January 2025

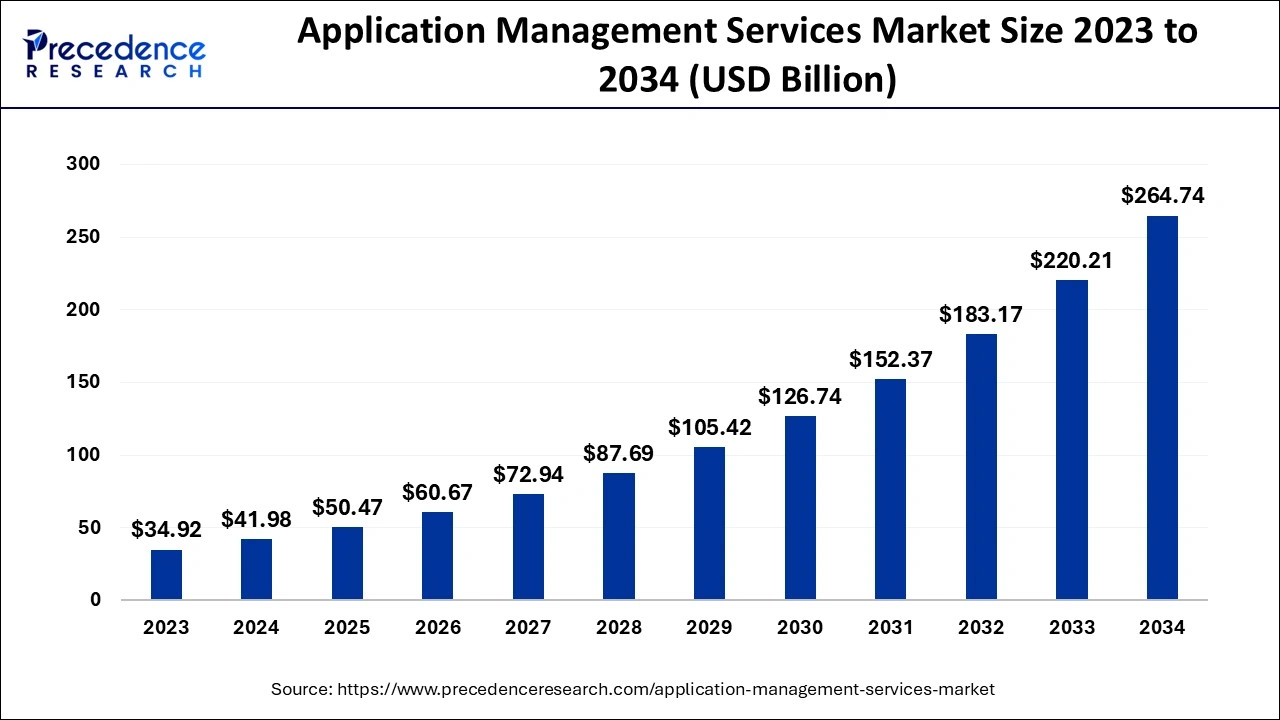

The global application management services market size accounted for USD 41.98 billion in 2024, grew to USD 50.47 billion in 2025 and is projected to surpass around USD 264.74 billion by 2034, representing a double-digit CAGR of 20.22% between 2024 and 2034. The North America application management services market size is evaluated at USD 15.95 billion in 2024 and is expected to grow at a CAGR of 20.36% during the forecast year.

The global application management services market size is calculated at USD 41.98 billion in 2024 and is predicted to reach around USD 264.74 billion by 2034, expanding at a CAGR of 20.22% from 2024 to 2034. The application management services market growth is attributed to the growing adoption of advanced technologies in various sectors.

