April 2025

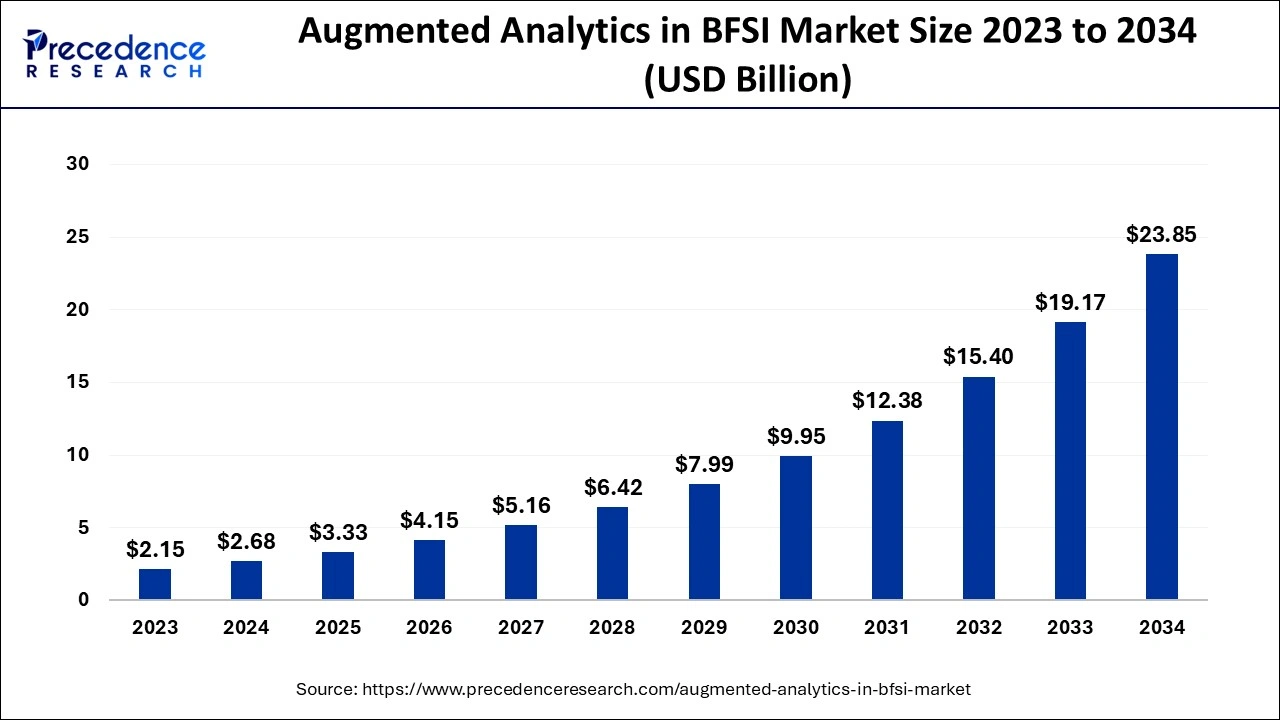

The global augmented analytics in BFSI market size accounted for USD 2.68 billion in 2024, grew to USD 3.33 billion in 2025 and is expected to be worth around USD 23.85 billion by 2034, registering a CAGR of 24.44% between 2024 and 2034.

The global augmented analytics in BFSI market size is calculated at USD 2.68 billion in 2024 and is predicted to reach around USD 23.85 billion by 2034, expanding at a CAGR of 24.44% from 2024 to 2034. The significant rise in the volume of data, the rising need for risk management, the increasing adoption of ML and AI technologies in the BFSI sector, and the growing focus on customer experience improvements are driving the growth of augmented analytics in BFSI market during the forecast period.

The financial services industry is experiencing a robust transformation, ushering in a new era of data-driven decision-making and customer-centric solutions which is majorly driven the evolving consumer expectations and rapid technological advancements. The AI integration in the augmented analytics in BFSI market is transforming existing processes and redefining the nature of financial services. AI has become a crucial innovation and efficiency in the BFSI market. It assists financial institutions in enhancing customer experiences, making better decisions, improving operations, and managing risks more effectively.

