estimated at USD 106.81 billion in 2024 and is predicted to increase from USD 116.17 billion in 2025 to approximately USD 244.85 billion by 2034, expanding at a CAGR of 8.65% from 2025 to 2034. The increasing geriatric population and the changing lifestyle habits are driving the growth of the antidiabetics market.

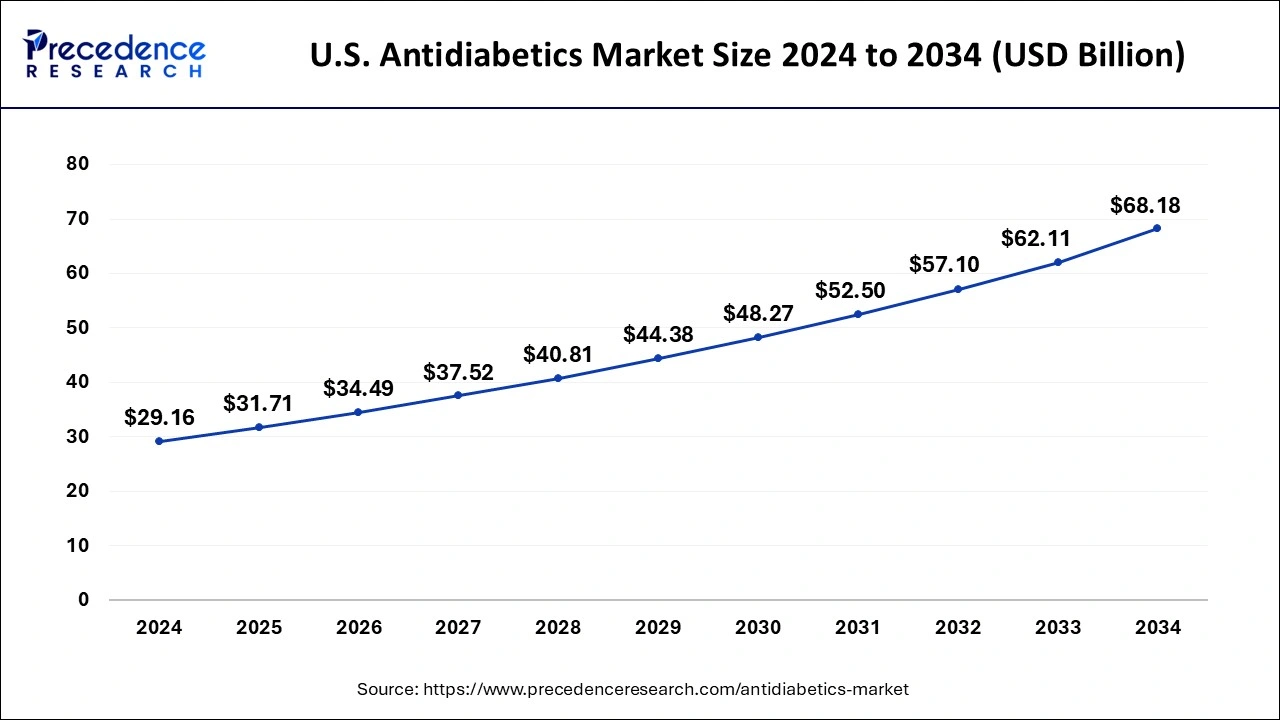

The U.S. antidiabetics market size was valued at USD 29.16 billion in 2024 and is expected to hit around USD 68.18 billion by 2034, poised to grow at a CAGR of 8.86% from 2025 to 2034.

