What is the Artificial Intelligence (AI) in Construction Market Size?

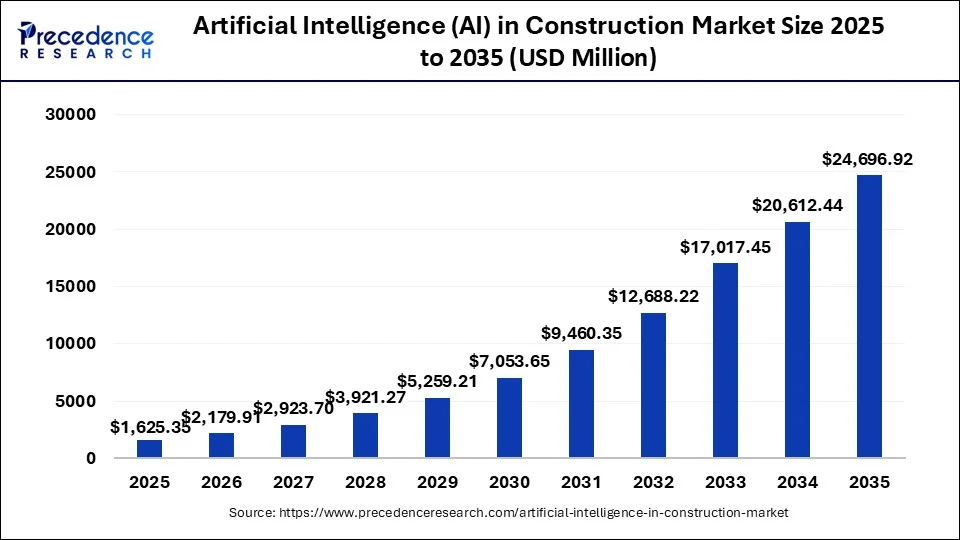

The global artificial intelligence (AI) in construction market size is calculated at USD 1,625.35 million in 2025 and is predicted to increase from USD 2,179.91 million in 2026 to approximately USD 24,696.92 million by 2035, expanding at a CAGR of 31.27% from 2026 to 2035.

Artificial Intelligence (AI) in Construction Market Key Takeaways

- The global artificial intelligence (AI) in construction market was valued at USD 1,211.90 million in 2025.

- It is projected to reach USD 24,696.92million by 2035.

- The artificial intelligence (AI) in construction market is expected to grow at a CAGR of 32.76% from 2026 to 2035.

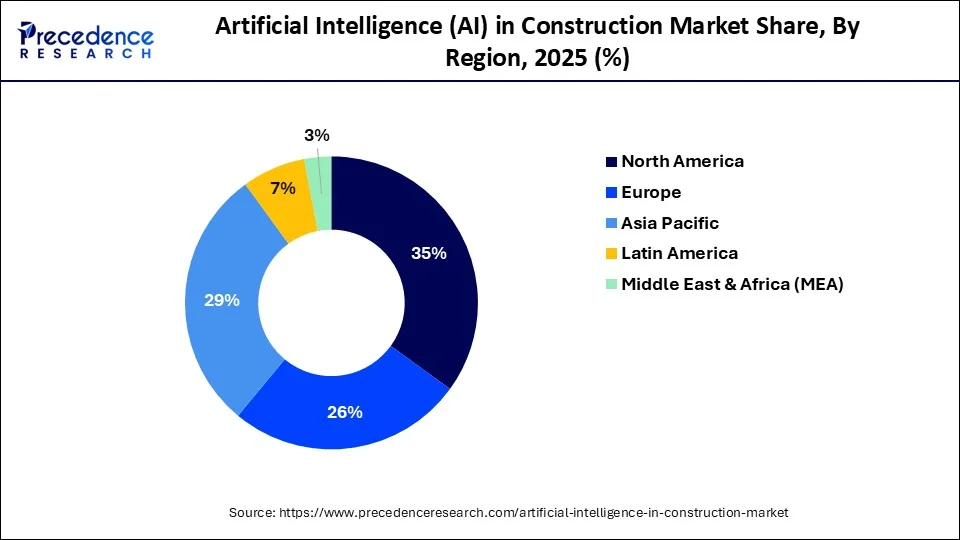

- The North America artificial intelligence (AI) in construction market size reached USD 424.15 million in 2025 and is expected to attain around USD 7,214.35 million by 2035, poised to grow at a CAGR of 32.76% between 2026 and 2035.