Augmented analytics uses artificial intelligence and machine learning (ML) to automate data preparation, data visualization, and insight generation, empowering bank employees from data analysts to business users to get clear and actionable insights. AI integration allows financial institutions to gain access to large amounts of data, speed up data analysis, and make decisions quickly and effectively. The adoption of this technology led to an increase in the overall efficiency of services and operations across the BFSI sector.

The augmented analytics in BFSI market involves efficiently utilizing advanced techniques such as machine learning (ML) and artificial intelligence (AI) to enhance data-driven decision-making processes across financial institutions. This technique assists organizations in making more timely and informed decisions which improves strategic planning and operational efficiency. Over the years, the banking, financial services, and insurance (BFSI) sector has been evolving, with more emphasis on automation, data quality, and personalized customer service. Several leading companies in the augmented analytics market within BFSI are continuously focusing on developing advanced AI-powered data analytics solutions to improve personalized customer experiences and improve decision-making processes. The growth of augmented analytics in the BFSI banking, financial services, and insurance (BFSI) market is driven by the large data volumes, increasing demand for real-time insights, rising regulatory requirements, improvements in fraud detection, growing adoption of digital banking, and optimizing customer experience.

| Report Coverage | Details |

| Market Size by 2034 | USD 23.85 Billion |

| Market Size in 2024 | USD 2.68 Billion |

| Market Size in 2025 | USD 3.33 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 24.44% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Deployment Model, Enterprise Size, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising data volumes in the BFSI industry

The increasing data volumes in the BFSI sector are expected to boost the expansion of augmented analytics in BFSI market in the coming years. The BFSI sector generates large amounts of data daily, which may include transactional data, market data, customer data, and others. These data are highly useful in making effective informed and effective business decisions. Managing and analyzing data manually can be very time-consuming.

To automate the data analysis process and allow BFSI sectors to make quickly data-driven decisions and assist users with useful insights has led to increasing adoption of augmented analytics as an advanced technology. By automating data preparation, analysis, and visualization, augmented analytics tools allow BFSI sectors to make quick data-driven decisions and assist users with useful information based on insights generated from the vast amounts of data available to them.

High cost of implementing augmented analytics

The high costs required to implement augmented analytics are anticipated to projected to hamper the market's growth. The implementation of augmented analytics requires significant investment which often discourages many BFSI organizations, especially small and medium-sized enterprises (SMEs) in lower and middle-income countries. Additionally, the rising concerns about data privacy and security are likely to limit the expansion of global augmented analytics in BFSI market.

BFSI companies deal with sensitive customer data such as such as personal and financial data and any breach of this data can result in extremely serious consequences. Such incidents lead to loss of customers' trust and damage to the reputation of the organization. Thus, these financial institution needs to ensure that their augmented analytics technology is secure and complies with data privacy regulations.

Favorable government regulation

The presence of supportive Government regulation is projected to offer immense growth opportunities for the augmented analytics in BFSI market during the forecast period. The banking, financial services, and insurance (BFSI) sector is highly regulated, and financial institutions are required to comply with several regulations and guidelines of the Government. Financial institutions are under constant scrutiny from authorized regulatory bodies. The adoption of augmented analytics assists these institutions in effectively managing their data and making more timely and informed decisions while adhering to regulatory requirements. In addition, the augmented analytics technology assists BFSI companies in improving their compliance processes, identifying any involved potential risks and fraudulent activities, enhancing decision-making capabilities, and monitoring transactions in real time.

The solution segment accounted for the dominating of the global market in 2023. The segment’s growth is majorly driven by the rising demand for solutions by the BFSI organizations. Augmented analytics solutions offer a wide variety of functionalities including data preparation, data integration, data visualization, and automated insights generation. Through using augmented analytics solutions, employees working in the BFSI firms can obtain valuable insights from large volumes of data, detect anomalies, identify patterns and trends, and facilitate in making data-driven decisions.

The service segment will witness considerable growth in the market over the forecast period. The service segment in augmented analytics offers lucrative opportunities for partnerships or collaborations. Several established financial institutions are partnering with prominent technology companies and analytics service providers to boost their analytical capabilities and speed up digital transformation.

The on-premise segment held the largest segment of the market in 2023. Cloud-based analytics platforms offer various benefits such as flexibility, scalability, and cost-effectiveness. It also enables BFSI organizations to leverage the power of advanced analytics without requiring high infrastructure investment. Moreover, cloud solutions provide real-time data access and collaboration. It also allows seamless integration across multiple departments and branches.

The cloud segment is expected to grow significantly in the market during the forecast period. On-premise augmented analytics solutions allow BFSI companies to benefit from rising data security, increasing control over their analytics infrastructure, and improving data governance.

The large enterprises segment held the dominating share of the market in 2023. The rapid growth of the segment is mainly driven by the rising spending by major banks on the implementation of cutting-edge IoT-enabled technologies. Large financial organizations are increasingly adopting augmented analytics to manage their financial operations effectively and quickly.

The small and medium-sized enterprises segment is expected to grow notably in the market during the forecast period. The rising awareness regarding the benefits offered by augmented analytics solutions such as increasing regulatory requirements, the rising need to analyze vast amounts of data quickly and accurately increasing adoption of digital banking, the rising need for fraud detection, and the increasing focus to enhance customer experience. These factors are expected to increase the implementation of augmented analytics technology in small and medium-sized financial institutions.

The fraud detection segment accounted for the highest share of the market in 2023 and is anticipated to grow at a robust CAGR over the forecast period. Fraud detection is one of the major applications of augmented analytics in the BFSI sector. Often traditional methods of detecting fraud fail due to the sophisticated techniques used by fraudsters. Augmented analytics tools leverage advanced AL and ML algorithms to detect anomalies and unusual patterns in transaction data, facilitating early identification of any involved fraudulent activities. Therefore, real-time detection capability significantly assists in preventing financial losses and gaining customer trust.

The customer analytics segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. Augmented analytics solutions can effectively analyze historical customer data and assist in identifying churn patterns. It also aids in predicting which customers are most likely to switch to a competitor or discontinue to get the services from the particular BFSI organization. The customer lifetime value (CLV) analysis for any individual customer is considered through their transaction history, past behavior, and engagement patterns.

The risk management segment is anticipated to grow notably in the market over the forecast period. Risk management applications of the augmented analytics in BFSI market assist financial institutions to continuously assess and mitigate various potential risks. Augmented analytics technology allows BFSI organizations to identify potential risks, and implement appropriate mitigation strategies which result in reducing financial losses and enhancing the overall stability.

North America held the dominant share of the augmented analytics in BFSI market in 2023 and is observed to witness notable growth during the forecast period. The growth of the region is observed to witness notable growth during the forecast period. In recent years, the region has the widespread adoption of the market. North America offers a highly well-established financial sector along with a favorable regulatory environment that encourages innovation. Additionally, the presence of major financial hubs including New York and Silicon Valley have increasingly invested in augmented analytics technology, which resulted in driving the regional market’s expansion in the coming years. Furthermore, a significant rise in the volume of data, the increasing adoption of AI and ML technologies, and the rising need for risk management.

Asia Pacific is observed to expand rapidly in the augmented analytics in BFSI market during the forecast period. The growth of the region is majorly attributed to the rising digitalization and extensive adoption of advanced technology in the region providing a source of a large pool of data, creating lucrative opportunities for banking, financial services, and insurance (BFSI) sectors to leverage augmented analytics tools. These advanced analytics techniques have the advanced analytics techniques and created an effective pathway for enhancing customer experiences, reducing fraudulent activities optimizing risk management, and streamlining operations.

By Component

By Deployment Model

By Enterprise Size

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

January 2025

November 2024