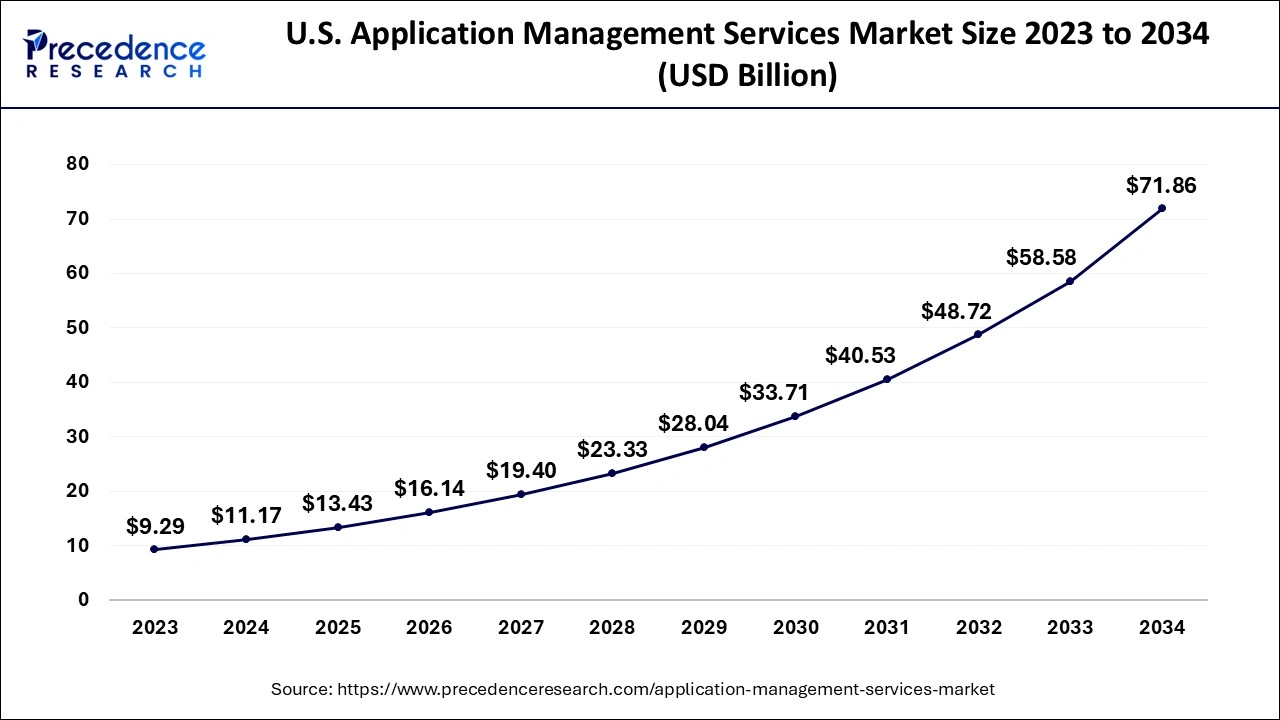

The U.S. application management services market size is exhibited at USD 11.17 billion in 2024 and is expected to be worth around USD 71.86 billion by 2034, growing at a CAGR of 20.43% from 2024 to 2034.

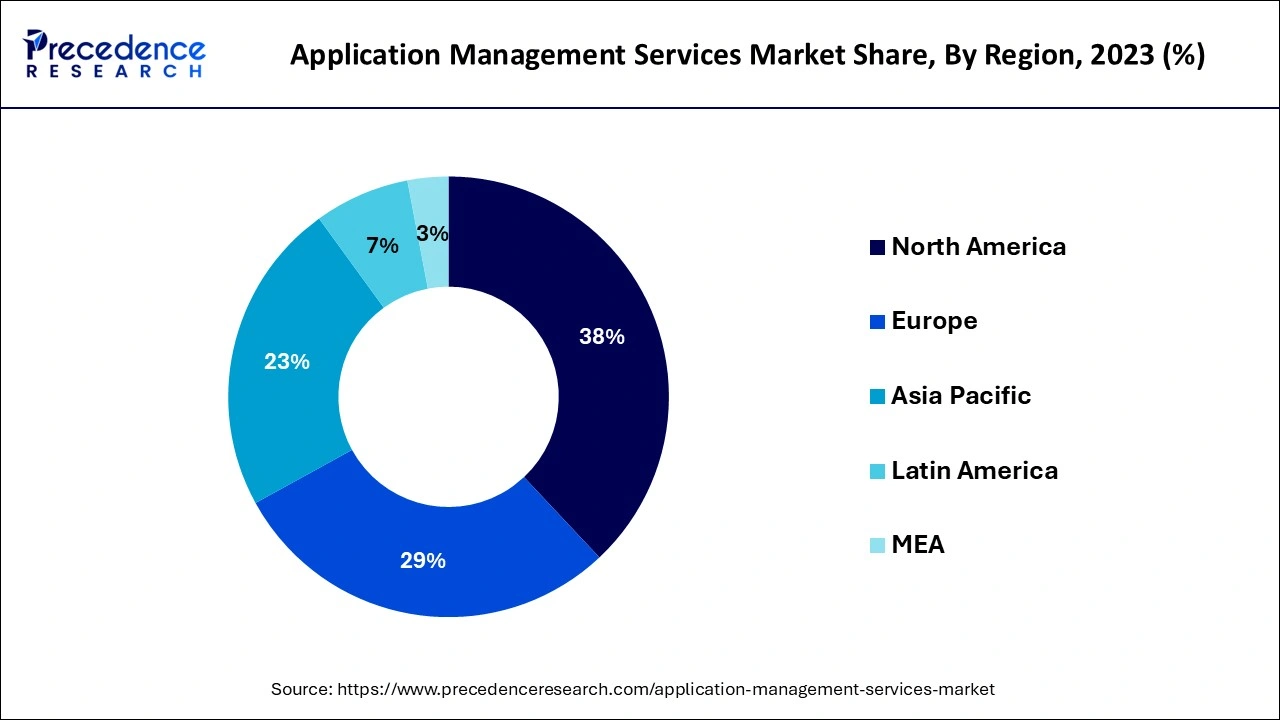

North America dominated the application management services market in 2023 due to its superior technological development, adoption of LVJD solutions, and high spending on IT by enterprises in various sectors. North American companies in 2023 explored AMS solutions to improve business operations, security, and increasing sophisticated applications. Furthermore, the need for cloud services and automation has also put additional pressure on AMS adoption in the region.

Asia Pacific is projected to host the fastest-growing application management services market in the coming years, owing to the rising investment in IT infrastructure, cloud services, and enterprise mobility. In IDC Asia Pacific for 2024, the rising focus of enterprises on adopting automation, artificial intelligence, and cloud technologies is expected to drive demand for AMS solutions. Additionally, the majority of governments and private enterprises are heavily investing in digital government services and smart city initiatives, for which AMS has an important role in optimizing applications for efficiency, security, and capacity.

The application management services market is continuing to grow due to the growing uptake of digital solutions in the commercial, industrial, and even government business segments. Existing and new organizations continue to embrace the use of multiple applications to support their internal and external processes. The need to transform, manage, and optimize these applications is therefore expected to grow in the future.

The application management services market services cover the most important and demanded areas where companies need to ensure the functioning, security, and cutting-edge performance of applications. Digital technology adaptation in industries including finance, healthcare, and retail, amongst others, demands durable application management to facilitate easy compatibility and UX. Furthermore, companies are including advanced smart technologies, such as the Internet of Things (IoT) and artificial intelligence, creating a growing demand for flexible application management services (AMS) solutions.

Impact of Artificial Intelligence on the Application Management Services Market

The application management services market is facilitated by AI, which improves the competency, precision, and reaction time required to handle applications on various platforms. The robotic process automation techniques brought into practice through the application of AI allow for tracking. This automates most monotone activities and even diagnosing problems, which minimizes the need for close supervision and reduction of human error. These tools are always running and providing performance data, likely problems, and suggestions for methodical application optimization. This promotes better service delivery and more dependable overall user experiences for businesses. Furthermore, AI-enabled analytics in application management help in strategic planning choices as they offer the intention of application usage and its characteristics, performance, and even opportunities for enhancement.

| Report Coverage | Details |

| Market Size by 2034 | USD 264.74 Billion |

| Market Size in 2024 | USD 41.98 Billion |

| Market Size in 2025 | USD 50.47 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 20.22% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service, Organization Size, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing demand for cost-effective IT solutions

Increasing demand for cost-effective IT solutions is anticipated to drive growth in the application management services market. Businesses from the private and public sides want to optimize their work while keeping costs low, which is why managed services are suitable for addressing large and complex applications. These services decrease the demands on internal IT headings, as they handle regular maintenance checks, troubleshooting, and application updates, thus not only minimizing operation costs but also maximizing production.

