April 2025

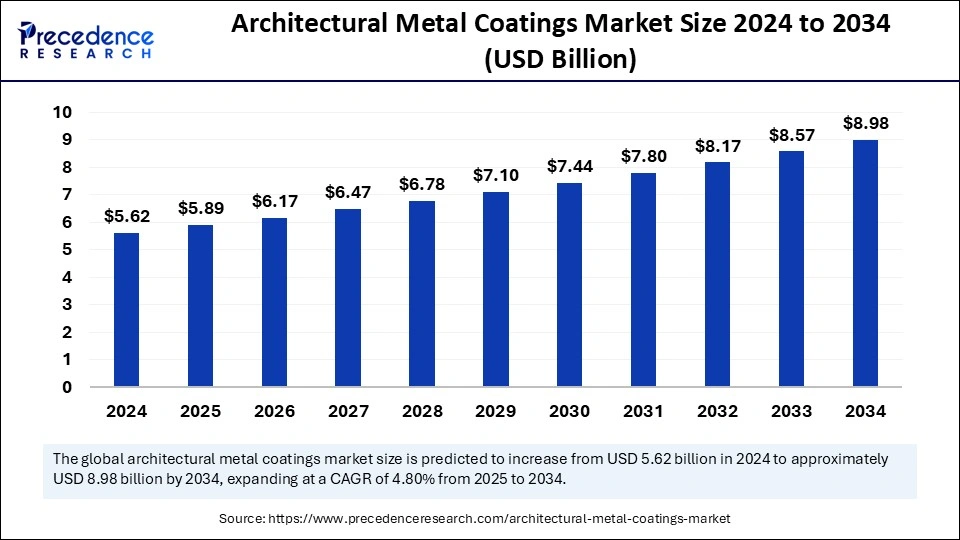

The global architectural metal coatings market size is calculated at USD 5.89 billion in 2025 and is forecasted to reach around USD 8.98 billion by 2034, accelerating at a CAGR of 4.80% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global architectural metal coatings market size accounted for USD 5.62 billion in 2024 and is predicted to increase from USD 5.89 billion in 2025 to approximately USD 8.98 billion by 2034, expanding at a CAGR of 4.80% from 2025 to 2034. The growth of the market is driven by the increasing awareness among individuals regarding the safety and emissions associated with architectural coatings, along with the growing infrastructure of the construction industry. The increased adoption of energy-efficient buildings, a stronger need to lower energy expenses, and the preference for less toxic materials are all contributing factors to the expansion of the architectural metal coating market.

Artificial intelligence is revolutionizing the market for architectural metal coatings by streamlining manufacturing operations, and enhancing product effectiveness, improving quality assurance, promoting sustainability. The merger of machine learning, predictive analytics, computer vision, and automation is transforming how coatings are formulated, applied, and maintained, resulting in greater efficiency, minimized waste, and enhanced product longevity. A key application of AI in this sector is smart formulation development. Algorithms powered by AI analyze extensive datasets related to the properties of raw materials, environmental factors, and coating performance, facilitating the development of high-performance coatings that offer improved durability, resistance to corrosion, and durability against weathering.

Predictive modeling driven by AI assists manufacturers in creating custom coatings adapted to particular architectural requirements, including self-cleaning surfaces, coatings that reflect heat, and finishes resistant to graffiti. By utilizing AI-enhanced material science, businesses can lessen the need for trial-and-error experimentation, speed up product development, and ensure consistent quality. AI is also vital for automated quality control and defect identification. AI systems integrated with computer vision technology can inspect coatings in real time, detecting flaws like uneven thickness, cracks, or adhesion problems that could jeopardize performance.

Robotic systems powered by AI in coating facilities can adjust application settings in real time, ensuring that coatings adhere to exact standards while reducing material waste. This automation not only enhances product dependability but also cuts labor costs and boosts production efficiency. Another significant advancement powered by AI in the architectural metal coatings sector is predictive maintenance and ongoing performance monitoring.

As AI technology progresses, its influence within the architectural metal coatings market will become increasingly significant. From smart coatings that adapt their properties based on environmental conditions to completely automated robotic application processes, AI-driven innovation is shaping the future of metal coatings. By adopting automation fueled by AI, predictive analytics, and sustainable practices, manufacturers are enhancing coating efficiency, durability, and environmental compliance, fundamentally transforming the architectural coatings sector.

Architectural metal coatings find applications in the building and construction industry, including cladding, roofing, wall panels, and doors and windows. These coatings provide both flexibility and durability. They protect against corrosion, UV radiation, and harsh weather conditions while also exhibiting high chemical and solvent resistance, strong performance, and environmentally friendly attributes that are safe for human health. The demand for sustainable architectural metal coatings with enhanced longevity and diverse color choices has increased. Architects are increasingly choosing innovative coil and extrusion finishes that promise durability, longevity, energy efficiency, and reduced maintenance.

