January 2025

Asthma Therapeutics Market (By Drug Class: Anti- inflammatory, Bronchodilators, Combination Therapy; By Product: Inhalers, Nebulizers; By Route of Administration: Oral, Inhaled, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

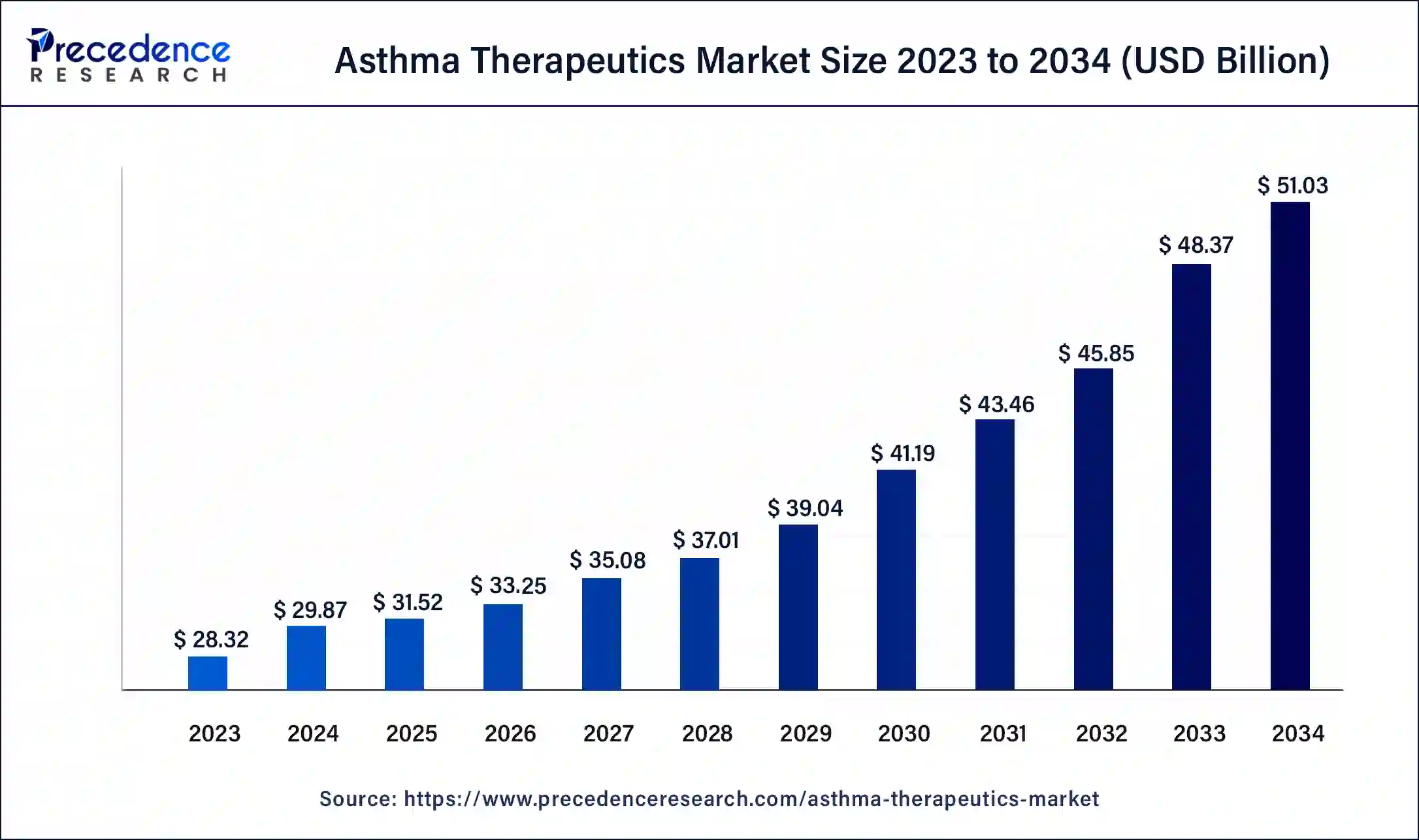

The global asthma therapeutics market size was USD 28.32 billion in 2023, accounted for USD 29.87 billion in 2024, and is expected to reach around USD 51.03 billion by 2034, expanding at a CAGR of 5.5% from 2024 to 2034. The North America asthma therapeutics market size reached USD 13.03 billion in 2023. The asthma therapeutics market is driven by the rising incidence of childhood asthma.

