April 2025

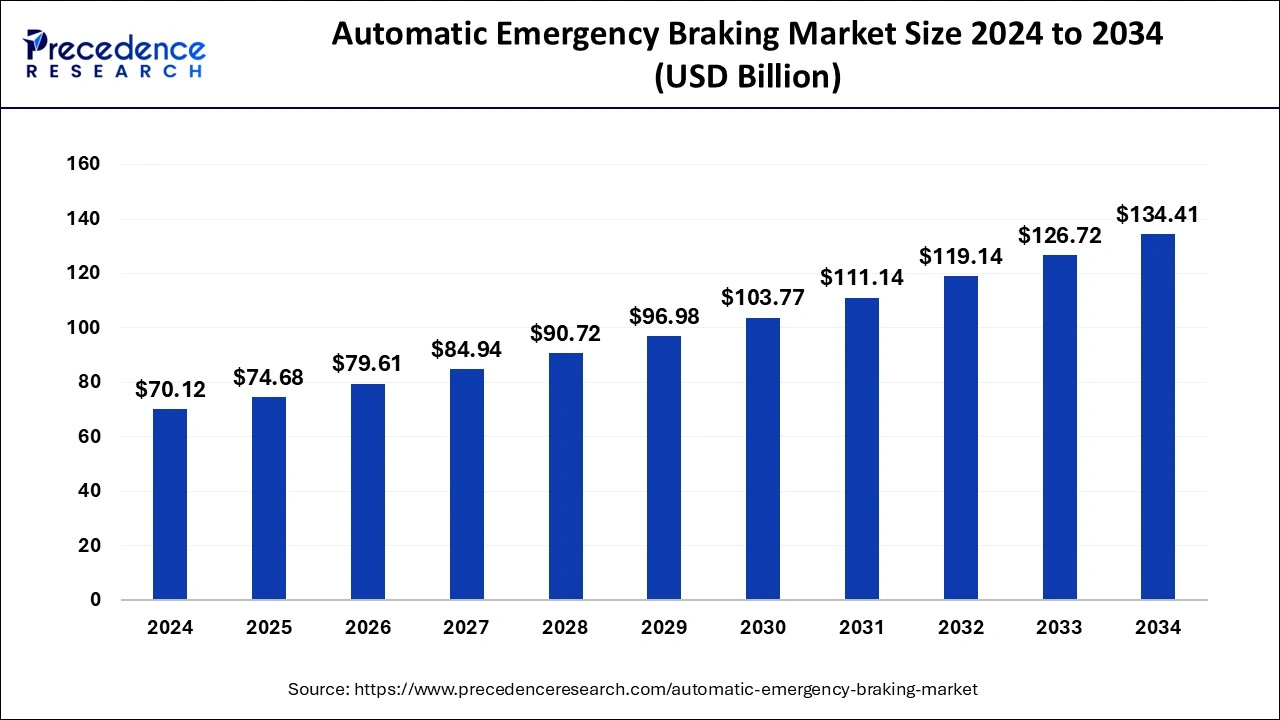

The global automatic emergency braking market size is calculated at USD 74.68 billion in 2025 and is forecasted to reach around USD 134.41 billion by 2034, accelerating at a CAGR of 6.72% from 2025 to 2034. The Asia Pacific automatic emergency braking market size surpassed USD 27.63 billion in 2025 and is expanding at a CAGR of 6.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automatic emergency braking market size was accounted for USD 70.12 billion in 2024 and is anticipated to reach around USD 134.41 billion by 2034, growing at a CAGR of 6.72% from 2025 to 2034. The adoption of advanced driver assistance systems in recently manufactured vehicles, improvements in vehicle positioning systems equipped with radar sensors along with the rising interests of researchers and manufacturers in developing real-world solutions for enhancing automotive safety is driving the growth of automatic emergency braking market.

