January 2025

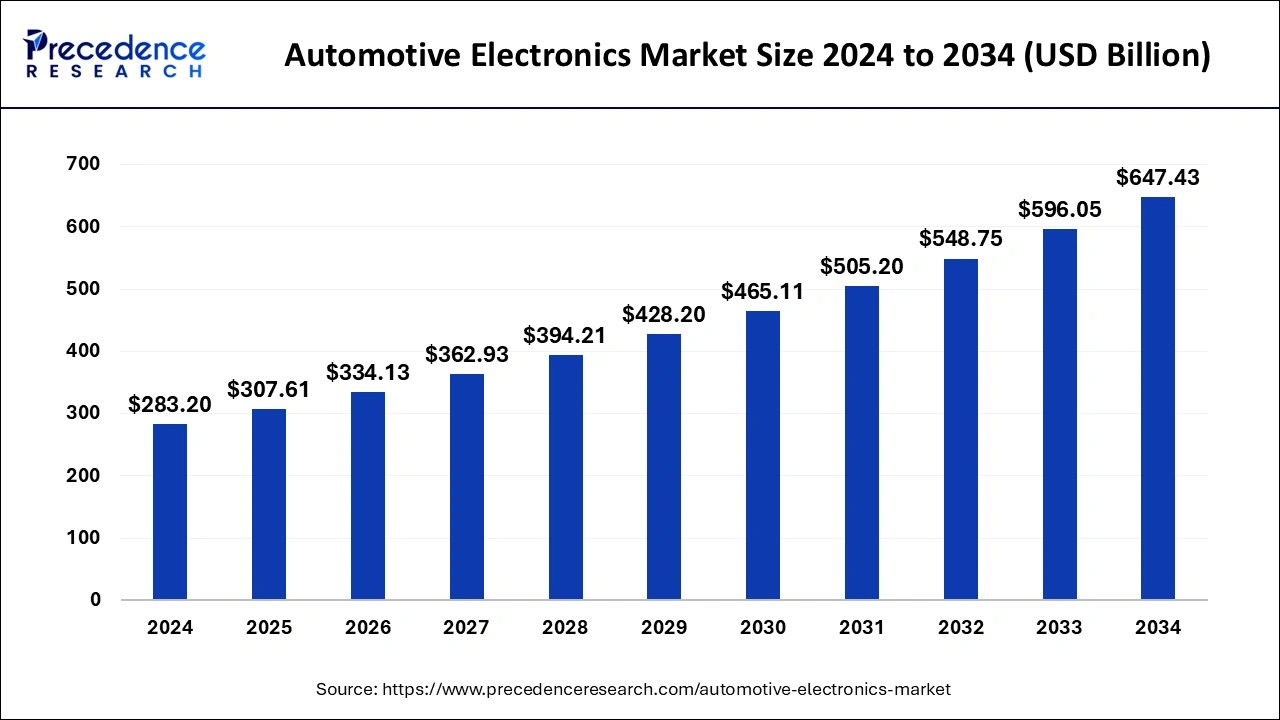

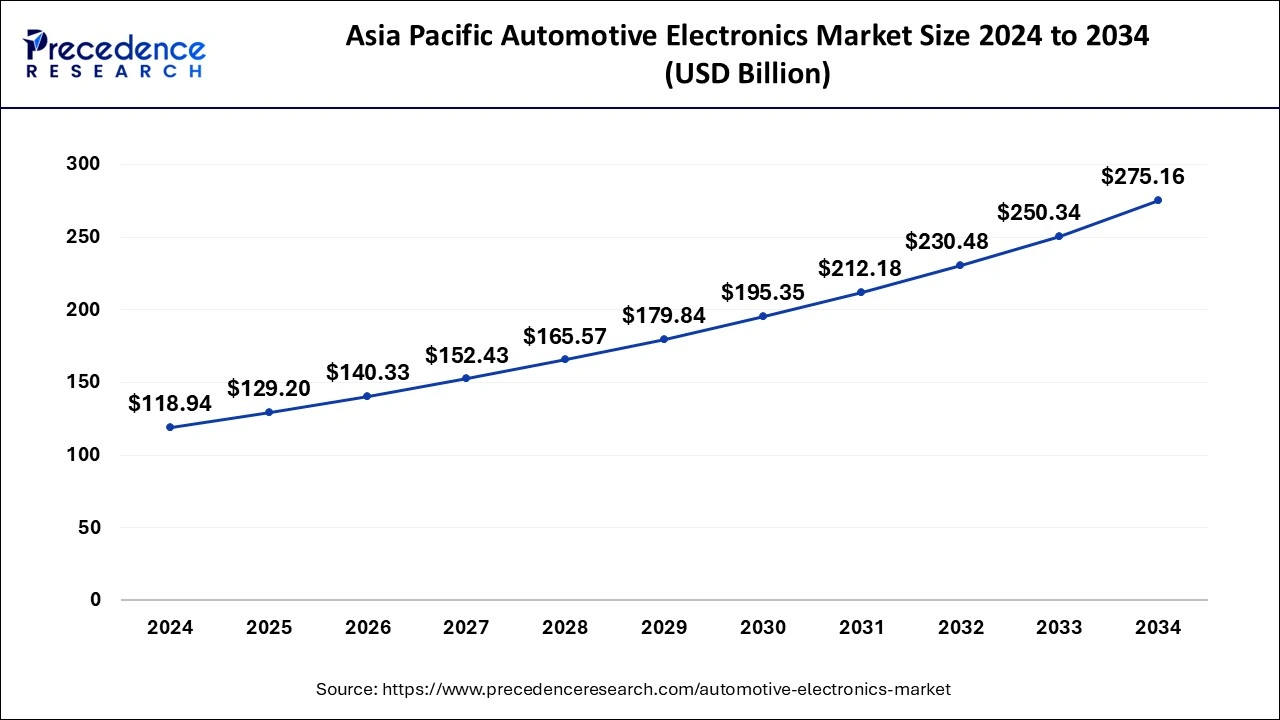

The global automotive electronics market size is calculated at USD 307.61 billion in 2025 and is forecasted to reach around USD 647.43 billion by 2034, accelerating at a CAGR of 8.62% from 2025 to 2034. The Asia Pacific automotive electronics market size surpassed USD 129.20 billion in 2025 and is expanding at a CAGR of 8.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive electronics market size was estimated at USD 283.20 billion in 2024 and is anticipated to reach around USD 647.43 billion by 2034, expanding at a CAGR of 8.62% from 2025 to 2034. The global automotive electronic market is attributed to the increasing implementation and integration of advanced safety systems such as automatic emergency lane departure warnings, parking assistance systems, airbags, and braking to decrease road accidents.

Artificial intelligence is a major and necessary trend in technology. There are various ways in which AI is being integrated into how they operate on the road and how vehicles are built. AI in cars aims to provide drivers, increase fuel efficiency, and improve with enhanced connectivity features. In addition, AI is applied in cars in various ways, such as robots that use AI to quickly assemble cars, driver-assistance systems that activate under certain scenarios, and sensors that help automotive vehicles navigate their surroundings. AI-based infotainment systems allow in-vehicle configurations such as mirror and seat settings tailored to the driver's needs and preferences. In addition, to prevent road accidents, AI solutions offer drivers real-time information on potential hazards, which is expected to drive the demand for the automotive electronics market in the coming years.

The Asia Pacific automotive electronics market size was evaluated at USD 118.94 billion in 2024 and is predicted to be worth around USD 275.16 billion by 2034, rising at a CAGR of 8.74% from 2025 to 2034.

