February 2025

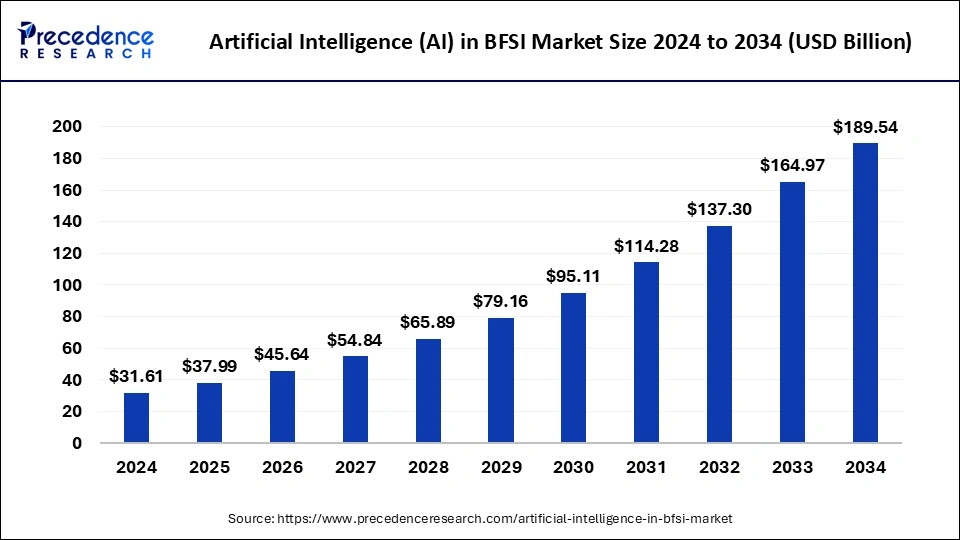

The global artificial intelligence (AI) in BFSI market size is calculated at USD 37.99 billion in 2025 and is forecasted to reach around USD 189.54 billion by 2034, accelerating at a CAGR of 19.62% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global artificial intelligence (AI) in BFSI market size was estimated at USD 31.61 billion in 2024 and is predicted to increase from USD 37.99 billion in 2025 to approximately USD 189.54 billion by 2034, expanding at a CAGR of 19.62% from 2025 to 2034. An increased surge in the digitalization of the finance sector needs to integrate with cutting-edge technologies like AI-based solutions to become a consumer-centric sector, which are the significant factors propelling the market globally.

The artificial intelligence (AI) in BFSI market refers to the integration of advanced technologies together, which aids in streamlining the various financial processes. BFSI stands for banking, financial services, and insurance. AI has a spectrum of applications in the BFSI market; it is incorporated with chatbots to help and support consumers, predictive analytics for risk assessment, fraud detection algorithms, and customized recommendations about financial status. Due to such a wide range of benefits, artificial intelligence (AI) in BFSI market is poised to grow significantly during the foreseeable period.

Furthermore, AI helps reduce repetitive errors and assist in the automation of routine tasks, therefore enhancing the overall cybersecurity of the system. Also, automation supported by AI is strengthening back-office operations by improving efficiency and helping create cost-effective solutions. In the management of risk and its outcomes, AI plays a critical role in fraud detection and meeting regulatory compliance. Overall, the artificial intelligence (AI) in BFSI market is witnessing a rapid surge globally and is headed towards becoming a highly dominant part of the various sectors to grow exponentially.

| Report Coverage | Details |

| Market Size by 2034 | USD 189.54 Billion |

| Market Size in 2025 | USD 37.99 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 19.62% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Application, End-use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Strategic decision-making is based on a huge dataset

The major driving factor of the artificial intelligence (AI) in BFSI market is data-driven decision-making processes, which led to the exponential growth of enterprises within a specific time frame and boosted the growth of the market globally. AI helps BFSI institutions analyze huge amounts of historical data by using machine learning algorithms for precise decision-making, which helps institutions expand.

Along with datasets, AI can analyze the behavior patterns of specific groups of consumers and market trends based on their behavior, which generates accurate predictions. Such a data-driven decision-making approach helps in early fraud detection, enhances risk assessment, and provides customized financial services.

Moreover, in the BFSI sector, AI technologies like virtual assistance and chatbots provide instant replies to consumer queries, help in routine tasks, and offer suitable recommendations. Such interactions between AI chatbots and human consumers are revolutionizing the BFSI sector. Increasing consumer engagement results in an increase in selling capabilities while improving loyalty and customer satisfaction.

The BFSI sector is more sensitive towards fraudulent activities, which needs to be pre-recognized to restrict the huge loss in these firms and protect them with robust security systems that are provided by artificial intelligence. It can identify dissimilar patterns in the data and transaction anomalies and aids in instant detection and preventive steps to apply and prevent data from fraudsters. Due to such unprecedented support provided by AI, the Artificial intelligence (AI) in BFSI market is poised to grow substantially in the global market.