AI plays an important role in automatic emergency braking (AEB) systems by analysing data from cameras and radar sensors to predict potential collisions, for determining the risk of collision, in decision-making such as automatically applying brakes for preventing or mitigating accidents and by detecting pedestrians leading to better protection of vulnerable road users thus making the braking response system more reliable, enhanced and safer. Moreover, the increased adoption of AI and deep learning tools in advanced driver assistance systems is helping in improving driving experience.

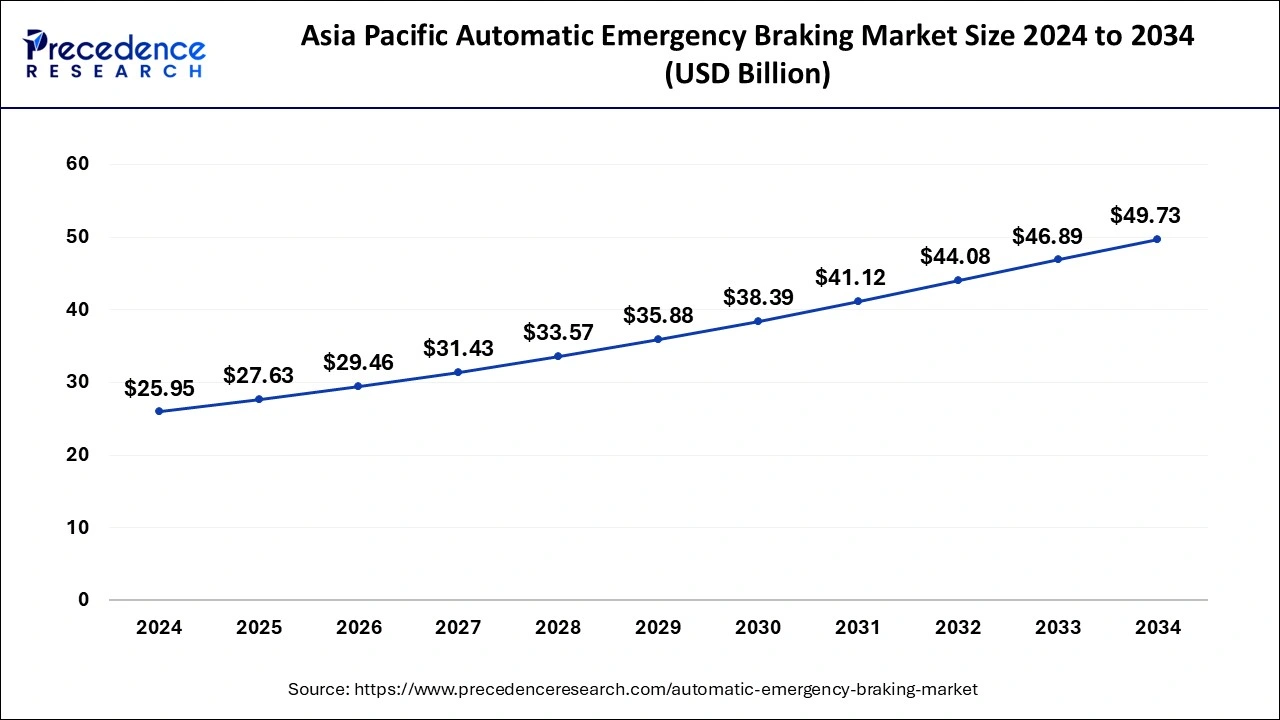

The Asia Pacific automatic emergency braking market size was evaluated at USD 25.95 billion in 2024 and is predicted to be worth around USD 49.73 billion by 2034, rising at a CAGR of 6.74% from 2025 to 2034.