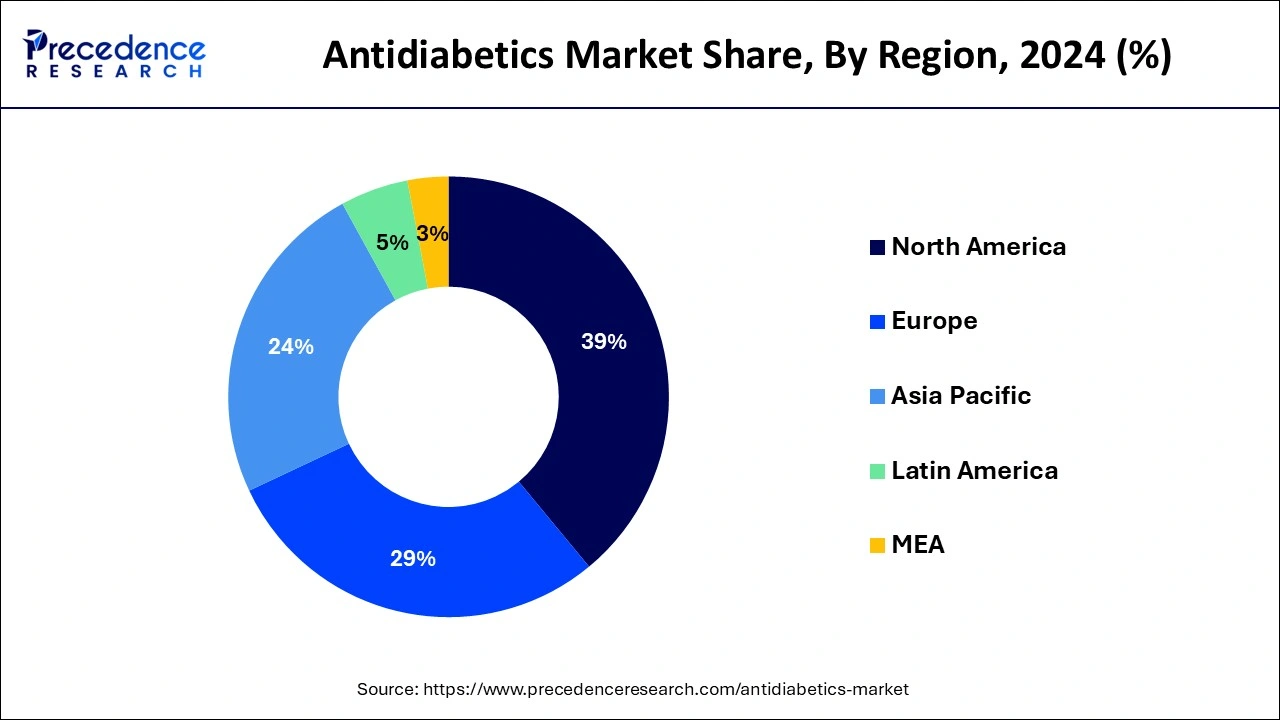

North America dominated the antidiabetics market with the largest share of 39% in 2024. North America has one of the highest prevalence rates of diabetes globally, with a significant portion of the population affected by the disease. The region's sedentary lifestyle, unhealthy dietary habits, and increasing rates of obesity contribute to the growing diabetes burden, driving the demand for antidiabetic medications. North America is home to some of the world's leading pharmaceutical companies, which play a pivotal role in driving innovation and market expansion in the antidiabetics sector. These companies invest heavily in research and development, clinical trials, and marketing efforts to introduce new antidiabetic drugs and expand their market share.

There is a growing awareness and emphasis on diabetes prevention, early detection, and management in North America. Healthcare initiatives, public awareness campaigns, and educational programs aimed at promoting healthy lifestyle choices and diabetes management contribute to higher diagnosis rates and treatment-seeking behavior.

Asia Pacific is expected to stand as the second largest marketplace while expanding at the fastest pace in the antidiabetics market during the forecast period. Asia Pacific is home to a vast population, including countries with some of the highest diabetes prevalence rates globally, such as India and China. The sheer size of the population contributes to a substantial market for antidiabetic drugs and therapies. With improving healthcare infrastructure and rising disposable incomes, there has been a corresponding increase in healthcare spending across Asia Pacific. As a result, more individuals have access to healthcare services, including diagnosis and treatment for diabetes, driving the demand for antidiabetic drugs.

Governments in Asia Pacific countries have implemented favorable regulatory frameworks for pharmaceutical products, including antidiabetics. Streamlined approval processes and market access policies encourage innovation, competition, and investment in the antidiabetics market. Economic development and urbanization in Asia Pacific have led to lifestyle changes characterized by reduced physical activity, increased consumption of processed foods, and higher stress levels, all of which are risk factors for diabetes. Urban areas, in particular, experience a higher prevalence of diabetes, driving the demand for antidiabetic treatments.

The antidiabetics market refers to the pharmaceutical industry segment dedicated to the research, development, manufacturing, and distribution of medications used in the treatment of diabetes mellitus. Diabetes mellitus is a chronic metabolic disorder characterized by high blood sugar levels over a prolonged period, resulting from either inadequate insulin production, ineffective insulin utilization, or both.

The antidiabetics market offers medications that aim to regulate blood glucose levels and manage the symptoms of diabetes to prevent complications such as cardiovascular disease, kidney failure, neuropathy, and blindness. These medications work through various mechanisms, including increasing insulin sensitivity, stimulating insulin production, inhibiting glucose absorption, and promoting glucose excretion.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.65% |

| Market Size in 2025 | USD 106.81 Billion |

| Market Size by 2034 | USD 244.85 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Patient Population, and By Route of Administration |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Government initiatives for controlling diabetes

Multiple government initiatives taken for controlling the prevalence of diabetes acts as a major driver for the antidiabetics market. Government initiatives often include public health awareness campaigns that educate individuals about diabetes prevention, early detection, and management. These campaigns raise awareness about the importance of lifestyle modifications, regular screening, and adherence to treatment regimens, thereby increasing the demand for antidiabetic medications.

