June 2024

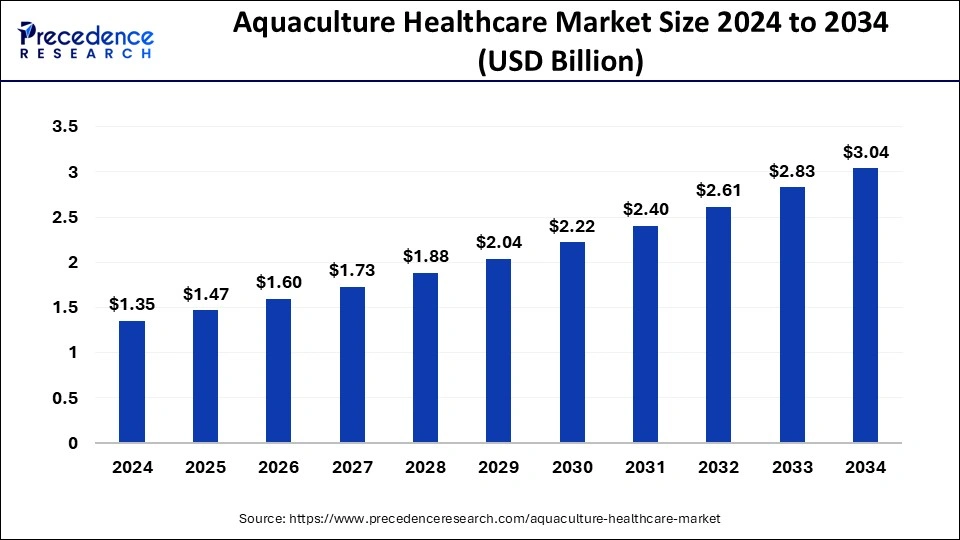

The global aquaculture healthcare market size accounted for USD 1.47 billion in 2025 and is forecasted to hit around USD 3.04 billion by 2034, representing a CAGR of 8.46% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aquaculture healthcare market size was calculated at USD 1.35 billion in 2024 and is predicted to increase from USD 1.47 billion in 2025 to approximately USD 3.04 billion by 2034, expanding at a CAGR of 8.46% from 2025 to 2034. The market is growing because more people worldwide are looking for fish protein.

Aquaculture refers to fish farming, where farmers intervene in rearing to enhance production through activities like stocking, feeding, and predator protection. Worldwide, 580 species are farmed in aquaculture, showcasing genetic diversity. Both developing country farmers and multinational companies practice aquaculture, with some owning the cultivated stock. Fish is culturally significant and has excellent nutritional benefits, offering protein, fatty acids, vitamins, minerals, and essential micronutrients.

Frequent consumer purchases drive the consistent demand for fish products. However, the global aquaculture healthcare market has been significantly impacted by the outbreak of the novel coronavirus. Fish is a valuable source of micronutrients and proteins, and people worldwide consume it for food. The Food and Agriculture Organization (FAO) reported an increasing per capita fish consumption over time. As the demand for quality fish rises, fishing activities have increased, leading to the depletion of wild fisheries.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.46% |

| Market Size in 2025 | USD 1.47 Billion |

| Market Size by 2034 | USD 3.04 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Species, Infection, Route of Administration, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for fish oil as it contains omega-3 fatty acids

Boosting the growth of the aquaculture healthcare market is the growing demand for fish oil, renowned for its omega-3 fatty acids. These essential fatty acids play a crucial role in treating cardiovascular diseases. The University of Maryland Medical Center states that fish oil can lower blood fat levels, diminishing the risk of stroke, heart attack, death, and abnormal heart rhythms in individuals with heart conditions.

Rise in prevalence of parasites and diseases in fishes

The increasing occurrence of parasites and diseases among farmed fish is set to drive the growth of the aquaculture healthcare market in the coming years. Like other farm animals, farmed fish are prone to various diseases, often influenced by poor water and nutrition quality, low oxygen levels, and overcrowding in fish farms. This susceptibility of aquatic animals to diseases is anticipated to lead to a higher demand for therapeutic solutions, consequently fostering the growth of the aquaculture healthcare industry.

