January 2025

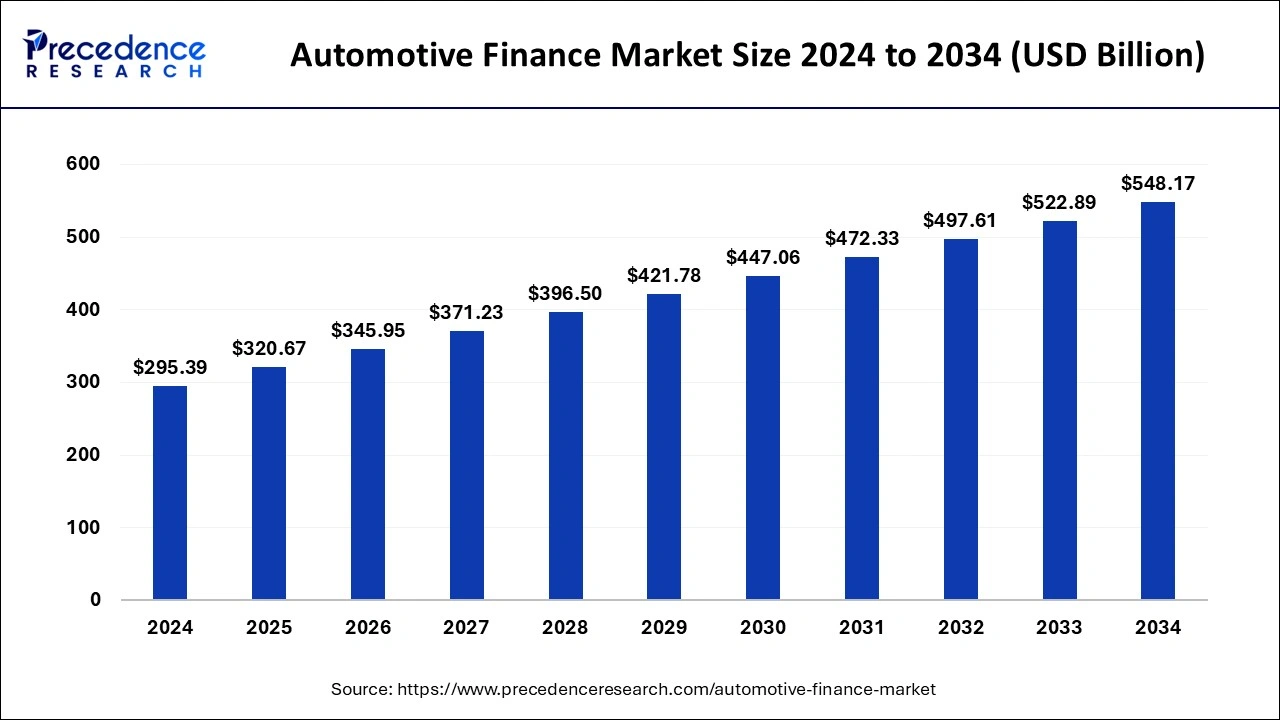

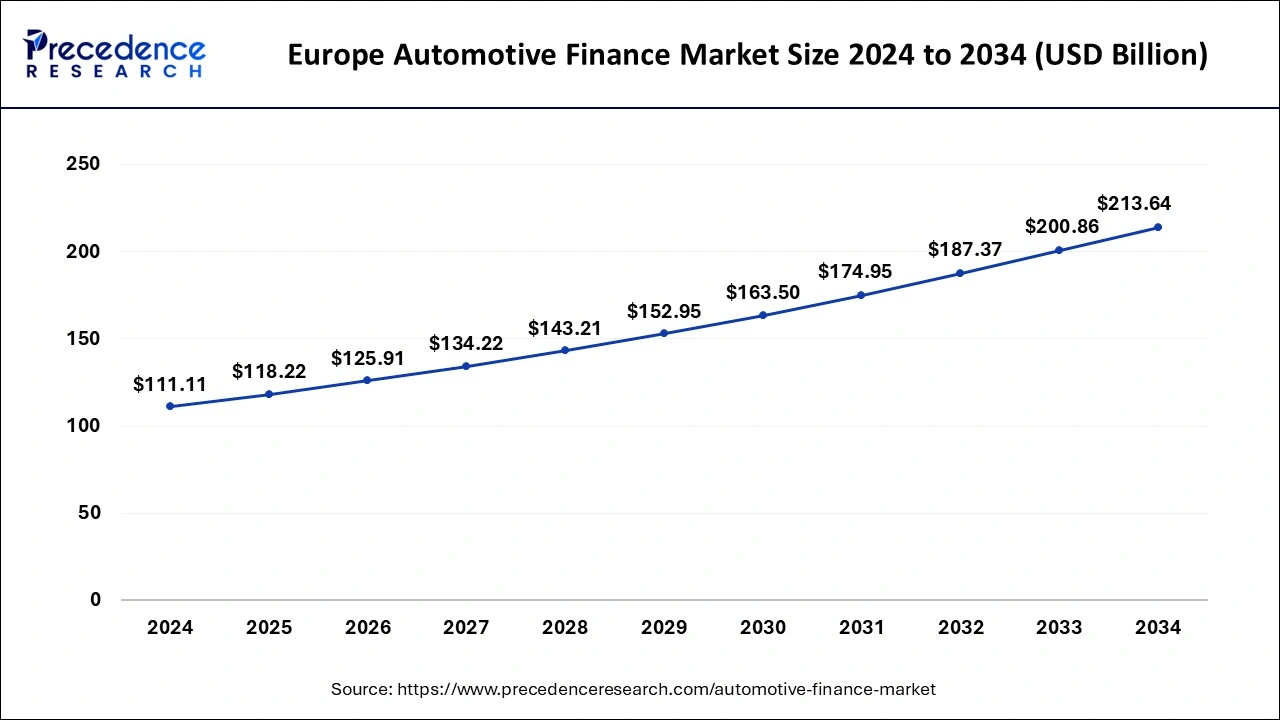

The global automotive finance market size is accounted at USD 320.67 billion in 2025 and is forecasted to hit around USD 548.17 billion by 2034, representing a CAGR of 6.38% from 2025 to 2034. The Europe market size was estimated at USD 111.11 billion in 2024 and is expanding at a CAGR of 6.76% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive finance market size accounted for USD 295.39 billion in 2024 and is expected to exceed around USD 548.17 billion by 2034, growing at a CAGR of 6.38% from 2025 to 2034.

The Europe automotive finance market size was evaluated at USD 111.11 billion in 2024 and is projected to be worth around USD 213.64 billion by 2034, growing at a CAGR of 6.76% from 2025 to 2034.