Increase in application management & data analytics users (2023-2024)

| Year | Increase in Users Focused on Application Management (%) |

| 2023 | 15% increase in data analytics-related skills demand |

| 2023-2024 | 8% increase in software applications usage in education |

| 2024 | 10% growth in IT analytics positions |

| 2023 | 12% rise in first-year applications involving analytics |

Hamper High Initial Costs of Implementation

High initial costs of implementing application management services are anticipated to hamper the application management services market growth. Small and medium-scale organizations struggle a lot with the initial capital expenditure in relation to infrastructure, licenses, and skilled workforce. Many of these services demand complex information technology to support them, complex software solutions, and experienced teams for integration, which is often costly to companies. This financial impact also restricts the adoption rate, bearing in mind that many companies cannot afford the capital needed at the beginning. Additionally, the high costs of implementing these services are anticipated to continue.

Growing need for advanced data analytics in application management

The growing need for advanced data analytics in application management represents a significant opportunity for the application management services market as businesses prioritize data-driven strategies to optimize performance. Application health monitoring, user behavior, and operational efficiency are managed by analytics tools, and hence, it will enable organizations to identify problems early enough and solve them. This trend further facilitates industries' use of application management services to advance their technologies.

The application maintenance & support segment held a dominant presence in the application management services market in 2023. This growth is in line with the WEF report, noting that businesses around the world focus on smooth application functionality for models of remote and flexible work and operation under disruptions. Application maintenance and support are expected to gain considerable adoption due to increased interest by organizations in maximizing the runtime of existing applications before replacement to minimize resource costs spent on new applications. Furthermore, as noted in the Future of Jobs Report, 2023, released by the WEF, there is a sustainable trend towards the optimization of IT resource.

The cloud application migration segment is expected to grow at the fastest rate in the application management services market during the forecast period of 2024 to 2034, as most businesses shift their activities to the cloud. This has been due to the flexibility, ease, and efficiency of cloud solutions, which have made it easier for industries such as manufacturing and banking, where the efficiency of data and space is important. Cloud application migration supports meeting the new compliance requirements, as the safe cloud environments are updated regarding the new data protection regulations. Furthermore, the companies interested in attaining greater agility, cost-effectiveness, and conformance with regulations within their data solutions further boost the demand for this technology.

The large enterprises segment accounted for a considerable share of the application management services market in 2023 due to the increased demands for addressing the underlying IT structures and global application landscapes. The U.S. Department of Commerce pointed out that large organizations within the finance, manufacturing, and retail segments are embracing expansion on IT. This led to a rise in the need for managed services that enhance application efficiency and security across different business areas. Many issues, including data management, adherence to international requirements, and scalability, are typically addressed by AMS solutions.

The SME segment is anticipated to grow with the highest CAGR in the application management services market during the studied years, owing to the continuing demand for cheap IT solutions that can also expand as an organization grows. Moreover, cloud computing and SaaS allow SMEs to acquire AMS at a greatly reduced cost compared to what large enterprises pay, boosting the adoption of AMS technology.

The BFSI segment led the global application management services market due to the increasing need for enhanced and secure application management solutions for a wide and integrated financial system to enhance the customer’s experience and address regulatory compliances. Deloitte's banking industry outlook for 2023 has identified that the promotion of the digital form of financial services is still steady for the BFSI sector. They are adapting trending digital industrial technologies, such as cloud and artificial intelligence applications, to improve the operating capacity and security of the data kept in the business. Furthermore, the increasing focus on user-driven digital banking experiences an emphasis on AMS solutions that facilitate, manage, and mitigate financial transactions, fraud, and customer interactions.

The healthcare & life science segment is projected to expand rapidly in the application management services market in the coming years, owing to the rise of demand for digital transformation in healthcare business applications. The healthcare industry worldwide is experiencing a digital transformation process within the framework of health services and pharmaceutical companies. They are using innovative technologies, including electronic health records (EHR), telemedicine, and cloud-based applications, to enhance the delivery of services and the subsequent outcomes. Additionally, there is a higher demand for AMS solutions to deal with new laws like GDPR or HIPAA and growing cybersecurity demand in healthcare applications.

By Service

By Organization Size

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

August 2024

April 2025