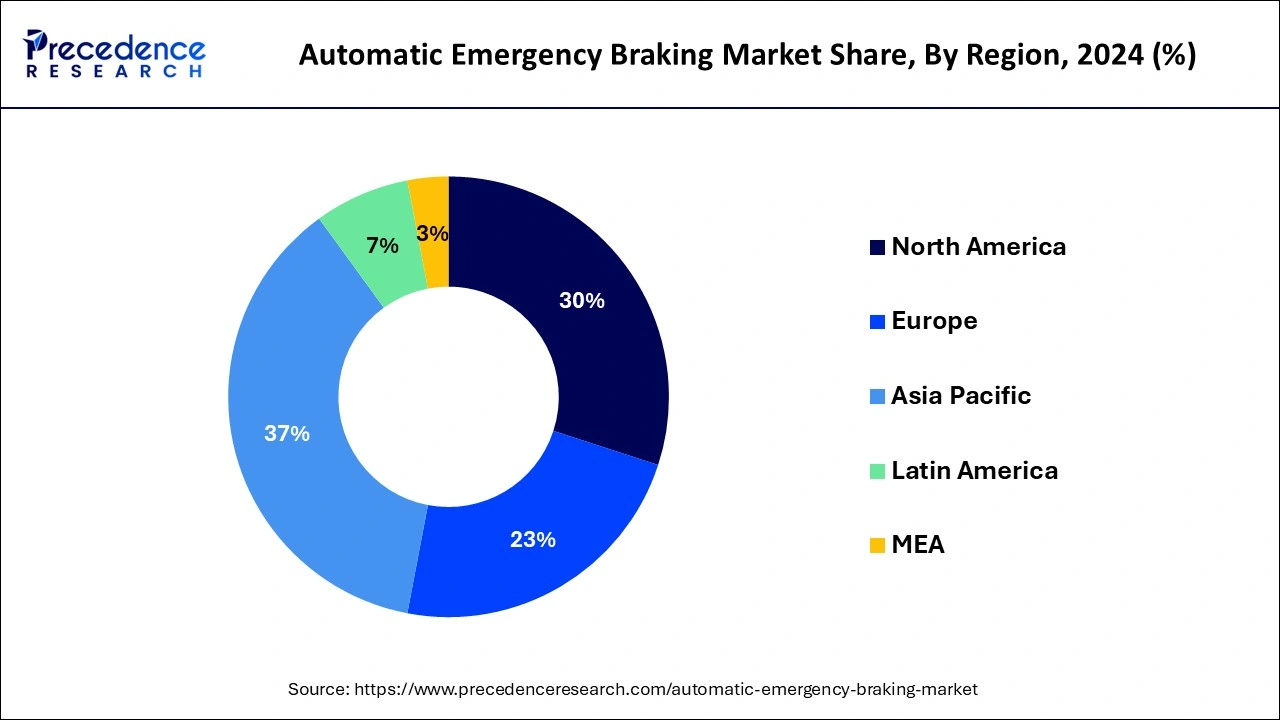

Asia Pacific region dominated the global market in 2024. The growth can be attributed to the increased consumer demand for vehicles with advanced safety features, presence of large manufacturing industries, implementation of regulations by government, rising disposable incomes and technological advancements in developing and integrating AEB systems in new cars as well as remodelled cars thereby fuelling the market dominance of this region.

Passenger cars and commercial vehicles also saw considerable drops in output, with 16.9% and 11.6 percent declines, respectively. But on the other hand, global electric vehicle (EV) sales surged by 39% to 3.2 million units in 2020, bringing the entire global EV stock to 11.3 million units. The International Organization of Motor Vehicle Manufacturers' newest figures show a considerable drop in output across all manufacturing regions, with the most significant drops in Latin America (24.8 percent), Western Europe (24%), and North America (24%). As of 2021, Germany ranked second in EV sales, after China, by overtaking U.S. in 2020. In terms of sales share, Norway was the top country with 75% of cars sold in Norway being electric, followed by Sweden, Netherlands, and Denmark (16%). This trend is expected to prevail during the long run and will drive the market growth.