The increase in adherence to green building standards and other initiatives aimed at minimizing environmental damage bolsters market growth. Coil-coated products are extensively utilized in applications such as wall panels, fascia, and roofing. Extrusion solutions require a factory application and encompass cleaning and pretreating pre-shaped aluminum extrusions, followed by a spraying process, and concluding with thermal curing. Products made through extrusion include storefronts, skylights, windows, canopies, and curtain wall panel systems. Extrusion coatings are applied after the products are developed, whereas coil coatings are applied prior to product formation.

Technological innovations in coating formulations and application methods are transforming the architectural metal coating industry. Innovations like nano-coatings have resulted in products that enhance durability and corrosion resistance while being eco-friendly. The creation of powder coatings, nano-coatings, and advanced liquid coatings has provided architects and builders with numerous options to satisfy both functional and aesthetic goals. These advancements deliver superior protection against corrosion, UV radiation, and mechanical wear, ensuring enduring safeguarding for metal surfaces. The integration of automation and precision in coating application techniques has also increased efficiency and decreased material waste, enhancing the attractiveness of these technologies to end-users.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.98 Billion |

| Market Size in 2025 | USD 5.89 Billion |

| Market Size in 2024 | USD 5.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing need for corrosion-resistant and long-lasting coatings in infrastructure development

A key factor driving the architectural metal coatings market is the increasing demand for high-performance coatings that provide exceptional corrosion resistance, durability, and aesthetic qualities in construction and infrastructure initiatives. With rapid urbanization and industrial growth occurring in both developed and developing countries, the necessity for protective coatings for metal surfaces in high-rise buildings, commercial centers, bridges, airports, and stadiums has surged dramatically. Architectural metal coatings are essential for prolonging the lifespan of metal structures by safeguarding them against environmental challenges such as moisture, UV rays, chemical exposure, and extreme temperatures.

The growing emphasis on sustainability and energy-efficient building practices has further advanced the uptake of cutting-edge coatings like low-VOC, energy-reflective, and self-cleaning solutions. Moreover, the rising interest in aesthetic qualities within contemporary architecture has intensified the demand for customizable coatings that offer a diverse array of colors, textures, and finishes, thereby promoting market expansion. Increased government investment in infrastructure development has been a significant catalyst for the growth of the architectural metal coatings market. As governmental and private sectors continue to channel resources into modernizing aging infrastructure and constructing new commercial and residential facilities, the need for robust and protective metal coatings will persist.

Strict environmental regulations on VOC emissions and hazardous materials

Even with significant growth potential, the architectural metal coatings market faces a major challenge due to stringent regulations concerning VOC (volatile organic compound) emissions and hazardous substances in coatings. Numerous traditional solvent-based coatings have high VOC levels, which contribute to air pollution, ozone depletion, and health risks, leading regulatory authorities globally to impose strict limits on their use. However, moving from traditional solvent-based coatings to environmentally friendly alternatives brings its own technical and financial hurdles, as waterborne and powder coatings often necessitate advanced application methods, higher production expenses, and specialized raw materials.

The fluctuating costs of raw materials, including resins, pigments, and additives utilized in metal coatings, further complicate the situation. Many chemical-based coating formulations depend on petroleum-derived ingredients, rendering them vulnerable to supply chain disruptions and price instability. The financial burden linked to complying with environmental regulations, switching to sustainable formulations, and ensuring product effectiveness could pose a significant constraint on market growth, particularly for smaller manufacturers with limited resources.

Increasing utilization of smart and energy-efficient coatings in green building initiatives

The rising prevalence of smart and energy-efficient coatings in green building projects offers a considerable growth opportunity for the architectural metal coatings market. With an increased focus on sustainable construction, energy savings, and eco-friendly materials, architects and builders are looking for advanced coatings that provide functional advantages beyond conventional protection and appearance. A notable innovation in this domain is the introduction of cool roof coatings, thermochromic coatings, and self-cleaning coatings, which enhance energy efficiency, lower maintenance costs, and advance building sustainability. For instance, cool roof coatings reflect sunlight and decrease heat absorption, thereby reducing indoor cooling expenses in warm climates.

Self-cleaning coatings leverage nanotechnology and photocatalytic features to decompose dirt, pollutants, and organic materials, lessening the need for frequent upkeep and cleaning. Governments and regulatory agencies around the world are actively encouraging the use of green building materials, including eco-friendly metal coatings, through incentives, tax breaks, and policy regulations. Certifications such as LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), and Energy Star Ratings are fostering greater demand for environmentally friendly coatings that aid in achieving energy efficiency and sustainability objectives.

