January 2025

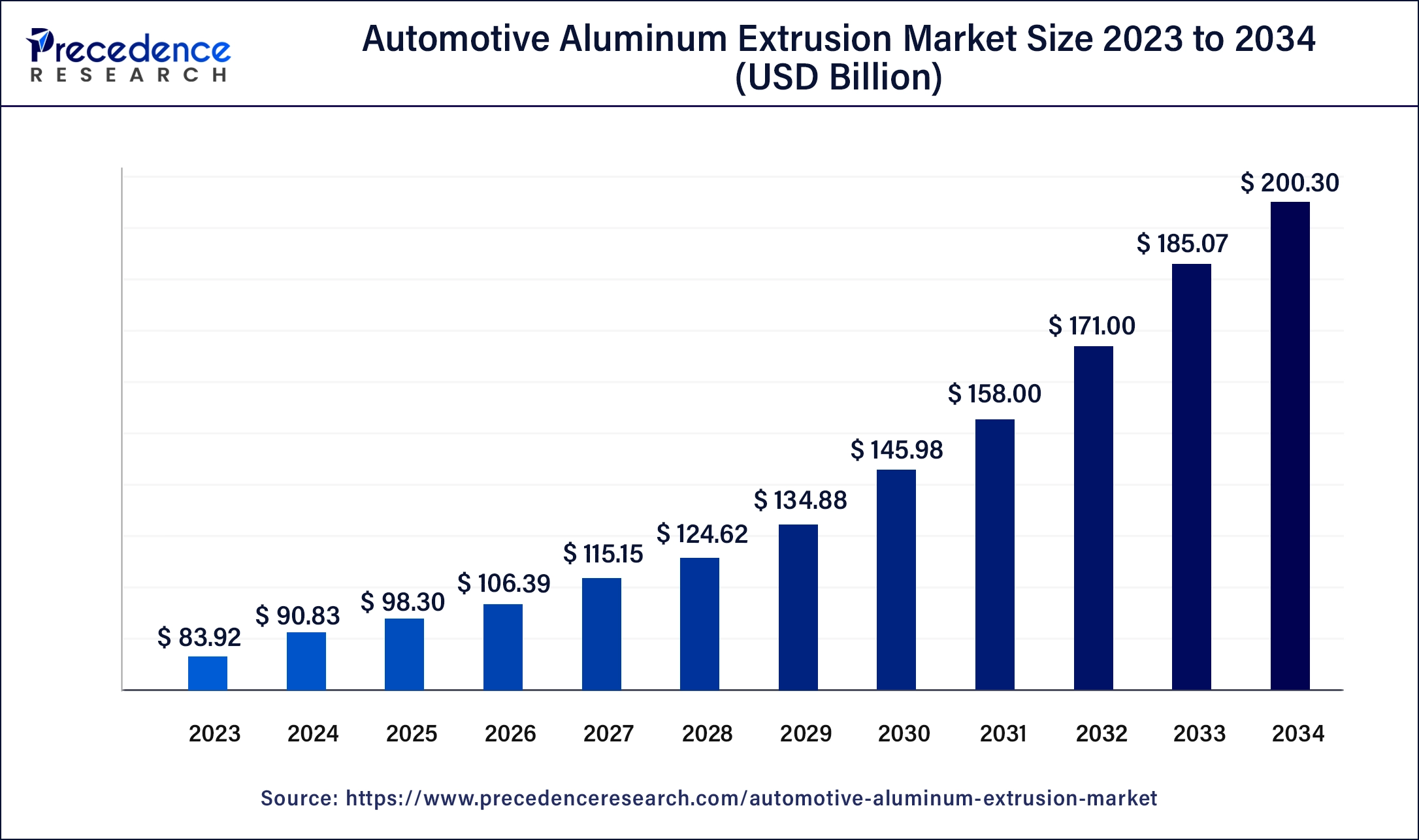

The global automotive aluminum extrusion market size was USD 83.92 billion in 2023, calculated at USD 90.83 billion in 2024 and is projected to surpass around USD 200.30 billion by 2034, expanding at a CAGR of 8.23% from 2024 to 2034.

The global automotive aluminum extrusion market size accounted for USD 90.83 billion in 2024 and is expected to be worth around USD 200.30 billion by 2034, at a CAGR of 8.23% from 2024 to 2034.

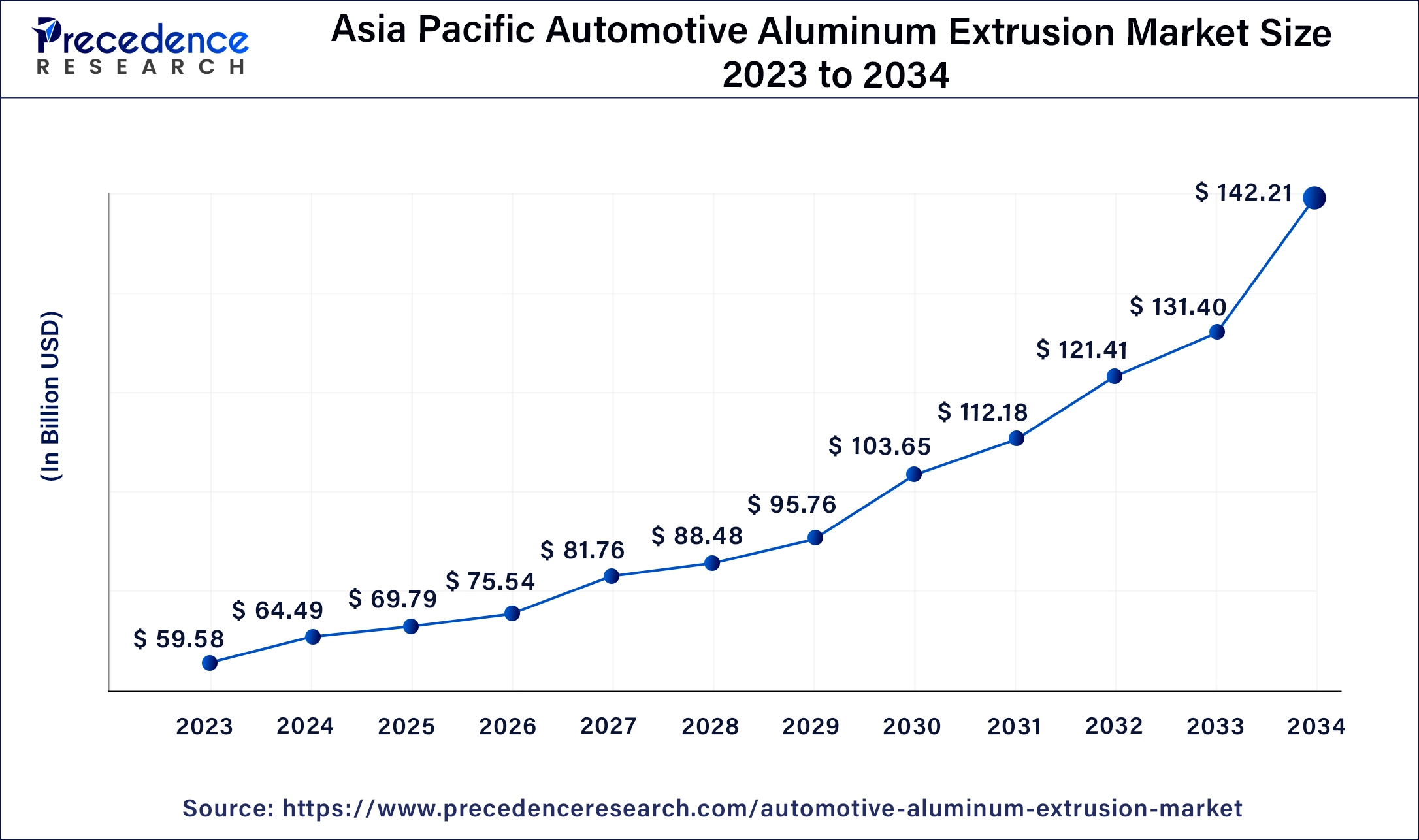

The Asia Pacific automotive aluminum extrusion market size was estimated at USD 59.58 billion in 2023 and is predicted to be worth around USD 142.21 billion by 2034, at a CAGR of 8.3% from 2024 to 2034.

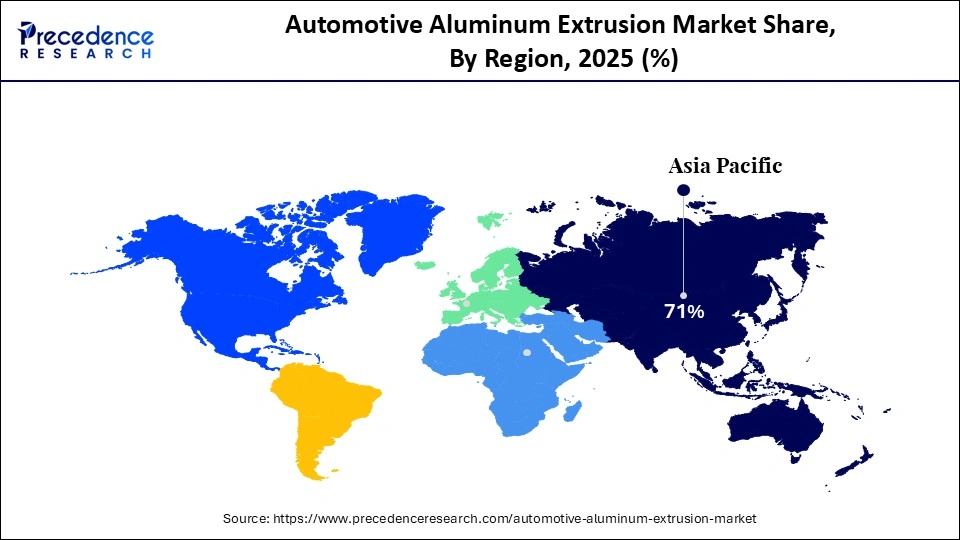

Based on the region, Asia-Pacific region accounted largest revenue share in 2023. The growth in demand for electric vehicles in Asia-Pacific as a result of fairly strict emission regulations is expected to push the automotive aluminum extrusion market in the region. Furthermore, the rising demand for various commodities such as battery covers and structural components for electric vehicles may boost the Asia-Pacific automotive aluminum extrusion market growth.

The North America region is expected to grow at a highest CAGR over the forecast period 2024 to 2034. The presence of a significant automobile industry in the U.S. is the primary factor for the growth of the market. The growing popularity of electric vehicles across Canada and Mexico is expected to increase the North America region’s automotive aluminum extraction market growth.

The expansion of the automotive aluminum extrusion market is being aided by revolutionary innovations in extrusion equipment. The demand for automotive aluminum extrusion has increased for the vehicles such as mini-compact vehicles, supermini vehicles, compact vehicles, mid-size vehicles, executive vehicles, luxury vehicles, utility vehicles, light commercial vehicles, heavy commercial vehicles, and buses & coaches.

The market for automotive aluminum extrusion is expected to develop due to an increase in demand for lightweight and robust extruded products in various types of industries. The weight of aluminum is less but is very strong metal as compared to others. These features of aluminum make it a perfect for huge structures and buildings that require additional strength while reducing weight. Aluminum objects have a good strength and rigidity, making them deform resistant.

Furthermore, extruded aluminum’s superior corrosion resistance is projected to drive the demand automotive aluminum extrusion in electronics, electricals, and medical industries. Unlike steel and iron, extrusions become highly corrosion resistant after anodizing or powder coating due to a thick layer of aluminum oxide. As a result, the cost of maintenance of automotive aluminum extrusion is quite low. However, the automotive aluminum extrusion market’s growth may be hampered by expensive initial setup costs and limited manufacturing efficiency.

The rise in government incentives to use aluminum extrusions in creating integrated photovoltaic systems is likely to promote the growth of the automotive aluminum market during the forecast period. Moreover, the surge in development in the construction and building industry is expected to boost the automotive aluminum extrusion market growth. On the other hand, the rising need for infrastructure development, residential, and commercial projects is expected to stifle the automotive aluminum extrusion market’s expansion.

The global automotive aluminum extrusion market is expected to grow during the forecast period, owing to an increase in demand for lightweight automobiles as a result of severe emission standards being implemented around the world. As a result, the demand for aluminum extrusion in automotive applications is projected to rise. The rise in global demand for electric vehicles is expected to push the automotive aluminum extrusion market, as the usage of aluminum in electric vehicles extends their range.

The increased use of aluminum in vehicles due to improved fuel efficiency is expected to enhance the global market. Since few decades, the use of aluminum in the automobile industry has increased steadily. After steel, the aluminum is the second most commonly used material in automobiles.

| Report Coverage | Details |

| Market Size in 2023 | USD 83.92 Billion |

| Market Size in 2024 | USD 90.83 Billion |

| Market Size by 2034 | USD 200.30 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.23% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Vehicle, Aluminum Grade, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Based on the type, the sub-structure segment accounted largest revenue share in 2023. As the demand for lightweight automobiles is growing, leading vehicle manufacturers are turning to aluminum for sub-structure, which is expected to increase the global automotive aluminum extrusion market growth.

On the other hand, the front side rail segment is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rise in the demand for interior designing for the buildings and houses. The growth in building and construction industry is contributing towards growth of automotive aluminum extrusion market.

Based on the vehicle, the utility vehicle segment dominated the market in 2023. This is attributed to the increase in demand for sport utility vehicles (SUVs) and multi utility vehicles (MUVs).

On the other hand, the compact vehicles segmentis estimated to be the most opportunistic segment during the forecast period. Compact vehicles have seen a significant increase in demand over the last decade, and they are quickly becoming a major sector for automobile and automotive manufacturers in the market.

Key Companies Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting different marketing strategies, such as new product launch, investments, partnerships, and mergers & acquisitions. The companies are also spending on the development of improved products. Moreover, they are also focusing on competitive pricing.

In March 2019, the Norsk Hydro ASA made an investment by purchasing two extrusion plants at Arconic, Brazil.

The various developmental strategies such as investments, new product launches, acquisition, partnerships,joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By Type

By Vehicle

By Aluminum Grade

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025