Nissan has claimed that autonomous emergency braking will be standard on a million vehicles in the United States by 2018.Except for those equipped with a manual transmission or a Nismo version, the AEBS technology will be added to the Rogue (X-Trail), Rogue Sport (Qashqai), Altima (Teana), Murano, Pathfinder, Maxima, Sentra (Sylphy), and Leaf EV.

Kia Australia intends to put out its Autonomous Emergency Braking (AEB) technology on the Picanto, which already boasts a long list of excellent features. To avoid crashes or lessen their consequences on other vehicles, the technology uses a radar-based system. This feature gives the Picanto a distinct advantage over the competition.

The stringent and mandatory regulations set by the National Highway Traffic Safety Administration (NHTSA) for equipping all new passenger cars and light truck with AEB systems by September 2029 which will include safety features such as pedestrian detection capabilities. These regulations imposed by the NHTSA will make U.S the first country in the world adopting Long-Wave Infrared (LWIR) cameras thereby significantly boosting the market growth in the upcoming years.

Automatic emergency braking is a mechanism that automatically applies the brakes in an emergency and helps to reduce the severity of a collision. The road vehicle safety system includes sensors that monitor the proximity of cars in front of them and recognizes situations when the vehicle's relative speed and distance from the obstacle signal a collision is likely to occur. Automatic emergency braking (AEB) is a popular active safety device for averting rear-end and pedestrian crashes. Based on video detection of an item in front of the car, this system is an advanced assistance system that detects impending crashes and reacts by automatically engaging the brakes.

During the early months of the global COVID-19 outbreak, the car industry was slammed heavily and it affected on the braking system as well. Automotive sales in China decreased 71 percent in February 2020 and by April sales in the U.S. declined by 47 percent. In Europe, to sales dropped by 80 percent in April 2020. But the automotive industry bounced back faster than expected. Automakers all over the world saw an increase in production levels from the third quarter of 2020 to the first quarter of 2021.The pandemic has accelerated tendencies across the mobility value chain that were already developing before it happened, as it did in other industries and geographic regions. Just like car buying, digitalization is also increasing efficiency in production. With supply chain optimization elements are more consistently tracked across the particular supply chain. This, too, is a continuation of a pattern that began long before the COVID-19 pandemic. Such factors helped the industry get back on track quickly.

| Report Coverage | Details |

| Market Size by 2034 | USD 134.41 Billion |

| Market Size in 2025 | USD 74.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Largest Market | Asia Pacifc |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Tecnology, Vehicle Type, Brake, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

On the basis of product type the market is segmented on two sub segments; Low-speed AEBS and High-speed AEBS. High –speed AEBS holds the highest market share while Low-speed AEBS is the most lucrative segment. Low-speed AEB, also known as city AEB, operates at speeds ranging from walking to roughly 30 km/h, with only one camera keeping a watch on the road ahead. High-speed systems employ more advanced cameras, sensors, and radars, allowing them to operate at speeds much exceeding Australia's 110km/h highway limit.

The system monitors the speed and distance of objects in the vehicle's path using cameras, sensors, or radars - or a mix of the three - and intervenes if the driver fails to respond in an emergency situation. If the car senses a probable accident, it may issue auditory and/or visual warnings to the driver before applying the brakes autonomously, even if the driver does not. The car will attempt to either lessen the impact of a collision or stop before an event happens using a combination of anti-lock brakes (ABS) and electronic stability control (ESC).

The AEBS is divided into two categories based on technology; crash imminent braking (CIB) and dynamic brake support (DBS). Dynamic brake support system is expected to remain dominant during the forecast time period. In circumstances where the driver fails to apply any braking or steering in response to an FCW warning, CIB systems additionally use forward-looking sensors to offer the information needed to determine when autonomous braking is necessary to avoid or lessen the impacts of a crash.In this case, a CIB system will automatically apply braking (varying from partial to complete braking based on the system design and circumstances) in an attempt to avoid or lessen the crash.

