April 2025

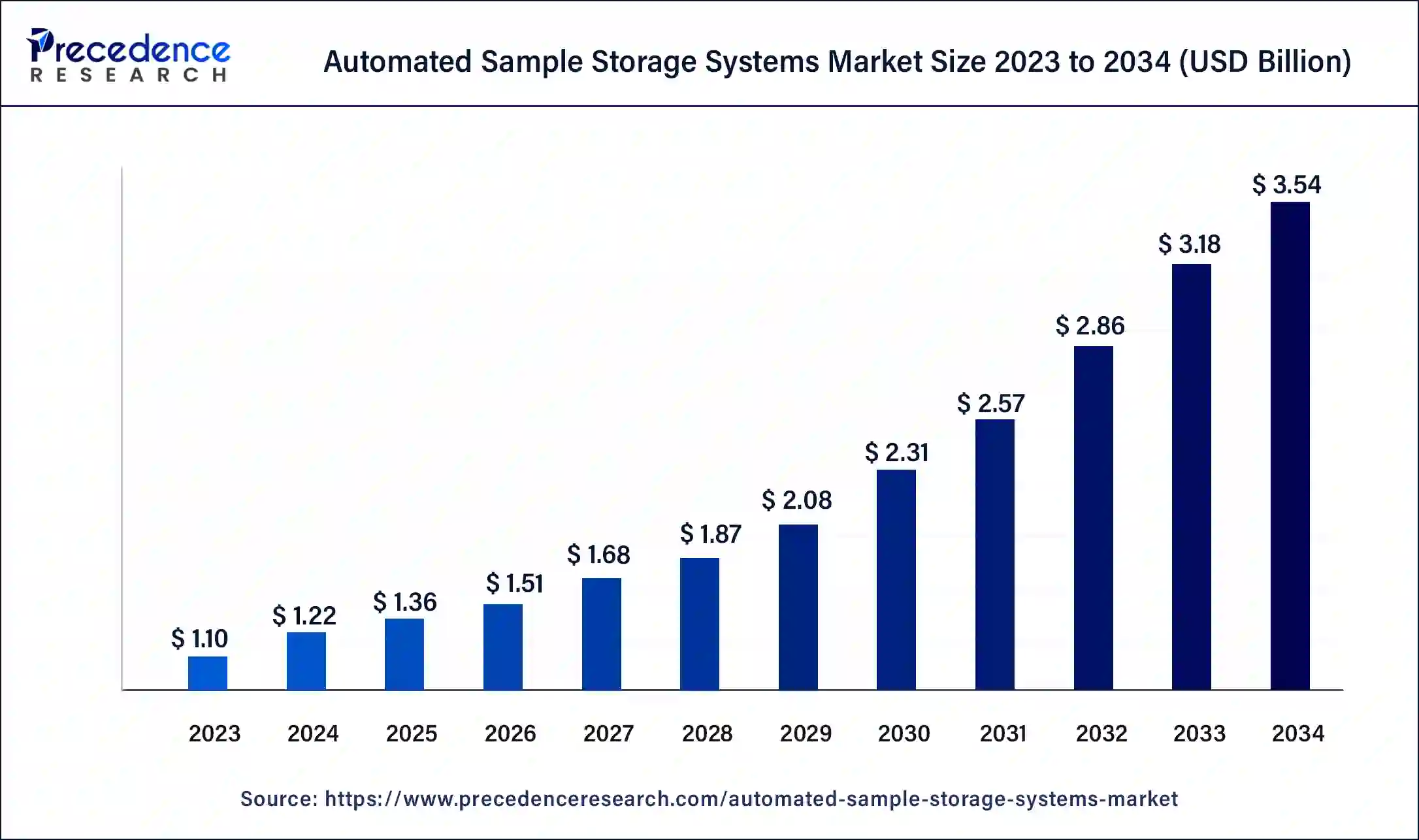

The global automated sample storage systems market size was USD 1.10 billion in 2023, calculated at USD 1.22 billion in 2024 and is expected to be worth around USD 3.54 billion by 2034. The market is slated to expand at 11.21% CAGR from 2024 to 2034.

The global automated sample storage systems market size is projected to reach around USD 3.54 billion by 2034 from USD 1.22 billion in 2024, at a CAGR of 11.21% from 2024 to 2034. The North America automated sample storage systems market size reached USD 420 million in 2023. The automated sample storage systems' benefits include helping to maximize sample accessibility and integrity, strong refrigeration designed for the protection of samples from disasters, and automated handling helps to improve sample protection and minimize sample temperature cycling.

