February 2025

Atopic Dermatitis Drugs Market (By Drug Class: Biologics, Calcineurin Inhibitors, PDE-4 Inhibitor, Corticosteroids, Others; By Route Of Administration: Topical, Injectable, Oral; By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

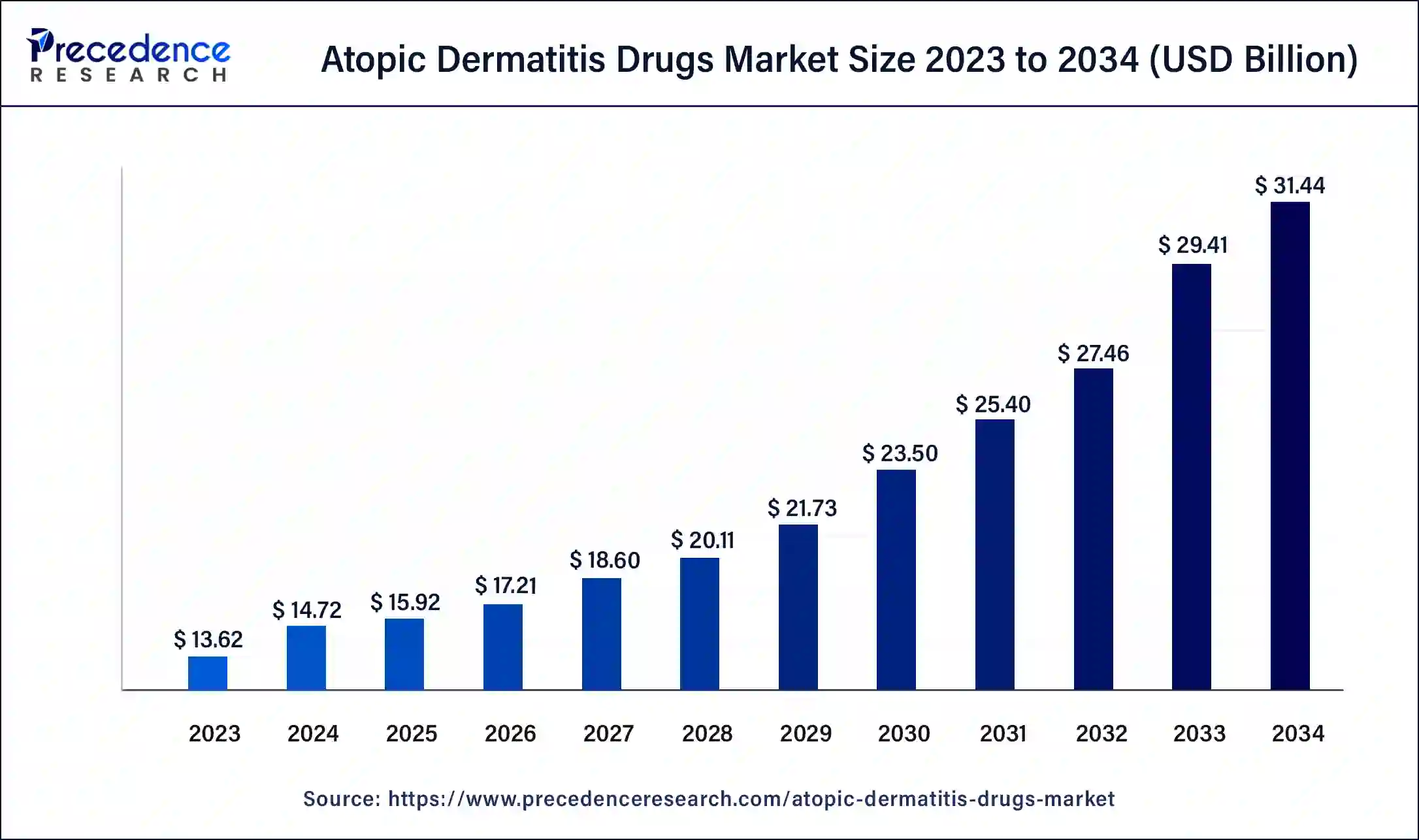

The global atopic dermatitis drug market size was USD 13.62 billion in 2023, estimated at USD 14.72 billion in 2024 and is expected to reach around USD 31.44 billion by 2034, expanding at a CAGR of 7.9% from 2024 to 2034.

