Augmented Reality (AR) And Virtual Reality (VR) In Manufacturing Market Size and Forecast 2025 to 2034

The global augmented reality (AR) and virtual reality (VR) in manufacturing market size was accounted for USD 12.74 billion in 2024 and is anticipated to reach around USD 100.01 billion by 2034, growing at a CAGR of 22.88% from 2025 to 2034. Rising technological advancements and the increasing demand for efficient manufacturing processes boost the growth of the augmented reality (AR) and virtual reality (VR) in manufacturing market during the forecast period.

Augmented Reality (AR) And Virtual Reality (VR) In Manufacturing Market Key Takeaways

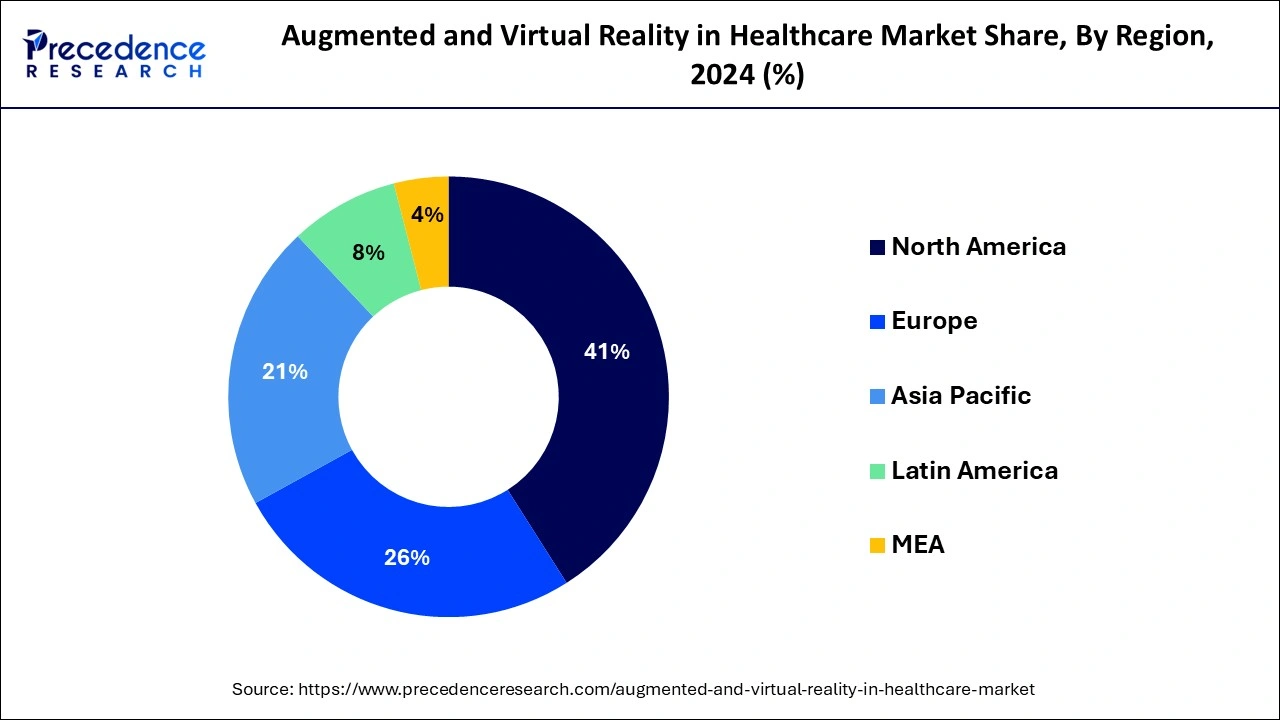

- North America dominated the global augmented reality (AR) and virtual reality (VR) in manufacturing market with the largest market share of 36% in 2024.

- Asia Pacific is expected to expand at a solid CAGR of 31.07% during the forecast period.