The polyester segment dominated the market with the largest share, primarily due to its affordability, durability, and adaptability in various architectural applications. Polyester-based coatings are commonly employed in both commercial and residential construction owing to their excellent adhesion, UV resistance, and ability to endure severe environmental conditions. These coatings are particularly favored for metal surfaces in doors, windows, curtain walls, and cladding systems, where aesthetic appeal and long-lasting protection are crucial. An additional advantage of polyester coatings is their customizability, as they come in an extensive array of colors, gloss levels, and finishes, making them well-suited for contemporary architectural designs. With progress in polyester resin technology, manufacturers have successfully created super-durable polyester coatings that offer heightened weather resistance, improved gloss retention, and prolonged lifespan.

The polyester segment dominated the market with the largest share in 2024, influenced by the increasing demand for high-performance coatings that offer excellent durability, abrasion resistance, and protection against chemicals. Polyurethane coatings are extensively utilized in architectural metal applications that necessitate remarkable resistance to severe weather, chemical exposure, and significant wear, such as in industrial buildings, high-rise constructions, and metal roofs. Furthermore, polyurethane coatings provide improved flexibility and impact resistance, making them particularly suited for metal facades, exterior wall panels, and urban infrastructure initiatives that experience various environmental stresses. As the construction sector moves towards more robust and enduring coating solutions, polyurethane coatings are increasingly favored by architects, builders, and developers who are in search of premium protective coatings with exceptional weatherproofing abilities.

The wall panels and facades segment dominated the market with the largest share since building exteriors necessitated advanced coatings to maintain long-term structural integrity, visual attractiveness, and resistance to weather. With growing investments in contemporary architecture, urban revitalization, and commercial property, the demand for coated metal panels in towering buildings, commercial centers, and industrial structures has risen substantially. Metal wall panels and facades are required to endure UV rays, temperature changes, moisture contact, and air pollutants, making high-quality architectural coatings essential. The expansion of smart cities and energy-efficient buildings has also bolstered the prominence of this segment, as architects and developers increasingly look for coatings that provide heat-reflective features, self-cleaning functions, and anti-corrosion capabilities.

The roofing and cladding segment will grow with a notable CAGR from 2025 to 2034 as the demand for weatherproof, energy-efficient, and lightweight metal roofing systems continues to increase. Metal roofing and cladding options are commonly employed in commercial, industrial, and residential construction due to their durability, minimal upkeep, and energy efficiency. In light of climate change issues and rising environmental regulations, there’s a growing preference for cool roof coatings and heat-reflective coatings that help to diminish heat absorption and energy usage in buildings. Architectural metal coatings applied to roofs and cladding panels improve thermal insulation, resist corrosion, and provide waterproofing, making them vital for the long-term sustainability of buildings.

Asia Pacific Market Trends

Asia Pacific dominated the architectural metal coatings market with the largest market share, fueled by rapid urbanization, extensive infrastructure development, and increased investment in the construction industry. This region is experiencing an upsurge in commercial, residential, and industrial construction endeavors, resulting in a heightened demand for high-quality architectural metal coatings. Countries like China, India, Japan, and South Korea are actively growing their real estate, transportation infrastructures, and manufacturing industries, which further drives the necessity for durable, weather-resistant, and energy-efficient coatings. A significant factor contributing to market expansion in the region is the increasing emphasis on smart cities and sustainable building methods.

Governments are implementing green building initiatives that encourage the adoption of eco-friendly and energy-efficient coatings. Architectural metal coatings are extensively utilized in high-rise buildings, airports, commercial complexes, stadiums, and housing projects, offering protection against corrosion, UV damage, and extreme weather conditions. The strong presence of both local and international coating manufacturers in Asia-Pacific has also reinforced the dominant position of this region, with companies investing in research and development to create advanced coating technologies suited for the varying climate conditions encountered in the region.

China

China holds the position as the primary contributor to the Asia Pacific market for architectural metal coatings, bolstered by a robust construction and infrastructure sector that generates considerable demand for protective and decorative coatings. As the largest construction market globally, China is consistent in its investment in substantial infrastructure projects, urban growth, and smart city initiatives, which require high-performance coatings for metal facades, cladding systems, and roofing materials. The government’s focus on eco-friendly buildings and sustainable architecture has also facilitated the increased use of low-VOC and energy-efficient coatings, thus promoting market expansion. Furthermore, leading manufacturers in China are channeling investments into nanotechnology-based and self-cleaning coatings to address the rising need for durable and low-maintenance metal surfaces.

India

India is experiencing swift growth in both commercial and residential construction, driven by urbanization, growing disposable incomes, and government initiatives such as the smart cities mission and housing for all. The surge in high-rise buildings, metro rail developments, and industrial complexes has greatly increased the demand for architectural metal coatings. Moreover, the hot and humid climate in India necessitates the implementation of corrosion-resistant and heat-reflective coatings, especially for roofing and cladding applications. As the steel and aluminum industries expand in India, the need for coatings that enhance durability and energy efficiency is anticipated to rise further. Major coating manufacturers are actively establishing local production facilities to meet the burgeoning domestic demand, reinforcing India's status as a significant market within Asia Pacific.

North American Market Trends

North America is the fastest growing market for the architectural metal coatings market, with a significant CAGR during the forecast period. This growth is majorly fueled by an increase in investments toward commercial and residential renovations, rising demand for energy-efficient coatings, and strict environmental regulations that advocate the use of sustainable coatings. The region is experiencing a substantial transition towards advanced coating technologies, with an uptick in the use of powder coatings, UV-curable coatings, and waterborne coatings that minimize VOC emissions while enhancing durability. The rising trend of incorporating metal-based architectural features, such as curtain walls, aluminum facades, steel roofing, and metal cladding systems, has further boosted the demand for both protective and decorative coatings. With the advent of sustainable and smart buildings, architects and developers in North America are in search of long-lasting, self-cleaning, and heat-reflective coatings that enhance building performance while adhering to environmental guidelines. Additionally, the growth of the industrial and commercial sectors has led to a heightened demand for coatings that offer exceptional corrosion resistance, UV stability, and chemical durability.

United States

The United States serves as a vital participant in the architectural metal coatings market, driven by a vigorous construction industry, government infrastructure initiatives, and an increasing emphasis on green buildings. The U.S. government has implemented incentives and regulations that promote the use of environmentally friendly coatings, resulting in a spike in the demand for low-VOC and energy-efficient coatings. The commercial real estate sector, including office buildings, shopping centers, and mixed-use properties, has significantly contributed to the heightened use of coated metal facades, panels, and roofing solutions. Additionally, the presence of leading global coating manufacturers such as Sherwin-Williams, PPG Industries, and Axalta Coating Systems has spurred ongoing innovation in the creation of high-performance architectural coatings.

Canada

Canada is experiencing consistent growth in the architectural metal coatings sector, driven by urban development, government-supported infrastructure projects, and a commitment to sustainability. The country's severe weather conditions, including harsh winters and high humidity levels, have fueled demand for weather-resistant and corrosion-proof coatings that safeguard metal structures from environmental harm. The rising construction of high-rise residential and commercial properties in cities like Toronto, Vancouver, and Montreal has further contributed to market growth. Moreover, Canada’s strong environmental policies and dedication to achieving net-zero emissions have resulted in a greater adoption of energy-efficient coatings, particularly within industrial and institutional building projects.

Europe Market Trends

Europe is considered to be a significantly growing area in the architectural metal coatings market, fueled by advancements in technology, stringent environmental standards, and an increasing emphasis on energy-efficient coatings. European nations are leading the way in sustainable construction methods, with rigorous building regulations and green certifications such as BREEAM (Building Research Establishment Environmental Assessment Method) and LEED (Leadership in Energy and Environmental Design), encouraging the use of low-VOC and environmentally friendly metal coatings.

The European architectural industry is transitioning towards high-performance, self-cleaning, and smart coatings, especially for metal facade systems, aluminum window frames, and steel structural elements. There is a growing need for advanced coatings that deliver exceptional durability, UV resistance, and anti-corrosion capabilities, particularly in coastal and industrial regions where metal surfaces face harsh environmental challenges. Furthermore, the increasing adoption of powder coatings and UV-curable coatings is transforming the market landscape, as these technologies offer enhanced sustainability and extended lifespans compared to traditional solvent-based coatings.

Germany

Germany stands out as a leader in architectural innovation and industrial manufacturing, making it a key market for architectural metal coatings. The nation's strong focus on energy-efficient construction and high-quality building materials has driven the demand for advanced coatings in both commercial and industrial settings. Additionally, the automotive and engineering sectors in Germany contribute to the need for high-performance coatings for metal structures, facades, and prefabricated components. With research institutions and leading industry players consistently working on next-generation coatings, Germany continues to be a prominent center for advancements in coating technology.

United Kingdom

The United Kingdom also plays a crucial role in the European architectural metal coatings market, characterized by strong demand for aesthetically pleasing, corrosion-resistant, and sustainable coatings. Urban development initiatives, smart city projects, and investments in contemporary infrastructure have resulted in the increasing use of coated metal materials in high-rise buildings, bridges, and commercial complexes. The UK’s dedication to lowering carbon emissions and promoting net-zero buildings has boosted the market for eco-friendly coatings, including powder and water-based options. The expansion of the commercial real estate sector, particularly in London and Manchester, has further heightened the need for high-quality architectural coatings.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

September 2024