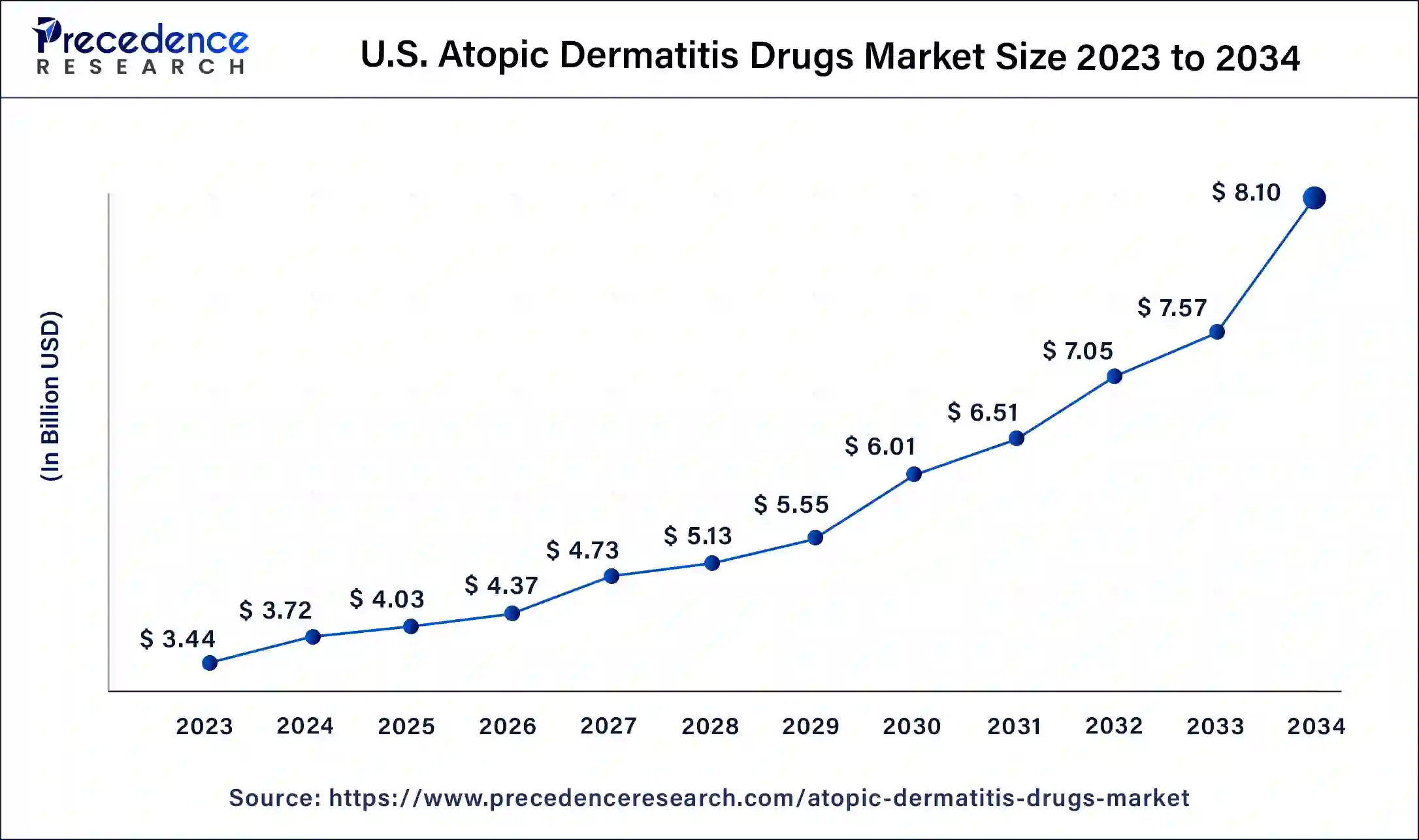

The U.S. atopic dermatitis drug market size was valued at USD 3.44 billion in 2023 and is estimated to reach around USD 8.10 billion by 2034, growing at a CAGR of 8.1% from 2023 to 2032.