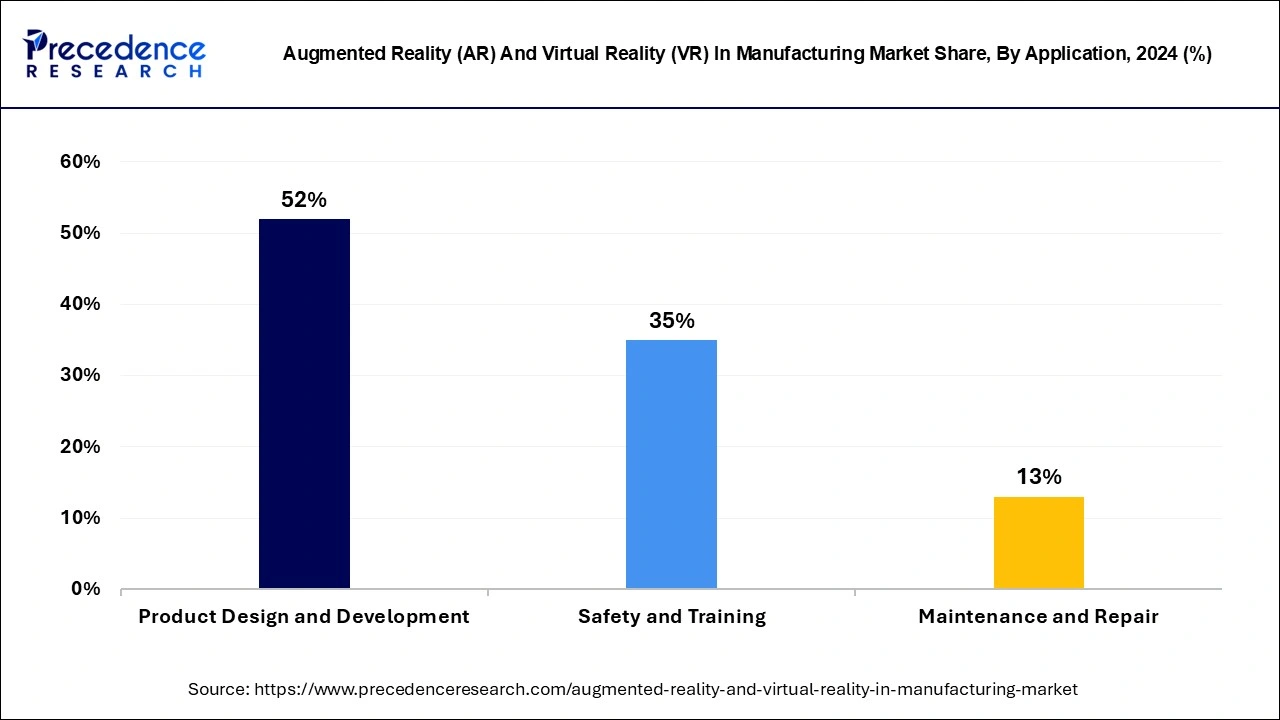

- By application, the product design and development segment contributed the highest market share of 52% in 2024.

- By application, the safety and training segment is projected to grow at a double digit CAGR of 27.14% during the forecast period.

- By technology, the augmented reality segment accounted for the highest market share of 74% in 2024.

- By technology, the virtual reality segment is expected to grow at a notable CAGR of 31.2% during the forecast period.

- By component, the hardware segment has held a major market share of 58% in 2024.

- By component, the services segment is expanding at a healthy CAGR of 29.1% over the forecast period.

- By device, the head-mounted display (HMD) segment recorded the highest market share of 62% in 2024.

- By device, the handheld devices segment I growing at the fastest CAGR of 29.1% during the forecast period.