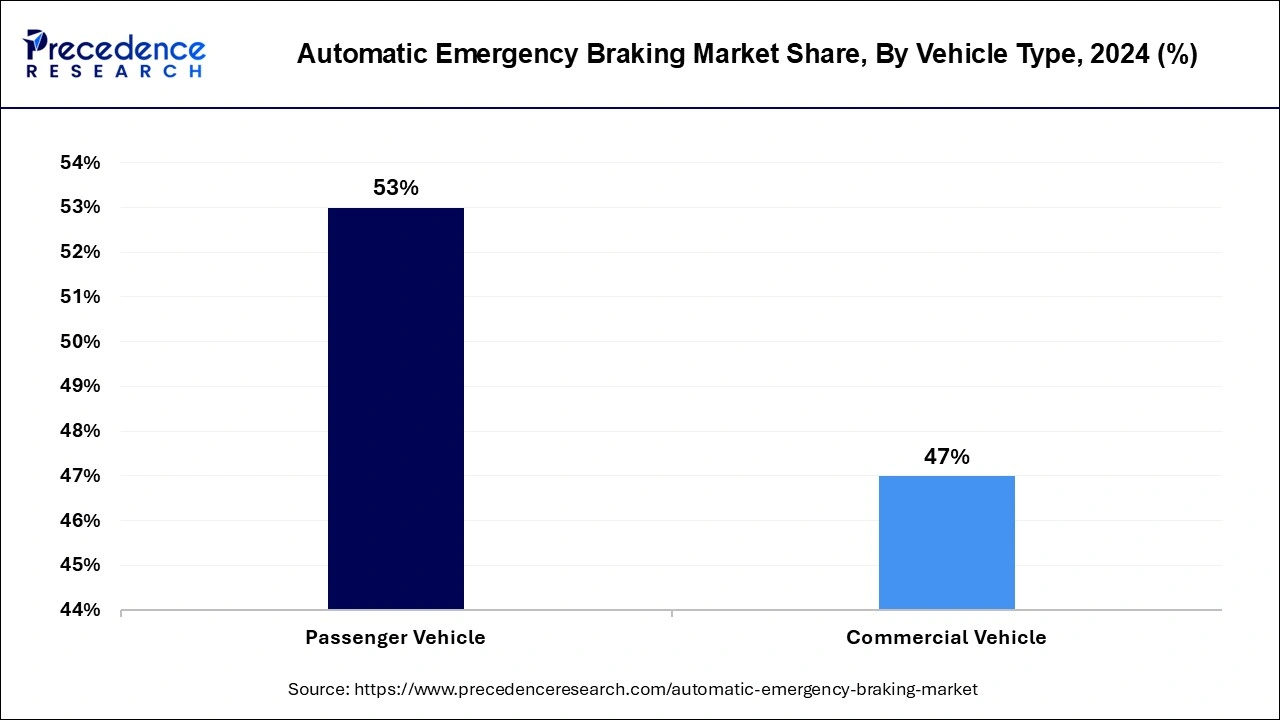

The market is divided into passenger and commercial vehicles based on vehicle type. Passenger cars are known as the motor vehicles which comprise of at least four wheels, and are used for the transportation of passengers, have no more than additional eight seats to the driver's seat. Passenger cars are vehicles with at the least four wheels, applied for the transfer of passengers, in addition to comprising only 8-10 seats as well as the driver's seat. Commercial automobiles include light industrial vehicles, heavy pickup trucks, coaches and vehicles. Light commercial automobiles are automobiles together with at least 4 wheels, used for carrying goods. Buses and coaches are employed for the transfer of passengers, composed of greater than eight car seats as well as the driver's seats, and having a new maximum mass more than the limit of light industrial vehicles. Heavy pickup trucks are vehicles designed for the transfer of heavy goods. Optimum authorized mass is finished the limit of light industrial vehicles. They contain tractor vehicles made for towing semi-trailers.

By Product

By Technology

By Vehicle Type

By Brake

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

July 2024