April 2025

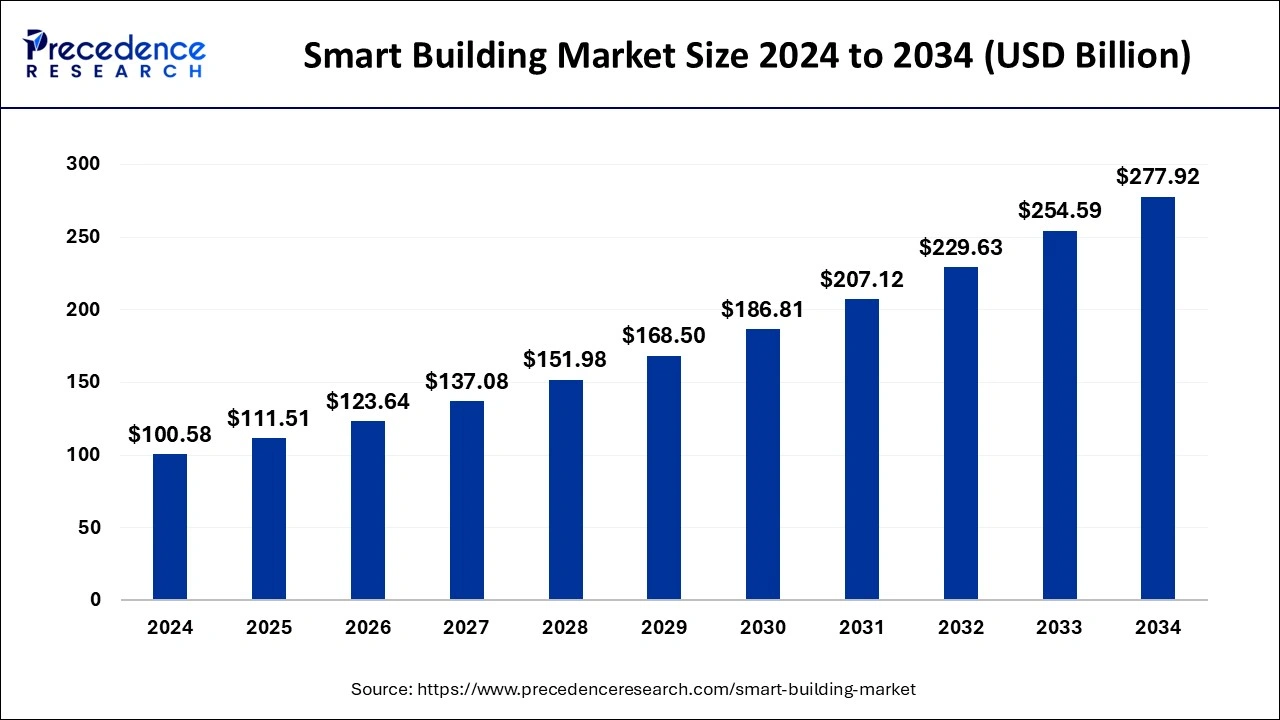

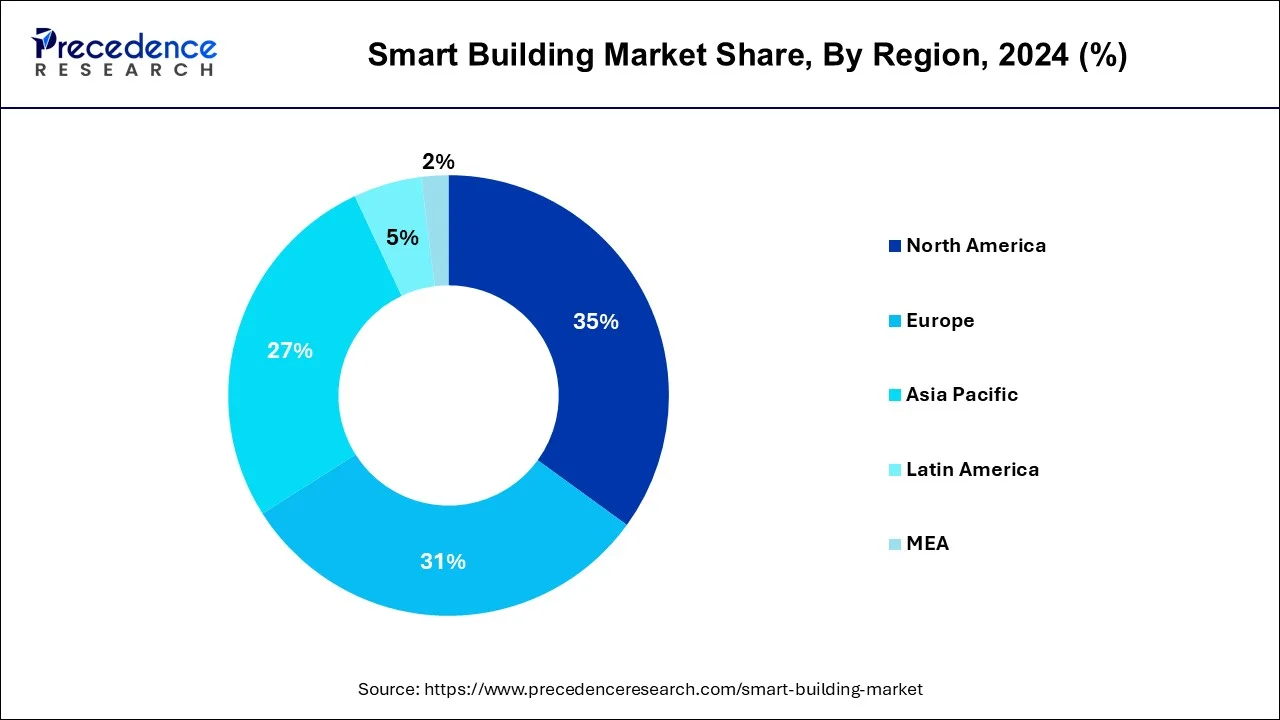

The global smart building market size is estimated at USD 111.51 billion in 2025 and is anticipated to reach around USD 277.92 billion by 2034, expanding at a CAGR of 10.70% from 2025 to 2034. The North America smart building market size reached USD 35.20 billion in 2024 and is expanding at a CAGR of 10.72% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart building market size was accounted for USD 100.58 billion in 2024 and is predicted to increase from USD 111.51 billion in 2025 to approximately USD 277.92 billion by 2034 with a CAGR of 10.70% from 2025 to 2034.

AI-driven smart building uses advanced data analytics to make calculated decisions based on real-time and historical data. Due to this data-driven approach, decision-making will be based on a higher degree of accuracy, from automated anomaly detection to facial recognition, predictive analytics, and behavior monitoring. It can help identify and respond to security threats. Tenants and guests will have another layer of security. The most exciting smart building improvements coming in on the back of AI have to be the level of personalization. AI systems can learn user preferences for temperature, lighting, and other environmental factors, offering a more comfortable and tailor-made experience.