Low acceptance

The low acceptance hinders the growth of the aquaculture healthcare market as it is a new and unconventional fish breeding technique for consumption. This lack of acceptance is linked to a general need for more awareness about aquaculture. The limited knowledge about diseases in aquatic animals is also expected to slow down the expansion of the aquaculture healthcare market. Additionally, the low awareness about the occurrence of diseases and the benefits of aquaculture healthcare significantly impacts industry revenue. This could lead to a slow rate of fish production and an increasing death rate, limiting market progression.

Increase in disposable income

Consumers' increasing disposable income motivates them to invest in highly nutritious food products, including fish. Moreover, the growing focus on health and wellness, along with changes in consumer lifestyles, is expected to contribute to the global growth of the aquaculture healthcare market. Expanding shrimp farming sites in China is also anticipated to boost the market growth.

Emergence of aquaponics

The increasing international interest in aquaponics is set to create valuable opportunities for market growth. Aquaponics is an innovative technology that cultivates fish and plants in a controlled environment. The waste produced by the fish, when converted into nitrate by nitrifying bacteria, becomes beneficial for plant growth. The growing adoption of aquaponics worldwide, driven by these advantages, is expected to contribute to the future development of the global aquaculture healthcare market. Additionally, introducing innovative launches in aquaponics has the potential to boost market growth further.

The drugs segment dominated the aquaculture healthcare market, holding the most outstanding revenue share in 2024. Aquaculture drugs play a crucial role in taking care of the health of aquatic animals. They contribute to various aspects such as building ponds, managing soil and water, enhancing aquatic productivity, formulating feed, controlling reproduction, promoting growth, and processing the final product to add value.

The medicated feed additives segment is expected to show significant growth over the forecast period. Medicated feed is recommended when there's a bacterial disease outbreak in farmed fish. These feeds are ready-made and have antibiotics to control specific bacterial infections by killing or stopping them from reproducing. Free amino acids and nucleotides are commonly added to stimulate feeding behavior. Squid, shrimp, clams, mussels, and polychetes are known to be effective in encouraging feeding. Pigments, specifically carotenoids, are responsible for giving fish their characteristic colors.

The fish segment held the largest market share in 2024. The demand for healthcare solutions in aquaculture has risen because more people want high-quality fish proteins. This trend is expected to drive the growth of this market segment.

Ponds and lakes are still bodies of water, but ponds are more miniature than lakes. In the shallow, sunny areas, there's a lot of life, including different types of fish. Rivers and streams are flowing bodies of freshwater. The water in a river or stream comes primarily from sources like melting glaciers or rainwater. Marine species need to be adapted to living in a place with a lot of salt. Freshwater habitats are ponds, lakes, rivers, and streams, while marine habitats include ocean and salty seas.

The bacterial infection segment dominated the aquaculture healthcare market in 2024. Many fish can suffer from bacterial infections like Aeromonas septicemia, Edwardsiellosis, Columnaris, and Streptococcosis. Some of these bacteria significantly cause economic losses in aquaculture globally. One common culprit is Aeromonas spp., a type of bacteria that often leads to bacterial hemorrhage in cultured fishes, especially in freshwater and tropical environments.

The viral infection segment is expected to witness notable growth in the forecast period. This is attributed to a chronic viral infection affecting the wild or captive marine and freshwater fish. It's caused by a specific DNA virus belonging to the Iridoviridae family. The infection can show up as benign, cauliflower-like lesions, usually found on the fish fins. This disease impacts various types of fish and is generally found worldwide.

The topical segment held the largest share of the aquaculture healthcare market in 2024. Topical therapeutics help reduce stress in handling fish and enhance outcomes, making them a popular alternative for fish farmers. Additionally, smaller fish and fry require topical immunizations before vaccination, increasing demand for this segment.

The retail aqua stores segment dominated the aquaculture healthcare market in 2024. This is attributed to the accessibility of numerous therapeutic solutions at retail stores. The increasing availability of specialty products stocked for aquatic animals at these aqua stores is anticipated to drive the expansion of this segment.

Asia-Pacific is likely to witness the fastest rate of expansion during the forecast period. The country's aquaculture healthcare market is experiencing growth due to increasing awareness of its importance. The market is also benefiting from higher research and development funding. Advanced rearing techniques for aquatic animals are contributing to this growth. Additionally, the prevalence of infectious diseases among aquatic animals is a significant factor, leading to the development of new products, such as aquaculture vaccines, to address these issues.

By Product

By Species

By Infection

By Route of Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

January 2025

December 2024

February 2025