January 2025

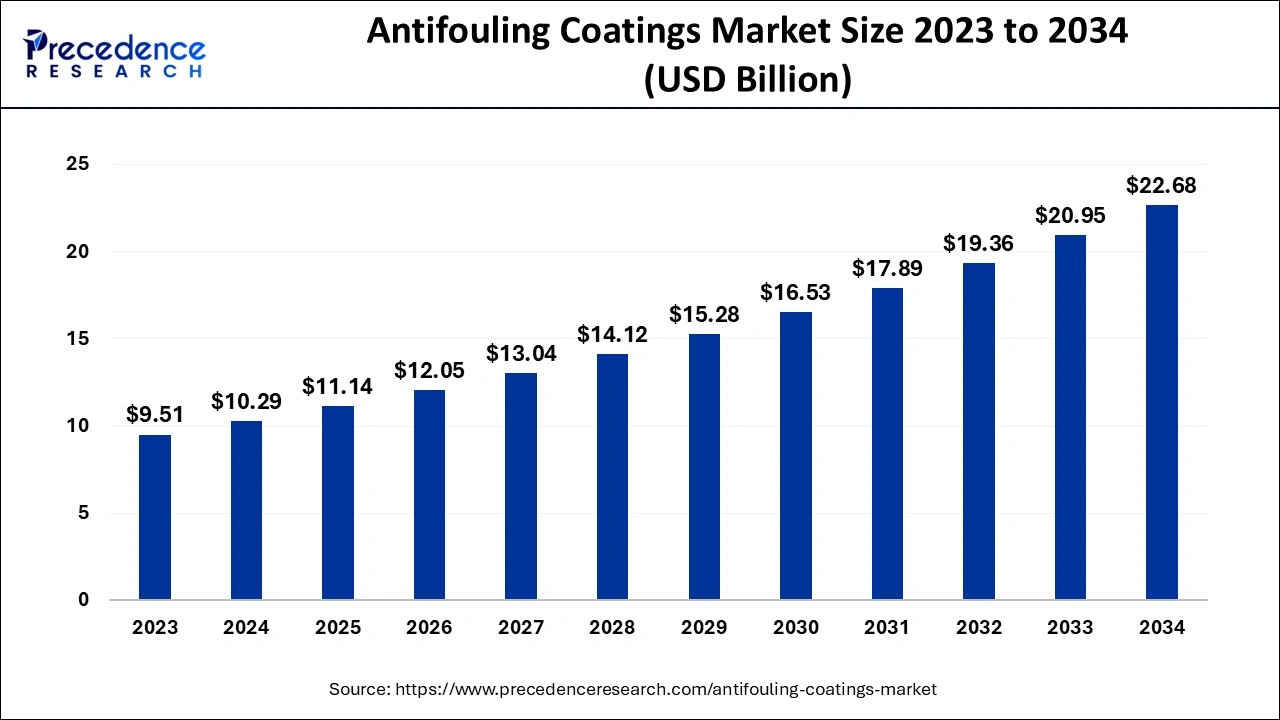

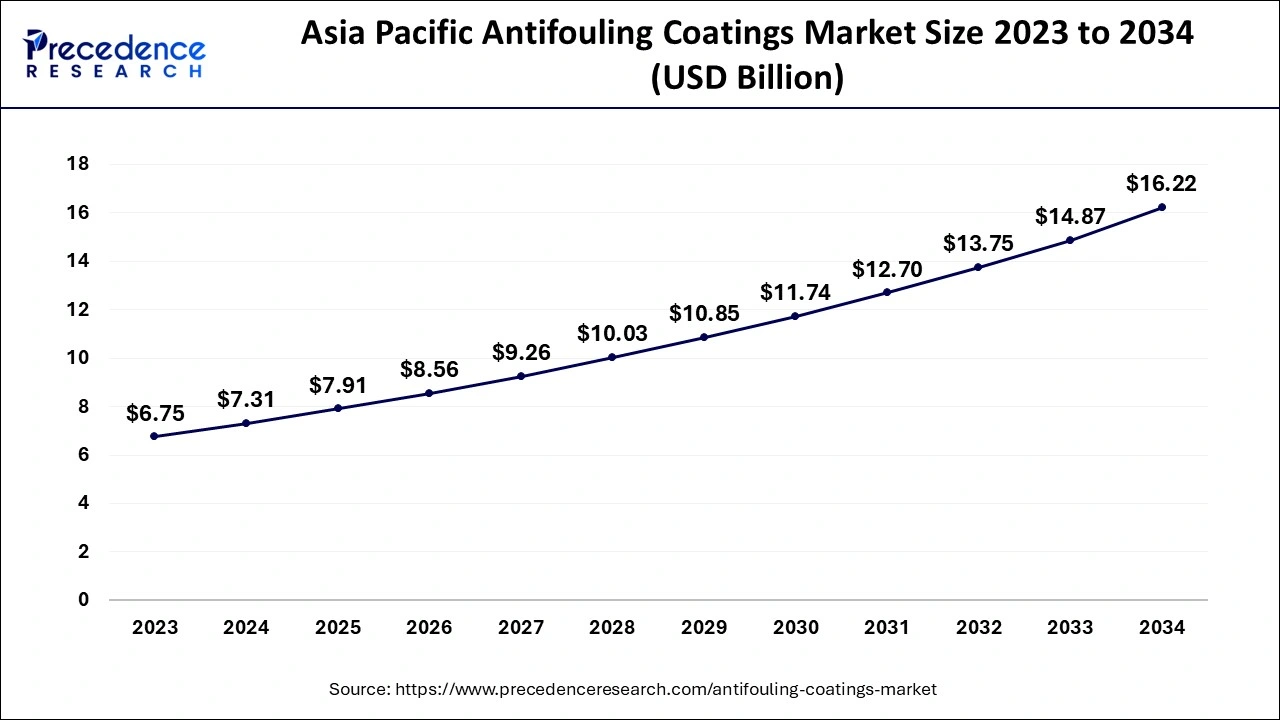

The global antifouling coatings market size accounted for USD 10.29 billion in 2024, grew to USD 11.14 billion in 2025 and is expected to be worth around USD 22.68 billion by 2034, registering a solid CAGR of 8.22% between 2024 and 2034. The Asia Pacific antifouling coatings market size is evaluated at USD 7.31 billion in 2024 and is expected to grow at a CAGR of 8.29% during the forecast year.

The global antifouling coatings market size is calculated at USD 10.29 billion in 2024 and is projected to surpass around USD 22.68 billion by 2034, expanding at a CAGR of 8.22% from 2024 to 2034. Increasing focus on sustainability and reformed government regulations for marine life protection is fuelling the market since the major key players in the antifouling coatings market are looking for comprehensive solutions for barriers like fuel costs and carbon emission, which are solvable by the antifouling coatings.

The Asia Pacific antifouling coatings market size is exhibited at USD 7.31 billion in 2024 and is anticipated to reach around USD 16.22 billion by 2034, growing at a CAGR of 8.29% from 2024 to 2034.