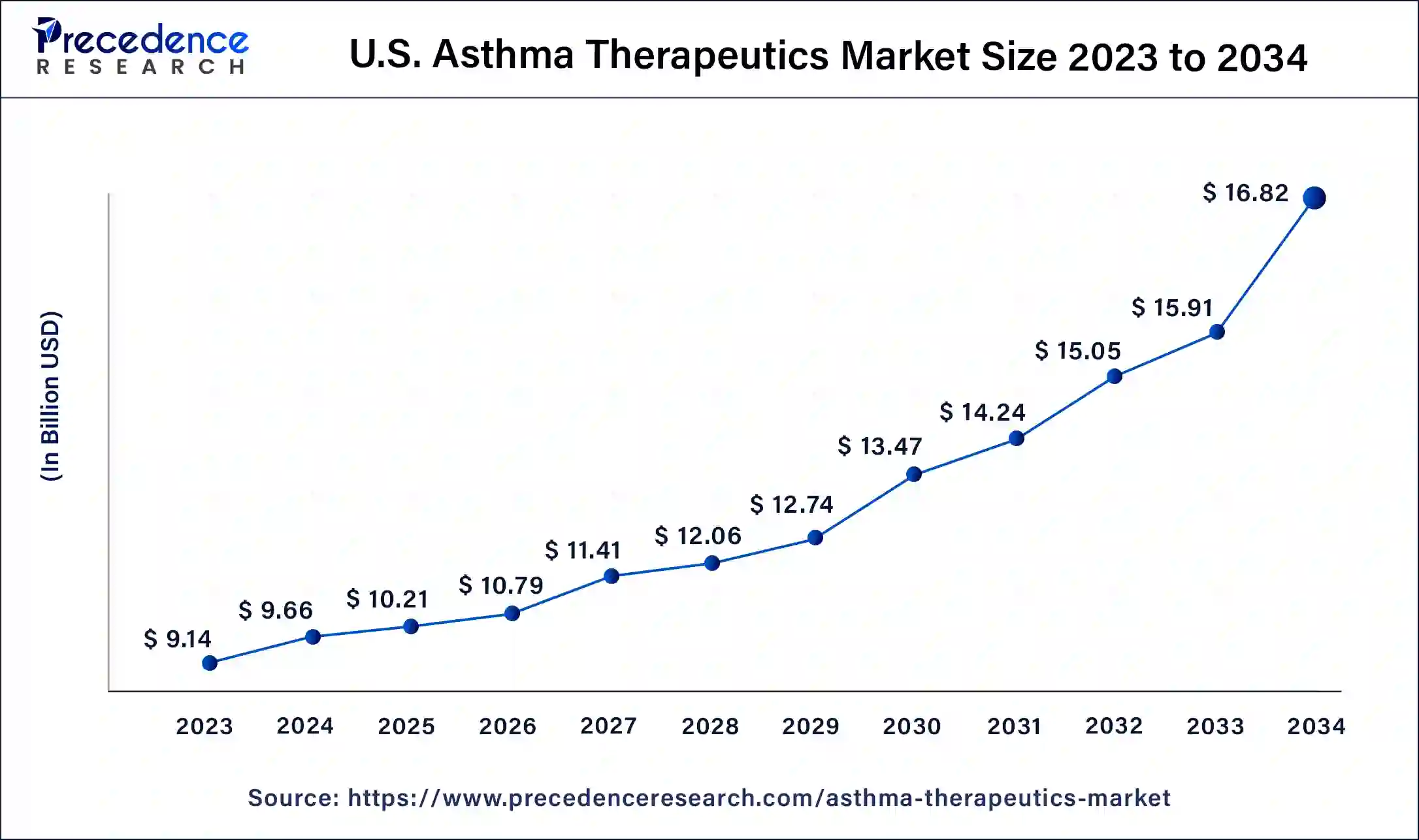

The U.S. asthma therapeutics market size was estimated at USD 9.14 billion in 2023 and is predicted to be worth around USD 16.82 billion by 2034, at a CAGR of 5.7% from 2024 to 2034.