Impact of AI on the Augmented Reality (AR) And Virtual Reality (VR) In Manufacturing Market

AI can have a positive impact on the market. AI algorithms help in creating personalized training programs by analyzing employees' interactions within AR and VR environments. AI algorithms have the ability to process and analyze vast amounts of data generated by AR and VR devices. This data allows manufacturers to optimize manufacturing processes. AI technologies detect manufacturing process flaws, reducing downtime and enhancing production output. Moreover, AI technologies provide guidance in the design process by simulating various scenarios in VR.

U.S. Augmented Reality (AR) And Virtual Reality (VR) In Manufacturing Market Size and Growth 2025 to 2034

The U.S. augmented reality (AR) and virtual reality (VR) in manufacturing market size was evaluated at USD 3.44 billion in 2024 and is predicted to be worth around USD 27.56 billion by 2034, rising at a CAGR of 23.13% from 2025 to 2034.

North America dominated the global augmented reality (AR) and virtual reality (VR) in manufacturing market with the largest market share of 36% in 2024. The U.S. contributed the most to this share due to the growing adoption of industrial revolution 4.0 in the manufacturing market.

Meanwhile,Asia Pacificis expected to expand at a solid CAGR of 31.07% during the forecast period.Japan and China held a significant share in the Asia Pacific market in 2022, and the continued rollout of 5G networks in the region is expected to further accelerate the adoption of AR and VR technologies in the manufacturing sector.

Market Overview

Augmented reality and virtual reality manufacturing is an advanced form of automation that incorporates digital technology into the production line. It combines the physical world with computer-generated graphics, data, and interactive elements to create an enhanced reality. Augmented reality (AR) and virtual reality (VR) technologies offer a 360-degree immersive experience in a simulated environment. Manufacturers are increasingly adopting AR and VR devices for simulative applications and to improve workforce training.

Key Benefits of AR and VR Technologies in Manufacturing are as follows:

- By enabling workers to envision designs and processes in 3D, AR/VR technologies are increasing output and effectiveness in the industrial sector. This decreases errors and speeds up production.

- By allowing virtual testing and prototyping, AR/VR technologies are lowering production costs by obviating the need for real prototypes and testing tools.

- By giving employees access to real-time information and training in a simulated environment, AR/VR technologies are enhancing safety in the industrial sector and lowering the likelihood of mishaps and injuries.

- Interactive product demonstrations and immersive encounters made possible by AR/VR technologies can improve the consumer experience and boost sales.

Augmented Reality (AR) And Virtual Reality (VR) In Manufacturing Market Growth Factor

- The growing emphasis on industrial automation is a major factor boosting the growth of the market.

- Rising advancements in AR and VR technologies to enhance the capabilities of image and sound capture contribute to market expansion.

- Companies are becoming awareness about the benefits of AR and VR technologies in training employees, thereby increasing their adoption. These technologies provide the immersive environment, which improves the learning process. The adoption of AR and VR can also assist organizations in cutting down R&D costs and redistributing resources for improved outputs.

- The rapid shift toward the Fourth Industrial Revolution and smart manufacturing fuels the growth of the market.

- The demand for AR and VR technologies in manufacturing industries is increasing due to the rising application of industrial robots, which can identify errors and offer real-time virtual support, reducing production downtime.

- Many governments are offering incentives and subsidies to encourage the adoption of advanced manufacturing technologies to support industrial automation initiatives.

Augmented Reality (AR) and Virtual Reality (VR) in Manufacturing Market Scope:

| Report Coverage | Details |

| Market Size in 2025 | USD 15.87 Billion |

| Market Size by 2034 | USD 100.01 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 22.88% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Technology, By Device and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Rise in government initiatives

Manufacturing sites need to be designed with emerging technologies in mind, and augmented reality can be utilized to improve worker safety and productivity. Many developing nations are taking initiatives and setting industry standards to drive the adoption of AR and VR on a global scale. For example, the National Electronics Policy proposed by MeitY aims to encourage innovation in emerging technologies such as 5G, IoT/sensors, AI, machine learning, VR, drones, robotics, additive manufacturing, photonics, and nano-based devices, particularly for early-stage startups.