- North America dominated the global artificial intelligence (AI) in construction market with the largest revenue share of 35% in 2025.

- Asia Pacific is expected to witness the fastest growth in the market in the upcoming period.

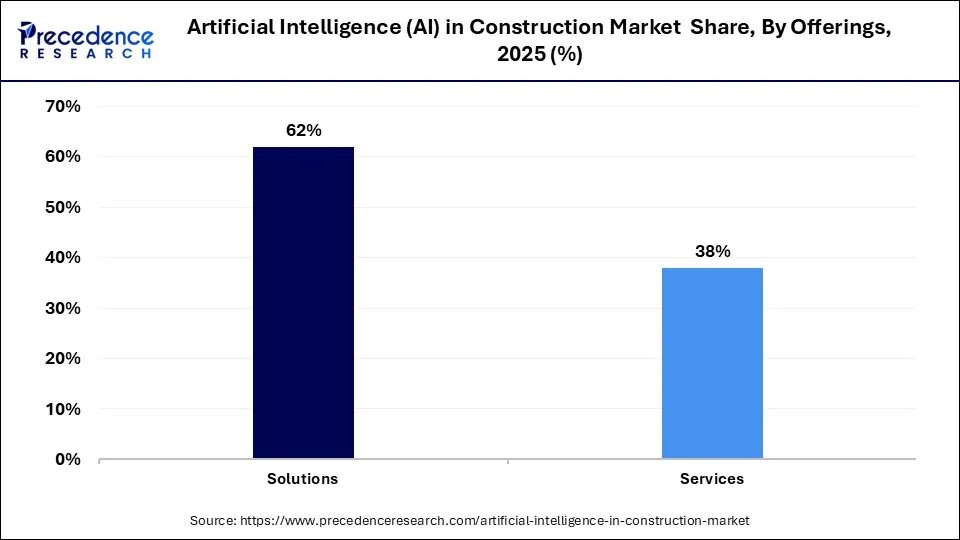

- By offerings, the solution segment held the largest revenue share of 62% in 2025.

- By deployment, the cloud segment is expected to show the fastest growth in the market in the foreseeable period.

- By organization size, the large enterprise segment dominated the market in 2025.

- By industry type, the institutional commercials segment is projected to witness the fastest growth rate during the forecasted years.

What are the Emerging Benefits of Artificial Intelligence (AI) in Construction?

The artificial intelligence (AI) in constructionmarket is rapidly growing, driven by advancements in machine learning, robotics, and data analytics. AI applications in construction include project management, design optimization, predictive maintenance, safety monitoring, and autonomous machinery. Increased efficiency, reduced costs, and enhanced safety are key benefits. Major players include IBM, Autodesk, and Trimble. The market faces challenges like high initial costs and a need for skilled labor. However, with ongoing innovation and increased adoption, it is poised for significant expansion in the coming years.

Artificial Intelligence (AI) in Construction Market Growth Factors

- AI enhances project management, reduces delays, and cuts costs by optimizing construction processes and resource allocation.

- Ongoing developments in AI algorithms and machine learning tools make AI applications more accessible and effective for construction firms.

- AI systems improve worker safety by monitoring construction sites in real time, identifying potential hazards, and ensuring regulatory compliance.

- AI aids in designing and constructing energy-efficient, eco-friendly buildings, supporting the global push for sustainability and smart city development.

- Increased investment in smart city projects drives the adoption of AI to manage urban infrastructure and improve the quality of life in cities.

- Regulatory frameworks and financial incentives for green building and technology adoption encourage the integration of AI in construction.

- AI-driven automation and predictive maintenance reduce operational costs and enhance profitability for construction companies.

- AI enables construction firms to leverage data analytics for better planning, forecasting, and risk management, leading to more informed decision-making.

- Cloud-based AI solutions offer scalable and customizable options, allowing construction firms to tailor AI applications to specific project needs.