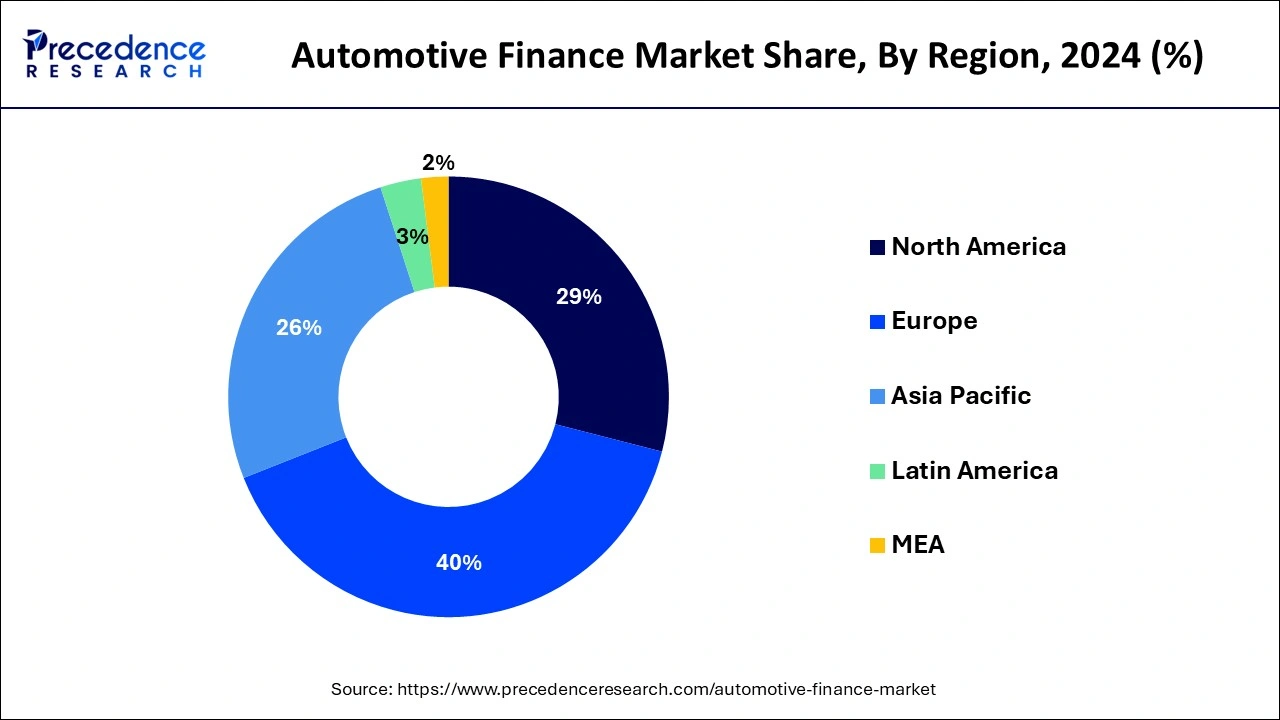

Europe holds the largest market and generated for more than 40% of the revenue share in 2024. Many automotive finance service suppliers can cause a territorial market expansion. Several market players concentrate on offering their services through mobile and online conduits, which gives these players an edge over traditional players. Simultaneously, the country's growing need for electric vehicles shows promising market growth.

The Asia Pacific is growing at the fastest rate during the projection period due to the existence of the most crowded countries like India and China, holding potential for the trade to grow. The Asia Pacific market is estimated to be the fastest-expanding regional market throughout the predicted period.

The increasing public schemes in economies like India, China and Japan promote development in the automotive industry and retain consumer interest are awaited to establish growth facilities for the regional market. The increasing population acts as a driving force for market expansion. Furthermore, the growing endorsement of telematics is also generating new opportunities for market extension.

Automotive finance refers to the monetary support obtained to buy a car with a small down payment. The creditor's loan can be paid up over a specific time in equivalent regular installments with an agreed-upon interest rate. The driving supplier types of automotive finance are banks, OEMs, etc. Banks are used to receiving sums of money in one go and then paying them back over time, along with interest. It is an institute approved to offer money and take deposits from verification and savings accounts.

The finance types comprise direct and indirect finance, and the vehicle types contain passenger, commercial, and other vehicle types. It also has different business procedures favored by decision-makers which enhanced the automotive finance growth and made a phenomenal stand in the industry. The market will rise with a prominent CAGR between 2024 to 2033.

Several automotive technology providers are adopting cryptocurrency-developed payments to improve their offerings. The increasing importance of cryptocurrency throughout automotive finance is expected to boost market growth. For example, Car Now advertised its deal with Cion Digital in March 2022.

The car now will offer auto dealers compliant and fast crypto payment and lending solutions over this association. Diverse automotive artificial intelligence technology suppliers are attempting to build AI-enabled credit platforms. Artificial intelligence technology is gradually being used in the automotive finance sector to improve credit underwriting action, analyze the information, precisely forecast whether the applicant can turn delinquent, and thus enhance the approval process.