Concern about data security

A major restraining factor that holds the potential to impede the artificial intelligence (AI) in BFSI market is the rising concern over data security, as BFSI institutions hold highly sensitive data and are prone to frequent data breaches due to their confidentiality. Since AI systems completely depend upon a huge amount of consumer information/organized Data to perform analysis and gain insights from it to plan a strategy, the risk of data leakage and unauthorized access by fraud has been increasing, leading to serious legal challenges.

The BFSI market works under certain regulations to perform smoothly without complications and adhere to regulatory compliances. The constantly changing and evolving nature of the complex regulations in the BFSI market creates a barrier to implementing the integrated AI system in the BFSI sector, as the banking and finance sector must follow updated rules and evolving compliance requirements over time. Thus, these are the restraining factors in the artificial intelligence (AI) in BFSI market, which needs to be acknowledged and grow beyond it by implementing a robust solution against it to work smoothly.

Rising preferences for personalized financial services

The significant opportunity an Artificial intelligence (AI) in BFSI market could hold is an increasing trend for personalized financial services due to its number of benefits and customization as per consumers' comfort and requirements. Generalization of BFSI services may not help foster the growth of the market exponentially as every consumer has a different financial background, views, and future plans that require customization to work at its best. Here, AI can work better to segregate the consumer's data and make useful insights from it to build personalized strategies to offer the best outcomes while providing security and individual preferences.

By predicting future trends based on historical data and empirical results with its analysis, AI can offer personalized suggestions for investment possibilities and financial products. Along with this, by providing a highly secure system to protect sensitive and confidential finance data of consumers, the chances of data breaches and unauthorized access get eliminated on a larger scale. It helps build the trust of consumers in particular banks or finance institutes, which eventually boosts the market growth and, therefore, increases the demand for AI-based solutions in the BFSI sector, fostering the market worldwide with rising popularity and creating a lucrative opportunity in the Artificial intelligence (AI) in BFSI market.

The solution segment held the highest share of the artificial intelligence (AI) in BFSI market in 2024. The growth of this segment is owing to the continuous efforts by financial institutes to perform smoother consumer interactions, mitigating the risk of fraud with standard legal compliance by leveraging the AI platforms in the BFSI sector. Financial institutes need to integrate AI solutions to digitalize their business so that it reaches the maximum people.

The solution segment is expected to record a prominent growth in the artificial intelligence (AI) in BFSI market during the foreseeable future period. The segment is proliferating in the global market due to the increased use of digital banking services, causing the generation of vast amounts of digital data that need to be analyzed to gain insights from it, which aids in developing consumer-centric models of business.

The machine learning segment is estimated to generate substantial revenue in the artificial intelligence (AI) in BFSI market in 2024. The machine learning process can be employed to analyze a number of use cases, such as analysis of market impact, management of risk, automation process in the banking sector, and financial monitoring with real-time data. Such benefits can be derived from the use of machine learning technology, which is the major cause of driving this segment globally.

The customer service segment is anticipated to grow at the highest rate in the Artificial intelligence (AI) in BFSI market over the forecasted years. The proliferation of this segment is due to the increasing demand for personalized experiences for consumers to gain trust and credibility by using AI-based solutions, which has created hype and become a trend now.

The bank segment will likely expand significantly in the the Artificial intelligence (AI) in BFSI market in the upcoming period. The growth of this segment is due to the proliferation of various AI platforms to support financial institutes, in particular, Banks, and it's adopted by various private and government banking enterprises to support personalized consumer services while generating new value propositions. Leveraging AI-driven technology in the banking sector enhances user experiences and streamlines repetitive processes.

North America accounted for the largest share of the global artificial intelligence (AI) in BFSI market in 2024. The growth of this region is due to the increasing number of start-ups that are AI-based and provide innovative solutions by leveraging cutting-edge AI technologies, which help resolve the banking sector's problem and reduce hindrances in their transaction and other processes. Similarly, these AI-based solutions can be applied to further financial service and insurance sectors, propelling the growth of the North American market worldwide.

Europe is expected to host the fastest-growing Artificial intelligence (AI) in BFSI market during the forecast period. The region has a favorable policy to develop AI-based solutions across the region, which is the major factor propelling market expansion. The European government has an AI act that supports a similar legal framework for AI across every industry, which further supports a disciplinary development of AI-based platforms tailored for every industry. Moreover, by using an AI platform for credit assessment, a non-conventional strategy can be used to gather data, such as collecting data from social media platforms and digital footprints and evaluating creditworthiness on the basis of transactions done in the past.

Asia Pacific is projected to expand at a notable rate in the global artificial intelligence (AI) in BFSI market in the upcoming years. The expansion of the artificial intelligence (AI) in BFSI market across Asia Pacific is due to the rapid digitalization of the banking sector in this region and an increasing number of financial technology businesses in India. Countries like China and India are emerging economies across the world; both are engaging in the development of AI-driven solutions and trying to capitalize on them on the global market. To achieve this target, fintech companies in India are leveraging cutting-edge technologies to deploy AI-based services and solutions for the lending landscape in the finance sector, particularly while providing innovative ideas for lending amounts from banks.

By Component

By Technology

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

December 2024

December 2024