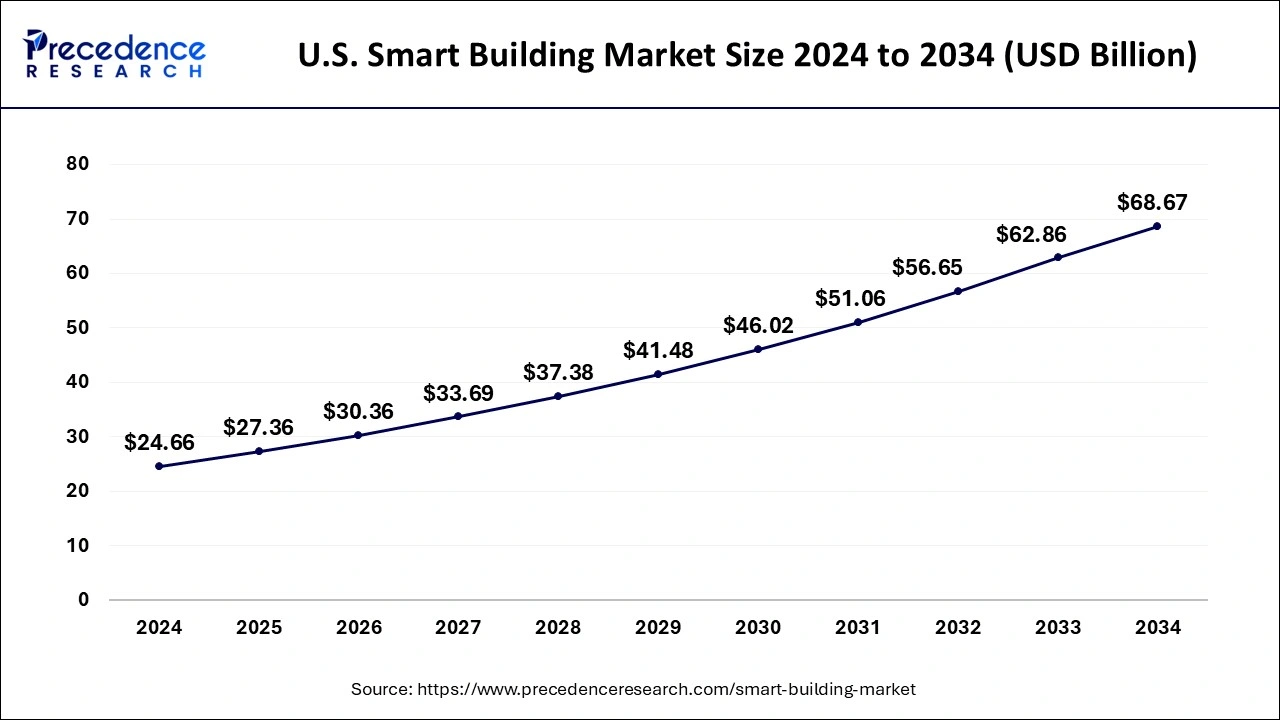

The U.S. smart building market size reached USD 24.66 billion in 2024 and is projected to be worth around USD 68.67 billion by 2034, growing at a CAGR of 10.78% from 2025 to 2034.

North America captured the major revenue share of 35% in 2024 and analyzed to augment the market during the forecast period. This is majorly attributed to the rapid adoption of advanced technologies in the region such as IoT, big data, cloud computing, deep learning, data analytics, and artificial intelligence. In addition, organizations in the U.S. are significantly investing in smart infrastructure to reduce energy consumption. As per a report published by Memoori in 2019, a total number of funding rounds for smart buildings was 184 in 2018, out of which North America accounted for nearly half of the total funding rounds.

The growth is attributed to the advanced infrastructure that can board smart automated solutions, the strong presence of key market players in this region, rising investments in green building technology, and environmental awareness within this region.

The growth of the smart building market in the North American region is being driven by rising government efforts for the acceptance and adoption of smart systems and solutions. The 'LEED' initiative, run by the U.S. Green Building Council in partnership with the Bank of America Charitable Foundation, assists local governments in adopting sustainable solutions. It is so essential to condense energy consumption in construction in order to encounter nationwide energy and ecological challenges while also dropping prices for building owners and tenants.

On the contrary, the Asia Pacific registered fastest growth during the forecast period. Rising initiatives for shopping malls, localities, and commercial offices with smart technologies projected to offer lucrative opportunities for the smart building market growth. In addition, the players in the Asia Pacific region are working towards enhancing the smart building services by developing the IoT-enabled building management systems across the region.

China and Japan are major contributors to regional technology development; for example, the establishments are profoundly capitalizing in smart building dealings such as building system and building controls incorporation to influence energy effectiveness and energy storage and distribute safer, smarter, and more supportable buildings. Simultaneously, the government is taking steps to assist the government's commitment to safeguarding the environment and its resources by making federal buildings more energy-efficient and decreasing greenhouse gas emissions, thereby accelerating the expansion of smart buildings.

A smart building is a term that talks about a building that automates its processes to take charge of its infrastructure, air conditioning system, heating, security systems, lighting, and others. A smart building deploys technology for making buildings more maintainable, effective, and safer. One of the useful trends of smart building market in the financing field is the model of Energy Services Company (ESCO) that offer inventive financial plan coupled with a full suite of energy conservation measures. In addition, the increasing trend of the smart city play a vital role to create more opportunities for the smart building industry.

One of the key factors driving the growth of smart building market is growing government initiatives for reducing energy consumption. According to the U.S., China Economic and Security Review Commission, government investment on smart city initiatives in China will exceed $38.92 billion in 2023. Such advancements also reveal a country's proclivity for implementing energy-saving technologies. In addition, the Canadian government is putting a strong emphasis on energy conservation, particularly in smart buildings, such as workplaces and houses. Furthermore, the UK has made noteworthy funding in smart building technologies, especially to lower the building sector's energy usage and carbon footprint.

Rising adoption of Internet of Things (IoT) devices in building management system expected to propel the market growth. Increasing cost of energy and rising environmental concern such as carbon emission & pollution are forcing builder to move towards smart building infrastructure that provides better security and cost saving wherever required. Smart buildings leverage cloud technology, sensors, and IoT connectivity that facilitates the user to remotely manage and control the lighting, air conditioning, security, and other house functioning. Smart buildings are more sustainable and energy efficient. However, lack of skilled professionals and coupled with increasing concern regarding IoT devices security may hinder the market growth.