For example, upstart reported the opening of upstart Auto Retail software in October 2021. This software includes AI-activated financing features, enabling lenders to improve their customer experience. Passive and active safety systems are notably destined to prevent human faults while operating vehicles. The reconstruction of the automotive industry, joined with the high-end AI and machine learning set-up, is refuelling the need for Artificial Intelligence in automotive.

The growing need for EVs and hybrid automobiles is tracked by the integration of AI units, as they improve the operational capacity, offer ease, and guard the vehicle via park-guided systems. The new car builders are providing OEM-derived AI chips that operate on different roles of a vehicle, and AI supports each element, from AC, lights, and cruise checks to directed parking and autonomous leading systems.

The increasing importance of captive automotive finance globally builds new market development opportunities. Captive finance is a subordinate of an automaker that offers loans and financial services to the firm's users. The advantages of starting a captive finance firm include personalized finance alternatives for users, apparatus rental programs, etc. The companies like Ford, Finance, Honda, Infiniti, and Nissan are seeing substantial expansion in captive finance. According to Experian data, clients purchased more than 91,000 used electric vehicles in 2022, up 45 percent from a year earlier.

Global commodity price inflation has compelled automotive manufacturing firms to raise vehicle expenses in recent years; moreover, the surging need from developing nations, high public taxes, and strict policies further bolster automobile costs. For example, Kia Motors raised its automobile expenses in the Indian market. Therefore, as disposable earnings in countries are also expanding, clients opt for automotive loans to fulfill their financial needs for buying a vehicle.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.38% |

| Market Size in 2025 | USD 320.67 Billion |

| Market Size by 2034 | USD 548.17 Billion |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Provider Type, Finance Type, Purpose Type, and Vehicle Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Online loan services have arisen as the most disruptive technology. It allows easy viewing, comparison, and application for loan services. The rising vehicle costs are propelling the request for automotive financial amenities. Though the need for automotive finance is saturated in developed nations, the developing countryside is anticipated to be a profitable aim market for financing corporations.

For example, most automotive loans in India are taken from nationalized and private banks, primarily owing to low interest. The rising automotive sales will directly lead to the expansion of the automotive finance market.

Automotive financing corporations are progressively moving towards more significant technical improvements to improve operational profits and client experience. For example- AI is increasingly making a substantial verdict for credit by answering customer questions about loan decisions in real time. For example, the average fourth-quarter new-automobile auto loan in Texas proposed a $787 monthly payment, the utmost in the nation. At the same time, Vermont has been afforded the most nominal monthly fee at $625.

The market is highly diverse, with many players like banks, financial institutions, OEMs, and captives. The high competition boosts the expenses on operations and marketing, as highly challenging to gain new consumers for these firms. Lower interest rates and transparent financing dealings are crucial to success in this market. New players in the market face meaningful challenges as renowned brands control it.

Opportunities

Stretching on budget

Budget is the most substantial component when considering car financing pros and cons. Car finance alternatives like PCP and PCH allow you to stretch out budgeting instead of scratching together the cash for a car outright. First deposits can be as low as 10% and will allow for spreading the rest of the loan for two to four years, at times longer.

The bank's segment dominated the market and generated for a maximum global revenue share of around 57.50% in 2024. The growth can be assigned to the fast-processing features with prerequisites for most minor records and the high-reliability features. However, these banks currently offer 100% financing for automobiles, which means clients are more interested in buying a new car. Banks are progressively adopting digital automotive finance to meet international client needs.

The OEMs section is expected to record the largest growth between 2025 and 2034. Automotive OEM offer more effective after-sales care due to the presence of equivalent automobile parts, like the vehicle financed, for repair or substitute. They are regarded as the future of mobility owing to their affirmative influence on new business models, focused on offering motor vehicle security via their captive funding corporations.

The direct segment led the market and captured the maximum global revenue of over 56% in 2024. Customers concentrate on determining the funding source which efficiently meets their requirements. Customers apply for car loans directly at credit unions, banks, and other lending corporations. Moreover, the clients have absolute control over the lending procedure. The consumer needs much more time to prefer a suitable lender in the direct loan process than in the indirect loan proceeding.

The indirect section is expected to record the largest growth between 2025 and 2034. The most significant advantage of the indirect finance type is that it permits consumers to draw instant expert guidance from independent financial experts. Even specialists ensure their clients decide the best way to finance a vehicle. In indirect auto financing, clients search for all loans at once.

The loan section dominated the market and owed a maximum revenue share of more than 60% in 2024. Loans are used as a standard automobile purchase process by worldwide residents. As credit advanced, leasing and finance firms had additional financial support sources to make approachable to consumers. Furthermore, banks and credit trade unions are targeting clients with low interest. The automotive loan corporations give consumers amenities like a vast system of partnerships, dedicated client support, and 24/7 access to favorable lending business loan accounts to improve client experience.

The leasing section is expected to record the largest growth from 2025 to 2034. This growth can be attributed to the rising number of leasing suppliers in emerging economies like India, China, and Japan. The leasing services are rendered for both new and used cars. The increasing digitization trend is a massive influence on the automotive leasing industry. Moreover, firms in vehicle leasing are improving customer experience and holding their profit margins by heavy investment in digitization technologies like blockchain.

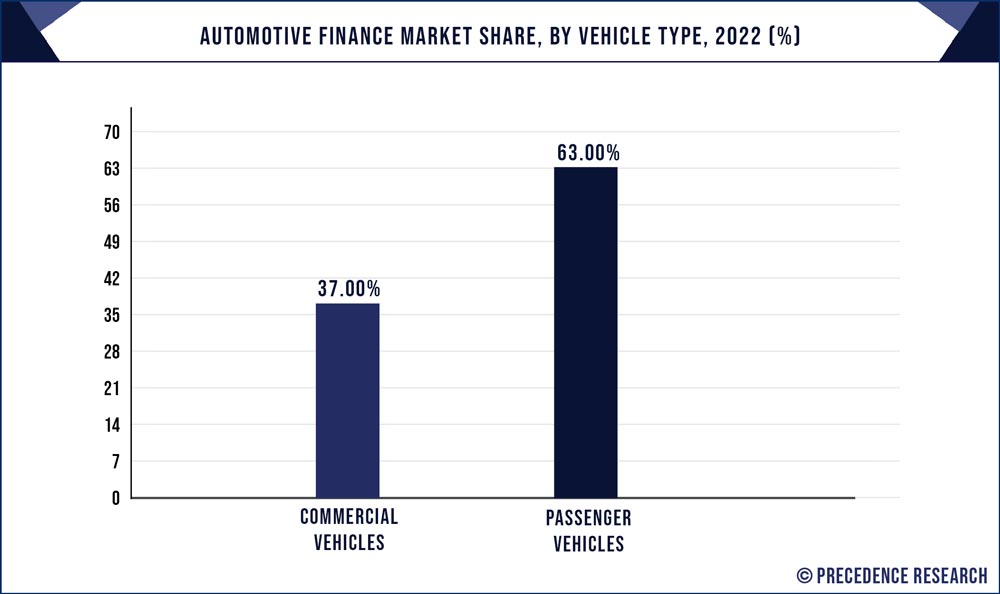

The passenger vehicles section dominated the market and generated more than 63% of the revenue share in 2024. Its growth can be attributed to the growing need for mobility due to the increased space between home, work, leisure, education, and shopping facilities. The automotive industry is growing due to the regular change in client needs. The need for innovations in safety systems, advanced driver-assistance systems, security, telematics, and autonomous vehicles is increasing, particularly in occupant means.

The commercial vehicles segment is expected to register remarkable growth from 2025 to 2034. Since commercial automobiles are costly compared to other cars, multiple banks and financial agencies have introduced sensible loan schemes, including simple terms and conditions. In addition, the processing time required to accept commercial vehicle loans is lower than for passenger vehicles. Simultaneously, the rising need for light commercial vehicles because of their versatile performance in varied conditions is driving growth.

By Provider Type

By Finance Type

By Purpose Type

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025