Some governments subsidize healthcare services, including medications for chronic conditions like diabetes, to make them more accessible and affordable to the population. Subsidies or reimbursement schemes reduce out-of-pocket expenses for patients, encouraging adherence to prescribed treatment regimens and boosting the uptake of antidiabetic medications. Government funding for diabetes research stimulates innovation in the development of new antidiabetic drugs and treatment modalities. Research grants and funding support clinical trials, drug discovery efforts, and technology advancements in diabetes management, leading to the introduction of novel therapies and treatment options in the market.

Regulatory hurdles

The requirement of regulatory approvals for antidiabetics drugs creates a significant restraint for the antidiabetics market. Regulatory agencies impose rigorous standards and requirements for the approval of new antidiabetic drugs and therapies. Companies must conduct extensive preclinical and clinical trials to demonstrate safety, efficacy, and quality, which can be time-consuming and resource intensive. Regulatory agencies require ongoing monitoring and reporting of adverse events associated with antidiabetic drugs to ensure patient safety. Companies must establish robust pharmacovigilance systems to track and assess the safety and effectiveness of their products, adding further regulatory burdens and potential liabilities.

Technological advancements in drug formulation

The integration of technologies in diabetes drug development is creating a opportunity for the growth of the antidiabetics market. Advancements in drug formulation technologies enable the customization and individualization of antidiabetic therapies based on patient-specific factors such as genetics, metabolism, and disease progression. This personalized approach to treatment enhances therapeutic efficacy and minimizes adverse effects, resulting in optimized patient care. echnological advancements enable the exploration of alternative routes of administration for antidiabetic drugs, such as inhalation, transdermal patches, and buccal delivery. These non-traditional delivery methods offer advantages such as rapid onset of action, reduced systemic side effects, and improved patient acceptance.

The insulin segment dominated the antidiabetics market with the largest share in 2024. Insulin is a critical treatment option for individuals with diabetes, particularly those with type 1 diabetes who require insulin injections to manage their condition. With the global prevalence of diabetes rising steadily, the demand for insulin has increased substantially. The development of insulin delivery devices, such as insulin pens, pumps, and continuous glucose monitoring systems, has improved the convenience and ease of insulin administration for patients.

These technological advancements have expanded the accessibility and utilization of insulin therapy. While type 2 diabetes is initially managed through lifestyle modifications and oral medications, many individuals eventually require insulin therapy as the disease progresses. With the rising incidence of type 2 diabetes worldwide, the demand for insulin among this patient population has also surged.

The drug class segment is expected to witness a significant growth rate in the antidiabetics market during the forecast period. The Biguanides, GLP-Agonists, Thiazolidinediones, Sulphonylureas, SGLT-2, Alpha-Glucosidase Inhibitors, DPP-4 Inhibitors, Meglitinides are sub-segments under the drug class segment. The rising demand for diabetes treatment along with the latest product launches promotes the expansion of the segment.

The geriatric segment held the dominating share of the antidiabetics market in 2024. Elderly individuals often have multiple risk factors for diabetes, including obesity, a sedentary lifestyle, and comorbid conditions such as hypertension and cardiovascular disease. These factors contribute to a higher incidence of diabetes among older adults and a greater need for antidiabetic treatment. Aging is associated with changes in metabolism, insulin sensitivity, and pancreatic function, which can lead to the development or worsening of diabetes in older adults. As a result, elderly individuals may require more intensive management of their diabetes with antidiabetic medications.

The oral segment led the market with the largest share in 2024. Oral antidiabetic medications offer a convenient and non-invasive treatment option for patients with diabetes. Compared to other forms of treatment such as insulin injections or implantable devices, oral medications are easier to administer and can be taken orally, often with meals. The oral antidiabetics market offers a wide range of medication options, including various classes such as biguanides, sulfonylureas, thiazolidinediones, DPP-4 inhibitors, SGLT-2 inhibitors, and others. This diversity allows healthcare providers to tailor treatment regimens to individual patient needs and preferences.

In many healthcare systems, oral antidiabetic medications are cost-effective compared to other forms of treatment such as insulin therapy or surgical interventions. This affordability makes oral medications accessible to a larger population of patients with diabetes, driving market demand and dominance.

The insulin pen/syringe segment is observed to witness the fastest rate of expansion in the antidiabetics market during the forecast period. Insulin pens and syringes offer a convenient and user-friendly method for administering insulin. Compared to traditional vial and syringe methods, insulin pens require less manual dexterity and are preferred by many patients, especially those with limited mobility or visual impairment. Insulin pens and syringes are designed for single-patient use, reducing the risk of contamination and infection transmission compared to multi-dose vials. This enhances patient safety and reduces the likelihood of needle-stick injuries.

By Product

By Patient Population

By Route of Administration

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client