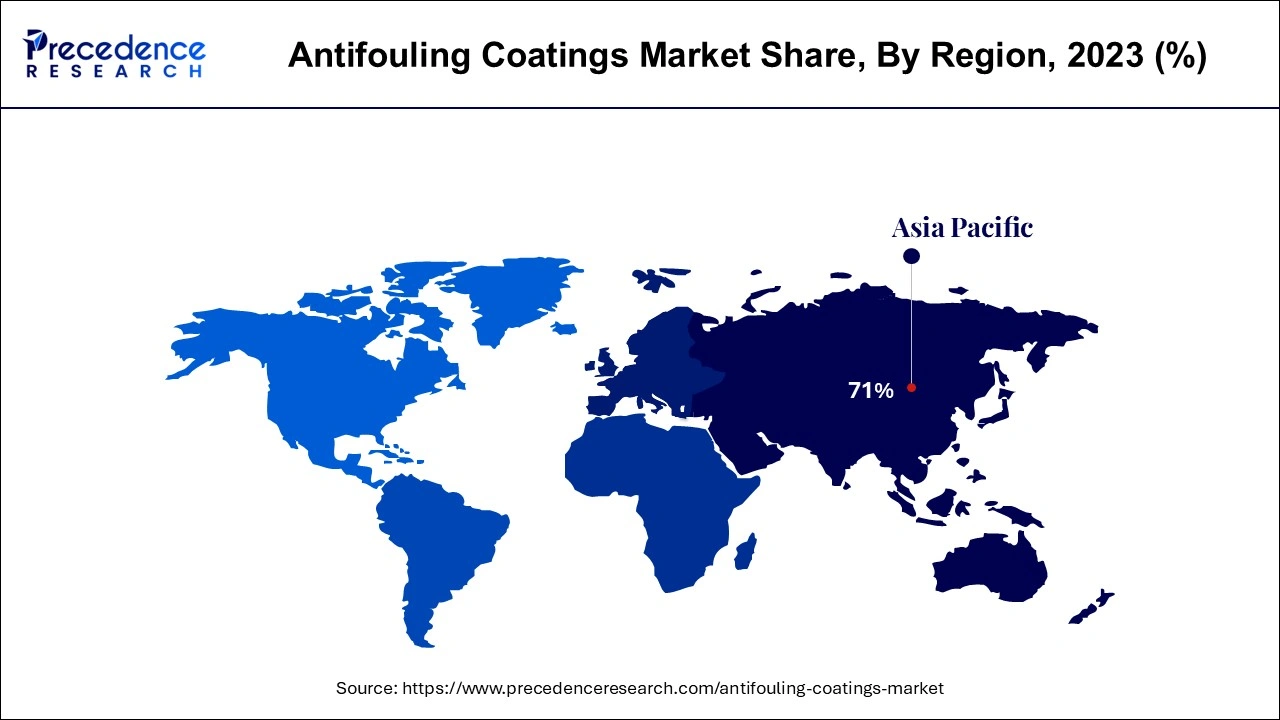

Asia Pacific accounted for the largest share of the antifouling coatings market in 2023. The dominance of the Asia Pacific is due to the presence of significant projects like shipbuilding and offshore oil and gas production and their infrastructure development. Increasing demand from evolving economies like India, Indonesia, and Vietnam for antifouling coatings is fuelling the region's growth further. Asia Pacific is, in fact, the world’s largest producer and manufacturer of ship fleets, according to the UN Trade and Development. Country-wise, China is expected to witness a significant growth rate during the foreseeable period owing to the presence of the country's large shipbuilding industry.

North America is expected to witness a notable growth rate in the antifouling coatings market during the foreseeable period. Market growth is driven by factors such as environmental regulations, surges experienced by shipping and marine-based industries, and technological advancements in the market. The innovative agendas followed by the primary players in the market are expected to accelerate market growth. Country-wise, the U.S. is dominating the global antifouling coatings market. The growth of this country is primarily due to the alarming signs of the need to resolve maritime issues due to the increasing transportation causing harmful effects on the marine ecosystem.

The growth of the antifouling market is due to the increasing demand from the shipping industry and the benefits provided by the antifouling paints and coatings to minimize friction, enhance fuel efficiency, and increase the demand for drilling rigs and production platforms. The industry is anticipated to further witness growth in the global market due to the affordable pricing and ease of availability.

With increasing concerns about fuel prices and environmental issues due to carbon emissions, every industry, including maritime, is looking for a sustainable and climate-friendly solution. Thus, the antifouling coatings market stands tall in this, driving its demand on a global scale.

AI Impact on the Antifouling Coatings Market

Artificial Intelligence (AI) has a significant impact on the antifouling coatings market since the paints and coatings industries use AI to gain a competitive advantage and reduce production costs and time. AI can help with color matching, formulation optimization, quality control, and predictive maintenance. AI can forecast coating performance, increase production efficiency, and improve consumer satisfaction by saving time, effort, and overall cost. AI in the paints and coatings sector needs collaboration with consulting companies to increase ROI and profits.

AI has a variety of roles in the paint and coatings industry, like developing corrosion-free coatings and paints and increasing self-lubrication as per environmental changes. Factors like the toxicity of the paint and coatings, price fluctuations based on the market demand, climate impact, and optional materials can also be forecasted with the help of AI and ML technologies. Computer vision and AI can be used to analyze the images of coatings and paints in bulk to develop smart coatings further by understanding the exact functioning of the microstructure. An article published by the American Coatings Association shows how AI is instrumental in using advanced algorithms that provide recommendations that further help to create better quality paints and environmentally friendly coatings.

| Report Coverage | Details |

| Market Size by 2034 | USD 22.68 Billion |

| Market Size in 2024 | USD 10.29 Billion |

| Market Size in 2025 | USD 11.14 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.22% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of the oil, gas, and offshore wind farm energy installation

The major driving factor for the antifouling coatings market is the expansion of oil, gas, and offshore wind energy installation, with a rising focus on renewable energy and clean sources for the market. Region-wise, North America and the South Asia Pacific region are the frontiers in the installation of renewable energy sources. North America has huge deposits of natural gas and oil.

Continued extraction of oil and gas for fuel requirements is the major driving factor in North America. Moreover, international trading and shipping are also increasing, which drives the antifouling coatings market. Also, there is an increasing focus on sustainability with reformed government regulations and technological advancement in the production sector.

Environmental impact

The major restraining factor for the antifouling coatings market is the negative environmental impact due to the dispersion of harmful substances in the ocean, which hazards the marine ecosystem. Despite the significant benefits, restraining factors like this affect the growth of the market on a global scale. Therefore, governments made stringent regulations to protect the marine ecosystem, which affects the business of antifouling coatings. Moreover, the high cost of the advanced coatings and their reapplication could hold a potential barrier for the market, especially for owners with budget constraints.

Advanced antifouling technology

The significant opportunity that antifouling coatings markets hold is the advancements in coating technology, such as nanotechnology based coatings and climate-friendly alternatives. The expansion of the maritime industry and offshore oil and gas activities represents substantial opportunities in the global market. The coatings can be applied to marine vessels, offshore structures, and other surfaces, creating lucrative opportunities for businesses in this small market and highlighting the importance of advanced coatings in major industries.

The copper-based antifouling paints segment accounted for the largest share of the antifouling coatings market in 2023. The growth of this segment is attributed to the new shipbuilding and repair activities that are causing rising demand for the leisure boat market. Copper-based coatings are highly effective in the prevention of fouls, minimizing drag, fuel consumption, and carbon emission, which is further helpful for climatic cycle preservation. Also, copper-based coatings reduce the need for frequent re-coatings and, thus, reduce maintenance costs.

The hybrid antifouling paints segment is anticipated to witness the fastest growth in the antifouling coatings market during the forecasted years. Increasing environmental concerns, advanced performance requirements, and increasing awareness for the adoption of sustainable solutions are the major driving factors for this segment. Hybrid antifouling paints are one of the most climate-friendly options as they consist of fewer hazardous chemicals or substances. They provide increased protection against fouling with the help of different technologies like copper-based and silicon-based. Ship owners are also looking for an advanced solution for fouling.

The shipping vessels segment held the dominating share of the antifouling coatings market in 2023. The growth of this segment is attributed to factors such as increasing demand for global trade and transportation. The demand for antifouling coatings increases in non-commercial sectors like recreational yachts and cruise ships due to the expansion of maritime tourism and leisure boating. Moreover, the increasing trade sector across the world is driving the demand for shipping vessels as they are critical for the transportation of services and major goods.

The fishing boats segment is anticipated to witness significant growth in the antifouling coatings market during the forecasted years. The growth of this segment is due to the rising demand for fishing activities and seafood. The growth of fishing fleets in the Asia Pacific and regions of Europe propelled the segment's demand further. Many fishing boat owners are looking to enhance their durability and overall performance by adopting protections provided by the antifouling coatings. Eco-friendly coats address the issue of the hazardous materials that harm the aquatic ecosystem.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

January 2025

January 2025