May 2025

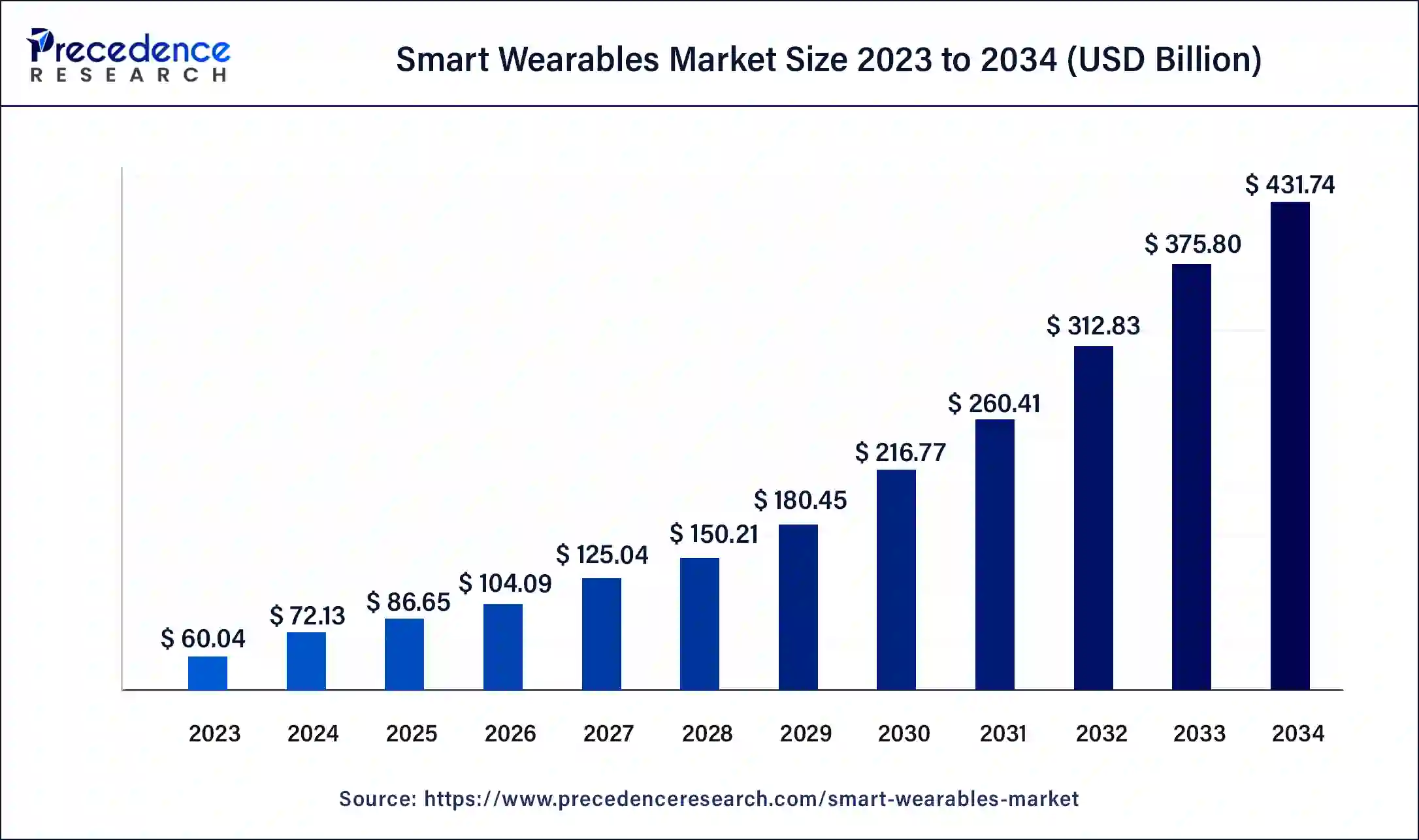

The global smart wearables market size was USD 60.04 billion in 2023, estimated at USD 72.13 billion in 2024 and is anticipated to reach around USD 431.74 billion by 2034, expanding at a CAGR of 19.59% from 2024 to 2034.

The global smart wearables market size accounted for USD 72.13 billion in 2024 and is predicted to reach around USD 431.74 billion by 2034, growing at a CAGR of 19.59% from 2024 to 2034. The smart wearables market is driven by an increased emphasis on managing chronic diseases and preventative healthcare.