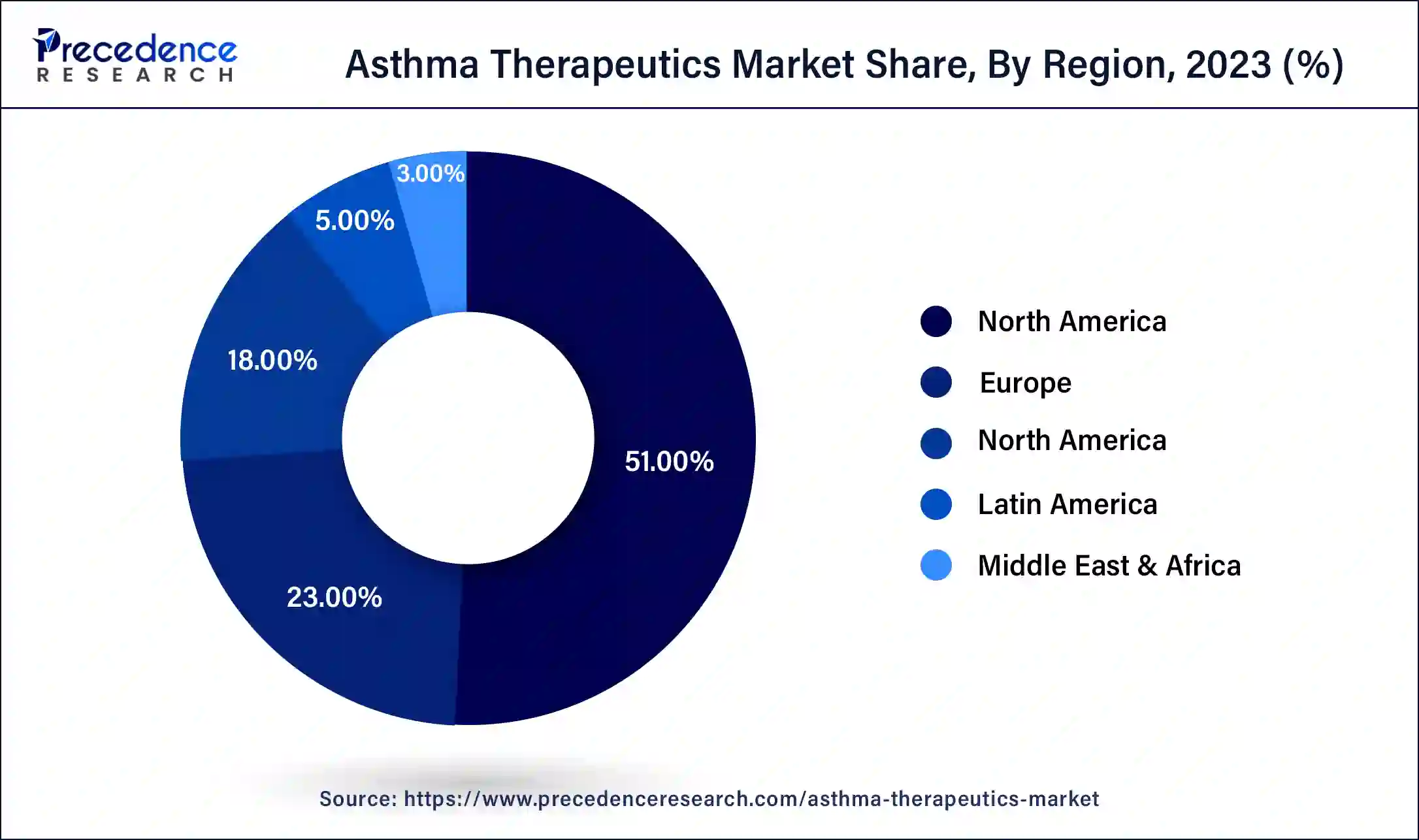

North America dominated the asthma therapeutics market with the largest share of 51% in 2023. A large percentage of the population suffers from asthma, making it a common ailment. The high prevalence of asthma in the area fuels the need for treatments. The regulatory landscape is favorable, fostering both pharmaceutical innovation and commercialization. Tight yet open regulatory environments guarantee the security and effectiveness of asthma treatments, stimulating industry expansion and capital inflows.

Researchers at Rutgers New Jersey Medical School have discovered a novel approach that may result in millions of people with asthma and other respiratory conditions, including chronic obstructive pulmonary disease (COPD), receiving more potent medication treatments.

Asia-Pacific is expected to witness the fastest rate of growth in the asthma therapeutics market during the forecast period of 2024-2034. Spending on healthcare is rising due to improving economic conditions in many Asia-Pacific nations. This promotes improved access to medical services, such as the diagnosis and treatment of asthma, which fuels market expansion. In the Asia-Pacific area, people and medical professionals are becoming more knowledgeable about asthma and managing it. Further propelling market expansion are increased education and awareness efforts that result in earlier diagnosis and treatment commencement.

The asthma therapeutics market revolves around the innovation, development and offering of drugs that specifically deal with asthma and other conditions caused by prolonged respiratory issues. The market offers services incorporated with simpler access to medical specialists, assistance with drug adherence, and early identification of possible exacerbations. Lessen airway inflammation to protect against long-term harm and enhance lung function.