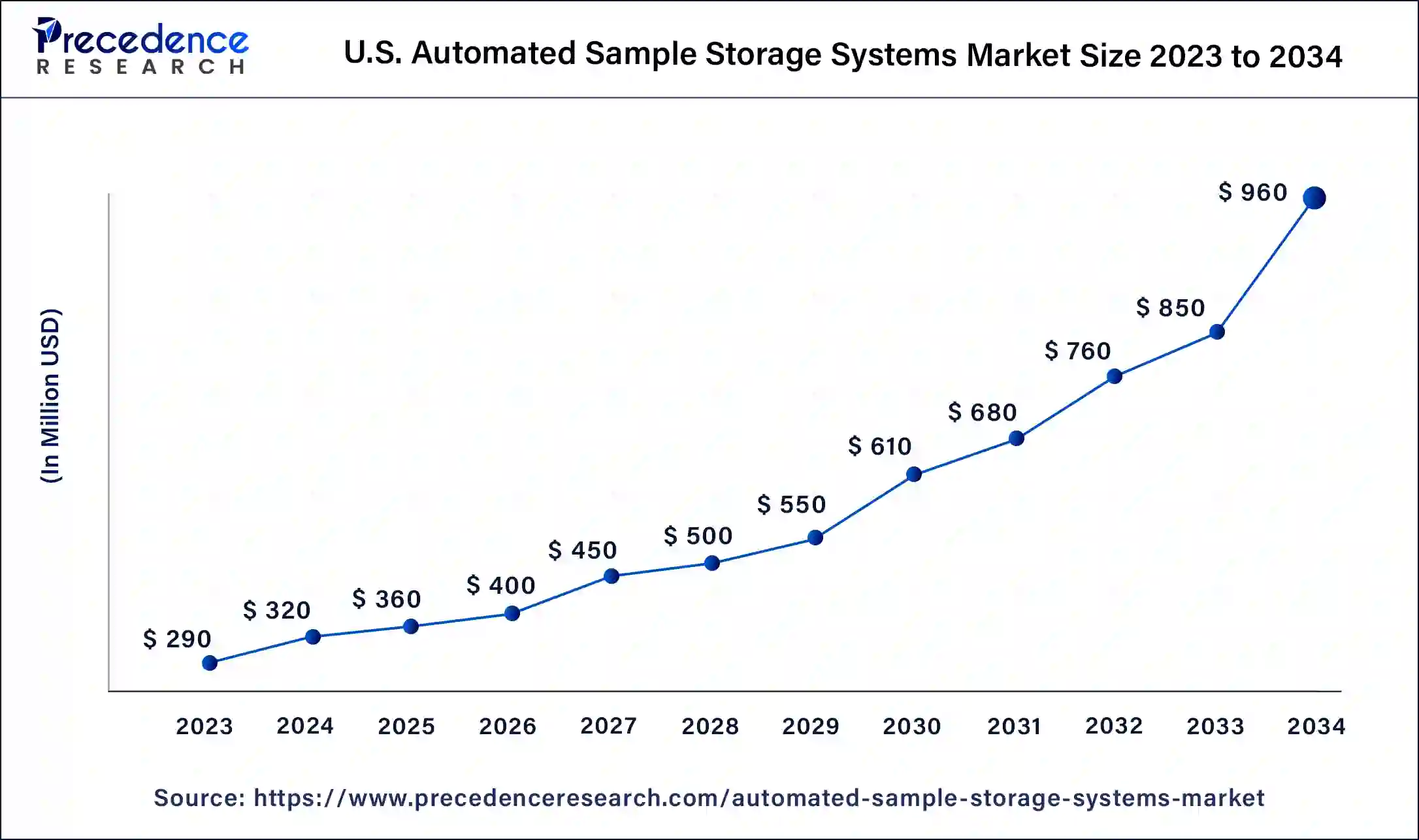

The U.S. automated sample storage systems market size was exhibited at USD 290 million in 2023 and is projected to be worth around USD 960 million by 2034, poised to grow at a CAGR of 11.49% from 2024 to 2034.

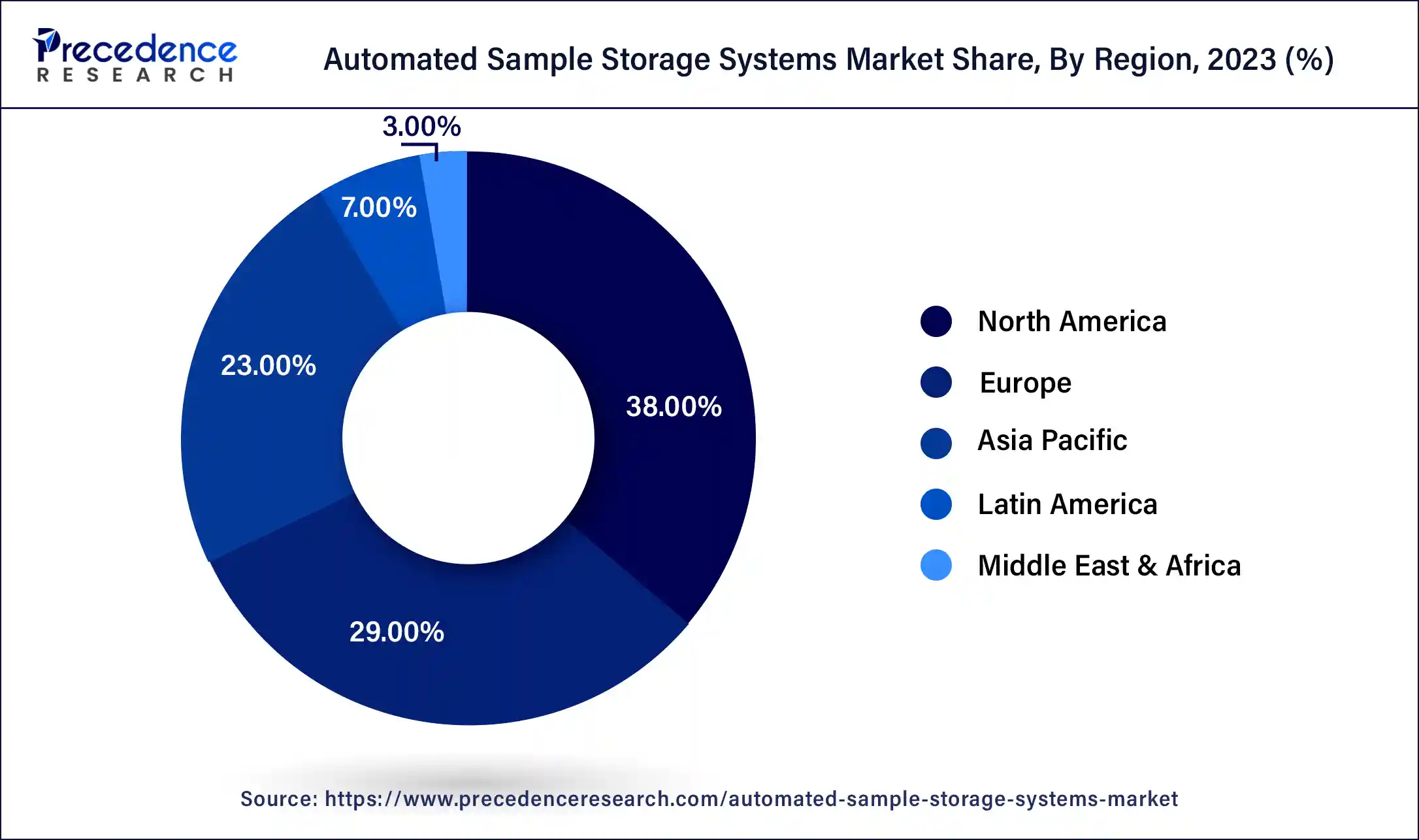

North America has contributed the biggest market share of 38% in 2023. Rising demand for laboratory automation, the presence of many market players, and supportive government initiatives contribute to the growth of the market in North America. A strong supplier network and easy availability of advanced technological products contribute to the growth of the market. The U.S. country is leading the growth of the market in the North American region. Strong refrigeration is designed for the protection of samples from disasters by key market players in North America.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. Significant investments from key players, a high number of patients to target diseases, and proceeding startups help the growth of the automated sample storage systems market in the Asia Pacific region. Improved ergonomics, tighter inventory control, improved picking throughput, increased picking accuracy, no need for manual search for samples, minimized sample temperature cycling, reduced costs and labor requirements, and improved floor space use can help the growth of the market in the Asia Pacific region.

Hamilton provides exact storage capacities with BiOS minus 80°C lab freezer.

| Example Capacities (Standard Racks) | BiOS M | BiOS L | BiOS XL |

| Hamilton 0.3mL | 906K–10.5M | 1.47M–17.0M | 3.26M–17.4M |

| Micronic 0.5mL | 661K–7.65M | 1.16M–12.5M | 2.40M–12.7M |

| Hamilton 0.6mL | 634K–6.8M | 1.00M–10.8M | 2.07M–11.0M |

| Hamilton 1.0mL | 392K–4.53M | 661K–7.65M | 1.47M–7.81M |

| Hamilton 2.0mL | 208K–2.41M | 343K–3.96M | 762K–4.05M |

| Nunc 5.0mL | 104K–1.14M | 166K–1.91M | 367K–1.95M |

The automated sample storage systems market refers to the computer-controlled storage devices that store samples like chemical compounds and biological samples used in many end-use industries, including life sciences, medical material management, seed storage and management, chemicals, etc. These systems help laboratory facilities retrieve and store samples effectively as necessary. The automated sample storage systems appear to offer the benefits of preserving sample quality, significant efficiency, and space-saving. The advantages of automated sample storage systems include streamlined sample management, energy efficiency, resource-saving with automation, and efficiency in sample retrieval.

How is AI Revolutionizing the Automated Sample Storage Systems?

AI-based automated sample storage systems help reduce many manual tasks and the complexity of traditional sample storage systems. The benefits of the use of artificial intelligence (AI) in automated sample storage systems include workload optimization, intelligent data tiering, and automated provisioning. Committed storage personnel may spend less time managing and monitoring storage systems as a result. AI-based automated sample storage systems can help to support recovery capabilities and intelligent backup.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.54 Billion |

| Market Size in 2023 | USD 1.10 Billion |

| Market Size in 2024 | USD 1.22 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Sample, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising investments in pharmaceutical and biotech industries

The rising investments in pharmaceutical and biotechnology industries contribute to the growth of the market. Rising demand for managing and storing large volumes of samples, including compounds and specimens, across the healthcare, biopharmaceutical, and pharmaceutical industries contribute to the growth of the automated sample storage systems market. The use of automated sample storage systems in pharmaceutical and biotech industries helps to improve remote monitoring, reduce equipment maintenance costs, and prevent failure. These factors help to the growth of the market.

Limitations of automated sample storage systems

The limitations of automated sample storage systems include the high costs of sample storage for short periods, differential requirements for sample management, psychological dependence on automation, increased risk of downtime, increased generation of vibrations, noise, and heat, overcrowding of personnel, infrastructure constraints and space requirement, increased costs for supplies, energy, and maintenance. These factors can hamper the growth of the automated sample storage systems market.

Research and development

The research and development in automated sample storage systems can be an opportunity to contribute to the growth of the market. To overcome the limitations like high costs of sample storage for a short time, psychological dependence on automation, different requirements for sample management, increased generation of noise, heat, and vibrations, increased risk of downtime, infrastructure constraints, and space requirements.

The automated compound storage system segment dominated the automated sample storage systems market with the largest market share of 51% in 2023. Automation plays an important role in compound storage management of automated sample storage systems. The benefits of an automated compound storage system include meeting consumer demand to maximum return on investments by effective life cycle planning, system availability, and cost reduction. This helps in reagent and compound tracking, permission levels of users, full standardized documents, rapidly increased productivity, and centralized storage of multiple containers, and adapts to changing needs without disruption. These factors help to the growth of the automated compound storage system segment and contribute to the growth of the market.

The automated liquid handling system segment is expected to be the fastest-growing during the forecast period. The automated liquid handling system benefits include increased productivity and satisfaction, time-saving, limited wastage, lowering costs, eliminating contamination and carryover, increased precision, accuracy, and speed, and reducing repetitive strain injuries and manual tasks. It also helps minimize human errors, which are always a risk in the laboratory, increases walk-away time, fast-track results, and supports high throughput workflows, which help the growth of the market. These factors help the growth of the automated liquid handling system segment and contribute to the growth of the automated sample storage systems market.

The compound samples segment led the market in 2023, with a market share of 66%. The increasing demand for compound samples in academic research institutes and biobanks contributes to the growth of the segment. Compound samples play an important role in pharmaceuticals, which are essential for the development and discovery of various medications, transdermal gels, topical creams, liquid suspensions, etc. The automated compound sample storage system helps to save space, maximize efficiency, streamline sample management, reduce cooling demands, increase energy efficiency, save resources with automated labor, protect sample quality, and increase efficiency in sample retrieval.

The biological samples segment is estimated to be the fastest-growing during the forecast period. In pharmaceutical research and development, biological samples play an important role. The benefits of biological samples include helping researchers with drug development and testing to understand potential side effects, safety, and drug efficacy; diverse populations help the development of disease treatments, and human-diseased cell lines, organs, tissues, and bodily fluids are essential for identification and validation of drug targets, personalized medicines, translational research, infectious diseases research, and antimicrobial resistance studies.

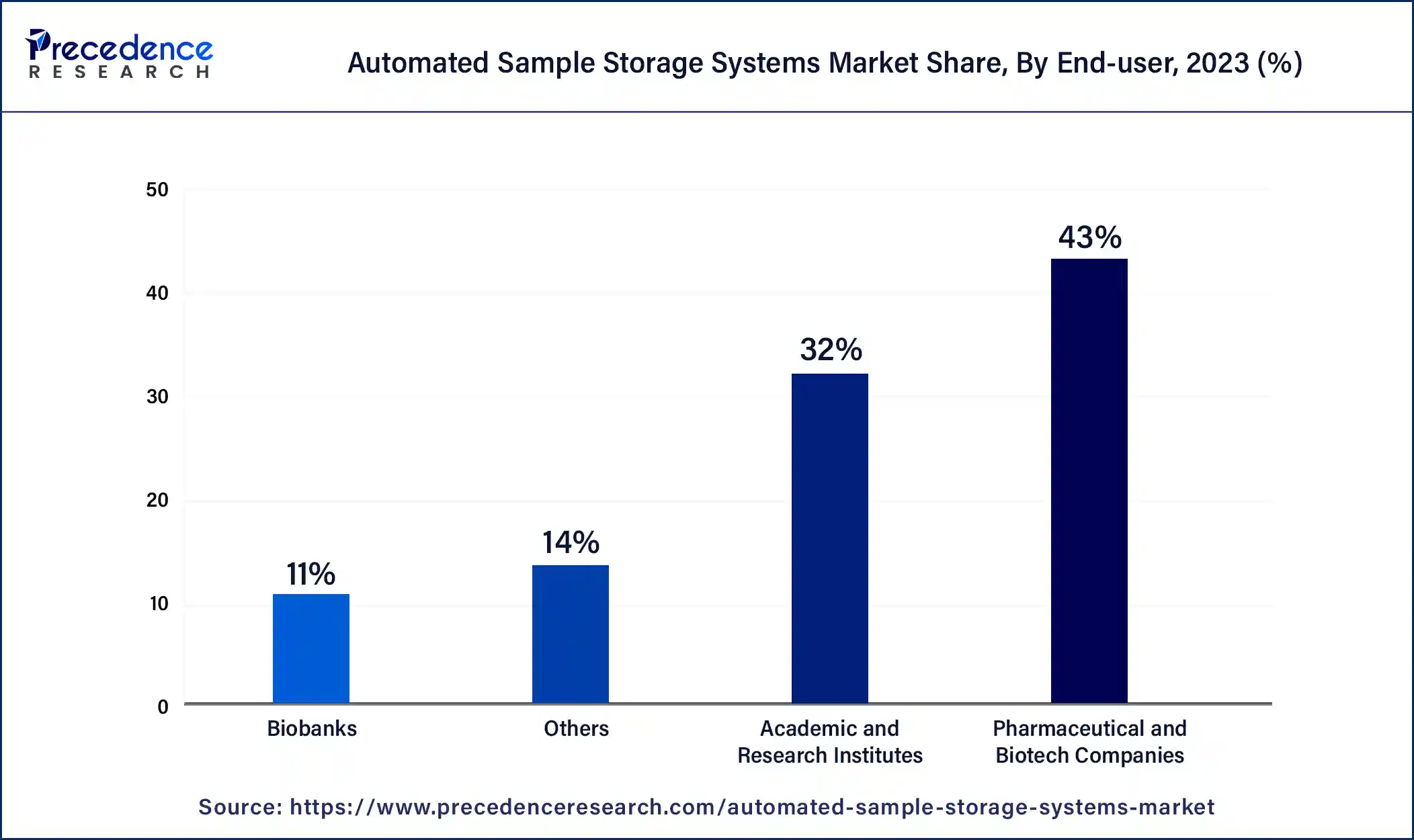

The pharmaceutical and biotech companies segment accounted for a major market share of 43% in 2023. Automated sample storage systems play an important role in pharmaceutical and biotech companies for drug discovery, research, and development. These systems are designed to store biological samples obtained from living organisms, including plants, animals, or humans, like genetic materials, cells, bodily fluids, and tissues, and compound samples, including a mixture of chemical compounds that may be synthetic or naturally occurring. Rising research & developments by pharmaceutical and biotech companies for drug discoveries have led to increased demand for automated sample storage systems.

The biobanks segment is anticipated to be the fastest-growing during the forecast period. The benefits of biobanks include access to a large pool of samples with data and support at the time of ongoing sample acquisition, biobanks are helpful for low or middle-income countries, high-quality control and assurance measures in place, making them reliable and safe spaces to store the samples, high-quality samples and data compliance to the high-quality standards throughout the entire work process.

Segments Covered in the Report

By Product

By Sample

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

December 2024

November 2024

November 2024