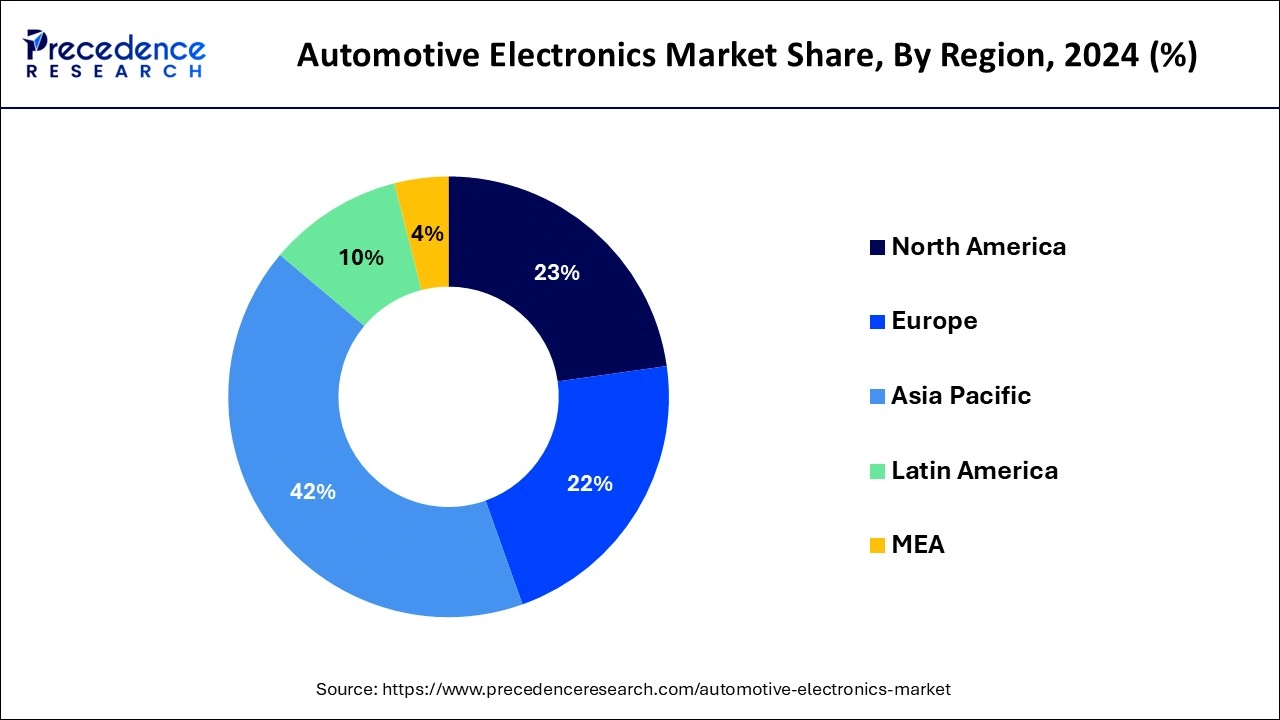

Asia Pacific dominated the automotive electronics market with the largest market share of 42% in 2024.

The market growth in the region is driven by increasing consumer awareness of safety features in emerging countries, increasing purchasing power of consumers, and increasing demand for advanced electronics in vehicles. By implementing modern manufacturing technology, automotive manufacturers in the region intend to enhance their production volume.

North America is expected to grow fastest during the forecast period. The automotive electronics market growth in the region is attributed to the increasing number of automotive electronics companies that are implementing collaboration and partnership initiatives to increase their demographic presence.

U.S. Automotive Electronics Market Trends

The market in the U.S. is anticipated to grow fastest during the forecast period. The market growth in the U.S. is attributed to the increasing consumer preference towards connected cars increasing demand for electric vehicles and rising government funding and regulations. Various vehicles in the U.S. are tailored with Internet access and the ability to communicate devices, such as cars, smartphones, and infrastructure. In addition, connected cars need sophisticated electronic systems to enable connectivity, which is further driving the growth of the automotive electronics market in the U.S.

China Automotive Electronics Market Trends

China is the fastest growing country in the automotive industry and is expected to grow the fastest during the forecast period across the globe. Government regulation, subsidies, and incentives enhancing NEVs have led to an increase in the demand for electric cars which is expected to propel the growth of the automotive electronics market. In addition, China has been heavily investing in autonomous driving technology and is experiencing growth in AI technologies, radar systems, LiDAR, and sensors.

India Automotive Electronics Market Trends

The market growth in the country is attributed to the rapid advancements in technology for the development of innovative and new automotive electronics products, such as advanced driver assistance systems (ADAS), navigation systems, and infotainment systems.

Automotive electronics are customized electronics designed for use in vehicles. These types of electronics can be exposed to, and are thus rated at, more severe temperature ranges when compared with regular electronics. Over the last decade, vehicle sensor improvements have led to pioneering autonomous driving mechanism that permits better visibility and consciousness. The special cutting-edge features in the modern vehicles include adaptive cruise control, park assistance, lane-keep support, traffic-sign identification and pedestrian recognition among others. Multiple features presented by original equipment manufacturers (OEMs) such as mechanized emergency braking organization, lane departure warning and airbag system among others have suggestively reduced road accidents across the world. Automotive electronics along with the existence of connected features and comprehensive computing technologies are improving automobile competences. These developments have been probable due to the substantial progress of electronic component in recently manufactured vehicles.

| Report Highlights | Details |

| Market Size in 2024 | USD 283.20 Billion |

| Market Size in 2025 | USD 307.61 Billion |

| Market Size by 2034 | USD 647.43 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.62% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Sales Channel, Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Increasing speed of modernization in automotive electronics industry is expected to pave the way for customers to better exploit their time in transportation to enjoy innovative services. As a result, customers will have additional time to participate in personal activities. Thus, an electronically smart automobile will consist of enhanced features. It is more relaxed, secure, and energy efficient. New reports and investigation on smart cars assert that higher than 65% of new cars will consist of smart technology by the end of 2022. As per a report published by BI Intelligence, around 94 million smart cars will be shipped by the end of 2022. And, approximately 82% of all cars transported by 2022 will be equipped with connected technology. This would result in a CAGR of nearly 35% from the present 21 million connected automobiles.

The current carrying devices segment has held a major market share of 42% in 2024.

