December 2024

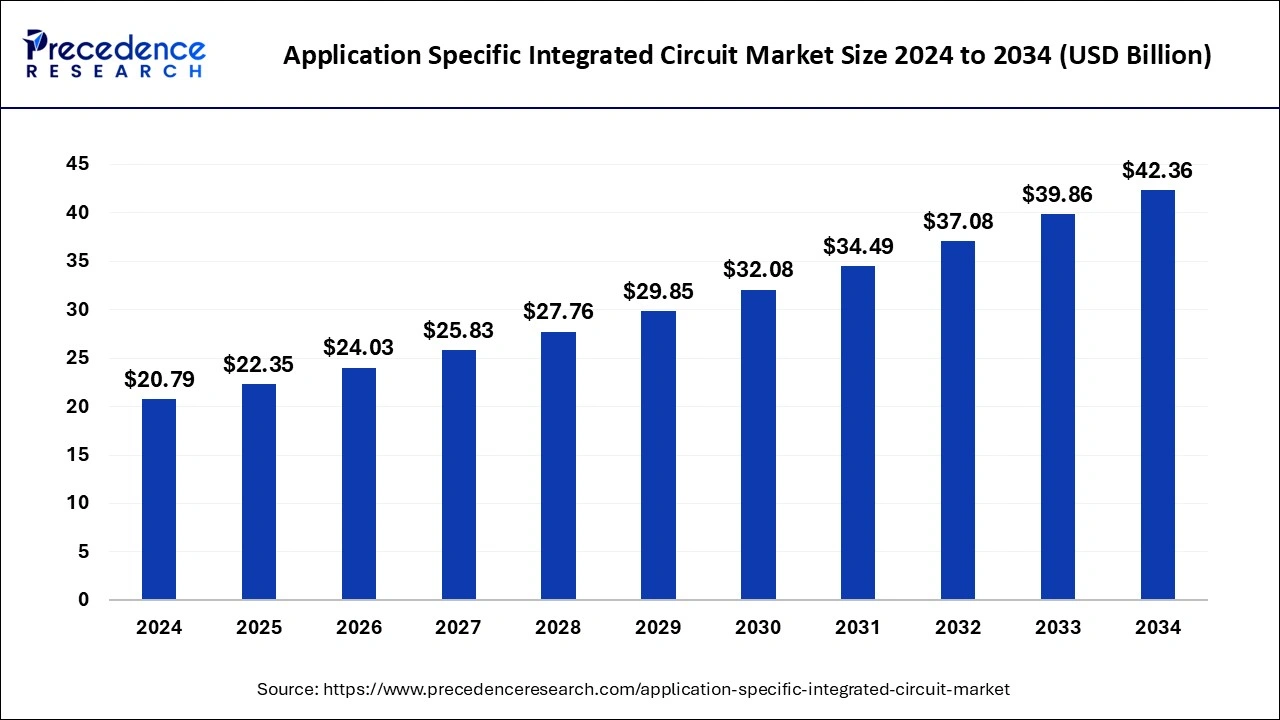

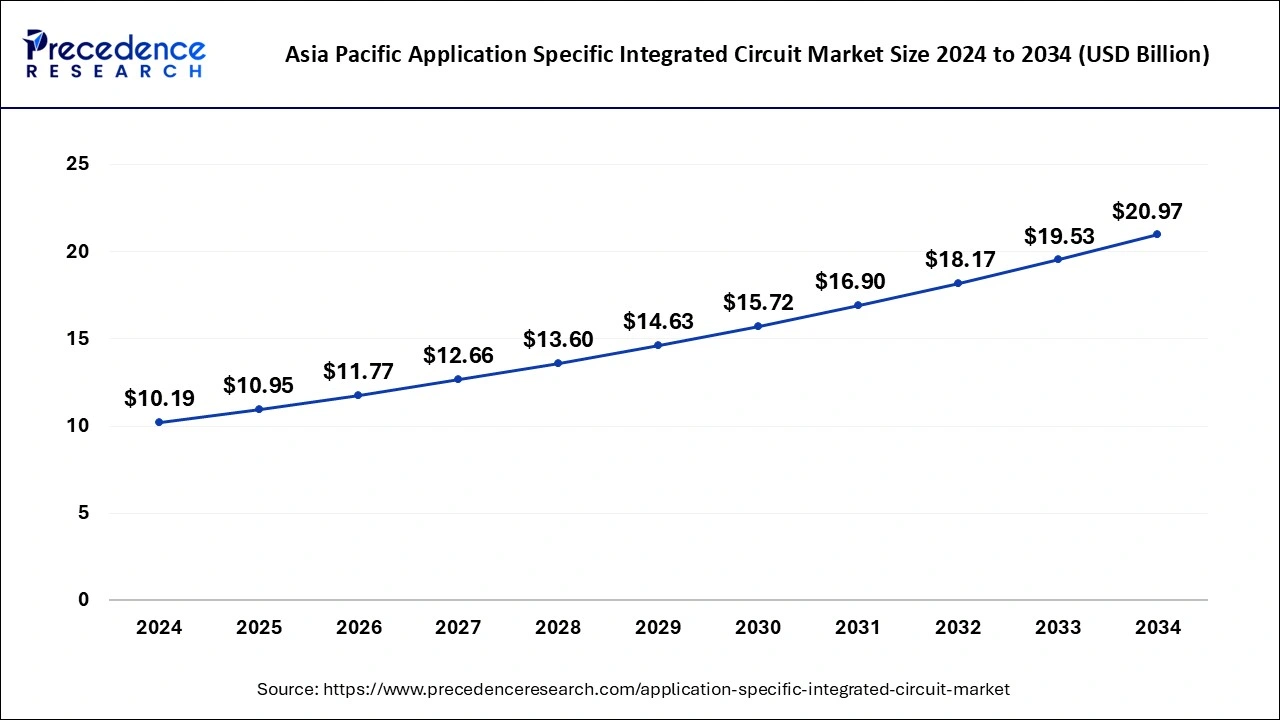

The global application specific integrated circuit market size is estimated at USD 22.35 billion in 2025 and is predicted to reach around USD 42.36 billion by 2034, accelerating at a CAGR of 7.38% from 2025 to 2034. The Asia Pacific application specific integrated circuit market size surpassed USD 10.95 billion in 2025 and is expanding at a CAGR of 7.48% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global application specific integrated circuit market size accounted for USD 20.79 billion in 2024 and it is expected to hit around USD 42.36 billion by 2034 with a registered CAGR of 7.38% from 2025 to 2034.

The Asia Pacific application specific integrated circuit market size was estimated at USD 10.19 billion in 2024 and is predicted to be worth around USD 20.97 billion by 2034, at a CAGR of 7.48% from 2025 to 2034.

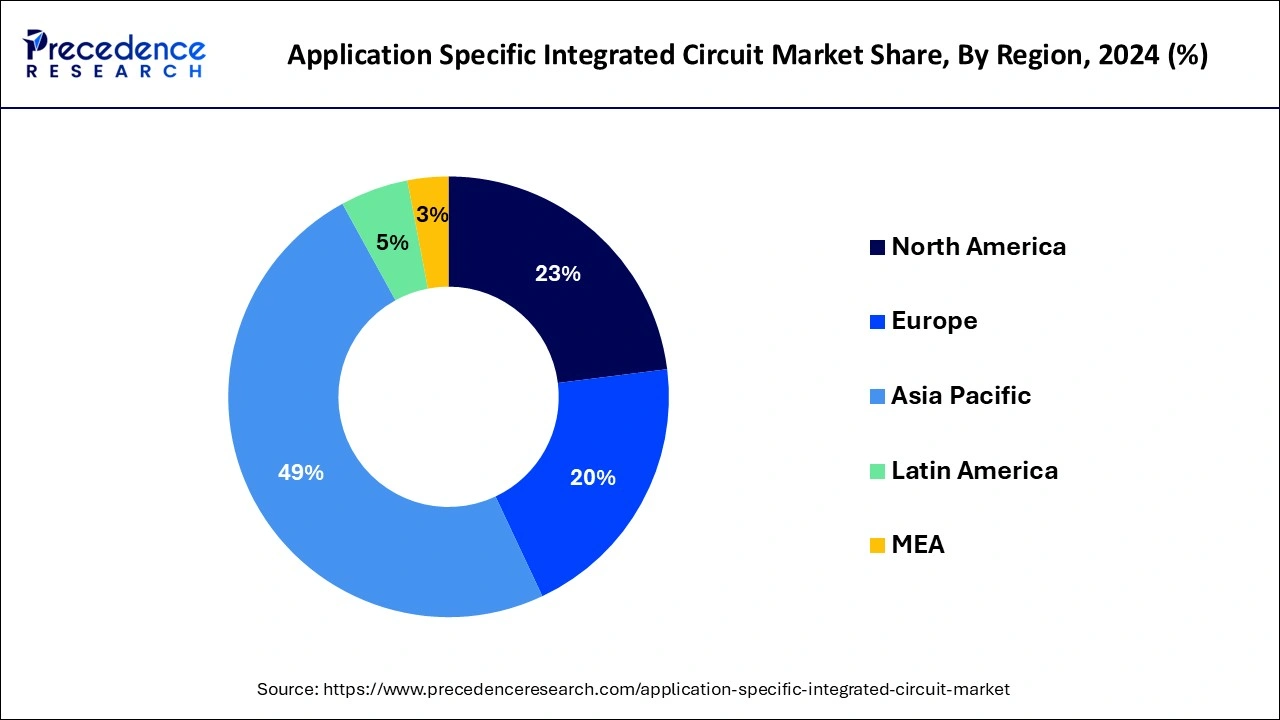

Asia Pacific leads the application specific integrated circuit market share in 2024 and is anticipated to grow remarkable during the forecast period. The quick rise in demand for energy-efficient equipment, as well as the increasing use of smartphones in the region, is accelerates the market growth. Growing digitization, greater penetration of high-tech gadgets, progress of automotive electronics, and increased demand for miniaturization are all driving market expansion in developing nations like China, Japan, and India. Furthermore, the existence of a large number of semiconductor businesses in the region, such as Infineon Technologies, as well as key consumer electronics companies like LG Electronics and Samsung Electronics Co., Ltd., is driving market expansion.

Over the projection period, North America is expected to be the fastest-growing region. The considerable presence of prominent firms in the region, such as Maxim Integrated Products Inc., Qualcomm Inc., Intel Corporation, and Texas Instruments Inc., is fosters the market growth. The United States currently dominates the region's market. In the United States, there is a lot of progress in consumer electronics, healthcare monitoring systems, and electric and hybrid automobiles. Because of its early adoption of the ASIC technology, North America has a large number of application specialized integrated circuit manufacturers and solution providers.

The application-specific integrated circuits market is likely to be driven by the constantly expanding demand for smartphones and tablets. Application-specific integrated circuits helps next-generation smartphones meet lower size and weight, high-bandwidth, low-cost, and long-battery-life criteria. In addition, with the introduction of smart gadgets and electrical items such as televisions, digital cameras, laptops, wearables, and gaming consoles that feature sophisticated technologies like flat screens, touch screen monitors and displays, and Bluetooth features, demand for ICs is rising. Furthermore, the demand for electronic components using ASICs has increased dramatically over time as a result of the growing usage of mechatronics in industrial and automotive applications.

Consumer electronics and telecommunications equipment were the first applications for application specific integrated circuits. These ICs are used in a variety of applications, including automotive pollution control, personal digital assistants, sensors, industrial, healthcare, and military and defense systems. The widespread usage of application-specific integrated circuits in industrial applications such as thermal controllers and 8-bit microcontrollers is having a substantial impact on the market for these devices. Traditional components such as solder joints and PCB traces are replaced with a single IC, reducing the chances of failure and resulting in exceptionally dependable industrial systems. Additionally, enterprises that demand exceptionally consistent technological systems, such as automotive, aerospace, defense, and military, are using these chips to avoid the numerous electronic system failures that these industries experience.

The unit cost for application-specific integrated circuits has been falling as a result of technology breakthroughs such as big data analytics, Internet of Things (IoT), blockchain, and machine learning, which has had a beneficial impact on the market globally. The innovations listed above are widely used in linked devices, data center facilities, and public clouds to allow corporate data to travel more quickly throughout the IT network. As a result, enterprises are putting these ICs into devices to enable the operation of new technologies, resulting in lower operational costs. In addition, as the electronics industry evolves, there is a constant need for innovation in application-specific integrated circuit designs to meet users' specialized needs.

| Report Coverage | Details |

| Market Size in 2025 | USD 22.35 Billion |

| Market Size by 2034 | USD 42.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.38% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segmented Covered | By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the Product, the semi-custom ASIC product segment leads the Application Specific Integrated Circuit Market accounting for more than 48.5% revenue share in 2024 and is expected to grow significantly during the forecast period. The semi-custom ASIC is further divided into two sub-categories: cell-based and array-based. Furthermore, because to its digital-logic and electrical properties such as inductance and capacitance, cell-based ASIC maintained the highest market of roughly 70.2% in 2020. These attributes contribute to the component's better electrical performance and high density. Furthermore, because cell-based ASICs have advanced inbuilt static random-access memory and internet protocol cores, they may be employed in any product, regardless of design complexity. This aids in the system's smooth operation.

By 2034, the full-custom ASIC segment is predicted to increase significantly. These integrated circuits (ICs) deliver faster and more reliable performance while also protecting intellectual property while consuming less power. In addition, the entire custom ASIC allows designers to customize logic cells, mechanical structures, layouts, and circuits, as well as optimize memory cells, all on a single IC, reducing processing time and risk. Due to its sophisticated design, the manufacturing period for these application specific integrated circuits is eight weeks for a given application, which is longer than semi-custom ASICs.

Based on the Application, the consumer electronics application segment leads the market accounting for more than 34% of revenue share in 2024 and is estimated to grow significantly in the upcoming years. On the back of the growing use of ASICs in phones, tablets, and laptops around the world, the consumer electronics vertical is expected to offer considerable growth prospects for all firms engaged in the value chain. These ASICs have a variety of benefits, including low power consumption, IP security, small size, and better bandwidth, which has led to increased acceptance in the consumer electronics market. Furthermore, the rapid innovation of electronic devices is allowing for consistent performance and energy efficiency, which is propelling the application specific integrated circuit market forward. These ICs are utilized in a variety of industries, including telecommunications, healthcare and industrial, in addition to consumer electronics.

Over the projected period, the industrial segment of the ASIC market is expected to increase significantly. In application specific integrated circuits, traditional components such as solder connections and PCB traces are replaced with a single IC, which helps to reduce the possibilities of failure and create reliable industrial systems. Furthermore, the market is being propelled forward by the increasing use of various components in industrial applications, such as microcontrollers, programmable timers, and thermal controllers. Furthermore, there are various producers of application specialized integrated circuits on the market that sell IC chips specifically built for industrial use. For instance, Custom "Mixed Signal" technology is available from Custom Silicon Solutions, Inc., a semiconductor business. The CSS555C industrial application specialized integrated circuit is a better version of the company's 555 timer. Other 555 timing devices use 10.0 percent less power than the CSS555C industrial ASIC.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

October 2024

December 2024

August 2024