Long-term remedies can be achieved by providing sustained bronchodilation, which lowers the likelihood of unexpected asthma episodes and investigates the possibility of changing the genes linked to the onset of asthma. Advancements in delivery of drugs and other initiatives taken for asthma disease management promote the market’s expansion.

Asthma Therapeutics Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.5% |

| Global Market Size in 2023 | USD 28.32 Billion |

| Global Market Size in 2024 | USD 29.87 Billion |

| Global Market Size by 2034 | USD 51.03 Billion |

| U.S. Market Size in 2023 | USD 9.14 Billion |

| U.S. Market Size by 2034 | USD 16.82 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Drug Class, By Product, and By Route of Administration |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing incidences of asthma and other respiratory disorders

Millions of people worldwide have asthma, a widespread chronic respiratory disease whose incidence is rising. There is an increasing need for efficient therapies as more people are diagnosed with respiratory conditions such as asthma and associated conditions. Better diagnosis methods make it possible to identify and categorize asthma cases more accurately. More focus is being placed on creating and applying targeted therapies suited to patient profiles due to increasingly accurate diagnoses. Thereby, the rising prevalence of asthma creates a driver for the asthma therapeutics market.

Presence of robust pipeline of agents to manage asthma

A robust pipeline signifies pharmaceutical companies' continuous research and development endeavors to generate novel and enhanced therapies for asthma. In response to unmet medical requirements, this encourages innovation and may result in the discovery of more potent medications that may have fewer adverse effects. A constant flow of new goods drives market growth through an expanding pipeline. New cures make money and encourage competition among pharmaceutical companies, which benefits patients by giving them better access to cutting-edge medical care.

Patent expiration of drugs

Generic versions of name-brand medications become accessible when their patents expire, thereby boosting competition. While this lowers consumer costs, it also means that pharmaceutical companies that make branded drugs make less money. This may discourage funding for investigating and creating novel asthma medications, reducing the chances of innovation in the asthma therapeutics market.

Increasing research and development for personalized medicine

Customizing medical care to each patient's unique needs is known as personalized medicine. This can include elements like genetic composition, environmental triggers, and particular symptoms in the case of asthma. Pharmaceutical companies and researchers can better understand the underlying causes of asthma and develop more tailored medicines by investing in research and development for personalized medicine in asthma treatment. Because the treatments are customized to meet each patient's specific needs, this technique enables the creation of more effective medications with fewer side effects.

The anti-inflammatory segment dominated the asthma therapeutics market with the largest share in 2023. Asthma patients can improve their symptoms and avoid exacerbations using inhaled corticosteroids (ICS), the cornerstone of anti-inflammatory therapy. ICS helps lower airway inflammation, edema, and mucus production. The domination of this market has also been aided by other anti-inflammatory drugs, such as monoclonal antibodies that target inflammatory pathways and leukotriene modifiers. These drugs give long-term asthma control and symptomatic relief, making them crucial elements of asthma management plans.

The combination therapy segment witnessed lucrative growth in the asthma therapeutics market during the forecast period. The efficacy of combining several drugs to target different areas of asthma therapy, such as inflammation control, bronchodilation, and symptom relief, was the main factor driving this growth. When compared to monotherapy, combination medicines are more effective and frequently lead to better overall disease management, fewer exacerbations, and better symptom control.

The inhalers segment dominated the asthma therapeutics market in 2023. Inhalers provide a simple and effective way to administer medicine to the lungs, where it is most required to reduce asthma symptoms. Metered-dose inhalers (MDIs), dry powder inhalers (DPIs), and nebulizers are just a few of the inhaler kinds available to meet the needs and preferences of various patients.

With inhalers, patients can maximize treatment efficacy and minimize systemic side effects by precisely dosing and delivering medication to the airways.

The nebulizers segment shows a notable growth in the asthma therapeutics market during the forecast period. Nebulizers provide several benefits, including excellent medicine administration to the lungs, user-friendliness, and suitability for patients with severe asthma or inhaler resistance. Furthermore, the creation of portable and user-friendly nebulizers has been made possible by technical improvements, which have improved patient compliance and convenience.

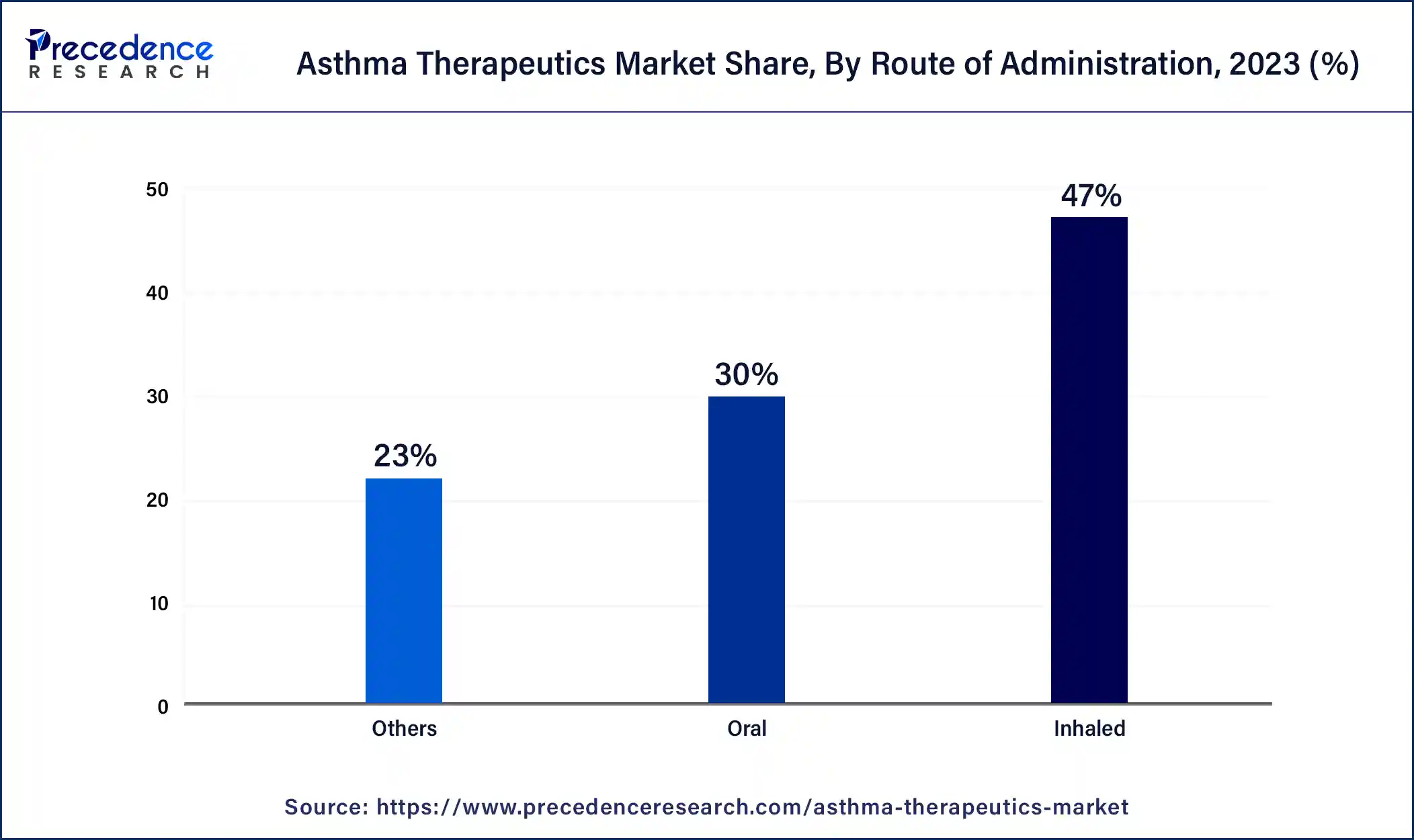

The inhaled segment is registered a maximum market share of 47% in 2023. Drugs are delivered straight to the lungs using inhaled treatments, essential for controlling asthma symptoms because they operate quickly and precisely at the site of inflammation. It generally has a good safety profile compared to systemic therapies, which limit systemic adverse effects by directly addressing the afflicted location. Due to ongoing developments in inhaler technology, inhalers are now more effective and user-friendly due to better medication delivery mechanisms.

The oral segment is observed to expand at the fastest pace in the asthma therapeutics market during the forecast period. Patients consider oral drugs more appealing than traditional inhalers because they are more convenient and straightforward to administer. Furthermore, improvements in oral asthma drugs' safety and effectiveness profiles have led to a rise in their use by patients and healthcare professionals. Furthermore, oral drugs offer a more thorough method of treating underlying inflammation and bronchoconstriction than inhalers alone, helping to manage asthma symptoms on a systemic level.

Segments Covered in the Report

By Drug Class

By Product

By Route of Administration

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

January 2025

January 2025