The increasing interest of consumers in building technology that reduces the operating cost, and the growing awareness of individuals towards the need for energy consumption are the key factors driving the revenue growth of this industry. In addition, numerous key vendors funding in progressive solutions for smart homes is augmenting the market growth during the forecast period. However, dearth of concurrence among standard bodies, and high cost of installation along with concerns over interactivity are hampering the market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 100.58 Billion |

| Market Size in 2025 | USD 111.51 Billion |

| Market Size by 2034 | USD 277.92 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.70% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, System, Technology |

| Regional Scope | North America, Europe, APAC, Latin America, MEAN |

Growing trend of smart city

Smart buildings play an important part in smart cities, but their development is separate from that of smart cities. Sensor networks in structures allow for real-time monitoring of electricity and water usage, tracking of sustainability performance, and interaction with other smart city components. As a result, the growing trend of smart city is driving the growth of global smart building market.

Increasing consumption of the energy

Smart buildings aim to address and alleviate the issues raised by rising energy consumption. Due to the implementation of advanced technologies automation systems, and energy management solutions, smart buildings optimize energy usage, enhance energy efficiency, and reduce energy consumption. This is achieved through features like occupancy-based lighting and HVAC control, smart metering and monitoring systems, intelligent energy management systems, and integration with renewable energy sources. Smart buildings contribute to reducing energy waste, lowering operational costs, and promoting environmental sustainability by managing energy consumption and making decisions based on real-time data. Therefore, increasing consumption of energy leads to the adoption of smart buildings, as its focus is the need for energy-efficient and sustainable building solutions.

Decreased greenhouse gas emissions

Europe has ambitious goals for 2050. Cutting emissions from buildings, which are responsible for roughly 30% of carbon dioxide emissions globally, is essential to achieving net zero. More than USD 5.42 trillion in investments in building energy efficiency will be required to achieve that goal by 2050, according to Morgan Stanley Research.

Smart buildings have a vital role in reducing greenhouse gas emissions. It minimizes energy consumption, particularly in heating and cooling operations. Buildings often generate large amounts of greenhouse gas emissions due to their energy-intensive operations. However, smart buildings use energy more efficiently, leading to a significant decrease in emissions. As a result of optimizing energy usage through the implementation of smart technologies, such as intelligent HVAC systems, advanced lighting controls, and building energy management systems (BEMS), smart buildings can achieve energy savings of around 30 to 40% compared to conventional buildings. This reduction in energy consumption directly translates to a decrease in greenhouse gas emissions.

Rising investments

According to research findings, in 2022, the investment level reached to $5.9 billion. Corporate investors are vital in supporting startups through funding and strategic partnerships. The top 20 highest-funded startups in the smart buildings space have received funding ranging from $225 million to $2.6 billion. Additionally, partnerships have been formed with established players in the industry, including building systems vendors, IoT and IT vendors, lighting suppliers, and facilities management service firms. Therefore, rising investments is expected to drive the smart building market.

Concerns regarding data privacy and security

Tenants and landlords benefit greatly from the deployment of technology like internet of things and sensors. The deployment of these technologies, however, poses a security risk to structures. Most IoT devices and sensors have insecure security, use non-standard communication protocols, and run on outdated, unpatched software, exposing smart buildings to a variety of vulnerabilities. Hackers constantly scan targets for technological flaws in order to gain access to a network and steal important data or take control of a facility.

Cybersecurity

The increasing adoption of Internet of Things (IoT) and cost reduction in sensors and cloud computing are disrupting the building industry, leading to the retrofitting or construction of smart buildings. Smart building technology offers various advantages such as enhanced occupant comfort, safety, efficiency, and sustainability. However, the rapid proliferation of this technology also raises the risk of cyberattacks on vulnerable endpoints. According to a research study, around 2346.1 million cyber-attacks occurred globally in the first of 2022. Security measures have often been overlooked in the deployment of smart building solutions, amplifying the potential risk exposure. The vulnerability of building automation systems (BAS) and the interconnectedness of smart building technologies is expected to restrain the market. Weak security protocols and lack of encryption in BAS make smart buildings susceptible to cyberattacks, increasing the risk for businesses. Additionally, the reliance on IoT devices introduces potential entry points for hackers, and human error, such as downloading malware or using weak passwords, further compounds the security challenges. Outdated software and the need for constant updates also contribute to the vulnerabilities.

Growing adoption of internet of things technology

Sensor-generated data is used to improve the building user experience, and internet of things-enabled devices are installed and used to increase building performance efficiency. It can also run all building management solutions on a single infrastructure with little to no manual intervention. Internet of things-enabled systems can be utilized for a variety of tasks, including lowering energy consumption, repairing and maintaining building systems, and lowering building administration costs.