Market Outlook

- Market Growth Overview: The artificial intelligence (AI) in construction market is growing rapidly due to increasing adoption of smart construction technologies, automation, and predictive analytics that enhance project efficiency and safety. Rising labor shortages and the need for cost-effective project management are further driving market expansion.

- Global Expansion: The market is expanding worldwide as construction companies adopt AI solutions for project planning, real-time monitoring, and predictive maintenance, improving productivity and reducing risks. Emerging regions such as Asia-Pacific and Latin America present significant opportunities due to rapid urbanization, infrastructure development, and increasing investment in smart construction technologies.

- Major Investors: Key investors in the AI in construction market include tech giants like IBM, Microsoft, Autodesk, and construction-focused startups, as well as private equity and venture capital firms investing in AI-powered construction solutions. These investors contribute by funding R&D, enabling product innovation, and supporting large-scale deployment of AI applications across global construction projects.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 24,696.92 Million |

| Market Size in 2025 | USD 1,625.35 Million |

| Market Size in 2026 | USD 2,179.91 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 31.27% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Offerings, Deployment, Deployment, Industry Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Improved efficiency and productivity due to AI

A major driver of artificial intelligence (AI) in constructionmarket is the increasing demand for improved efficiency and productivity. The construction industry has historically struggled with project delays, cost overruns, and safety concerns, making the adoption of AI technologies a crucial solution. AI offers significant enhancements in project management through predictive analytics, which helps in anticipating potential issues before they arise, ensuring projects stay on schedule and within budget.

Another significant driver of the artificial intelligence (AI) in constructionmarket is the advancement in AI and machine learning technologies, which have become more accessible and affordable. These advancements enable construction firms to leverage AI for design optimization, automating repetitive tasks, and enhancing overall project planning.

- In June 2022, Stellenbosch-based Agile Business Technology (ABT) partnered with U.S, group OpenSpace to launch its 360° capture and artificial intelligence (AI) platform for construction projects in South Africa. With 360° images generated in OpenSpace to document an evolving job site, teams can radically improve their collaboration. The software also made it easy to perform quality control, note progress, and do inspections to help identify safety hazards.

AI-powered tools can analyze vast amounts of data from previous projects to identify best practices and improve future project outcomes. Safety is another critical factor driving AI adoption. AI systems can monitor construction sites in real time, identifying potential hazards and ensuring compliance with safety regulations. This reduces the risk of accidents and enhances worker safety, which is a top priority for construction companies.

The rise of smart cities and the increasing focus on sustainable building practices are propelling the demand for the artificial intelligence (AI) in constructionmarket. AI can optimize energy usage, improve waste management, and ensure buildings are designed with sustainability in mind. Government regulations and incentives for green construction further support this trend.

Restraint

High initial investment

One significant restraint of the artificial intelligence (AI) in constructionmarket is the high initial investment required for implementing AI technologies. Construction companies, especially small and medium-sized enterprises (SMEs), often face financial constraints that make it challenging to allocate substantial capital for AI adoption. The costs associated with acquiring advanced AI tools, integrating them with existing systems, and training personnel to effectively use these technologies can be prohibitive.

Additionally, the construction industry is traditionally conservative and slow to adopt new technologies. There is a general reluctance to change established processes, and a lack of understanding of AI's potential benefits further hampers its adoption. Companies may also face challenges in justifying the return on investment (ROI) of AI projects, especially when the benefits are long-term and not immediately apparent. The complexity of AI integration, requiring specialized knowledge and skills, adds another layer of difficulty. Construction firms may struggle to find or develop the necessary expertise to manage and maintain AI systems, leading to resistance to adopting these advanced technologies. Consequently, the high initial investment and integration challenges serve as notable restraints in the artificial intelligence (AI) in constructionmarket.

Opportunity

Smart city initiatives

One significant opportunity in the artificial intelligence (AI) in constructionmarket is the growing trend toward smart city initiatives. As urbanization increases, cities worldwide are investing in smart infrastructure to enhance the quality of life, improve efficiency, and ensure sustainability. AI technologies play a crucial role in the development of these smart cities by optimizing construction processes, improving resource management, and enabling the creation of intelligent buildings.

AI can provide real-time data analytics and predictive insights, allowing for better planning and execution of construction projects. This ensures timely completion and reduces costs, which are critical factors for large-scale urban development projects. Additionally, AI-driven solutions can enhance energy efficiency, waste management, and safety protocols in construction, aligning with the goals of smart city projects. The increasing support from governments and municipalities for smart city projects, coupled with significant investments in urban infrastructure, presents a lucrative opportunity for artificial intelligence (AI) in constructionmarket. Companies that can offer innovative AI solutions tailored to smart city requirements will find themselves in a strong position to capitalize on this growing demand, driving market growth and technological advancements.

Segment Insights

Offerings Insights

The solution segment held the largest market share of the artificial intelligence (AI) in constructionmarket globally. The growth of this segment is attributed to several factors, like the regenerative design of buildings or construction areas, which can be simulated by using AI tools before starting construction, making it easy to adopt. Also, AI solutions can offer various complex task optimizations where accuracy is needed. Summarizing the long documents related to the administrative works in the context of legal policies and compliance set by the authority to build any construction within an area they have legally.

- In November 2022, Disperse.io, a UK-based construction technology company with a platform that used AI to help project managers track work, capture data from building sites, and make better project decisions, launched a new product, Impulse, that highlights issues gleaned from 360° site scans captured in its platform. This solution integrated performance insights into building elevations and presented problems to project managers.

Deployment Insights

The cloud segment is expected to show the fastest growth in the artificial intelligence (AI) in constructionmarket in the foreseeable period. The dominance of this segment is due to its versatile offering and convenience, which are provided by cloud-based solutions for enterprises that want to employ artificial intelligence solutions. Cloud-based AI solutions offer scalability, which allows enterprises to expand their operations easily and with significantly low-cost investments. They provide accessibility, enabling teams to access critical data and tools from anywhere, fostering collaboration and real-time decision-making. Additionally, cloud solutions are cost-effective, reducing the need for extensive hardware and maintenance.

The inherent flexibility of cloud platforms allows for seamless integration with other technologies and systems used in construction. Major providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are continually enhancing their offerings, further driving adoption. Consequently, the cloud segment is expected to maintain its leading position in the artificial intelligence (AI) in constructionmarket.

Organization size Insights

The large enterprise segment dominated the market in 2024. This segment dominates the artificial intelligence (AI) in construction market due to its substantial financial resources, enabling significant investment in advanced technologies. These enterprises benefit from economies of scale, leveraging AI to optimize large-scale projects, enhance efficiency, and reduce costs. Their extensive operational scope requires sophisticated AI solutions for project management, predictive analytics, and safety monitoring. Additionally, large enterprises often lead in innovation, adopting cutting-edge AI tools to stay competitive. Their established market presence and ability to integrate AI seamlessly into existing workflows further solidify their dominance in this market.

Industry Type Insights

The institutional commercials segment is projected to witness the fastest growth rate during the forecasted years. The institutional and commercial segments dominate the artificial intelligence (AI) in constructionmarket due to their complex and large-scale project requirements. These sectors often involve high-value, multifaceted projects such as hospitals, universities, office buildings, and retail centers, which benefit significantly from AI-driven solutions. AI enhances project management, design optimization, and predictive maintenance, leading to increased efficiency, reduced costs, and improved safety.

Moreover, these segments typically have the financial resources and motivation to invest in advanced technologies to ensure timely project completion and adherence to regulatory standards. The need for smart building solutions, driven by sustainability and energy efficiency goals, further propels AI adoption in institutional and commercial construction. Consequently, these segments are at the forefront of integrating AI to enhance operational effectiveness and project outcomes.

Regional Insights

U.S. Artificial Intelligence (AI) in Construction Market Size and Growth 2026 to 2035

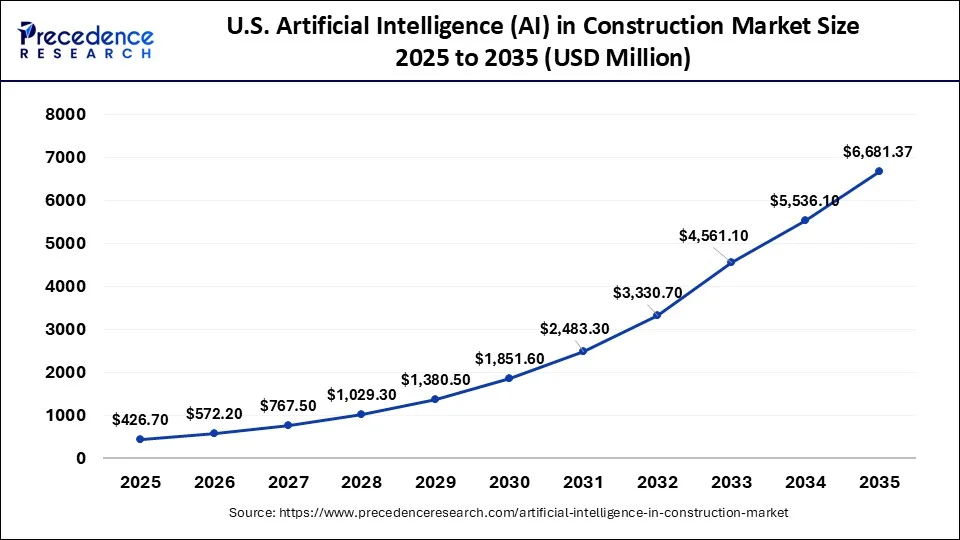

The U.S. artificial intelligence (AI) in construction market size is exhibited at USD 426.70 million in 2025 and is projected to be worth around USD 6,681.37 million by 2035, growing at a CAGR of 31.67% from 2026 to 2035.

How did North America Dominate the Market in 2025?

North America dominated the global artificial intelligence (AI) in construction market in 2024. The region's robust construction industry, coupled with a high adoption rate of advanced technologies, drives the integration of AI into construction processes. The presence of major technology companies and AI innovators, such as IBM, Microsoft, and Google, provides the necessary infrastructure and expertise to support AI development and implementation in construction.

Moreover, North America benefits from substantial investments in infrastructure projects and smart city initiatives, particularly in the United States and Canada. These investments create a conducive environment for the deployment of AI solutions to enhance efficiency, safety, and sustainability in construction projects. Thus driving the artificial intelligence (AI) in construction market.

Additionally, the region's regulatory framework encourages the use of advanced technologies for improved safety and environmental compliance. Government incentives and policies aimed at promoting green building practices further support AI adoption in construction. The combination of technological leadership, substantial investments in infrastructure, and supportive regulatory policies position North America as a dominant region in the artificial intelligence (AI) in constructionmarket, fostering continuous growth and innovation.

Exploration of Robust Automation: Supports the U.S. Market

The U.S. market possesses a major revenue share, with substantial efforts in boosting automations, such as the development of AI-driven cameras and drones for analysing footage to compare site progress against BIM and blueprints, determining deviations, misalignments, or incomplete tasks in real-time. Furthermore, the U.S. companies are bolstering robots that have AI algorithms to operate labour-intensive and dangerous tasks, like bricklaying, welding, and 3D printing of structures.

Emphasis on the Digital Revolution is Fueling the Asia Pacific

Asia Pacific is expected to witness the fastest growth in the market in the upcoming period, driven by rapid urbanization, economic growth, and substantial infrastructure investments. Countries like China, India, and Japan are in charge of implementing AI to enhance efficiency, reduce costs, and improve safety in construction projects. Government initiatives promotingsmart cities and sustainable building practices further accelerate AI adoption. Additionally, Asia's technological advancements and increasing focus on digital transformation create a favorable environment for AI integration in construction. The region's large-scale construction projects and tech sector make Asia a hotspot for AI-driven growth in the construction industry.

- In September 2022, Construction technology financial company Briq acquired billing software Swipez, an India-based fintech company that automated billing and revenue collection. Briq's platform supported the ability of construction companies to automate critical financial workflows in the planning and forecasting processes, such as corporate planning, labor and materials forecasting, projects forecasting, and revenue forecasting.

Executing Autonomous Road Construction: Elevates the Chinese Market

The prospective growth of artificial intelligence (AI) in construction market in China will be driven by embracing autonomous road development. Particularly, in mid-2025, China introduced resurfacing 158 kilometres of the Beijing–Hong Kong–Macao Expressway using a fleet of AI-enabled, autonomous machinery, such as robotic pavers and rollers guided by the Beidou satellite system.

Leveraging Immersive Regulation & AI Factories is Propelling Europe

Europe is experiencing a notable growth in the market due to the emerging digital construction alliance (DCA) regulation in 2026. This will mandate the greater adoption of AI and digital technologies in all public construction projects. As well as the European Commission has also unveiled a network of AI Factories across the continent to facilitate startups, SMEs, and researchers with access to AI-assisted supercomputers, training, and technical expertise, with major joint investments.

A Surge in Data and Monitoring: Impacts the German Market

Fund provision by the German Federal Ministry of Education and Research (BMBF) for the ConWearDi project, which has established an AI-powered web platform to connect diverse value chains. It employs sensors to recognise the construction state, allowing remote management and predictive maintenance.

What Potentiates the Market in Latin America?

The artificial intelligence (AI) in construction market in Latin America is expected to grow at a substantial rate in the upcoming period. This growth is fueled by various factors like rising investments in automation technology, increasing awareness of worker safety, and a rise in demand for enhanced productivity in construction projects. AI-powered solutions are helping construction companies optimize workforce allocation, detect hazards, and streamline equipment management. With infrastructure projects expanding in Latin America, AI is becoming a critical component for efficiency and compliance.

Brazil Market Trends

Brazil is considered a major player in the Latin American market. Labor shortages and rising project demands in Brazil are fueling the high adoption of AI-driven automation. Autonomous machinery and robotic systems help to bridge workforce gaps while also boosting productivity and efficiency. It also helps to reduce human errors, improving project timelines and quality. Rising construction activities in the country are also influencing the market.

What Opportunities Exist in the Middle East & Africa (MEA) for the Market?

The Middle East & Africa (MEA) presents immense opportunities for the artificial intelligence (AI) in construction market. These opportunities arise from the increasing demand for AI-powered cameras and drones for real-time monitoring. These tools and systems help to detect unsafe behaviors, hazardous conditions, or unauthorized access, thus improving safety outcomes. The region also benefits from strong, supportive government regulations, which help in creating a strong push for AI-enabled safety systems.

Saudi Arabia Market Trends

Rising concerns about worker safety in high-risk environments are accelerating AI adoption across the construction industry in the country. The region is also witnessing a growing use of drones, computer vision, and robotics. Increasing collaborations between construction firms and technology providers are also supporting innovation.

Key Players Offerings

- Autodesk Inc.- A vital company explores Construction IQ for risk prediction, AI-powered symbol detection for takeoffs, and suggested submittals within AutoSpecs.

- Building System Planning Inc.- It unveiled GenMEP, a generative design add-on for Autodesk Revit.

- Smartvid.io Inc.- This usually offers automated safety monitoring, a safety observation module, predictive analytics, and other AI-enabled solutions.

- Doxel Inc.- It specifically executes an AI-driven development tracking solution for the construction industry.

- Bentley Systems Inc- This mainly leverages AI solutions through its Bentley Infrastructure Cloud and iTwin platform.

Artificial Intelligence (AI) in Construction Market Companies

- Autodesk Inc.

- Building System Planning Inc.

- Smartvid.io Inc.

- Doxel Inc.

- Bentley Systems Inc

Recent Developments

- In April 2023, Autodesk and VC Group agreed to accelerate digital transformation in the construction industry. Under the recent Government Decision on the approval of the Roadmap for the Application of Building Information Modelling (BIM) in the construction sector, Autodesk is expected to provide guidance and assistance to VC Group in their efforts to adopt technologies and digitize design and construction consultancy.

- In June 2022, Siemens, a pioneer in accelerated graphics and artificial intelligence (AI), and NVIDIA, a pioneer in infrastructure, building technology, and transportation, collaborated to establish the Industrial Metaverse.

Segments Covered in the Report

By Offerings

- Solutions

- services

By Deployment

- Cloud

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By Industry Type

- Residential

- Institutional

- Commercials

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting