April 2025

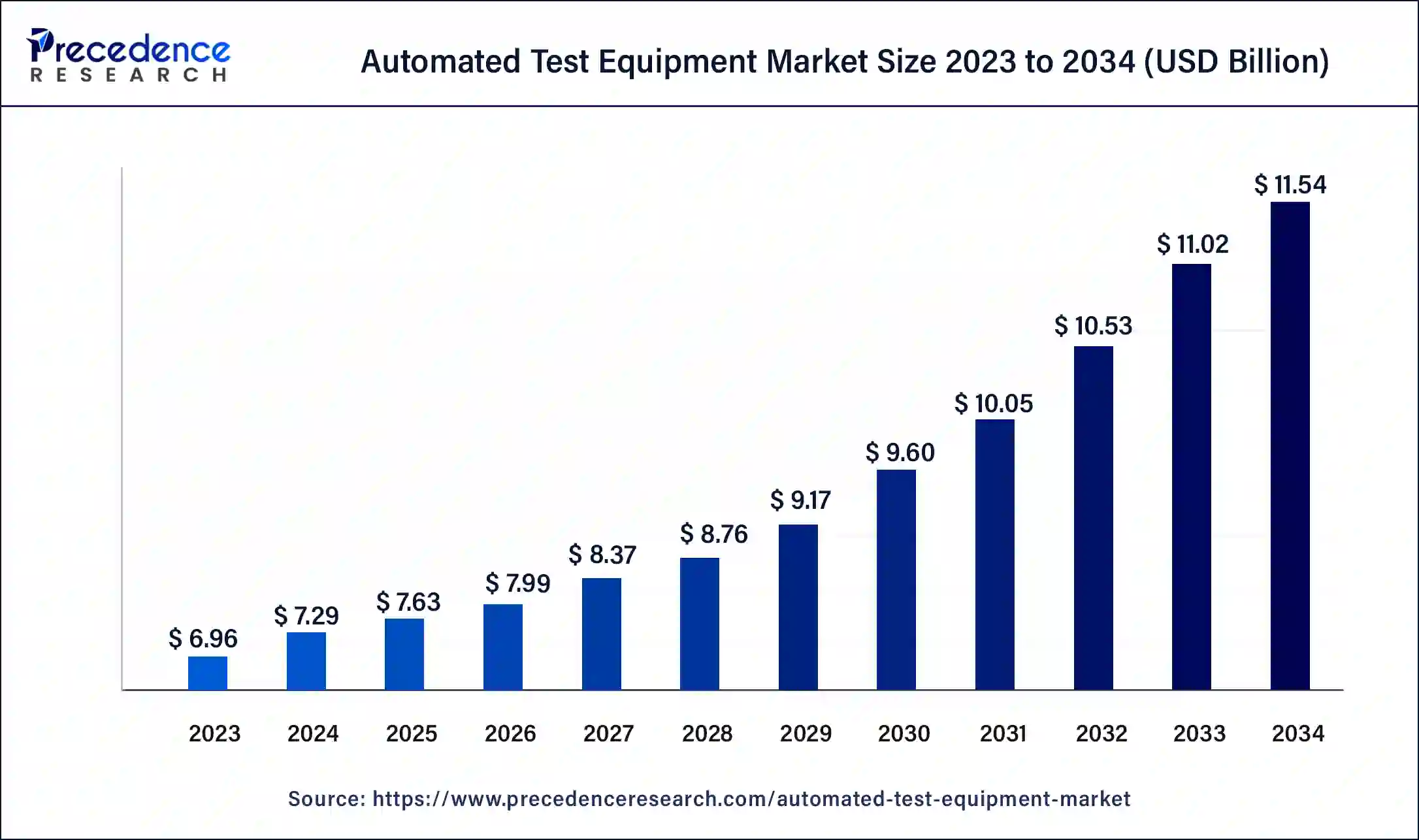

The global automated test equipment market size was valued at USD 6.96 billion in 2023, calculated at USD 7.29 billion in 2024 and is expected to reach around USD 11.54 billion by 2034, expanding at a CAGR of 4.7% from 2024 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automated test equipment market size accounted for USD 7.29 billion in 2024 and is expected to reach around USD 11.54 billion by 2034, expanding at a CAGR of 4.7% from 2024 to 2034.

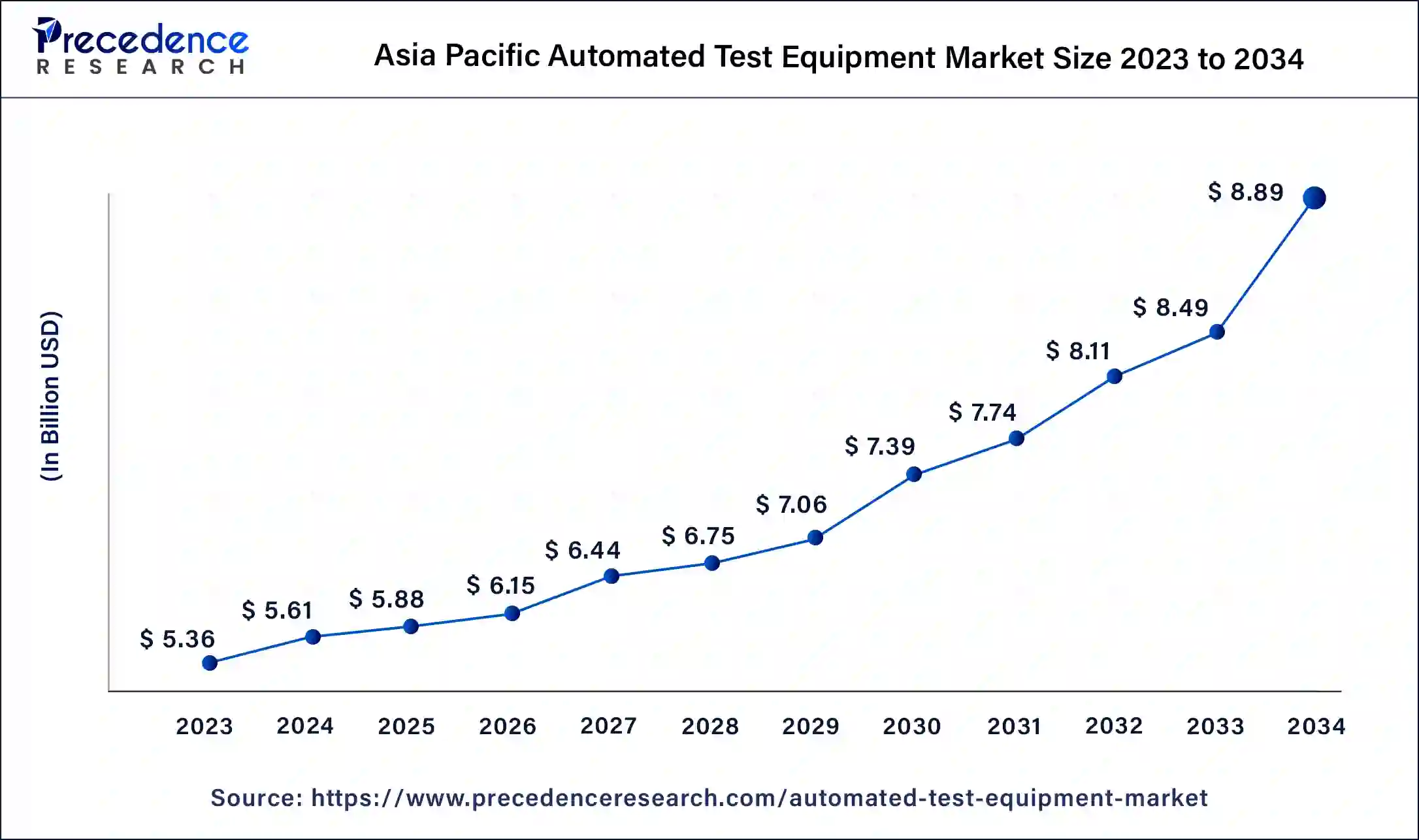

The Asia Pacific automated test equipment market size was exhibited at USD 5.36 billion in 2023 and is predicted to be worth around USD 8.89 billion by 2034, at a CAGR of 4.9% from 2024 to 2034.

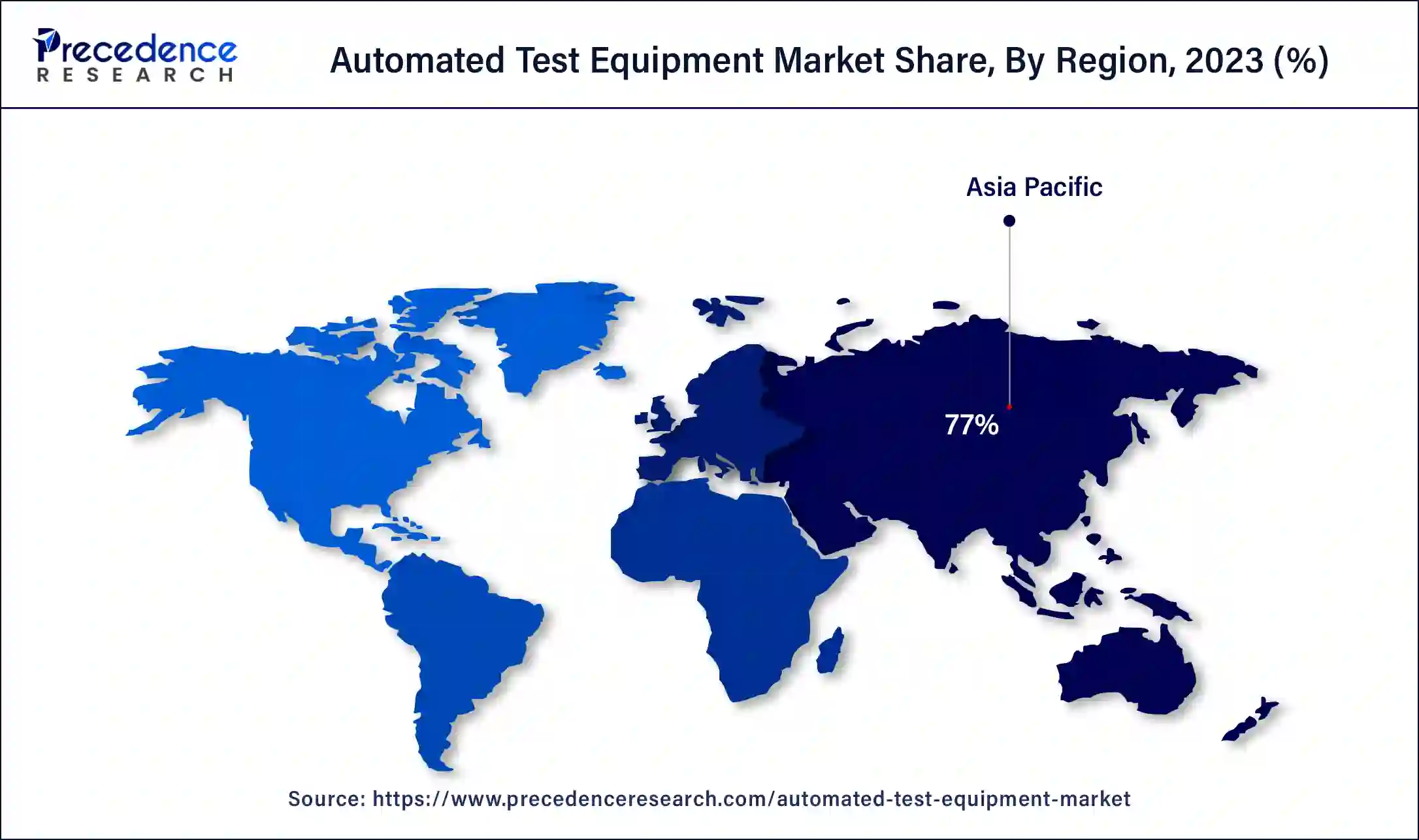

The Asia Pacific region is estimated to dominate the market with the contribution of more than 77% of revenue share in 2023 owing to the presence of major market players in the region. China and Taiwan in this region will dominate the market share. Some of the future technologies that are adapted by the major market players in this region includes faster mixed-signal testers, fine-pitch probe cards, Adaptive testing, advanced Design-For-Test (DFT), design standards and others. Additionally, the supportive Government policieswith the provision of incentives and tax benefits offered by the Government of the developing nations such as India and China for the establishment of the fabrication plants will fuel the market growth. Such establishments of the fabrication plants will facilitate the production of semiconductor equipment’s including assembly, packaging, and automated test equipment and these factors are anticipated to drive the growth of the automated test equipment market in the Asia Pacific region.

North America is also expected to witness a remarkable growth in the upcoming yearsowing to the increase in adoption of automated test equipments in the aerospace and defense sector.

The rapid growth of the automotive and semiconductor industry is expected to drive the market growth. The surge in demand for high quality consumer electronics products will contribute positively towards the market growth. The semiconductor companies deploy the automated test equipment in order to amplify the performance capability, speed of operation and to reduce the cost of production of the semiconductor devices. These attributes are expected to drive the growth of the automated test equipment market.

The rise in demand for the System on chip devices will fuel the market growth. Also, the increase in electronics components in the automobiles and the rapid increase in demand for the electric vehicles in the market is anticipated to boost the market. Furthermore, with the enhancement of technology integrated with the design complexity of the electronic components that needs essential testing are the factors that will positively impact the growth of the automated test equipment market.

The rise in demand for the implementation of 5G technology across the world is the major factor in the telecom industry that is expected to drive the market growth. On 27th April 2021, Marvin Test Solutions, Inc. a provider of innovative test solutions for military, aerospace, and manufacturing organizations announced that, its product TS-900e-5G production test system for 5G mm wave semiconductor devices is extensively used by the semiconductor manufacturers. The extensive use of these solutions is due to the attribute that it enables manufacturers to meet high-throughput production demands for mm Wave semiconductor devices. TS-900e-5G is ideal for both wafer probing and package test with support for most popular production automation and handling tools. Moreover, the advancements in the semiconductor manufacturing processes along with the expansion of the wireless networks across the globe will significantly impact the growth of the automated test equipment market.

The rise in demand for the automated test equipment’s across diverse industry verticals such as consumer electronics, IT and telecommunications, defense, automotive, healthcare and others is expected to foster the market growth rate. It also helped in reducing the producing cost and the time utilized in the manufacture of the devices. It helps in checking the performance of the electronic devices and this helps in preventing a faulty device from entering into the market. All these factors are estimated to fuel the growth of the automated test equipment market.

The presence of favorable Government policies for the development of semiconductor devices, and the heavy investments made by the Government of the developing nation such as China, India, Taiwan and others to produce advanced semiconductor manufacturing plants is estimated to drive the growth of the automated test equipment market.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.96 Billion |

| Market Size in 2024 | USD 7.29 Billion |

| Market Size by 2034 | USD 11.54 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.7% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Largest Market | APAC |

| Fastest Growing Market | North America |

| Segments Covered | Product, End User, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Based on the Product, the market is divided Non-Memory ATE, Memory ATE and Discrete ATE. In the product segment, the non-memory automated test equipment’s is expected to dominate the market with a market share of more than 67% in terms of revenue in 2023. The market dynamics is significantly changed with the innovation of internet of things(IoT) devices and autonomous vehicles. The demand for the automated test equipment’s has been increased in the defense and aerospace sectors for developing defect free devices. These attributes act as the drivers of the market.

Also, the complexities involved in the manufacturing of the semiconductor chips require a robust testing process that can be ensured by the use of automated test equipment’s. Therefore, the rise in demand for the semiconductor chips in the market is anticipated to drive the growth of the automated test equipment market.

Based on the end use, the IT and telecommunication segment accounts for the largest market share contributing more than 50% of the global revenue in 2023. The increasing penetration of semiconductors in the manufacture of IT system components and the telecom equipment will contribute significantly towards the growth of the automated test equipment market. The rise in complexity and performance level of the semiconductor devices used in the electronics products along with the enhancement of semiconductor device technology is anticipated to fuel the market growth.

In the aerospace and defense sector, the electronic devices used should be of high quality as any defect may lead to serious accidents and therefore the manufacturing of the electronic devices for the aerospace and defense sector, must be tested thoroughly with the help of automated test equipments and this attribute is estimated to fuel the market growth.

Furthermore, the increase demand for the consumer electronics products is estimated to drive the market growth. Also, with the surge in demand for the electric vehicles in the automotive industry has positively impacted the growth of the market.

By Product

By End User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

February 2025

March 2025

January 2025