Occupancy-based HVAC control

Occupancy-based HVAC control in smart buildings presents a significant market opportunity. Manual HVAC systems that operate on fixed time schedules without considering occupancy levels lead to energy inefficiencies. However, with occupancy-based control using sensors and algorithms like the ClevAir solution, ventilation is optimized in real-time based on temperature and CO2 measurements. This dynamic approach allows for energy savings by adjusting airflow according to occupancy levels, resulting in cost reduction for tenants, increased comfort for occupants, and improved energy efficiency. Therefore, occupancy-based HVAC control is expected to lead the market offering both economic and environmental benefits.

Lack of coordination between government and organizations

For internet of things and existing smart building technologies to operate together, there will be a lot of collaboration between standard organizations, enterprises, city governments, and other stakeholders.

Complexity of IoT integrations

The main challenge in the smart building market is understanding and dealing with the complexity of IoT integrations. With a diverse ecosystem of devices and protocols, lack of standards, scalability considerations, data management and security concerns, interoperability issues, skill gaps, and cost considerations, navigating the complexity of smart building integrations requires a comprehensive understanding of the IoT ecosystem, careful planning, and collaboration with industry experts. Selecting scalable, interoperable, and secure integration solutions while staying updated with emerging technologies is crucial for successfully transitioning to a smart building infrastructure.

The services segment is expected to account for the largest share over the next decade due to upsurge in the implementation of intelligent building solutions, and growing demand for professional services such as system integration, support and maintenance, consulting services, and deployment. Market solution suppliers for smart buildings provide a wide range of services. Smart building service providers assist in the implementation of intelligent automation and technology for cost-effective building operation and maintenance.

Solutions segment is projected to continue its dominance during the forecast period. The augmented share of the solutions segment is mainly due to the rising demand for smart infrastructure across the public. Moreover, the rising trend along with increasing awareness among the public for the reliable and energy saving home appliances and features analyzed to open up new opportunities for the market players.

Solutions segment is further sub-segmented into building infrastructure management, security & emergency management, and energy management. Building infrastructure management held the largest revenue share in 2019 owing to rising need for a platform to optimize and control the large building infrastructure.

Building infrastructure management is further bifurcated into elevators and escalators system, smart water management system, parking management system, and others. Out of them, elevators & escalators system expected to flourish rapidly in the market owing to its increasing application in malls, residential societies, shopping centers, and large showrooms.

Commercial segment dominated the global smart building market in 2024 owing to rising concern of energy consumption along with several government regulations for the real estate sector to increase their focus on reducing energy consumption. Hotels, healthcare centers, and other commercial sectors are increasingly focused towards reducing IoT-enabled devices to reduce energy consumption. For instance, in September 2019, Marriott International partnered with Samsung and Legrand to convert their guest rooms into smart rooms where all devices were voice activated. The partnership aimed to uplift the global sustainability efforts of the hotel by elevating the gest experience.

This is due to increased energy consumption concerns, as well as many government rules requiring the real estate sector to focus more on lowering energy usage.

On the other hand, the residential segment is expected to witness the fastest growth over the forecast period due to the rising trend of smart home devices along with increasing security concerns in the building. Additionally, sensors, voice & mobile control devices facilitate users to have access of major home appliances and areas under continuous surveillance and control.

The global smart building market is fragmented and highly competitive owing to presence of significant number of players in the market. Some well-established market players are highly focused towards strengthening their market position by new development and investments in the market. For instance, IBM Corporation is actively providing smart building solutions and analytics for various types of commercial, residential, and industrial infrastructures. In June 2018, IBM Corp. announced that several new clients have deployed cutting-edge smart building solutions build on cloud using IoT technology. New clients such as Karantis, Sodexo, HUF Haus, and R +V Versicherung have signed an agreement with IBM Corp. to provide smart building solutions. In spite of growth prospects in the market, not all technology sectors experience the equivalent rate of adoption. Hence, utmost prospect subsists for industrialists by differentiating among segments and shine in those sections bestowing the highest growth probable, and commercialize different market-ready solutions.

This research report analyzes and predicts growth of market size at global, regional, and country levels. It also offers comprehensive study of the up-to-date industry developments in all of the sub-segments from 2021 to 2033. In order to study thoroughly this research study classified global smart building market depending upon different parameters such as component, application and region:

By Component

By System

By Technology

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

May 2025

May 2025

May 2025