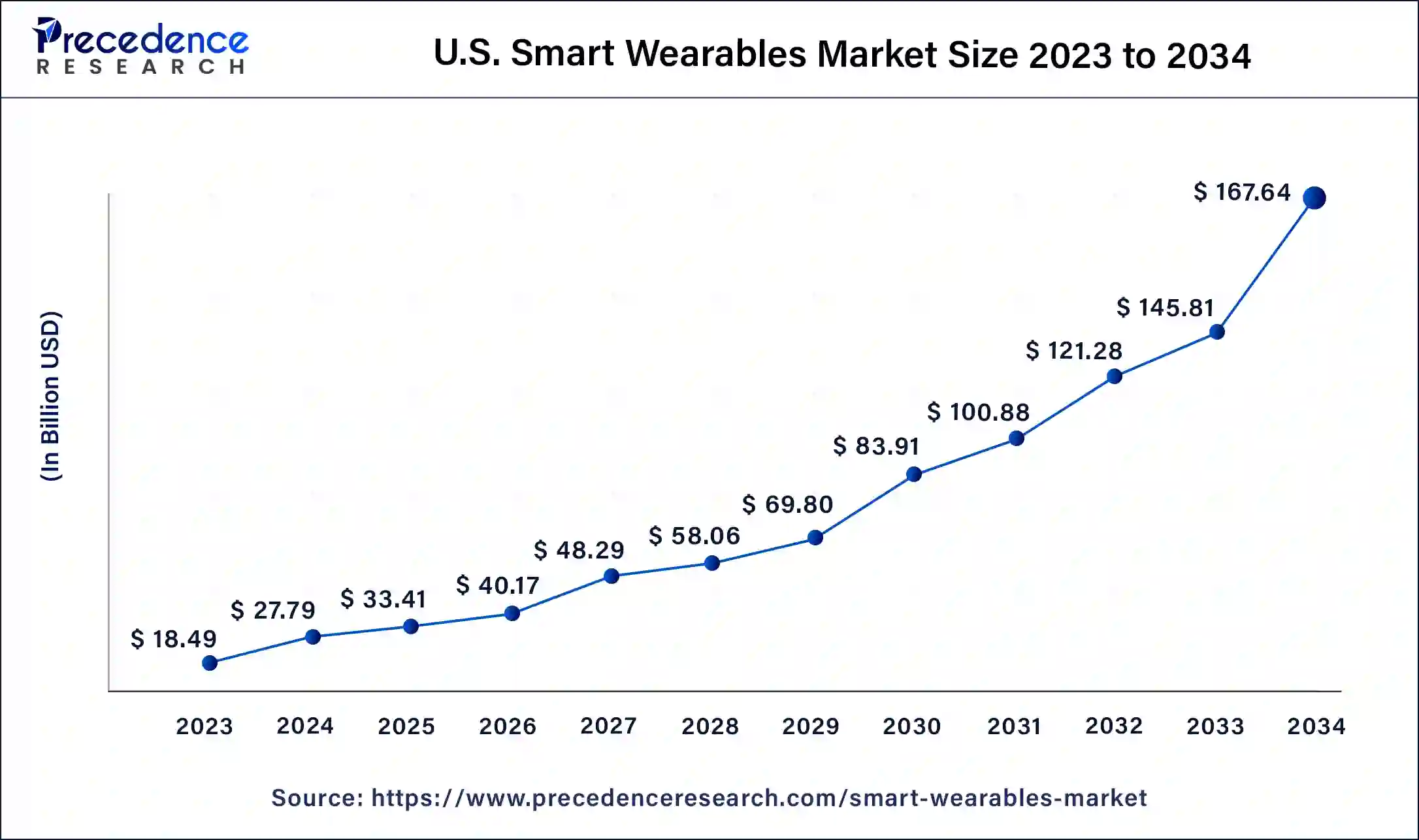

The U.S. Smart Wearables market size was estimated at USD 18.49 billion in 2023 and is expected to be worth around USD 167.64 billion by 2034 at a CAGR of 19.69% from 2024 to 2034.

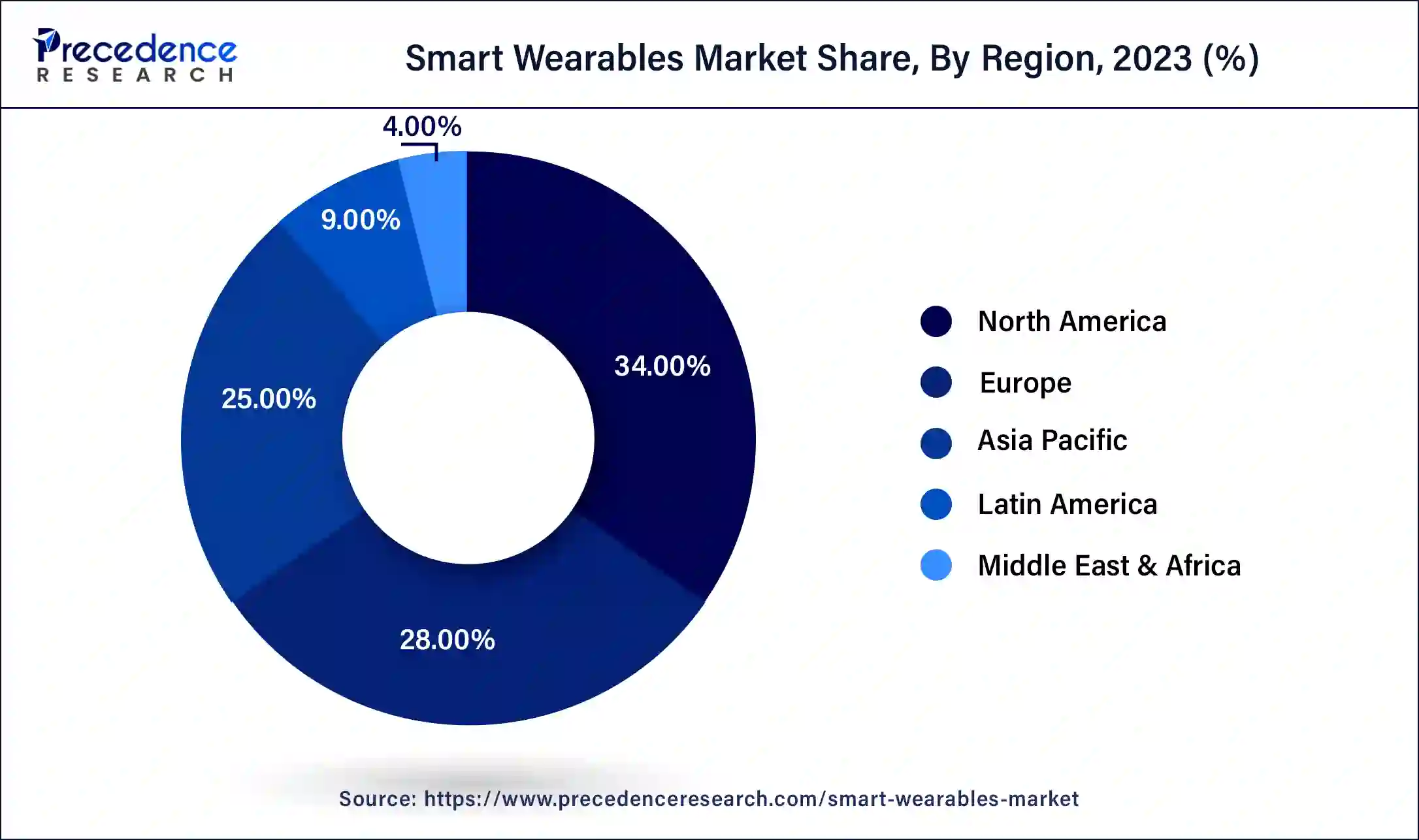

North America had the largest market share in 2023 in the smart wearables market. Due to North America's robust health and fitness culture, smart wearables such as smartwatches and fitness trackers are becoming increasingly important tools for managing one's own health. It's trendy to purchase devices that track physical activity, monitor heart rate, and offer health insights. Well-established retail and online distribution channels are advantageous for North America. Smart wearables are widely available and simple to reach thanks to major retail chains like Best Buy and Walmart and e-commerce behemoths like Amazon.

Asia-Pacific is observed to be the fastest growing in the smart wearables market during the forecast period. Asia-Pacific consumers are becoming more concerned about health. The market for wearables that track heart rate, sleep patterns, physical activity, and other health data is growing as people become more conscious of their fitness and overall health. This trend is particularly strong in cities where lifestyle-related health problems are becoming increasingly common. The swift expansion of e-commerce platforms in the area greatly boosts the market for smart wearables. Online retailers provide customers with convenient home delivery, competitive prices, and simple access to a large selection of products. Market expansion is made possible by the significant regional presence of e-commerce behemoths like Amazon and Alibaba.

The consumer electronics industry includes wearable gadgets usually equipped with enhanced functionality, connection features, and sensors, which is referred to as the "smart wearables market." Smartwatches, fitness trackers, smart glasses, and other wearable technology are among the gadgets in this category intended to enhance daily tasks, track health indicators, send alerts, and promote communication.

Users of smart wearables can keep an eye on a range of health measures, including heart rate, activity level, sleep habits, and more. This data improves health outcomes by enabling people to make knowledgeable decisions about their lifestyle and fitness objectives. By facilitating remote patient monitoring, early disease identification, and continuous vital sign monitoring, wearable technology can transform the healthcare industry. This may result in less expensive and more individualized medical treatments and better patient outcomes.

For example, Recently, Oura and Gucci teamed to track health metrics like heart rate and sleep using fashion wearables.

Smart Wearables Market Data and Statistics

According to thousands of adults who participated in the Health Information National Trends Survey, approximately thirty percent of Americans track their fitness and health using wearable technology, including bands or smart watches. More than 80% of wearable device users said they would provide their doctor with information from the device to support health monitoring. Less than 25% of individuals who have cardiovascular disease or are at risk for it, however, wear wearable technology.

Worldwide wearable band shipments

| Vendor | Q4 2022 Shipments (Million) |

| Apple | 13.8 |

| 4.0 | |

| Xiaomi | 3.6 |

| Huawei | 3.2 |

| Samsung | 2.9 |

| Others | 22.5 |

| Total | 50.0 |

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 19.59% |

| Market Size in 2023 | USD 60.04 Billion |

| Market Size in 2024 | USD 72.13 Billion |

| Market Size by 2034 | USD 431.74 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Connectivity, Application, Sales Channels, By End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for advanced, aesthetically appealing products

Brands are setting themselves out in a crowded market by emphasizing the visual appeal of their products. Their distinctive styles, high-quality materials, and cutting-edge innovations help them stand out. Consumer attraction is greatly aided by marketing methods that effectively showcase smart wearables' functional and aesthetic aspects. Brands that effectively convey the distinctive value propositions of their products typically outperform competitors in the marketplace.

Contemporary smart wearables are made to fit easily into the user's daily routine and be worn comfortably all day. These gadgets are designed to fit many elements of daily life, whether a smartwatch that goes well with work clothes or a fitness tracker that looks like an elegant bracelet. The adaptability of smart wearables can be worn in various environments (such as the office, gym).

Increasing awareness regarding fitness

The modern world places a greater focus on health and wellness; therefore, people actively look for ways to track and raise their fitness levels. The benefits of consistent physical activity are becoming more widely recognized, whether the objective is weight loss, improving athletic performance, or just living a healthy lifestyle. Gamification and social connectedness are two common ways smart wearables increase user motivation and engagement. Gamified tasks, accomplishment badges, and social sharing features encourage users to stay engaged and compete with friends or other enthusiasts. This social component encourages accountability and a sense of community, which can greatly increase commitment to exercise programs.

Limited computational power

Excessive computing demands use more energy and accelerate battery drain. Wearables have limited processing power, so they often must choose between battery life and performance. To increase battery life, manufacturers must optimize hardware and software, which may restrict the release of new features and enhance device performance. Due to limited processing capacity, users may become frustrated by slow interfaces and delayed responses to their inputs.

Manufacturers may omit sophisticated features that demand more processing power to preserve seamless operation, which would restrict the device's usability. More complex interactions, such augmented reality, gesture control, and voice recognition, demand a lot of processing power. The performance and execution of these functionalities are limited by limited power.

Integration of artificial intelligence

Wearables can be included in a smart home system and using AI algorithms to learn the user's habits and preferences, different home appliances can be programmed to operate automatically. The improved range and performance of BLE 5.4 can enable effective communication with various IoT devices in the house. For instance, a wearable device may determine that its users prefer to listen to relaxing music after work and tell the smart speaker to start playing their preferred playlist as soon as they enter.

The smartwatches segment dominated the smart wearables market in 2023. Due to their usefulness and ease of use, smartwatches have grown in popularity in recent years. Beyond telling time, these gadgets can monitor exercise objectives, transmit and receive smartphone notifications, make calls, and send messages right from the wrist. The capacity of a smartwatch to track fitness goals is by far its most beneficial feature. Numerous variants are equipped with sensors that track steps done, calories burnt, and heart rate. Notifications from the smartphone can be sent to it. It can get notifications for incoming calls, emails, messages, and even social media straight to the wrist. This eliminates the need to continually check one's phone and keeps one linked to the digital world.

The fitness trackers segment shows a notable growth in the smart wearables market during the forecast period. Fitness trackers are often wearable electronics worn on the wrist. Depending on the manufacturer or model, they may resemble a band with a tiny digital display or a digital watch. Most fitness trackers monitor heart rate, sleep patterns, and steps taken. Additionally, some have linked apps that monitor general development, establish objectives, and provide guidance to assist in reaching fitness targets. The most popular fitness tracker brands include Jawbone, Garmin, and FitBit.

The health benefits of fitness trackers include real-time monitoring of overall performance and cardiovascular health. Studies have also revealed that users of fitness trackers frequently extend their workouts in addition to real-time monitoring, typically because of daily goal setting.

The bluetooth segment held a significant share in the smart wearables market in 2023. Vital indicators, sleep patterns, and physical activity are all continuously monitored. Simple data transfer for thorough analysis and feedback to fitness and health applications. Smart wearables are becoming more and more popular among consumers thanks to developments in technology and health consciousness. expansion into new areas of communication, entertainment, healthcare, and sports.

The fitness & wellness segment dominated in 2023 and expected to sustain the position in the smart wearables market during the forecast period. Consumers can measure their fitness and health in real time with wearables, especially smartwatches and fitness trackers. Metrics like steps taken, heart rate, sleep patterns, and calories burned can be tracked to help people make better lifestyle decisions and enhance their general well-being.

The healthcare & medical segment is observed to be the fastest growing in the smart wearables market during the forecast period. Healthcare professionals understand the importance of wearable technology for early diagnosis and preventative care. Continuous monitoring, which wearables offer, is essential for identifying irregularities that go undetected during routine check-ups with the doctor. Gamification features are incorporated into a lot of wearables to boost user engagement. These gadgets encourage users to lead healthy lives through goal setting, feedback, and reward systems. Consumers and healthcare providers are receiving a seal of authenticity and assurance from the increased regulatory clearance of wearables as medical devices. This is promoting acceptance and integration into therapeutic practices on a wider scale.

The fashion & lifestyle segment shows a notable growth in the smart wearables market during the forecast period. Wearables now have more capability because of modern connectivity choices including Bluetooth, Wi-Fi, and near-field communication (NFC), which enables seamless connections with other smart devices. Wearables must be interconnected to become popular lifestyle goods. More and more customers are looking for goods that suit their tastes and style. This desire is met by wearables with customized features like changeable bands and configurable watch faces.

The modern retail segment is expected to witness the fastest rate of growth in the smart wearables market during the forecast period. Smart wearables are becoming more visible and appealing because of the use of creative marketing strategies by contemporary retail divisions. Tech-savvy consumers are being efficiently reached through influencer relationships, targeted marketing, and compelling social media campaigns. Promotions and discount offer greatly increase sales volumes during popular shopping holidays like Cyber Monday and Black Friday. For smart wearables, modern retailers provide better after-sale services, such as convenient return policies, longer warranties, and specialized customer assistance. Customers are more satisfied and confident after using these services, which increases their likelihood of purchasing expensive smart wearables.

The individual segment dominated the smart wearables market in 2023. Technological developments have made it possible to create more powerful, small, and energy-efficient components. This has made it possible for manufacturers to cram a lot of functions into compact, wearable gadgets. Brands have used influence and celebrity endorsements to increase the allure of their goods. This tactic has successfully expanded the audience it touched and generated excitement about introducing new products.

The industrial and commercial segment is observed to be the fastest growing in the smart wearables market during the forecast period. Wearable technology can be tailored to fulfill certain operating needs in the commercial and industrial sectors. Its versatility renders it advantageous in many sectors, ranging from manufacturing and logistics to retail and healthcare. Wearables, for instance, can monitor employees' motions in the manufacturing process and offer ergonomic input to help reduce injuries. Over time, smart wearables can result in significant cost savings, even with the initial expenditure.

Businesses can realize a significant return on their investment by increasing productivity, decreasing downtime, boosting security, and making the most of available resources. Wearable technology has financial advantages, further highlighted by its ability to reduce workplace accidents and related expenditures.

Segments Covered in the Report

By Product Type

By Connectivity

By Application

By Sales Channels

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

December 2024

May 2025

April 2025