There are also favorable initiatives to promote automation and innovation in the industry, and government support is increasing. The IEEE Standards Association has developed numerous IT and BP standards in Europe, which aim to develop global standards related to digital reality, AR, VR, human augmentation, and related areas, all of which are contributing to market growth.

Key Market Challenges

The potential for privacy and security issues with virtual reality

Augmented reality can give rise to privacy and security concerns. It blurs the line between what is real and what is not, which can lead to fears of being deceived or manipulated. This is particularly true in instances where social media users might be inclined to believe fake news if they see it posted by their Facebook friends. Augmented reality involves overlaying digital content onto the real world, and it has applications in entertainment and gaming, among other things.

Key Market Opportunities

Simplified repair process and improved quality management

AR technology can provide manufacturing companies with a more efficient way to manage equipment maintenance and quality control. In the past, employees had to rely on outdated manuals to identify and address problems with production equipment. However, augmented reality can eliminate the need for these traditional guides. By wearing AR-enabled wearable technology, employees can save time by quickly identifying and resolving issues, without having to refer to a manual.

Component Insights

The hardware segment has held a major market share of 58% in 2024and is expected to maintain its dominance over the forecast period. The growth of the hardware segment is attributed to the increasing adoption of AR and VR devices across various industries. Additionally, technological advancements, networking, and connectivity improvements are likely to drive the demand for AR and VR headsets in the market.

The services segment is expanding at a healthy CAGR of 29.1% over the forecast period. This growth is primarily due to the rise in immersive technology-related consulting and service offerings, including maintenance, training, and security services, which are expected to witness continued growth in the future.

The services segment is a new market, and several augmented and virtual reality technology companies are investing in service firms. For instance, in February 2022, ESI Group and CIMPA partnered to offer manufacturers integrated VR solutions with existing product lifecycle management processes.