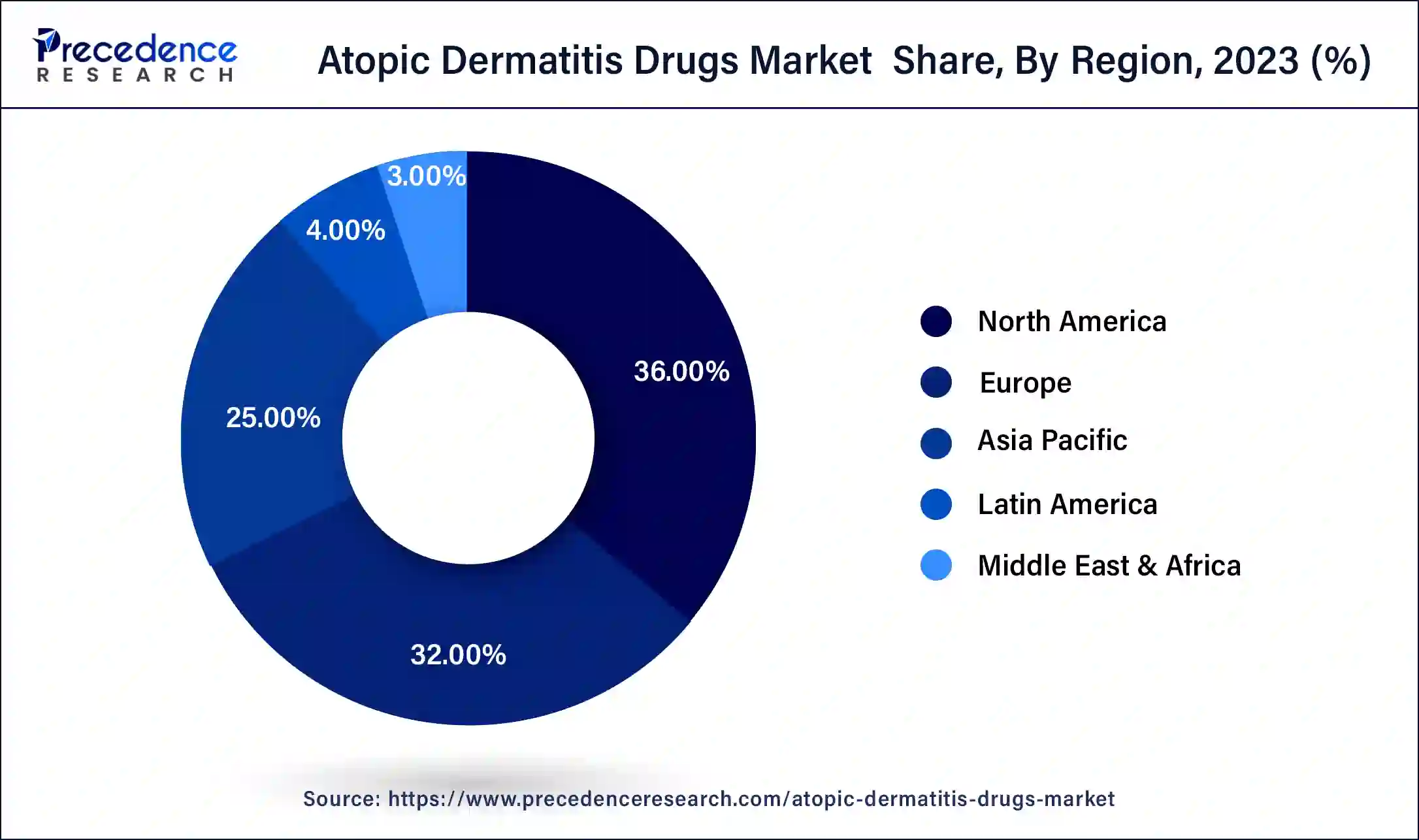

North America has held the largest revenue share 36% in 2023. In North America, the atopic dermatitis drugs market has witnessed a growing emphasis on biologics and targeted therapies, reflecting a strong focus on innovation. The region has seen increased investment in research and development, leading to the introduction of novel treatment options. Patient-centric care models and telemedicine adoption have gained traction, facilitating access to specialized care. Regulatory approvals and healthcare infrastructure make North America a key market, with a rising demand for effective atopic dermatitis treatments.

Asia-Pacific is estimated to observe the fastest expansion The Asia-Pacific region has shown notable growth in the atopic dermatitis drugs market due to a rising prevalence of atopic dermatitis, particularly in densely populated countries. Increasing healthcare expenditure and a shift towards westernized lifestyles have contributed to this surge in demand. Additionally, the region has witnessed the adoption of cost-effective treatment options, such as topical steroids. However, regulatory complexities and healthcare access disparities remain challenges in some parts of Asia-Pacific, requiring tailored market strategies to address these variations.

The atopic dermatitis drugs market in Europe is marked by robust research and development activities, yielding innovative therapies. With a growing awareness of atopic dermatitis and its impact on patients' lives, there's an increasing emphasis on patient-centric care models and telehealth solutions. Regulatory processes are relatively streamlined, contributing to a favorable environment for drug approvals and market growth in this region.

Atopic dermatitis is a chronic inflammatory skin condition. It is managed with various drugs such as topical corticosteroids that include hydrocortisone, reduce inflammation and itching. Calcineurin inhibitors like tacrolimus and pimecrolimus help control flare-ups by suppressing the immune response. Non-steroidal topical medications, such as crisaborole, are an alternative for mild cases. Systemic treatments like oral corticosteroids or immunosuppressants may be prescribed for severe atopic dermatitis. Biologic agents like dupilumab specifically target immune molecules responsible for the condition.

Emollients and moisturizers are essential for daily care. The choice of atopic dermatitis drug depends on the patient's age, severity, and individual response, with a focus on minimizing symptoms and improving skin health.

The atopic dermatitis drugs market is experiencing substantial growth driven by various factors. Increasing prevalence of atopic dermatitis, a chronic skin condition is characterized by inflammation and itchiness. As the number of individuals affected by this condition rises, the demand for effective treatments escalates. Moreover, ongoing advancements in drug development and researchers and pharmaceutical companies are making strides in creating innovative therapies to address atopic dermatitis. These therapies include biologics, topical steroids, and other novel treatments that offer improved outcomes for patients. These advancements are contributing to the market's expansion.

Furthermore, there is a noticeable shift towards patient-centric approaches within the industry. Tailoring treatments and management strategies to individual patient needs is becoming increasingly important. This patient-centric focus enhances the quality of care and presents new business opportunities in the form of patient support programs and resources. However, the industry does face several challenges. Stringent regulatory requirements and lengthy approval processes can hinder new drugs' development and market entry. The high cost of atopic dermatitis drugs can also be a burden for many patients, affecting accessibility. Moreover, the industry's competitive landscape can result in pricing pressures for manufacturers.

Nonetheless, there are several promising business opportunities within the atopic dermatitis drugs market. Investing in the development of targeted and biologic therapies can provide a competitive advantage. Offering patient support programs and resources can enhance brand loyalty and patient outcomes. Exploring emerging markets and expanding the product portfolio globally can unlock new avenues for growth. In summary, the market is projected to witness growth due to disease prevalence, drug innovations, and patient-centric care, despite regulatory and pricing challenges.

| Report Coverage | Details |

| Market Size by 2034 | USD 31.44 Billion |

| Market Size in 2023 | USD 13.62 Billion |

| Market Size in 2024 | USD 14.72 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.9% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Drug Class, Route of Administration, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing disease prevalence and advancements in drug development

Increasing disease prevalence and advancements in drug development are pivotal factors surging the demand for atopic dermatitis drugs in the market. The rising incidence of atopic dermatitis, a chronic inflammatory skin condition, drives the need for effective treatment options. As more individuals are diagnosed with this ailment, the market experiences a natural expansion in response to growing patient demand.

Simultaneously, the continuous progress in drug development is transforming the landscape of atopic dermatitis treatment. Cutting-edge innovations like biologics, topical steroids, and novel therapies provide more efficient and precisely targeted solutions. This compels both patients and healthcare providers to show a growing interest in these advanced treatments. Not only do these innovations hold the promise of improved clinical outcomes, but they also elevate the overall standard of patient care. Consequently, the synergy between increasing disease prevalence and drug development breakthroughs positions the market for substantial growth as it addresses the needs of a growing patient population with more effective and advanced therapeutic options.

High treatment costs and regulatory hurdles

High treatment costs and regulatory hurdles act as significant restraints on the atopic dermatitis drugs market. Firstly, the high cost of atopic dermatitis drugs poses a considerable barrier to market demand. High expenses associated with atopic dermatitis drugs place a financial strain on patients, ultimately diminishing their ability to access and afford these treatments. Consequently, a significant number of individuals find it challenging to cover the costs of these medications, compelling them to choose more cost-effective alternatives rather than embracing these drugs. The cost factor also affects the willingness of healthcare systems and insurance providers to cover these medications, further hindering their widespread use.

Moreover, regulatory hurdles can impede market growth. The pharmaceutical sector is subject to stringent regulations that oversee the development and approval of drugs. These procedures are typically time-consuming and resource intensive. The protracted approval timelines can result in delays in bringing new therapies to the market, while the expenses involved in meeting regulatory mandates can be substantial. As a result, manufacturers may be deterred from investing in research and development for atopic dermatitis drugs, and potential innovations may be slowed down, affecting market growth, and limiting treatment options for patients.

Personalized medicine and patient support programs

Personalized medicine and patient support programs are two crucial factors driving the surge in market demand for atopic dermatitis drugs. Personalized medicine involves tailoring treatment plans to an individual's specific genetic, environmental, and clinical factors. This approach guarantees that patients receive treatments tailored precisely to their unique conditions. As a consequence, pharmaceutical companies are intensifying their research and development investments to create treatments that adhere to the principles of personalized medicine.

Additionally, patient support programs play a pivotal role in bolstering market demand. These programs provide a range of services to atopic dermatitis patients, including education, access to resources, and assistance with treatment adherence. By offering such support, pharmaceutical companies foster patient loyalty and improve treatment compliance, ultimately leading to better disease management and higher demand for atopic dermatitis drugs.

As patients experience improved quality of life and outcomes, they are more likely to seek ongoing treatments, driving sustained market growth. Together, personalized medicine and patient support programs are shaping the future of the atopic dermatitis drugs market, making it more patient-centered and dynamic.

Impact of COVID-19

The COVID-19 pandemic significantly impacted the atopic dermatitis drugs industry. While the demand for chronic disease treatments remained, the market faced several challenges. Delays in clinical trials and regulatory processes hindered drug development and approvals. The pandemic disrupted healthcare systems, affecting patient access to care and diagnosis. Additionally, the economic uncertainty led some patients to postpone or forgo treatment, impacting market revenues.

On the positive side, the crisis accelerated the adoption of telemedicine, enabling remote consultations and prescription refills. The pharmaceutical industry also demonstrated resilience by adapting to remote work and implementing safety measures in drug manufacturing. As the pandemic subsided, the market saw a gradual recovery, with a renewed focus on research and development in atopic dermatitis drugs, and an increased emphasis on patient-centric approaches. Overall, while the market faced temporary setbacks, it demonstrated adaptability and potential for growth in the post-pandemic era.

According to the Drug class, biologics has held 43% revenue share in 2023. Single Biologics are a class of atopic dermatitis drugs made from living organisms or their components. They work by targeting specific immune system molecules that play a role in the disease's development. In the atopic dermatitis drugs market, biologics have gained prominence as they offer highly targeted, effective treatment with fewer side effects compared to traditional therapies. Market trends show an increasing focus on the development of novel biologics, emphasizing patient-specific approaches, which have the potential to revolutionize atopic dermatitis management.

The PDE4 Inhibitors segment is anticipated to expand at a significantly CAGR of 10.8% during the projected period. In contrast, PDE4 Inhibitors are small-molecule drugs that target an enzyme involved in the inflammatory response. While they are less specific compared to biologics, they have displayed potential in mitigating inflammation and alleviating itching in individuals with atopic dermatitis. Market trends demonstrate a rising interest in PDE4 Inhibitors as a treatment option, with ongoing research endeavors aimed at enhancing their effectiveness and widening their footprint within the treatment landscape.

The injectable segment is anticipated to hold the largest market share of 48% in 2023. Injectable drugs, a pivotal category in the treatment of atopic dermatitis, are administered through injections, ensuring rapid and precise delivery of medication directly into the bloodstream. This approach is typically reserved for severe cases of the condition, offering a robust therapeutic option. Notably, recent trends underscore a growing interest in biologic injectables. These biologics target specific immune pathways, heralding a promising paradigm shift in treatment.

They have shown potential in providing more effective outcomes with fewer side effects, thus capturing a growing share of the market. The expansion of the injectable atopic dermatitis drugs market is attributed to the development of these novel biologics, coupled with increasing patient preference for therapies offering enhanced effectiveness and precision.

The oral segment is projected to grow at the fastest rate over the projected period. Oral medications represent another significant facet of the atopic dermatitis drugs market. Delivered in pill or capsule form, these drugs are often prescribed for individuals with moderate to severe atopic dermatitis, offering both effectiveness and convenience. Recent trends within this segment focus on the development of Janus kinase (JAK) inhibitors and systemic corticosteroids as increasingly viable treatment options.

As more patients seek manageable, systemic solutions for their condition, the market for oral atopic dermatitis drugs continues to expand. This growth is further bolstered by pharmaceutical companies' investments in pioneering oral therapies, which promise to redefine the landscape of treatment for this dermatological condition.

The Hospital Pharmacies segment had the highest market share of 57% on the basis of the end user in 2023. Hospital Pharmacies, as end user in the atopic dermatitis drugs market, primarily serve inpatient and outpatient hospital settings. They play a crucial role in providing immediate access to medications for severe cases and ensuring continuity of care for patients during their hospital stay. Hospital pharmacies are integral in facilitating the timely administration of specialized atopic dermatitis treatments, often collaborating with healthcare teams to ensure the best therapeutic outcomes.

Recent trends within hospital pharmacies include an increased focus on formulary management to optimize drug usage, particularly prioritizing newer, more effective atopic dermatitis treatments, including biologics that have shown promising results in managing this challenging condition.

The retail pharmacies segment is anticipated to expand at the fastest rate over the projected period. Retail pharmacies are at the forefront of patient care and often emphasize patient education and support programs. This aligns with the patient-centric approach trend in the market, aiming to empower patients with knowledge and resources to enhance treatment adherence and outcomes. They also serve as a vital link between healthcare providers and patients, facilitating the prescription and distribution of atopic dermatitis medications, while also offering counseling on proper usage and potential side effects to ensure comprehensive care for those affected by this skin condition.

By Drug Class

By Route Of Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

January 2025

March 2025