The current-carrying devices segment dominated the global automotive electronics market due to high cost of components including connectors and wiring harness. Furthermore, government initiatives comprising Make in India and influences such as fewer labor costs and intensifying disposable income in evolving economies have led to an upsurge in the production of passenger cars and light commercial vehicles.

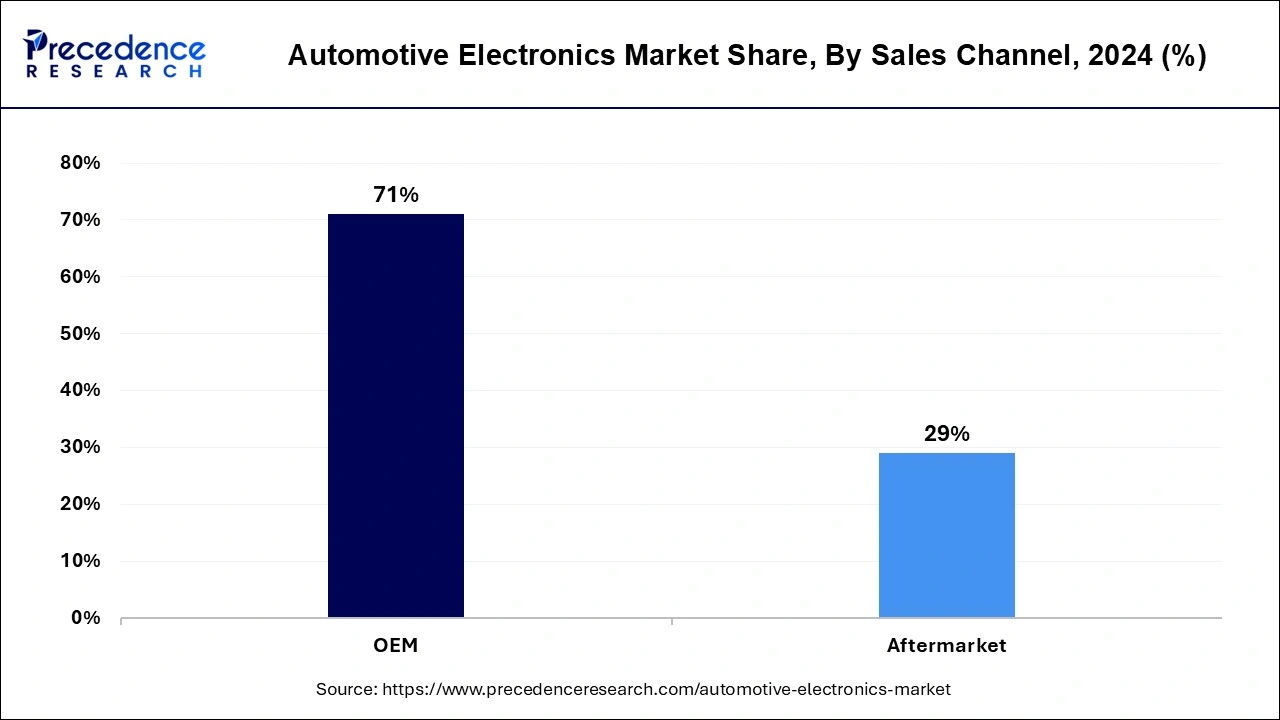

The OEM segment contributed the highest market share of 71% in 2024.

The original equipment manufacturer or OEM segment occupied the leading market portion in 2024, as most of the electronic components are incorporated while the vehicle manufacturing phase. As electronic components provided by the OEMs are extremely durable OEM market is projected to develop at a momentous growth rate during years to come.

Safety Systems led different application segments and reported more than 24% market share in terms of revenue in 2024. Some of the prominent driving forces for the market growth include government guidelines that aim to minimalize road accidents and loss of passenger lives, rising requirement for transportation management systems, specially in the logistic industry.

Due to prevalent electronics systems in automobile operations, manufacturers have been able to enhance the driving performance, riders' and driver's comfort and fuel efficiency. Number of electronics components is increasingly growing with time due to need to recover everything from fuel effectiveness and driver security. As a consequence, more mechanisms are getting converted from mechanical systems to electronic ones.

Prominent market participants are emphasizing on tactics such as novel product launch, business development, collaborations and acquisition to withstand the strong market rivalry. Leading competitors contending in global automotive electronics market are as follows:

In order to better recognize the current status of acceptance of automotive electronics, and policies adopted by the foremost countries, Precedence Research predicted the future evolution of the Automotive Electronics market. This research study offers qualitative and quantitative insights on Automotive Electronics market and assessment of market size and growth trend for potential market segments.

By Type

By Sales Channel

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025