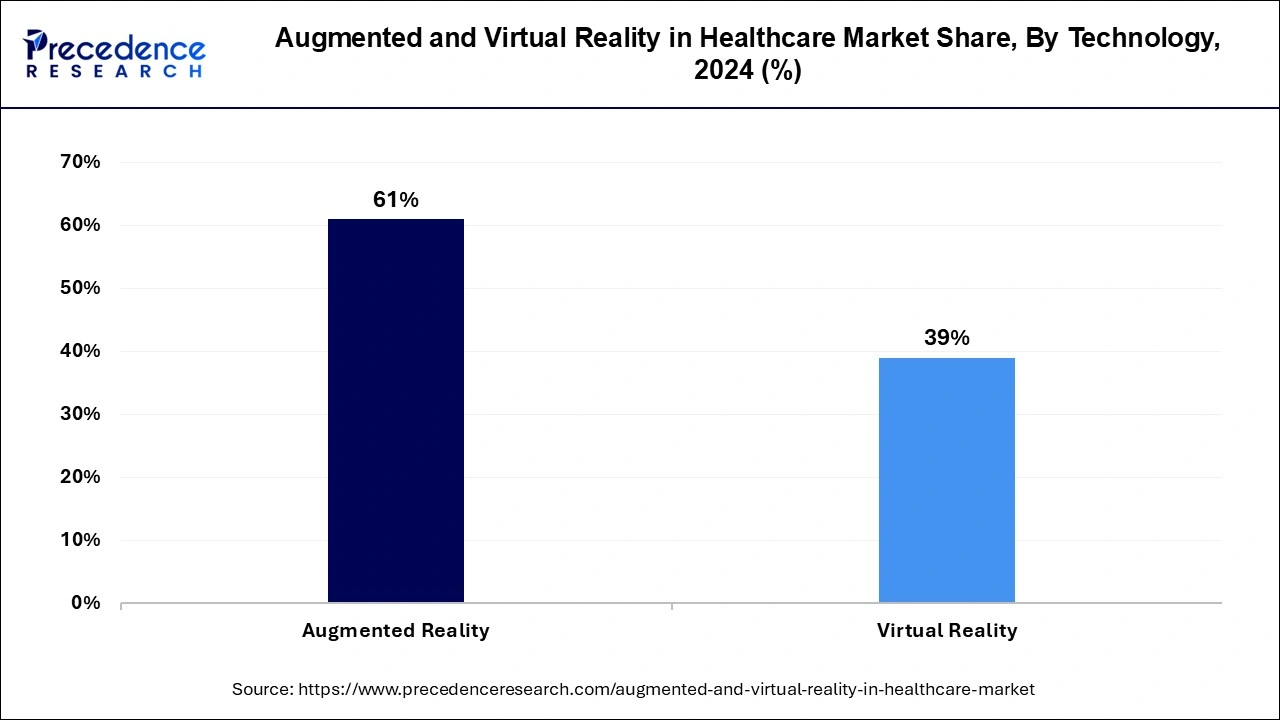

Technology Insights

The augmented reality segment accounted for the highest market share of 74% in 2024,mainly because manufacturers prefer AR technology since it enables them to access both manual and automated data simultaneously. This growth is also attributed to the use of AR technology for production training, improving process efficiency, and employee well-being, leading to an increase in the AR in manufacturing market. Additionally, the use of AR for maintenance in manufacturing plants is contributing to industry growth.

The virtual reality segment is expected to grow at a notable CAGR of 31.2% during the forecast period. This growth can be attributed to the widespread adoption of virtual reality and the increasing popularity of industrial IoT, industrial robots, and smart factories, which have created a primary platform for VR applications in the manufacturing industry. The ability of VR to offer a 360-degree content view experience in a highly immersive environment during modern production presents many opportunities for market growth.

Device Insights

The head-mounted display (HMD) segment recorded the highest market share of 62% in 2024, driven by the growing demand for HMD devices and smart glasses for enterprise and industrial applications. This trend is expected to continue throughout the forecast period due to the use of HMDs for product improvement.

The handheld devices segment I growing at the fastest CAGR of 29.1% during the forecast period. This growth is due to the increasing demand for high-quality immersive technology. Hand-held AR and VR devices provide users with the freedom to experience technological advancements without having to wear devices on their heads or sit near any display terminal. The rising popularity and growing user base of handheld devices are projected to further boost market demand.

Application Insights

The product design and development segment contributed the highest market share of 52% in 2024and is expected to continue dominating the market over the forecast period. By utilizing AR and VR technologies in product creation and development uses, manufacturers have boosted market competition. Therefore, the convenience of using AR and VR technologies for product design and development fuels the market growth.

The safety and training segment is projected to grow at a double digit CAGR of 27.14% during the forecast period. The maintenance and repair sector is driven by the demand for efficient enterprise maintenance and repair tools across companies. AR and VR in security and training have been gaining momentum due to the adoption of advanced technologies in training programs.

Augmented Reality (AR) and Virtual Reality (VR) in Manufacturing Market Companies

- Microsoft Corporation

- Google LLC

- Samsung Group

- Vuzix Corporation

- SkillReal

- Ediiie

- EON Realty, Inc.

- Kaon Interactive Inc.

- Worldviz, Inc.

- SoluLab

- ESI Group

Recent Developments

- In August 2024, Jeh Aerospace partnered with GridRaster to revolutionize aerospace manufacturing by integrating Spatial AI, AR, and VR technologies to enhance training and inspection processes.

- In May 2024, Siemens and Sony entered into a collaboration to develop a virtual reality headset for the industrial metaverse. This headset is designed using Siemens' NX software.

- In April 2024, AutoVRse, the AR and VR training solutions provider, partnered with JSW to revolutionize workplace safety training through VR technology.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Technology

- Augmented Reality

- Virtual Reality

By Device

- Head-mounted Display

- Head-up Display

- Handheld Devices

By Application

- Product Design & Development

- Safety & Training

- Maintenance & Repair

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting